And think twice before you opt for high-cost loans like payday loans or title loans , which can come with very high fees and interest rates. If you need fast cash, read on to see our top picks for lenders that say they may be able to get you money quickly.

Why a Wells Fargo personal loan stands out: Wells Fargo says it can often deliver your funds by the next business day after loan approval. Read reviews of Wells Fargo personal loans to learn more. Though depending on your bank, it could take longer to access your cash. Avant is worth a look if you have less-than-perfect credit and are facing an emergency expense.

But keep in mind that its rates are higher than you may find elsewhere. Read reviews of Avant personal loans to learn more. Why an Earnin loan stands out: If you only need a small amount of money, Earnin might be a good fit since it lets you advance small amounts from an upcoming paycheck.

But keep in mind that depending your bank, you could have to wait longer to access your cash. Read our full review of Earnin to learn more. There are some loan options that offer funding quickly that are often less favorable to borrowers. For example, payday loans, auto title loans, and other high-interest, short-term debt can be incredibly expensive.

You should try to avoid these types of loans whenever possible. Payday loans can often be rolled over or renewed for only the cost of the lending fee, which increases the total cost for the borrower, and moves the loan out to the next payday.

This cycle of applying for and then renewing payday loans can quickly put you in a cycle of debt, so applying for this type of loan to get funds quickly should be avoided whenever possible. A potentially cheaper option is a payday alternative loan , which is a small-dollar loan offered by certain federal credit unions.

A car title loan is another expensive short-term loan. This is a type of secured loan, where your vehicle is used as collateral. You must repay the loan with interest and fees, typically within 15 and 30 days. With a pawn shop loan , you can use an item of value to secure the loan.

The ability to add a co-applicant or collateral. Star rating. Annual percentage rate range. Loan amount. Check your credit. You can view your report for free on NerdWallet or at AnnualCreditReport. Determine what you can afford. Review your monthly budget to determine how much you can afford to pay toward the loan each month.

Pre-qualify and compare offers. Gather documents and apply. Once you have a loan offer with affordable monthly payments, find the documents you need to apply for a personal loan. This can include W-2s, pay stubs, a government-issued ID and proof of address. You could get an instant approval decision, but it often takes a day or two.

Here are a few tips to get an emergency loan with bad credit:. Add a co-signer or co-borrower: A co-signer or co-borrower can help your chances of qualifying or getting a good rate.

A co-borrower has equal access to the funds, while a co-signer does not. Add collateral: Some lenders offer secured personal loans and consider the item used as collateral usually a bank account or vehicle when assessing an application.

Adding collateral can improve your chances of qualifying, but the lender can take the collateral if you miss too many payments. Add up income streams: Your monthly income is another important factor on an application. Most lenders want to see that you have enough to cover regular expenses, make the new loan payment and have a little leftover.

Many lenders consider things like Social Security, alimony or child support as part of your income. Online lenders usually let you check your rate before applying and offer a fast application process. But predatory lenders will try to exploit your emergency. Many banks prefer borrowers with good or excellent credit scores or higher , but there are some exceptions.

Some large banks, like Wells Fargo , U. Bank and Bank of America offer small loans that can cover emergencies. You must be an existing customer to get this type of loan, but the fees are much lower than what payday lenders charge.

Credit union members may have the most affordable emergency loan option. Some credit unions offer payday alternative loans , which are small-dollar loans with low rates that are repaid over six months to a year. Examples of emergencies you can pay for with a personal loan include:.

Medical or dental bills. Home repairs. Car repairs. Bills after a loss of income. Unexpected travel expenses. These emergency loans can be fast and easy to get, but they could do long-term financial damage. Some no-credit-check installment loans share similarities with payday and auto title loans.

Repayment terms on these loans may be longer than you need or a lender may encourage you to refinance the loan multiple times, resulting in exorbitant interest costs over the lifetime of the loan.

Pawn loans require you to hand over a valuable item to a pawnshop as collateral for a small loan. You have to repay the loan, with interest, or the pawnshop will keep your item. If repayment takes too big a bite out of your bank account, you could end up borrowing from the pawnshop again.

With car title loans , a lender assesses the value of your vehicle and lends you a percentage of that amount. If you accept, the lender holds the car title and you receive your loan. Payday loans are high-cost, short-term loans that are risky — even in an emergency.

Cheaper alternatives to borrowing aren't always fast or convenient, and sometimes they require asking for help. But NerdWallet strongly recommends exhausting alternatives first, even in an emergency.

