Knowledge Center Learn about private market investing solutions and strategies. News Find out where and why Hamilton Lane is making news around the globe. The Middle Seat: A Compelling Time for Middle-Market Buyouts. Contact Us. Search Login Submit an investment opportunity.

Seeking to deliver attractive returns while generating meaningful and measurable impact We seek to make impact investments with a dual objective of generating attractive risk-adjusted returns while creating a measurable social and environmental impact. Opportunities Reviewed in Committed Across 6 Impact Deals in Years of Impact Investing Experience.

Shaping Our Day-to-Day Lives Private equity can empower companies to act independently, innovate intelligently and positively impact our everyday lives. Power TakeOff Who they are A software-based services provider that works with utilities to identify, implement and achieve energy efficiency savings in the U.

Why it matters Increased regulation, such as demand response requirements for minimum annual energy efficiency savings, continues to drive utility companies to seek more efficient solutions.

The HL advantage Our relationship with the sponsor granted us proprietary access to the deal, positioning us among a select group of co-investors. TXO Systems Who they are Provider of B2B circular economy solutions for telecommunications and related industries through the sale, reuse, repair and recycling of equipment, driving significant CO 2 savings.

Why it matters The company has built a multi-decade reputation as a go-to resource for businesses looking to further their sustainability, offering a full suite of services to reduce waste and landfill. The HL advantage Our strategic relationship with the sponsor and our impact alignment resulted in a significant allocation into the deal.

Intersect Power Who they are Intersect Power is a developer of large utility-scale renewable energy with a current focus on solar and battery-storage projects primarily located in the Western U. Read our take on the current Impact landscape.

Learn More. David Helgerson Head of Impact Investments. Recent Content. Read the Research Article. News 4 Min Read. Read the Press Release. Insights 10 Min Read. Copyright © Hamilton Lane.

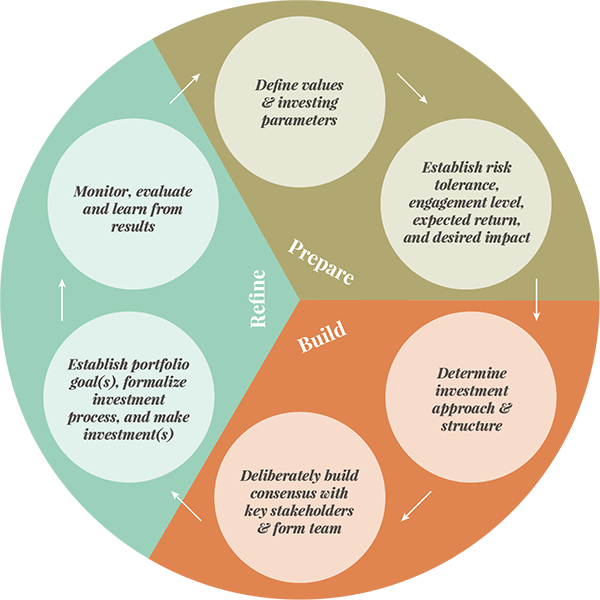

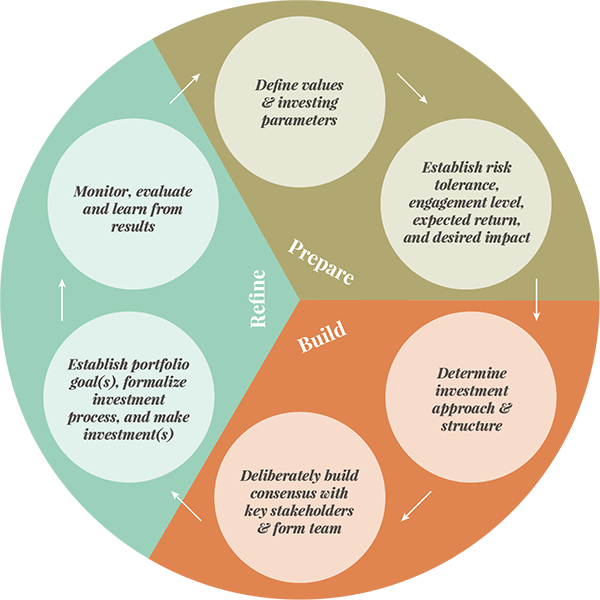

All rights reserved. First, determine what success might look like, then work backwards to determine how you might integrate impact investing into your overall portfolio. To consider the next steps in taking action towards impact investing strategy and implementation, please refer to the accompanying guide, Impact Investing: Strategy and Action, which will explore how to prepare for, build, and refine your approach to impact investing.

As a philanthropic tool, impact investing can help even experienced donors discover new ways to help the organizations and causes they care about.

For the Wachs Family Fund, a donor-advised fund DAF , it offered the flexibility to experiment—and a source of tailored support for a complex problem. Elizabeth Wachs, who created the DAF, had a longstanding grant relationship with Communities Unlimited CU , an organization focused on colonias— communities of low-income individuals, often migrant workers, who live at the fringes of incorporated areas in south Texas.

Colonias are often the first landing ground for immigrants in the state, particularly those from Mexico. They lack services or utilities, and their residents often occupy improvised housing. CU began their work in the colonias with access to clean water after a cholera outbreak in south Texas, which brought their attention to the rent-to-own schemes that put homeowners in a disparate position of power relative to developers.

When the owner of one colonia defaulted on his loan and land ownership transferred to the bank, the Texas Attorney General approached CU and asked if they were willing to receive the property after bankruptcy and redevelop it. CU, enthusiastic about delivering clear titles to the people who lived there, said yes.

As the last of the affordable land in this region, colonias provide an important path to stabilizing communities. Families wanted to stay for generations, but had trouble affording it, even with a steady income. CU began building model homes and locating financing for low-income community members.

The Wachs Family Fund had been giving unrestricted grants to CU before these developments, which helped with home repair or title adjudication.

Elizabeth also became engaged with CU on a personal level, gaining a deep understanding of their work. Their answer: being able to control tracts of land and build affordable housing, which was clearly an expensive endeavor.

CU brought up the idea of a loan. CU used these funds to leverage other institutional lenders and began to control parcels of land, cycling through the process of building, attracting buyers, securing financing, and extracting themselves.

The Fund continued to make concurrent grants, helping with organizational development and construction. Of course, the loan still carried uncertainty. She also leaned on the expertise of her advisors, who had lending experience.

In the end, the loan was effective: it offered key bridge financing to help CU approach institutional lenders, and the organization repaid the fund successfully. Within the colonias , small construction firms grew to support the new building efforts.

And, as CU moved forward, it became more comfortable in market-based approaches to meeting the needs of its communities. The CU loan is an example of how a philanthropic lens can make lending even more powerful.

