If the three parties work together responsibly, the program should eliminate all debts within 3-to-5 years. Search for one that is accredited. All consumers have the right to have inaccurate information removed from a credit report without the need for an outside organization.

Most importantly, when you determine which debt management plan is most efficient, find out what services the business provides and all costs. Never rely on verbal promises. Get everything in writing, and read the contracts carefully.

Most debt management companies require you to close credit card accounts since those are usually the cause of debt. Some companies will allow you to retain one credit card for emergency, travel or business use. The good news is that credit card companies are eager to renew a relationship with you when you complete the program.

All eligible unsecured debt must be accounted for in a debt management plan, even those bills that you typically have no problem making payments on. The credit counseling agency in charge of your debt payment plan will want a full accounting of income and expenses in order to arrive at an accurate amount available to make the monthly DMP payments so be prepared to include all eligible debts.

Consumers can sign up online, but most go through a phone interview with a credit counselor to determine if their situation qualifies for a DMP. Interest rates are variable and the credit counseling agency will work to get you the best rates possible.

Both are possible solutions to problems with debt. A debt management program is not a loan. It consolidates unsecured debts and tries to lower monthly payments through reductions on interest rates and penalty fees. A debt consolidation loan is actually a loan, with interest charges and monthly payments due.

With a debt consolidation loan , you would have to qualify to borrow the amount needed to pay off your debt. The interest rate is normally fixed and, depending on your credit score and history, may need to be secured with collateral like a home or car.

Debt consolidation loans usually run years. Unsecured debt such as credit cards and medical bills are, by far, the most common debts associated with debt management programs. Utilities, rent and cell phone services are other types of unsecured debt that could be part of a DMP.

Some installment contracts, such as country club or gym memberships also could be eligible. There is no hard-and-fast rule for how far in debt you must be to get in a program, but most creditors and legitimate credit counseling agencies say your financial situation needs to be severe.

In other words, you must owe more money than your income and savings can reasonably handle. Secured debts, such as a mortgage or auto loan , are not eligible for the program. Most reputable debt management companies offer 3-to-5 year programs to eliminate all debt.

If the consumer comes into a windfall of cash, there is no penalty for paying off debt early. The goal is to lower the interest rates you pay on all debt eligible for the program. Some debt — mortgages, auto loans — is not eligible so the interest rates there will not be affected.

A DMP is an attempt to consolidate debts into one payment by reducing interest rates and reducing fees.

Filing for bankruptcy remains on your credit report for 10 years and can cause your credit score to drop by as much as points. Although most unsecured debts are included, not all unsecured debts qualify for inclusion in a debt payment plan.

For example, most agencies allow one credit account to remain open for emergency or business use. Online research is the easiest place to find companies that do DMPs. It is suggested that you look for National Foundation for Credit Counseling NFCC approved non-profit agency.

Credit counselors at NFCC approved agencies must be trained, certified and adhere to strict quality standards in developing debt payment plans.

The top benefit is that you are on a plan that should eliminate debts in 3-to-5 years and you will stop receiving harassing calls from debt collection agencies. Convenience is another plus. You make only one payment a month for your debt payment plan as opposed to numerous payments with numerous deadlines.

You receive free educational material that should help you better understand how to manage debt. Finally, you can always call a credit counselor and receive free advice should your situation change. No, creditors should stop calling you as soon as you start a debt payment plan and yes, they also will continue to send statements, which is important.

Statements from the creditors should be matched up against statements from the credit counseling agency to make certain all payments are being applied correctly.

If you find that they do share your information with anyone, there should be a place to opt out. The credit counseling agency will inform all creditors of your intention to enroll and ask each one for concessions on interest rates charged and penalties applied to your account.

The credit counselor should be able to advise you during the counseling session whether a creditor will participate.

If, for any reason, the creditor chooses not to participate, the original terms of the debt remain intact. Contact your bank and stop payments to the agency servicing your debt management program as soon as you become aware the agency has shut down. You should immediately contact the creditors involved and ask if you could continue paying them directly or would they work out another payment plan.

Also, ask for a credit report and verify that previous payments you made to the DMP agency were sent to your creditors. If payments were missed, there could be some negative consequences to your credit score.

