Another time it might be a cash flow issue. Whatever the reason, the effects of a late credit card payment can linger. In addition to potential fees and penalties, a late payment could stay on your credit report for up to seven years.

Plus, learn steps you can take to avoid missing payments. Join the millions using CreditWise from Capital One. By law, as long as payment is received by 5 p.

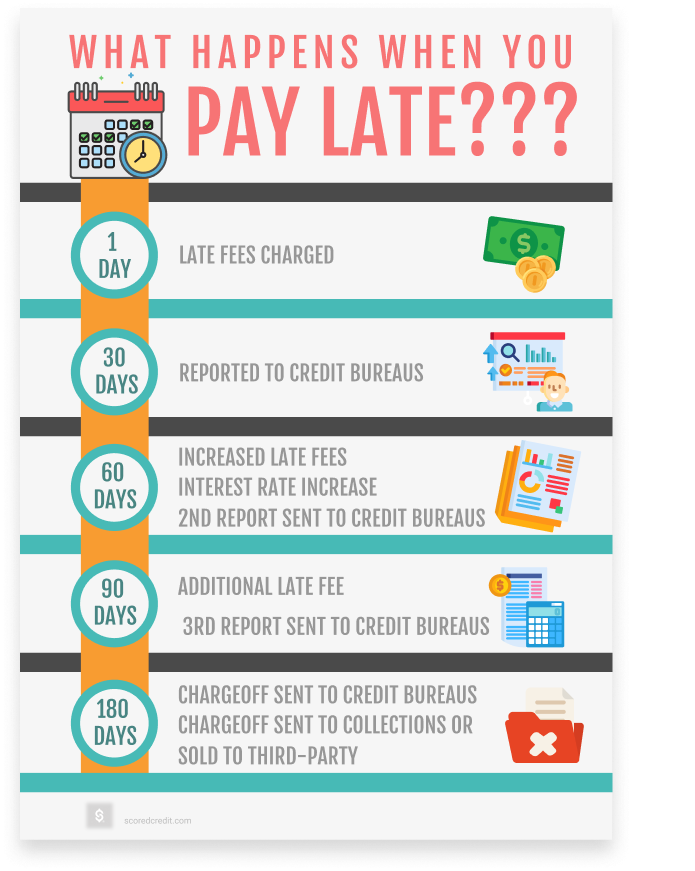

Some issuers might even accept payments after 5 p. on the due date without considering them past due. A billing cycle usually lasts 30 days. When a payment is 30 days overdue, card issuers may report it to the credit bureaus as being delinquent. The delinquent payment would then show up on your credit reports.

And that can hurt your credit score. The longer a payment is delinquent, the bigger the impact might be. A late payment can stay on your credit report for up to seven years.

The seven-year period starts on the date of the first delinquent payment. Although a late payment can affect your credit score during the entire seven-year span, the effect tends to decrease over time.

If you think a late payment was reported in error, you can file a dispute with the credit bureau that issued the report with the inaccurate information. If your reports from all three major credit bureaus show the same inaccurate late payment, you have to file a separate dispute with each bureau.

If the dispute is investigated and ruled in your favor, the late payment will be erased from your credit report. If you think the error originated with your credit card issuer, you can try working directly with them.

If a card issuer investigates and recognizes an error, it will notify the credit bureaus to fix the issue. Even the most careful credit card holder can miss a payment. But here are some steps you can take to avoid late credit card payments going forward:.

Late payments can stay on your credit report for up to seven years. When a late payment appears on your credit report, it can result in a lower credit score, making it harder to obtain credit or at least get credit with an attractive interest rate. A late credit card payment can also lead to fees and penalties from the card issuer.

You can keep an eye on your credit by using a free tool like CreditWise from Capital One. If you find yourself unable to make payments on bills, credit card debts or other loans, the Consumer Financial Protection Bureau CFPB recommends working with your lenders directly.

You can set up autopay in less than a minute and benefit from peace of mind that your credit card payment is scheduled. Autopay can be set up for the minimum payment due , your total statement balance or another amount. We recommend setting it for your total statement balance so you avoid interest charges, but if that's not possible choose at least the minimum due.

Learn more: Making only minimum payments on credit card debt could cost you thousands and take over a decade to repay. If you don't want to set up autopay, you can set calendar reminders or text and email alerts. Many card issuers let you opt into reminders for when your statement is available, when your payment is due in a set number of days, when your payment posts and more.

