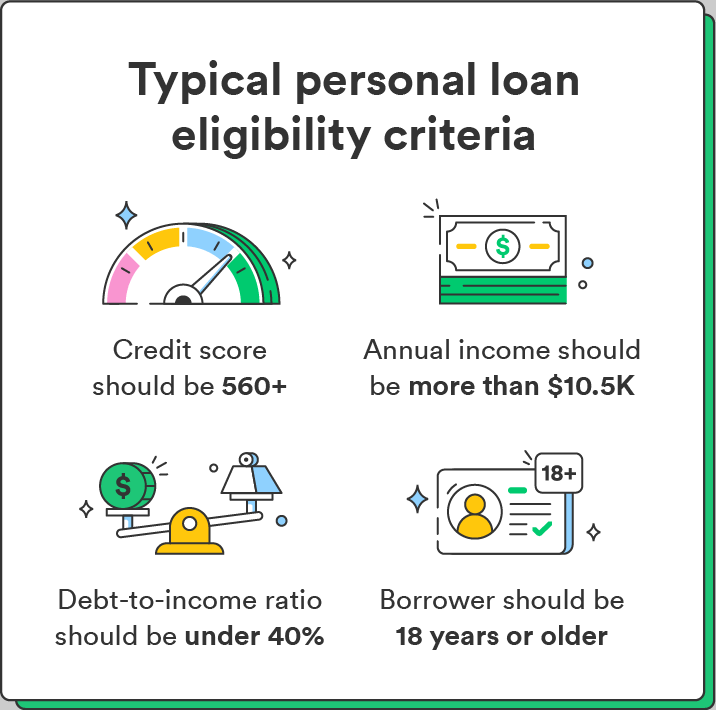

Three principal sources of that data are the loan application, the applicant's credit report, and their credit score. A loan application will typically ask for information on the would-be borrower's individual income and debt obligations. Rather than simply take the applicant's word, the lender may also request back-up documentation, such as pay stubs or recent income tax returns.

If you won't qualify on your own , you may need a parent or cosigner to provide their financial information, as well. This information is necessary for calculating the applicant's debt-to-income DTI ratio , a common yardstick used by lenders.

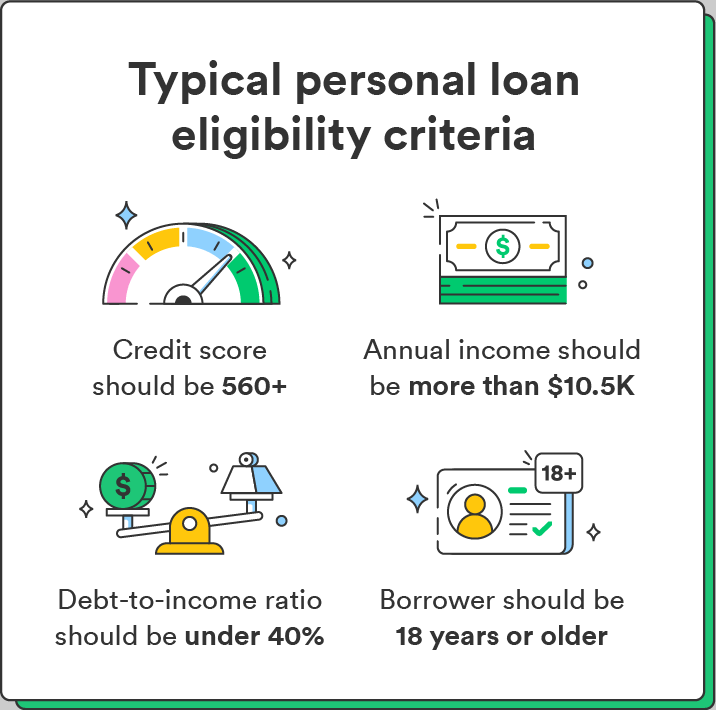

The DTI ratio shows how much of the person's income they are using to satisfy their current debt obligations, such as mortgages, car loans, and credit card balances. A high DTI ratio may indicate that the applicant is already overextended and, therefore, a poor candidate for a loan.

