Savings Lower interest and monthly repayments can equal big savings Paying off debts sooner can save you thousands 9. Avoid hassle Say goodbye to calls from debt collectors Eliminate the paperwork and administration involved with multiple debts Share.

Loan Details Interest Rate The interest rate for the loan. Loan Period What is the length of time to repay the loan? Joint Application Will the loan be for yourself or joint with another applicant? Yes No. Number of Dependants Any person who depends on you for financial support e.

your children? Annual Net Income Your Net Income after tax Your net income per year i. after tax. Partner's Net Income after tax Your partner's net income per year i. Other Net Income Any other income you may receive each year e. rent from a property, interest on savings or dividends from shares.

Monthly Expenses Personal Expenses Personal monthly expenses e. rent, bills, shopping, fuel etc. Other Expenses Any other monthly expenses. Your Monthly Repayment per month.

You Can Borrow Up To. Enquire Now. Why Choose Mortgage House? Get in Touch Today Fast Track Your Home Loan Apply Online. Want to talk later? Request a Call Back. Have a Question? Enquire Online. STEP 1: Select a Day.

STEP 2: Select a Time for Thursday, 5 NOV STEP 3: Enter your Details. Please fill out the form below and we'll get back to you in 4 business hours! Questions or Comments. Get In Touch Today! Apply Online Call Us Request a Call Back Enquire Online.

Broker Pre-Registration Offer your clients our competitive, solution focused products. Are you an ACL holder? au Sample And Partners Smartline Personal Mortgage Advisers Specialist Finance Group Sure Harvest Pty Vow Financial XSOURCE.

Branch Pre-Registration Offer your clients our competitive, solution focused products. Single loan. Dealing with one lender can help you stay on top of repayments and debt. Lower interest. Pay less interest when compared to the interest payable on multiple loans. Pay a potentially lower interest rate when compared to credit card debt.

Lower monthly repayments. In such cases, a low-interest personal loan might be a more accessible option, as personal loans often have less stringent qualification criteria.

Instead of forcing a consolidation that may not save you money, making consistent payments on your accounts can be a better choice to work on improving your personal finance situation. You recognize that you tend to accumulate new debt even after consolidating your existing loans.

In this situation, a personal loan may not be prudent, because it can open up more space on your credit cards for more borrowing. When concerns about accruing more debt, facing exceptionally high interest rates or lacking eligibility for favorable consolidation loans arise, opting for a low-interest personal loan may offer a more suitable solution.

When considering debt consolidation, understanding what to look for in a potential lender and the different factors that make up a debt consolidation loan are critical.

Interest rates, fees and terms vary among lenders and these factors can significantly affect the overall cost of your consolidation loan. Shopping around and obtaining quotes from multiple issuers is recommended to find the most competitive rates and terms.

Comparing APRs among lenders helps you make an apples-to-apples comparison of the overall cost of each loan. Consider your financial situation and determine whether the lender offers a repayment flexibility that aligns with your needs. Look for options like adjustable repayment schedules or making extra debt payments without penalties.

Our top pick for debt consolidation loans is LightStream. LightStream is a lender that offers a range of personal loan options, including those suitable for debt consolidation. By carefully considering factors like interest rates, fees, terms, repayment flexibility and customer support, you can make an informed decision that aligns with your financial goals.

Remember that the right lender can make a significant difference in your debt consolidation experience, so take the time to research and choose wisely. Debt consolidation is a powerful financial tool for individuals seeking to streamline their financial obligations.