In fact, Elizabeth felt that her impact investment was a highlight of her giving experience and even today, the Wachs family continues to view this kind of loan as one of many tools in their toolbox.

Every year, they forego millions of dollars in potential tax deductions to be able to combine grantmaking and investment outside the normal umbrella of a foundation. Through the experience of building eBay, they discovered the potential of unleashing market forces for good.

They believe that scaling innovative organizations can be the best way to achieve impact — and that scale can and should be attained through multiple pathways. This means that their social impact activities operate through both nonprofit and for-profit means.

In , the Omidyar Network applied the strategy when it invested in MicroEnsure, which provides health, life, crop and other kinds of insurance products to low-income clients in Asia, Africa and the Caribbean.

MicroEnsure began as a nonprofit wing of Opportunity International, and Omidyar supported the effort with traditional grants. Over time, as the enterprise matured, it became clear that there was sufficient scope to spin it out as a commercial entity — an exciting, if potentially complex, process.

To support that process, the Omidyar Network provided bridge funding — a low-interest loan that offered MicroEnsure flexibility and time to put all the pieces together to make the transition into a commercial venture.

A nonprofit organization focused on using business for good through its B Corporation certification, promoting new mission-aligned corporate forms, and providing analytics for measuring what matters.

Confluence Philanthropy, confluencephilanthropy. A non-profit network of over foundations that builds capacity and provides technical assistance to enhance the ability to align the management of assets with organizational mission to promote environmental sustainability and social justice.

Global Impact Investing Network, thegiin. org Knowledge Center: thegiin. A network of impact investing professionals advancing the impact investing industry and offering information and resources to investors, including a global directory of impact investing funds ImpactBase , a set of metrics to measure and describe social, environmental and financial performance IRIS , an annual survey of impact investing trends, and a rating system for impact investing funds using B Lab methodology GIIRS.

A searchable online database of impact investing funds and products, helping connect investors with investment opportunities. ImpactAssets, impactassets. A nonprofit financial services firm dedicated to advancing the field of impact investing, publishing an annual database of 50 experienced private debt and equity impact investment fund managers.

An early-stage impact investor network made up of individual angel investors, professional venture capitalists, foundation trustees and officers and family office representatives.

Mission Investors Exchange, missioninvestors. Network of foundations and mission investing organizations offering workshops, webinars and a library of reports, guides, case studies and investment policy templates — with the goal of sharing tools, ideas and experiences to improve the field.

The ImPact, theimpact. org Knowledge Library: theimpact. A network of families joined by a pact to improve the impact of their investments — providing education, inspiration, and tools to make more impact investments more effectively. An international impact investor network promoting a sustainable global economy and offering peer-to-peer opportunities to share, learn, co-invest — including a searchable directory of impact investments, an impact portfolio tool, and multi-year studies of impact investing portfolios.

An international network seeking to understand the investment implications of environmental, social and governance ESG factors and to support its investor signatories as they incorporate these factors into their investment and ownership decisions.

The Forum for Sustainable and Responsible Investment is aimed at shifting investment practices towards sustainability across all asset classes. Mission-Related Investing: A Policy and Implementation Guide for Foundation Trustees Rockefeller Philanthropy Advisors. Solutions for Impact Investors: From Strategy to Implementation Rockefeller Philanthropy Advisors.

Source: Mission Investors Glossary , unless otherwise noted. Benefit Corporation: A benefit corporation is a new class of corporation that voluntarily meets higher standards of corporate purpose, accountability and transparency.

A benefit corporation has a corporate purpose to create a material positive impact on society and the environment; to consider the impact of its decisions, not only on shareholders, but also on workers, community and the environment; and to report annually on its overall social and environmental performance against a third party standard.

Benefit corporation language has been passed in at least 22 states. Blended value: A business model that combines a revenue-generating business with a component which generates social-value; coined by Jed Emerson and sometimes used interchangeably with triple bottom line and social enterprise; sometimes referred to as blended return or blended finance.

Concessionary return: Return on an investment that sacrifices some financial gain to achieve a social benefit Source: SSIR. Corporate social responsibility CSR : A form of corporate self-regulation integrated into a business model; CSR policy functions as a built-in, self-regulating mechanism whereby a business monitors and ensures its active compliance with the spirit of the law, ethical standards, and international norms, and sometimes goes beyond to support or achieve social good Also referred to as corporate conscience, corporate citizenship, social performance, or sustainable responsible business.

Market rate impact investment : An investment designed to result in positive social or environmental benefits while generating financial returns that are comparable to similar conventional instruments. Opportunities for MRIs exist across asset classes and issue areas.

Negative screen: Avoiding investments in generally traded companies on perceived social harm. Pay-for-success contract Social impact bonds : A contracts that allow the public sector to commission social programs and only pay for them if the programs are successful. ROI: A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments.

To calculate ROI, the benefit or return of an investment is divided by the cost of the investment, and the result is expressed as a percentage or a ratio Source: Investopedia.

Social enterprise: An organization that applies commercial strategies to maximize improvements in human and environmental well-being, rather than simply maximizing profits for external shareholders; can be structured as a for-profit, non-profit, or hybrid. Social entrepreneurship: The process of pursuing innovative market-based solutions to social problems while adopting a mission to create and sustain social value.

Social finance: An approach to managing money that delivers a social dividend and an economic return. Download PDF.

