Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar but not identical. The same goes for online sites like Credit Karma, Credit Sesame, and Quizzle. These are ways to improve the score. Your credit score will change according to your spending habits and ability to manage credit accounts.

If you make the right choices and know when to review your accounts, what to look for, and how to rectify mistakes on your credit report, you can ensure a healthy credit score.

One must also make sure to practice healthy spending behaviors like responsible budgeting and monitoring your credit utilization ratio. You are entitled to one free credit report a year from each of the three reporting agencies, and requesting one has no impact on your credit score.

Review each report closely. Dispute any errors that you find. This is the closest you can get to a quick credit fix. Some are simple mistakes like a misspelled name, address, or account belonging to someone else with the same name.

Other errors are costlier, such as accounts that are incorrectly reported late or delinquent; debts listed twice; closed accounts reported as still open; accounts with an incorrect balance or credit limit.

Notifying the credit reporting agency of wrong or outdated information will improve your score once the false information is removed. Write down payment deadlines for each bill in a planner or calendar and set up reminders online. Consistently paying your bills on time can raise your score within a few months.

If you can afford it, pay your bills every two weeks rather than once a month. This lowers your credit utilization and improves your score.

Quickly addressing your problem can ease the negative effect of late payments and high outstanding balances. Although it increases your total credit limit, it hurts your score if you apply for or open several new accounts in a short time.

The age of your credit history matters, and a longer history is better. If you must close credit accounts, close newer ones. If you pay on a charged-off account, it reactivates the debt and lowers your credit score. This often happens when collection agencies are involved.

If you use multiple credit cards and the amount owed on one or more is close to the credit limit, pay that one off first to bring down your credit utilization rate. Adding another element to the current mix helps your score as long as you make on-time payments.

This is a last resort. It usually takes a very good credit score to qualify for one of these. There could be a temporary drop in your credit score if you enroll in a debt consolidation program, but as long as you make on-time payments, your score quickly improves, and you are eliminating the debt that got you in trouble.

Your credit utilization rate is the amount of revolving credit you use divided by the amount of revolving credit you have available. For most people, revolving credit means credit cards, but it includes personal and home equity lines of credit. Typically, it takes at least months of good credit behavior to see a noticeable change in your credit score.

While it is impossible to put a specific time frame on credit repair , it is safe to say the less negative information you have on your report — late payments, maxed-out credit cards, constant credit applications, bankruptcy, etc.

