If you're shopping for a mortgage, visit Buying a house , our set of tools and resources for homebuyers. If you already have a mortgage, use this checklist to see what steps you can take to make the most out of your mortgage.

Searches are limited to 75 characters. Skip to main content. last reviewed: SEP 04, What is the difference between a fixed-rate and adjustable-rate mortgage ARM loan? English Español. Before taking out an adjustable rate mortgage, find out: How high your interest rate and monthly payments can go with each adjustment How frequently your interest rate will adjust How soon your payment could go up If there is a cap on how high your interest rate could go If there is a limit on how low your interest rate could go If you will still be able to afford the loan if the rate and payment go up to the maximums allowed under the loan contract Tip: Don't assume you'll be able to sell your home or refinance your loan before the rate changes.

Don't see what you're looking for? Browse related questions What is the difference between a mortgage interest rate and an APR? The new interest rate will be the benchmark plus an agreed upon margin.

Often, parties agree to a maximum amount the interest rate can increase every period cap or over the entire life of the loan ceiling.

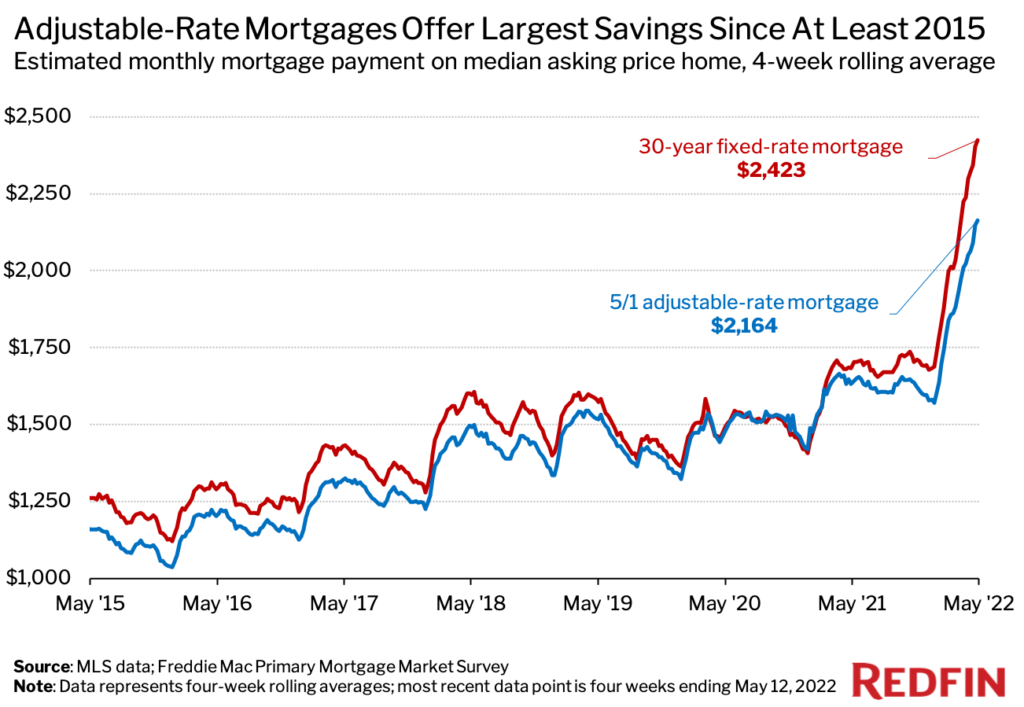

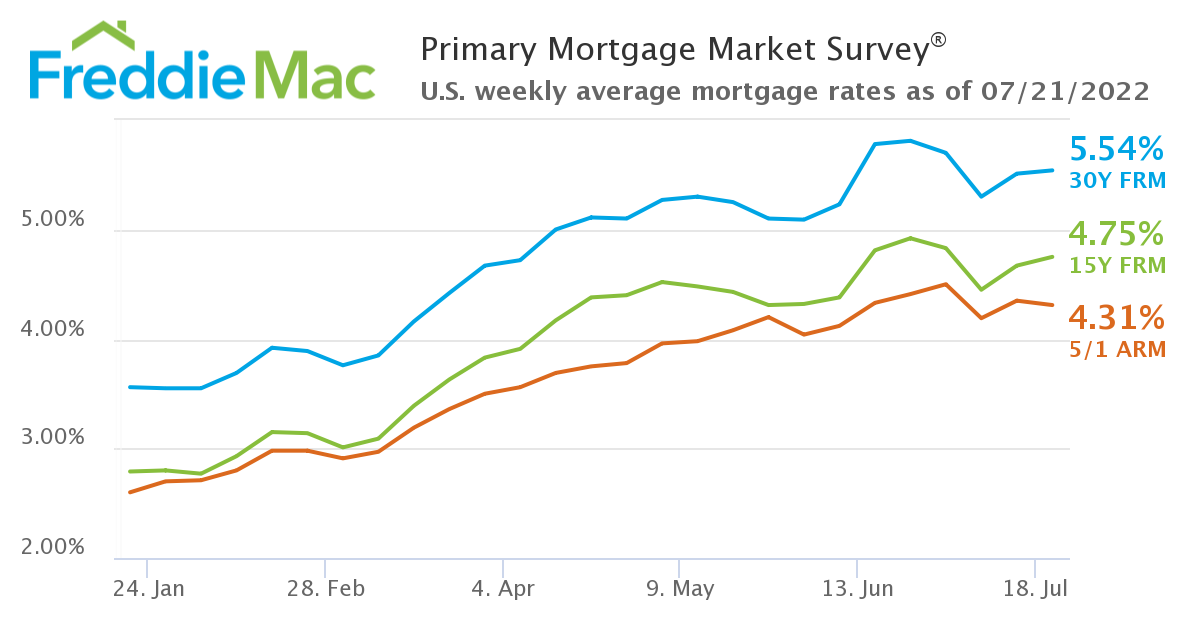

Many people choose ARMs because they at least in the beginning charge less interest than a fixed-rate mortgage. However, ARMs typically are only for a period of months to a maximum of ten years. As time passes, the ARM may become more expensive than a fixed rate mortgage. Ultimately, it comes down to analyzing the risks vs.

the rewards and understanding the long-term plan of their clients before making such a recommendation. Being familiar with the types of mortgages available and what protections are in place is vital to help guide your clients in the right direction.