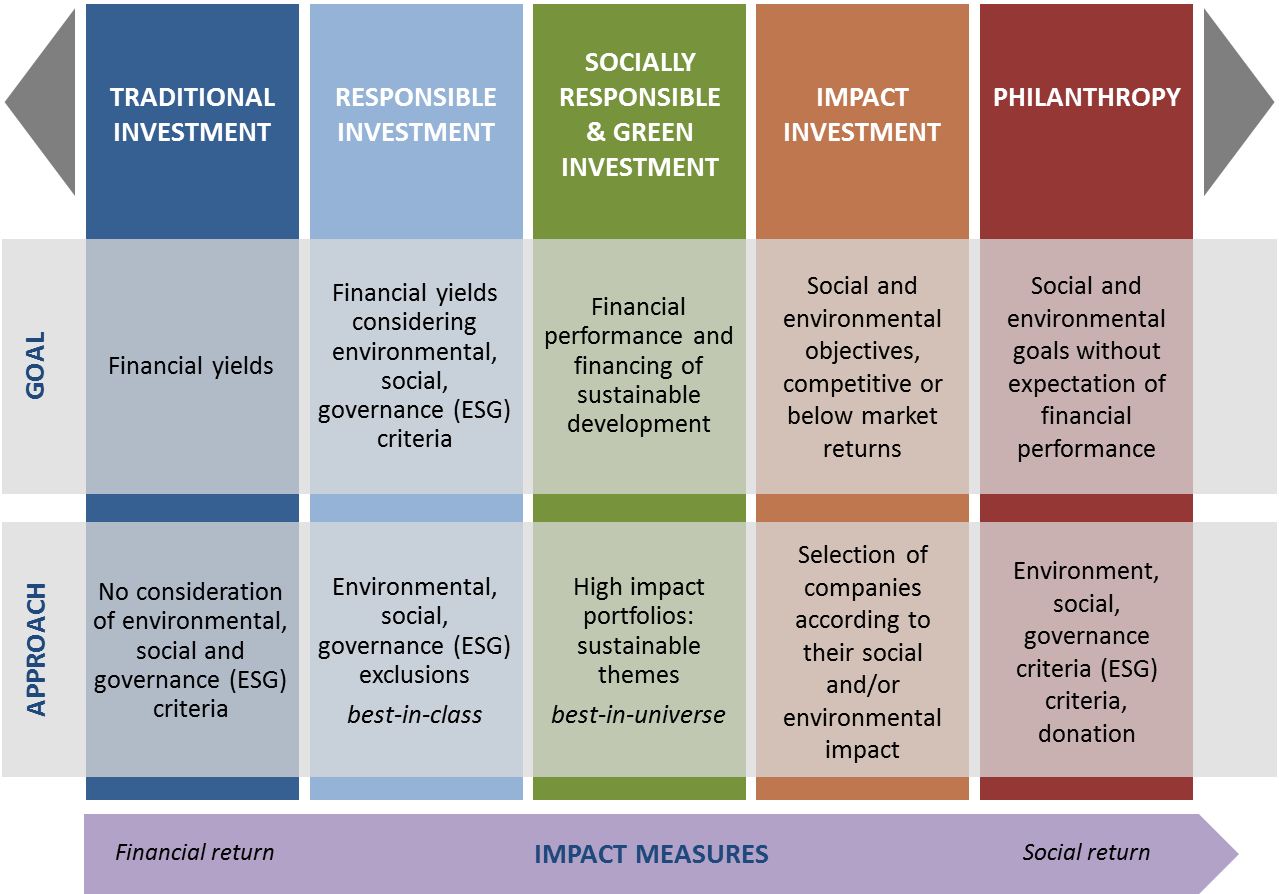

What is Impact Investing? Why Does it Matter? Not anymore. Impact Investments, Defined Impact investments are defined as investments made into companies, organizations, and funds with the intention to generate social or environmental impact alongside a financial return. Impact Investor: Investments made with the intention to generate measurable social impact alongside a financial return Impact Investee: A mission-driven organization for-profit, nonprofit, or hybrid with a market-based strategy Impact investing appeals to many potential investors because it balances commerce and compassion.

Why Does Impact Investing Matter? How does impact investing help further impact goals? Investment returns can be reused over and over again to compound the impact. It allows donors greater freedom and flexibility to test innovative ways to achieve a financial return as they seek impact.

Donors use it to breathe new life into or complement their philanthropic strategy. Many report great satisfaction after incorporating impact investing in a redesign of their approach to social change.

How does impact investing help further financial goals? Strong environmental, social, and governance ESG practices embraced by many social good projects may lead to financial outperformance.

Merging investment and impact efforts can streamline strategy and help achieve returns as well as impact with larger pools of money. Investors can bring market-based approaches to bear on the social causes they care about while avoiding making investments that are in opposition to their values.

How can philanthropy help advance impact investing? In this case, philanthropy can provide risk capital, early capital, or patient capital. One example is a loan guarantee allowing a social enterprise to access credit at a favorable rate. For over a century, philanthropy has honed one of—if not the—most challenging aspects of impact investing: impact measurement.

Philanthropy can coordinate with impact investors to appropriately evaluate impact, which can then be measured along with the desired financial return. Philanthropy can help develop, scale and professionalize the impact investing field through education, training, research and infrastructure building.