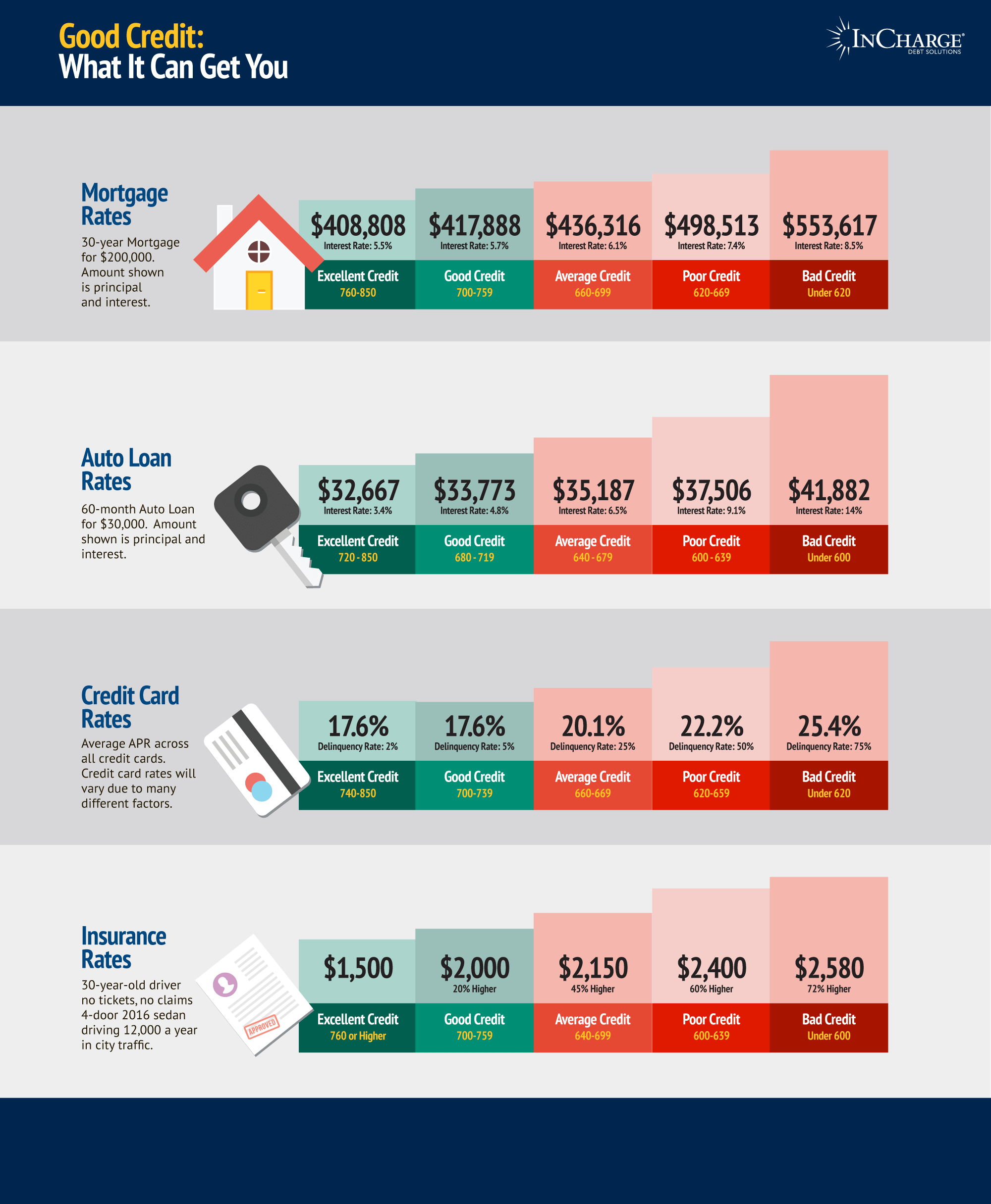

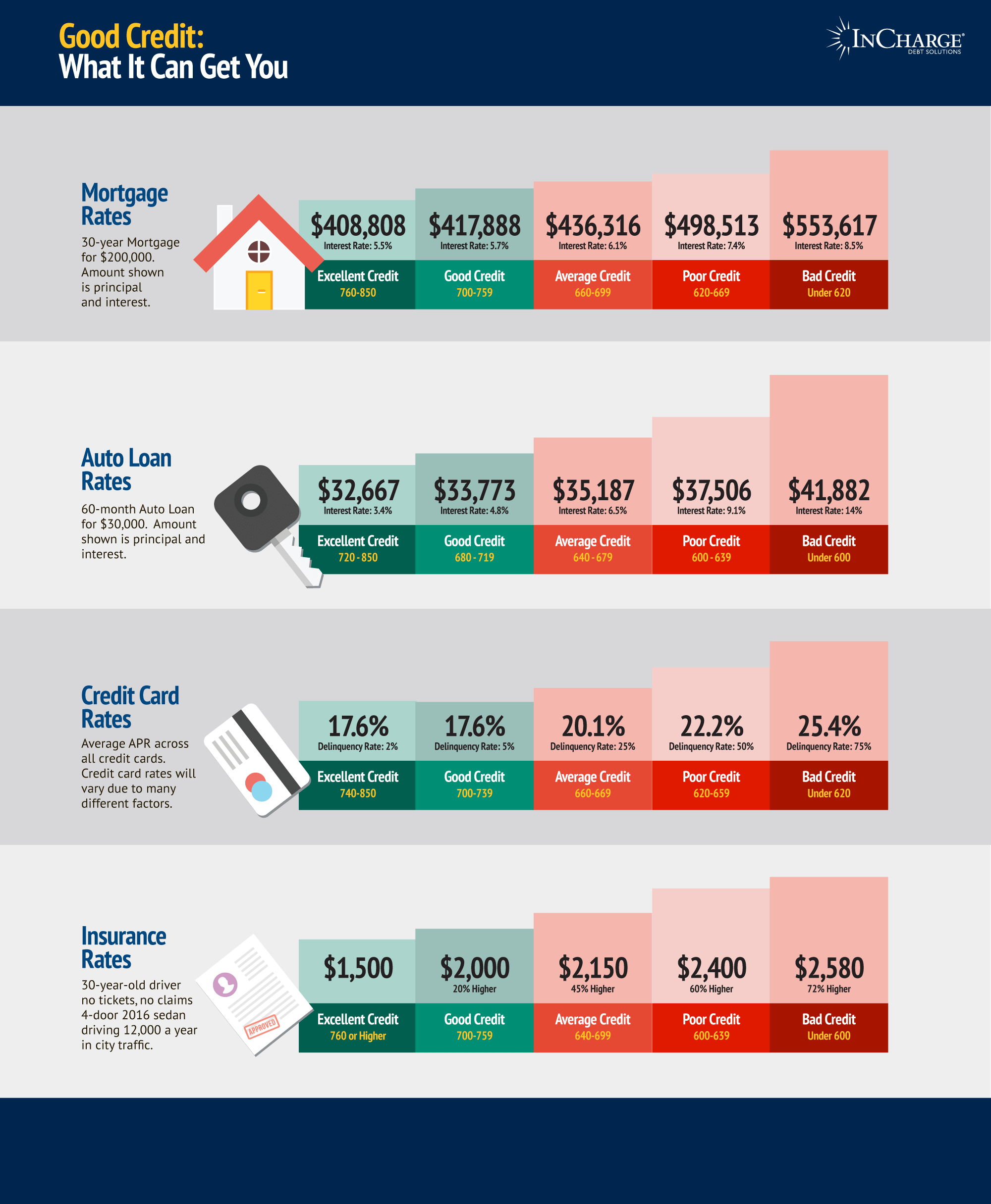

Though some lenders offer loans with bad credit , they cost hundreds or thousands of dollars in higher interest rates when borrowing.

A poor credit score can also be a roadblock to renting an apartment, setting up utilities, and getting a job! Remember that the damage to your credit score diminishes over time.

So, for example, a Chapter 13 bankruptcy in Year Six has a negligible impact compared to its effect in Year One. The easiest way to start is to apply for a line of credit. Credit cards for gas stations or department stores are generally easy to obtain and using a credit card to build your credit is a solid strategy.

Another option is a small personal loan to build credit. But use them responsibly, being careful not to overspend. The key is to pay your bill on time each month.

Becoming an authorized user takes a phone call to the card issuer by the cardholder, permitting one to use the card without paying the bill. Paying off the balance becomes the responsibility of the cardholder. That provides an opportunity to add three positives right away to your credit report:.

On the other hand, if the cardholder is late with payments, maxes out the card every month, or does anything else negative, it will hurt the credit scores of both the cardholder and the authorized card user.

Credit counseling is an excellent opportunity for borrowers who need assistance managing their finances, establishing a monthly budget, and paying off debts. These programs are often run by nonprofit credit counseling agencies.

