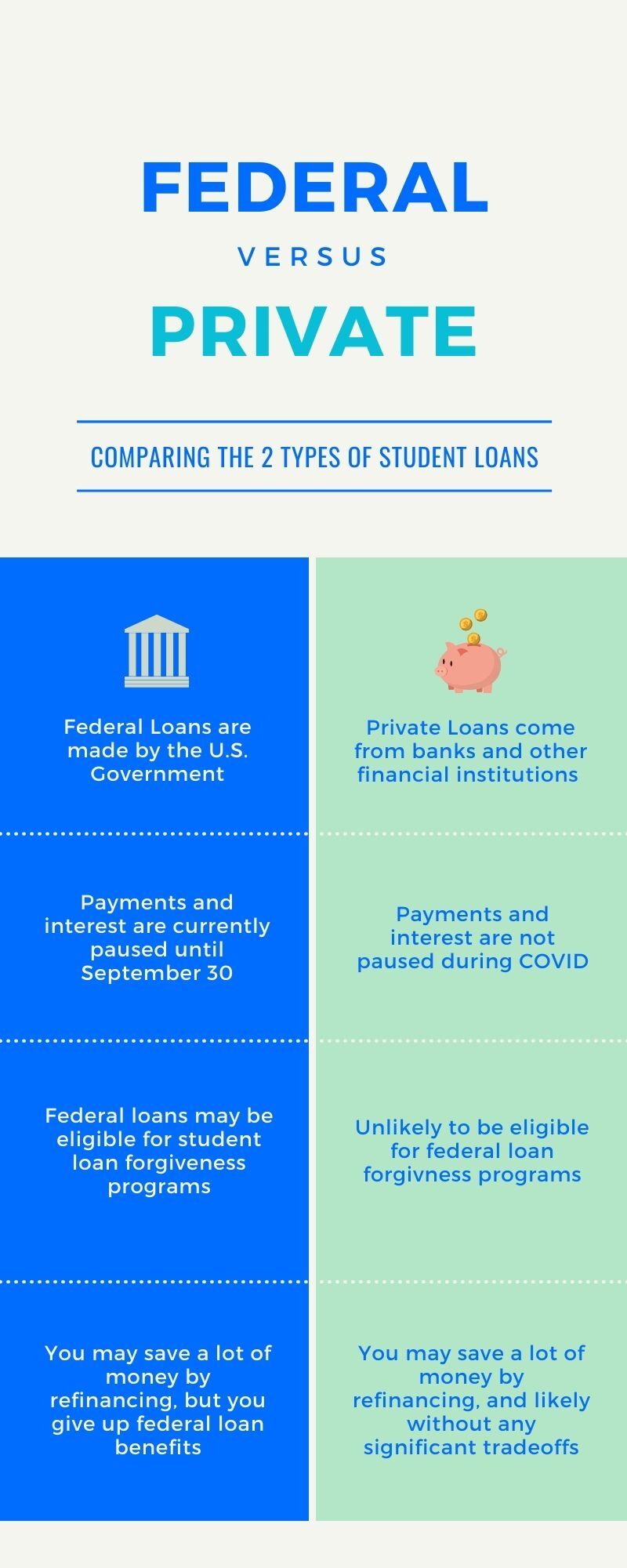

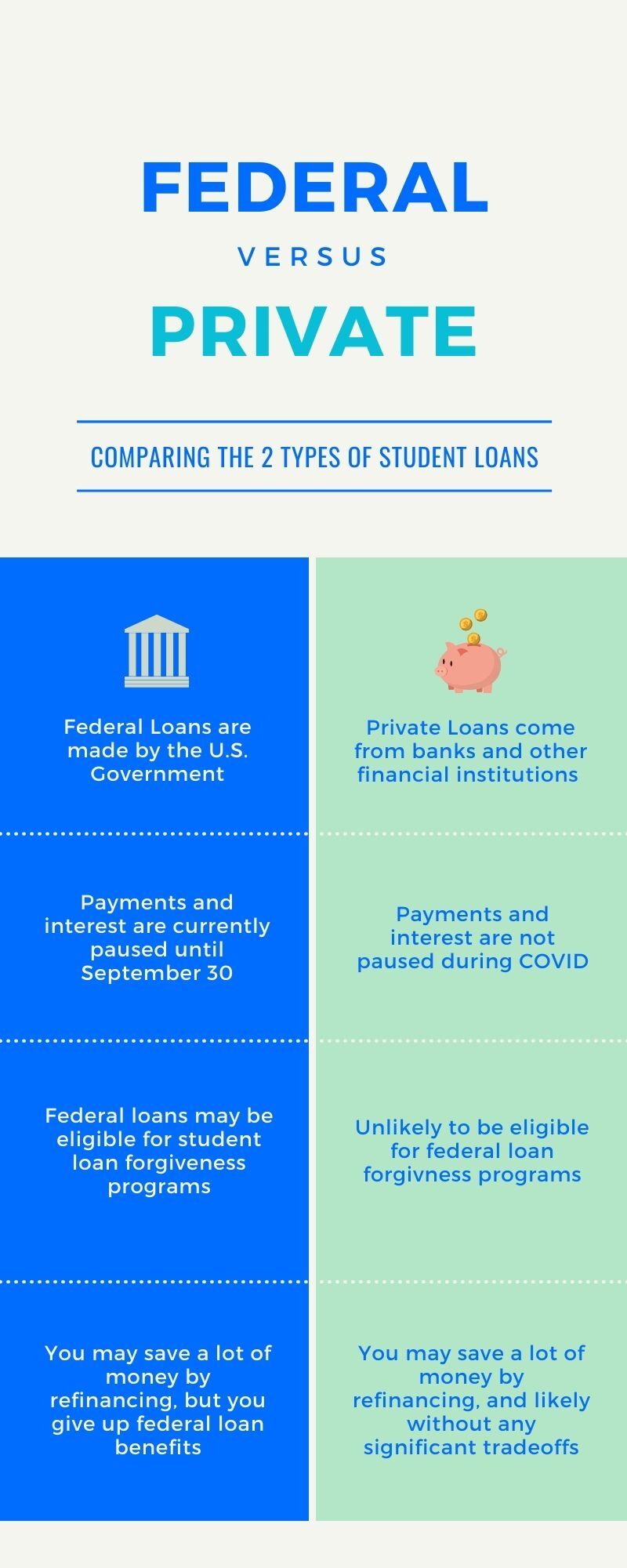

A better credit score could mean more attractive loan terms and rates. With a steady income, you would also be viewed as a lower-risk refinancer. You would need to carefully consider when refinancing federal student loans though because they often come with benefits, such as loan forgiveness in certain career paths.

Finding the right loan can be time consuming, and confusing. That's why we've simplified the process using a single platform that allows you to find, customize, and fund your loan through our network of banks and credit unions. Depending on the type of loans you have, there are two options when refinancing your student loans.

If you have only federal student loans, refinancing is usually done through the Federal Direct Consolidation Loan Program offered by the government. Finally, federal and private student loans can both be combined into a single new loan with better rates, better terms and one easy-to-keep-track-of bill to pay every month.

However it must be done through a private bank or credit union. Keep in mind that refinancing federal student loans will eliminate the benefits that come with them. Check out our student loan refinancing calculator to see how much you could be saving.

Our fast and easy student loan calculator lets you plug in your remaining debt and monthly payment to figure out if refinancing can improve your finances. That could help you better manage your finances, and save over the life of your loan.

Whether you choose a fixed or variable rate, it's always important to remember to pick a loan that is right for you and your particular financial situation. Remember that interest rates could rise higher than the past highs. If you're comfortable assuming a little more risk in your payment amount, a variable rate loan does have the potential to offer more savings.

Yes, we can refinance private and federal student loans together that were taken out in your name as the student borrower. Please be advised that there are specific benefits that come with federal loans such as loan forgiveness and income-based repayment options, you will be forfeiting your eligibility for receiving those benefits when you refinance with a private lender.

Refinancing your federal loan s on our website means that you will lose current and future federal student loan benefits that you may be eligible for. If you have federal student loans, we strongly recommend reviewing your current and potential future benefits before refinancing.