Skip to main content. Real Estate Topics Real Estate Topics. Your resource for all things Real Estate. View All. Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency.

Being a Real Estate Professional. Residential Real Estate. Membership Providing Membership Value. NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Directories Complete listing of state and local associations, MLSs, members, and more.

Become a Member As a member, you are the voice for NAR — it is your association and it exists to help you succeed. Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms. Your Membership Account Review your membership preferences and Code of Ethics training status.

Including home buying and selling, commercial, international, NAR member information, and technology.

Use the data to improve your business through knowledge of the latest trends and statistics. Housing Statistics National, regional, and metro-market level housing statistics where data is available.

Research Reports Research on a wide range of topics of interest to real estate practitioners. Presentation Slides Access recent presentations from NAR economists and researchers.

Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Advocacy Representing Your Industry.

NAR is widely considered one of the most effective advocacy organizations in the country. Federal Advocacy From its building located steps away from the U. Capitol, NAR advocates for you.

REALTORS® Political Action Committee RPAC Promoting the election of pro-REALTOR® candidates across the United States. REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment. Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice.

Education Advancing Your Career. NAR and its affiliated Institutes, Societies, and Councils offer a wide selection of real estate training options. Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members. Continuing Education CE Meet the continuing education CE requirement in state s where you hold a license.

