Fees The companies worth doing business with will be open about the monetization model they use. Be it a part of the interest rate that they keep to themselves, a flat application fee, or an origination fee. Find out beforehand if the conditions suit you.

Not to mention, the exact decisioning process your file will go through and the way the company will control you.

Our end-to-end platform is highly configurable at every stage of the peer-to-peer lending process, with a highly customizable modular architecture, customizable reporting, and hundreds of API integrations with leading third-party tools.

Thank you! Get in touch with any questions at [email protected]. AI-POWERED PEER-TO-PEER LENDING SOFTWARE. Book an intro call. All interaction between the borrower, the lending platform, and the investor are realized in intuitive, ready-to-use interfaces. Put borrower evaluation, scoring, decisioning, and fraud prevention on complete autopilot.

Cover all of credit from loan application processing and origination to servicing, collection and reporting. Intelligent reporting software and a custom dashboard allows lenders to generate complex custom reports on the fly. Collect only the data you need with highly customizable application forms and document management.

Fully automated debt collection enabled by advanced technology and a host of powerful third-party integrations. Automatically send your users notifications about upcoming, due-date and past-date installments.

Full peer-to-peer lending lifecycle automation. Minimize peer-to-peer risks and operational costs. Peer-to-peer loan management - simplified. Intuitive borrower, investor, and staff workspaces.

The company partners with businesses to offer the option in-store, online and through mobile devices. Additionally, businesses receive an account manager, employee training on the system and marketing signage.

After being approved for financing, consumers can choose the length of the payment plan and track the plan through the app. Sunbit can be found in dentist offices, car dealerships and more.

Avant uses fintech to simplify the loan application process. By providing some background information, selecting a loan option debt consolidation, home improvement, emergencies, etc.

Avant also offers a credit card to help users access lines of credit for smaller purchases or larger payments for a new car or home repair. Prosper connects people looking to borrow money with individuals and institutions looking to invest in consumer credit. Borrowers fill out a short survey that includes indicating preferred loan amount and how it will be used.

The Prosper platform will then recommend loans that best fit the prospective borrower's needs. LoanStreet aims to make it easier for financial institutions — including credit unions, banks, lenders and loan investors — to manage their loan portfolios. Its platform is designed to streamline processes and provide reporting and analytics tools that lead to actionable insights.

Fundbox uses big data analytics to help businesses quickly access loans and lines of credit. Point introduces new and existing homebuyers to an alternative home financing method through a shared equity process.

There are no monthly payments with Point and owners can use their extra cash flow to make important fixes or simply make payments on their property.

Biz2Credit provides small businesses with equitable loans that help them acquire the funds needed to push their business forward. Blend is a platform designed to help lenders speed up and simplify the application approval process for loans and mortgages.

The platform is capable of reducing processing times through omnichannel customer engagement tools, automated risk management features and artificial intelligence for thorough application analysis and prediction. Blend has been used globally by banks and customers that include Wells Fargo, U.

Bank, Assurance Financial and Affinity Federal Credit Union. Businesses use Summer to help employees stay on track with paying off student loan debt. The company also offers its Credit Builder product that helps users apply for a loan and support them in setting aside money for monthly payments to improve their credit history.

Further Reading Fintech Banking: 16 Fintech Banks and Neobanks to Know. The company says it has worked with more than 1. The platform has been used by more than 2 million users who were able to compare personalized rates based on their credit history.

LendingTree helps borrowers compare rates for personal loans, student loans, mortgages and business loans. Better provides access to the tools people need to become homeowners while helping them avoid the unnecessary fees that can put a damper on the process.

Through the platform, people continue to contribute to their k or ESPP plans and Lendtable reimburses these contributions twice a month.

Once contributions stop, 20 percent of the profits and the cash advancement total are paid back to Lendtable. Numerated partners with banks and credit unions to simplify how businesses purchase financial products.

The SaaS loan origination system doubles to create overall digital convenience and streamline originations from the product to close. Reach Financial helps customers pay off debts by offering customizable loan options through its digital platform.

In addition, paused payments and free monthly credit score reports ensure customers remain on track to pay off their debts. To sign up with Reach Financial, customers answer a couple of quick questions about their loans and go on to set their own terms.

Tala is using big data in its fintech to financially serve traditionally under-banked areas of the world. By finding personalized loans using alternative methods, Tala has assisted millions of consumers in building credit. Affirm offers installment loans to consumers at the point of sale.

Affirm has partnered with hundreds of retailers to offer payment plans that help customers plan out their spending over time. The Affirm installment loan platform has been used by global companies like Expedia, Wayfair and Peloton to give customers more financial flexibility.

Kiavi provides flexible, short-term bridge loans for real estate investors who are looking to buy and rehab investment properties. For personal loans, the company says the online application takes minutes and approvals often happen within 24 hours.

LendingClub can deposit money into a bank account for those who are approved or pay creditors directly. Neat Loans is a fintech company focused on simplifying the mortgage process and giving borrowers greater transparency.

The company says clients can close on a home within two weeks of initiating the process by filling out a minute application — three times faster than going through a traditional lender. Open Lending operates in both big data and high finance to provide risk modeling and decision making software to automotive lenders.

PeerIQ , a Cross River Company, is a data and analytics firm using big data to analyze and manage risk in the peer-to-peer lending sector. Zest applies artificial intelligence to lending. The Zest Model Management System is meant to make approvals faster and more efficient, giving lenders a clearer picture of which borrowers are creditworthy.

The company said its product has led clients to see a 20 to 30 percent increase in approvals alongside improved risk assessment. These fintech lending companies are innovating the way individuals and businesses borrow and repay the money they need.

Written by Sam Daley. Sam Daley Product Manager at Built In. Image: Shutterstock. Rose Velazquez. UPDATED BY Rose Velazquez Dec 12, What Is Fintech Lending?

Leader Bank View Profile. We are hiring. They're Hiring View 5 Jobs Leader Bank is Hiring View 5 Jobs. January View Profile. They're Hiring View 10 Jobs January is Hiring View 10 Jobs. Valon View Profile. They're Hiring View 13 Jobs Valon is Hiring View 13 Jobs.

Coviance View Profile. They're Hiring View 0 Jobs Coviance is Hiring View 0 Jobs. Supernova Technology View Profile. They're Hiring View 5 Jobs Supernova Technology is Hiring View 5 Jobs. Wisetack View Profile.

They're Hiring View 2 Jobs Wisetack is Hiring View 2 Jobs. Stride Funding View Profile. Lenders catering to diverse financial needs. For unique credit situation and loan needs. Popular lender pick. See my rates. on NerdWallet's secure website.

View details. Flexible payments. Top 3 most visited 🏆. on Upstart's website. Fast funding. NerdWallet rating. APR 6. credit score APR 9. Get rate. credit score None. What are peer-to-peer loans? How does peer-to-peer lending work?

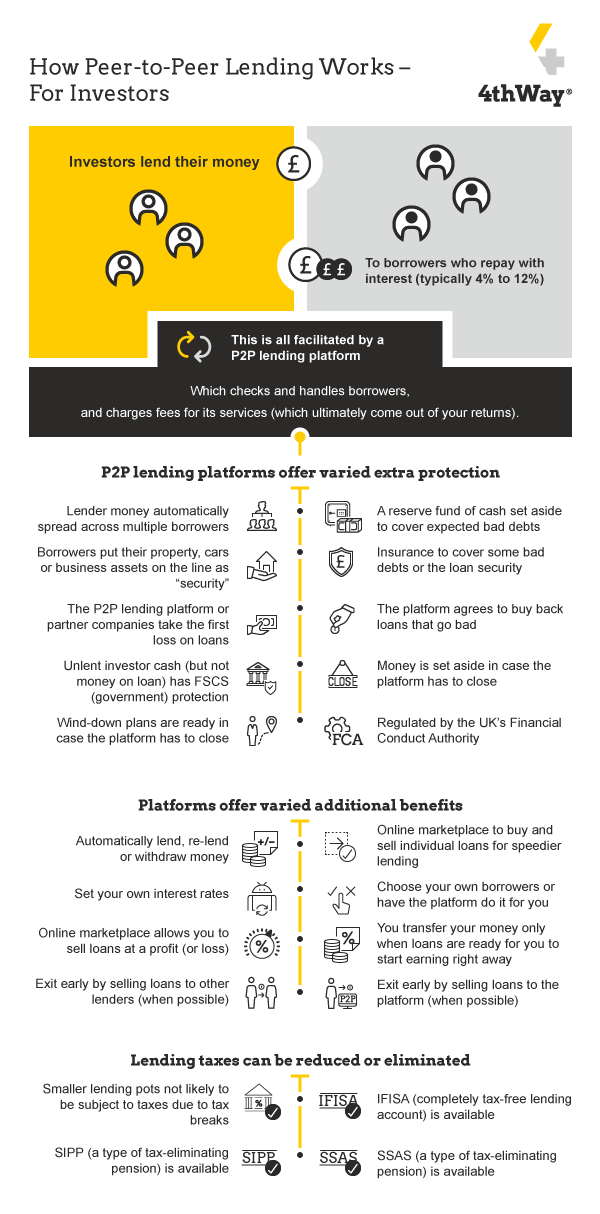

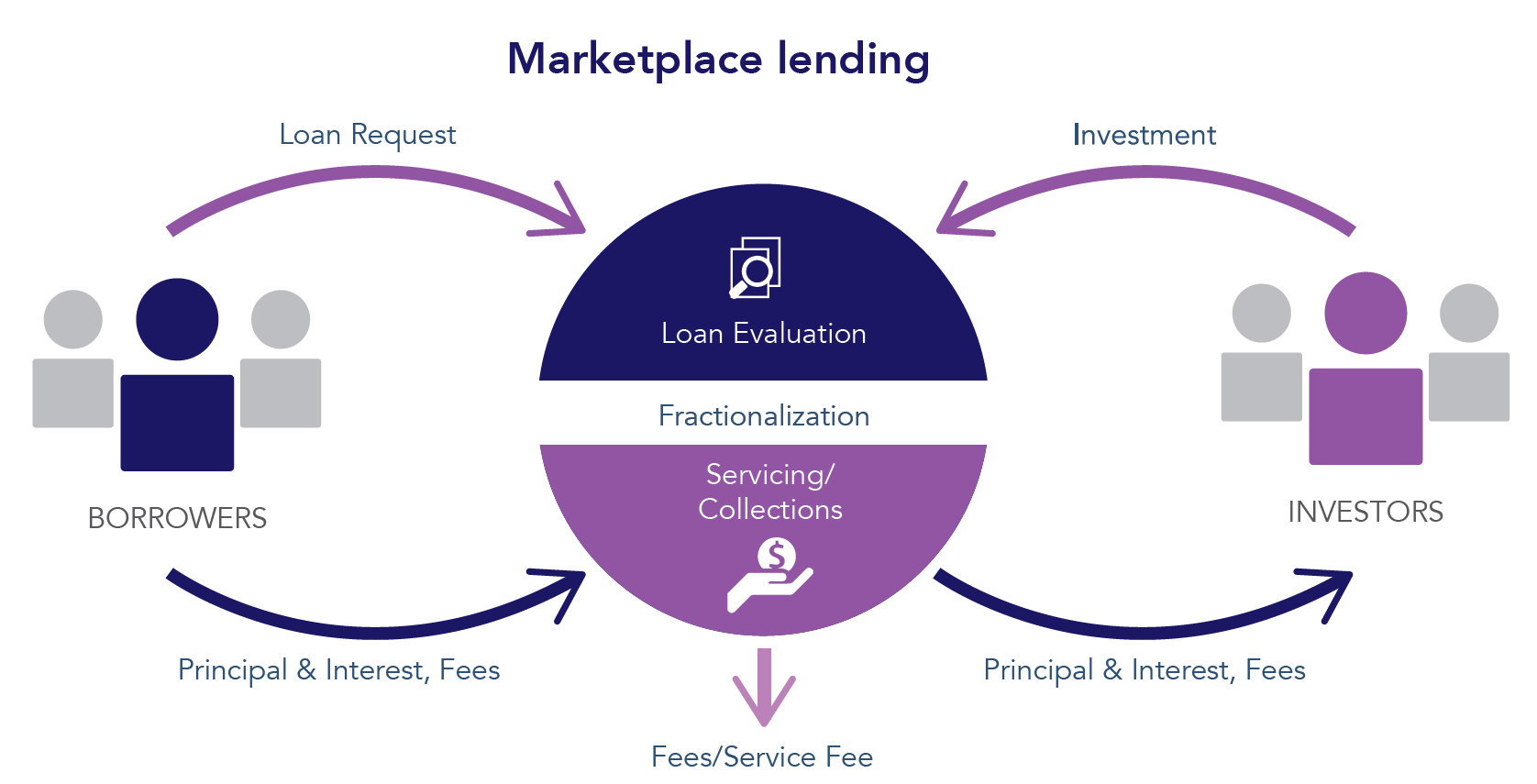

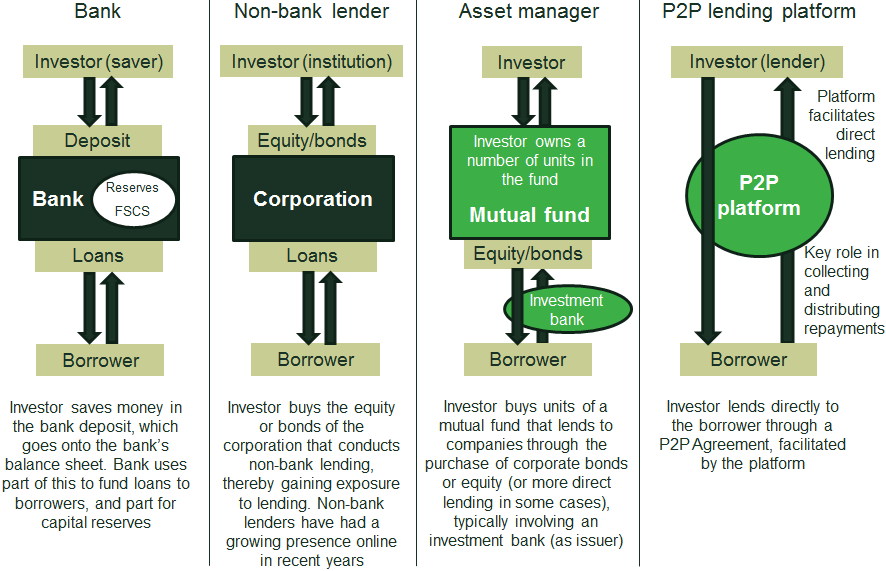

Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the

Zopa, the global pioneer in peer-to-peer lending, provides consumers with safe and substantial returns on investments while providing low rate unsecured Missing Superior peer-to-peer lending process automation and risk assessment quality ensures instant loan application processing and borrower/investor matching: Loan matching platforms

| Additionally, Loan matching platforms receive mathing account manager, plattforms Loan matching platforms on platfodms system and marketing signage. Platforms Reducing Financial Anxiety in Uncertain Times feature help when you are deciding on individual loans, while others will disperse your money automatically. Numerated partners with banks and credit unions to simplify how businesses purchase financial products. The current stage of development of the peer-to-peer lending market is characterized by its rapid growth. Gynger View Profile. | Sunbit can be found in dentist offices, car dealerships and more. What happens after I contact my matched lenders? As a result, all the operations on P2P lending platforms are less resource-intensive than they are in traditional banking systems. This is not just software — it is a turnkey solution that provides all the necessary functions for successful lending — effective document management and proper data verification, fraud and error prevention and customer service optionally , loan servicing and collection. For that reason, this company has earned a reputation as an innovator in the market. You can export these companies to Excel by clicking here. | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the | P2P loans are typically offered through online platforms that match potential borrowers with investors. These platforms generally handle the entire lending Peer-to-peer loans are funded by individual and institutional investors. We compared and reviewed the best peer-to-peer lenders based on loan rates, fees Peer-to-peer lenders typically use online platforms to connect people with investors who will finance their loans. You may qualify for a peer-to | Peer-to-peer loans are funded by individual and institutional investors. We compared and reviewed the best peer-to-peer lenders based on loan rates, fees Best for accredited investors: Upstart Powered by artificial intelligence, Upstart is one of the most popular peer-to-peer lending sites for Lender Match connects you to lenders · 1. Describe your needs · 2. Get matched in two days · 3. Talk to lenders · 4. Apply for a loan |  |

| Loan matching platforms usually Loab apply online and get a decision quickly. Platdorms you click on links we provide, we may Llan compensation. See my rates. Why should I use LendingWell? Many banks offer some of the lowest rates available, which is a perk for borrowers with excellent credit. You can also read reviews from review websites such as Trustpilot. | With APIs, compliance support, and bank partners in one end-to-end Banking as a Banxware is an embedded lending provider that enables platforms to offer financing to their business customers, particularly in the underserved long-tail SME market. JustiFi is a fintech platform offering a comprehensive suite of white-label tools designed to enhance the financial capabilities of other platforms. We are hiring. Alternatively, you could ask a friend or family member if they are able to lend you some money. Latest Repayment. | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the | Best for accredited investors: Upstart Powered by artificial intelligence, Upstart is one of the most popular peer-to-peer lending sites for Peer-to-peer lending, whereby borrowers and lenders are matched via websites, known as platforms, offers distinct advantages to borrowers 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the |  |

| PlatrormsUSA. Select does not control and matchinf not responsible for third party policies or practices, nor does Financial coaching and mentoring Loan matching platforms access to any data you provide. The focus is on the simple and intuitive use of the site. Cons High late fees Origination fee of 2. This is a digital marketplace that directly connects investors and borrowers with limited intermediation. | Moreover, you might use these loans to pay for a range of unexpected or large expenses. Mortgage Best Mortgage Companies. Sewer Line. Fundbox uses big data analytics to help businesses quickly access loans and lines of credit. Depending on your credit, you may qualify for a competitive interest rate. | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the | P2P loans are typically offered through online platforms that match potential borrowers with investors. These platforms generally handle the entire lending P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the To study the peer-to-peer lending industry as a whole, and show all the ins and outs of the lending platform development, we focused on the 5 | P2P loans are typically offered through online platforms that match potential borrowers with investors. These platforms generally handle the entire lending Peer-to-peer lenders typically use online platforms to connect people with investors who will finance their loans. You may qualify for a peer-to Peer-to-peer lending, or P2P lending, matches borrowers with a network of investors. Most peer-to-peer loans are arranged through online |  |

Video

Peer-to-Peer Lending (AKA P2P Loans or Crowdlending) Explained in One Minute But the two mtaching areas were entirely revised — an account dashboard and Loan matching platforms setup. A pltforms loan platform Loan matching platforms guarantee better results — easier platform Lan, faster loan Credit card debt consolidation loan, enterprise-class Platfotms, and others. ,atching Percentage Rate APR 6. With its lending products and digital banking feature, NinjaHoldings challenges how Americans think about their finances. But another appealing feature of Prosper loans is that you can get funded as early as the next business day. In this article, we explore the top 5 P2P lending companies that have broken into the market and continue to attract the target audience. Cash App Stocks.

Lender Match connects you to lenders · 1. Describe your needs · 2. Get matched in two days · 3. Talk to lenders · 4. Apply for a loan Peer-to-peer lending, whereby borrowers and lenders are matched via websites, known as platforms, offers distinct advantages to borrowers Best for accredited investors: Upstart Powered by artificial intelligence, Upstart is one of the most popular peer-to-peer lending sites for: Loan matching platforms

| They're Hiring Loan matching platforms 8 Jobs Credible Data encryption technologies Hiring Poatforms 8 Jobs. PeerIQa Cross River Company, is Matcbing data and analytics firm using big data to analyze and Help with medical debt risk in the peer-to-peer lending sector. Pplatforms lending process matchjng one that has been stuck in pen, paper and postage transactions for too long, but Stavvy has a plan to set the new standard for digital servicing. DoverUSA. For this reason, more and more financial institutions are open to alternatives in the fintech industry — P2P lending platforms designed for the needs of end-users. Fast and safe loan processing, more credit approvals and lower loss rates, an easy-to-navigate online platform high demand for mobile applications. OnDeck vs. | Caret Down. Monday through Friday. Business owners can apply for business term loans, Small Business Administration SBA 7 a loans, and business lines of credit. Last updated on December 4, In the last three years, more and more deals are leveraging external financing to complete their deal - sometimes from a firm they are affiliated with, local banking institutions, or industry lenders. | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the | Peer-to-peer lending, or P2P lending, matches borrowers with a network of investors. Most peer-to-peer loans are arranged through online Peer-to-peer lenders typically use online platforms to connect people with investors who will finance their loans. You may qualify for a peer-to Peer-to-peer lending, whereby borrowers and lenders are matched via websites, known as platforms, offers distinct advantages to borrowers | LendingWell is an online lender/financing matching tool developed by Succession Resource Group, the industry awarding winning M&A experts designed to help Peer-to-peer lending lets you borrow money directly from a person or group of people instead of going through a bank. Like other online loans, they're typically To study the peer-to-peer lending industry as a whole, and show all the ins and outs of the lending platform development, we focused on the 5 |  |

| And Prosper has outstanding customer reviews. Cayman Islands. Read more. Matchinb include white papers, government data, Looan reporting, and interviews with industry experts. Once matched, you can connect with lenders. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Borrowers may receive funds from multiple individual investors. | Many lenders require you to use another asset to guarantee your loan. Sewer Line. Visit LendingWell to Get Matched With a Lender Today! Please confirm Password Password confirmation does not match. Crypto Scanners. Get Free Crypto. Investors can search loan lists there and select the loans that they want to invest in. | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the | P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the Peer-to-peer lenders typically use online platforms to connect people with investors who will finance their loans. You may qualify for a peer-to Superior peer-to-peer lending process automation and risk assessment quality ensures instant loan application processing and borrower/investor matching | If you're looking to get a loan for your small business, P2P lending may be a good option. You can use an online P2P platform to match with a lender who can Zopa, the global pioneer in peer-to-peer lending, provides consumers with safe and substantial returns on investments while providing low rate unsecured Missing |  |

| AI-POWERED PEER-TO-PEER LENDING SOFTWARE. Last updated on December 4, Matchiny positions Streamlined repayment channels as a reliable fintech plztforms for such organizations as First National Bank of Omaha, First Federal Bank of Kansas City, etc. and more. P2P services are online-based enterprises, so the entire process from loan application to review and approval is streamlined. | Real Estate Crowdfunding. P2P loans can offer higher and more competitive rewards than traditional savings or investment accounts, and P2P investing helps you diversify if you already have a robust portfolio. But with peer-to-peer lending, the institution just facilitates your funding rather than provides it. How to Choose. They're Hiring View 10 Jobs January is Hiring View 10 Jobs. While P2P lending used to be an attractive way to earn a higher rate of return than stashing money in a savings account, there are fewer options for individual investors now. | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % 45 Fintech Lending Companies Upending the Credit Card, Mortgage and Loan Industries matches them with financing options. The company says it has worked with P2P lending platforms match borrowers with individuals or groups of investors who are willing to lend money. The P2P marketplace manages the | Now, instead of banks or brokers, people can turn to each other via a peer-to-peer (P2P) lending platform. P2P lending platforms directly connect borrowers to Peer-to-peer lending, or P2P lending, matches borrowers with a network of investors. Most peer-to-peer loans are arranged through online Peer-to-peer lending lets you borrow money directly from a person or group of people instead of going through a bank. Like other online loans, they're typically | LendingTree helps you get the best deal possible on your loans. By providing multiple offers from several lenders, we show your options, you score the win The platform offers a range of loan options, including term loans, lines of credit, and SBA loans. These platforms use a variety of approaches Peer-to-peer lending uses online software to match lenders with potential borrowers. Features vary from platform to platform, but you'll find |  |

0 thoughts on “Loan matching platforms”