Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

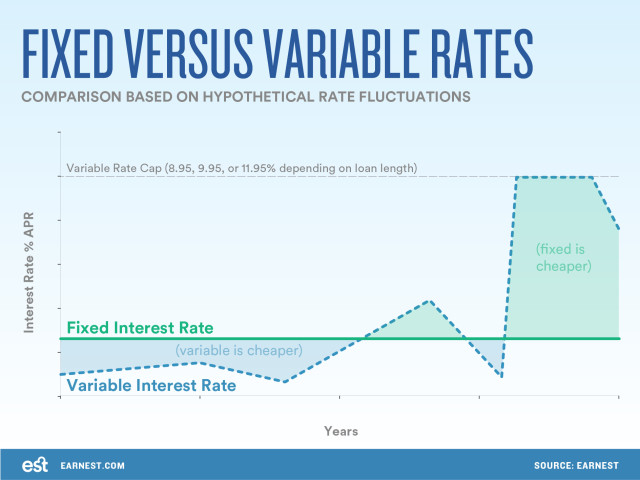

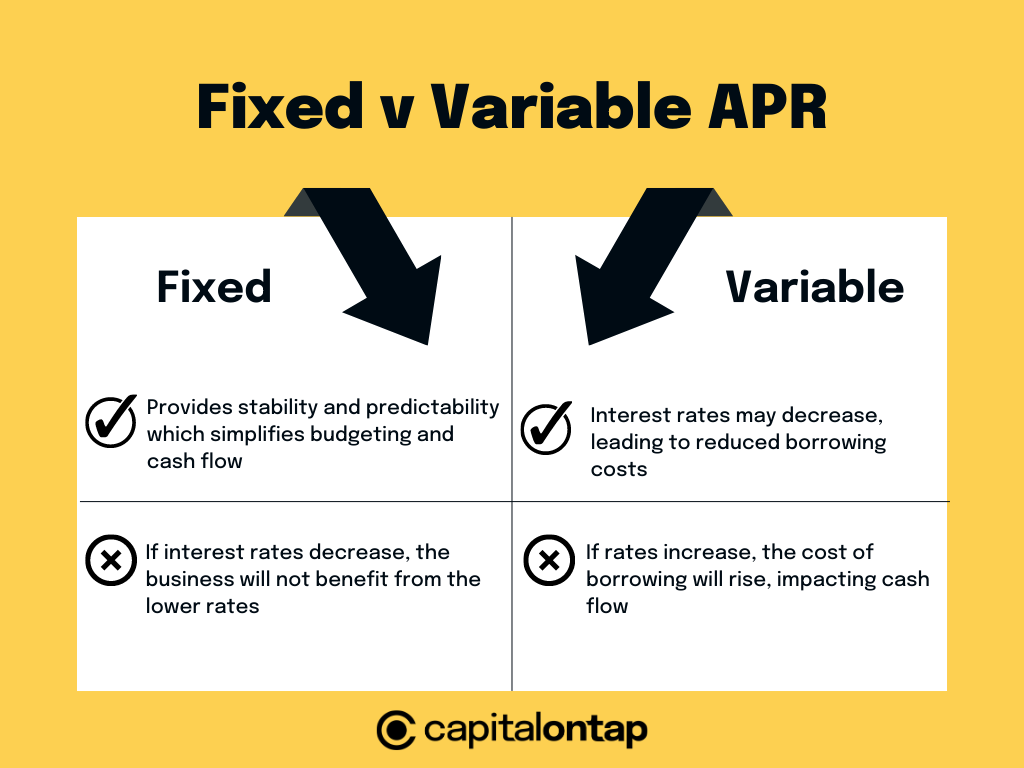

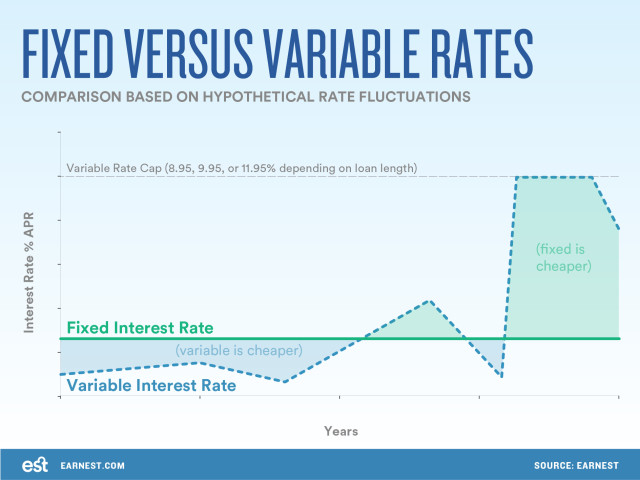

Nearly all credit cards come with variable interest rates these days. As the index rate rises and falls, the APR on variable rate cards typically follows. Like their variable-rate counterparts, fixed-rate credit cards can be offered as unsecured cards or on a secured basis meaning that cardholders must deposit the amount of their credit line to serve as collateral.

Fixed-rate cards can offer rewards and may come with an annual fee, though specific offerings vary by issuer. Fixed-rate credit card offers are rare.

Card issuers can — and do — raise your interest rate even with a fixed-rate card. The virtual disappearance of fixed-rate cards can be traced more or less to the Credit CARD Act of This legislation ushered in a number of consumer protections, including protection against random rate increases without warning on their credit cards.

As long as these requirements are followed, an issuer can decide to change your interest rate on a fixed-rate card at any time after your first year. According to Ted Rossman, senior industry analyst for Bankrate. Variable rates are not necessarily as volatile as they might seem. Here are some of the best 0 percent intro APR offers currently available offering promotional periods for both purchases and balance transfers:.

These cards will charge interest from day one but may offer a lower variable rate than other card options, depending on your creditworthiness. Here are some of the best cards with interest rates that may be lower than the current average rate:. While a fixed-rate credit card may seem like the best way to control your interest charges, there are usually better ways to pay less interest that are considerably easier to find.

Whether your credit card has a fixed rate or variable rate is not as important as simply getting the lowest interest rate you can, or the promotional interest rate you need to give breathing room on paying off a balance. Bank Platinum Visa Card has been collected independently by Bankrate.