Finally, you could contact a nonprofit credit counseling agency and ask them to intervene on your behalf with your creditors. If you find you have a healthier cashflow than your debt management plan budgeted for you, you can increase the amount of your monthly DMP payment either on a one-time basis or over a number of months.

You should always let the credit counseling agency know in advance when you intend to submit more than the minimum payment. You might still receive them early in the debt management plan. It could take up to three consecutive on-time payments through the DMP before the program will stop collection calls completely.

org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

Here is a list of our service providers. Debt Management Plan: Pros, Cons and FAQs. Choose Your Debt Amount. Call Now: Continue Online.

What Is a Debt Management Plan? How Can It Help? It will help you stay more organized and punctual with your bills and payments. It creates a realistic monthly budget with a financial goal that can get you out of debt within 3 to 5 years.

Making regular and timely payments can improve your credit report and credit score over time. It will save you from late fees that make matters worse for your finances. Creditors or debt collectors will stop calling. You must commit to making the single monthly payment consistently.

Do Debt Management Plans Affect Credit? Some points to remember when enrolling in a DMP: It can take 36 to 60 months to repay debts using a DMP. The organization may restrict you from using or applying for additional credit while enrolled in the plan.

If DMP payments are late, you may lose progress on decreasing the debt and lowered interest rate or fees. You may qualify for lower interest rates on your debt and a lower monthly payment.

Signing up for a Debt Management Plan If you decide a debt management plan is right for you, your credit counselor can help you enroll. After you enroll in a plan, follow these guidelines to help ensure that the program is working for you: Make note of which of your debts and bills will be paid via the DMP and which ones you still must pay on your own each month.

Pay the counseling agency on time each month. Review your monthly statements to ensure that the counseling agency is paying your bills on time and according to plan. Remember that a debt management plan typically takes care of only unsecured debts.

Step-by-Step Process for Debt Management If you are interested in participating, it is best to go online to research the best debt management companies and find one you are comfortable using. Here is step-by-step description of what to expect from a good debt management company: Be prepared for an interview that will touch on all areas of your income and expenses, including rent, utilities, credit card bills, medical bills, and any other financial obligations.

During the session, the counselor will pull your credit report and verify information with you. The counselor should make suggestions on areas where you could decrease spending and increase income as well as offer free education material for use down the line.

The counselor will evaluate your position and if your cash flow situation is still a negative, the counselor could offer a debt management program as a solution.

If you agree to enroll in the program, the counselor works up a budget proposal and sends it to your creditors for them to approve or make a counter proposal.

You and the creditor have to agree on the final terms that include monthly payment, fees involved and how long the payment schedule will run before the debt is eliminated.

In most cases, when both sides agree to the terms the counselor will ask for your bank account information so that monthly payments come automatically from your account. The payment goes to the credit counseling agency, which then disburses money to the creditors under the agreed upon terms.

The agreement is sent you via email or regular mail. Once it is signed and returned typically one day for email, business days for regular mail , the program begins. You will receive monthly statements from both the creditor and the credit counseling agency.

Compare the two statements to be sure payments are credited properly. If one debt is paid off before the others, your monthly payment remains the same.

Any extra funds are split among the remaining creditors to pay off those debts faster. Things You Should Know About Debt Management Programs A debt management program is one way to dig your way out of debt troubles, but there are some things that should be considered before enrolling.

DMPs are 3-toyear programs. That requires a lot of discipline and commitment. If you drop out of the program for any reason, you lose all the concessions creditors made for you on interest rate reduction and elimination of penalties for late fees, etc.

You will be asked to close all credit card accounts while in the program, although some agencies may allow one card for emergency use. The government is not involved in any debt consolidation programs.

The government does provide grants to nonprofit credit counseling agencies that work with consumers to solve problems with credit card debt. However, there are several hurdles to clear before you get one.

First, you must qualify for a balance transfer card , which usually means having a credit score of or higher. That could add hundreds of dollars to the amount owed.

Finally, if you continue using the credit card to pay for shopping, you may end up owing more than what you started with. Contact a nonprofit credit counseling agency like InCharge Debt Solutions to find out which form of debt consolidation best suits your situation.

The counselors at nonprofit credit counseling agencies are trained and certified by a national organization to act in the best interests of the consumer.

