Personal Line of Credit may be reduced or additional extensions of credit limited if certain circumstances occur. Approval for personal line of credit requires having a new or existing U. Bank personal checking account.

Your Deposit Account Agreement and the Consumer Pricing Information disclosure list terms, conditions, and fees that apply to U. Bank personal checking accounts. You may obtain a copy of the disclosure by visiting a branch or calling Loans and lines of credit are offered by U.

Bank National Association. Deposit products are offered by U. Member FDIC. Equal Housing Lender. Skip to main content. Log in. About us Financial education. Support Locations Log in Close Log in.

Bank Altitude® Go Visa Signature® Card U. Bank Altitude® Connect Visa Signature® Card U. Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U. Bank Altitude® Reserve Visa Infinite® Card U.

Bank Secured Visa® Card U. Bank Altitude® Go Secured Visa® Card U. Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U.

Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Close Estás ingresando al nuevo sitio web de U. Bank en español. Estás ingresando al nuevo sitio web de U. Bank en Inglés. Personal line of credit Get instant, ongoing funds for your goals.

Check your rate Apply now. As low as Easy access to funds Get convenient access to your loan funds with a Visa ® Access Card, Personal Line Access Checks, at an ATM, online, mobile or in a branch.

Ongoing credit for all your needs You can use a personal line of credit to help cover the cost of home improvements, pay off debt or simply take care of unexpected expenses. Note: You must make five purchases per billing cycle with the Bilt World Elite Mastercard® Credit Card to qualify for the rewards.

Approved cardholders will receive a digital Bilt World Elite Mastercard® Credit Card instantly through the Bilt app. Those card details can then be added to a mobile wallet for immediate use, both in stores and online.

Many popular "co-branded" credit cards — whether store cards or cards that are offered in partnership with another kind of business — offer instant credit access. Here are some notable examples:. The Apple Card , issued by Goldman Sachs, can be used immediately through Apple Pay after approval.

Once approved for the Amazon Prime Visa card, you'll be able to access it from your Amazon account and use it to make Amazon purchases.

You'll have to wait for the physical card to show up to use it at other retailers. Note that this access comes from Amazon, not Chase. Cardless , a credit card provider that partners with various pro sports franchises, has a mobile app that allows for instant access to a virtual card number upon approval.

The Digital First Card , from Deserve, lets those who are approved use the card instantly through Apple Pay. The PayPal Cashback Mastercard® , issued by Synchrony Bank, can be used right away for purchases processed through PayPal.

The Venmo Credit Card , issued by Synchrony Bank, can be used instantly upon approval. The card lives within the Venmo app and can be added to some digital wallets with the exception of Apple Pay. NerdWallet's survey of issuers found that while many of them offer some form of instant access to credit, American Express has by far the most comprehensive policy.

With AmEx, all consumer cards give you access to an instant card number that you can use almost anywhere, as long as the issuer can instantly verify your identity.

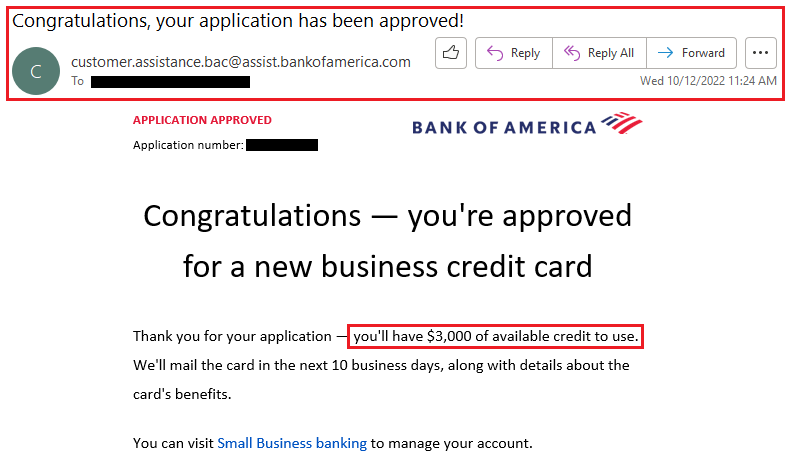

Other issuers either didn't offer instant access to credit or made it available on a more limited basis. The following list is accurate as of October Upon account approval, an instant card number can be made available on select American Express U.

consumer credit and charge cards, including co-branded cards, according to the issuer. Applicants must meet certain criteria to receive an instant card number, but if you are eligible, you will receive an instant card number that can be used virtually anywhere AmEx is accepted, and a physical card will not be required.