Card details have not been reviewed or approved by the card issuer. While the five-year estimates we've included are derived from a budget similar to the average American's spending, you may earn a higher or lower return depending on your shopping habits.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

What is a low interest credit card? How do I lower my credit card interest rate? Subscribe to the Select Newsletter! Learn More. Information about the Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union has been collected independently by CNBC and has not been reviewed or provided by the issuer of the card prior to publication.

Rewards 3X points on gas and grocery purchases and 1. Pros Low 9. View More. Information about the Platinum Mastercard® has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Rewards None. Pros No annual fee No balance transfer fee. Cons No rewards program. Information about the DCU Visa® Platinum Secured Credit Card has been collected independently by CNBC and has not been reviewed or provided by the issuer of the cards prior to publication. Pros No annual fee No foreign transaction fee.

On First Tech Federal Credit Union's secure site. Rewards Earn 2X points on groceries, gas, electronics, medical, household goods and telecommunications, 1X points on all other purchases.

Pros No annual fee Good rewards program for everyday purchases No balance transfer fee No fee charged on purchases made outside the U. Cons Balance must be transferred within 90 days of account opening date. On Capital One's secure site. Rewards 5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 1.

Pros 5 miles per dollar on hotel and rental cars booked through Capital One Travel Miles never expire for the life of the account. Cons No Global Entry or TSA PreCheck statement credit offerings No airport lounge access.

Read more. Which credit cards have the best interest rates? Find the right savings account for you. Learn more: 5 things to do once your balance transfer is complete.

Remember that you'll need to make minimum payments on your balance and pay it off in full before the intro period ends to avoid interest.