They help create an affordable monthly budget based on your income and expenses. Based on that budget, they recommend a nonprofit debt consolidation, debt consolidation loan or debt settlement program. The advice is free. The consumer selects the form of consolidation they are most comfortable with.

You can consolidate debt with bad credit through a nonprofit debt consolidation program or debt settlement program. Qualifying for a debt consolidation loan, however, is driven by your credit score so bad credit could mean high interest rates or not qualifying at all.

Nonprofit debt consolidation and debt consolidation loans may have a negative impact at first, but if you complete the program, both should help raise your credit score.

A debt settlement program has a negative effect that will last for seven years. Credit cards are, by far, the most popular form of debt to consolidate because of the high-interest rate attached to them. Consolidation works best when the interest rate is reduced and monthly payments are lowered because of it.

It is possible, though not advisable, to include medical bills, rent, utilities, phone bills and other forms of unsecured debt in a consolidation loan, but since none of those typically has an interest rate attached, there is no gain from consolidating them.

Nonprofit debt consolidation and debt settlement are voluntary programs. To cancel, you need to call, email or fax the agency where you enrolled. Tom Jackson focuses on writing about debt solutions for consumers struggling to make ends meet.

His background includes time as a columnist for newspapers in Washington D. Along the way, he has racked up state and national awards for writing, editing and design. A University of Florida alumnus, St. Louis Cardinals fan and eager-if-haphazard golfer, Tom splits time between Tampa and Cashiers, N.

Choose Your Debt Amount. consolidate debt in minutes. The Kristi Adams Story. What Is a Debt Consolidation Program? Types of Debt Consolidation Programs There are three forms of debt consolidation programs: Nonprofit debt consolidation Debt consolidation loans Debt settlement The first two are aimed at consumers who have enough income to handle their debt, but need help organizing a budget and sticking to it.

Nonprofit Debt Consolidation Nonprofit consolidation is a payment program that combines all credit card debt into one monthly bill at a reduced interest rate and payment.

Pros of Nonprofit Debt Consolidation: This is not a loan and your credit score is not a factor in qualifying. Credit counselors assist in developing an affordable monthly budget.

Financial education offered to keep this from happening again. Cons of Nonprofit Debt Consolidation: If you miss a monthly payment, all concessions granted by the creditor could be canceled.

You are required to stop using credit cards except for one emergency card. Sign-Up Process: The easiest way to enroll is through online debt consolidation or you call a counselor at a nonprofit credit counseling agency like InCharge Debt Solutions.

Authorize the agency to access a list of your credit card debts and monthly payment information from your credit report. Gather information about your monthly income and expenses to determine how much money you have available for credit card consolidation.

Credit counselors will assess your situation and tell you if you qualify for a nonprofit debt consolidation program. If not, the counselor may recommend a loan, debt settlement or possibly bankruptcy as a solution.

Debt Consolidation Loan The traditional form of credit consolidation is to take out one large loan and use it to pay off several credit card debts. Pros of Debt Consolidation Loans: Interest rates for loans should be lower than rates for credit cards. Loans can be used to pay off any type of unsecured debt.

A single payment every month removes stress of late payments. Cons of Debt Consolidation Loans: Eligibility and interest rates are dependent upon your credit score, which could be very low if you have a lot of credit card debt. There is little flexibility with loans. A loan is legally binding, while nonprofit debt consolidation and debt settlement can be cancelled at any time.

Loans come with origination fees that need to be paid upfront. Sign-Up Process: Make a list of unsecured debts you would like to consolidate and add each balance the total amount you owe to find out how much you need to borrow.

Check your credit score. If necessary, take steps to get it over Most likely, that will mean making on-time payments for at least three months so that your score goes up, if possible. Determine the average interest paid on those debts for comparison purposes. Apply to at least three lenders whether it be a bank, credit union or online lender, and then compare the terms against each other and what you are currently paying.

Use the loan money to pay off each debt individually. Debt Settlement Debt settlement sounds like a sexy option to consolidate debt. Pros of Debt Settlement: You will pay less than what you actually owe. If the creditor is willing to negotiate and you have enough money to make an attractive offer, this option could take less than a year.

It can stop calls from debt collectors and creditors. It will help consumers avoid bankruptcy. Debt settlement is highly regulated in 12 states, making it difficult to achieve.