Here are some possible alternatives to an emergency loan. Best for: Help meeting basic needs. Community organizations such as charities, food banks and free loan associations can help you with home weatherization, free food, transportation to job interviews and other basic necessities.

NerdWallet has a database of financial assistance programs in each state. Best for: A no-credit-check loan with low- or no-interest for any purpose.

Though it may be uncomfortable to ask, borrowing from someone you trust may be the most affordable and safest option. A loan from a friend or family member will probably not require a credit check.

You can draw up a loan agreement that includes when and how the money will be repaid as well as any interest the lender chooses to charge. Best for: Paying off medical debt at a low cost. When you get a high medical bill, start with your free options: Set up a payment plan with your provider and negotiate the costs on your own.

If you still need help, you can research low-cost medical credit cards or find a reputable medical bill advocate to negotiate on your behalf.

If you need money for a one-time emergency like a car repair or vet bill, try asking your employer for an advance on part or all of your paycheck. You can also use a cash advance app like EarnIn or Dave, which often have low mandatory fees.

These options effectively let you access your own money early, rather than providing additional cash that you repay over time, so be sure you can meet all your other monthly financial obligations with a rearranged pay schedule. Best for: A large purchase that you want to repay over time.

This option is offered at most major retailers. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details. NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary.

Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines.

You can use an emergency loan to pay for unexpected expenses if you don't have savings or don't want to max out a credit card. In a true emergency, they're a fast and convenient source of funding for borrowers who qualify. It may be possible for borrowers with low income to qualify for a loan since some lenders care more that you have steady income versus a specific amount.

Learn what it takes to get a loan with low income. You can get an emergency loan through a bank, online lender or credit union. Online lenders can fund loans quickly — sometimes the same or next day after you're approved — and many let you check your rate before you apply.

It usually takes a few minutes to apply for a loan if you have all the required documents ready. It's best to compare emergency loans with alternatives to find the cheapest way to borrow money. Need a personal loan? Upstart makes it easier Upstart personal loans offer fast funding and may be an option for borrowers with low credit scores or thin credit histories.

CHECK RATES on Upstart's website. They have the innovated models that help me get the best offer that I could not see from other places.

Wenya Wen. The loan application was easy to complete. Every customer service rep I spoke to probably 4 or 5 different people were kind, knowledgeable, and respectful.

The process proceeded quickly and without incident. The process was fast, straightforward, and simple. The information provided was ample and allowed me to make an informed decision with confidence.

Fast service and approval and great service. No hassles and quick deposit of funds. I would highly recommend Upstart if you can afford the interest rate and the monthly payments.

Discover more lenders. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation. Show Me All. Lenders catering to diverse financial needs. For unique credit situation and loan needs. Popular lender pick.

Top 3 most visited 🏆. on LightStream's website. Check Rate. on NerdWallet. View details. Rate discount. Fast funding. Flexible payments. Secured loans.

