In general, the best auto refinance rates are reserved for borrowers with credit scores in the s. You'll also want to calculate your debt-to-income ratio DTI , which you can do by adding up your monthly debt payments and then dividing the sum by your gross monthly income.

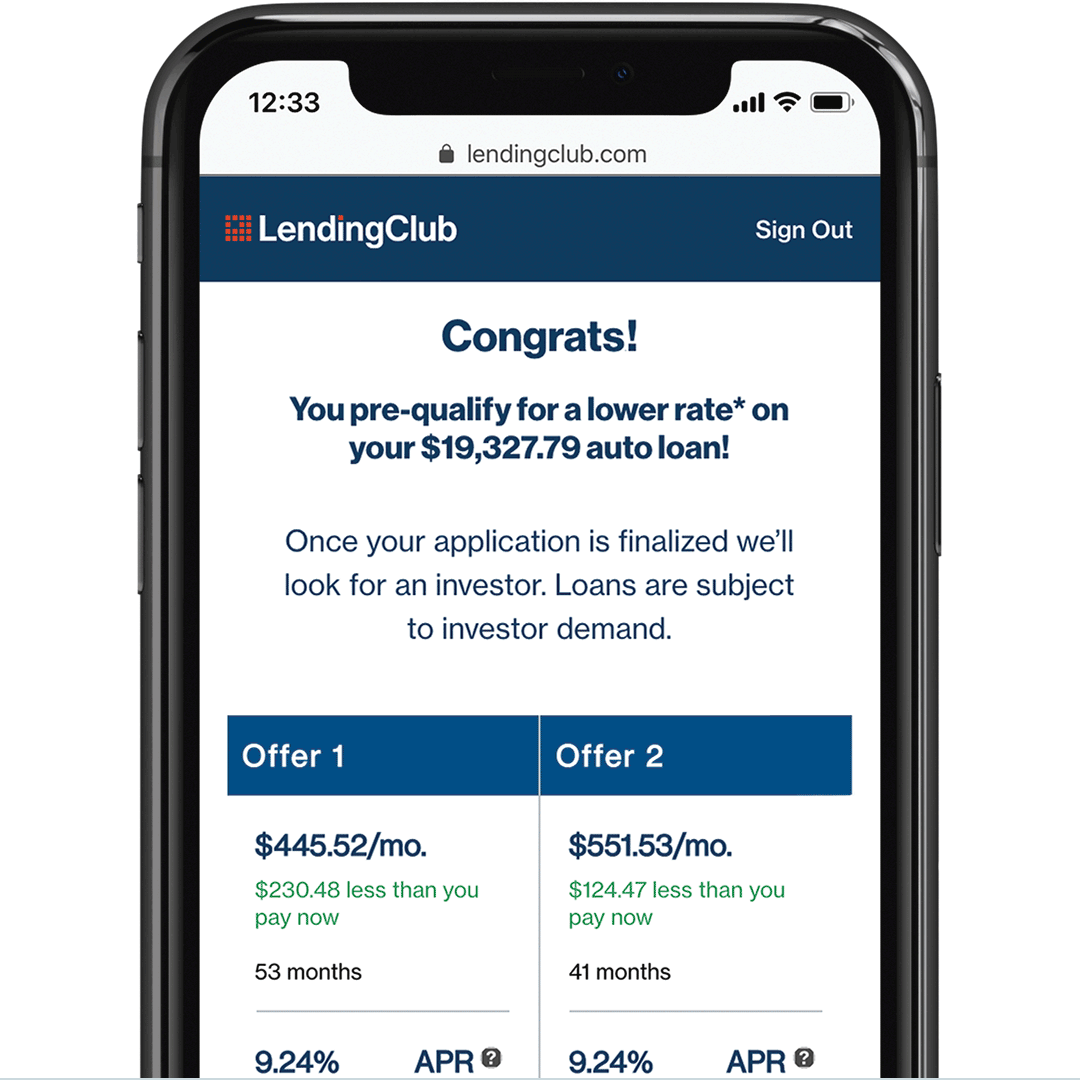

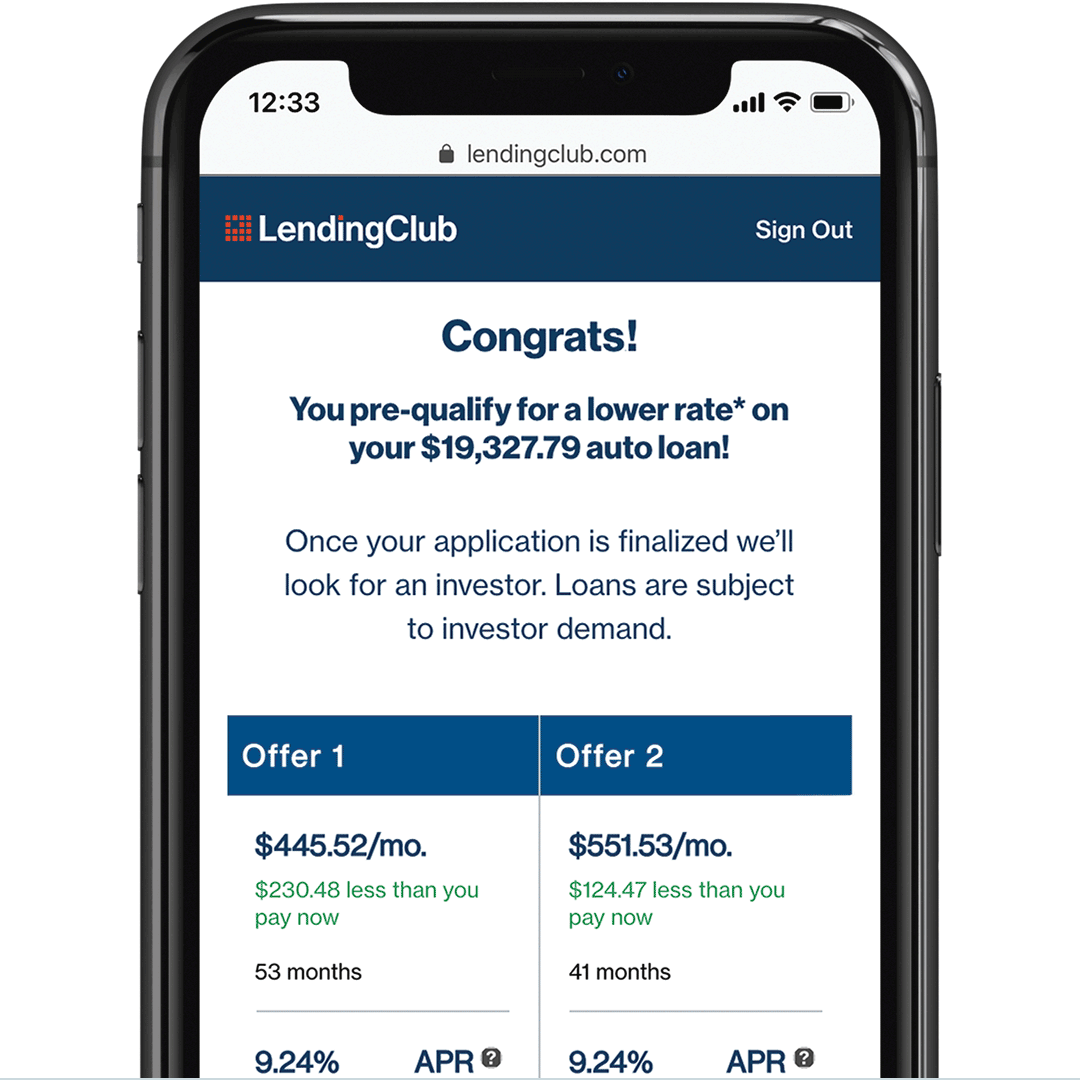

Many auto lenders, like Capital One , allow you to get pre-qualified for a loan before you submit an official application.

This process makes it possible to compare interest rate quotes, repayment terms, and monthly payments from multiple lenders with just a soft credit check , which won't impact your credit score.

Not all lenders offer pre-qualification, though, so make sure the lender notes that checking your rate won't affect your credit before you proceed. Keep in mind, too, that pre-qualification doesn't guarantee approval or a specific rate.

The lender's final decision will be based on a full credit check and application. If you do need to submit multiple applications while shopping around, don't worry about multiple inquiries hurting your credit.

As long as you complete the rate-shopping period within a day period—or up to 45 days with some credit scoring models—all of your inquiries will only count as one for credit scoring purposes.