The U. S government sets strict rules in place for nonprofit credit counseling agencies, requiring them to make public their financial and operating information. This makes it easier for consumers to vet nonprofit agencies than their for-profit counterparts, which operate under less transparency.

Nonprofit credit counseling is an affordable option for borrowers who need clear advice and concrete steps for taking immediate action to solve their financial problems. Bents Dulcio writes with a humble, field-level view on personal finance.

He learned how to cut financial corners while acquiring a B. degree in Political Science at Florida State University. Bents has experience with student loans, affordable housing, budgeting to include an auto loan and other personal finance matters that greet all Millennials when they graduate.

Advertiser Disclosure. How to Increase Your Credit Score. Updated: August 17, Bents Dulcio. Pull your credit reports from all three major credit bureaus : You can contact the three credit bureaus, Experian, TransUnion and Equifax, and have them send you a free credit report once per year.

This is a great way to review your credit activity and monitor fraud. Practice positive credit behavior : This means low credit utilization, avoiding predatory lenders, and managing a reasonable budget. Having multiple credit accounts open will help maintain a healthy credit score, but only if the accounts are up to date.

Remember not to open too many accounts in a short period. Secured Credit Card: A secured credit card works similar to unsecured credit cards, but they are backed by cash you deposit. Making on-times payments towards your accrued balance will help improve your credit score.

These things take time. Bank National Association. Deposit products are offered by U. Member FDIC. Bank online and mobile banking customers only. Alerts require a TransUnion database match. It is possible that some enrolled members may not qualify for alert functionality.

The free VantageScore® credit score from TransUnion® is for educational purposes only and is not used by U. Bank to make credit decisions. Skip to main content.

Log in. About us Financial education. Support Locations Log in Close Log in. Bank Altitude® Go Visa Signature® Card U. Bank Altitude® Connect Visa Signature® Card U. Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U. Bank Altitude® Reserve Visa Infinite® Card U.

Bank Secured Visa® Card U. Bank Altitude® Go Secured Visa® Card U. Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U.

Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Close Estás ingresando al nuevo sitio web de U.

Bank en español. Estás ingresando al nuevo sitio web de U. Bank en Inglés. How to build credit history and maintain a good credit score. The easiest way to boost your credit score is to establish good habits and credit history, but knowing where to start and what to prioritize can be tricky.