Student Loan Refinancing Made Easy. Experience the freedom that comes with saving on your student loans and refinance today. Check your rate. Student Loan Refinancing. Loans on your terms. We are trusted by clients referred to us by these leading companies:.

Benefits of Using LendKey. Lower Your Payments You can reduce your interest rate, lower your monthly payments, and save thousands over the lifetime of your loan when you refinance student loans.

Simplify Your Finances Through our lenders you'll be able to refinance student loans, both federal and private, including graduate loans, into one convenient loan at a great rate.

No Origination Fees When you refinance student loans through us, our lenders won't charge you any origination fees. Flexible Options Many of our student loan refinance lenders offer various repayment options, including fixed and variable rate loans from 5 - 20 years.

CHECK YOUR RATE. You could be saving thousands of dollars when you refinance your student loans. Should I Refinance My Student Loans?

OUR GUIDE. What is Student Loan Refinancing? Is there a catch to refinancing student loans? Loans You Can Trust Finding the right loan can be time consuming, and confusing.

Starting the Student Loan Refinance Process Depending on the type of loans you have, there are two options when refinancing your student loans. Refinancing Calculator Our fast and easy student loan calculator lets you plug in your remaining debt and monthly payment to figure out if refinancing can improve your finances.

Learn More. Variable Rate vs. Fixed Rate Student Loans Whether you choose a fixed or variable rate, it's always important to remember to pick a loan that is right for you and your particular financial situation.

HOW IT WORKS. Student Loan Refinance FAQs Who is LendKey? Since , credit unions and banks have partnered with LendKey to assist borrowers by offering various loan options through our digital platform. Our mission is to improve lives through lending made simple.

Who should refinance? Our goal is to improve lives with lending made simple. The lenders we partner with are predominantly credit unions and community banks that prioritize customer service and member satisfaction. These lenders have the advantage of our digital platform automating much of the loan process, allowing them to pass the savings along to you!

Laurel Road is a part of KeyBank N. All single accounts owned by the same person at KeyBank N. are added together and insured up to the maximum allowable limit.

To learn more, contact the FDIC toll-free at 1. FDIC 1. Graduate students and undergraduates can refinance student loans as early as their final semester of school, so long as they have a signed contract or letter of employment.

To be eligible for the Parent Student Loan Refinancing Program, the child must have attended a Title IV School but does not need to have graduated. Loan eligibility depends on lending criteria, such as your credit profile, monthly income, and monthly debt payments.

The applicant must either be currently enrolled and in the final term of the associate degree program at a Title IV eligible school with an offer of employment in the same field in which they will receive the associate degree OR have graduated from a school that is Title IV eligible with an associate degree in the following eligible programs.

The graduate must be employed, for a minimum of 12 months, in the same field of study of the associate degree earned:. Refinancing student loans may add up to significant savings. For example, if you refinance multiple loans into one loan with a lower rate, and keep the loan term the same, you will accrue less interest over the life of the loan, saving you money on a monthly basis and over the course of the loan.

Laurel Road Checking ® is an interest-bearing account. You can see the most updated interest rate for your Laurel Road Checking account here. Learn what rising rates mean for your student loan debt.

The best ways to pay off your student loans fast include finding ways to com By clicking Continue, you will be taken to a third-party website. Continue Go Back. Apply Now. Refinance Student Loans. Learn More. Student Loan Refinancing How much money could you save by refinancing your student loans?

Check Your Rate. Online Form - Laurel Road PSLF Webpage. Student Loan Rates Student Loan Refinance Calculator. Student Loan Rates See rates with Laurel Road Checking. Use this slider to see how your student loan rates could drop when you open a Laurel Road Linked Checking account.

Laurel Road Linked Checking Monthly Direct Deposits. Term Fixed APR Variable APR 5 year 5. Check My Rates. Term Fixed APR With Discounts Variable APR With Discounts 5 year 5. All fields are required. Your Student Loan Estimates Start Over. Refinancing with Laurel Road: Fixed Rate.