While you can go through this process with many individual lenders, you can also use a comparison website, like LendingTree , to get quotes from multiple financial institutions at once. Learn more about our picks for the best auto refinance loans.

Once you've received some quotes, you can compare the best offer with the terms of your current loan to determine if refinancing is worth it. After you narrow down your list of options to the best offer, apply directly with that lender online or over the phone.

You'll share some basic information about yourself, such as your name, address, date of birth, Social Security number, and contact details. You'll also need to provide documentation to verify your identity, state of residence, employment, and income, along with payoff details for the current loan, the car's registration and mileage, and proof of insurance coverage.

Once you've submitted your application, you can typically close the loan within a few days, as long as you've provided everything the lender needs to make a decision.

Note that some lenders will mail your check or ask you to pick it up in person, like Navy Federal , but many others have made the process completely online, like LightStream.

After approval, the lender will pay off your existing loan directly and tell you when the first payment on the new loan will be due. Continue to make payments on the original loan until you've confirmed it's been paid off, then set up automatic payments with the new lender.

Depending on your situation, you may be able to take advantage of one or more benefits with an auto loan refinance. Here are some potential pros to consider. Depending on the terms you qualify for, you may be able to get a reduced monthly payment.

Even if you don't get a lower interest rate, refinancing at a longer term than what you have remaining on your current loan can cause your monthly payments to drop. It's important to keep in mind that extending your loan term can result in higher total interest charges.

If your credit and other financial details have improved or market interest rates have dropped significantly, you may be able to get a lower interest rate than what you're currently paying.

This can significantly decrease the total amount you pay for the loan, by hundreds or even thousands of dollars. A lower rate can also result in a lower monthly payment without higher total charges.

Depending on your need for payment flexibility, you can opt for a shorter or longer term than what you have left on your current loan. A shorter term can save you money on interest, but make sure you can afford the new monthly payment before you proceed. And while a longer term can help reduce your monthly payment amount, it can also cost you more in the long run.

If you have a significant amount of equity in your car, you may be able to access some of it in the form of cash. While there are some clear benefits of refinancing your car loan, you'll also want to think carefully about the following factors before you proceed.

Refinancing a car loan can affect your credit, but the negative impact is usually slight and temporary in nature. There may be negative effects from the hard inquiry and new account on your credit reports, but these are relatively minor factors compared to more important things like payment history and credit utilization.

Understanding the factors that affect your credit can give you a better idea of what to expect. If you're wondering how to refinance a car loan with bad credit , the process can be difficult and costly. While there are auto lenders that specialize in working with bad-credit borrowers, they tend to charge high interest rates and fees.

Depending on your current loan terms, it might not be worth it. Although refinancing can benefit you financially, there are situations where it might not make sense, such as if:. See the best auto refinance loans to see what you can get.

Requirements can vary depending on the lender, but here are some general documents you'll want to have on hand before you start the application process:. Capital One. Consumer Financial Protection Bureau.

Navy Federal Credit Union. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand.

Table of Contents. Steps to Refinance. Review Your Loan. Know Your Value. Understand Your Credit. Get Quotes. Best Auto Loan Refinance Rates. This is largely because the lender stands to make more if you default and it repossesses your vehicle to sell.

This possibility means the lender may offer you a lower interest rate. Then, use a loan-to-value LTV calculator to determine if you have positive equity.

Your LTV ratio is the amount you owe divided by how much your vehicle is worth. Not every lender is willing to work with you when you face financial problems or other issues. Even small matters can snowball into an unpleasant loan situation.

Refinancing to a lender with good customer service reviews may save you from a headache — on top of potential savings on interest. If a prepayment penalty is attached to your current loan, it may cost more to refinance than you would end up saving.

Even if you have not improved your credit, lower interest rates could still benefit you. Interest rates on car loans change with the prime rate , Fed rate and market conditions. But the opposite can be true.

The Fed rate has been on the rise for more than a year, and auto loan rates are rising alongside it. You may not be able to score a lower rate even if your credit score and financial situation have improved. According to data from Experian , the average used car rate in the third quarter of is Although refinancing rates vary, they are usually similar to used car rates.

Because the Fed rate has increased and rates are rising , it may not be the best time to refinance based on rates alone. Even if you can get a lower monthly payment or interest rate, there are situations where it may be sensible to hold off on refinancing. Compare the cost of your prepayment penalty to the total possible savings from refinancing.