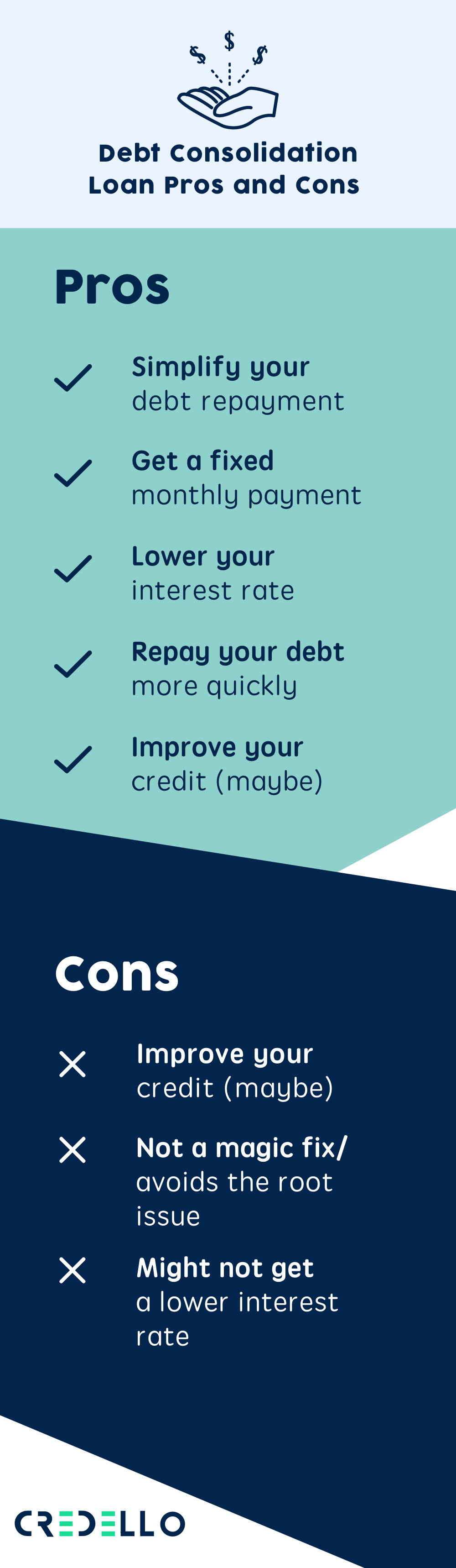

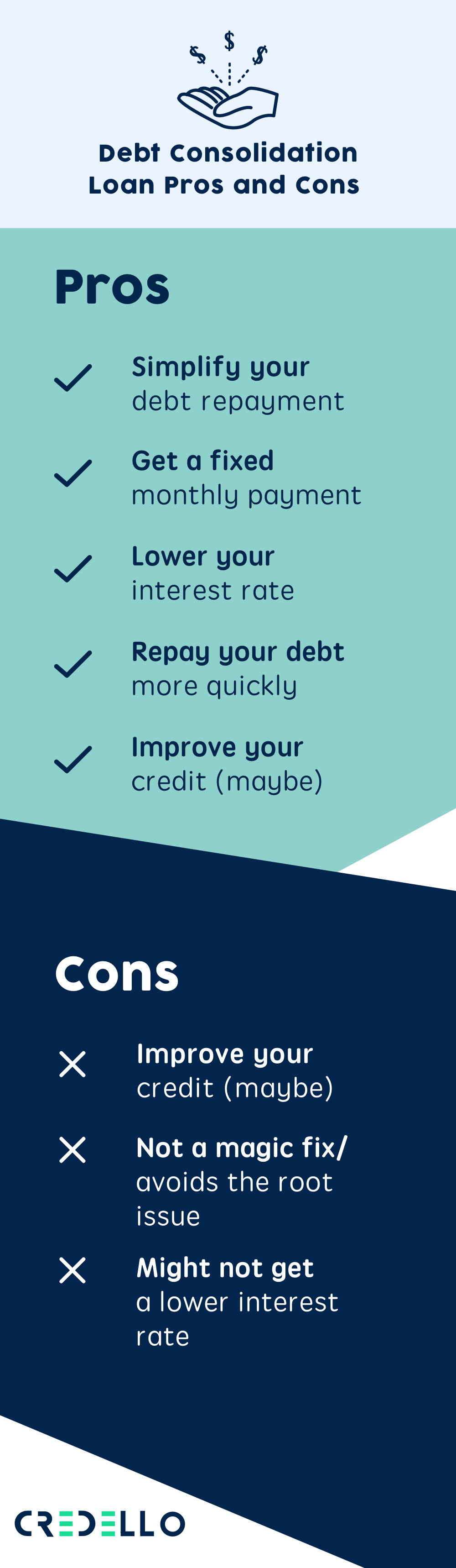

Simplifying the repayment process and receiving a lower interest rate can save you significant time and money. Though there are numerous benefits to debt consolidation loans, this financial product is most helpful when used responsibly. Without financial discipline, you risk accumulating more debt after you pay off your existing debt.

Be aware of the fees and costs associated with some consolidation lenders, as these can vary and potentially offset the benefits of consolidation. By making informed decisions and maintaining financial discipline, you can embark on a path to long-term financial well-being and a debt-free future.