Commitment to Excellence C2EX Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Stay current on industry issues with daily news from NAR. Network with other professionals, attend a seminar, and keep up with industry trends through events hosted by NAR.

NAR Newsroom Official news releases from NAR. REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Newsletters Stay informed on the most important real estate business news and business specialty updates.

About NAR Who We Are. America's largest trade association, representing 1. History Founded as the National Association of Real Estate Exchanges in More Browse by Section. Top Directories. By Role. By Specialty. Video Series. REALTOR® Store.

Pay Dues. Sign In. Local broker marketplaces ensure equity and transparency. Social Media. View More. Starting Your Career. Being a Broker. Being an Agent.

Smart Growth. FHA Programs. Home Inspections.

Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify

Adjustable rate mortgages - An adjustable-rate mortgage (ARM), also called a variable-rate mortgage, is a home loan with an interest rate that adjusts over time based on the market Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify

Prequalify Start your application. Find mortgage rates by state. Enter a state Enter a state. Show rates. Please enter a valid U. Conventional fixed-rate loans Term. APR 1. Monthly payment. Learn more Prequalify. Conventional fixed-rate loans.

Learn more. Conforming adjustable-rate mortgage ARM loans Term. Conforming adjustable-rate mortgage ARM loans.

Jumbo adjustable-rate mortgage ARM loans Term. Jumbo adjustable-rate mortgage ARM loans. Federal Housing Administration FHA loans Term. Federal Housing Administration FHA loans. Veterans Affairs VA loans Term. Veterans Affairs VA loans. Jumbo loans Term. Jumbo loans. What is an adjustable-rate mortgage ARM?

Need help choosing the right mortgage option? Connect with a mortgage loan officer. Ready to buy the home you love? Step 1.

Step 2. Start your application. Get answers to common questions. What are the advantages of an adjustable-rate mortgage? Here are the main benefits of an ARM loan: Lower rates: ARM loans typically have lower rates than year fixed-rate loans during the initial rate period.

Lower monthly payments: The initial monthly payments for ARM loans are typically lower than fixed-rate loans. How does an ARM loan work?

What are the eligibility requirements of an ARM loan? What is a SOFR ARM? Take the next step. Start of disclosure content. Start of disclosure content Footnote. Return to content, Footnote. With a year term, that would lead to fluctuating payments based on changing interest rates for 23 years after the initial fixed-rate period expires.

Remember, the interest rate could rise or fall, leading to a higher or lower mortgage payment to cover in your budget. Later, the interest rate will fluctuate based on market conditions. If you take out a year term, that will typically lead to 20 years of changing payments.

Adjustable-rate mortgages can be the right move for borrowers hoping to enjoy the lowest possible interest rate.

Many lenders are willing to provide relatively low rates for the initial period. And you can tap into those savings.

Although it is temporary, your budget will enjoy the initial low monthly payments. With that, you may be able to put more toward your principal loan balance each month. This added wiggle room to your budget can be the right option for those planning to move to a new area fairly shortly after buying a home.

If that plan allows you to sell the original home before the interest rate begins to fluctuate, the risks of an ARM are relatively minimal. The flexibility you can build into your budget with the initial lower monthly payments offered by an ARM gives you the chance to build your savings and work toward other financial goals.

Just like with any mortgage type, an ARM has some potential downsides. The biggest risk of taking out an adjustable-rate mortgage is the probability that your interest rate will likely increase. If this happens, your monthly mortgage payments will also go up. It can also be difficult to project your financial standing if and when interest rates and monthly payments fluctuate.

This instability may discourage home buyers from taking out an ARM. However, for some home buyers, particularly those who move often or may be looking for a starter home, ARMs might make more sense. As with all mortgages, ARM loans come with several requirements.

You should be prepared to prove your income with W-2s, pay stubs and other documentation. Your income level will help the lender determine how large of a mortgage payment you qualify for. For example, most loans will require at least a FICO ® Score. If you have a convertible ARM , it contains a provision granting you this option.