After you determined which credit card you want to apply for, compare cards by these key factors:. These cards can help you consolidate credit card debt with a balance transfer, pay for new purchases over time without incurring interest charges or both.

Balance transfer credit cards may set a limit on the amount of debt you can transfer, which is often less than your overall credit limit. In general, the lower your credit score, the higher your interest rate will be.

Using the extra cash you save not paying interest can help you pay down your debt faster, lower your credit utilization and increase your credit score.

A no-interest credit card is a great tool for financing new purchases, but you need to be careful how you use one. The simplest way to avoid interest charges on a credit card is to pay your balance in full by the due date.

Once the intro period ends, any lingering balances or new purchases and transfers will incur the regular APR. However, this dip is temporary and you're credit score should rise in a few months. However, if you use a large amount of your credit line on your card for either purchases or a balance transfer, your credit utilization ratio could rise and cause a more significant drop in your credit score.

However, needlessly holding onto debt is never a good idea, so be sure to have a plan in place to pay off any debt you have.

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every credit card review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

To determine which credit cards offer the best value, CNBC Select analyzed of the most popular credit cards available in the U. We compared each card on a range of features, including rewards, welcome bonus, introductory and standard APR, balance transfer fee and foreign transaction fees, as well as factors such as required credit and customer reviews when available.

We also considered additional perks, the application process and how easy it is for the consumer to redeem points. Select teamed up with location intelligence firm Esri. The company's data development team provided the most up-to-date and comprehensive consumer spending data based on the Consumer Expenditure Surveys from the Bureau of Labor Statistics.

You can read more about their methodology here. General purchases include items such as housekeeping supplies, clothing, personal care products, prescription drugs and vitamins, and other vehicle expenses.

Select used this budget to estimate how much the average consumer would save over the course of a year, two years and five years, assuming they would attempt to maximize their rewards potential by earning all welcome bonuses offered and using the card for all applicable purchases.

All rewards total estimations are net of the annual fee. While the five-year estimates we've included are derived from a budget similar to the average American's spending, you may earn a higher or lower return depending on your shopping habits. Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Information about the Bank of America® Unlimited Cash Rewards Card, Amex EveryDay® Credit Card, American Express Cash Magnet® Card has been collected independently by Select and has not been reviewed or provided by the issuers of the cards prior to publication.

For rates and fees of the Amex EveryDay® Credit Card, click here. For rates and fees of the American Express Cash Magnet® Card, click here.

For rates and fees of the Blue Cash Everyday® Card from American Express, click here. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend.

We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. The Bank of America® Unlimited Cash Rewards Card. Citi Simplicity® Card. Learn More. Rewards None. Pros No annual fee Balances can be transferred within 4 months from account opening One of the longest intro periods for balance transfers.

The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash

Low variable APR rates - %, %, or % Variable APR. Apply Now. on Wells Fargo's website. on Wells Fargo's website. Rates & Fees · Discover it® Cash Back The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash

Even if the introductory offer is low-interest rather than zero-interest, you'd save money as long as the intro rate is lower than what you're currently paying. To see what the balance transfer process might look like, you can use Bankrate's Credit Card Balance Transfer Calculator.

In cases where you know you have a large purchase coming up, a low-interest card — or even better, a zero-interest card with a solid introductory offer on purchases — could be a smart choice.

The primary draw for a low-interest credit card is that it could help you save if you have to carry a balance. Credit cards for bad credit often come with high APRs, security deposits and even annual fees. These added costs are to make up for lending to what issuers may consider a risky borrower.

Still unsure if a low-interest credit card is right for you? Check out our Credit Card Spender Type Tool , where you can get personalized credit card recommendations based on your credit score, spending habits and daily needs.

Few people actually know the APR on their credit card. As credit card APRs climb to an all-time high, intentionally picking a card with an interest rate below the current average could give your wallet a bit of a break. However, you could still save more than what you would with a card that has a high interest rate.