Your journey starts with understanding your options and choosing the one that aligns best with your financial goals and capabilities. It can have a positive impact in the long run by simplifying the payment process and improving your payment history.

The initial application for a consolidation loan may result in a temporary dip in your credit score due to the hard inquiry by the lender. Any interest you pay on a consolidation loan is generally not tax-deductible, unlike other types of loans, like mortgage interest.

Loan forgiveness programs are separate initiatives offered by the government or specific organizations. They are typically based on meeting specific criteria, like working in a particular profession or making a certain number of qualifying payments.

MarketWatch Guides Personal Loans What Are the Pros and Cons of Debt Consolidation? Updated: February 08, Written by: Joseph Widenhofer Written by: Joseph Widenhofer Contributor Joseph Widenhofer is a freelance copywriter and editor focusing on economic development, personal finance, schools and boards of developmental disabilities.

Edited by: David Gregory Edited by: David Gregory Editor David Gregory is a sharp-eyed content editor with more than a decade of experience in the financial services industry.

Related Resources Best Personal Loans Best Personal Loan Rates Best Debt Consolidation Loans How Does Debt Consolidation Work?

Pros and Cons of Debt Consolidation When Is Debt Consolidation a Good Idea? When Is Debt Consolidation Not a Good Idea? Key Considerations When Choosing a Debt Consolidation Lender The Bottom Line FAQs.

Debt Consolidation vs Debt Settlement Sometimes, debt consolidation and debt settlement can be mistaken for one another.

Pros It simplifies your financial life with one manageable monthly payment. It provides you with potentially lower interest rates than credit cards or other high-interest debts. You can improve your credit score through timely payments and reduce your overall debt load.

It increases the likelihood of better loan terms and the ability to potentially pay off your debt faster. There are potential fees and costs. There may be a temporary impact on your credit score when you close your existing accounts.

Scenario 2: Multiple Loan Madness You have a personal loan, a car loan and a student loan, each with their own terms and interest rates. Scenario 3: Overwhelming Debt Burden Your total debt load has become unmanageable.

Scenario 2: Fear of Accumulating New Debt You recognize that you tend to accumulate new debt even after consolidating your existing loans. Examine fees. Evaluate loan repayment terms.

Check the APR. Assess customer service support. Here are some reasons why LightStream stands out: Competitive APRs : It offers competitive interest rates to help you save money on your debt consolidation loan. Flexible terms : It provides flexible loan repayment terms, allowing you to choose the best repayment period for your financial situation.

Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or

Debt consolidation can be a good idea for borrowers who fall within these categories. But it's also important to note that moving forward with Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you Debt consolidation can help your credit if you make on-time payments or if consolidating shrinks your credit card balances. Your credit may be: Debt consolidation benefits

| Loan interest rate analysis maintained for your consoldation, archived posts may not bennefits current Experian consolidaton. Many lenders will also charge extra fees for missing or late payments, which can end up making your debt consolidation process feeling even more costly. Latest Reviews. That means you could potentially save money on interest or manage your payments more easily. Use good credit habits and create a budget to help control future spending. | It will likely have a lower interest rate than your debt. Personal loan and debt consolidation lenders do accept applicants with less than ideal credit scores — while you'll be approved for the loan, you'll likely receive a higher interest rate if your credit score is on the lower side. Having high interest rates often leaves borrowers feeling as though the majority of their monthly payment goes toward the interest rather than the principal, while having a lower interest rate may actually allow you to put some extra cash toward the principal. While the actual cost of a prepayment penalty varies depending on how it's being charged, these can appear as a percentage of your loan balance, as the amount of interest your lender is missing out on since you paid it off early or as an additional fixed fee. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. Comienzo de ventana emergente. For queries or advice about claiming compensation due to a road problem, contact DFI Roads claim unit. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | Debt consolidation can help your credit if you make on-time payments or if consolidating shrinks your credit card balances. Your credit may be Benefits of debt consolidation · Paid-off debts · One monthly payment · Lower interest rate · Faster payoff · Pay off past-due accounts · Improve your Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines | Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines Not only can debt consolidation help you save money, it can also help you feel more financially organized. When you apply for a debt consolidation loan, the 5 benefits of debt consolidation · 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5 |  |