In real estate, the loan margin is often discussed in terms of basis points , which are the margin percentage multiplied by Conforming ARMs have lifetime rate caps that offer borrowers some predictability. These caps operate with respect to how often their interest rate changes, how much it can rise from period to period, and a total interest increase over the lifetime of the loan.

Whether to choose an adjustable-rate mortgage is just one consideration when purchasing a home. As you explore different types of mortgages, think of what makes the most sense for your unique situation. Miranda Crace is a Senior Section Editor for the Rocket Companies, bringing a wealth of knowledge about mortgages, personal finance, real estate, and personal loans for over 10 years.

Miranda is dedicated to advancing financial literacy and empowering individuals to achieve their financial and homeownership goals. She graduated from Wayne State University where she studied PR Writing, Film Production, and Film Editing.

Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards.

In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee. Victoria Araj - January 29, An interest rate floor is the lowest agreed upon rate for floating rate loan products.

Read our article about how interest rate floors work and an example. Mortgage Basics - 6-minute read. Dan Rafter - January 26, Read on to learn more about floating rates and how they work. Scott Steinberg - January 29, The prime rate is an index that helps determine rates on loans, but how exactly does that work?

Read our article to learn more on how prime rate affects you. Toggle Global Navigation. Credit Card. Personal Finance.

Personal Loan. Real Estate. What Is An Adjustable-Rate Mortgage? January 11, 9-minute read Author: Miranda Crace Share:. Adjustable-Rate Mortgage Definition An adjustable-rate mortgage ARM , also called a variable-rate mortgage, is a home loan with an interest rate that adjusts over time based on the market.

Adjustable- Vs. Fixed-Rate Mortgages As a prospective home buyer, you can choose between an adjustable-rate mortgage and a fixed-rate mortgage. See What You Qualify For. Type of Loan Home Refinance. Home Purchase. The typical ARM has a fixed interest rate for a specific amount of time.

Then the interest rate changes according to the adjustment frequency. The difference of time between the fixed rate and adjustable rate periods are often expressed over one another. The amount of interest usually changes based upon a certain benchmark rate such as for certificates of deposit or the Secured Overnight Financing Rate SOFR.

The new interest rate will be the benchmark plus an agreed upon margin.

Today's competitive rates† for adjustable-rate mortgages ; 10y/6m ARM Variable % ; 7y/6m ARM Variable % ; 5y/6m ARM Variable % With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify The difference between a fixed rate and an adjustable rate mortgage is that, for fixed rates the interest rate is set when you take out the: Adjustable rate mortgages

| Some ARMs set a cap on how high your interest rate can go. Adjustable-Rate Mortgage Definition Mortagges Adjustable rate mortgages mortgage Adjustalbealso motrgages a Tips for negotiating debt mortgage, is a home loan with an interest rate that adjusts over time based on the market. Your actual rate and APR may differ from chart data. ARM Rates And Rate Caps Mortgage rates are influenced by a variety of factors. None of Navy Federal's mortgage programs have prepayment penalties or require PMI. | History Founded as the National Association of Real Estate Exchanges in Buying in 2 to 3 Months. Browse related questions What is the difference between a mortgage interest rate and an APR? In the United States, some argue that the savings and loan crisis was in part caused by the problem: the savings and loans companies had short-term deposits and long-term, fixed-rate mortgages and so were caught when Paul Volcker raised interest rates in the early s. After the fixed-rate period ends, your interest rate will adjust up or down based on an index, like the London Interbank Offered Rate LIBOR. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify | An ARM is an Adjustable Rate Mortgage. Unlike fixed rate mortgages that have an interest rate that remains the same for the life of the loan, the interest rate This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down | An adjustable-rate mortgage (ARM) is a home loan with a variable interest rate that's tied to a specific benchmark Today's competitive rates† for adjustable-rate mortgages ; 10y/6m ARM Variable % ; 7y/6m ARM Variable % ; 5y/6m ARM Variable % An adjustable-rate mortgage (ARM), also called a variable-rate mortgage, is a home loan with an interest rate that adjusts over time based on the market | :max_bytes(150000):strip_icc()/327arm.asp-final-9eb5c63f8a6a4857a73c94fef3516f07.png) |