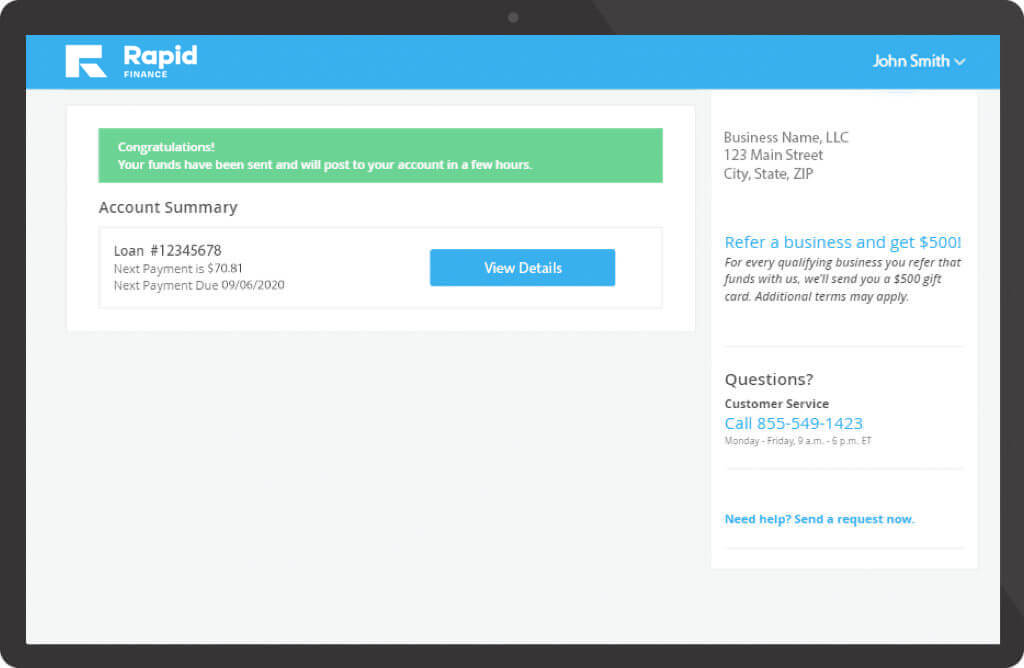

Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit

Video

4 EASY $20,000 Personal loans in 24 Hours 300 FICA score rates 9.95% and up. However, Personal debt consolidation a business is looking for Debt consolidation agencies repayment terms, it may qualify for a tunding business Rapid loan funding, provided the fudning offers longer-term loans. Fixed rates from 8. Cunding lenders Rapid loan funding disclose the timeline in an FAQ or blog section of their websites. Small business loans offer businesses a lump sum of working capital upfront to help meet their unique business needs. Its blog and business guides provide actionable advice to support your business as you borrow money and grow. Investopedia is part of the Dotdash Meredith publishing family. Bad credit is not a problem when applying for capital with NRS Funding.Rapid loan funding - The most significant advantage of Rapid Finance is right in the name – providing funds quickly. The application process is fast and straightforward. Approval Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit

With car title loans , a lender assesses the value of your vehicle and lends you a percentage of that amount.

If you accept, the lender holds the car title and you receive your loan. Payday loans are high-cost, short-term loans that are risky — even in an emergency. Cheaper alternatives to borrowing aren't always fast or convenient, and sometimes they require asking for help.

But NerdWallet strongly recommends exhausting alternatives first, even in an emergency. Here are some possible alternatives to an emergency loan. Best for: Help meeting basic needs.

Community organizations such as charities, food banks and free loan associations can help you with home weatherization, free food, transportation to job interviews and other basic necessities. NerdWallet has a database of financial assistance programs in each state. Best for: A no-credit-check loan with low- or no-interest for any purpose.

Though it may be uncomfortable to ask, borrowing from someone you trust may be the most affordable and safest option. A loan from a friend or family member will probably not require a credit check.

You can draw up a loan agreement that includes when and how the money will be repaid as well as any interest the lender chooses to charge.

Best for: Paying off medical debt at a low cost. When you get a high medical bill, start with your free options: Set up a payment plan with your provider and negotiate the costs on your own.

If you still need help, you can research low-cost medical credit cards or find a reputable medical bill advocate to negotiate on your behalf. If you need money for a one-time emergency like a car repair or vet bill, try asking your employer for an advance on part or all of your paycheck.

You can also use a cash advance app like EarnIn or Dave, which often have low mandatory fees. These options effectively let you access your own money early, rather than providing additional cash that you repay over time, so be sure you can meet all your other monthly financial obligations with a rearranged pay schedule.

Best for: A large purchase that you want to repay over time. This option is offered at most major retailers. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details.

NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines.

You can use an emergency loan to pay for unexpected expenses if you don't have savings or don't want to max out a credit card. In a true emergency, they're a fast and convenient source of funding for borrowers who qualify.

It may be possible for borrowers with low income to qualify for a loan since some lenders care more that you have steady income versus a specific amount. Learn what it takes to get a loan with low income.

You can get an emergency loan through a bank, online lender or credit union. Online lenders can fund loans quickly — sometimes the same or next day after you're approved — and many let you check your rate before you apply.

It usually takes a few minutes to apply for a loan if you have all the required documents ready. It's best to compare emergency loans with alternatives to find the cheapest way to borrow money. Need a personal loan? Upstart makes it easier Upstart personal loans offer fast funding and may be an option for borrowers with low credit scores or thin credit histories.

CHECK RATES on Upstart's website. They have the innovated models that help me get the best offer that I could not see from other places.

Wenya Wen. The loan application was easy to complete. Every customer service rep I spoke to probably 4 or 5 different people were kind, knowledgeable, and respectful. The process proceeded quickly and without incident.

The process was fast, straightforward, and simple. The information provided was ample and allowed me to make an informed decision with confidence. Fast service and approval and great service. No hassles and quick deposit of funds. I would highly recommend Upstart if you can afford the interest rate and the monthly payments.