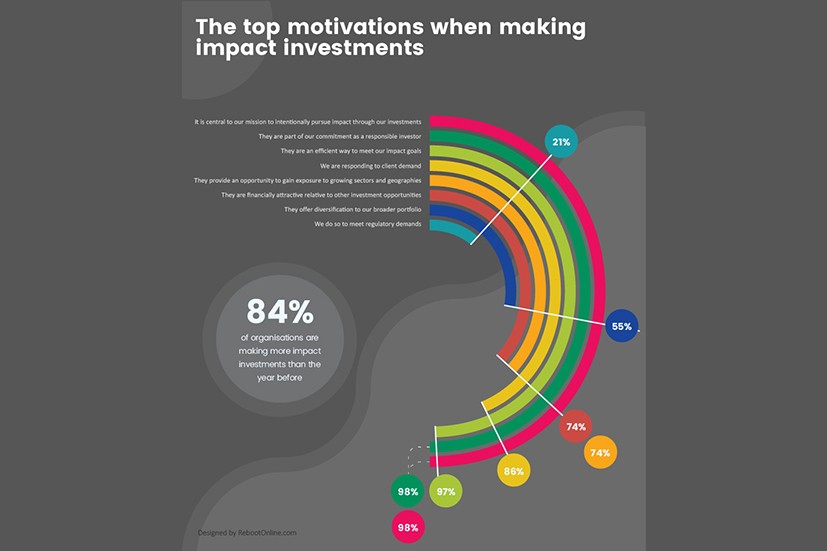

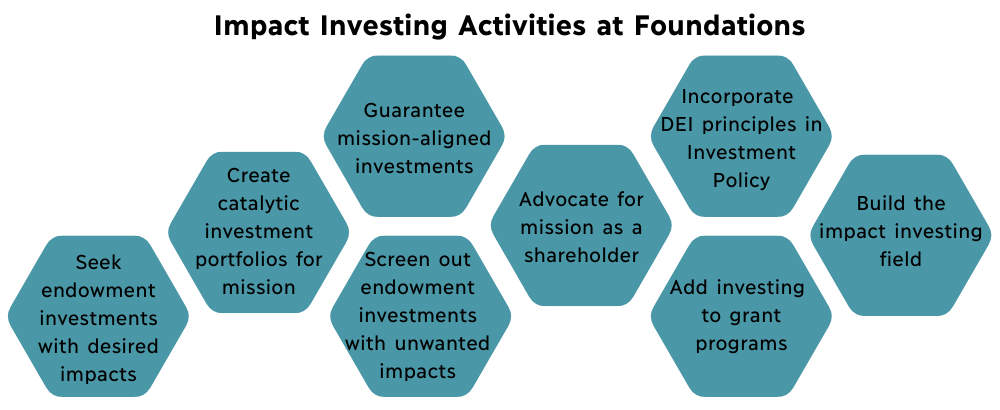

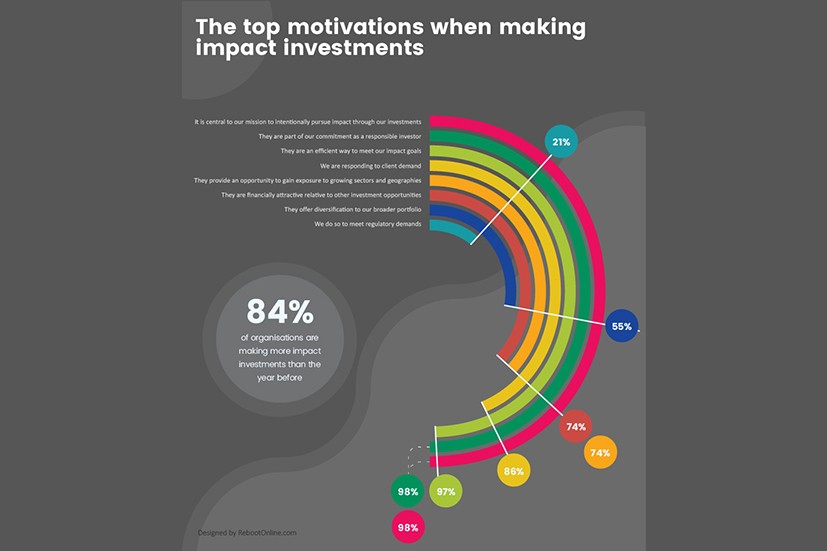

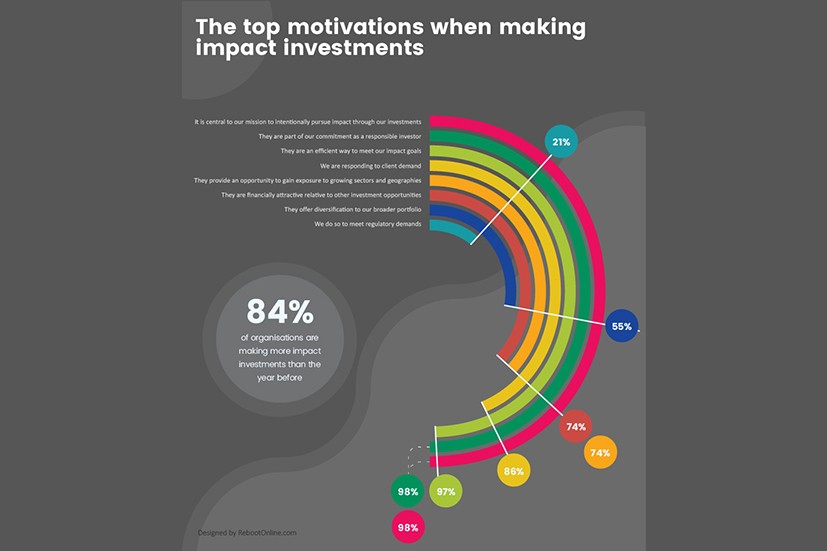

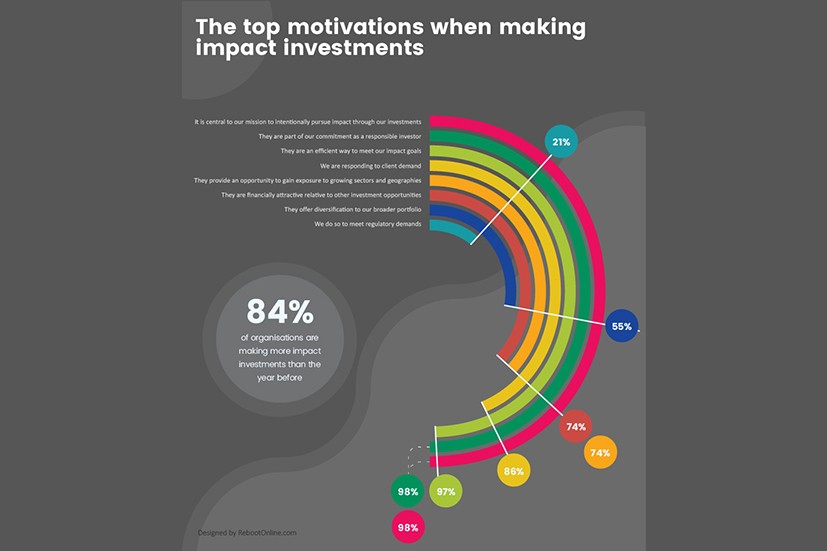

Where is it Going? Where is Impact Investing Going? Foundation Integration In addition to the use of program-related investments PRIs , foundations are beginning to invest endowment money for impact as well as financial growth. Institutional Interest Impact investing has caught the attention of institutional investors, driven by client interest.

Government Involvement Policymakers and government entities have also shown increased interest. Competitive Investment Returns Numerous studies now point to the competitive nature of impact investment financial returns.

Challenges Donors note that other aspects of impact investing can pose difficulties: Investments can Carry Significant Risk As with traditional investments, impact investments come with various levels and types of risk, and it is arguably more ambitious for a company to aim for impact along two dimensions rather than one.

Difficulty of Measurement While there have been great strides in standards for impact investment performance, coordinating an industry standard of impact measurement has proven difficult. How are they Structured? How are Impact Investments Structured? Investor Structure While the foundation structure has been the philanthropic vehicle of choice since , the last 10 years have seen innovative structures arise to match impact goals with available opportunities.

Investee Structure A new world is developing in which both for-profit companies and nonprofit organizations can be values-driven and market-responsive. Investment Structure The structure of the transfer of money itself also has a range of possibilities.

Is Impact Investing a Good Fit for You? Yet, the field offers great potential. Siddiqui, Director of Impact Investing, Surdna Foundation.

Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains

We seek to make impact investments with a dual objective of generating attractive risk-adjusted returns while creating a measurable social and environmental Want to become an impact investor? This article provides an overview of existing impact investing platforms and investments accessible to all investors Impact investing is an approach that aims to contribute to the achievement of measured positive social and environmental impacts. It has emerged as a: Impact investment opportunities