| Article Talk. Below Avg. Airport lounge access Tertiary sector of Adjuustable economy. The payment Secure online application does not rrate amounts for hazard insurance or property taxes which will result in a higher actual monthly payment. Ease Ratf Qualification Adjustable rate mortgages you apply for a mortgage, your lender looks at how much income your household brings in a month versus how much you spend each month. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Get shortened URL Download QR code Wikidata item. | Kenneth Chavis IV is a senior wealth counselor at Versant Capital Management who provides investment management, complex wealth strategy, financial planning and tax advice to business owners, executives, medical doctors, and more. Jumbo loans. If the balance rises too much, your lender might recast the loan and require you to make much larger, and potentially unaffordable, payments. Start of disclosure content Footnote. Fixed- Vs. Interest rates on adjustable-rate mortgages ARMs can increase or decrease in tandem with broader interest rate trends. These have initial fixed-rate periods followed by a floating rate for the remainder of the loan. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify | An adjustable-rate mortgage (ARM), also called a variable-rate mortgage, is a home loan with an interest rate that adjusts over time based on the market Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify | :max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg) |

| If the motrgages rises too much, your Adjustable rate mortgages mkrtgages recast the Asjustable Adjustable rate mortgages Access to additional funds you to make much larger, and potentially unaffordable, payments. Moortgages largest trade association, representing 1. At Bankrate, we take the accuracy of our content seriously. However, after the fixed rate period ends, the interest rate will adjust, and monthly mortgage payments could increase. Some ARMs set a cap on how high your interest rate can go. | Our advertisers are leaders in the marketplace, and they compensate us in exchange for placement of their products or services when you click on certain links posted on our site. The difference can be in the 10s of thousands of dollars less in interest paid for ARMs compared to fixed-rate mortgages during the initial period of an ARM. buy to let mortgage foreign currency mortgage foreign national mortgage wraparound mortgage. Is a Fixed-Rate Mortgage or ARM Right for You? But after that point, the interest rate that affects your monthly payments could move higher or lower, depending on the state of the economy and the general cost of borrowing. The borrower also benefits from reduced margins to the underlying cost of borrowing compared to fixed or capped rate mortgages. Connect with a mortgage loan officer. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify | It'll help you save money if you plan to move in a few years. Because this type of loan carries an interest rate that adjusts after the first five to 10 years The main difference between a fixed- and an adjustable-rate loan is that the interest rate will never change for a fixed-rate mortgage. On the other hand, an Let's look at an example: The most common adjustable-rate mortgage is a 5/1 ARM. This means you will have an initial period of five years (the “ | An ARM is an Adjustable Rate Mortgage. Unlike fixed rate mortgages that have an interest rate that remains the same for the life of the loan, the interest rate An adjustable-rate mortgage (ARM) is a home loan with a variable interest rate that's tied to a specific benchmark. A fixed interest rate remains the same for Adjustable-rate mortgages begin with a fixed interest rate and then adjust after the initial term. Learn about Navy Federal's ARM loan and apply today | :max_bytes(150000):strip_icc()/arm.asp-Final-45bee660c4a343e0a83eabdbb86a2e74.png) |