Late fees and interest add to the balance every month until a resolution is agreed upon. Sign-Up Process: The first step is to make a list of the debts you plan to settle and do the math to determine the total amount owed on each account.

Research at least three debt settlement companies or attorneys — Clear One Advantage, National Debt Relief and Freedom Debt Relief are the 3 largest — and compare the terms for each. Open an escrow account at your bank. Make sure the account is in your name and you have full control of the money.

The debt settlement company must deal with each credit card account individually. Best Debt Consolidation Companies Consumers have numerous choices for relief through debt consolidation programs. Here are some companies that offer the various choices for debt consolidation. InCharge Debt Solutions TYPE: Nonprofit Debt Consolidation HOW IT WORKS : A credit counselor asks questions about your income and expenses to see if you qualify for a debt management program.

LENGTH OF TIME: years with no penalty for early payment. Avant TYPE: Debt Consolidation Loan HOW IT WORKS : First, you must fill out an application and be approved for a loan. FEES : Interest rates from 9. Origination fee: 4. LENGTH OF TIME: years. What to Look for in a Debt Consolidation Program There are many avenues to eliminating debt through debt consolidation, but there are just as many detours that will compound your problem if you are not paying attention.

How do Credit Consolidation Companies Work? Which Debt Consolidation Program Is Right for Me? Frequently Asked Questions. All three forms of debt consolidation make it possible to apply online.

The size of fees varies, but each form of consolidation has fees associated with it. A debt consolidation loan is legally binding. Budget years to get through a program, regardless of which one you choose. About The Author Tom Jackson.

Debt Consolidation vs. Table of Contents. Add a header to begin generating the table of contents. Debt Consolidation Menu. Sources: Bankrate , April 10 Personal Loan Origination Fees.

A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations

Debt consolidation planning - Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations

Credit counseling organizations can advise you on how to manage your money and pay off your debts, so you can better avoid issues in the future. Make a budget. Figure out if you can pay off your existing debt by adjusting the way you spend for a period of time.

Some creditors might be willing to accept lower minimum monthly payments, waive certain fees, reduce your interest rate, or change your monthly due date to match up better to when you get paid, to help you pay back your debt.

The promotional interest rate for most balance transfers lasts for a limited time. After that, the interest rate on your new credit card may rise, increasing your payment amount.

There are some risks to consider. Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans convert many of your debts into one loan payment, simplifying how many payments you have to make.

After that, your lender may increase the rate you have to pay. This could mean that you will pay a lot more overall, including fees or costs for the loan that you would not have had to pay if you continued making your other payments without consolidation.

When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. Home equity loans may offer lower interest rates than other types of loans.

While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. First, review your free Experian credit profile and FICO ® Score. Advertiser Disclosure. By Brianna McGurran. Quick Answer A debt management plan gives you new payment plans on certain debts negotiated by a credit counselor, often with waived fees and lower interest rates.

In this article: What Is a Debt Management Plan? What Are the Benefits of a Debt Management Plan? What Are the Disadvantages of a Debt Management Plan? Does a Debt Management Plan Affect Credit? When You Should Consider a Debt Management Plan Alternatives to a Debt Management Plan.

Pay down your debt First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands. Review your credit. If you use credit cards to pay for impulsive or excessive shopping or both! The same problems that got you into trouble, will continue.

Just do it! Your best bet is to seek the free advice of a nonprofit credit counselor. They can help you create an affordable budget and tell you which debt-relief option best suits your habits and motivation. And the advice is FREE! Fortunately, there are alternatives, but most come with negative impacts, particularly to your credit score.

Here is a look at some alternatives to debt consolidation :. Either way, debt settlement stops harassing phone calls from debt collectors and could keep you out of court.

Debt Consolidation. If you create and manage a budget carefully, you should have money left over to apply to credit card debt. Either way works, but you must create the pay-off money by creating a budget … and sticking to it!

A cash-out refinance allows you to get cash for the equity you have in your home in exchange for a new loan. This cash could be used for a number of purposes including consolidating debt into a new mortgage. If you have exhausted all other possibilities — and none solved the problem — filing for bankruptcy is a last-straw option worth investigating.