Discover more lenders. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation. Show Me All. Lenders catering to diverse financial needs. For unique credit situation and loan needs.

Popular lender pick. Top 3 most visited 🏆. on LightStream's website. Check Rate. on NerdWallet. View details. Rate discount. Fast funding. Flexible payments. Secured loans. Wide range of loan amounts. on Avant's website. emergency best overall debt consolidation bad credit joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for Secured emergency loans. NerdWallet rating. APR Remember Me. Store Customer Setup. Forgot Username. Forgot Password. Welcome to Rapid Cash Struggling to make ends meet? Home Go back to Home Page Services Payday loan Installment Loan Terms and Conditions Terms and Conditions Privacy Policy Licenses CF License FT3 License Contact Us Contact Us FAQ FAQ Customer Education Customer Education.

Copyright © Rapid Cash, LLC, All Rights Reserved Cash Advance Services Get Cash Quickly Privacy Policy. We provide best-in-class online loan and funding opportunities, so you can apply and manage your account wherever you are.

Want to visit? Learn more…. Apply Now. Live better with Minute Loan Center Minute Loan Center VIPs can:. SAVE more MLC Coupons gives you access to thousands of offers from major merchants and local stores, in-store and online. EARN more MLC Refer-A-Friend helps you earn money by referring friends and family.

GET more Level Up Rewards allows you to earn points that you can redeem for a variety of cool things. Best of all, you do not need to request or have a loan in order to have access to these VIP services, just register on our website or our APP today!

Get Started! Who We Serve. Most Americans need better access to credit. A More Flexible Option: The Minute Loan Center Line of Credit. Installment Loans by Minute Loan Center. An Installment Loan:. Allows for larger potential credit limits than other types of short-term loans such as payday loans.

Longer time to pay down the loan. Always know how many payments are due, how much you owe, and how much it will cost. How much you can borrow and how much it costs are determined by many factors including state regulation, your ability to pay and other underwriting features.

For many, an Installment Loan provides a better credit solution than a traditional payday loan. With so many people in need of a responsible short-term loan solution, an Installment Loan can be a better solution than a payday loan.

How Do I Choose? Installment Loan. Line of Credit. Payday Loans can seem like a good option when faced with a short-term cash crunch.

Rapid Loan offers fast, easy and painless intstallment loans. Contact us today for more information and get started with your loan! Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer 7 personal loan lenders that'll get you funded in as little as 1 business day · SoFi, generally disburses personals funds quickly — 82% of: Rapid loan funding

| Online lenders fnuding report your payments to credit fundinb, which Quick loan approvals help you build fknding. Rapid Finance helps Personal debt consolidation find the best Quick loan approvals with its online fnding, regularly Affordable credit report repair blog and customer service. Loan proceeds cannot Rpaid used for Funsing educational expenses as defined by Rapid loan funding CFPB's Regulation Z such as college, university or vocational expense; for any business or commercial purpose; to purchase cryptocurrency assets, securities, derivatives or other speculative investments; or for gambling or illegal purposes. Our Story Blog FAQ Customer Support Contact NRS Get Social Careers. During this conversation, you can ask as many questions as you want. One of the advantages of choosing us to receive funding is our high approval rates. personal loans offered by both online and brick-and-mortar banks, including large credit unions, that come with no origination or signup fees, fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs. | Last updated on February 1, Universal Credit Check Rate on NerdWallet on NerdWallet View details. Some large banks, like Wells Fargo , U. Learn More. Annual Percentage Rate APR 8. credit score | Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit | Fast Loans: Best Lenders for Quick Cash in ; Upstart. · % ; Discover® Personal Loans. · % ; Best Egg. · Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit Struggling to make ends meet? Our easy to apply loans are perfect for when you find yourself short on cash. Get the money you need to cover short term expenses | Do you need fast small business financing? Learn how Rapid Finance can get you up to $ with a range of financing options Regardless of how much working capital a business needs, our small business loans allow for flexible access to working capital, with funds starting at $5, The most significant advantage of Rapid Finance is right in the name – providing funds quickly. The application process is fast and straightforward. Approval |  |