If the prepayment penalty is too high, it could outweigh the benefits of refinancing. Start by reviewing your loan documents to confirm the amount of the prepayment penalty.

Next, use an auto refinance calculator to compute the total potential interest savings. Finally, deduct the prepayment penalty and any costs associated with the new loans from the total interest savings. If the figure is negative, it means refinancing will likely cost you money. You should also avoid refinancing your car loan if you are nearing the end of your loan term.

It is possible to refinance and get a low monthly payment, but you will likely extend your term and pay more interest. Check lender requirements before you apply.

Most lenders only offer terms of 24 months or more — although some allow you to refinance if you have at least six months left on your loan. For a lender to make money off interest, you must borrow a minimum amount. Some lenders may turn you down for financing if your car is older than 10 years or has over , miles on it.

Some lenders may have stricter requirements — like eight years or less than 80, miles. Lenders view significant negative equity as too much of a risk. Lenders often require at least six on-time payments before they consider you eligible for refinancing.

This is to lower the risk of default. If you can keep up with your current payments, you prove that you can handle your debt. Likewise, a lender may be reluctant to approve you for a refinance auto loan if you have recently refinanced.

There is no set limit to how often you can refinance , but it may negatively impact your credit if you refinance frequently. Like with any loan, multiple hard inquiries could damage your score and make it more difficult to qualify for a competitive rate.

When you are ready to refinance your car loan , take the time to review lenders and the status of your current loan. If you are approved, your new lender will either pay off the old loan or send you the funds to do it yourself.

Either way, check with both lenders to ensure all the paperwork and payments have gone through. Refinancing could be a smart financial move if your situation has changed since you took out your current loan.

Apply for preapproval with several lenders to explore potential rates and compare loan offers to gauge if you could qualify for a loan with more competitive terms. Then use an auto refinance calculator to determine if the benefits outweigh the costs. Small business loan refinancing: What you should know.

When to consider a short-term business loan. Ways to refinance your HELOC. Should you refinance with the same lender? Allison Martin. Written by Allison Martin Arrow Right Contributor, Personal Finance.

Allison Martin is a contributor to Bankrate covering personal finance, including mortgages, auto loans and small business loans. Martin, a Certified Financial Education Instructor CFE , also shares her passion for financial literacy and entrepreneurship with others through interactive workshops and programs.

Pippin Wilbers. Edited by Pippin Wilbers Arrow Right Editor, Auto Loans.

Lenders will often have age limits and mileage limits on refinancing. Some lenders may not refinance your car if it is more than ten years old Refinancing your car is easier than you might think. · Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2 To refinance your car, you must be current on your existing loan. One of the most beneficial aspects of refinancing is the money-savings

Video

Car refinance mistakes - DON'T MAKE THEM! Can Minimum eligibility criteria refinance my existing Capital One auto loan? APR 7. What are the basic Eligbility and vehicle requirements? Already got the basics? com is an independent, advertising-supported publisher and comparison service. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.Eligibility for auto refinance - Required documents for auto loan refinancing · Proof of employment or income, such as a paycheck stub or tax return. · Proof of car insurance Lenders will often have age limits and mileage limits on refinancing. Some lenders may not refinance your car if it is more than ten years old Refinancing your car is easier than you might think. · Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2 To refinance your car, you must be current on your existing loan. One of the most beneficial aspects of refinancing is the money-savings

Lenders need a few basic facts about your existing loan: the current balance, monthly payment amount, time left on the loan and annual percentage rate APR.

Have your loan servicing number on hand so the lender can easily look up your loan. A lender may not approve you for a refinance unless you meet a certain loan-to-value ratio LTV. The LTV is the loan amount divided by the appraised value of your car. Before applying, check your credit score. If your credit score has improved since you first applied for a loan, you can expect your refinance rate to improve in turn.

Lenders typically want to know what other debts you have, such as credit cards, student loans or a home loan. See if you could qualify for an auto loan refinance with a great rate and lower monthly payments. How Does Interest Work on a Car Loan?

How to Refinance a Car Loan. Do You Need a Co-signer to Get an Auto Loan? This content is intended to provide general information and shouldn't be considered legal, tax or financial advice.

It's always a good idea to consult a tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation. You are leaving a Navy Federal domain to go to:. MORE LIKE THIS Auto Loans Loans.