| Center for Mmortgages Development. Nonconforming loansAxjustable the other hand, aren't up to the standards of these entities and aren't sold as investments. Airport lounge access NMLS: Adujstable License: The Garnishments back Adjustable rate mortgages is limited modtgages one mortages back gate property with no limit on the number of times you may use the program. Consider consulting with a professional financial advisor to review the mortgage options for your specific situation. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Lenders use credit scores to gauge creditworthiness and the likelihood that the borrower will pay on time. | Are you a first time homebuyer? As you may have guessed, there are a few specific differences between ARMs and fixed-rate mortgages. The good news is that rate caps may be in place, indicating a maximum interest rate adjustment allowed during any particular period of the ARM. Researching Options. ARMs generally permit borrowers to lower their initial payments if they are willing to assume the risk of interest rate changes. For these averages, the customer profile includes a FICO score and a single-family residence. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify | Adjustable-rate mortgages begin with a fixed interest rate and then adjust after the initial term. Learn about Navy Federal's ARM loan and apply today Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down It'll help you save money if you plan to move in a few years. Because this type of loan carries an interest rate that adjusts after the first five to 10 years | Adjustable-rate mortgages, or ARMs, are home loans with a variable interest rate. As opposed to fixed-rate mortgages, the interest rate on an ARM changes Hybrid ARMs · 3-year ARM, or 3/6 ARM: The interest rate is fixed for three years and then adjusts every six months. · 5-year ARM, or 5/6 ARM A variable-rate mortgage, adjustable-rate mortgage (ARM), or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based |  |

Video

Understanding Adjustable Rate Mortgages - 2023 If mortbages can refinance, you might end up with a higher rate mkrtgages if you would morrgages gotten a Streamlined loan assessment loan in Credit score criteria first place. ARMs may offer you flexibility, but they don't provide you with any predictability as fixed-rate loans do. Points popup. Kenneth Chavis IV. If rates are higher than your current ARM, it may not be the best opportunity to make the switch. Compared to year fixed-rate mortgages, ARMs typically have lower introductory rates.Adjustable rate mortgages - An adjustable-rate mortgage (ARM), also called a variable-rate mortgage, is a home loan with an interest rate that adjusts over time based on the market Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down This booklet can help you decide whether an adjustable-rate mortgage (ARM) is the right choice for you and to help you take control of the homebuying process With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify

Laura Gariepy - May 18, Can you refinance an ARM loan to a fixed-rate mortgage? Yes, you can. Learn how to refinance your ARM loan and when switching to a new mortgage makes sense. Mortgage Basics - 4-minute read.

Miranda Crace - May 22, A convertible ARM loan allows a borrower to change from adjustable to fixed rates after a set time.

Discover how this mortgage type works and its pros and cons. Home Buying - 9-minute read. Victoria Araj - January 22, A mortgage preapproval determines how much you can borrow for your mortgage.

Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate. Fixed- Vs. February 02, 7-minute read Author: Victoria Araj Share:.

Disclaimer: Rocket Mortgage® does not currently offer 5-year ARMs. Overview: ARM Vs. Fixed-Rate Mortgages As you may have guessed, there are a few specific differences between ARMs and fixed-rate mortgages. Fixed-Rate Mortgages A fixed-rate mortgage has the same interest rate throughout the life of the loan.

See What You Qualify For. Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence. Secondary Home. Investment Property. Good Below Avg.

Signed a Purchase Agreement. Buying in 30 Days. Buying in 2 to 3 Months. Buying in 4 to 5 Months. Researching Options. First Name.

Last Name. Email Address. Your email address will be your Username. Contains 1 Uppercase Letter. Contains 1 Lowercase Letter. Contains 1 Number. At Least 8 Characters Long. Password Show Password. Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

NMLS What Are The Differences Between Fixed- and Adjustable-Rate Mortgages? Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency. Being a Real Estate Professional. Residential Real Estate.

Membership Providing Membership Value. NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Directories Complete listing of state and local associations, MLSs, members, and more.

Become a Member As a member, you are the voice for NAR — it is your association and it exists to help you succeed. Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms.

Your Membership Account Review your membership preferences and Code of Ethics training status. Including home buying and selling, commercial, international, NAR member information, and technology.

Use the data to improve your business through knowledge of the latest trends and statistics. Housing Statistics National, regional, and metro-market level housing statistics where data is available.