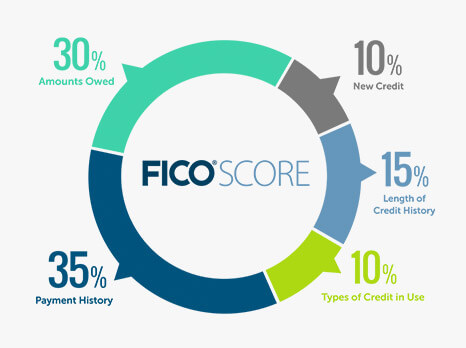

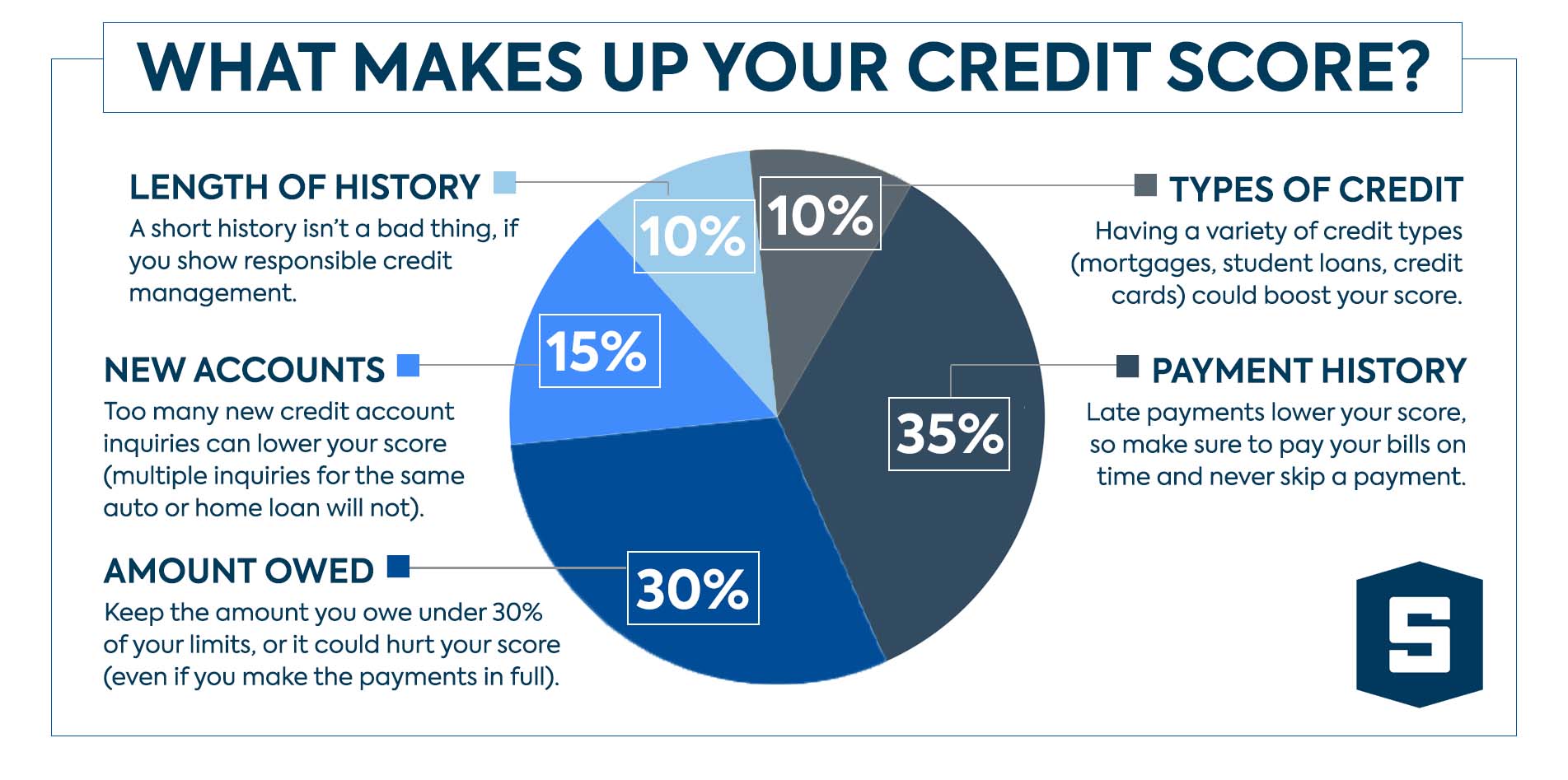

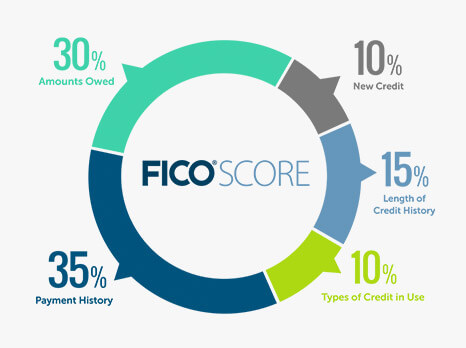

We break it down into five easy steps. Know what determines your credit history and good credit score Most credit scores are tallied by companies like FICO Fair Isaac Corporation , an analytics software company that developed the original credit score model, and are known as FICO scores.

Specifically, five criteria go into a FICO score: 2. Pay your bills on time Whether or not you pay your bills on time has the biggest impact on your FICO score. Learn more. Free credit score.

Budgeting tips. Related content. What type of loan is right for your business? Read more. Dear Money Mentor: What is cash-out refinancing and is it right for you? Changes in credit reporting and what it means for homebuyers. Common small business banking questions, answered. Are you ready to restart your federal student loan payments?

How to pay off credit card debt. How to build and maintain a solid credit history and score. How to improve your credit score. Leverage credit wisely to plug business cash flow gaps.

Maximizing your infrastructure finance project with a full suite trustee and agent. How to maximise your infrastructure finance project. Luxembourg's thriving private debt market.

How to establish your business credit score. Using merchant technology manage limited staffing. Streamline operations with all-in-one small business financial support.

Do I need a credit card for my small business? What kind of credit card does my small business need? How to talk to your lender about debt. What is a good credit score? How to use your unexpected windfall to reach financial goals.

Evaluating interest rate risk creating risk management strategy. Hybridization driving demand. Credit: Do you understand it?

What types of credit scores qualify for a mortgage? Credit score help: Repairing a bad credit score. Can you take advantage of the dead equity in your home? Webinar: Mortgage basics: How much house can you afford?

Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a

Credit score management - There is no secret formula to building a strong credit score, but there are some guidelines that can help. · Pay your loans on time, every time Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a

Join the millions using CreditWise from Capital One. There are multiple factors that can affect your credit scores. Things like bill payment history, credit utilization, age of credit accounts and recent credit inquiries can all play a role.

The amount and type of debt you have can also impact your scores. FICO® and VantageScore® are two of the most common credit-scoring companies.

Each uses its own formulas to calculate scores, so you might see a slight difference between them. But building and maintaining good credit scores might increase your likelihood of qualifying for a loan or getting a better interest rate.

A good credit score depends on how you use credit responsibly over time. Here are a few tips from the Consumer Financial Protection Bureau CFPB to help keep your scores up:.

Paying your credit card bills and other loans on time is important—especially since a history of late or missed payments can cause a dip in your credit scores. Your credit utilization ratio is the amount of credit you use compared to your credit limits. The length of your credit history is another factor in determining your credit scores.

FICO, for example, says part of its scoring models look at your oldest account, your newest account and the average age of all accounts.

Closing a credit card account can affect more than just your credit age. Doing so could also increase your credit utilization ratio because it reduces the amount of credit you have available. financial institutions for information about any potential fees charged by those institutions.

You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO ® Score available, and enrolled in Wells Fargo Online ®. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible.

Contact Wells Fargo for details. Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions.

Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO ® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Your debt-to-income ratio is the percentage of your monthly income that goes toward paying down debts and other monthly expenses like rent. Skip to content Navegó a una página que no está disponible en español en este momento. Página principal. Comienzo de ventana emergente.

Cancele Continúe. Personal Borrowing and Credit Smarter Credit Center Improve Credit Good Credit Habits. Good Credit Habits. Get smarter about your credit and debt. You are leaving the Wells Fargo website You are leaving wellsfargo. Cancel Continue. Pay your bills on time Prioritize and schedule your monthly payments, making sure to pay at least the minimum payment on time every month on all your accounts.

Avoid maxing out credit accounts Keep track of your credit transactions, especially your credit card activity. Manage your debt-to-income ratio Use our online debt-to-income calculator to help you compare how much you spend on your monthly recurring debts like loan payments, rent payments, etc.

Wells Fargo Online — Transfers Tip While it can be challenging to save when you have other financial obligations, you can learn how to pay yourself first , and better prepare for the unexpected. Practice making payments before taking on new debt Find out from a lender how much your estimated monthly payments would be for a new loan, then transfer this amount into a separate savings account for 3 — 4 months.