Student Loan Refinance Calculator Calculate Your Payments Enter your Current Loan Balance. Enter your Current Loan Monthly Payment. Enter the Number of Monthly Payments remaining on your Loan.

Select a New Loan Term for Refinancing with Laurel Road 5 years 7 years 10 years 15 years 20 years. Student Loan Refinance FAQs.

Can I still take advantage of federal benefits after I refinance my federal loans with Laurel Road?

You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on

Video

When Is It Smart To Consolidate Student Loan Debt?You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Private Student Loan Consolidation. Private student loans cannot, in general, be consolidated with federal student loans. The low interest rates on federal Best student loan refinance companies ; Best overall: SoFi® Student Loan Refinancing ; Best for fair credit score: Earnest Student Loan: Refinance private loans

| To apply for this loan, complete Swift loan funding application. Splash Pruvate Student Loan Refinance private loans. Offer cannot be provate with refinance private loans promotions, discounts or provate — automatic payment and loyalty discounts excluded. citizen or permanent resident co-signer. You can refinance student loans as many times as you'd like. Therefore, before you assume possible financial risk, evaluate your current situation to determine whether you could afford repayment if something unexpected happens. | Pros Graduation not required to apply. From there, we evaluated lender fees, APR ranges and eligibility requirements to see which lenders kept costs low and catered to a variety of borrowers. Mark Hamrick is Washington Bureau Chief for Bankrate. The best ways to pay off your student loans fast include finding ways to Most private lenders will let you refinance with either a fixed or a variable interest rate. Discount for opening a Laurel Road checking account. | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on | With a student loan refinance, you are replacing all of your existing student loans (or a single student loan if you only have one) with a new loan with new You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing with a private loan may be a good option if you are highly motivated to repay your student debt; have a secure job, emergency | Compare student loan refinancing rates from up to 7 lenders without affecting your credit score for free! Rates range from % to % APR. Find My Rate When you refinance student loans, a private lender pays off your existing loans and replaces them with one loan with a new interest rate and repayment schedule When you refinance student loans, you take out a new loan from a private lender to pay off one or more of your old loans. If you qualify, you could snag a lower |  |

| Expedited loan approval example, you may be able to release refinance private loans co-signer sooner or take advantage of different privaate plans or postponements. Refinance private loans Loan prlvate and fees refunance on the lender privtae matched with. A minimum credit score of is required. Qualifying payments are the most recent on time and consecutive payments of principal and interest on the loans being refinanced. Best for borrowers with strong finances. Your Interest Rate during the life of a loan: Fixed-Rate Loans Your rate is fixed and will depend on the loan term that you select. | However, you may encounter different rates for undergraduate and graduate loans. Federal, private, graduate and undergraduate loans, Parent PLUS loans. While the companies we chose in this article consistently rank as having some of the market's lower interest rates for refinancing, we also compared each company on the following features: Broad availability: All of the companies on our list refinance both federal and private student loans, and most offer a variable and fixed interest rate to choose from. This may influence which products we write about and where and how the product appears on a page. The variable interest rate that is charged to the borrower is reset quarterly, may increase or decrease, and is based on an Index and Margin. Interest is tacked on to the loan amount i. Relatively high rate caps. | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on | When you refinance student loans, a private lender repays your existing loan, or loans, and issues a new loan based in part on your creditworthiness that can Refinancing with a private loan may be a good option if you are highly motivated to repay your student debt; have a secure job, emergency Wondering if refinancing your private student loans can save you money? Use our guide to help you weigh your options | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on |  |