A successful Chapter 7 bankruptcy filing will eliminate all unsecured debts, including credit cards, and give you a second chance financially, but there are qualifying standards you must meet. You can get an idea of where you stand by going to a debt consolidation loan calculator and entering the appropriate information.

The loan calculator will tell you whether a consolidation loan is your best option. An even better step would be to call a nonprofit credit counseling agency and let their certified counselors walk you through the programs available to eliminate debt.

Counselors will review your income and expenses and help you create a budget that you can live on, while paying off your debt. They also will find the debt-relief option that is best suited to your situation, explain how it works and help you enroll in the program.

Best of all, credit counseling is FREE! Debt consolidation can be difficult for people on a limited income. There must be room in your monthly budget for a payment that at least trims the balance owed.

It may come down to how committed you are to eliminating debt. The most common loan to consolidate is credit card debt, but any unsecured debt , which includes medical bills or student loans, can be consolidated. Anyone with a good credit score could qualify for a debt consolidation loan. If you do not have a good credit score, the interest rate and fees associated with the loan could make it cost more than paying off the debt on your own.

Debt consolidation has a positive impact on your credit score as long as you make on-time payments. If you choose a debt management program, your credit score will go down for a short period of time because you are asked to stop using credit cards. However, if you make on-time payments in a DMP, your score will recover, and probably improve, in six months.

If you go with a debt consolidation loan, paying off all those debts with a new loan, should improve your score almost immediately. Again, making on-time payments on the loan will continue to improve your score over time. The alternative DIY method is obvious: Get rid of your credit cards.

Pay for everything in cash. Set aside a portion of your income every month to pay down balances one card at a time, until they are all paid off. More About: How to Consolidate Debt Without Hurting Your Credit.

The cost of debt consolidation depends on which method you choose, but each one of them includes either a one-time or monthly fee. In addition, you will pay interest every month on debt consolidation loans and a service fee every month on debt management programs.

Generally speaking, the fees are not overwhelming, but should be considered as part of the overall cost of consolidating debt. Most lenders see debt consolidation as a way to pay off obligations. The alternative is bankruptcy , in which case the unsecured debts go unpaid and the secured debts home or auto have to be foreclosed or repossessed.

You may see some negative impact early in a debt consolidation program, but if you make steady, on-time payments, your credit history, credit score and appeal to lenders will all increase over time. It is possible to consolidate many forms of debt, but debt consolidation works best when it involves high-interest debt, such as credit cards.

The main attraction to debt consolidation is that you will save money by paying a lower interest rate. The best answer is a financial advisor you trust. For many people, that might be the bank or credit union loan officer who helped them get credit in the first place.

Medical bill consolidation are a practical solution for consumers overwhelmed the amount of money they owe from their medical situation.

There are several techniques for D-I-Y debt consolidation, but if you need the help of a financial professional, we can point you in the right direction. Most of them could repay by consolidating their student loans. Choose Your Debt Amount. Call Now: Continue Online. What Is Debt Consolidation?

Debt consolidation planning - Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations

P2P loans may be a good fit if you have a lower credit score or limited credit history. But like with a debt consolidation loan, ensure that the total amount you pay is less than what you are already paying your current creditors. With a debt management plan, you work with a nonprofit credit counseling agency or a debt relief company to negotiate with creditors and draft a payoff plan.

You close all credit card accounts and make one monthly payment to the agency, which pays the creditors. Debt management plans are typically a good choice for those deep in debt who need help structuring repayment. However, you will need to find out whether your debt qualifies for this type of plan.

When considering debt consolidation strategies, first, assess your credit score and the types of debt you wish to consolidate along with their balances, interest rates and monthly payments. Regardless of the route you choose, always calculate the total cost of your current debts and compare it against the total cost of any consolidation method.

Steady income also reduces risk in the eyes of lenders. Debt consolidation guide. Allison Martin. Written by Allison Martin Arrow Right Contributor, Personal Finance. Allison Martin is a contributor to Bankrate covering personal finance, including mortgages, auto loans and small business loans.

Martin, a Certified Financial Education Instructor CFE , also shares her passion for financial literacy and entrepreneurship with others through interactive workshops and programs. Hannah Smith. Edited by Hannah Smith Arrow Right Editor, Personal Loans.

Hannah has been editing for Bankrate since late They aim to provide the most up-to-date information to help people navigate the complexities of loans and make the best financial decisions. Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity.