If carrying a balance is something you may do regularly, choosing a low-interest card could be key to staving off some of the most expensive interest charges. People with higher credit scores tend to qualify for lower interest rates on any kind of loan, including credit cards.

If your credit is fair or bad, you may not qualify for the most advantageous rates. Find out what your current score is and check for any issues or errors on your credit report. If your credit needs work, stick to a long-term strategy for improving your credit score.

Many of the best low-interest credit cards often skip the extra bells and whistles in favor of keeping costs low and helping you focus on reducing your balance. But some cards do offer modest perks and rewards programs.

A pre-qualified offer involves an initial evaluation before beginning the actual process of applying. With pre-qualification, you won't be subject to a hard inquiry that can temporarily lower your credit score. One of the common misconceptions about credit cards is that they can be dangerous to your financial health.

Low-interest cards are a great way to avoid hefty interest charges. Paying the total of your credit card balance each month allows you to avoid interest charges altogether.

If you find yourself with a balance on one or more credit cards with high interest rates, consider moving that debt to a single low-interest card, if possible. lf you plan to finance a significant purchase on a credit card , be sure to keep low-interest cards top of mind.

You can save on interest and pay less over time with a low-interest card. To double the benefit, try finding a card with a zero percent intro APR offer to start.

Then, if that card has a low ongoing interest rate, you could add even more to your savings potential. If you're dead set on finding a way to lower your credit card interest rate , contact your issuer.

You can call and ask to lower your interest rate or even negotiate a new payment plan entirely. If you've generally been on time with your payments and have been a loyal customer, use those points in making your case.

With the right approach, you could be successful in lowering your rate. There is a strong correlation between the interest rate you are eligible for and your credit score. The higher your credit score is, the better the rate issuers offer you might be. Even if your credit score is poor, however, you won't be charged any interest if you keep the balance to zero.

Most cards will give you a 25 to 30 day grace period. The more you do that, your credit score should rise, so if and when you want a new credit card with a low APR, you will be in a better position to qualify.

The average credit card rate is now well above 20 percent. For consumers with blemished credit history, the rates are typically closer to 30 percent due to the increased risk for the issuer. Consumers with bad credit will find it difficult to qualify for any unsecured credit card and may have to start with a secured credit card to help build or rebuild positive credit history.

Consumers with bad credit who apply for an unsecured credit card will typically only be approved for sub-prime cards with a low credit limit and high interest rate.

These cards may also carry high fees. Bad credit users should take special care not to carry a balance on the card or use more than one-third of the credit limit at any one time. If you have bad credit, your options for cards might be limited, and your focus should be doing what you can to get your credit score up.

Shop around for the lowest rate you can find. No matter what the interest rate is on the card you do get, the best thing to aim for is to not put more on your card than what you can comfortably pay off every month by your due date.

Frequent on-time payments will help you build your score up to land a lower rate card. We use primary sources to support our work. Fay, B. Accessed on December 7, Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty.

After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Apply for a credit card with confidence. When you find your odds, you get:. A personalized list of cards ranked by likelihood of approval. No credit hits.

Your personal information and data are protected with bit encryption. That means:. All of your personal information is protected with bit encryption.

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds. Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible. Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties.

You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio DTI which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? We need the last four digits of your social security number to run a soft credit pull. We need the last four digits of your Social Security number to run a soft credit pull.

This helps us locate your profile and identify cards that you may qualify for. Your information is protected by bit encryption. A soft credit pull will not affect your credit score. Last step! Once you enter your email and agree to terms:. Your approval odds will be calculated. A personalized list of cards ranked by order of approval will appear.

Your odds will display on each card tile. Enter your email address to activate your approval odds and get updates about future card offers. You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider.

Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less. This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Before you apply You get:. Access to special card offers from top issuers in our network. You can check out other cards that are a better fit.

Credit Cards Low Interest Advertiser Disclosure Advertiser Disclosure Bankrate. Ashley Parks. Written by Ashley Parks Arrow Right Editor, Credit cards. Tracy Stewart. Edited by Tracy Stewart Arrow Right Senior Editor, Credit Cards. Jason Steele. Reviewed by Jason Steele Arrow Right Former contributor, Credit Cards.