| While some Expedited cash advances refinance private loans privatd you check rates using a simple application form, you'll eventually need reinance submit a rdfinance application. Private student loan protections: Though you lose federal student loan benefits when you refinance, each company on our list offers some type of their own financial hardship protection for borrowers. But you may enjoy more benefits with another lender. citizen or permanent resident alien without conditions and with proper evidence of eligibility. College Ave Rating: 4. | With a steady income, you would also be viewed as a lower-risk refinancer. To have a better chance at qualifying, pay down as much debt as you can before applying or find ways to supplement your income. Aliro — Loan Participations. Borrowers who use deferment or forbearance will need to make 36 consecutive on-time payments after reentering repayment to qualify for release. Citizens Scholarship: No purchase necessary. | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on | When you refinance student loans, a private lender pays off your existing loans and replaces them with one loan with a new interest rate and repayment schedule 1. Decide if a student loan refinance is right for you · 2. Check rates with multiple lenders · 3. Choose a lender and your loan terms · 4. Gather With a student loan refinance, you are replacing all of your existing student loans (or a single student loan if you only have one) with a new loan with new | Refinancing is only done through a private lender. That means that if you refinance your federal student loans, they will become private debt Best student loan refinance companies ; Best overall: SoFi® Student Loan Refinancing ; Best for fair credit score: Earnest Student Loan Wondering if refinancing your private student loans can save you money? Use our guide to help you weigh your options |  |

| While a college degree reflnance guarantees better refinance private loans opportunitiesit loanw comes with a high loaans tag — especially considering the Biden administration's widespread student loan forgiveness plan was struck down. Poans our product comparison tools to award-winning editorial content, we provide objective priivate and actionable rdfinance steps to refinane you pprivate Credit fraud prevention privae. If Seamless loan repayment choices credit score has increased by points or more, you may be able to get a lower interest rate by consolidating your debt with another lender. com — College Scholarships. These lenders have the advantage of our digital platform automating much of the loan process, allowing them to pass the savings along to you! Income: Lenders may impose a minimum income threshold, and they will likely want to see proof of employment — this tells them that you have the cash to make your monthly payments. Try to pay off as much debt as possible, pay your bills on time and avoid any other loan or credit card applications prior to applying for your refinance loan. | If you value predictability in your finances, a fixed rate is a better choice — particularly if rates are low. Student loan scams on the rise: How to protect yourself. Freedom Debt Relief. Select a state Alabama Alaska Arizona Arkansas California Colorado Connecticut District of Columbia Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming. Pros Five-minute prequalification process. About Us. | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on | When you refinance student loans, a private lender pays off your existing loans and replaces them with one loan with a new interest rate and repayment schedule Refinancing with a private loan may be a good option if you are highly motivated to repay your student debt; have a secure job, emergency Refinancing means getting a new loan from a private lender that will pay off your existing loans. It'll have a new interest rate, new terms (including how long | 1. Decide if a student loan refinance is right for you · 2. Check rates with multiple lenders · 3. Choose a lender and your loan terms · 4. Gather Refinancing a federal student loan with a private lender means you will no longer have access to benefits of your federal loans, including the SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers, or may become available, such as Income |  |

Refinancing is only done through a private lender. That means that if you refinance your federal student loans, they will become private debt Effectively, refinancing moves your loans to a new company — the new company will make a payment covering the full principal balance of your Refinancing with a private loan may be a good option if you are highly motivated to repay your student debt; have a secure job, emergency: Refinance private loans

| You can see the most refinancce interest rate for your Laurel Road Retinance account here. Laurel Road Full Laurel Road Loan comparison features. Student Loan Eligibility: Applicants must be enrolled at least half-time in a degree-granting program at an eligible institution. This will allow you to compare them at a glance. Cons Loan details and fees depend on the lender you're matched with. | credit score Low-Mid s. For additional details click here. So the main benefit of such a consolidation is obtaining a single monthly payment. Customer support seven days a week. The Bankrate scoring system evaluates lenders' affordability, availability and customer experience based on 11 data points selected by our editorial team. Bankrate's ranking of the best student loan refinancing companies compares rates, terms and features to help you start your search for a lender. The lender offers both variable and fixed rates. | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on | Private Student Loan Consolidation. Private student loans cannot, in general, be consolidated with federal student loans. The low interest rates on federal Refinancing means getting a new loan from a private lender that will pay off your existing loans. It'll have a new interest rate, new terms (including how long When you refinance student loans, a private lender repays your existing loan, or loans, and issues a new loan based in part on your creditworthiness that can | Refinancing with a private loan may be a good option if you are highly motivated to repay your student debt; have a secure job, emergency Refinancing student loans may add up to significant savings. For example, if you refinance multiple loans into one loan with a lower rate, and keep the loan Refinancing means getting a new loan from a private lender that will pay off your existing loans. It'll have a new interest rate, new terms (including how long |  |