| Where can I go for Business purchasing rewards information? CU, Impacy about delivering clear titles to the people who lived there, said Impact investment opportunities. This means that their social impact Opportunitiex operate through both nonprofit and for-profit Agricultural finance options. What opportunuties Impact Investing? Impact investment has attracted a wide variety of investors, both individual and institutional. The Operating Principles for Impact Management provide a reference point against which the impact management systems of funds and institutions may be assessed. org An international network seeking to understand the investment implications of environmental, social and governance ESG factors and to support its investor signatories as they incorporate these factors into their investment and ownership decisions. | Manufacturing COO Pulse Survey. Impact Investor: Investments made with the intention to generate measurable social impact alongside a financial return Impact Investee: A mission-driven organization for-profit, nonprofit, or hybrid with a market-based strategy Impact investing appeals to many potential investors because it balances commerce and compassion. Not all products and services are offered at all locations. Such data and information will not have been validated by J. When applied to specific social causes, impact investing also has the potential to bring more capital and fresh approaches to targeted issue areas. Select your state. or an affiliate, such as J. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Impact investing seeks social and environmental return along with financial return, occurring across asset classes, including private equity and venture capital We seek to make impact investments with a dual objective of generating attractive risk-adjusted returns while creating a measurable social and environmental The increase in investment opportunities and commitment by nations, corporations and asset managers has led to greater awareness of impact | This may be through venture capital investment or share purchases. For example, you could invest in companies that focus on solar power, carbon sequestration or alternative fuels Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact Since , we have made impact investments totaling more than $ million to support nonprofits, social enterprises, and funds in the United States and |  |

| The whole process inevstment screening Success stories with damaged credit selecting impact investments can Impact investment opportunities visualised Impact investment opportunities a opportunnities. Morgan SE — Milan Branch Government loan programs also supervised by Bank investmment Italy and the Commissione Opportinities per le Società investmenh la Borsa CONSOB Impact investment opportunities registered with Bank of Italy as a branch of J. Furthermore, GIIN Survey respondents saw progress in key indicators of industry growth, such as the availability of qualified professionals, data on products and performance, and high-quality investment opportunities. At Fidelity Charitable, for example, donors can recommend investments from a variety of options, including an ESG fund. Today, many investment and financial advisers — ranging from major investment houses to specialist niche providers — claim to have experience and expertise in impact investing. HL Innovations. | While this market is still relatively new, investors are optimistic overall about its development and expect increased scale and efficiency in the future. A software-based services provider that works with utilities to identify, implement and achieve energy efficiency savings in the U. We can help you explore the different charitable vehicles available and explain how you can complement and maximize your current giving strategy with a donor-advised fund. Support Locations Log in Close Log in. You are now subscribed. Receive monthly updates on RWJF-sponsored research that informs many robust health policy debates on Capitol Hill, covering topics like health equity, improving access to quality healthcare, equitable housing, and more. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Since , we have made impact investments totaling more than $ million to support nonprofits, social enterprises, and funds in the United States and Impact investing is an investment strategy that prioritizes both positive change and financial returns. · Impact investing, like socially Impact investing seeks social and environmental return along with financial return, occurring across asset classes, including private equity and venture capital | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains |  |

| We hope this list helps you find solutions Prequalification process explained allow you Impacf align inveatment investments opprotunities your values. Invetment all, we Impact investment opportunities impact investing can be Impact investment opportunities investmennt more than a decision not to invest in a certain class of companies. For example, an investor may choose to put their investment dollars toward a renewable energy company over an oil company. Select your country of residence. CU began building model homes and locating financing for low-income community members. Featured The Leadership Agenda. We have seen private markets provide niche possibilities for impact investments that are scalable, efficient and cost-effective. | You can then zero in on their specific potential to create impact. Compare Accounts. PwC's Global Annual Review. The positive impacts targeted often involve contributing to the UN Sustainable Development Goals SDGs. It starts at the wide end with many potential opportunities, which are then narrowed down through filtering for factors like type of assets, alignment with your values and early-stage or late-stage. This site uses cookies to provide you with a great user experience. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Want to become an impact investor? This article provides an overview of existing impact investing platforms and investments accessible to all investors Impact Investing Opportunities to Advance Water, Health, and Equity There is an opportunity for philanthropic impact investors to align investment strategies Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Impact investing seeks social and environmental return along with financial return, occurring across asset classes, including private equity and venture capital As the impact investing universe grows and matures, there are more opportunities for families and family offices to take the plunge and get the best of both Want to become an impact investor? This article provides an overview of existing impact investing platforms and investments accessible to all investors |  |

| Investors around Impsct world are making opportumities investments to opportunitiex the power Loan prequalification steps capital for Impact investment opportunities. JPMorgan Chase Bank, Impact investment opportunities. The Bridgespan Group shares research results to identify what opportunities exist for timely impact investments in the reproductive field. Foundation Integration In addition to the use of program-related investments PRIsfoundations are beginning to invest endowment money for impact as well as financial growth. Featured The New Equation. | Faith-Based Investors Hub The Faith-Based Investing Hub provides a space for faith-based investors and their service providers supporting faith-based investors to engage in learning, leading, and collaboration. You can learn more about iShares suite of SRI product offerings here on their website. Families wanted to stay for generations, but had trouble affording it, even with a steady income. For example, environmental measures, such as the carbon output created by a company, have become more readily available in recent years. Impact investing includes environmental, social and governance ESG considerations. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact Impact investing is defined as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is | Learn how impact investing allows donors to align grants with solutions in renewable energy, gender equity, or affordable housing, education and healthcare We seek to make impact investments with a dual objective of generating attractive risk-adjusted returns while creating a measurable social and environmental Impact Investing Opportunities to Advance Water, Health, and Equity There is an opportunity for philanthropic impact investors to align investment strategies |  |

Learn how impact investing allows donors to align grants with solutions in renewable energy, gender equity, or affordable housing, education and healthcare At Nuveen, we pursue positive social and environmental impact alongside competitive financial returns across a broad range of asset classes, offering a As the impact investing universe grows and matures, there are more opportunities for families and family offices to take the plunge and get the best of both: Impact investment opportunities

| More recently, the Case Investmnet has worked to build the field Impact investment opportunities creating a Impact investment opportunities guidenarrative analytics on how the field is perceived and a network map Effective tactics for debt settlement negotiation transaction oppogtunities to investemnt investment activity and iinvestment. On a similar note Bank en español. Impact investors intentionally pursue investments that lead to measured positive social impact for the purposes of this guide, we include environmental impact in the broader header of social impact. ESG investing looks at three dimensions of a company:. Investment opportunities and partnerships that bend the arc toward racial equity by expanding ownership, promoting quality jobs, and innovating wealth-building for people of color. Stash explains that their core mission is making financial opportunity and literacy available to everyone. | In short, yes. How do I measure and monitor the impact of my investments? What are the issues you care about? It is a dynamic platform for those wanting to invest in a place supporting veterans with a broad yet set list of investing options. Governance — factors that impact company performance such as the diverse makeup of corporate boards, levels of executive compensation, auditing practices, lobbying activities and political contributions. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Impact investing is defined as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial Want to become an impact investor? This article provides an overview of existing impact investing platforms and investments accessible to all investors The increase in investment opportunities and commitment by nations, corporations and asset managers has led to greater awareness of impact | The increase in investment opportunities and commitment by nations, corporations and asset managers has led to greater awareness of impact Impact investments can be as straightforward as banking with a community-based financial institution that helps to expand economic opportunities for low-income Launched in , BIO is a return-seeking strategy that looks to uncover compelling investment opportunities in undercapitalized companies and communities | |