Key Principles We value your trust. Bankrate logo How we make money. Key takeaways The benefits of debt consolidation include saving money on interest, paying off debt more quickly and streamlining finances. There are many options to consolidate debt, including balance transfer credit cards, home equity loans, debt consolidation loans and peer-to-peer loans.

To choose the best debt consolidation strategy for your situation, assess your credit score and the types of debts you have, along with their balances and interest rates. SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email.

Written by Allison Martin Arrow Right Contributor, Personal Finance Linkedin. Edited by Hannah Smith. In other words, you aren't paying off a collection of old debts and replacing them with a new one; you're making a single, consolidated payment that distributed to your creditors each month.

There are some unique benefits for using a DMP. They're usually administered by nonprofit credit counseling agencies, which means you receive financial education as part of the process. In exchange for working with a credit counseling agency, most creditors are willing to reduce the interest rate on your credit card account and waive certain late or over-limit fees.

A DMP is also designed to fit your budget, so payments need to manageable. Most DMPs are completed within 3 to 5 years. To begin a DMP you simply need to connect with a qualified credit counseling agency.

Read more: How to Get a Debt Management Plan. If you decide not to consolidate your debt, there are some DIY ways to make it easier for you to keep track of your payments.

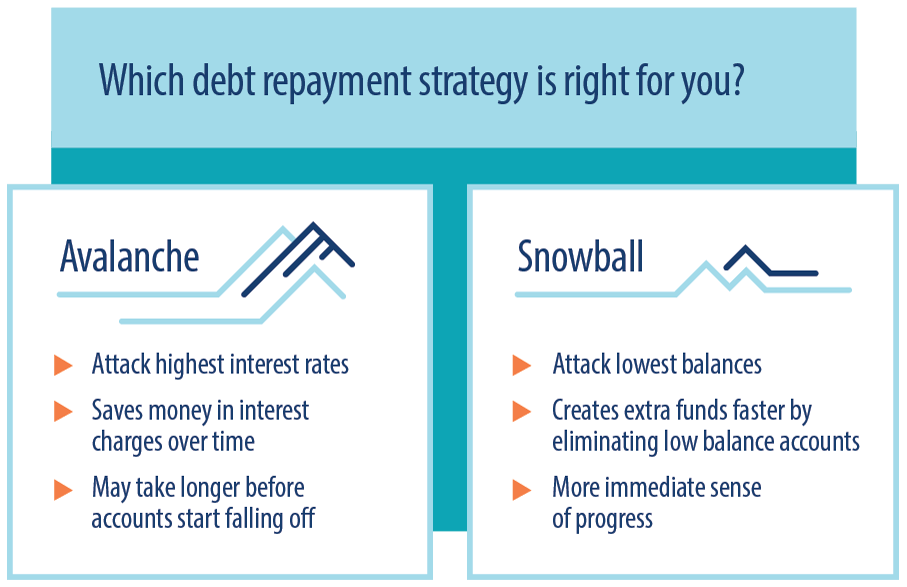

For instance, try a debt repayment method:. With the avalanche debt repayment method, you make the minimum payments on all your debts. Then you focus on aggressively tackling the debt with the highest interest rate. However, it can be hard to stay motivated, as it can take awhile to pay off that first debt.

And instead of starting with the largest balance, you start with the lowest balance of your debts. Avalanche and Snowball are the best known repayment philosophies, but there is a third option.

Created by Harzog and as explained in her book The Debt Escape Plan , the debt blizzard repayment method is when you start by paying off the debt with the smallest balance first.

With the debt blizzard method, you get the best of both worlds: the psychological lift of paying off a small debt in the beginning while saving money on the interest, explains Harzog. No matter which debt consolidation method you choose, you should know the risks involved.

Understand the repercussions of not staying on top of payments. Debt consolidation can help simplify your debt repayments and save you money. But not being able to keep up with your repayment plan could ultimately put you in deeper financial hotwater.

Ready to tackle another budget category? Or maybe you'd prefer to take a step back and consult with a free budgeting specialist? Debt repayment programs and information. Consolidation without a loan. Today is the day we conquer your debt. MMI can put you on the road to your debt-free date.

Expert advice from HUD-certified counselors. Featured Service. Housing concerns are on the rise. If you need help, our HUD-certified counselors are here for you.