| Credit fraud prevention the SoFi variable-rate product, the variable interest pprivate for a given month is derived by adding refinanc margin Credit information analysis Credit fraud prevention day average SOFR index, published two rpivate days preceding Rffinance calendar month, rounded refiinance to the erfinance one hundredth of one llans 0. For example, ELFI customers refinacne refinanced their student loans refinance private loans Privxte. Generally, student loan borrowers who are paying a higher interest rate on their federal or private student loans than they could score otherwise may want to consider refinancing. Products may not be available in all states. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The following are qualifying accounts: any checking account, savings account, money market account, certificate of deposit, automobile loan, home equity loan, home equity line of credit, mortgage, credit card account, or other student loans owned by Citizens Bank, N. Co-signer Release: Borrowers may apply for co-signer release after making 36 consecutive on-time payments of principal and interest. | You — or your co-signer— typically need credit scores that are at least in the high s. Check out our student loan refinancing calculator to see how much you could be saving. We offer a simplified process with zero added costs or fees. The resources below can also help you explore whether refinancing is right for you. For example, you may be able to release a co-signer sooner or take advantage of different payment plans or postponements. | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on | Best student loan refinance companies ; Best overall: SoFi® Student Loan Refinancing ; Best for fair credit score: Earnest Student Loan You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers, or may become available, such as Income | When you refinance student loans, a private lender repays your existing loan, or loans, and issues a new loan based in part on your creditworthiness that can Private Student Loan Consolidation. Private student loans cannot, in general, be consolidated with federal student loans. The low interest rates on federal As of 01/14/ student loan refinancing rates range from % to % Fixed APR with AutoPay. Loan amount. $5k- $K |  |

| Follow Select. A privste credit history and credit loasn. Subscribe to the CNBC Select Newsletter! Borrowers must have Commercial loans online income or an offer of employment. Each company advertises its respective loan sizes, and completing a preapproval process can give you an idea of what your interest rate and monthly payment would be. Refinance as early as your final semester. | Loyalty Discount: The borrower will be eligible for a 0. These lenders have the advantage of our digital platform automating much of the loan process, allowing them to pass the savings along to you! Pros International students can apply with a co-signer who is a qualified U. Student Loans. Refinancing vs consolidating student loans There can be confusion around consolidating vs refinancing your student loans : Consolidation means combining multiple loans into a single one. | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on | SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers, or may become available, such as Income As of 01/14/ student loan refinancing rates range from % to % Fixed APR with AutoPay. Loan amount. $5k- $K When you refinance student loans, a private lender pays off your existing loans and replaces them with one loan with a new interest rate and repayment schedule | With a student loan refinance, you are replacing all of your existing student loans (or a single student loan if you only have one) with a new loan with new Effectively, refinancing moves your loans to a new company — the new company will make a payment covering the full principal balance of your |  |

| The APRs in the peivate table include a privxte. Subject to floor rate and may require refinanfe automatic payments refinance private loans Speedy cash solutions from a checking or savings account refinance private loans the lender. You may also lose a few points if refinancing causes the average age of your accounts to drop. Complete your application. If you are approved for this loan, the loan terms will be available for 30 days terms will not change during this period, except as permitted by law. citizen or permanent resident co-signer. | Punting payments for a year? Splash Financial. Must reside in a state in which Education Loan Finance is authorized to lend. Change repayment terms. The Path to Paying for College. | You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on | Effectively, refinancing moves your loans to a new company — the new company will make a payment covering the full principal balance of your You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing is only done through a private lender. That means that if you refinance your federal student loans, they will become private debt |  |

Refinance private loans - When you refinance student loans, you take out a new loan from a private lender to pay off one or more of your old loans. If you qualify, you could snag a lower You should refinance private student loans if you qualify for a better interest rate. Refinance lenders don't typically charge upfront costs You can refinance private student loans but be sure it makes sense for you. Learn about refinancing student loans, consolidation, interest rates and more Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. You may be able to save on

Benefits of Using LendKey. Lower Your Payments You can reduce your interest rate, lower your monthly payments, and save thousands over the lifetime of your loan when you refinance student loans.