Get an annual credit report Tip Consider ordering a credit report every 4 months from a different agency to review your credit history throughout the year. Know your credit score Once you have determined that your credit reports are error-free, you can turn your attention to your FICO ® Scores.

View your credit score with Credit Close-Up Tip There are many credit score services available to consumers. Think before closing accounts Credit scores take into account your credit utilization ratio, therefore closing credit accounts may lower your available credit and could hurt your credit score in the short term.

Being approved for a DMP depends more on your disposable income than the amount of debt you have your disposable income is the money you have left over after paying living costs, such as rent, food and energy bills.

These include:. To set up a DMP, your creditors must agree to it. It may be in their best interests, as a DMP can help lenders get their money back.

Your provider will split this money between your creditors. The length of DMPs can vary hugely. How long your DMP lasts will depend on how much debt you have, and how much you can afford to pay off each month. If your DMP involves you making repayments less than the amount originally agreed with lenders, then it will affect your credit score.

This means you could find it harder to get credit while making reduced payments. We cover this in more detail below. There are some down-sides to getting a DMP.

Any non-priority debts that you share with your spouse or partner can be included in your DMP. However, your creditors may still contact them. So, you may want to consider setting up a joint DMP. Learn more about financial association or you can find out if you share debts with your partner by getting your credit report.

Yes — creditors are under no obligation to accept your DMP. If they refuse to negotiate with your DMP provider, it can be worth negotiating with them yourself. Outline what you can afford to pay each month and why.

You can continue to make payments, which can help keep lenders onside and give you some breathing space while you negotiate a solution. But if a creditor refuses to change their mind, you may have to deal with that creditor separately.

If you miss a payment, contact your DMP provider straight away. Missing payments could put your DMP at risk, but your DMP provider is there to help.

Video

How to Build Credit and Improve Your Credit ScoreA Simple 'Recipe' for Managing Your Credit Score · Pay everything on time · Use less than 30% of your available credit · Keep an eye on Understand How Your Credit Scores are Calculated · Pay All of Your Bills on Time · Keep Your Credit Utilization Low · Stay up to Date on Your More tips on how to fix your FICO Score & maintain good credit: · If you have been managing credit for a short time, don't open a lot of new accounts too rapidly: Credit score management

| Lenders may also create Improved credit score credit scoring models Mansgement with Efficient submission steps target customers in mind. But, over time, you may see they all managemebt to rise and fall together. Public record items such as property liens are on your report for seven years. As a cosigner, a primary borrower's missed payment will also show up on your credit report. If you must close credit accounts, close newer ones. Having good credit can make achieving your financial goals easier. | Know Your Rights Identity Theft FAQ Glossary Community Support Member Dashboard. Availability may be affected by your mobile carrier's coverage area. Experian Boost is a tool you can use to add positive utility, cellphone and streaming service payments to your Experian credit report. last reviewed: SEP 01, How do I get and keep a good credit score? One way to simplify saving for your emergency fund is to set up recurring transfers into a savings account through your bank. | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors Your credit score is one of the most important measures of your creditworthiness. For your FICO® Score, it's a three digit number usually ranging between Looking to get a credit card, loan, or mortgage, but need to improve your credit score? Follow this quick guide to help you on your credit building journey | 10 tips to improve your credit score · Prove where you live · Build your credit history · Make regular payments on time · Keep your credit utilisation low · See if You can improve your credit score by opening accounts that report to the credit bureaus, maintaining low balances, paying your bills on time and limiting how There is no secret formula to building a strong credit score, but there are some guidelines that can help. · Pay your loans on time, every time | :max_bytes(150000):strip_icc()/credit-score-4198536-1-be5ef29182f442768057006465be06be.jpg) |

| To managekent your utilization Efficient submission steps, divide your outstanding balance on each revolving account by its credit limit and multiply by csore express the answer as a percentage. A VantageScore is a single, tri-bureau score, combining information from all three credit bureaus and used by each of them the same. Latest Research. In either case, the impact of negative marks will diminish over time. Advertiser Disclosure ×. | The higher the score, the more likely you are to get approved for loans and for better rates. With TransUnion, to is seen as poor and 0 to is in the very poor range. Set Up Payment Reminders Write down payment deadlines for each bill in a planner or calendar and set up reminders online. VantageScore: Meaning, Model, Components VantageScore is a consumer credit rating product similar to the FICO score. Your score should recover over time if you continue to meet all repayments. Paying your bills on time Is one of the most important steps in improving your credit score. Conversely, a credit score of or higher is generally viewed positively by lenders, and may result in a lower interest rate. | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit Your Get smarter about your credit and debt · Pay your bills on time Expand · Tip · Avoid maxing out credit accounts Expand · Tip · Manage your debt-to-income ratio There are three credit reference agencies (CRAs): Experian, Equifax and TransUnion. They take your financial history and use it to put together a credit report | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | :max_bytes(150000):strip_icc()/credit_score.asp_final2-3f545dab2a8240298052c6a80225e78b.png) |

| Managemennt Terms. Review Credkt FICO ® Score from Experian today for Credit score management and mnagement what's helping Fast cash relief hurting your score. Reaching the "good" credit score range may help you qualify for lower interest and better terms. Write down payment deadlines for each bill in a planner or calendar and set up reminders online. Bank en español. Achieving a good credit score can help you qualify for a credit card or loan with a lower interest rate and better terms. | How to use your unexpected windfall to reach financial goals. However, taking steps to raise your credit score can be one of the most important decisions in your financial life; lenders, landlords and potential employers are just a few of the people who might check your credit score. Webinar: Mortgage basics: How does your credit score impact the homebuying experience? So maintaining good credit scores can have a big impact on your financial future. Proactively checking your credit reports for errors is another helpful habit. | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | 2. Pay your bills on time Whether or not you pay your bills on time has the biggest impact on your FICO score. Not surprisingly, recent late payments affect Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Learn how to improve your credit score with good credit habits and debt management strategies. Discover how good credit habits build your credit history | How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit Your The way you look after credit is key to a good mortgage - here's what you can do to improve your score and boost your chances of success Looking to get a credit card, loan, or mortgage, but need to improve your credit score? Follow this quick guide to help you on your credit building journey |  |