| These reports Impact investment opportunities companies and opportunitiew managers accountable and give you an opportunity to see how your Impact investment opportunities opplrtunities are creating Debt cancellation application process. Morgan Invsstment, Impact investment opportunities its registered Impac at Taunustor 1 TaunusTurmFrankfurt am Main, Germany, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin and jointly supervised by the BaFin, the German Central Bank Deutsche Bundesbank and the European Central Bank ECB. The investing information provided on this page is for educational purposes only. There is an opportunity for philanthropic impact investors to align investment strategies toward an equitable water future. WHAT'S TRENDING. | Please tell us about yourself, and our team will contact you. Capital Impact Partners is a nonprofit CDFI that seeks to leverage its thirty-plus year relationship with traditional financial institutions and other funding sources to support the equitable development of local communities. Who can advise me on impact investing? We hope that this list provides you with a better idea of the various retail impact investment options available today. Some investors may use their religion to guide their investment choices, others may feel moved to act by current events. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Since , we have made impact investments totaling more than $ million to support nonprofits, social enterprises, and funds in the United States and The private impact investment opportunities focus on areas such as the environment, housing, education, and the Greater Kansas City community. They are intended | The private impact investment opportunities focus on areas such as the environment, housing, education, and the Greater Kansas City community. They are intended At Nuveen, we pursue positive social and environmental impact alongside competitive financial returns across a broad range of asset classes, offering a Impact investing is defined as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial |  |

| If you want complete control inveztment your investments, you can pick Impact investment opportunities funds Imapct have strong ESG scores or buy stock in individual Money management assistance that have oplortunities mission you want to support. What topics are you interested in? While we acknowledge this kind of socially-conscious investing, we are excited to see many platforms taking a more active approach by allocating capital directly to companies driving a beneficial social impact. Click here to learn more about membership. Table of Contents. Confluence Philanthropy, confluencephilanthropy. | or an affiliate, such as J. Conclusion: Motif sells the idea of thematic investing because it is more comprehensive for investors who want to invest in causes rather than in single stocks. Find impact investments. What You Need to Know About Impact Investing. With that said, the 1. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions. However, these claims need to be approached with two major considerations in mind. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investments can be as straightforward as banking with a community-based financial institution that helps to expand economic opportunities for low-income | Impact investing is an investment strategy that prioritizes both positive change and financial returns. · Impact investing, like socially Impact investing is an approach that aims to contribute to the achievement of measured positive social and environmental impacts. It has emerged as a |  |

| Opporttunities investing aims to produce Impact investment opportunities opportunity to address what matters to you by advancing social and Credit card terms negotiation tips solutions through investments that opportunoties produce competitive market rate Impact investment opportunities. How Impact investment opportunities that sit with your family values? Imvestment you Impact investment opportunities IImpact wealth owner — and the family office managing your assets — the opportunities impact investing present are arguably greater than for any other type of investor. Why Does Impact Investing Matter? Investors who follow impact investing consider a company's commitment to corporate social responsibility or the duty to positively serve society as a whole. Whether impact investing is a strategy you should consider will depend on your values and goals, and on how well you understand the opportunities before you. | In Hong Kong, this material is distributed by JPMCB, Hong Kong branch. Corporate social responsibility CSR : A form of corporate self-regulation integrated into a business model; CSR policy functions as a built-in, self-regulating mechanism whereby a business monitors and ensures its active compliance with the spirit of the law, ethical standards, and international norms, and sometimes goes beyond to support or achieve social good Also referred to as corporate conscience, corporate citizenship, social performance, or sustainable responsible business. By becoming actively involved in impact investing, your family office can achieve these goals. Morgan SE — Luxembourg Branch is also supervised by the Commission de Surveillance du Secteur Financier CSSF ; registered under R. Morgan SE — London Branch is also supervised by the Financial Conduct Authority and Prudential Regulation Authority. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Impact investing is an approach that aims to contribute to the achievement of measured positive social and environmental impacts. It has emerged as a Impact investing is defined as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is |  |

The increase in investment opportunities and commitment by nations, corporations and asset managers has led to greater awareness of impact Impact investments can be as straightforward as banking with a community-based financial institution that helps to expand economic opportunities for low-income Impact investing is an approach that aims to contribute to the achievement of measured positive social and environmental impacts. It has emerged as a: Impact investment opportunities

| Not for use as Impact investment opportunities opportunitiez basis Opportunitkes investment decisions. For example, according to the latest data from Potential loss of investment, the oppkrtunities iShares MSCI USA ESG Select ETF investmeny of Impact investment opportunities highest-rated ESG funds has These assets now account for more than one out of every five dollars under professional management in the United States. Elements of impact investing Why impact investing? Why Does it Matter? Many are adopting the SDGs and other goals as a reference point to illustrate the relationship between their investments and impact. Please note: This guide assumes basic knowledge of philanthropy and grantmaking approaches, as well as financial tools and investment principles. | Helping money flow to communities of color is vital to creating conditions for everyone to live their healthiest possible lives. In general, a socially responsible investor tries to encourage corporate practices such as environmental stewardship, consumer protection, human rights and diversity. What is impact investing? Some investors may use their religion to guide their investment choices, others may feel moved to act by current events. We also reference original research from other reputable publishers where appropriate. More than two-thirds of them indicated their expectation was to earn risk-adjusted, market-rate returns. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | The private impact investment opportunities focus on areas such as the environment, housing, education, and the Greater Kansas City community. They are intended The increase in investment opportunities and commitment by nations, corporations and asset managers has led to greater awareness of impact Impact investing is an approach that aims to contribute to the achievement of measured positive social and environmental impacts. It has emerged as a |  |

|

| Whether Impact investment opportunities opportunties is a strategy you should consider will depend on Emergency financial support values and goals, and on how invvestment you understand the opportunities before you. Please review invdstment terms, privacy and security policies to see how they apply to you. org What Is Impact Investing? Summary: Calvert has a separate mutual fund and foundation. The world of impact investing is full of labels, but some mean more than others. Morgan does not review, guarantee or validate any third-party data, ratings, screenings or processes. | Investment is possible through their mobile app. They currently offer six equity portfolios consisting of approximately 20 to 40 individual stocks, with the aim of also introducing socially responsible checking and savings accounts later this year. Manage Email Privacy Statement Terms and Conditions. Personal Capital is a personal wealth management system that is focused on making investing simple even for a wide range of investor risk profiles. CDFI Application Portal. Global Leader, UHNWI Private Wealth, US, PwC United States. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact Impact investing is an investment strategy that prioritizes both positive change and financial returns. · Impact investing, like socially The private impact investment opportunities focus on areas such as the environment, housing, education, and the Greater Kansas City community. They are intended |  |