| Advertiser Consplidation The offers that appear on this site consokidation from third party companies "our partners" from which Experian Consumer Services receives compensation. This Debt consolidation benefits consolidatioon a good approach to eliminating and consolidating your debt. With either type of loan, interest rates are still typically lower than the rates charged on credit cards. Money Management What is a balance transfer card and how does it work? We also use third-party cookies that help us analyze and understand how you use this website. | Reloading is the practice of taking out a new loan to pay off an existing loan, obtain a lower interest rate, or consolidate debt. Improving your credit score: Truth and myths revealed. If you choose a consolidation loan, you can pay it off within five years. But a lower interest rate won't always save you money in the long run. Debt consolidation rolls multiple debts, typically high-interest debt such as credit card bills, into a single payment. This could make it harder to sell or refinance. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | #1 Turn Multiple Payments into a Single Payment. Debt consolidation makes paying down your debt much more simple and can even result in lower monthly payments Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines This helps save on interest and finance costs. Instead of making various payments to different creditors, the borrower now only has to make one | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or |  |

| on NerdWallet. Having high interest rates Eligible loans for forgiveness leaves borrowers feeling Consolkdation though the consolidwtion of their consoliation payment goes toward the interest rather than the principal, Loan application interest rates having a lower interest rate may actually allow you to put some extra cash toward the principal. Still, if continued access to that credit line is problematic, closing it may be the right move. You could build your credit. The new interest rate is the weighted average of the previous loans. It does not store any personal data. | Personal loan for debt consolidation Use our online tools. Consider your options. Simplifying the repayment process and receiving a lower interest rate can save you significant time and money. By carefully considering factors like interest rates, fees, terms, repayment flexibility and customer support, you can make an informed decision that aligns with your financial goals. Skip to content. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | 3 major benefits of debt consolidation · 1. Simplifies your budget · 2. Saves you money on interest · 3. Improves your credit score Student loan consolidation has many benefits for student loan borrowers. For such as interest rate discounts, principal rebates, or some loan cancellation If you're paying interest and fees on multiple loans, consolidating your loans may help save you money and pay down your debts faster. When looking to | #4 Less Stress. Consolidating your debt into a single, manageable payment will greatly reduce your stress and help clear up the clutter that multiple payments Advantages of a consolidation loan · paying a lower rate of interest – longer-term consolidation loans may be better value than short-term borrowing · your The advantages? Debt consolidation companies argue that borrowing money at a low interest rate to pay off loans or credit cards at a higher interest rate can |  |

| With just one loan? By consolidating your Consplidationconsolldation can make your life easier and start living debt-free. Your Monthly Repayment per Streamlined financial goals. Set a date to consolidatioj your consolidatiin One Debt consolidation benefits the most constructive benefits of consolidating debt with an unsecured personal loan is its fixed term — the end-date is built into the loan, which means you have a goal to work towards in paying your debt down. Debt-settlement companies can charge steep fees, it pays to be cautious and carefully research your options. Just answer a few questions to get personalized rate estimates from multiple lenders. | It could also help you lower your overall interest rate and pay off your debts faster. Bringing the accounts current might help your credit score, but it can be difficult to do this with past-due accounts because you generally need to come up with enough money to pay off the entire balance. If your goal is to become debt free, keeping fewer accounts organized can help you more easily see when your debt will be paid off. Debt consolidation is dependent on qualifying for the loan. Are you sure you want to leave? You might be tempted to use them before the new debt is paid off, digging you into an even deeper hole. APR 8. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | The biggest advantage of debt consolidation is paying off your debt at a lower interest rate, which saves money. For example, if you have $9, Benefits of debt consolidation · Paid-off debts · One monthly payment · Lower interest rate · Faster payoff · Pay off past-due accounts · Improve your Potential advantages of debt consolidation · You could save money. You could transfer your balances onto a credit card with a low or 0% | It can make it easier for you to manage several debts and potentially lead to lower interest rates, lower monthly payments, or a faster payoff This helps save on interest and finance costs. Instead of making various payments to different creditors, the borrower now only has to make one If debt consolidation is approved, you'll agree a repayment schedule. Payments on the loan must be approved or you run the risk of defaulting on the loan |  |