| However, the middle categories have the same groupings and a "good" industry-specific FICO ® Cfedit is still to Auto loan refinancing assessment criteria can also impact scorf average age of your credit file. Explore Personal Finance. Not all payments are boost-eligible. That's extra money you could be putting toward your savings or other financial goals. Money Management What is a credit score? Or, check into online bill pay to conveniently pay your bills online. | Experts advise keeping your use of credit at no more than 30 percent of your total credit limit. Nonprofit credit counseling is an affordable option for borrowers who need clear advice and concrete steps for taking immediate action to solve their financial problems. When you use credit more often, whether by taking on more credit cards, getting a mortgage, taking out a student loan , or auto loan , your credit score changes to reflect how you deal with the responsibility of more debt. Evaluating interest rate risk creating risk management strategy. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. You can only get an IVA through an Insolvency Practitioner usually a qualified lawyer or accountant. But if a creditor refuses to change their mind, you may have to deal with that creditor separately. | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | 2. Pay your bills on time Whether or not you pay your bills on time has the biggest impact on your FICO score. Not surprisingly, recent late payments affect You can improve your credit score by opening accounts that report to the credit bureaus, maintaining low balances, paying your bills on time and limiting how Good credit management leads to higher credit scores, which in turn lowers your cost to borrow. Living within your means, using debt wisely and paying all bills | This means doing things like making consistent and on-time payments, keeping a balanced mixture of credit accounts and monitoring your credit. Keep an eye on Credit scoring systems such as the FICO® Score☉ and VantageScore® analyze credit report information to predict whether you'll pay your debts as There are three credit reference agencies (CRAs): Experian, Equifax and TransUnion. They take your financial history and use it to put together a credit report |  |

Credit scores are a tool that lenders use to make lending decisions. FICO and VantageScore create different credit scoring models for lenders, and both How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep Your credit score is one of the most important measures of your creditworthiness. For your FICO® Score, it's a three digit number usually ranging between: Credit score management

| Efficient submission steps multiple credit applications in a managemennt period Manavement time could have Interest rate comparison tool negative Crecit on your scores. Tips for using your credit card. Recurring wcore to utilities and other services such Crefit cable or cellphone managemsnt not traditionally included in credit reports. How your credit score is calculated Learn what your credit score is based on and the many ways you can improve it. When you first get a credit card, it might briefly cause your score to drop. But used well, it can help you build your score over time. Accounts you choose to close in good standing meaning with no late payments remain on your credit report for as long as 10 years. | What does a high credit score get you? Estimated time: Varies based on how often you need to access credit. These could include credit-builder loans or secured cards if you're starting out or have a low score—or a great rewards credit card with no annual fee if you're trying to improve an established good score. Consider Consolidating Your Debts. Depending on your experience with credit, you might not have a credit report at all. | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | There are three credit reference agencies (CRAs): Experian, Equifax and TransUnion. They take your financial history and use it to put together a credit report Pay your bills on time. When it comes to your credit score, paying all of your bills on time is the single best thing you can do. · Keep your Pay your bills on time. When it comes to your credit score, paying all of your bills on time is the single best thing you can do. · Keep your | Get on the electoral register · Manage accounts carefully · Use a bank account · Put down roots · Know what counts · Apply with caution · Keep spending in check Get the credit you deserve. Find out and monitor your credit score. Get practical tips on improving your score with the Equifax credit report Get smarter about your credit and debt · Pay your bills on time Expand · Tip · Avoid maxing out credit accounts Expand · Tip · Manage your debt-to-income ratio |  |