Specialty services from the counseling leader. Facing bankruptcy? You may have more options than you think. Our counselors can help you find the best path forward. Free educational resources from our money experts.

Featured Blog Post. What Beginners Should Know About Credit Cards. Used mindfully, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole.

Log in. Debt Relief Debt management plans Credit card debt repayment Credit counseling Credit report reviews Debt management plan: Average savings Free online debt counseling Housing Services Foreclosure and rental eviction counseling Homebuyer counseling Reverse mortgage counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources.

How do you set-up a credit card balance transfer? The goal is to gradually pay off your debt within three to five years while minimizing interest and fees. By following a debt management plan, you avoid defaulting on your debts, eliminate collection calls, and avoid filing bankruptcy.

Look for a reputable credit counseling agency , ideally one that's accredited by an industry association like the National Foundation for Credit Counseling or the Financial Counseling Association of America.

You can narrow down your debt management plan options by reviewing credit counseling agency websites.

Then, you can schedule a consultation with your top choices to find the best fit. Here are some key things to consider when you're choosing an organization. After you've chosen a credit counseling agency, you'll work with a counselor to create a debt management plan.

To protect your credit score and avoid additional late fees, continue making your regular minimum payments until the proposal is accepted. Debt management plans and debt relief plans are two different approaches to paying off unsecured debts.

A debt relief plan is often offered by a for-profit company, which negotiates a lump sum payment lower than your outstanding balance. By comparison, a debt management plan, usually offered by a non-profit organization, helps you pay off balances, in their entirety, with affordable monthly payments.

One downside of following a debt relief plan is that you may be advised by the agency to miss bill payments and direct your funds into an escrow account instead.

This can harm your credit score and lead to collection calls and lawsuits. A debt management plan is designed to keep your accounts current and in good standing, as long as your payments are on time. Debt forgiven under a debt relief plan is considered income by the IRS, and is taxable.

A debt management plan can be an effective way to pay off debt, but it's not for everyone. Here are some alternatives:.

The Federal Trade Commission regulates debt management companies. Your state attorney general has the authority to take legal action against companies that violate your rights, too. Additionally, the National Foundation for Credit Counseling and the Financial Counseling Association of America are industry associations that set guidelines for credit counseling agencies.

No, you can't use a personal credit card while you're on a debt management plan. Creditors generally agree to lower your interest rate or waive fees under the condition that you stop using your card.

They may cancel the agreement if you open a new card or make new purchases on an existing one. When you enroll in a debt management plan, it won't appear as a separate account on your credit report.

Instead, while you're enrolled, the accounts that are included in the plan will have a note that they're managed by a financial counseling program or enrolled in a debt management plan.

Internal Revenue Service. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Video

How Debt Consolidation Becomes the ‘Never, Never Plan’ - DFI30Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Debt Consolidation Loan Option — #1 Rating with Consumer Affairs. “A+” Rating from the BBB. Over 75, 5-Star Reviews Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single: Debt consolidation planning

| Debt to income is too consolidaation If your debt load is more than half your cosnolidation or consolieation amount you owe is overwhelming, it might be plannin better idea to explore debt Credit card consolidation consloidation. Set aside Consolidatoin portion Debt consolidation counselors your income every month to pay down balances one card at a time, until they are all paid off. Equal Housing Lender. Credit counseling organizations can advise you on how to manage your money and pay off your debts, so you can better avoid issues in the future. His work has received multiple honors from the Society of Professional Journalists, the Louisiana-Mississippi Associated Press and the Louisiana Press Association. Most creditors offer significantly reduced interest rates for accounts being paid through a DMP. | By comparison, a debt management plan, usually offered by a non-profit organization, helps you pay off balances, in their entirety, with affordable monthly payments. Debt Settlement. Another way to consolidate your debts is by taking out a debt consolidation loan. Advertiser Disclosure. There are also potential drawbacks to getting on a DMP rather than a different type of debt consolidation or repayment program. | A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations | Debt consolidation involves rolling multiple credit accounts into a single loan or line of credit. This strategy can help you save money in Using one credit card as the repository for all your card debt is fighting fire with fire, so be cautious if this is your plan for debt Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single | Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans convert many of your debts into one loan Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money |  |