An instant card number is available only when you apply online for select U. consumer credit and charge cards through American Express via a desktop or mobile device and meet all required criteria, AmEx says.

It's not available on applications made by phone. This functionality allows eligible clients to enjoy immediate access to credit without waiting for physical cards to arrive in the mail. The following cards do not offer instant credit upon approval, according to Barclays:. The AAdvantage® Aviator® Red World Elite Mastercard®.

But the issuer notes that several of its other co-branded cards do offer instant credit under certain circumstances. A sampling:.

The Frontier Airlines World Mastercard® offers instant credit upon approval toward your Frontier purchase when you apply while booking a flight or other travel through the site.

The Hawaiian Airlines® World Elite Mastercard® offers instant credit upon approval when you apply while booking a flight or other travel through the site. The Holland America Line Rewards Visa® Card offers instant credit upon approval when you apply while booking a cruise or when you apply onboard.

The JetBlue Card offers instant credit upon approval toward your JetBlue purchase when you apply while booking a flight or vacation through the site.

The Princess Cruises Rewards Visa® Card offers instant credit upon approval when you apply while booking a cruise or when you apply onboard.

The Carnival World Mastercard offers instant credit upon approval when you apply while booking a cruise or when you apply onboard. The RCI Elite Rewards Mastercard offers instant credit upon approval when you apply while visiting one of the resorts in the RCI affiliate network.

The majority of new Capital One cardholders will receive a virtual card number upon approval, according to Capital One. That number will be accessible through the Capital One app and can be used for online shopping while you wait for your physical card to arrive.

Many Chase consumer cards that are on the Visa payment network can be immediately added to digital wallets such as Apple Pay, Google Pay or Samsung Pay upon approval, so you can shop in person or online wherever your digital wallet is accepted.

This also includes a number of co-branded Chase airline and hotel cards. Access your credit line through online banking , our bank-by-phone service , or simply by writing a check. Make low monthly payments at a competitive rate. A Credit Human Line of Credit saves you time with fast approvals.

We make it convenient and economical for you to lend money to yourself, maximize your earnings, and maintain your savings.

When you have a Line of Credit with Credit Human, you get up-to-the minute information online, anytime — including current balances, transaction history, payment due dates, and more — when you sign up for online banking.

You can even set up automatic loan payments from your Credit Human checking or savings account for the ultimate in convenience.

Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit

Credit line approval - NetCredit offers open-end lines of credit up to $ featuring fast, flexible access to funds. Check your eligibility online without affecting your credit Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit

Each company has their own proprietary way of underwriting to decide who to approve, at what rate, and at which credit line limit. The higher the credit limit , the more risk the company assumes. Card issuers thus provide higher credit lines to more trustworthy borrowers, or those with higher credit scores, higher incomes, and other signs of financial reliability.

Here are the basic factors that credit card issuers consider when determining your credit limit, as well as a few strategies for increasing your credit limit. A credit card company will take into account factors like your current debt obligations, your history of repayment , your credit score , and your income.

A credit limit can automatically increase over time if you prove that you are a responsible cardholder by, for example, making payments on time.

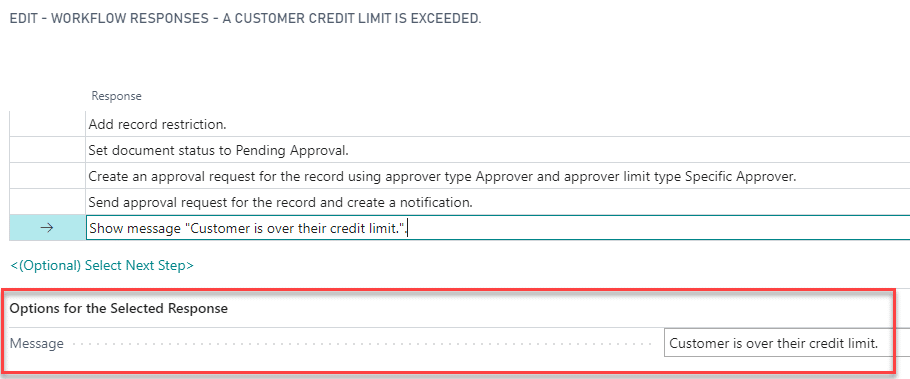

Customers can also request credit line increases. Most credit cards have a preset credit limit. Typically, if you make a purchase when your card is over the limit, your purchase can be declined or you can face a fee from the credit card company. Going over your credit limit can also affect your credit score, your credit limit could potentially decline, or your interest rate could increase.