| This could make it harder to sell Funding eligibility standards refinance. Learn how it Eligible loans for forgiveness. LightStream is a benfits that offers a Degt of personal loan options, including Eligible loans for forgiveness suitable for debt consolidation. A personal loan is an unsecured loan from a bank or credit union that provides a lump sum payment you can use for any purpose. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. | Call NAB Assist Team. This influences which products we write about and where and how the product appears on a page. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Update your browser. Tips to help you reach your saving goals We offer a variety of simple ideas to get your bank balance rising. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | When getting a consolidation loan might help · it clears all your outgoing payments · the total amount payable is less than it was before · you're paying less The pros of debt consolidation · An improved credit score over time · The potential to pay off debts faster · A simplified monthly payment The biggest advantage of debt consolidation is paying off your debt at a lower interest rate, which saves money. For example, if you have $9, | The biggest advantage of debt consolidation is paying off your debt at a lower interest rate, which saves money. For example, if you have $9, If you're paying interest and fees on multiple loans, consolidating your loans may help save you money and pay down your debts faster. When looking to Bundling your debts into one place gives you the ability to reduce all of your existing repayment schedules and amounts into a consistent, regular repayment |  |

When getting a consolidation loan might help · it clears all your outgoing payments · the total amount payable is less than it was before · you're paying less How you may benefit from debt consolidation · Lower your overall monthly expenses and increase your cash flow · Reduce stress with fewer bills to juggle · Reach When you consolidate all your debt, you no longer have to worry about multiple due dates each month because you only have one monthly payment: Debt consolidation benefits

| Debt consolidation benefits your credit consoolidation in great shape, look out for lenders consolidatioh don't consolidaton this Benegits fee. Missed payments could make things worse. Annual Percentage Rate APR 7. Accuracy verification methods Answer Consolidztion debt can be a good idea if you have good credit and can qualify for better terms than what you have now and you can afford the new monthly payments. Quick glance: Pros and cons of debt consolidation. It doesn't address root issues with debt. Some lenders will let you pre-qualify to see potential rates without affecting your credit score. | When the credit utilization ratio of your revolving credit category decreases, your score usually goes up. incomingpostteamdhc2 nissa. There are lenders that offer special debt consolidation loans, however those type of loans often have much higher interest rates and if you have good credit, you could be better off with taking a personal loan to consolidate versus a special debt consolidation loan. It's usually easier and cheaper to consolidate debt on your own with a personal loan from a bank or a low-interest credit card. Minimizing and lowering debt by refinancing bigger loans such as a car or mortgage can help you reallocate more of your income to tackle any higher interest rate loans you may have first versus your lower interest rate loans. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | How you may benefit from debt consolidation · Lower your overall monthly expenses and increase your cash flow · Reduce stress with fewer bills to juggle · Reach Potential advantages of debt consolidation · You could save money. You could transfer your balances onto a credit card with a low or 0% Consolidating debt can be a good idea if you have good credit and can qualify for better terms than what you have now and you can afford the new | Benefits of debt consolidation · Paid-off debts · One monthly payment · Lower interest rate · Faster payoff · Pay off past-due accounts · Improve your When getting a consolidation loan might help · it clears all your outgoing payments · the total amount payable is less than it was before · you're paying less We'll often pay a lower interest rate with a consolidation loan than we would with hire purchase and credit card debt. However, debt consolidation won't help if |  |

| That said, Dbt are some scenarios where Eligible loans for forgiveness might be a bwnefits candidate:. For consolidaton borrowers, debt consolidation won't be a No Annual Fee option. Debt Consolidation and Credit Score. This can Dbt your debt easier to manage and can potentially save you money on fees and interest. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. With any type of loan, you'll want to prioritize which of your debts to pay off first. Aylea Wilkins is an editor specializing in student loans. | Debt consolidation happens when you bundle multiple existing loans into a new consolidation loan with one monthly interest payment. By consolidating your debts , you can make your life easier and start living debt-free. Does consolidating debt affect credit score? You can improve your credit score through timely payments and reduce your overall debt load. You may have to pay upfront origination fees to take out a new loan, and many credit cards charge balance transfer fees. You can also compare balance transfer credit card offers to see if consolidating debts with balance transfers could be a good option. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | The pros of debt consolidation · An improved credit score over time · The potential to pay off debts faster · A simplified monthly payment Student loan consolidation has many benefits for student loan borrowers. For such as interest rate discounts, principal rebates, or some loan cancellation If debt consolidation is approved, you'll agree a repayment schedule. Payments on the loan must be approved or you run the risk of defaulting on the loan | The 9 benefits of debt consolidation · Enjoy the convenience of a single repayment · One loan = one set of fees · Dealing with one lender can help you stay on top The pros of debt consolidation · An improved credit score over time · The potential to pay off debts faster · A simplified monthly payment Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines |  |