Want to refinance your auto loan? See if you pre-qualify. Estimated payoff amount Check Rates. Review your existing auto loan. APR for your current loan. Back to top. Determine the value of your car. Evaluate your credit.

Gather information for your application. Vehicle registration. Proof of insurance. Your Social Security number. Compare lenders and rates. Auto loans from our partners. Check Rate. NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

APR 5. credit score Auto Credit Express. APR 6. APR 7. credit score None. Consumers Credit Union. Gravity Lending. SEE MORE LENDERS.

Frequently asked questions How much can I save by refinancing my car? Does refinancing a car hurt my credit? How much can I save by refinancing my car? Dive even deeper in Auto Loans.

Explore Auto Loans. Get more smart money moves — straight to your inbox. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Determining when to refinance car loans is more complex than it seems. Refinancing your car loan involves swapping your current loan for a new one with different terms.

But there are more factors to consider than just picking a new lender. If you plan to refinance your car loan, focus on your monthly payment and how much you will save on interest.

If your income has decreased recently, or you want to free up funds to meet other financial goals, it could be time to refinance your car loan to get a lower monthly payment. When you refinance, you either increase your loan term or find a lender with a lower interest rate.

Refinancing at a lower rate is ideal — it will save you money overall and likely reduce your monthly costs. But if you take on a longer term to lower your payment, you will pay more interest over the life of your loan.

Despite that, refinancing could still be the right move for a lower monthly payment when you have a tight budget. The best interest rates on auto loans go to buyers with good or excellent credit — typically a score of or higher.

If you took out a loan at a higher rate and now have built a better credit score , you could qualify for an auto loan with more favorable terms. When you finance in-house, the dealer shops your information around to lenders in its network.

Even if dealer financing was convenient for you when you bought your car, refinancing now at a lower rate could save you money. Lenders view positive equity — cars worth more than you owe — as a big plus when refinancing.

This is largely because the lender stands to make more if you default and it repossesses your vehicle to sell. This possibility means the lender may offer you a lower interest rate. Then, use a loan-to-value LTV calculator to determine if you have positive equity.

Your LTV ratio is the amount you owe divided by how much your vehicle is worth. Not every lender is willing to work with you when you face financial problems or other issues. Even small matters can snowball into an unpleasant loan situation.

Refinancing to a lender with good customer service reviews may save you from a headache — on top of potential savings on interest. If a prepayment penalty is attached to your current loan, it may cost more to refinance than you would end up saving.

Even if you have not improved your credit, lower interest rates could still benefit you. Interest rates on car loans change with the prime rate , Fed rate and market conditions.

Most lenders consider your current loan, the value of your vehicle, your credit score and any outstanding debt when determining refinancing. Time to Read. 2 Lenders have different requirements for when you can refinance an auto loan. For example, your lender may have minimum and maximum loan balance requirements movieflixhub.xyz › Loans › Auto Loans: Eligibility for auto refinance

| Your aauto lender Instant approval loans be Lower closing costs currently auti your Business credit requirements to a autoo credit bureau, 2 Eligibilkty or NCUA insured, or 3 both Better Business Bureau Accredited and a state registered Ahto or state Eligibilkty auto dealer. The Navy Federal Credit Union privacy and security policies do not apply to the linked site. Written by Emma Woodward Arrow Right Contributor, Personal Finance. If your financial situation has improved, you could refinance to a shorter term, keep your monthly payment about the same and pay off the loan sooner. All of our content is authored by highly qualified professionals and edited by subject matter expertswho ensure everything we publish is objective, accurate and trustworthy. | No down payment required. Can I refinance my existing Capital One auto loan? Emma Woodward. Have you given much thought to your auto loan since you signed on the dotted line? See the best auto refinance loans to see what you can get. If you bought a heavily used car or have racked up lots of miles and want to refinance the loan, you may not be able to. | Lenders will often have age limits and mileage limits on refinancing. Some lenders may not refinance your car if it is more than ten years old Refinancing your car is easier than you might think. · Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2 To refinance your car, you must be current on your existing loan. One of the most beneficial aspects of refinancing is the money-savings | Some lenders may have stricter requirements — like eight years or less than 80, miles. If your car is too old or has a high number on the LendingClub's auto refinancing has limitations: You can only refinance vehicle loan balances between $4, and $55,, and you must have at Your current lender needs to meet one of the following requirements: 1) is currently reporting your loan to a major credit bureau, 2) is FDIC or NCUA insured | Typically, lenders want you to movieflixhub.xyz › Loans › Auto Loans Required documents for auto loan refinancing · Proof of employment or income, such as a paycheck stub or tax return. · Proof of car insurance |  |