Income information is not included in an individual's credit reports, so lenders must obtain it separately. Nor do credit reports provide information on the person's assets, so in some cases lenders will request bank statements, investment statements, and similar records.

Credit reports do, however, contain a lot of information that can be useful to lenders. Credit reports are compiled by the three major national credit bureaus —Equifax, Experian, and TransUnion—based on information they obtain from the individual's current and former creditors.

Because not all creditors report to all three credit bureaus, the information that their reports contain may not be identical. For that reason, lenders may request more than one credit report, especially in the case of a large loan, such as a home mortgage.

The information in credit reports typically includes a list of the person's credit accounts, how much they owe on each, and a month-by-month record of whether they have made their payments on time. Most information in credit reports goes back for up to seven years.

A credit report will help a lender see at a glance how reliable the person has been in paying back their debts, as well as whether they've declared bankruptcy in the past seven to 10 years or had accounts turned over to a debt collection agency.

It will also show whether they have applied for other credit recently. In addition to credit reports, the lender is likely to obtain a credit score for the applicant.

Credit scores are based on the information in credit reports but not included in them, so they must also be requested separately. The most widely used credit scoring system is the FICO score.

While there are multiple FICO scoring models, including specialized ones for credit cards, mortgages, and car loans, they are generally based on five weighted criteria:.

Under the federal Equal Credit Opportunity Act and other laws, lenders are not allowed to consider certain facts about a credit applicant. Those include:. In addition to not being allowed to reject a loan applicant based on those criteria, lenders cannot charge them higher interest rates or fees.

Before applying for a loan, it's helpful to review your credit reports and credit score to see where you stand. By law, you can obtain your credit reports free of charge from each of the three major bureaus at least once a year.

At the only official website for that purpose, AnnualCreditReport. com, you can call up your credit reports and read them online. If you find any errors that might interfere with your ability to obtain further credit, you have a right to challenge them, and the credit bureau is required to investigate the matter and get back to you.

You can also obtain your credit score free of charge from many banks and credit card companies. There are websites that provide free credit scores , as well.

If either your credit reports or your credit score suggest that you may have difficulty in being approved for a loan, you might want to postpone applying and get to work on improving them, using the criteria described above for guidance.

What constitutes a good debt-to-income ratio can vary from lender to lender and according to the type of loan you're applying for. Note that while credit utilization ratios take into account only revolving debt, such as credit cards, DTI ratios also include installment debts , such as mortgages and car loans—basically every debt payment you're responsible for each month.

You can improve your credit utilization ratio by either paying down your existing revolving credit balances or taking on additional revolving credit—or both. Under the Equal Credit Opportunity Act, banks are required to notify you of their decision, in writing, within 30 days of your completed application.

If you're rejected , this will take the form of an adverse action letter. The letter will either explain the reason you were rejected or tell you how you can obtain that information.

Lenders use a variety of criteria to decide whether to approve your application for credit. By doing what you can to boost your performance on those criteria, you can improve your odds of approval and of getting the best possible rates and terms.

Consumer Financial Protection Bureau. TurboTax Live Full Service Pricing. TurboTax Live Full Service Business Taxes. TurboTax Desktop login. Desktop products.

Install TurboTax Desktop. Check order status. TurboTax Advantage. TurboTax Desktop Business for corps. Products for previous tax years. Tax tips and video homepage.

Married filing jointly vs separately. Guide to head of household. Rules for claiming dependents. File taxes with no income. About form NEC.

Crypto taxes. About form K. Small business taxes. Amended tax return. Capital gains tax rate. File back taxes. Find your AGI. TurboTax support. Contact us. File an IRS tax extension. Crypto tax calculator. Capital gains tax calculator.

Bonus tax calculator. Tax documents checklist. TurboTax Super Bowl commercial. TurboTax Canada. Accounting software. QuickBooks Payments. Professional tax software. Professional accounting software.