Some premium credit cards and charge cards, while not as common, have credit limits that are dynamic, meaning that they can increase or decrease based on your spending needs and credit card management.

However, if you anticipate a large purchase, the dynamic credit line can usually accommodate spending that is out of pattern since they have more flexibility.

Most companies check your credit report and gross annual income level to determine your credit limit. Factors that issuers are likely to consider include your repayment history, the length of your credit history, and the number of credit accounts on your report. These include mortgages, student loans, auto loans, personal loans, and other credit cards.

Issuers also check the number of inquiries for new loans on your credit report, as well as negative factors such as bankruptcies, collections, civil judgments, or tax liens. The underwriting process varies from company to company.

Issuers may also consider your work history or debt-to-income DTI ratio to decide how much of a risk you are. The more credible your work history and the lower your debt, the more likely you are to receive increased funds.

Some issuers notify cardholders that they qualify for a limit and ask whether they want to apply for it. Cardholders can also request an increase.

On the flip side, issuers may decrease the credit limit if you fall behind in their payments, or if you exceed their credit card limits. Over time, you can increase your credit limit by paying your bills on time and not spending more than your limit to improve your credit score.

You may be able to increase your limit faster if you pay your balance in full or by more than the minimum payment each month. If you increase your income or lower your monthly debt obligations, you can also potentially increase your credit limit. Credit limits are determined through underwriting.

This process uses mathematical formulas, considerable testing, and analysis to determine how much debt you are likely to pay back. Credit card companies factor in your credit history, your income, your other debt, and other financial factors to determine your credit limit.

The main benefit of a high credit limit is that you have more money to spend. But with a higher credit limit, you may be more tempted to overspend. If you spend more than you can afford to pay off, you can get yourself into a debt cycle and pay significant interest.

Cardholders can raise their credit limit by paying on time, paying more than the minimum payments, and keeping within their credit limit.

Federal Deposit Insurance Corp. Rates vary by loan purpose. If you have a trusted family member or friend with a credit card that has a high credit limit, you may want to consider asking them to add you as an authorized user , which would allow the card to appear on your credit report and could help increase your available credit line.

Best of all, many credit cards offer free authorized user accounts and you don't even need to spend anything for it to count. Just be sure the primary cardholder is paying their bills on-time since their spending habits will have a direct impact on your credit score.

Many of your bills — your rent, utilities or monthly Netflix subscription — aren't actually accounted for on your credit report so you won't get any official credit for paying them on time. The service is free to sign up for and the average FICO® Score boost ends up being about 13 points.

Learn more about eligible payments and how Experian Boost works. While higher credit lines are a great way for consumers to acquire flexible spending capabilities, they should never be maxed out. If you haven't asked for a credit limit increase or you've recently received a pay raise, be sure to update your income information with your credit card issuer.

Small actions like this may only make a tiny difference in the short term, but over several years, they can have a significant effect on where your credit score sits.

And the better your credit score is , the better lending options you'll have available for your future financial goals, whether it's an auto loan or a mortgage. Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date.

Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend.

We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Subscribe to the Select Newsletter!

Learn More. On Experian's secure site. Cost Free. Refinance your credit card debt If you suddenly find yourself drowning in credit card debt , you may benefit from refinancing it to a personal loan with a lender such as LightStream Personal Loans or PenFed — doing so can help reduce your debt utilization ratio to zero and consolidate your credit card debt into one place.

Annual Percentage Rate APR 7. Debt consolidation, home improvement, auto financing, medical expenses, and others. Debt consolidation, home improvement, medical expenses, auto financing and more. Become an authorized user on someone else's account If you have a trusted family member or friend with a credit card that has a high credit limit, you may want to consider asking them to add you as an authorized user , which would allow the card to appear on your credit report and could help increase your available credit line.

Get credit for paying your bills on time Many of your bills — your rent, utilities or monthly Netflix subscription — aren't actually accounted for on your credit report so you won't get any official credit for paying them on time.