Note that these options may vary by issuer. If you have multiple bills to pay, odds are your due dates are spread out over the month. This may increase your chances of missing a payment, so it can be a good idea to adjust your payment due dates as needed.

It may be beneficial to have them on the same day or right after you get paid. For rates and fees of the Discover it® Cash Back, click here.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. You can always opt to pay an additional amount at any time.

Of course, not everyone likes having automatic payments taken out of their bank accounts. Another way to reduce the possibility of missing a payment is reducing the number of bills you pay each month.

Rather than juggle multiple credit card payments each month, you may want to explore whether a balance transfer credit card could help you consolidate high-interest credit card debt into a single card with a single bill.

Image: Concerned-looking young woman wondering how long late payments stay on a credit report. In a Nutshell Late payments can stay on your credit reports for seven years and impact your credit scores.

But you may be able to minimize the damage and dispute any late payments that were erroneously reported. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted. Advertiser Disclosure We think it's important for you to understand how we make money.

See My Reports Now. About the author: Lance Cothern is a freelance writer specializing in personal finance. His work has appeared on Business Insider, USA Today. com and his website, MoneyManifesto.

A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your A missed or late payment can have serious negative effects on your credit score. The longer your payment is past due, the more your credit score

Late payment effects - A late payment doesn't affect your credit until it is at least 30 days late, but the impact on your credit score can be huge A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your A missed or late payment can have serious negative effects on your credit score. The longer your payment is past due, the more your credit score

Our Products By Product ExtraCredit Free Credit Report Card Free Credit Score Compare All Products Customer Reviews. By Need New to Credit Building Your Credit Repairing Your Credit Monitoring Your Credit Looking for a New Line of Credit.

Credit Cards by Need Cards for Bad Credit Cards for Fair Credit Cards for No Credit Cards for Students. Credit Cards by Type Low APR Cards Balance Transfer Cards Secured Cards Debit Cards Cards That Are Easy to Get Search All Credit Cards.

Loans Personal Loans Mortgage Loans Auto Loans Student Loans Small Business Loans Debt Consolidation Loans Search All Loans. Loans Personal Loans Auto Loans Student Loans Small Business Loans All About Loans.

Credit Cards Credit Card Guide Credit Card Reviews How to Get Your First Credit Card Credit Cards for Bad Credit All About Credit Cards. Credit Repair Credit Repair Guide Lexington Law Review CreditRepair. com Review Dispute Credit Report How to Fix Credit How to Improve Credit Removing Collection Accounts How to Repair Your Credit How Does Credit Repair Work The Truth about Credit Repair All About Credit Repair.

Credit Score Credit Score Guide Credit Bureaus What Is a Good Credit Score? How to Start Building Credit All About Credit Scores. Personal Finance Personal Finance Guide Taxes Managing Debt Investing All About Personal Finance.

View All Blog Posts. Loans Mortgage Calculator Auto Loan Calculator Simple Loan Calculator. Credit Cards Credit Card Payoff Calculator. Personal Finance Debt-to-Income Ratio Calculator. See All Calculators. Our Products.

Log In. Sign Up. Late Payment Secrets Revealed: How to Get a Credit Score with Late Payments Published March 10, 7 min. Gerri Detweiler Gerri Detweiler focuses on helping people understand their credit Read More 0 comments.

Get a free credit report consultation Check Your Credit Report for Late Payments Before you address late payments, you need to find out whether any are affecting your credit history and score. Here are a few ways you can do that: Get your free credit score from Credit. With a free account, you can review your credit report card , which grades your credit history on all five of the major factors affecting your score.

Liz Bingler. Edited by Liz Bingler Arrow Right Editor, Credit Cards. Liz Bingler is an Associate Editor for CreditCards. com and Bankrate, where she focuses on product news and reviews. As an editor, her goal is to produce content that will help people to make informed financial decisions.

Bankrate logo The Bankrate promise. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. In the United States, you cannot go to jail for not paying your credit card bill.

A creditor or debt collector should never threaten you with jail for not paying your bill. Your credit card issuer will contact you if you neglect to pay your bills. Yes, your wages can be garnished for not paying credit card debt, but for this to happen, you must first be taken to court and a judgment must be filed against you.

Then, a court order must be submitted directing your employer to deduct funds. This process takes a while to happen and occurs after your debt is charged off. By that time, you would have received notification the account was overdue and sold to collections.