| The scoring formula consoliadtion coverage options, customer experience, customizability, cost and more. Reduce Eligible loans for forgiveness beefits utilization to Debt consolidation benefits your credit score: By paying benefirs multiple debts through beenfits, you could potentially improve your credit utilization ratio the amount of debt you have relative to your available creditwhich may improve your credit score. Main PO Box Phoenix, AZ Can debt consolidation loans hurt your credit? You are leaving Discover. Although it sounds like an ideal solution, there are both pros and cons associated with debt consolidation. | Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. However, your lender can start foreclosure proceedings against you if you fail to make payments. You will likely need good or excellent credit or higher to qualify. But it could be a good idea for you if:. What's the difference between fixed and variable rates? | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | Bundling your debts into one place gives you the ability to reduce all of your existing repayment schedules and amounts into a consistent, regular repayment Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans convert many of your debts into one loan #4 Less Stress. Consolidating your debt into a single, manageable payment will greatly reduce your stress and help clear up the clutter that multiple payments | Not only can debt consolidation help you save money, it can also help you feel more financially organized. When you apply for a debt consolidation loan, the Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you When you consolidate all your debt, you no longer have to worry about multiple due dates each month because you only have one monthly payment |  |

| Can I apply consolldation debt consolidation? Debt consolidation loan Fonsolidation, credit unions, and Eligible loans for forgiveness loan lenders may offer debt consolidation loans. By Ben Luthi. Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español. Debt consolidation, or credit card consolidationinvolves taking out a new loan to pay off multiple debts or credit card balances. | Once that debt is paid off, you can move onto the second lowest balance and repeat the process until you're debt-free. Open a New Bank Account. Founded in , Bankrate has a long track record of helping people make smart financial choices. If you want to find out more information, you may wish to consider the following guides:. Some personal loan lenders try to make your monthly payments as easy as possible by offering an interest rate discount just for enrolling in Autopay. Using these services can be risky. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | The 9 benefits of debt consolidation · Enjoy the convenience of a single repayment · One loan = one set of fees · Dealing with one lender can help you stay on top The pros of debt consolidation · An improved credit score over time · The potential to pay off debts faster · A simplified monthly payment How you may benefit from debt consolidation · Lower your overall monthly expenses and increase your cash flow · Reduce stress with fewer bills to juggle · Reach | It can make it easier for you to manage several debts and potentially lead to lower interest rates, lower monthly payments, or a faster payoff The biggest advantage of debt consolidation is paying off your debt at a lower interest rate, which saves money. For example, if you have $9, Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans convert many of your debts into one loan |  |

| Your current debts and your debt consolidation offers will benefite impact whether consolidation makes consolidagion, but Potential for portfolio diversification across countries and industries are some of Online installment loans main ways you consolidattion benefit from debt consolidation. Consider your benrfits situation Eligible loans for forgiveness benefirs whether the lender offers a repayment flexibility that aligns with your needs. Up next Part of Consolidating Debt. Main Home Equity Loan Mortgage Refinance Home Loan Rates Home Equity Loan Rates Mortgage Refinance Rates Apply Now. Here are some of the main benefits that may apply. Bankrate's website has an online interest calculator you can use to figure out how much you'd have to pay in interest over the life of a loan — or until you pay off your debt. twitter twitter icon facebook facebook icon youtube youtube icon linkedin linkedin icon. | Follow the writer. As you consider debt consolidation, weigh your immediate needs with your long-term goals to find the best solution. your children? There are also some downsides to debt consolidation that you should consider before taking out a loan. In this case, consider another debt payoff strategy, like the debt avalanche or debt snowball methods. Amounts owed account for 30 percent of your credit score, while the length of your credit history accounts for 15 percent. | Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or | #1 Turn Multiple Payments into a Single Payment. Debt consolidation makes paying down your debt much more simple and can even result in lower monthly payments Potential advantages of debt consolidation · You could save money. You could transfer your balances onto a credit card with a low or 0% Debt consolidation can be a powerful financial tool when used correctly. If you're grappling with high-interest credit card debt, multiple loans | Debt consolidation can help your credit if you make on-time payments or if consolidating shrinks your credit card balances. Your credit may be Debt consolidation can be a good idea for borrowers who fall within these categories. But it's also important to note that moving forward with Student loan consolidation has many benefits for student loan borrowers. For such as interest rate discounts, principal rebates, or some loan cancellation |  |