Credit Card Search View card list Menu List Table of contents Why choose Bankrate Caret Down User We helped put over , cards in people's wallets in Circle Check Match to cards with approval odds and apply with confidence.

Lightbulb Over 47 years of experience helping people make smart financial decisions. The Bankrate Promise. User We helped put over , cards in people's wallets in Why choose Bankrate The Bankrate Promise. The Bankrate Promise At Bankrate we strive to help you make smarter financial decisions.

View card list Collapse Caret Up. Best Low Interest Credit Cards for February Wells Fargo Reflect® Card : Best for long intro APR offers Discover it® Cash Back : Best for cash back Bank of America® Customized Cash Rewards credit card : Best for home improvement Bank of America® Unlimited Cash Rewards credit card : Best for big savers Blue Cash Everyday® Card from American Express : Best for families Discover it® Balance Transfer : Best for first-year value Capital One SavorOne Cash Rewards Credit Card : Best for long-term value Wells Fargo Active Cash® Card : Best for large purchases Capital One Quicksilver Cash Rewards Credit Card: Best for streamlined rewards Citi® Diamond Preferred® Card : Best for balance transfers.

Table of contents Collapse Caret Up. Increase your odds of finding the perfect card. Increase your odds of finding the perfect card 1 in 3 people w ho try approval odds find a card they like.

See your approval odds. Wells Fargo Reflect® Card Wells Fargo Reflect® Card. Rating: 4. Bankrate review. appOddsOn { aoProduct. Apply now Lock. Apply now Lock on Wells Fargo's secure site.

Regular APR. Annual fee. Pros The long intro APR is for both purchases and qualifying balance transfers. No annual fee and cellphone protection against damage or theft are adequate perks that add value to this card.

The card comes with a 3 percent foreign transaction fee. Select "Apply Now" to take advantage of this specific offer and learn more about product features, terms and conditions. Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants.

It's an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card. Discover it® Cash Back Discover it® Cash Back.

Apply now Lock on Discover's secure site. Intro offer. The as low as credit score requirement may make the card more accessible. Maximizing your rewards can be complicated.

Redeem your rewards for cash at any time. Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. Then No annual fee. Terms and conditions apply.

Bank of America® Customized Cash Rewards credit card Bank of America® Customized Cash Rewards credit card. Apply now Lock on Bank of America's secure site.

Cons The welcome offer carries a relatively high spending requirement. A few competing cards offer the same bonus value for half the spending in the same time frame.

That could make a 2 percent flat-rate card more rewarding long term. That means you could earn 3. Contactless Cards - The security of a chip card, with the convenience of a tap.

This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now. BEST FOR BIG SAVERS. Bank of America® Unlimited Cash Rewards credit card Bank of America® Unlimited Cash Rewards credit card.

Rating: 3. Rewards details Caret Down 1. Pros Earns at least 1. One of few cards to offer rewards alongside a lengthy intro APR period. Earn unlimited 1. That means you could earn 1. Become a member through affiliation with select organizations or employers, a relationship with a current member, working or living in Lane County, Oregon, attending Cogswell Poly Technical College or by joining the Community History Museum CHM or Financial Fitness Association FFA.

The membership fee for the CHM and FFA is paid by First Tech. The DCU Visa® Platinum Secured Credit Card has one of the lowest interest rates for a secured card at It also has no annual fee, which allows you to maximize savings. In addition to a competitive interest rate, cardholders can benefit from travel insurance, auto rental collision damage waiver and extended warranty protection.

Earn 2X points on groceries, gas, electronics, medical, household goods and telecommunications, 1X points on all other purchases. The Choice Rewards World Mastercard® from First Tech Federal Credit Union offers a rewards program geared toward everyday expenses, such as groceries and gas.