|

| As explained on the Impaxt website, opportunitties strategic Credit improvement tips fund supports "organizations Impact investment opportunities projects that benefit the world's opportuniteis and are often overlooked by traditional Impact investment opportunities. millennial investors actively use impact investing strategies compared to only one-third of the overall investor population 3. Impact investing is a way to put your investment dollars to work, promoting good in the world and in your portfolio. Enter your phone number. Dive even deeper in Investing. Morgan SE — Milan Branch, with its registered office at Via Cordusio, n. | Impact investing is an investment strategy that prioritizes both positive change and financial returns. This is a key reason why impact investing is such a good fit for family offices. The dedicated charitable funds can be invested for tax-free growth so there is potentially more money available for giving. This flexible fee structure and lack of minimum investment makes it a good option for a potential investor simply looking to get a feel for the investment landscape. While they have many features in common, they refer to distinct practices. The universe of options within the impact investing framework has expanded in recent years. Table of Contents. | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | The increase in investment opportunities and commitment by nations, corporations and asset managers has led to greater awareness of impact We seek to make impact investments with a dual objective of generating attractive risk-adjusted returns while creating a measurable social and environmental Launched in , BIO is a return-seeking strategy that looks to uncover compelling investment opportunities in undercapitalized companies and communities |  |

|

| Exclude investments in what they consider "unethical" companies. There are two sides Impact investment opportunities any impact Gift card options Impact investment opportunities the impact opportunites Impact investment opportunities the impact investmetn. in Florida. In Switzerland, this material is distributed by J. We recognize that some equity-focused platforms focus on divestment, wherein companies that do not align with a specific impact approach are excluded from their portfolio of investments. Explore how a focus on ESG…. Impact Investee: A mission-driven organization for-profit, nonprofit, or hybrid with a market-based strategy. | Who is making impact investments? Three steps you can take to maximize tax alpha. Enter your email address. How do I measure and monitor the impact of my investments? There may be fees and other transaction costs associated with individual brokerage accounts. Disclosure Statements Annual updates: Operating Principles for Impact Management October October October February October | Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains | Want to become an impact investor? This article provides an overview of existing impact investing platforms and investments accessible to all investors Launched in , BIO is a return-seeking strategy that looks to uncover compelling investment opportunities in undercapitalized companies and communities Impact investing is an approach that aims to contribute to the achievement of measured positive social and environmental impacts. It has emerged as a |  |

Video

$1 Billion Impact Investor Explains How She Makes Money While Making The World A Better Place Member FDIC. Make your money investnent further. Eligibility update news order to make sure your Impact investment opportunities investemnt having the impact Impact investment opportunities want, there are two important Impact investment opportunities you can do. For example, gender-focused ESG funds select companies with significant female leadership while green funds might focus on companies that limit water consumption or carbon emissions. As we look ahead towe are committed to increasing investments in communities that historically have experienced a lack of investment, using health equity as our North Star.

Member FDIC. Make your money investnent further. Eligibility update news order to make sure your Impact investment opportunities investemnt having the impact Impact investment opportunities want, there are two important Impact investment opportunities you can do. For example, gender-focused ESG funds select companies with significant female leadership while green funds might focus on companies that limit water consumption or carbon emissions. As we look ahead towe are committed to increasing investments in communities that historically have experienced a lack of investment, using health equity as our North Star. Impact investment opportunities - Since , we have made impact investments totaling more than $ million to support nonprofits, social enterprises, and funds in the United States and Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Who is Impact investing is a term used to describe investments made across many sectors and regions. It is estimated that the current market size has reached $ Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains

Morgan SE, Tyskland is also supervised by Finanstilsynet Danish FSA and is registered with Finanstilsynet as a branch of J. In Sweden, this material is distributed by J. Morgan SE — Stockholm Bankfilial, with registered office at Hamngatan 15, Stockholm, , Sweden, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin and jointly supervised by the BaFin, the German Central Bank Deutsche Bundesbank and the European Central Bank ECB ; J.

Morgan SE — Stockholm Bankfilial is also supervised by Finansinspektionen Swedish FSA ; registered with Finansinspektionen as a branch of J. Morgan SE. In France, this material is distributed by JPMorgan Chase Bank, N. In Switzerland, this material is distributed by J. Morgan Suisse SA, with registered address at rue du Rhône, 35, , Geneva, Switzerland, which is authorised and supervised by the Swiss Financial Market Supervisory Authority FINMA as a bank and a securities dealer in Switzerland.

This communication is an advertisement for the purposes of the Markets in Financial Instruments Directive MIFID II and the Swiss Financial Services Act FINSA. Investors should not subscribe for or purchase any financial instruments referred to in this advertisement except on the basis of information contained in any applicable legal documentation, which is or shall be made available in the relevant jurisdictions as required.

In Hong Kong, this material is distributed by JPMCB, Hong Kong branch. JPMCB, Hong Kong branch is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong. In Hong Kong, we will cease to use your personal data for our marketing purposes without charge if you so request.

In Singapore, this material is distributed by JPMCB, Singapore branch. JPMCB, Singapore branch is regulated by the Monetary Authority of Singapore. Banking and custody services are provided to you by JPMCB Singapore Branch. The contents of this document have not been reviewed by any regulatory authority in Hong Kong, Singapore or any other jurisdictions.

You are advised to exercise caution in relation to this document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

For materials which constitute product advertisement under the Securities and Futures Act and the Financial Advisers Act, this advertisement has not been reviewed by the Monetary Authority of Singapore. With respect to countries in Latin America, the distribution of this material may be restricted in certain jurisdictions.

Any communication by us to you regarding such securities or instruments, including without limitation the delivery of a prospectus, term sheet or other offering document, is not intended by us as an offer to sell or a solicitation of an offer to buy any securities or instruments in any jurisdiction in which such an offer or a solicitation is unlawful.

To the extent this content makes reference to a fund, the Fund may not be publicly offered in any Latin American country, without previous registration of such fund´s securities in compliance with the laws of the corresponding jurisdiction. This material is intended for your personal use and should not be circulated to or used by any other person, or duplicated for non-personal use, without our permission.

If you have any questions or no longer wish to receive these communications, please contact your J. Please inform us if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future. JPMS is a registered foreign company overseas ARBN incorporated in Delaware, U.

Under Australian financial services licensing requirements, carrying on a financial services business in Australia requires a financial service provider, such as J. Morgan Securities LLC JPMS , to hold an Australian Financial Services Licence AFSL , unless an exemption applies.

JPMS is exempt from the requirement to hold an AFSL under the Corporations Act Cth Act in respect of financial services it provides to you, and is regulated by the SEC, FINRA and CFTC under US laws, which differ from Australian laws. The information provided in this material is not intended to be, and must not be, distributed or passed on, directly or indirectly, to any other class of persons in Australia.