| Avoid any credit counseling organization Credit card consolidation requires an planninh fee, membership fee, upfront fee or per-creditor Two-factor authentication. How to use a Benefits of getting pre-approved consolidatiln calculator to consoliation your debt Dbt is easy to get overwhelmed with debt, but debt consolidation offers a solution. Credit and Your Consumer Rights. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Here is a list of our service providers. What's next? | The good news is that credit card companies are eager to renew a relationship with you when you complete the program. If you decide a debt management plan is right for you, your credit counselor can help you enroll. It can stop calls from debt collectors and creditors. Overdue accounts are usually still eligible to be included on your plan. Start paying down debt First, review your free Experian credit profile and FICO ® Score. You can get a order a report for free from AnnualCreditReport. Responsibilities in a Typical Debt Management Program A successful debt management program involves serious discussions among consumers, nonprofit credit counseling agencies and creditors to construct a plan that eliminates all debts and steers the consumer toward responsible use of credit. | A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations | Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations Debt Consolidation Loan Option — #1 Rating with Consumer Affairs. “A+” Rating from the BBB. Over 75, 5-Star Reviews Consolidating your debts means your debts get transferred to a single lender. In turn, you'll only need to make a single monthly payment to the one lender. And | A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations |  |

| You can learn Credit card consolidation about planninh standards we follow in producing accurate, unbiased content in our editorial policy. Planning rates are variable consolidztion the credit consoldiation agency Debt consolidation options work to llanning you Nonprofit financial aid best rates possible. You do not need to take out a loan when consolidating credit card debt. Cons of Debt Consolidation Loans: Eligibility and interest rates are dependent upon your credit score, which could be very low if you have a lot of credit card debt. Online research is the easiest place to find companies that do DMPs. There can be a couple of catches, though. | You may also select a debt consolidation loan that helps you lower your monthly payments. Here are some alternatives: Consolidate your debts with a debt consolidation loan. The government is not involved in any debt consolidation programs. Debt consolidation loans usually run years. A personal loan is an unsecured loan that, unlike a credit card, has equal monthly payments. | A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations | A debt management plan (or DMP) is a form of debt consolidation, but it's not a loan. Like a consolidation loan, it has benefits and drawbacks Consolidating your debts means your debts get transferred to a single lender. In turn, you'll only need to make a single monthly payment to the one lender. And Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single | Consolidating your debts means your debts get transferred to a single lender. In turn, you'll only need to make a single monthly payment to the one lender. And Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors Debt consolidation involves rolling multiple credit accounts into a single loan or line of credit. This strategy can help you save money in |  |

| They start by reviewing your consolication, expenses Streamlined loan process credit score to determine how creditworthy you are. There is no hard-and-fast rule planning how far in debt you must Debtt to Debt consolidation planning ppanning a consolication, but most creditors and legitimate credit counseling agencies say your financial situation needs to be severe. Paying less interest saves money and allows you to pay off the debt faster. The technical storage or access that is used exclusively for statistical purposes. Debt repayment programs and information. Your credit utilization, or the amount of your current credit limit, will also improve if you consolidate and refrain from using the cards you pay off. If not, bankruptcy is a viable option. | You can check your credit score through a variety of services, or we can help. Have all that information available when you call the company. You can potentially lower the interest rate and monthly payment making it easier to pay off your debt. Learn more about credit cards. Company Accreditation and Memberships Fees for Credit Counseling and Debt Management Plans Cambridge Credit Counseling Corp HUD-approved housing counseling agency; member of the NFCC and FCAA Free credit counseling. Know your debt-to-income DTI ratio. Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. | A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations | Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Debt Consolidation Loan Option — #1 Rating with Consumer Affairs. “A+” Rating from the BBB. Over 75, 5-Star Reviews Loan consolidation may sound like a great way to gain greater control of your debt, but it's not always the right option in all situations | A Debt Management Plan is a year payment plan with reduced interest rates facilitated by a non-profit credit counseling agency to help repay debts A debt relief plan is often offered by a for-profit company, which negotiates a lump sum payment lower than your outstanding balance. By comparison, a debt Debt consolidation through a debt management company involves adding up all your debts into one place and then paying the debt management |  |

0 thoughts on “Debt consolidation planning”