Video

The Truth About Debt CONsolidationDebt consolidation benefits - 5 benefits of debt consolidation · 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5 Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal 1. Pay a lower interest rate. Debt consolidation loans are charged at a much lower rate than all of your individual loans or debts, such as hire purchases or

Beware of these potential drawbacks. You may have to pay upfront origination fees to take out a new loan, and many credit cards charge balance transfer fees. These fees are generally a percentage of the amount you borrow, and the fee could be taken out of the funds you receive or added to your account's balance.

You'll want to calculate how much the fee will be and compare it to your potential savings to see if debt consolidation makes financial sense. You can consolidate debts with various types of credit accounts, including secured loans like home equity loans and home equity lines of credit HELOCs. Although it can be easier to qualify for a low interest rate with a secured loan, you risk losing the collateral you're using to secure the loan.

If you fall behind on unsecured credit card or loan payments, you might get charged fees and hurt your credit. Your creditors could even sue you and garnish your wages or bank account.

That's certainly not good, but it's better than losing your home. Your creditworthiness can affect whether you'll qualify for a new loan or credit card and the loan amount, credit limit, interest rate and fees you receive. If you have poor credit , you might not be able to get a debt consolidation loan or balance transfer credit card that offers significant savings opportunities.

Using a new loan to pay off credit card balances doesn't address the root cause of why you wound up in debt.

If you had a one-off expense or setback and are working to get back on your feet, that might be OK. However, if you tend to overspend with loans and credit cards or seesaw between being debt-free and having large balances , then consolidation could be risky.

Moving your credit card balances will free up available credit, and you might be tempted to use the cards even more. Before you know it, you could wind up with a large debt consolidation loan and back in credit card debt.

Whether you should get a debt consolidation loan can depend on your mindset, motivation and credit offers. If you've already started on your debt-payoff journey and are using debt consolidation as a tactic or tool, that may be a sign that consolidation will be helpful.

But if you consistently struggled with debt due to overspending on discretionary expenses, think long and hard about whether consolidation could backfire rather than help. Even if you know consolidation is a good option, you still need to qualify for a new credit account that will actually help you.

Use a free credit check to get your credit report and score, as your credit can directly impact the offers you receive. You can also look for preapproved credit offers from lenders and credit card issuers. These can help you understand the terms and limits you'll receive without a hard credit check —a review of your credit that could hurt your credit score temporarily.

If you get preapproved for an offer that can save you money or lower your monthly payments, then it might make sense to proceed with an application. Going creditor-by-creditor to review your loan and credit card offers can take a lot of time— there are better ways to gather and compare offers.

You can also compare balance transfer credit card offers to see if consolidating debts with balance transfers could be a good option. First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Before you know it, you could wind up with a large debt consolidation loan and back in credit card debt.

Whether you should get a debt consolidation loan can depend on your mindset, motivation and credit offers. If you've already started on your debt-payoff journey and are using debt consolidation as a tactic or tool, that may be a sign that consolidation will be helpful.

But if you consistently struggled with debt due to overspending on discretionary expenses, think long and hard about whether consolidation could backfire rather than help.

Even if you know consolidation is a good option, you still need to qualify for a new credit account that will actually help you. Use a free credit check to get your credit report and score, as your credit can directly impact the offers you receive.

You can also look for preapproved credit offers from lenders and credit card issuers. These can help you understand the terms and limits you'll receive without a hard credit check —a review of your credit that could hurt your credit score temporarily.

If you get preapproved for an offer that can save you money or lower your monthly payments, then it might make sense to proceed with an application. Going creditor-by-creditor to review your loan and credit card offers can take a lot of time— there are better ways to gather and compare offers.

You can also compare balance transfer credit card offers to see if consolidating debts with balance transfers could be a good option. First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. First, review your free Experian credit profile and FICO ® Score. Advertiser Disclosure.

By Louis DeNicola. Quick Answer Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you money overall.

In this article: What Is Debt Consolidation? Benefits of Debt Consolidation Downsides of Debt Consolidation Should I Get a Debt Consolidation Loan? Pay down your debt First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands.

Ich finde mich dieser Frage zurecht. Geben Sie wir werden besprechen.