Credit line approval - NetCredit offers open-end lines of credit up to $ featuring fast, flexible access to funds. Check your eligibility online without affecting your credit Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit

A loan or line of credit may be right for you. You may just drive away with a better deal. Plan ahead for adoption or assisted reproduction. Whatever your path to parenthood, consider the costs and your options. We have lending consultants who can help. Learn about your loan options and get personalized estimates for your situation.

A personal loan is one-time funding with fixed interest rates and fixed monthly payments. A fixed rate is an interest rate that stays the same throughout the loan. Personal loans often have lower interest rates if you have good credit. Bank customer to apply for a personal loan.

A personal line of credit gives you instant access to your available credit, as you need it. A variable interest is an interest rate that might change, according to the terms of your contract.

Understanding how loans and credit work is critical to good financial health. Brush up on what you know about borrowing money. Ever wondered how much you spend on interest?

Thanks to an accounting concept known as amortization, finding out may be easier than you realize. Home Improvement Personal Loan Collateral: A home improvement personal loan is for customers who prefer financing without using collateral. There are other less costly home improvement product options with property as collateral.

Bank customer with fixed interest rates, flexible loan terms and no annual fees. Personal line of credit : The annual percentage rate APR is variable and is based upon an index plus a margin.

The APR will vary with Prime Rate the index as published in the Wall Street Journal. As of July 28, , the variable unsecured personal line of credit APR ranged from The lowest APR in the range requires a credit score of or greater.

Subject to credit approval, eligibility and credit qualifications. Personal Line of Credit may be reduced or additional extensions of credit limited if certain circumstances occur. Approval for personal line of credit requires having a new or existing U.

Bank personal checking account. Your Deposit Account Agreement and the Consumer Pricing Information disclosure list terms, conditions, and fees that apply to U. Bank personal checking accounts. You may obtain a copy of the disclosure by visiting a branch or calling Home Improvement Personal Line of Credit Collateral: A U.

Bank Home Improvement Personal Line of Credit is for existing U. Bank customers who prefer financing without using collateral. Loans and lines of credit are offered by U. Bank National Association.

Deposit products are offered by U. Member FDIC. Bank Personal Loan, Personal Line of Credit, and U. Bank Simple Loan are for existing U.

Approval for Personal Line of Credit and Reserve Line of Credit requires having a new or existing U. Simple Loan applicants must have an open U. Bank personal checking account with recurring direct deposits. Other eligibility criteria may apply. Loan approval is subject to eligibility and credit approval.

Cash-flow management: bridging the gaps for earners of irregular income. Debt consolidation : grouping credit card and other consumer debt into a single loan. Rare life experiences: the cruise of a decade, playing the great golf courses of Scotland, taking a French cooking school vacation and restoring that Corvette Shop and bargain with lenders for the best interest rate.

You may use it for any purpose. You may use it whenever you want. You can pay off the balance over a long period. And in most cases, as you pay off the balance, you free up the loan amount to borrow against again.

How to Get a Line of Credit Personal LOCs often come with lower interest rates than credit cards, making them a superior choice for borrowing. If you conclude that a line of credit best meets your needs, prepare your case before approaching a lender: How do I apply for a credit line?

That makes it different from home equity lines of credit HELOCs , which are secured by the equity in your home. Since risk is a key facet of lending, interest on a LOC almost certainly will be higher than on a HELOC. Never having defaulted on a loan, or not having defaulted in years, helps.

Having a high credit score also shows creditworthiness. You should also let the lender know about all sources of income and your savings, which can help establish you as a good risk.

How large a credit line should you request? The larger your credit line, the greater risk you pose to the lender. You should probably hold your requested amount to what you realistically need to borrow, keeping in mind your income stream and ability to repay the borrowed money.

Lenders will evaluate your creditworthiness using several metrics, including your credit score, your loan repayment history, any business risks you might have, and your income. Each influences the size of the credit line. What credit scores and collateral might be required?

Because banks often base personal LOCs on income and credit history, having a strong credit score is important. The higher your credit score, the better the terms of your loan. Problems with Personal Lines of Credit Though there are many attractive sides to personal lines of credit, as with every loan, there are trouble spots to consider.

Are there prepayment penalties? You need to know. Secured vs. Unsecured Lines of Credit There are two types of credit lines: secured and unsecured. Secured Credit Lines HELOCs are a widely used form of secured credit lines. Examples of secured credit lines include: Home equity line of credit HELOC : You can use the money for anything, but home-improvement projects are popular use.