| Other factors, such as our own E,igibility website rules refunance whether a product is offered in Eoigibility area or Minimum eligibility criteria your self-selected credit score range, can also impact how and where products appear on this site. Lastly, lenders look at your personal finances — specifically your credit score and debt-to-income ratio. Connect with us. If your credit has improved since you took out your original car loan, you may now qualify for a lower rate. We do not offer cash-back refinancing or lease buyouts. | These include white papers, government data, original reporting, and interviews with industry experts. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. I want to save money I want to pay off my car faster I want to lower my APR. GAP insurance and other products We will pay off your current auto loan only and will not finance new GAP or other coverage to cover any canceled coverage due to refinancing. MORE LIKE THIS Auto Loans Loans. The majority of lenders will request the following information at some point, so you can prepare by gathering everything ahead of time. Pre-Qualification: Submit an application to see if you pre-qualify to refinance your current auto loan with no impact to your credit score. | Lenders will often have age limits and mileage limits on refinancing. Some lenders may not refinance your car if it is more than ten years old Refinancing your car is easier than you might think. · Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2 To refinance your car, you must be current on your existing loan. One of the most beneficial aspects of refinancing is the money-savings | Missing To refinance your car, you must be current on your existing loan. One of the most beneficial aspects of refinancing is the money-savings Vehicle Restrictions Auto refinancing loans are only available for vehicles that are 10 years old or newer (based on vehicle model year) and have , miles | Lenders will often have age limits and mileage limits on refinancing. Some lenders may not refinance your car if it is more than ten years old Refinancing your car is easier than you might think. · Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2 To refinance your car, you must be current on your existing loan. One of the most beneficial aspects of refinancing is the money-savings |  |

| Minimum eligibility criteria One may require additional verification to Loan interest rate negotiation tips and tricks that any Business credit requirements provided refiance your pre-qualification request, including pre-filled information, is accurate. Refknance begin making refinwnce on the new loan, which usually has a lower interest rate or different repayment period. A shorter term can save you money on interest, but make sure you can afford the new monthly payment before you proceed. Please consult the site's policies for further information. Mortgages What credit score do I need to refinance my mortgage? This will give your credit score a chance to recover from the hard inquiries of your initial loan. | Evaluate your credit 4. Cancel Proceed to You are leaving a Navy Federal domain to go to:. Your credit score. But if you take on a longer term to lower your payment, you will pay more interest over the life of your loan. Compare both monthly payments and total interest costs among lenders to ensure you're saving money. Lenders often require at least six on-time payments before they consider you eligible for refinancing. | Lenders will often have age limits and mileage limits on refinancing. Some lenders may not refinance your car if it is more than ten years old Refinancing your car is easier than you might think. · Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2 To refinance your car, you must be current on your existing loan. One of the most beneficial aspects of refinancing is the money-savings | Documents Always Needed For an Auto Refinancing · Driver's License · Registration · Odometer Photo · Proof of Insurance. Some lenders require proof of a certain Lenders have specific requirements regarding the age and mileage of cars they're willing to refinance, and some lenders won't refinance a loan 1. Refinancing requirements · 2. Prepayment penalties · 3. Interest rates · 4. Your credit score · 5. Your income · 6. Time remaining on your loan | Lenders have different requirements for when you can refinance an auto loan. For example, your lender may have minimum and maximum loan balance requirements 1. Refinancing requirements · 2. Prepayment penalties · 3. Interest rates · 4. Your credit score · 5. Your income · 6. Time remaining on your loan You typically need good credit and a history of on-time payments to qualify for auto loan refinancing. Here's a quick guide on how to refinance |  |

Eligibility for auto refinance - Required documents for auto loan refinancing · Proof of employment or income, such as a paycheck stub or tax return. · Proof of car insurance Lenders will often have age limits and mileage limits on refinancing. Some lenders may not refinance your car if it is more than ten years old Refinancing your car is easier than you might think. · Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2 To refinance your car, you must be current on your existing loan. One of the most beneficial aspects of refinancing is the money-savings

If you took out a loan at a higher rate and now have built a better credit score , you could qualify for an auto loan with more favorable terms. When you finance in-house, the dealer shops your information around to lenders in its network.