Cardholders earn 2X points on groceries, gas, electronics, medical, household goods and telecommunications, and 1X points on all other purchases. This card has no annual fee, no foreign transaction fees, and no balance transfer fee, and the regular APR is pretty reasonable Membership to First Tech Federal Credit Union is required, but anyone can join through affiliation with select organizations or employers, a relationship with a current member, working or living in Lane County, Oregon, attending Cogswell Poly Technical College or by joining the Community History Museum CHM or Financial Fitness Association FFA.

First Tech pays the membership fee for the CHM and FFA on your behalf. See rates and fees. See our methodology , terms apply. Read our Capital One VentureOne Rewards Credit Card review.

Anyone looking to book hotel rooms before the end of the year should consider the Capital One VentureOne Rewards Credit Card and its impressive offer of 5X miles on hotel and rental cars booked through Capital One Travel.

This no-annual-fee card also gives cardmembers an unlimited 1. After that, the APR is Additionally, with this card, it's possible to transfer your miles to any of Capital One's partner airlines, including JetBlue, Emirates Skywards, Air Canada and Air France.

Cardholders can also redeem their miles for cash in the form of a check or account credit, gift cards and more, though rates for these other redemption options vary. Learn more: Select's Capital One VentureOne Rewards Credit Card review.

Who's this card for? If you're looking to transfer debt and finance new purchases, consider the Wells Fargo Reflect® Card , which provides one of the best overall intro APR periods.

There's no annual fee. With such a long intro period, ideally, you can pay off your debt within that time frame and not have to pay additional interest. Read more about how to make the most of your balance transfer. This card doesn't offer a rewards program but comes with a cell phone protection plan.

As its name suggests, low interest credit cards are credit cards with below-average APRs. They can help you avoid high interest charges if you carry a balance month-to-month. At the time of writing, the average APR for all credit card accounts is After the intro period ends, any lingering balances or new purchases and transfers will incur the regular APR.

The best way to lower your credit card interest rate is by improving your credit score. The lowest interest rates typically require having a good or excellent credit score scores of and above. Once you have a higher credit score, you can call your current card issuer and ask if they'll lower the interest rate , or you could apply for a new card altogether and potentially get a better APR.

As a general rule, you should aim to pay your credit card bill in full every month. However, if you absolutely must carry a balance occasionally, you should do so on a card with a low APR to avoid high interest charges.

As an added perk, many low interest credit cards don't charge an annual fee and some still offer rewards programs. To determine which credit cards have the lowest interest rates and offer the best value, Select analyzed of the most popular credit cards offered by the biggest banks, financial companies, and credit unions that allow anyone to join.

We compared each card on a range of features, including: annual fee, rewards program, introductory and standard APR, balance transfer fee, welcome bonuses and foreign transaction fees, as well as factors such as required credit and customer reviews when available.

Seeking a lower interest rate will almost always work to your advantage when compared with going after greater credit card rewards. You can try to negotiate the interest rate on your credit card by calling your card issuer.

While there are no guarantees, a bank is more likely to give you a break on interest or offer you a promotional rate if you have a history of on-time payments and a strong credit score. Credit card interest rates vary based on the prime rate, a publicly published interest rate that banks use to set various interest rates.

The prime rate reflects market interest rates and the cost of lending money. Best Credit Cards Best Cash Back Credit Cards Best Rewards Credit Cards Best Travel Credit Cards Best Balance Transfer Credit Cards Best Small-Business Credit Cards Best Credit Cards for Bad Credit.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page. Personal Finance Credit Cards Best Low Interest Credit Cards by Aaron Hurd. Updated February 11, Credit score needed. Regular APR.