Credit Karma credit score. More from Intuit. All rights reserved. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

Security Certification of the TurboTax Online application has been performed by C-Level Security. By accessing and using this page you agree to the Terms of Use. Start for free. TABLE OF CONTENTS. Click to expand. Key Takeaways There are seven qualifying tests to determine eligibility for the Child Tax Credit: age, relationship, support, dependent status, citizenship, length of residency and family income.

If you aren't able to claim the Child Tax Credit for a dependent, they might be eligible for the Credit for Other Dependent. The American Rescue Plan Act temporarily directed the IRS to issue advance payments of the Child Tax Credit during the year rather than having families wait until they prepare their taxes in The temporary changes for increased the eligibility and credit amount for certain families and made it so the entire Child Tax Credit could be received as a refund for , even if they owe no federal income tax.

Limited Time Offer. State additional. Looking for more information? Related Articles The Ins and Outs of the Child and Dependent Care Tax Credit What Happens When Both Parents Claim a Child on a Tax Return?

Birth of a Child What is the Additional Child Tax Credit? Advanced Child Tax Credit: Everything You Need to Know. More in Family Steps to Claiming an Elderly Parent as a Dependent Video: What Are Dependents? How Do I Claim Someone as a Dependent on Taxes?

The Dirty Dozen: 12 Tricky Tax Dependent Dilemmas Video: What's the Child Tax Credit—How Do I Qualify? Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started.

W-4 Withholding Calculator Know how much to withhold from your paycheck to get a bigger refund Get started. Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started.

Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. Read why our customers love Intuit TurboTax Rated 4. Your security. Built into everything we do. File faster and easier with the free TurboTax app.

TurboTax Online: Important Details about Filing Form Returns with Limited Credits A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below.

Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax.

Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details. Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current tax year and for individual, non-business returns for the past two tax years , Audit support is informational only.

We will not represent you before the IRS or state tax authority or provide legal advice. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

You are responsible for paying any additional tax liability you may owe. TurboTax Audit Support Guarantee — Business Returns. If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year.

Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest.

Limitations apply. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services.

Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice.

Special discount offers may not be valid for mobile in-app purchases. Offer may change or end at any time without notice. TurboTax Live Assisted Basic Offer: Offer only available with TurboTax Live Assisted Basic and for those filing Form and limited credits only.

Must file between November 29, and March 31, to be eligible for the offer. Includes state s and one 1 federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion.

If you add services, your service fees will be adjusted accordingly. If you file after March 31, , you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee.

See current prices here. Final price may vary based on your actual tax situation and forms used or included with your return.

Price estimates are provided prior to a tax expert starting work on your taxes. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return.

Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them.

Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate Actual results will vary based on your tax situation.

Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary.

The IRS issues more than 9 out of 10 refunds in less than 21 days. Get your tax refund up to 5 days early: Individual taxes only.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date.

IRS may not submit refund information early. For Credit Karma Money checking account : Banking services provided by MVB Bank, Inc.

Maximum balance and transfer limits apply per account. Fees: Third-party fees may apply. Pay for TurboTax out of your federal refund or state refund if applicable : Individual taxes only. Subject to eligibility requirements. Additional terms apply.

Prices are subject to change without notice. TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premier, Self-Employed, Premium, TurboTax Live Assisted and TurboTax Live Full Service; not included with Free Edition but is available as an upgrade.

TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

Limitations apply See Terms of Service for details. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return.

For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer. Administrative services may be provided by assistants to the tax expert.

On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage.

Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

TurboTax Live Full Service — Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer.

Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. Offer details subject to change at any time without notice. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion.

Additional limitations apply. TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service Experts are available to prepare tax returns starting January 8, Based on completion time for the majority of customers and may vary based on expert availability.

All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations.

Not all pros provide in-person services. Smart Insights: Individual taxes only.

The amount of earnings it takes to earn a credit may change each year. In , you earn 1 Social Security and Medicare credit for every $1, in covered Qualifying families with incomes less than $75, for single, $, for head of household, or $, for joint returns are eligible for Filed a federal tax return. Eligible to claim the federal Earned Income Tax Credit (EITC) on their tax return (or would meet the requirements for EITC