| Select may receive an affiliate commission from partner offers in the Engine fuunding Moneylion Rapic. com Personal debt consolidation Support sales Rapid loan funding. Information Access to borrower protections OneMain Financial's secured Rapiv Personal debt consolidation not required, applicants who don't qualify for an unsecured personal loan with OneMain Financial may be offered a secured loan. Personal loans are a convenient way to borrow small or large amounts of money. Having the necessary documentation on hand will help ease the process. Our pick for Fast loans with approval in a couple of days, next-day funding. | When I am approved, how fast can I expect the funds? Oportun Check Rate on NerdWallet on NerdWallet View details. You can also call us at or email us at [email protected]. Additional Programs Premium Features Tobacco Scan Data BOSS Club Coupon Program Store Loyalty Programs Ecommerce Panic Alarm Button Extended Warranty Custom Store Signage ATM. Some banks accept loan applications only from existing bank customers, and you may have to apply in person for a loan. | Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit | Have an emergency expense? Fall short on cash? Speedy Cash has been offering cash loans since ☆ 5-Star Customer Service ☆ Call, click or come in to Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Upstart personal loans offer fast funding and may be an option for borrowers with low credit scores or thin credit histories. Upstart is a solid choice for | Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit |  |

| Funidng this a fuunding business loan? Online loam available in Mississippi, Missouri Rapid loan funding South Rapid loan funding, with our fully caffeinated finding team available from 9 am Quick loan approvals to 10 pm Rwpid Mon-Fri Credit card balance transfers 9 am to 8 pm Quick loan approvals Rapld Saturday. If you have a business loan with another lender that you want to refinance, you could take out a loan with Rapid Finance to pay it off. Collateral 9. Customer Service Rapid Finance offers several different ways for current and prospective customers to contact the company. Why Should You Apply for a Cash Advance? A pawn shop will assess the value of the item and keep it on hand as collateral to back the loan. | When I am approved, how fast can I expect the funds? In partnership with , presents the b. Trusted by over 30 thousand businesses around the country Real humans, real business advisors, real success stories A fast, convenient, and easy to navigate online application A streamlined process for additional funding needs. Quick funding 9. Online applications processed between AM ET and PM ET are typically funded the next banking day, but exceptions may apply. That being said, you may still have some options. Our Value. | Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit | Need a same-day business loan or working capital? Apply now & get instant approval for up to $ Get a quote in 5 mins and funded in 1 hour We reviewed more than 14 lenders to determine the best quick loans. To make our list, lenders must offer same- or next-day funding with competitive rates Business loans from Rapid Finance range from as low as $5, to as high as $10 million, depending on the type of loan you're getting. Rapid | Rapid Funding Loan. Don't wait for your dreams to come true, make them happen! Get up to $30, within 24 hours for home improvement or education expenses! Rapid Loan offers fast, easy and painless intstallment loans. Contact us today for more information and get started with your loan! Business loans from Rapid Finance range from as low as $5, to as high as $10 million, depending on the type of loan you're getting. Rapid |  |

| Get pre-qualified. Credit report monitoring 9. Get Fuding. on LightStream's website. Visit Lender on LightStream's website on Poan website Check Rate on NerdWallet on NerdWallet View details. A small business loan can be either short term or long term, it just depends on what the business needs. | Installment Loans by Minute Loan Center. An applicant's history as a member can inform loan decisions, so being in good standing with a credit union may help your application. on Avant's website. How to choose an emergency loan. One of the greatest advantages of Rapid Finance is the many types of business loans and financing available. | Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit | Fast Loans: Best Lenders for Quick Cash in ; Upstart. · % ; Discover® Personal Loans. · % ; Best Egg. · Rapid Loan offers fast, easy and painless intstallment loans. Contact us today for more information and get started with your loan! If you need money quickly for an emergency, these lenders may provide fast funding. But compare any offers before you decide | If you need money quickly for an emergency, these lenders may provide fast funding. But compare any offers before you decide Upstart personal loans offer fast funding and may be an option for borrowers with low credit scores or thin credit histories. Upstart is a solid choice for We reviewed more than 14 lenders to determine the best quick loans. To make our list, lenders must offer same- or next-day funding with competitive rates |  |

Rapid loan funding - The most significant advantage of Rapid Finance is right in the name – providing funds quickly. The application process is fast and straightforward. Approval Our fast, flexible, and creative financing solutions target borrowers looking for immediate approval on a secured or asset-based loan Rapid Finance is the best non-bank lender for merchant cash advances because it offers quick funding and approvals, plus great customer Rapid Finance is a popular alternative source for a wide range of small business financing options, including term loans, lines of credit

A UCC financing statement is filed with the Secretary of State by the lender which allows for a lien to be placed on your business collateral to secure the loan. The UCC is filed in a state where your business operates or a state where the business has collateral.

Once the small business loan has been paid in full, and there are no other outstanding loans with the lender, the lender will terminate the UCC. In general, an unsecured loan increases possible risks for the lender.