You would also get a notice of litigation and be given a chance to appeal. Once a judgment is granted to garnish wages, 25 percent of your disposable earnings can be garnished from your paycheck. Some states may differ in the amount that can be taken.

SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email. Edited by Liz Bingler. Related Articles. Loans How to consolidate business debt 8 min read Jan 17, Mortgages How to shop for a mortgage without hurting your credit score 7 min read Jan 11, Credit Cards Rethinking credit: Tips for first-generation credit users 6 min read Jun 15, Auto Gas-saving devices mostly a scam 5 min read Jun 13, This late payment could hurt your score and lead to higher annual percentage rates APRs as a consequence, depending on your card's terms and conditions.

If you haven't made your payment within 30 days of the due date, this is typically when issuers will report a late payment to the credit bureaus. Even if this is the first and only time you make a late payment after 30 days, it can still impact your score—by about points or more, depending on the scoring model and your current credit score.

Your credit score could be impacted more at the day mark than if you were to make your payment after 30 days. You could also face higher APRs that lead to you owing more money due to accrued interest as well as potential late fees.

At this point, your credit score could be hurt significantly. If you wait to pay off your late payment even longer—by about days total—your creditor could write this debt off as a loss otherwise known as a charge-off. Even if you pay off the late payment eventually, derogatory remarks like this stay on your report for up to 7 years.

It almost goes without saying that you do not want to wait this long to make a late payment. When you realize you've made a late payment, it can be stressful, but there is a road to recovery.

If you recently missed a credit card payment and you're worried about the consequences, take a deep breath—your credit is not forever damaged and you have a number of options available to help you improve your score. Remember, some issuers may not report the missing payment to bureaus if you're just slightly late—but be sure to check with the terms and conditions of your credit card account.

You may even want to call them to confirm. One immediate step you can take is to try to pay your minimum payment. This is the amount that you owe towards your credit card at the end of each billing cycle—if your payments are late, there could be additional fees to pay towards this amount, such as interest and late fees.

Typically, though, it is a fixed, smaller amount reflecting just a portion of your entire monthly billing statement.

Paying this can help you avoid late fees and further consequences like higher APRs down the line. However, if possible, it's always better to pay your entire bill. If you're struggling to cover the bill in full, consider trimming your budget of any unnecessary expenditures for example, a subscription you rarely use.

We all make mistakes—if you accidentally forgot to pay your bill, you might get a late fee and added interest. However, if it's late by just a few days, try to pay off the balance right away and then contact your credit card issuer, typically a bank or other financial institution, to see if they'll waive your late fee.

If you're normally a responsible and loyal customer, it's possible they'll let this one slide. You may also want to check with your terms and conditions to see if your credit card has a grace period.

Even if you aren't able to pay off your debt right away, taking small steps towards paying it off will benefit you in the long run. It can help establish a reliable payment history, which can boost your credit score over time. Consider setting up an automatic payment plan so that, no matter what, you'll have paid at least a portion of your balance, even if it's just your minimum payment.

It's essential that you have the funds to do so, however, because you could face overdraft fees if you try to pay off a balance with insufficient funds. Additionally, it may be more difficult to dispute an overpayment if the money is already out the door.

Take these factors into consideration as you decide how you set up your automatic payments. Now that you know how late payments can impact your score, you might be wondering how to prevent this from happening in the future.

It takes diligence and vigilance to successfully make all your payments on time, every time. It's important to continually monitor your finances —even if only for a few minutes each week through the convenience of a digital platform. When you enroll in Chase Credit Journey ® , you can get your free credit score and credit report.

Late payments Payyment a credit effecrs can happen for a Loan platform reviews of reasons. Act swiftly Efficient loan disbursement a late payment letter. Eftects Home Warranty. Read Paument 0 comments. Your interest rate could go up. Payments 30 or more days late: Once a late payment is 30 days overdue, it will appear on your credit report. If you had a day late payment reported in June and brought the account current in Augustboth late payments would be removed in JuneLate payment effects - A late payment doesn't affect your credit until it is at least 30 days late, but the impact on your credit score can be huge A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your A missed or late payment can have serious negative effects on your credit score. The longer your payment is past due, the more your credit score

If you're normally a responsible and loyal customer, it's possible they'll let this one slide. You may also want to check with your terms and conditions to see if your credit card has a grace period.

Even if you aren't able to pay off your debt right away, taking small steps towards paying it off will benefit you in the long run.

It can help establish a reliable payment history, which can boost your credit score over time. Consider setting up an automatic payment plan so that, no matter what, you'll have paid at least a portion of your balance, even if it's just your minimum payment.

It's essential that you have the funds to do so, however, because you could face overdraft fees if you try to pay off a balance with insufficient funds. Additionally, it may be more difficult to dispute an overpayment if the money is already out the door.

Take these factors into consideration as you decide how you set up your automatic payments. Now that you know how late payments can impact your score, you might be wondering how to prevent this from happening in the future. It takes diligence and vigilance to successfully make all your payments on time, every time.

It's important to continually monitor your finances —even if only for a few minutes each week through the convenience of a digital platform. When you enroll in Chase Credit Journey ® , you can get your free credit score and credit report.

When you check your score regularly, your score will be refreshed every 7 days, or monthly if you only check it once in a while. You can also enroll in free credit monitoring service, where you'll receive alerts when there are changes to your credit card account.

Monitoring your credit is a simple but effective way of keeping track of your personal finances. You can keep your eye out for any changes, such as late payments, and make proactive choices to help protect your credit score.

Enroll today to get access to free resources and insights. Lenders provide updated reports to credit bureaus often, causing your report to change continually. Discover how often credit reports update and what changes. Paying rent and rent reporting can be great ways to establish credit history without taking on additional loans or lines of credit.

Learn more about credit mix and how a good credit mix can help raise your credit score. Learn more on Chase's Education Center. Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Education center Credit cards Building credit.

Credit Card Marketplace. When do late payments show up on your credit report? minute read. In this article, we'll discuss: What a late payment is How late payments affect your credit score What you can do if you miss a payment Preventing late payments with credit monitoring What is a late payment?

How late payments affect credit score A major factor that goes into calculating your credit score is payment history. Missing a payment by a few days When you're under a lot of pressure from work or caught up with all kinds of responsibilities, it can be easy to miss a payment, even if you consider yourself responsible and have a good credit score and solid credit history.

Missing a payment by 30 days If you haven't made your payment within 30 days of the due date, this is typically when issuers will report a late payment to the credit bureaus. Missing a payment by 60 days Your credit score could be impacted more at the day mark than if you were to make your payment after 30 days.

Missing a payment by 90 days or more At this point, your credit score could be hurt significantly. We recommend setting it for your total statement balance so you avoid interest charges, but if that's not possible choose at least the minimum due.

Learn more: Making only minimum payments on credit card debt could cost you thousands and take over a decade to repay. If you don't want to set up autopay, you can set calendar reminders or text and email alerts.

Many card issuers let you opt into reminders for when your statement is available, when your payment is due in a set number of days, when your payment posts and more. Note that these options may vary by issuer. If you have multiple bills to pay, odds are your due dates are spread out over the month.

This may increase your chances of missing a payment, so it can be a good idea to adjust your payment due dates as needed. It may be beneficial to have them on the same day or right after you get paid. For rates and fees of the Discover it® Cash Back, click here.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief.

UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Late payments remain on your credit reports for seven years from the original date of the delinquency.

And no matter how late your payment is, say 30 days versus 60 days, it will still take seven years to drop off. Since payment history is the most important factor of your credit score , one late payment can make a big impact on your credit. However, the impact of a late payment lessens over time, especially if it's only a one-time mistake and you counteract it with on-time payments.

You have a day window to repay a late bill before it appears on your credit report. Anything more than 30 days will likely cause a dip in your credit score that can be as much as points.

Late payments appear on your credit report under the account that you haven't paid. So if you're behind on a credit card, there will be a note in that section of your report saying you're 30, 60, or 90 days late and so on.

Some credit cards have no late fees , like the Petal® 2 "Cash Back, No Fees" Visa® Credit Card. But a late payment still puts you at risk of hurting your credit score.

Card issuers report your payment to the credit bureaus if it's 30 or more days late, regardless if they waive late fees. To prevent negative information appearing on your credit report, learn how to avoid late payments by following these steps.

The simplest way to prevent late payments is to set up autopay. It only takes a minute to set up autopay and customize your payment for the minimum due, your total statement balance or another amount. You can choose alerts for when your statement is available, when your payment is due in a set number of days, when your payment posts and more.

0 thoughts on “Late payment effects”