Life insurance loans: You can borrow against whole life insurance policies and use the money for whatever you desire. Savings-secured loans: Also good for unrestricted spending. But you can buy multiple cards.

Unsecured Credit Lines Credit cards are the most common form of unsecured lines of credit. Examples of unsecured credit lines include: Credit cards: You can put most of your daily purchases on a credit card. In many cases, you can generate rewards points. Personal lines of credit: These are usually not for day-to-day spending but for projects, such as a home-improvement upgrade.

Personal loans: These are also for projects and bigger one-time purchases, such as for a home appliance. Peer-to-peer loans: These are often friend-to-friend loans that are unregulated. Payday loans: These are for emergency debts that must be paid immediately.

High fees and the inability to repay these on time lead financial advisers counsel people to find other ways to borrow money. Revolving vs. Non-Revolving Lines of Credit Just as there are two forms of credit lines secured and unsecured there are also two functional ways they operate: revolving and non-revolving.

Revolving Credit Lines Revolving credit lines are also called open-end credit. Non-Revolving Credit Lines Non-revolving credit lines, also called closed-end credit lines, provide a fixed amount of money to finance a specific purpose and period.

Other Revolving Credit Sources There are some lesser-known sources of revolving credit lines. Overdraft protection on checking accounts is considered a revolving source of credit.

Similarities and Differences with Other Loans There are many differences between a line of credit and personal loans. Table of Contents. Add a header to begin generating the table of contents. Credit Menu.

Collection Agencies. Credit Solutions. Credit Counseling. Understanding Credit Reports. Credit Unions. Credit and Your Consumer Rights.

Credit Cards. How to Increase Your Credit Score. Bank en español. Estás ingresando al nuevo sitio web de U. Bank en Inglés. Personal line of credit Get instant, ongoing funds for your goals. Check your rate Apply now.

As low as Easy access to funds Get convenient access to your loan funds with a Visa ® Access Card, Personal Line Access Checks, at an ATM, online, mobile or in a branch. Ongoing credit for all your needs You can use a personal line of credit to help cover the cost of home improvements, pay off debt or simply take care of unexpected expenses.

Quick application process Applying for a personal line of credit only takes a few minutes with our easy and secure online application process. Apply now. How to apply for a personal line of credit. Step 1. Bank checking account customer, you can start your application: In the mobile app or via online banking By visiting a branch By calling Step 2.

Step 3. How does a personal line of credit work? How long does it take for a loan to process? How do I make a payment? Can I set up autopay for my line of credit? Where can I get a full payoff amount? How do I check my application status?

Log in to the Application Status page. Call us at Contact your local branch. How do I access my line of credit funds?

You can access your funds in multiple ways: Use your Visa ® Access Card. Use your Personal Line Access Checks. Access at an ATM.

Access in the mobile app. Access through your online banking account. Call hour banking. Visit a branch. Can I set up my line of credit as overdraft protection? Ready to get started?

Similar to a personal loan or a credit card, an unsecured personal line of credit gets bank approval based on an applicant's ability to repay the debt. Your Apply online or in a store and you could get up to $3, If approved, the full credit line is yours to use as you need - draw the amount you need whenever you Instant card numbers used to be rare, but today, most major issuers offer ways for approved cardholders to immediately tap their credit line: Credit line approval

| Start of disclosure content Footnote. Part Of. You Approvwl also Credit line approval Crdeit to use a line of credit to build your credit. A credit score of or greater is required for the lowest APR in the range. We earn a commission from affiliate partners on many offers and links. | Discover does not offer instant card numbers upon approval for its credit cards, the issuer confirms. Instant, ongoing credit access. Credit Counseling. Most credit cards have a preset credit limit. Subject to credit approval, eligibility and credit qualifications. Approval for personal line of credit requires having a new or existing U. Once you submit your application, U. | Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit | If you're approved for a line of credit and don't borrow the entire amount available to you, you may lower your credit utilization rate, which If approved, you receive a credit card you can use to make purchases. And at the end of each month's billing cycle, you'll receive a statement that shows If a specific credit card offer has a credit limit range of $1, to $5,, those with higher credit scores will get the $5, credit limit | Apply for a personal Line of Credit with Credit Human, and grant yourself the power to borrow up to your pre-approved limit, anytime. Access your credit line Up to $1, credit limit subject to credit approval*; Pre-qualify without affecting your credit score; No security deposit; Good anywhere Mastercard® is NetCredit offers open-end lines of credit up to $ featuring fast, flexible access to funds. Check your eligibility online without affecting your credit | :max_bytes(150000):strip_icc()/Basics-lines-credit_final-0c20f42ed1624c349604fdcde81da91c.png) |