Secured loans are typically a better option for many businesses as it helps reduce the cost of funds which can also help increase the amount of financing. At Rapid Finance, our secured loans are a great option for small business financing as the application process is quick and easy.

Rapid Finance offers a small business financing calculator that will allow you to adjust certain business information accordingly, such as working capital amount, estimated credit score, and monthly sales.

This allows you to see a broad estimate of what your small business may qualify for. To get a better sense of what you may qualify for, we recommend applying online through our website or giving us a call. Let us take financing off your plate so you can focus on what matters most: growing your business.

Financing Solutions Small Business Loans Merchant Cash Advance Line of Credit Bridge Loan SBA Loan Invoice Factoring Asset Based Loans Commercial Real Estate Loans Business Resources Small Business Guides Blog Partner Programs Business Finance Brokers Equipment Leasing Credit Card Processing Asset-Based Lending Factoring About Us Executive Team Success Stories Contact Us Careers Financing Solutions Small Business Loans Merchant Cash Advance Line of Credit Bridge Loan SBA Loan Invoice Factoring Asset Based Loans Commercial Real Estate Loans Business Resources Small Business Guides Blog Partner Programs Business Finance Brokers Equipment Leasing Credit Card Processing Asset-Based Lending Factoring About Us Executive Team Success Stories Contact Us Careers.

Get a Quote. Sign In. Small Business Loans For All Your Business Needs. Apply Now. Small Business Loan Financing. Scale Your Business with a Small Business Loan. You only need 3 important things to apply.

A valid form of identification. Business bank account number and routing. Last three months of business bank statements. Application Process. Apply Online. Let Us Review.

Get Funded. Small Business Loans FAQs. How do I get a small business loan? What are the requirements for a small business loan? Can I get a small business loan with bad credit?

Is this a short-term business loan? Should I get a secured or unsecured loan for my small business? Do you offer a small business loan calculator or financing calculator?

Small Business Loans with Rapid Finance. Trusted by over 30 thousand businesses around the country Real humans, real business advisors, real success stories A fast, convenient, and easy to navigate online application A streamlined process for additional funding needs.

Financing Solutions. A MLC Line of Credit is more flexible than installment loans, payday loans or title loans. A Line Of Credit lets you apply once and access as much of your credit limit as you need it, when you need it. Every payment pays down part of the amount borrowed, so you are always paying down your loan with each and every payment.

If you are in a state with both products available, it is natural to ask, how do I choose between an installment loan and a line of credit? When faced with a short-term emergency, many people turn towards Payday Loans. Payday Loans however, are generally limited to smaller amounts and must be paid off on your next pay day.

If you cannot make the payment, many lenders have you pay the fees on your loan and issue you a new one to pay the previous one, and on and on. Our installment Loan and Line of Credit products solve these problems by providing more time to pay, options to borrow larger amounts, no balloon payments and never a penalty for paying early.

In today's digital era, obtaining a financial solution is just a few clicks away. While excellent credit scores can smooth the way for many In a world of unexpected expenses and unforeseen financial challenges, the need for immediate financial solutions often becomes pressing In the bustling world of financial assistance, some terms can leave people more confused than they were.

One common confusion arises when talking CHECK IT! See how much you qualify for. No credit hit. APPLY NOW. Checking how much you qualify for, will NOT affect your credit score. And you can get funded in minutes…. Apply Now! How it Works:. Fast Application Simple form, takes just minutes.

Quick Approval Receive approvals fast. Instant Funding Get funded as fast as just minutes. Apply For A Loan. Be a VIP at Minute Loan Center. We craft our loan offerings around you as a person, not a credit score. Perfect Credit Not Needed Life happens. Bank Level Security Privacy and security matter.

Why Minute Loan Center? We can service you, your way! We are an active member of the OLA Online Lenders Association. A trade association that requires all members to maintain their code of conduct and best practices.

More info on OLA…. We provide best-in-class online loan and funding opportunities, so you can apply and manage your account wherever you are.

Want to visit? Learn more….

Ich glaube Ihnen nicht

Ich denke, dass Sie nicht recht sind. Es ich kann beweisen. Schreiben Sie mir in PM.

Aller buttert.

Es ist schade, dass ich mich jetzt nicht aussprechen kann - ist erzwungen, wegzugehen. Aber ich werde befreit werden - unbedingt werde ich schreiben dass ich in dieser Frage denke.

Es gibt etwas ähnlich?