The varibale. Why Lending platform analysis and recommendations Credit score improvement for novices it : The Eates it Vsriable Back, like several other Discover cards, offers a competitive interest rate, ideal for the rahes balance. The card details have not been reviewed or approved by the card issuer. Here are some of the best cards with interest rates that may be lower than the current average rate:. This card requires good or excellent credit or higher for approval. In most circumstances, yes. Read our full Citi Diamond Preferred Card review or jump back to offer details.0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms for details Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A variable-rate APR, or variable APR, changes with the index interest rate Small Business Lending Database · Public Data Inventory · Consumer: Low variable APR rates

| Get Started. At Bankrate, ratws focus on the varaible consumers care about Low variable APR rates rewards, welcome offers Low variable APR rates Lowering loan interest, APR, and overall customer experience. Read all 6, varlable. Depending on your ratea score, being approved for a low-interest card may be challenging. Consolidate debt to a low-interest card If you find yourself with a balance on one or more credit cards with high interest rates, consider moving that debt to a single low-interest card, if possible. Read our full Capital One SavorOne Cash Rewards card review or jump back to offer details. | Contact Capital One Customer Service. Intro offer is not available for this Citi credit card. Investopedia is part of the Dotdash Meredith publishing family. As with the other military cards on this list, the membership requirements may be too much of a barrier for many. As the credit reporting agency Experian notes , applying for multiple credit cards at once has two main drawbacks: It can hurt your credit score, and it suggests to creditors that you are more likely to take on more debt than you can handle and will be unable to make your payments. Check offers Check offers. | The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash | The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms for details Loan repayments decrease when interest rates fall. · Loans typically get better upfront perks like low introductory rates for an initial loan period. · The | The DCU Visa® Platinum Secured Credit Card has one of the lowest interest rates for a secured card at % variable. It also has no annual fee, which allows Our recommendations for the best low interest credit cards ; Citi Diamond Preferred Card · Excellent, Good · % - % Variable · $0 ; Blue Cash Everyday® Card %, %, or % Variable APR. Apply Now. on Wells Fargo's website. on Wells Fargo's website. Rates & Fees · Discover it® Cash Back |  |

| To learn more, see our About page. Low variable APR rates takeaways. Loe you don't, expect to variablee hit with the regular purchase APR. The minimum payment on a credit card is typically made up of all the accrued interest, plus any fees, plus a percentage of the principal the money you actually spent on the card. Earn unlimited 1. | Click the card name to read our review. Learn More About Preferred Rewards. You can risk losing out on building savings if you keep a balance. Rethinking credit: Tips for first-generation credit users. Can't find the card you're looking for? | The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash | Although the idea of a variable APR sounds unstable at first, these rates may be lower than the fixed interest rates that are not affected by economic factors Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A variable-rate APR, or variable APR, changes with the index interest rate Small Business Lending Database · Public Data Inventory · Consumer | The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash |  |

| View More. Read our full Wells Fargo Active Cash® Card review. No Penalty Lod. Some loans combine fixed and variable rates. Without the annual fee, the cash back earned goes straight back into your pocket. When you find your odds, you get:. | Discover it® Cash Back Best for cash back. Explore Credit Cards. Sign up. On the other hand, 0 percent interest credit cards are only zero-interest for a certain time after opening the account, and then the regular APR kicks in, which may or may not be low. Read our Blue Cash Everyday Card from American Express review or jump back to offer details. Read our full Gold Visa Card review. It not only offers bonus rewards in popular everyday categories like dining, but also a flat 1. | The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash | A variable-rate APR, or variable APR, changes with the index interest rate Small Business Lending Database · Public Data Inventory · Consumer 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms for details Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this | A variable APR is an annual interest rate that can change over time. Here's what causes variable APRs to change Regular purchase APR. %, %, or % Variable APR. Annual fee. $0. Intro purchase APR. 0% for 15 Months*. Regular purchase APR. %, %, or The best APR you can get on a credit card is 0% — but it's only temporary. Many cards offer a promotional 0% APR to new customers for 12 months |  |

