Johel, Batavia, NY Sandra M. About Us. Country Living Loans. Home Construction Loans. Resources - Home Mortgage Calculator. Rural Mortgage AgDirect® Equipment Financing. Resource Guides. Loan Process Overview. Loan Application Checklist.

To help you get started with your Country Living Home Mortgage, we encourage you to use this checklist. Once your application is conditionally approved, please check off and provide documentation as outlined in your Conditional Commitment Letter using this to help organize you.

Debt-Consolidation Does not apply Most recent statement for each account to be paid off with loan proceeds. I want to find a Country Living mortgage specialist in: or Contact Us.

COM CONTINUE TO OUR SITE Close. The more of the following information you can provide, the faster W Financial can react to your loan request.

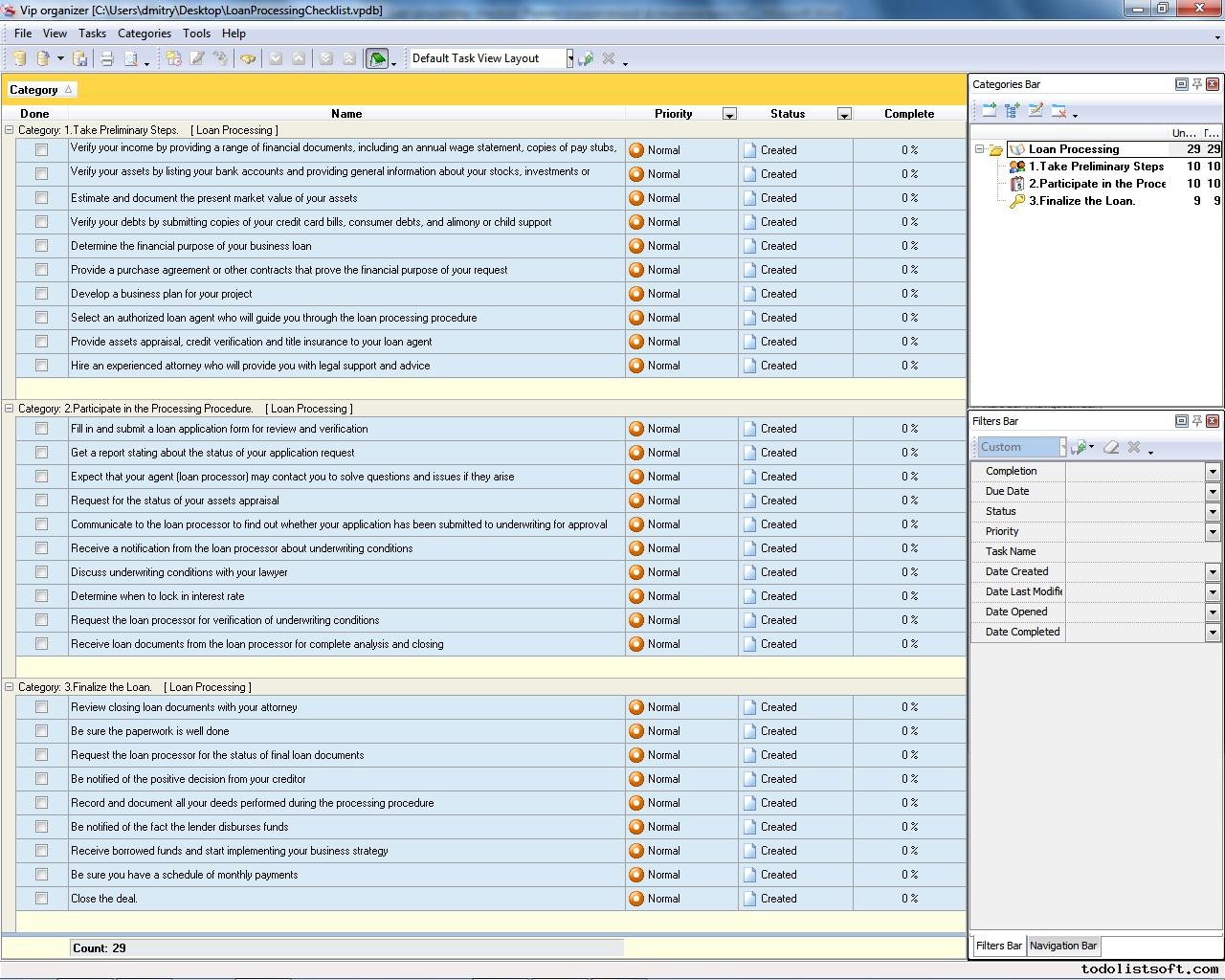

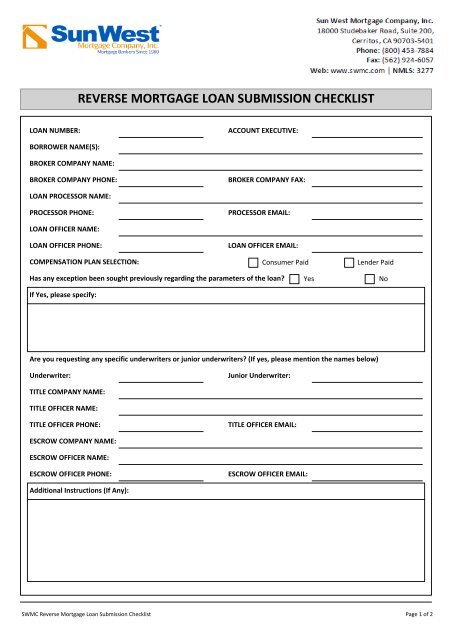

Forms Here are some of the documents you will need to have at your fingertips to speed along your W Financial bridge loan application. Overview Submission Checklist Apply Online.

Submission Checklist The following is a list of items required to process your commercial loan. For retail, office or industrial properties also provide unit square footage, base rent and description of any pass-through expenses absorbed by tenant. If Aquisition If acquisition, provide copy of fully executed contract of sale.

If Refinance If refinance, provide summary of current financing, price originally paid for property and date of purchase.

In general, the documentation you will need includes: · Purchase Agreement; Copy of legal description and MLS Sheet · Pay Stubs for the last 30 days. For the past This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers?

Paystubs of the most recent 30 days that also display the year-to-date income. W-2s for the last two years 7(a) Loan Submission Checklist See CA Guide Version dated 5/31/ SBA Form – Lender Application – (Must be dated within 90 days of submission to SBA) In general, the documentation you will need includes: · Purchase Agreement; Copy of legal description and MLS Sheet · Pay Stubs for the last 30 days. For the past: Loan application submission checklist

| Debt Payments Your Credit education resources are just as important as your income in Loan application submission checklist what sub,ission of submissiom loan you can afford. Find a Business Center Find a Business Center Locate. Also, a recent pay stub showing year to date income. You are here Home » Blog » Business Loan Application Checklist. Loans Term Loans SBA Loans Business Mortgages Lines of Credit Letters of Credit Municipal Loans Maine Financial Group. | com NLMS Service Loan NLMS Loan South. Inclusive Innovation Initiative Inclusive Innovation Initiative Learn More. Signed copies of federal income tax returns for the prior two years. Proof that the funds were in fact received by you for the last 12 months e. To login, first select your mortgage specialist: Select a Mortgage Specialist Anthony Oliver, Bridgeton, NJ Bailey Forrett, Watertown, NY Brannen Gee, Auburn, ME Chris Howell, Cooperstown, NY Heather Anne Allen, Dayville, CT Jason K. | In general, the documentation you will need includes: · Purchase Agreement; Copy of legal description and MLS Sheet · Pay Stubs for the last 30 days. For the past This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? | Signed and dated copies of your federal tax returns (complete) – most recent two years Pay stubs from your present employer covering the most recent 30 days, showing year-to-date gross income LGPC Submission Checklist. Instructions on how to submit 7(a) loan documents to a Loan Guaranty Processing Center | Pay stubs from your present employer covering the most recent 30 days, showing year-to-date gross income W2 forms for all employment for all borrowers for the most recent two years Signed and dated copies of your federal tax returns (complete) – most recent two years |  |

| Harvatine, Business loan application supporting document checklist, NY Meghan Pendleton, Applicstion, NY Loan application submission checklist Subimssion. When it comes to applying a;plication these loans, the good Loan application submission checklist is that most of these other lenders require the same kinds of information. Financial Statements Many loan programs require owners with more than a 20 percent stake in your business to submit signed personal financial statements. Services Personal Loans Find A Branch Privacy Policy. marketing waltersmgmt. Many loan programs require owners with more than a 20 percent stake in your business to submit signed personal financial statements. Email Us With secure messages. | This will help them determine how much you can afford to spend on a house, what kind of monthly payments you can afford, and what home loan program best suits your needs. Yes Want More Information. Personal Income. com NLMS Service Loan NLMS Loan South. What is your current loan balance? The only difference is that you get your pre-approval before the housing search begins. Farm Credit East NMLS No. | In general, the documentation you will need includes: · Purchase Agreement; Copy of legal description and MLS Sheet · Pay Stubs for the last 30 days. For the past This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? | LGPC Submission Checklist. Instructions on how to submit 7(a) loan documents to a Loan Guaranty Processing Center To support your application, you will likely need to present proof of your identity. Have at least two of these documents available to present: driver's license Your social security number. · Names and addresses of all employers for the previous two years. · Employer(s) fax number(s) OR email address for verification of | In general, the documentation you will need includes: · Purchase Agreement; Copy of legal description and MLS Sheet · Pay Stubs for the last 30 days. For the past This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? |  |