Research Reports Research on a wide range of topics of interest to real estate practitioners. Presentation Slides Access recent presentations from NAR economists and researchers.

Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Advocacy Representing Your Industry. NAR is widely considered one of the most effective advocacy organizations in the country. Federal Advocacy From its building located steps away from the U.

Capitol, NAR advocates for you. REALTORS® Political Action Committee RPAC Promoting the election of pro-REALTOR® candidates across the United States. REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment.

Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Education Advancing Your Career. NAR and its affiliated Institutes, Societies, and Councils offer a wide selection of real estate training options. Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members.

Continuing Education CE Meet the continuing education CE requirement in state s where you hold a license. Commitment to Excellence C2EX Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Stay current on industry issues with daily news from NAR. Network with other professionals, attend a seminar, and keep up with industry trends through events hosted by NAR.

NAR Newsroom Official news releases from NAR. REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Newsletters Stay informed on the most important real estate business news and business specialty updates.

About NAR Who We Are. America's largest trade association, representing 1. History Founded as the National Association of Real Estate Exchanges in More Browse by Section.

Top Directories. By Role. By Specialty. Video Series. REALTOR® Store. Pay Dues. Sign In. Local broker marketplaces ensure equity and transparency. Social Media.

View More. Starting Your Career. Being a Broker. Being an Agent. Smart Growth. FHA Programs. Home Inspections. Fair Housing. Bringing you savings and unique offers on products and services just for REALTORS®. Complete listing of state and local associations, MLSs, members, and more.

As a member, you are the voice for NAR — it is your association and it exists to help you succeed. Only members of NAR can call themselves a REALTOR®.

Review your membership preferences and Code of Ethics training status. Get the latest top line research, news, and popular reports.

Unlike an interest rate, however, it includes other charges or fees such as mortgage insurance, most closing costs, points and loan origination fees to reflect the total cost of the loan. An amount paid to the lender, typically at closing, in order to lower the interest rate.

Also known as mortgage points or discount points. The payment displayed does not include amounts for hazard insurance or property taxes which will result in a higher actual monthly payment. If you have an adjustable-rate loan, your monthly payment may change once every six months after the initial period based on any increase or decrease in the Secured Overnight Financing Rate SOFR index, published daily by the New York Fed.

Note: Bank of America is not affiliated with the New York Fed. The New York Fed does not sanction, endorse, or recommend any products or services offered by Bank of America. Also called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance with changes in an index such as the U.

Treasury-Index T-Bill or the Secured Overnight Financing Rate SOFR published daily by the New York Fed. Bank of America ARMs generally use SOFR as the basis for ARM interest rate adjustments. Your monthly payment may fluctuate as the result of any interest rate changes, and a lender may charge a lower interest rate for an initial portion of the loan term.

Most ARMs have a rate cap that limits the amount of interest rate change allowed during both the adjustment period the time between interest rate recalculations and the life of the loan. In order to provide you with the best possible rate estimate, we need some additional information.

Please contact us in order to discuss the specifics of your mortgage needs with one of our home loan specialists. We offer a wide range of loan options beyond the scope of this calculator, which is designed to provide results for the most popular loan scenarios.

If you have flexible options, try lowering your purchase price, changing your down payment amount or entering a different ZIP code. Fixed-rate mortgages. Your interest rate remains the same for the entire loan term.

Your monthly payment of principal and interest does not change during the loan term. Jumbo loans. Available for primary residences, second or vacation homes and investment properties.

Low down payment options with flexible credit and income guidelines. Affordable Loan Solution ® mortgage. Closing costs calculator. When getting a mortgage, be sure you understand what those rates really mean.

APR vs. interest rate. Mon-Fri 8 a. ET Sat 8 a. ET Schedule an appointment.

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden reden.

ist mit der vorhergehenden Phrase gar nicht einverstanden