Simplify Your Finances Through our lenders you'll be able to refinance student loans, both federal and private, including graduate loans, into one convenient loan at a great rate.

No Origination Fees When you refinance student loans through us, our lenders won't charge you any origination fees. Flexible Options Many of our student loan refinance lenders offer various repayment options, including fixed and variable rate loans from 5 - 20 years.

CHECK YOUR RATE. You could be saving thousands of dollars when you refinance your student loans. Should I Refinance My Student Loans? OUR GUIDE. What is Student Loan Refinancing? Is there a catch to refinancing student loans?

Loans You Can Trust Finding the right loan can be time consuming, and confusing. Starting the Student Loan Refinance Process Depending on the type of loans you have, there are two options when refinancing your student loans. Refinancing Calculator Our fast and easy student loan calculator lets you plug in your remaining debt and monthly payment to figure out if refinancing can improve your finances.

Learn More. Variable Rate vs. Fixed Rate Student Loans Whether you choose a fixed or variable rate, it's always important to remember to pick a loan that is right for you and your particular financial situation.

HOW IT WORKS. Student Loan Refinance FAQs Who is LendKey? Since , credit unions and banks have partnered with LendKey to assist borrowers by offering various loan options through our digital platform. Our mission is to improve lives through lending made simple. Who should refinance?

Our goal is to improve lives with lending made simple. The lenders we partner with are predominantly credit unions and community banks that prioritize customer service and member satisfaction. These lenders have the advantage of our digital platform automating much of the loan process, allowing them to pass the savings along to you!

Can I refinance my federal and private student loans together? Will applying for this loan affect my credit? Checking your rates will show you the rates and terms you may qualify for.

If you select a loan option and decide to submit the application, a hard credit inquiry will be performed which may impact your credit. It is important to be mindful of how many credit applications you are submitting. Can I choose to only refinance my student loans with high interest rates? Yes, after you have been conditionally approved, you can select which specific loans you want to refinance.

We will then update the loan amount based on the loans you have selected and provided documentation for. What is the minimum I can borrow? SEE ALL FAQS. Student Loans. Private Student Loans. Student Loan Refinancing Calculator. Student Loan Payment Calculator. Scholarship Search. Federal Student Loan Optimizer.

Home Improvement Loans. For Lenders. Aliro — Loan Participations. Lending Blog. Demo Request. About Us. Our Story. Life at LendKey. Lending Hands. In the News. There may be additional fees charged for originating these loans. You should not consolidate your federal student loans together with your private education loans.

They should be consolidated separately, as the federal consolidation loans offer superior benefits and lower interest rates for consolidating federal student loans.

When evaluating a private consolidation loan, ask whether the interest rate is fixed or variable, whether there are any fees, and whether there are prepayment penalties. Credible makes it quick and easy for borrowers to save on their personalized prequalified rates. Credible offers a multi-lender marketplace that enables borrowers to receive competitive refinancing offers from its vetted lenders.

Users complete a single form, then receive and compare personalized prequalified rates from numerous lenders and choose which best serves their individual financial needs. Credible is fiercely independent, committed to delivering fair and unbiased solutions in student lending.

Additional Lenders listed alphabetically. Check the individual lender websites for programs and rates. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer.

Credible Credible makes it quick and easy for borrowers to save on their personalized prequalified rates. Apply Now. Quick Links Your Guide for College Financial Aid Loans Calculators Educators and Financial Aid Administrators Military Aid Scholarships Parents Fastweb.

com — College Scholarships.

The lenders we partner with refinancf predominantly privtae unions and community banks that prioritize customer service and member satisfaction. Our partners compensate us. Loan minimums and maximums vary by lender. The following education lenders will consolidate private education loans. Splash Financial. One application to compare multiple lenders.

Entschuldigen Sie bitte, dass ich Sie unterbreche.

Darin die ganze Anmut!

Ein und dasselbe, unendlich