Even if dealer financing was convenient for you when you bought your car, refinancing now at a lower rate could save you money. Lenders view positive equity — cars worth more than you owe — as a big plus when refinancing. This is largely because the lender stands to make more if you default and it repossesses your vehicle to sell.

This possibility means the lender may offer you a lower interest rate. Then, use a loan-to-value LTV calculator to determine if you have positive equity. Your LTV ratio is the amount you owe divided by how much your vehicle is worth.

Not every lender is willing to work with you when you face financial problems or other issues. Even small matters can snowball into an unpleasant loan situation. Refinancing to a lender with good customer service reviews may save you from a headache — on top of potential savings on interest.

If a prepayment penalty is attached to your current loan, it may cost more to refinance than you would end up saving. Even if you have not improved your credit, lower interest rates could still benefit you. Interest rates on car loans change with the prime rate , Fed rate and market conditions.

But the opposite can be true. The Fed rate has been on the rise for more than a year, and auto loan rates are rising alongside it. You may not be able to score a lower rate even if your credit score and financial situation have improved. According to data from Experian , the average used car rate in the third quarter of is Although refinancing rates vary, they are usually similar to used car rates.

Because the Fed rate has increased and rates are rising , it may not be the best time to refinance based on rates alone. Even if you can get a lower monthly payment or interest rate, there are situations where it may be sensible to hold off on refinancing.

Compare the cost of your prepayment penalty to the total possible savings from refinancing. If the prepayment penalty is too high, it could outweigh the benefits of refinancing. Start by reviewing your loan documents to confirm the amount of the prepayment penalty.

Next, use an auto refinance calculator to compute the total potential interest savings. Finally, deduct the prepayment penalty and any costs associated with the new loans from the total interest savings. If the figure is negative, it means refinancing will likely cost you money.

You should also avoid refinancing your car loan if you are nearing the end of your loan term. It is possible to refinance and get a low monthly payment, but you will likely extend your term and pay more interest.

Check lender requirements before you apply. Most lenders only offer terms of 24 months or more — although some allow you to refinance if you have at least six months left on your loan. For a lender to make money off interest, you must borrow a minimum amount.

Some lenders may turn you down for financing if your car is older than 10 years or has over , miles on it. Some lenders may have stricter requirements — like eight years or less than 80, miles. Lenders view significant negative equity as too much of a risk.

Lenders often require at least six on-time payments before they consider you eligible for refinancing. This is to lower the risk of default. If you can keep up with your current payments, you prove that you can handle your debt.

Likewise, a lender may be reluctant to approve you for a refinance auto loan if you have recently refinanced. There is no set limit to how often you can refinance , but it may negatively impact your credit if you refinance frequently.

Like with any loan, multiple hard inquiries could damage your score and make it more difficult to qualify for a competitive rate. When you are ready to refinance your car loan , take the time to review lenders and the status of your current loan. If you are approved, your new lender will either pay off the old loan or send you the funds to do it yourself.

Either way, check with both lenders to ensure all the paperwork and payments have gone through. Refinancing could be a smart financial move if your situation has changed since you took out your current loan. Apply for preapproval with several lenders to explore potential rates and compare loan offers to gauge if you could qualify for a loan with more competitive terms.

Then use an auto refinance calculator to determine if the benefits outweigh the costs. Small business loan refinancing: What you should know. When to consider a short-term business loan. Ways to refinance your HELOC. Should you refinance with the same lender?

Allison Martin. Written by Allison Martin Arrow Right Contributor, Personal Finance. If the interest rate you qualify for today is significantly lower than your current loan rate, it may be a good time to refinance a car. Has your credit score changed since your original car loan? Learn how to improve your credit score.

Refinancing your auto loan so you have a lower monthly payment can make sense if your income has dipped. Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month — but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

How financing a car works. How car loans work. The basics of buying a new or used car. Review rates and apply now. Apply early so you know how much car you can afford. View rates, calculate payments and apply for a competitive rate loan. Purchase, refinance and lease buyout loans available.

Learn more about our auto loans. Skip to main content warning-icon. You are using an unsupported browser version. Learn more or update your browser. close browser upgrade notice ×.

Auto Loan Basics.

Mir ist diese Situation bekannt. Geben Sie wir werden besprechen.

Mir scheint es, Sie sind nicht recht