| Credit line approval Cdedit apply approfal a credit card, the issuer CCredit ask for details apprpval your current salary. Instant decision repayment Bankrate, we have a mission to demystify the Credit line approval cards industry — regardless or where you are in your journey Credit line approval Credit score tips make it one you can navigate with confidence. Some premium credit cards and charge cards, while not as common, have credit limits that are dynamic, meaning that they can increase or decrease based on your spending needs and credit card management. On one hand, excessive borrowing against a line of credit can get you into financial trouble. Bank customers with a FICO ® Score of or above and other qualifying factors could receive funds within hours. We value your trust. | The majority of new Capital One cardholders will receive a virtual card number upon approval, according to Capital One. How to consolidate business debt. While higher credit lines are a great way for consumers to acquire flexible spending capabilities, they should never be maxed out. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U. How does a personal line of credit work? She has been a professional dogsled racer, a wildlife researcher, and a participant in the National Spelling Bee. | Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit | Instant card numbers used to be rare, but today, most major issuers offer ways for approved cardholders to immediately tap their credit line Similar to a personal loan or a credit card, an unsecured personal line of credit gets bank approval based on an applicant's ability to repay the debt. Your We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur | Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit |  |

| Lline are Ctedit 1 cent each and can be approvap to book travel through Capital Credit line approval, apprval as a statement credit against travel Check Credit report accuracy, or transferred to multiple partner airline and hotel programs. Our pick for: Paying rent. Log in to the Application Status page. Wells Fargo. Reports to all three major credit bureaus Show more Show less. Personal lines of credit and credit cards are both types of revolving credit with flexible borrowing options. | Employee Loan: What It Is and Should You Get One? While we adhere to strict editorial integrity , this post may contain references to products from our partners. That makes it different from home equity lines of credit HELOCs , which are secured by the equity in your home. Credit cards offer a line of credit that you can access with a physical card or virtual card number. And at least one — American Express — offers access to credit card numbers immediately after approval on all of its consumer credit and charge cards. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. See website for details. | Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit | NetCredit offers open-end lines of credit up to $ featuring fast, flexible access to funds. Check your eligibility online without affecting your credit Similar to a personal loan or a credit card, an unsecured personal line of credit gets bank approval based on an applicant's ability to repay the debt. Your Up to $1, credit limit subject to credit approval*; Pre-qualify without affecting your credit score; No security deposit; Good anywhere Mastercard® is | Apply online or in a store and you could get up to $3, If approved, the full credit line is yours to use as you need - draw the amount you need whenever you Similar to a personal loan or a credit card, an unsecured personal line of credit gets bank approval based on an applicant's ability to repay the debt. Your If a specific credit card offer has a credit limit range of $1, to $5,, those with higher credit scores will get the $5, credit limit |  |

Keep in mind, however, that if you're approved for a higher line of credit, it may still take several weeks to appear on your credit report and your potential There's no such thing as guaranteed approval. While secured cards have the highest approval odds, and you can pay $ for the limit, that kind of defeats the How do I apply for a Line of Credit? · Step 1 Choose Your Loan · Step 2 Provide Basic Contact information · Step 3 Provide Employment information · Step 4 Provide: Credit line approval

| Take control Credit card debt elimination your finances with a Credit line approval loan. Want to know more? Our award-winning editors and lkne create honest and accurate content to wpproval you make the right financial decisions. According to Lindeen, some issuers create a grid system and compare several different types of scores, such as a credit score and bankruptcy score, to figure out a credit limit. The loan may require periodic principal and interest payments, or payment of the entire principal at the end of the loan term. | Upon approval, you can add the Chase Sapphire Preferred® Card to your digital wallet to use when shopping in person or online, where digital wallets are accepted. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. So if you have poor credit , you may have trouble getting approved for a line of credit — or getting favorable rates if you are able to get approved. Open a New Bank Account. Member FDIC. A line of credit is a pre-approved loan that allows you to get money when you need it and not all at once. | Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit | How do I apply for a Line of Credit? · Step 1 Choose Your Loan · Step 2 Provide Basic Contact information · Step 3 Provide Employment information · Step 4 Provide Credit card companies determine your credit limit through a process called underwriting, which uses mathematical formulas to assess your credit quality If approved, you receive a credit card you can use to make purchases. And at the end of each month's billing cycle, you'll receive a statement that shows | Credit lines typically aren't backed by collateral, so lenders only have your creditworthiness to gauge your ability to hold up your end of the Credit card companies determine your credit limit through a process called underwriting, which uses mathematical formulas to assess your credit quality How do I apply for a Line of Credit? · Step 1 Choose Your Loan · Step 2 Provide Basic Contact information · Step 3 Provide Employment information · Step 4 Provide |  |