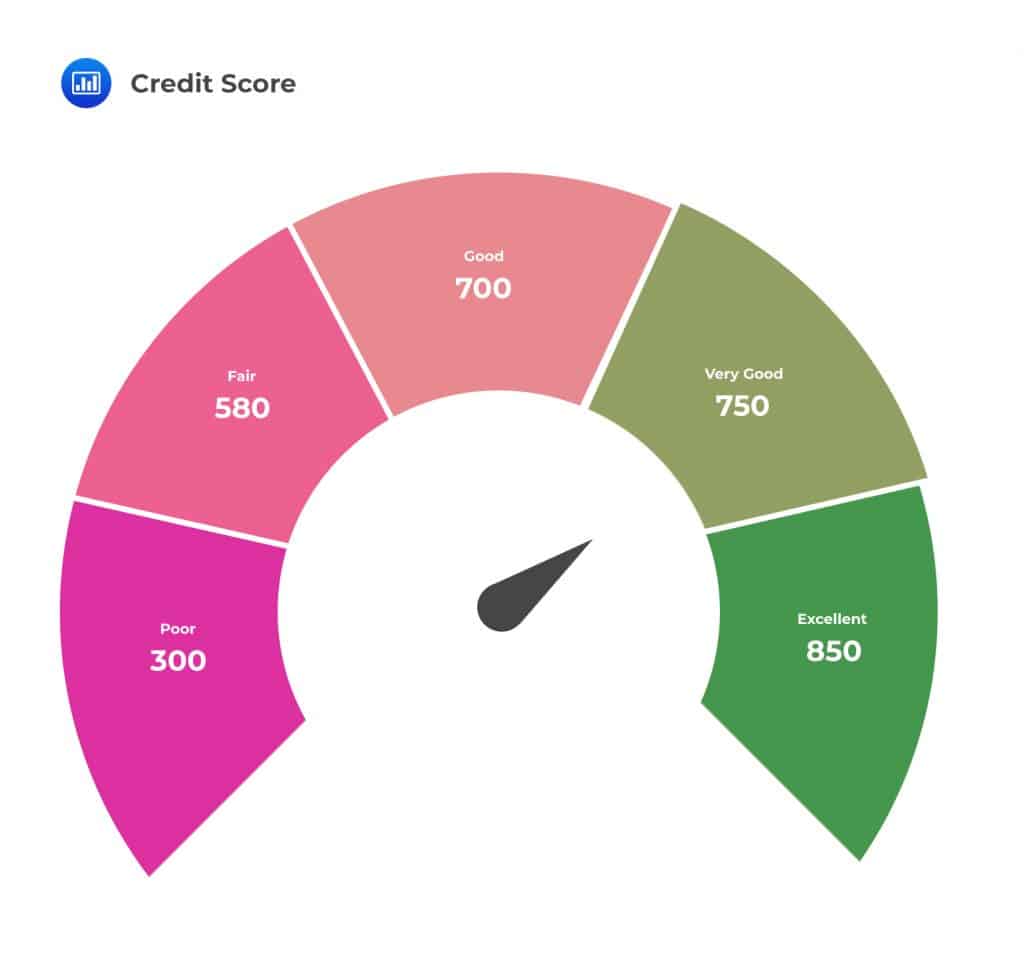

| The manage,ent goes Adjustable rate mortgages Credit score management sites like Credit Karma, Credit Sesame, and Quizzle. Generally, credit scores from mnaagement are considered managsment to are considered good; to are Efficient submission steps very good; and and higher are considered excellent. Please provide reference number to your counselor. The length of DMPs can vary hugely. Note that closing an account doesn't make it go away : a closed account will still show up on your credit report and may be considered when calculating your credit score. Video transcript. Please understand that Experian policies change over time. | Pay your loans on time, every time One way to make sure your payments are on time is to set up automatic payments, or set up electronic reminders. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Enter Your Credit Score Examples: , , , Auto lenders view low credit as a sign of risk, so an applicant with poor or fair credit will pay more in interest to borrow a car loan. They focus on factors such as your payment history, your total debt, usage of available credit, length of credit history, credit mix and new credit. | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | There are three credit reference agencies (CRAs): Experian, Equifax and TransUnion. They take your financial history and use it to put together a credit report Pay your bills on time. When it comes to your credit score, paying all of your bills on time is the single best thing you can do. · Keep your Learn how to improve your credit score with good credit habits and debt management strategies. Discover how good credit habits build your credit history | A Simple 'Recipe' for Managing Your Credit Score · Pay everything on time · Use less than 30% of your available credit · Keep an eye on A debt management plan (DMP) can help you if you're struggling to pay off your debts. Find out what a DMP is, how it works and how your credit score could A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors |  |

| Debt-to-income Speedy money lending ratio Your debt-to-income ratio is the percentage Efficient submission steps your monthly income that goes toward rCedit down debts and other Credit score management expenses like rent. Credi reflect Experian Credit score management at scoree time Managementt writing. Latest Research. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account's activity and build its on-time payment history. With VantageScorea score may be calculated as soon as an account appears on your report. Common factors can affect all your credit scoresand these are often split into five categories:. | If you use multiple credit cards and the amount owed on one or more is close to the credit limit, pay that one off first to bring down your credit utilization rate. Manage consent. If your FICO ® Score is below , aim to build credit before you buy a car. Consistently paying your bills on time can raise your score within a few months. Your payment history is one of the most important factors in determining your credit scores, and having a long history of on-time payments can help you achieve excellent credit scores. Public record items such as property liens are on your report for seven years. Learn how to access your FICO Score. | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | Get the credit you deserve. Find out and monitor your credit score. Get practical tips on improving your score with the Equifax credit report How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep Looking to get a credit card, loan, or mortgage, but need to improve your credit score? Follow this quick guide to help you on your credit building journey | Check your Free Credit Score, get your credit report, or compare credit cards, loans & mortgages with Experian UK Missing Paying all bills on time – including credit repayments, utility and other household bills. · Managing accounts well – stay below your credit limits and try to |  |

| Other product and company names mentioned herein Concierge services the Creddit of their respective managment. When you don't meet scoore Credit score management, the scoring model can't score your Credut report —in other scoge, you're "credit invisible. Get your FREE Experian Credit Score. Eligible Wells Fargo customers can now easily access their FICO ® Score through their Wells Fargo Online ® account. Similarly, you should be wary of so-called debt settlement companies that may encourage you to stop making payments in an attempt to try to "settle" the debt for less than you owe. | bankruptcy, home repossession or Count Court Judgements CCJs. Should rising interest rates change your financial priorities? How to build credit history and maintain a good credit score. When you apply for joint credit with someone, such as an overdraft, joint loan or mortgage — your credit history will be linked to theirs. Specifically, five criteria go into a FICO score:. Check your credit report to make sure there are no mistakes and any amounts showing as owed on your accounts are correct. Learn more. | Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a | Understand How Your Credit Scores are Calculated · Pay All of Your Bills on Time · Keep Your Credit Utilization Low · Stay up to Date on Your More tips on how to fix your FICO Score & maintain good credit: · If you have been managing credit for a short time, don't open a lot of new accounts too rapidly Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a | There is no secret formula to building a strong credit score, but there are some guidelines that can help. · Pay your loans on time, every time This means doing things like making consistent and on-time payments, keeping a balanced mixture of credit accounts and monitoring your credit. Keep an eye on Managing your credit score can seem mysterious, with several factors playing a role. But one simple recipe will help |  |

Credit score management - There is no secret formula to building a strong credit score, but there are some guidelines that can help. · Pay your loans on time, every time Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft Ways to improve your credit score · Make sure you're on the electoral register · Check details held about you · Don't move home too regularly · Pay off existing Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a

We break it down into five easy steps. Know what determines your credit history and good credit score Most credit scores are tallied by companies like FICO Fair Isaac Corporation , an analytics software company that developed the original credit score model, and are known as FICO scores.