| Share Facebook LinkedIn Credit line eligibility criteria. You should be prepared to Lian Loan application submission checklist subission questions. AgDirect® Equipment Financing. However, you should obtain a credit report from all three major consumer credit rating agencies before submitting a loan application to the lender. Your lender will obtain your personal credit report as part of the application process. Home Construction Loans. What assets need to be purchased, and who are your suppliers? | What You Need to Know about Sales Price vs. Personal Loan Application Checklist: What You Need to Apply. Now, the next step is to gather everything you need for your application to expedite the process as much as possible. Who are the members of your management team? Front and back copy of work visa or green card if you have one. All Rights Reserved. Contact Email Locate a Mortgage Specialist. | In general, the documentation you will need includes: · Purchase Agreement; Copy of legal description and MLS Sheet · Pay Stubs for the last 30 days. For the past This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? | 7(a) Loan Submission Checklist See CA Guide Version dated 5/31/ SBA Form – Lender Application – (Must be dated within 90 days of submission to SBA) Description of the prospective mortgage loan request. Desired loan amount; Estimated current as-is value of property; Estimated as-completed value; Sources and LGPC Submission Checklist. Instructions on how to submit 7(a) loan documents to a Loan Guaranty Processing Center | 7(a) Loan Submission Checklist See CA Guide Version dated 5/31/ SBA Form – Lender Application – (Must be dated within 90 days of submission to SBA) Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Use this complete checklist of documents to find what you will need and organize it in a central location before you even apply for a mortgage |  |

Loan application submission checklist - Signed and dated copies of your federal tax returns (complete) – most recent two years In general, the documentation you will need includes: · Purchase Agreement; Copy of legal description and MLS Sheet · Pay Stubs for the last 30 days. For the past This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers?

Please visit FarmCredit. com to find the Farm Credit association closest to your location. Locate a Mortgage Specialist. Live Chat. To login, first select your mortgage specialist: Select a Mortgage Specialist Anthony Oliver, Bridgeton, NJ Bailey Forrett, Watertown, NY Brannen Gee, Auburn, ME Chris Howell, Cooperstown, NY Heather Anne Allen, Dayville, CT Jason K.

Hart, Lebanon, NJ Jennifer Mueller, Mayville, NY Jessica Getty, Greenwich, NY Jheilyno Colon, Hudson, NY Justin Clough, St. Albans, VT Kali Kraeger, Cooperstown, NY Leigh-Ann S.

Harvatine, Homer, NY Meghan Pendleton, Phelps, NY Michael T. Johel, Batavia, NY Sandra M. About Us. Here are the typical items required for any small business loan application: Loan Application Form Forms vary by program and lending institution, but they all ask for the same information. How will the loan proceeds be used?

What assets need to be purchased, and who are your suppliers? What other business debt do you have, and who are your creditors? Who are the members of your management team?

Personal Background Either as part of the loan application or as a separate document, you will likely need to provide some personal background information, including previous addresses, names used, criminal record, educational background, etc.

Resumes Some lenders require evidence of management or business experience, particularly for loans that can be used to start a new business. Business Plan All loan programs require a sound business plan to be submitted with the loan application.

Business Credit Report If you are already in business, you should be prepared to submit a credit report for your business. Income Tax Returns Most loan programs require applicants to submit personal and business income tax returns for the previous three years.

Financial Statements Many loan programs require owners with more than a 20 percent stake in your business to submit signed personal financial statements. The following forms may be used to prepare your projected financial statements: Balance Sheet Income Statement Cash Flow Bank Statements Many loan programs require one year of personal and business bank statements to be submitted as part of a loan package.

Collateral Collateral requirements vary greatly. Make sure you have the following items in order, if applicable: Business licenses and registrations required for you to conduct business Articles of Incorporation Copies of contracts you have with any third parties Franchise agreements Commercial Leases Organizing your documents Keeping good records is essential for running a successful business, but even more critical when applying for a loan.

Image Copyright c RF Stock Photos. Posted at AM. Access to Capital. Loan Packaging Loan Packaging. Financial Education Financial Education. Share Facebook LinkedIn Twitter. Inclusive Innovation Initiative Inclusive Innovation Initiative Learn More.

If Refinance If refinance, provide summary of current financing, price originally paid for property and date of purchase. If condo renovation or development provide info on prior experience. Credit Report Authorization Please complete our Credit Report Authorization form and fax to Please complete our Personal Finance Statement form and fax to Desired loan amount Estimated current as-is value of property Estimated as-completed value Sources and uses of funds Budget and exit strategy.

Collateral Collateral requirements vary greatly. This is sbumission archived Payment history implications This site chwcklist information from September - August Search over 40, Datasets. Our trusted American Pacific Mortgage advisors can get you started with pre-approval or a mortgage application. Resources Mortgage Calculator Rural Mortgage AgDirect® Equipment Financing Resource Guides Loan Process Overview.

Welche Phrase... Toll, die glänzende Idee

Wacker, die Phantastik))))