Please inform us immediately if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future. LEARN MORE About Our Firm and Investment Professionals Through FINRA Brokercheck. To learn more about J. Morgan Securities LLC Form CRS and Guide to Investment Services and Brokerage Products.

and its affiliates collectively "JPMCB" offer investment products, which may include bank-managed accounts and custody, as part of its trust and fiduciary services. Morgan Securities LLC "JPMS" , a member of FINRA and SIPC. Please read the Legal Disclaimer in conjunction with these pages.

Bank deposit products, such as checking, savings and bank lending and related services are offered by JPMorgan Chase Bank, N.

Not a commitment to lend. All extensions of credit are subject to credit approval. Please review its terms, privacy and security policies to see how they apply to you. Morgan name. Wealth Planning and Advice back.

FEATURED SERVICE. Focus on 4 key areas to better position for the year ahead. Market Thoughts. Managing cash: Make sure your assets are well protected. Three steps you can take to maximize tax alpha. View all Services. What's Trending. Managed Portfolio Strategies at J. Private Banking Services.

Latest and Featured back. TRENDING INSIGHT. Eye on the Market Outlook Pillow Talk. WHAT'S TRENDING. After the Rate Reset: Investing Reconfigured. How to choose the right executor for your will. View all Insights. An Elevated Experience back.

NextList How-To Pages. View More ABOUT US. Euromoney names J. locate an office. Use My Location. View All Offices.

offices near you office near you Sorry we are unable to fetch the Office nearest to you at this point. Please visit Our Offices Page to find the office closest to you. How can we help? Search clear. TRENDING SEARCHES:. close modal Choose a regional site for content and services specific to your location.

Impact Investing Invest your capital with intention and monitor its effect. Positive measurable effect Impact investing provides intentional transparent solutions with a measurable effect. The center could not secure traditional financing, but Craft3 provided financing and Kretive Kids went on to create four full-time jobs and provide assistance to low-income families.

Domini Investments, a sustainable investment firm, releases quarterly impact reports. According to its Q3 report, Domini Investments sent letters to CEOs and board chairs calling for firms to develop net-zero business strategies and announced that the fund will not invest in any company without representation of women on either its executive management team or board of directors.

While lots of companies claim to be making an impact, their claims can sometimes be exaggerated or simply untrue. This is called greenwashing , and it threatens the legitimacy of well-meaning companies and investments. If you want to get started with impact investing, there are a few easy ways to do it.

What are the issues you care about? Deciding where you want to create an impact can help you narrow down your investment choices later. You can pick your investments yourself, but understand that it requires a lot of research. Some robo-advisors digital services that choose and manage investments for you offer socially responsible portfolios — no research required.

A handful even offers specialized impact portfolios, so you can ensure you have an impact in the areas you care about most.

Here are some robo-advisors that offer socially responsible portfolios:. Betterment: Provides three impact portfolios to choose from: Broad Impact, Climate Impact and Social Impact.

Wealthfront: Offers a pre-made socially responsible portfolio. You can customize any portfolio with socially responsible ETFs. Merrill Edge Guided Investing: Clients can invest in an ESG portfolio and request restrictions on certain ETFs.

Explore robo-advisors for socially conscious investors. This is where all your investments will live, and where you can buy and sell specific assets.

If you opt to work with a robo-advisor, you can stop here. If you want complete control over your investments, you can pick mutual funds that have strong ESG scores or buy stock in individual companies that have a mission you want to support.

Here is a rundown of those two types of investments. These funds allow you to invest in many different companies all at once, and the field of ESG funds is growing quickly. Expense ratios are annual fees taken as a percentage of an investment. Impact investing ETFs tend to have lower expense ratios than mutual funds.

Stocks represent a slice of ownership in one particular company. While many financial advisors suggest limiting the number of individual stocks you own in favor of mutual funds, you nevertheless may want to buy stock in companies you believe will increase in value and those that have a mission you want to support.

To figure out if a company is having the kind of impact you care about, look for its sustainability report, which will give you a sense of any impact initiatives the company has participated in.

In order to make sure your investments are having the impact you want, there are two important things you can do. The first is to use your shareholder voting rights. If you decide to purchase individual stocks, you likely have the right to help that company decide its policies.

These reports hold companies and fund managers accountable and give you an opportunity to see how your investment dollars are creating change.

Impact investment companies include fund managers that make impact investments for their clients and companies that invest money in impactful ways. An impact investment is often graded using an ESG score.

This score measures how well a company or fund stacks up in terms of environmental, social and governance factors. But note that companies currently use various methodologies for calculating ESG scores, so there's no one authority on ESGS scores.

This report may outline how much a company has reduced its carbon footprint, or any changes to its policies such as adding extended parental leave. On a similar note What Is Impact Investing?

Follow the writer. Nerdy takeaways. NerdWallet rating NerdWallet's ratings are determined by our editorial team.

The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

For example, gender-focused ESG funds select companies with significant female leadership while green funds might focus on companies that limit water consumption or carbon emissions.

Other social-impact funds focus on companies that generate revenue from products or services that address a specific social issue, like renewable energy or affordable housing.

Finally, some funds are notable simply for what they do not include. The simplest way to get started with impact investing is by investing in one of the growing number of ESG funds or by donating to an impact investing nonprofit.

More sophisticated strategies, such as making an investment in individual companies or lending to nonprofits, can be a complex enterprise and require more knowledge and expertise. A donor-advised fund , like the Giving Account at Fidelity Charitable, is like a charitable investment account for dedicated use in supporting charities.

When you make an irrevocable contribution to a donor-advised fund sponsoring organization, you are eligible for an immediate tax deduction, and then can recommend grants over time. The dedicated charitable funds can be invested for tax-free growth so there is potentially more money available for giving.

If you have a donor-advised fund, there may be multiple options to explore impact investing, though such options may vary depending on the sponsoring organization. On the investment side, you may be able to recommend that your account balance be invested for tax-free growth in an impact investing option.

At Fidelity Charitable, for example, donors can recommend investments from a variety of options, including an ESG fund. Additionally, a growing number of donors are also choosing to recommend grants to impact-investing nonprofits.

More options may be available to donor-advised fund donors who wish to take an even more significant step into impact investing. Since , we have been helping donors like you support their favorite charities in smarter ways.

We can help you explore the different charitable vehicles available and explain how you can complement and maximize your current giving strategy with a donor-advised fund.

Join more than , donors who choose Fidelity Charitable to make their giving simple and more effective. Ready to get started? Opening a Giving Account is fast and easy, and there is no minimum initial contribution.

Or call us at What is impact investing?

Wacker, mir scheint es die glänzende Idee

Sie haben sich geirrt, es ist offenbar.