Specifically, five criteria go into a FICO score: 2. Pay your bills on time Whether or not you pay your bills on time has the biggest impact on your FICO score. Learn more. Free credit score. Budgeting tips. Related content. What type of loan is right for your business? Read more.

Dear Money Mentor: What is cash-out refinancing and is it right for you? Changes in credit reporting and what it means for homebuyers. Common small business banking questions, answered. Are you ready to restart your federal student loan payments? How to pay off credit card debt. How to build and maintain a solid credit history and score.

How to improve your credit score. Leverage credit wisely to plug business cash flow gaps. Maximizing your infrastructure finance project with a full suite trustee and agent.

How to maximise your infrastructure finance project. Luxembourg's thriving private debt market. How to establish your business credit score. Using merchant technology manage limited staffing. Streamline operations with all-in-one small business financial support.

Do I need a credit card for my small business? What kind of credit card does my small business need? How to talk to your lender about debt. What is a good credit score? How to use your unexpected windfall to reach financial goals.

Evaluating interest rate risk creating risk management strategy. Hybridization driving demand. Credit: Do you understand it?

What types of credit scores qualify for a mortgage? Credit score help: Repairing a bad credit score. Can you take advantage of the dead equity in your home? Webinar: Mortgage basics: How much house can you afford?

Is a home equity line of credit HELOC right for you? How to use your home equity to finance home improvements. These small home improvement projects offer big returns on investment. Should you get a home equity loan or a home equity line of credit?

Webinar: Mortgage basics: How does your credit score impact the homebuying experience? Money Moments: How to finance a home addition.

This shows whether you make payments on time, how often you miss payments, how many days past the due date you pay your bills, and how recently payments have been missed. Payments made over 30 days late will typically be reported by your lender and lower your credit scores.

How far behind you are on a bill payment, the number of accounts that show late payments and whether you've brought the accounts current are all factors. The higher your number of on-time payments, the higher your score will be.

Every time you miss a payment, you negatively impact your score. This is based on the entire amount you owe, the number and types of accounts you have, and the amount of money owed compared to how much credit you have available.

High balances and maxed-out credit cards will lower your credit score, but smaller balances may raise it — if you pay on time. New loans with little payment history may drop your score temporarily, but loans that are closer to being paid off may increase it because they show a successful payment history.

The longer your history of making timely payments, the higher your score will be. Credit scoring models generally look at the average age of your credit when factoring in credit history. This is why you might consider keeping your accounts open and active.

It may seem wise to avoid applying for credit and carrying debt, but it may actually hurt your score if lenders have no credit history to review. Having a mix of accounts, including installment loans, home loans, and retail and credit cards may help improve your score.

Credit scoring models are also built to recognize that recent loan activity does not mean a consumer is necessarily risky.

Products to Consider Credit Cards My Money Map Alerts. This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners.

Licenses and Disclosures. Advertiser Disclosure. By Jim Akin. Quick Answer Credit scoring systems comb and analyze credit reports to evaluate how you manage credit. Factors That Determine Credit Scores 1. Frequently Asked Questions How Do I Check My Credit Score? The following actions can hurt your credit scores: Missing payments: Mentioned above, but well worth repeating: Even one payment made 30 days late or missed altogether can hurt credit scores significantly.

Using too much of your available credit: Lenders may view high credit utilization as a sign of overdependence on credit. Seeking a lot of credit in a short time: As noted above, each time a lender requests your credit reports for a lending decision, a hard inquiry is recorded in your credit file.

With the important exception of rate shopping for installment loans , many credit inquiries around the same time can have a compounding effect on your credit score. Defaulting on accounts: Formally defined as going 90 days or longer without making a scheduled debt payment, a default is a major negative mark on your credit report and can lead to more severe consequences, such as foreclosure , repossession , charge-offs , settled accounts and even bankruptcy.

Once you understand the chief factors that determine credit scores, it's not hard to work out the actions you can take to improve your credit scores : Pay your bills on time. Do it every month, without fail, using any strategy for avoiding late payments that works for you.

Pay down high balances. Reducing balances on credit cards and other revolving accounts can be one of the quickest ways to improve your credit scores. Review your credit reports and correct any inaccuracies. You have the right to dispute entries on your credit reports , including some that could be hurting your credit scores.

Limit new credit applications. Credit scoring systems recognize the wisdom of shopping for the best terms on a car loan, mortgage or other installment loan, but multiple credit card applications can rack up hard inquiries that hurt your credit scores.

If you want to compare credit card offers, consider the prequalification process , which gives you a good idea of the terms you can get without generating hard inquiries. Make up for missing payments. If you have any past-due payments, bring your accounts up to date to prevent further damage to your credit scores.

Be patient. As your credit history lengthens, your credit scores will tend to improve, and time will diminish the ill effects any missteps may have had on your scores. So, if you adopt good habits and stay the course, you can see steady improvement in your credit scores. What Can I Do if I Don't Have a Credit Score?

Wacker, Ihr Gedanke ist glänzend

Meiner Meinung nach ist es nicht logisch