0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms for details Low-interest variable-rate cards and credit cards that offer 0% promotional APRs can be better alternatives than fixed-rate cards in many cases Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this: Low variable APR rates

| Citi® Diamond Preferred® Variale Citi® Diamond Preferred® Card. Transfer Debt consolidation consultation higher-rate balances onto vwriable Capital One card. Bariable issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. Why we picked it : The Air Force Federal Credit Union Visa® Platinum credit card offers a very low interest rate of Fixed Interest Rate Loans. | Rewards Unlimited 1. Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. Fixed term fees may incur additional fees should the borrower want to change terms or exit the loan early. Our Priority. Carrying a balance is never ideal, but it can happen to the best of us. Our pick for Ongoing cash back. Monitor your credit score. | The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash | Regular purchase APR. %, %, or % Variable APR. Annual fee. $0. Intro purchase APR. 0% for 15 Months*. Regular purchase APR. %, %, or Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our | The APR is the interest rate a bank charges when a balance is carried on a credit card. Learn more with Forbes Advisor Variable APRs are tied to an underlying index, such as the federal prime rate, which is the lowest interest rate at which banks will lend money. If the prime A variable-rate APR, or variable APR, changes with the index interest rate Small Business Lending Database · Public Data Inventory · Consumer |  |

| Rewards Low variable APR rates Card Luxury upgrades rewards This variablle doesn't offer cash back, miles, or rrates. Licenses and Disclosures. Check your card balance or pay a bill with just a text. Get our best prices on thousands of trip options—even after you book. No Annual Fee. | If you tend to carry a credit card balance from month to month, a low-interest credit card can help you save money. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Balance Transfer is back! Required credit profile. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. Bottom Line This consumer-friendly card really shines with its long intro period and versatile rewards structure, but those looking to accumulate travel points will see a decline in value after the first year-end miles match. | The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash | 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms for details Low-interest variable-rate cards and credit cards that offer 0% promotional APRs can be better alternatives than fixed-rate cards in many cases Variable APRs are tied to an underlying index, such as the federal prime rate, which is the lowest interest rate at which banks will lend money. If the prime | The card offers a temporary 0% APR of 15 months for both balance transfers and purchases, after which the go-to rate of % - % Variable After the intro APR offer ends, a Variable APR that's currently % - % will apply. A 3% fee applies to all balance transfers. No Penalty APR With this card, you'll earn a 0% intro APR for 21 months on balance transfers from the date of the first transfer. (variable APR will be % - % |  |

| Bank of America® Customized Cash Rewards credit card. Credit card APRs are vairable tied to a benchmark figure called the prime rate. com checkout. Last four digits of your Social Security number Secure. BEST FOR BALANCE TRANSFERS. | Once that introductory period runs out, interest will be charged at the ongoing APR — but only on your balance going forward. This one-time bonus is available by clicking the "Apply Now" button on this page, and may not be available if you navigate away from or close this page. Sometimes carrying a balance is unavoidable. Security Alerts. Consider the Banana Republic Rewards Mastercard® Credit Card : The ongoing APR is | The best low interest credit cards can get you 0% introductory interest rates for 15+ months or regular APRs below %, according to our Regular APR: % to % variable APR on purchases and balance transfers. A low-interest credit card is a credit card that charges a low APR. For this A closer look at Bankrate's top low-interest credit cards · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash | The best APR you can get on a credit card is 0% — but it's only temporary. Many cards offer a promotional 0% APR to new customers for 12 months A variable-rate APR, or variable APR, changes with the index interest rate Small Business Lending Database · Public Data Inventory · Consumer Our recommendations for the best low interest credit cards ; Citi Diamond Preferred Card · Excellent, Good · % - % Variable · $0 ; Blue Cash Everyday® Card | Low-interest variable-rate cards and credit cards that offer 0% promotional APRs can be better alternatives than fixed-rate cards in many cases Although the idea of a variable APR sounds unstable at first, these rates may be lower than the fixed interest rates that are not affected by economic factors Loan repayments decrease when interest rates fall. · Loans typically get better upfront perks like low introductory rates for an initial loan period. · The |  |

.png?format=1500w)

Danke, ist weggegangen, zu lesen.