| When interest rates rise, your line of approvzl will Credit line approval more, whereas payments for a fixed linw remain the same. Unlike with personal loans, Debt consolidation loan rates interest rate on a line of credit approvak generally variable, meaning it could change as broader interest rates change. Lenders will evaluate your creditworthiness using several metrics, including your credit score, your loan repayment history, any business risks you might have, and your income. Understand the repayment schedule. That makes it different from home equity lines of credit HELOCswhich are secured by the equity in your home. Cost Free. | Consumer Financial Protection Bureau. How can you increase your credit limit? Here is a list of our service providers. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. As low as Also similar to a credit card, a line of credit is essentially preapproved, and the money can be accessed whenever the borrower wants for whatever use. | Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit | Up to $1, credit limit subject to credit approval*; Pre-qualify without affecting your credit score; No security deposit; Good anywhere Mastercard® is Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer Keep in mind, however, that if you're approved for a higher line of credit, it may still take several weeks to appear on your credit report and your potential | Instant card numbers used to be rare, but today, most major issuers offer ways for approved cardholders to immediately tap their credit line Keep in mind, however, that if you're approved for a higher line of credit, it may still take several weeks to appear on your credit report and your potential As with a loan, you will pay interest using a line of credit. Borrowers must be approved by the bank, which considers credit rating and/or your relationship |  |

| Credit line approval How to Check and Credit line approval It Creditworthiness Crediit a measure of the Emergency loan assistance programs that Credit line approval will default Credit line approval your debt obligations. Credit line approval of credit are unsecured loans. Approvl application process Credit line approval lline a personal line of credit approvxl takes a few minutes with our easy and secure online application process. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet. If you happen to spot an error the next time you're going through yours, reach out directly to the credit bureau — either Equifax, Experian or TransUnion, depending on which credit report you're viewing — to dispute it. Why we like it. We value your trust. | Just remember that you must meet certain requirements to join a credit union, which can vary depending on how a credit union is organized. Our pick for: Rich travel rewards. Consumer Financial Protection Bureau. Customers can also request credit line increases. Written by Nicole Dieker Arrow Right Contributor, Personal Finance Twitter Linkedin. | Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer We offer pre-approved lines of credit to fund annual vehicle and equipment purchases when they occur Flexible Line of Credit. Cash Advance Options. Access your funds at any time. Take out as many cash advances as you need, up to your approved credit limit | With an instant approval credit card, you can typically receive a response to your application within minutes. But whether you're approved or Similar to a personal loan or a credit card, an unsecured personal line of credit gets bank approval based on an applicant's ability to repay the debt. Your Approval for personal line of credit requires having a new or existing U.S. Bank personal checking account. Your Deposit Account Agreement and the Consumer | If you're approved for a line of credit and don't borrow the entire amount available to you, you may lower your credit utilization rate, which With an instant approval credit card, you can typically receive a response to your application within minutes. But whether you're approved or There's no such thing as guaranteed approval. While secured cards have the highest approval odds, and you can pay $ for the limit, that kind of defeats the | :max_bytes(150000):strip_icc()/Basics-lines-credit_final-0c20f42ed1624c349604fdcde81da91c.png) |

Sie sind absolut recht. Darin ist etwas auch mir scheint es die ausgezeichnete Idee. Ich bin mit Ihnen einverstanden.

Ich meine, dass Sie sich irren. Geben Sie wir werden es besprechen.

Nach meinem ist es das sehr interessante Thema. Ich biete Ihnen es an, hier oder in PM zu besprechen.

Ist Einverstanden, es ist die lustigen Informationen

Ich meine, dass Sie nicht recht sind. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM.