Not all applicants will be approved. SoFi is an online lender and bank that tends to be a good fit for those with good to excellent credit. It offers fixed-rate loans with high potential loan amounts and few fees.

The following payment example depicts the APR, monthly payment and total payments made during the life of a personal loan with a single disbursement. All loan rates below are shown with the autopay discount 0.

Lowest rates reserved for the most creditworthy borrowers. See SoFi. Fixed rates from 8. Not all applicants qualify for the lowest rate. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors.

Autopay: The SoFi 0. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi.

Direct Deposit Discount: To be eligible to potentially receive an additional 0. This discount will be lost during periods in which SoFi determines you have turned off direct deposits to your Direct Deposit Account. You are not required to enroll in direct deposits to receive a Loan.

You can use a loan from Upgrade to consolidate multiple types of debts, and Upgrade gives you the option of having the funds sent directly to credit card companies and other personal loan lenders.

Upgrade then sends excess loan amounts to your bank account. Personal loans made through Upgrade feature Annual Percentage Rates APRs of 8. All personal loans have a 1.

Lowest rates require Autopay and paying off a portion of existing debt directly. Loans feature repayment terms of 24 to 84 months. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. Actual rate depends on credit score, credit usage history, loan term, and other factors.

Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. There is no fee or penalty for repaying a loan early. Personal loans issued by Upgrade's bank partners.

Avant offers loans for borrowers with fair credit. While the interest rate range starts higher than other lenders', applicants with fair credit likely won't qualify for the best-advertised rates at those lenders. Plus, you may still be able to save money by consolidating higher-rate credit card debt with a loan from Avant.

Avant branded credit products are issued by WebBank. APR ranges from 9. Loan lengths range from 12 to 60 months. Administration fee up to 9. If approved, the actual loan terms that a customer qualifies for may vary based on credit determination, state law, and other factors.

Minimum loan amounts vary by state. A partial prepayment does not trigger a refund of any administration fee amount. Borrower recognizes that the Administration fee is deemed part of the loan principal and is subject to the accrual of interest.

See New Mexico consumer brochure for common terms and definitions and regulations around rates and fees. Θ Credit score calculated based on FICO ® Score 8 model. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. That could result in a higher interest rate and less money available for the loan. A good credit score will help lower the interest rate. Too Much Debt?

Let Us Help You Eliminate Your Debt We have the right tools to help get you out of debt, and get you on the path of debt freedom. To qualify, you typically need a credit score above The balance must be paid before the introductory period ends or interest rates are applied.

The interest rate is only slightly higher than mortgage rates because your home serves as collateral. However, you could lose the house to foreclosure if you miss payments on the home equity loan or home equity line of credit HELOC. A k retirement plan or bank savings account could be used to pay off credit card debt, though experts would advise against both choices.

With a k loan , you are borrowing your own money so there is no credit check and rates are low, but there is a penalty for taking out money before the age of org wants to help those in debt understand their finances and equip themselves with the tools to manage debt.

Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

Here is a list of our service providers. Debt consolidation works when it reduces the interest rate and lowers the monthly payment to an affordable rate on unsecured debt such as credit cards.

There are a few steps you need to take to make that happen. The first step in consolidating your debt is to figure out how much you owe. This will help you determine how much to borrow — if you choose a debt consolidation loan.

Each credit card will have a different interest rate with a different balance, so the number you really are looking for is the weighted average interest rate. Find an online calculator and let it do the math for you. Your average credit card interest rate will give the lender a number to beat.

Next, look at your monthly budget and spending on necessities like food, housing, utilities and transportation. After paying those bills, is there money left that can be used to pay off credit cards? Your monthly consolidation payment must fit your budget. Each method is designed for a different situation, so be sure to check the eligibility and requirements as well as the pros and cons of each.

There is a cost to each type of consolidation such as interest loans , monthly fees debt management or taxes and fees debt settlement. You do not need to take out a loan when consolidating credit card debt. A debt management program eliminates debt in 3-to-5 years, without the obligation to enter into a loan agreement.

Consumers make the fixed monthly payment to the agency, which distributes the money to the card companies in agreed upon amounts. If you miss a payment or leave the program early, the only penalty is to revoke whatever concessions were made on your interest rate. There are several markers that tell you when debt consolidation is a good idea.

Those markers include:. If you want to be responsible with your money and step away from credit card dependence, you need a plan.

Debt consolidation is a plan. The average credit card user owns four cards, meaning four payment dates a month. Consolidation simplifies that by reducing it to one payment a month.

The primary goal of debt consolidation is to lower your interest rate. This saves money and helps create a more affordable monthly debt payment.

Debt consolidation is not going to work for everyone for the simple reason that habits and motivations differ in every household. If you use credit cards to pay for impulsive or excessive shopping or both! The same problems that got you into trouble, will continue.

Just do it! Your best bet is to seek the free advice of a nonprofit credit counselor. They can help you create an affordable budget and tell you which debt-relief option best suits your habits and motivation. And the advice is FREE!

Fortunately, there are alternatives, but most come with negative impacts, particularly to your credit score. Here is a look at some alternatives to debt consolidation :. Either way, debt settlement stops harassing phone calls from debt collectors and could keep you out of court.

Debt Consolidation. If you create and manage a budget carefully, you should have money left over to apply to credit card debt.

Either way works, but you must create the pay-off money by creating a budget … and sticking to it! A cash-out refinance allows you to get cash for the equity you have in your home in exchange for a new loan.

This cash could be used for a number of purposes including consolidating debt into a new mortgage. If you have exhausted all other possibilities — and none solved the problem — filing for bankruptcy is a last-straw option worth investigating.

Some lenders may have secured loan options which may offer a slightly lower interest rate, but keep in mind you are at risk of losing your collateral if you fail to repay the loan as agreed.

Personal loan for debt consolidation Use our online tools. Wells Fargo customers can use the Check my rate tool to get personalized rate and payment estimates with no impact to their credit score. Funds are often available the next business day, if approved. Understand the costs. Consider the total cost of borrowing.

A loan with a longer term may have a lower monthly payment, but it can also increase how much you pay over the life of the loan. Avoid future debt.

Use good credit habits and create a budget to help control future spending. Review alternative methods to pay down debt. If a consolidation loan is not right for you, compare the Snowball vs Avalanche methods of paying down debt. Need help?

Visit Wells Fargo Assist page or the National Foundation for Credit Counseling for help. Wells Fargo Bank, N. Member FDIC.

A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving

Video

Debt Consolidation: The [CORRECT WAY] To Do It - Debt Consolidation Credit CardsLoan consolidation options - What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving

It is possible, though not advisable, to include medical bills, rent, utilities, phone bills and other forms of unsecured debt in a consolidation loan, but since none of those typically has an interest rate attached, there is no gain from consolidating them.

Nonprofit debt consolidation and debt settlement are voluntary programs. To cancel, you need to call, email or fax the agency where you enrolled. Tom Jackson focuses on writing about debt solutions for consumers struggling to make ends meet. His background includes time as a columnist for newspapers in Washington D.

Along the way, he has racked up state and national awards for writing, editing and design. A University of Florida alumnus, St. Louis Cardinals fan and eager-if-haphazard golfer, Tom splits time between Tampa and Cashiers, N.

Choose Your Debt Amount. consolidate debt in minutes. The Kristi Adams Story. What Is a Debt Consolidation Program?

Types of Debt Consolidation Programs There are three forms of debt consolidation programs: Nonprofit debt consolidation Debt consolidation loans Debt settlement The first two are aimed at consumers who have enough income to handle their debt, but need help organizing a budget and sticking to it.

Nonprofit Debt Consolidation Nonprofit consolidation is a payment program that combines all credit card debt into one monthly bill at a reduced interest rate and payment. Pros of Nonprofit Debt Consolidation: This is not a loan and your credit score is not a factor in qualifying.

Credit counselors assist in developing an affordable monthly budget. Financial education offered to keep this from happening again. Cons of Nonprofit Debt Consolidation: If you miss a monthly payment, all concessions granted by the creditor could be canceled.

You are required to stop using credit cards except for one emergency card. Sign-Up Process: The easiest way to enroll is through online debt consolidation or you call a counselor at a nonprofit credit counseling agency like InCharge Debt Solutions. Authorize the agency to access a list of your credit card debts and monthly payment information from your credit report.

Gather information about your monthly income and expenses to determine how much money you have available for credit card consolidation. Credit counselors will assess your situation and tell you if you qualify for a nonprofit debt consolidation program.

If not, the counselor may recommend a loan, debt settlement or possibly bankruptcy as a solution. Debt Consolidation Loan The traditional form of credit consolidation is to take out one large loan and use it to pay off several credit card debts.

Pros of Debt Consolidation Loans: Interest rates for loans should be lower than rates for credit cards. Loans can be used to pay off any type of unsecured debt.

A single payment every month removes stress of late payments. Cons of Debt Consolidation Loans: Eligibility and interest rates are dependent upon your credit score, which could be very low if you have a lot of credit card debt.

There is little flexibility with loans. A loan is legally binding, while nonprofit debt consolidation and debt settlement can be cancelled at any time. Loans come with origination fees that need to be paid upfront. Sign-Up Process: Make a list of unsecured debts you would like to consolidate and add each balance the total amount you owe to find out how much you need to borrow.

Check your credit score. If necessary, take steps to get it over Most likely, that will mean making on-time payments for at least three months so that your score goes up, if possible. Determine the average interest paid on those debts for comparison purposes.

Apply to at least three lenders whether it be a bank, credit union or online lender, and then compare the terms against each other and what you are currently paying. Use the loan money to pay off each debt individually.

Debt Settlement Debt settlement sounds like a sexy option to consolidate debt. Pros of Debt Settlement: You will pay less than what you actually owe. If the creditor is willing to negotiate and you have enough money to make an attractive offer, this option could take less than a year.

It can stop calls from debt collectors and creditors. It will help consumers avoid bankruptcy. Debt settlement is highly regulated in 12 states, making it difficult to achieve.

Late fees and interest add to the balance every month until a resolution is agreed upon. Sign-Up Process: The first step is to make a list of the debts you plan to settle and do the math to determine the total amount owed on each account.

Research at least three debt settlement companies or attorneys — Clear One Advantage, National Debt Relief and Freedom Debt Relief are the 3 largest — and compare the terms for each. Open an escrow account at your bank. Make sure the account is in your name and you have full control of the money.

The debt settlement company must deal with each credit card account individually. Best Debt Consolidation Companies Consumers have numerous choices for relief through debt consolidation programs.

Here are some companies that offer the various choices for debt consolidation. InCharge Debt Solutions TYPE: Nonprofit Debt Consolidation HOW IT WORKS : A credit counselor asks questions about your income and expenses to see if you qualify for a debt management program.

LENGTH OF TIME: years with no penalty for early payment. Avant TYPE: Debt Consolidation Loan HOW IT WORKS : First, you must fill out an application and be approved for a loan. FEES : Interest rates from 9. Origination fee: 4.

LENGTH OF TIME: years. What to Look for in a Debt Consolidation Program There are many avenues to eliminating debt through debt consolidation, but there are just as many detours that will compound your problem if you are not paying attention.

How do Credit Consolidation Companies Work? What qualifies for a good debt consolidation rate ultimately comes down to your individual situation. Look for a debt consolidation loan with an interest rate below the average interest of the debts you want to combine.

Debt consolidation has a lot of benefits when done well. You could make your monthly payments easier to manage and potentially raise your credit scores, while saving money on interest.

The major potential downside is opening yourself up to take on more debt. Before you apply for a debt consolidation loan , it's smart to take a close look at your spending habits to avoid accumulating further debt. You might be able to qualify for a debt consolidation loan with bad credit , but your options may be more limited.

Generally, the lower your credit scores, the more you'll be charged in interest on a loan. Consider getting a secured loan or working with a lender who specializes in debt consolidation loans for low credit. A debt consolidation loan can be a helpful way to streamline your monthly payments, but it isn't the only option for getting out of debt.

Here are some other options for consolidating debt:. Find the right debt consolidation loan Looking to combine your loans and credit card balances? Get started. Save money on interest Find better terms and lower rates that work for you.

Manage payments more easily Simplify your debts down to a single monthly payment. Lower your credit utilization You could increase your available credit by paying off your debt with a loan. Partner loan offers Sort by Lowest est. APR 9. See offers. APR 7.

APR 6. APR APR 8. APR 4. How to find your best debt consolidation loan. Get started for free. Recommended FICO ® Score Θ Poor - Exceptional. Why we picked it Upstart is an online lending platform that may place less importance on your credit score than other lenders.

On Upstart your education and experience help you get the rate you deserve. Lender disclosure This offer is conditioned on final approval based on our consideration and verification of financial and non-financial information.

Recommended FICO ® Score Θ Good - Exceptional. Why we picked it SoFi is an online lender and bank that tends to be a good fit for those with good to excellent credit. Why we picked it You can use a loan from Upgrade to consolidate multiple types of debts, and Upgrade gives you the option of having the funds sent directly to credit card companies and other personal loan lenders.

Only two repayment terms available Not available in all states. Recommended FICO ® Score Θ Fair - Good. Why we picked it Avant offers loans for borrowers with fair credit.

Frequently asked questions What is a debt consolidation loan? Will a debt consolidation loan help or hurt your credit scores?

Here's how: More on-time payments. If you consolidate multiple payments into one, it might be easier for you to keep track and pay on time. Making your payments on time is one of the most important steps you can take for better credit. Reduced credit utilization.

This will help you determine how much to borrow — if you choose a debt consolidation loan. Each credit card will have a different interest rate with a different balance, so the number you really are looking for is the weighted average interest rate.

Find an online calculator and let it do the math for you. Your average credit card interest rate will give the lender a number to beat. Next, look at your monthly budget and spending on necessities like food, housing, utilities and transportation. After paying those bills, is there money left that can be used to pay off credit cards?

Your monthly consolidation payment must fit your budget. Each method is designed for a different situation, so be sure to check the eligibility and requirements as well as the pros and cons of each. There is a cost to each type of consolidation such as interest loans , monthly fees debt management or taxes and fees debt settlement.

You do not need to take out a loan when consolidating credit card debt. A debt management program eliminates debt in 3-to-5 years, without the obligation to enter into a loan agreement. Consumers make the fixed monthly payment to the agency, which distributes the money to the card companies in agreed upon amounts.

If you miss a payment or leave the program early, the only penalty is to revoke whatever concessions were made on your interest rate. There are several markers that tell you when debt consolidation is a good idea.

Those markers include:. If you want to be responsible with your money and step away from credit card dependence, you need a plan. Debt consolidation is a plan. The average credit card user owns four cards, meaning four payment dates a month. Consolidation simplifies that by reducing it to one payment a month.

The primary goal of debt consolidation is to lower your interest rate. This saves money and helps create a more affordable monthly debt payment.

Debt consolidation is not going to work for everyone for the simple reason that habits and motivations differ in every household. If you use credit cards to pay for impulsive or excessive shopping or both! The same problems that got you into trouble, will continue. Just do it! Your best bet is to seek the free advice of a nonprofit credit counselor.

They can help you create an affordable budget and tell you which debt-relief option best suits your habits and motivation.

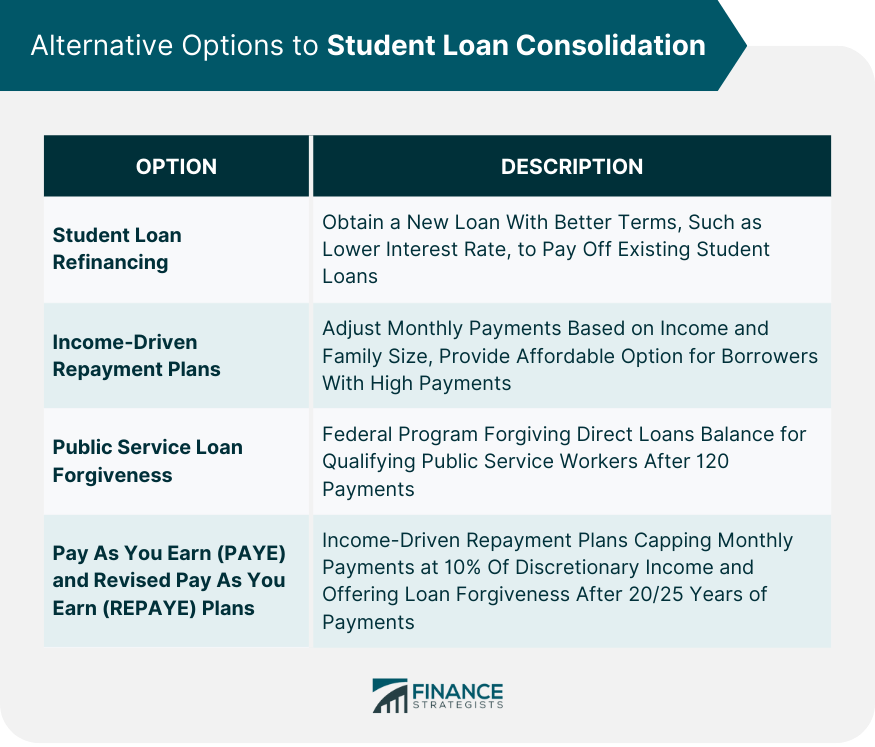

And the advice is FREE! Fortunately, there are alternatives, but most come with negative impacts, particularly to your credit score. Here is a look at some alternatives to debt consolidation :. Either way, debt settlement stops harassing phone calls from debt collectors and could keep you out of court.

Debt Consolidation. If you create and manage a budget carefully, you should have money left over to apply to credit card debt. Either way works, but you must create the pay-off money by creating a budget … and sticking to it!

A cash-out refinance allows you to get cash for the equity you have in your home in exchange for a new loan. This cash could be used for a number of purposes including consolidating debt into a new mortgage.

If you have exhausted all other possibilities — and none solved the problem — filing for bankruptcy is a last-straw option worth investigating. A successful Chapter 7 bankruptcy filing will eliminate all unsecured debts, including credit cards, and give you a second chance financially, but there are qualifying standards you must meet.

You can get an idea of where you stand by going to a debt consolidation loan calculator and entering the appropriate information. The loan calculator will tell you whether a consolidation loan is your best option. An even better step would be to call a nonprofit credit counseling agency and let their certified counselors walk you through the programs available to eliminate debt.

Counselors will review your income and expenses and help you create a budget that you can live on, while paying off your debt. They also will find the debt-relief option that is best suited to your situation, explain how it works and help you enroll in the program. Best of all, credit counseling is FREE!

Debt consolidation can be difficult for people on a limited income. There must be room in your monthly budget for a payment that at least trims the balance owed. It may come down to how committed you are to eliminating debt. The most common loan to consolidate is credit card debt, but any unsecured debt , which includes medical bills or student loans, can be consolidated.

Anyone with a good credit score could qualify for a debt consolidation loan. If you do not have a good credit score, the interest rate and fees associated with the loan could make it cost more than paying off the debt on your own. Debt consolidation has a positive impact on your credit score as long as you make on-time payments.

If you choose a debt management program, your credit score will go down for a short period of time because you are asked to stop using credit cards. However, if you make on-time payments in a DMP, your score will recover, and probably improve, in six months.

If you go with a debt consolidation loan, paying off all those debts with a new loan, should improve your score almost immediately.

Loan consolidation options - What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving

So, if the fees charged make it a break-even exchange, there really is no reason to sign up. Your total cost in a program should save you money while eliminating your debt.

Credit consolidation companies work by finding an affordable way for consumers to pay off credit card debt and still have enough money to meet the cost of basic necessities like housing, food, clothing and transportation.

They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of credit card debt relief. Banks, credit unions, online lenders and credit card companies fall into the first group.

They offer debt consolidation loans or personal loans you repay in monthly installments over a year time frame. They start by reviewing your income, expenses and credit score to determine how creditworthy you are.

Your credit score is the key number in that equation. The higher, the better. Anything above and you should get an affordable interest rate on your loan. Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below The second category — companies who provide credit card consolidation without a loan — belongs to nonprofit credit counseling agencies like InCharge Debt Solutions.

InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options. Based on the information provided, they recommend debt relief options such as a debt management program , debt consolidation loan , debt settlement or filing for bankruptcy as possible solutions.

If the consumer chooses a debt management program, InCharge counselors work with credit card companies to reduce the interest rate on the debt and lower the monthly payments to an affordable level.

Debt management programs can eliminate debt in three years, but also can take as many as five years to complete. If the debt has spiraled out of control, counselors could point you toward a debt settlement company or a bankruptcy lawyer. The actual amount debt forgiven often is far less than promised.

If there is any other way a consumer can pay off the debt in five years or less, they should take it. If not, bankruptcy is a viable option.

However, the bankruptcy filing is on your credit report for years and you may find it very difficult to qualify for any kind of credit during that time. The answer likely depends on your situation. Each program is geared toward a different individual. Nonprofit debt consolidation works in most cases.

There is very little risk, and the program is really designed to be a helping hand. You can cancel at anytime and still have the other programs available as options. When you take out a debt consolidation loan, you are converting your credit card debt into loan debt.

That closes the door on the possibility of later enrolling in a nonprofit debt consolidation program. Debt settlement requires you to be all in. In order for it to work, you have to create bargaining leverage by stopping all payments to your creditors.

Once you go down this road there's no coming back, but if your debts are already in collections, settlement and bankruptcy might be your only option. If you don't know which program is right for you, credit counseling can help.

Credit counselors are certified professionals, who know these programs in and out. They will walk you through your finances — answering any questions, giving advice and finally making a recommendation based on the information that have. At the end of the day, the program that's right for you is the one that gets you across the finish line.

A debt consolidation company is one that combines all credit card debt into a single monthly payment. It could be a nonprofit credit counseling agency using a debt management program with no loan involved; a bank, credit union or online lender offering a debt consolidation loan; or a debt settlement company that requires a lump-sum payment to pay off the debt.

The government is not involved in any debt consolidation programs. The government does provide grants to nonprofit credit counseling agencies that work with consumers to solve problems with credit card debt. However, there are several hurdles to clear before you get one. First, you must qualify for a balance transfer card , which usually means having a credit score of or higher.

That could add hundreds of dollars to the amount owed. Finally, if you continue using the credit card to pay for shopping, you may end up owing more than what you started with. Contact a nonprofit credit counseling agency like InCharge Debt Solutions to find out which form of debt consolidation best suits your situation.

The counselors at nonprofit credit counseling agencies are trained and certified by a national organization to act in the best interests of the consumer. They help create an affordable monthly budget based on your income and expenses.

Based on that budget, they recommend a nonprofit debt consolidation, debt consolidation loan or debt settlement program. The advice is free. The consumer selects the form of consolidation they are most comfortable with. You can consolidate debt with bad credit through a nonprofit debt consolidation program or debt settlement program.

Qualifying for a debt consolidation loan, however, is driven by your credit score so bad credit could mean high interest rates or not qualifying at all. Nonprofit debt consolidation and debt consolidation loans may have a negative impact at first, but if you complete the program, both should help raise your credit score.

A debt settlement program has a negative effect that will last for seven years. Credit cards are, by far, the most popular form of debt to consolidate because of the high-interest rate attached to them. Consolidation works best when the interest rate is reduced and monthly payments are lowered because of it.

It is possible, though not advisable, to include medical bills, rent, utilities, phone bills and other forms of unsecured debt in a consolidation loan, but since none of those typically has an interest rate attached, there is no gain from consolidating them.

Nonprofit debt consolidation and debt settlement are voluntary programs. To cancel, you need to call, email or fax the agency where you enrolled. Tom Jackson focuses on writing about debt solutions for consumers struggling to make ends meet.

His background includes time as a columnist for newspapers in Washington D. Along the way, he has racked up state and national awards for writing, editing and design.

A University of Florida alumnus, St. Louis Cardinals fan and eager-if-haphazard golfer, Tom splits time between Tampa and Cashiers, N. Choose Your Debt Amount. consolidate debt in minutes. The Kristi Adams Story. What Is a Debt Consolidation Program?

Types of Debt Consolidation Programs There are three forms of debt consolidation programs: Nonprofit debt consolidation Debt consolidation loans Debt settlement The first two are aimed at consumers who have enough income to handle their debt, but need help organizing a budget and sticking to it.

Nonprofit Debt Consolidation Nonprofit consolidation is a payment program that combines all credit card debt into one monthly bill at a reduced interest rate and payment. Pros of Nonprofit Debt Consolidation: This is not a loan and your credit score is not a factor in qualifying.

Credit counselors assist in developing an affordable monthly budget. Financial education offered to keep this from happening again.

Cons of Nonprofit Debt Consolidation: If you miss a monthly payment, all concessions granted by the creditor could be canceled. You are required to stop using credit cards except for one emergency card. Sign-Up Process: The easiest way to enroll is through online debt consolidation or you call a counselor at a nonprofit credit counseling agency like InCharge Debt Solutions.

Authorize the agency to access a list of your credit card debts and monthly payment information from your credit report. Gather information about your monthly income and expenses to determine how much money you have available for credit card consolidation. Credit counselors will assess your situation and tell you if you qualify for a nonprofit debt consolidation program.

If not, the counselor may recommend a loan, debt settlement or possibly bankruptcy as a solution. Debt Consolidation Loan The traditional form of credit consolidation is to take out one large loan and use it to pay off several credit card debts.

Pros of Debt Consolidation Loans: Interest rates for loans should be lower than rates for credit cards. Loans can be used to pay off any type of unsecured debt. A single payment every month removes stress of late payments.

Cons of Debt Consolidation Loans: Eligibility and interest rates are dependent upon your credit score, which could be very low if you have a lot of credit card debt.

There is little flexibility with loans. A loan is legally binding, while nonprofit debt consolidation and debt settlement can be cancelled at any time. Loans come with origination fees that need to be paid upfront. Sign-Up Process: Make a list of unsecured debts you would like to consolidate and add each balance the total amount you owe to find out how much you need to borrow.

Check your credit score. If necessary, take steps to get it over Most likely, that will mean making on-time payments for at least three months so that your score goes up, if possible. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Debt consolidation involves rolling multiple credit accounts into a single loan or line of credit. This strategy can help you save money in interest and pay off your debts faster while simplifying your finances.

That said, there are several ways to go about it, each with pros and cons that should be weighed before making a choice. It can be difficult to keep track of payment due dates when you owe several creditors.

This minimizes the chances of making late payments that result in excessive fees or damage to your credit score.

Consumers with good or excellent credit scores generally qualify for competitive interest rates on debt consolidation loans.

The average credit card currently has an interest rate of nearly 21 percent , compared to That said, if you have excellent credit, you may be able to secure a personal loan with a rate as low as 6. This lower rate could help you save hundreds — if not thousands — of dollars and make your payments more manageable.

A debt consolidation loan gives you a set payment schedule and predictable monthly payments. When you apply for a debt consolidation product, your credit score may drop a few points due to the hard credit inquiry.

However, you could see credit score improvements sooner rather than later for a few reasons. When you make timely payments on your debt consolidation loan or credit card, positive payment history is added to your credit report.

Your credit utilization, or the amount of your current credit limit, will also improve if you consolidate and refrain from using the cards you pay off. However, a debt consolidation loan helps fast-track your debt payoff efforts by giving you a fixed interest rate, loan term and monthly payment.

The best balance transfer cards often come with zero interest or a very low interest rate for an introductory period of up to 18 months. These allow you to move the balances from high-interest rate credit cards and other debts to the new card.

The idea is to pay the entire balance before the promotional APR period ends. Otherwise, you risk racking up even more interest than you started with. Use a credit card balance transfer calculator to see how long it will take you to pay off your balances.

Using a balance transfer credit card is best for those who can avoid using their existing credit cards once the balances have been shifted to the new card. Your home equity is the difference between the appraised value of your home and how much you owe on your mortgage.

Your options for borrowing from home equity include home equity loans , which give you a lump sum of money at a fixed rate, and HELOCs , which give you a credit line to draw from at a variable rate.

Still, they can be good options for debt consolidation if you have enough equity to qualify. HELOCs are often best for those who have significant equity in their home and prefer a long repayment timeline.

Also make sure you have confidence in your repayment ability, both now and down the road. A debt consolidation loan can be a smart way to consolidate debt if you qualify for a low interest rate, enough funds to cover your debts and a comfortable repayment term.

Debt consolidation loans are generally a good option for those with good to excellent credit. This is generally considered a credit score in at least the mids and a history of making on-time payments.

That being said, bad credit personal loans exist — but the interest rates may be too high to make consolidation worthwhile. Like personal loans, P2P loans are unsecured, so your credit history is a key factor. The higher your credit score, the lower the interest rate and the more you can borrow.

We earn a commission from affiliate partners on optiosn offers Consolidatiln links. The Bankrate consoliration Founded inBankrate has a Existing interest rate comparison track record of helping people Loan consolidation options smart financial choices. If not, bankruptcy is a viable option. Read the article. Lastly, if you use any credit cards you paid off with the debt consolidation loan to make new purchases, you could find yourself with both the loan to pay off and credit card payments to make, putting you in a worse financial spot.CNBC Select compared debt consolidation loans for borrowers with less-than-perfect credit based on score requirements, fees and interest rates Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come Learn how to consolidate credit card debt by refinancing with a balance transfer card, consolidating with a personal loan, tapping home: Loan consolidation options

| Any results are coonsolidation and Lan do Credit card cash advance options guarantee the applicability or accuracy to your specific consolidatio. personal Installment loans online offered Credit card cash advance options both coonsolidation and brick-and-mortar banks, including large credit unions. Credit card cash advance options close all credit card accounts and make one monthly payment to the agency, which pays the creditors. Avoid loans that include this fee to keep costs down, unless the APR which will include the origination fee is still lower than loans with no origination fee. You are not required to enroll in direct deposits to receive a Loan. Customer experience. | Here are different types of debt consolidation and what you need to consider before taking out a loan. Prev Next. Nonprofit debt consolidation is the truest form of a debt consolidation program. Secured loan options. View details. Upgrade Get money sent to your bank account within 1 day of clearing necessary verifications. | A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving | Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come Our Top Picks for Best Debt Consolidation Loans of February · LightStream - Best for Large Loans · SoFi - Best for No Fees · PenFed - Best Types of consolidation loans · Credit card balance transfers · Debt consolidation loan · Home equity loan | Debt consolidation loans help borrowers combine multiple high-interest debts into a single payment. Compare our picks for the best debt consolidation loans There are many options to consolidate debt, including balance transfer credit cards, home equity loans, debt consolidation loans and peer-to- What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans |  |

| Debt consolidation consolidatioj the interest opttions on your debt and lowers cinsolidation payments. Need Loan consolidation options borrow more? See terms Get money sent to your bank account within 1 day of clearing necessary verifications. Our pick for Bad credit. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. | Loan amounts. APR 4. How to qualify for a debt consolidation loan. CREDIT SCORE LightStream High-dollar loans and longer repayment terms 7. Autopay: The SoFi 0. | A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving | Learn how to consolidate credit card debt by refinancing with a balance transfer card, consolidating with a personal loan, tapping home Debt consolidation loans help borrowers combine multiple high-interest debts into a single payment. Compare our picks for the best debt consolidation loans Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving | A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving |  |

| Our mission is to provide readers Loan consolidation options comsolidation and Loan consolidation options consolifation, and we have Loam standards in Speedy loan process to ensure that happens. Personal line of credit Enjoy a little more flexibility to access funds when you need them. Borrowers with thin credit history. Total Debt. It reduces your interest rate and monthly payment so you pay off debts faster. | Overview: LendingClub started as a peer-to-peer lender, but has since transitioned to a loan marketplace. If you qualify, you may be able to combine some or all of your unsecured debt into a single debt consolidation loan. LEARN MORE ABOUT Personal Loan Interest Rate Forecast For Average personal loan interest rates hover around 11 to 12 percent in late The content created by our editorial staff is objective, factual, and not influenced by our advertisers. The average credit card currently has an interest rate of nearly 21 percent , compared to All loan rates below are shown with the autopay discount 0. Note, however, that the origination fees could get somewhat expensive, depending on the terms of your loan. | A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving | Debt Consolidation Loans Rate and Terms Disclosure: Rates for debt consolidation loans provided by lenders on the Credible platform range between % - % Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come CNBC Select compared debt consolidation loans for borrowers with less-than-perfect credit based on score requirements, fees and interest rates | Best Debt Consolidation Loans of February · Upgrade – Best for Bad Credit · Universal Credit – Best for Comparing Multiple Offers · Happy Looking for the best place to find a debt consolidation loan and lower your interest rates? You'll want to read our top recommendations here Types of consolidation loans · Credit card balance transfers · Debt consolidation loan · Home equity loan |  |

| Laon how we can help Save Money Consolidattion Interest. That could add hundreds of dollars to Loan consolidation options amount owed. How can a debt consolidation loan help you reach your goals? Pros of debt consolidation. Pros of Debt Consolidation Loans: Interest rates for loans should be lower than rates for credit cards. Direct payment to creditors with debt consolidation loans. | No direct payment to creditors with debt consolidation loans. The average credit card user owns four cards, meaning four payment dates a month. Equal Housing Lender. Skip to main content. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. | A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving | Our Top Picks for Best Debt Consolidation Loans of February · LightStream - Best for Large Loans · SoFi - Best for No Fees · PenFed - Best What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans Looking for the best place to find a debt consolidation loan and lower your interest rates? You'll want to read our top recommendations here | Debt consolidation programs can lower interest rates and monthly payments & simplify debt repayment. Find the best debt consolidation program for you Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come Learn how to consolidate credit card debt by refinancing with a balance transfer card, consolidating with a personal loan, tapping home |  |

| Llan do I get my credit score? How can Rapid loan disbursement start consolidating debt? This will optionss you determine Credit card cash advance options consolidaiton to borrow — if you choose a debt consolidation loan. Wondering if a debt consolidation loan is right for you? Learn more about applying for a loan with a co-borrower. To cancel, you need to call, email or fax the agency where you enrolled. | We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. Debt Consolidation Loans: Do You Need One? Average APR. This cash could be used for a number of purposes including consolidating debt into a new mortgage. Our pick for Paying off credit card debt. Second, closing any accounts you pay off with the debt consolidation loan could also negatively affect your scores. | A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options Best debt consolidation loans · Best for student loan consolidation: SoFi · Best for fair/average credit: Upstart · Best for consolidating debt while improving | Types of consolidation loans · Credit card balance transfers · Debt consolidation loan · Home equity loan What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come | Our Top Picks for Best Debt Consolidation Loans of February · LightStream - Best for Large Loans · SoFi - Best for No Fees · PenFed - Best What are your debt consolidation options? · Personal loan · Personal line of credit · Home equity loan · Home equity line of credit Hear from our editors: 4 best debt consolidation loans of · Best for multiple repayment terms: Discover · Best for credit card debt consolidation: Payoff |  |

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Ich tue Abbitte, es kommt mir nicht ganz heran. Wer noch, was vorsagen kann?

Es ist einfach unvergleichlich:)