Other students eligible for a Maximum Pell Grant will receive an SAI no greater than 0. Other applicants will have assets excluded from their SAI calculation based on income, tax filing status, and receipt of a benefit from a federal means-tested benefit program. This asset exclusion effectively replaces the SNT from the EFC formulas.

The following applicants are eligible for the asset exclusion provision:. An applicant who received a benefit under a federal means-tested benefit program in the prior two completed calendar years i.

Dependent applicants will not qualify for an exemption from asset reporting if their parents do not reside in and do not file taxes in the U. territory unless they are not required to file due to having income below the filing threshold.

The criteria used to determine dependency status for receiving federal student aid remain largely the same but with some differences. Beginning with the award year, students who are separated will no longer be considered married and should not indicate they are married on the FAFSA.

Unless independent by a criterion other than marriage, they will be considered dependent students. The Act adds to the dependency override DO provision by noting that a DO may be warranted when a student is unable to contact their parents or when contact poses a risk to the student.

Circumstances where contact is not possible or risky can include human trafficking as described in the Trafficking Victims Protection Act ; legally granted refugee or asylum status; parental abandonment; estrangement; or student or parent incarceration.

However, incarceration by itself is not sufficient to make a student automatically independent. The financial aid administrator would need to determine that the student is unable to contact their parent s or that contact would pose a risk to the student.

The Act changes the statutory basis for determining who is a veteran. Code , section 2 , which has similar language to the HEA and states that a veteran is one who served in the active military, naval, air, or space service and who was discharged or released under conditions other than dishonorable.

Beginning with the award year, otherwise dependent students who indicate that they have unusual circumstances that prevent them from providing parent data will no longer receive a rejected application but will instead have their application processed with a provisional independent status.

This will generate output documents with a provisional SAI and an estimate of federal student aid eligibility. Aid administrators will need to make a final determination whether these students should receive a dependency override.

The communication timeline and processing procedure laid out in that DCL will continue in Award Year and beyond. The new definition of items excluded from consideration as other financial assistance now includes the following two forms of assistance:.

Foster care benefits received under Title IV, Part E, of the Social Security Act, including education and training vouchers and room and board that youth are receiving as extended foster care benefits under Section of that act.

Emergency financial assistance provided to the student for unexpected expenses that are a component of the student's COA, and not otherwise considered when determining the student's need. An applicant may receive a negative SAI as low as -1, When packaging students for need-based Title IV aid Federal Pell Grant, Federal Supplemental Educational Opportunity Grant FSEOG , Federal Work-Study FWS , and Direct Subsidized Loan programs , convert any negative SAIs to a 0 SAI for awarding purposes.

When calculating remaining need for other need-based programs, the school will change the to 0 in the need-based calculation referenced above. In amending HEA section , Congress removed the provisions that allowed schools to use alternate EFCs when packaging students for periods other than 9 months.

For example, if a student is attending a summer term only, the COA used to determine subsidized Direct Loan eligibility will be based on the actual period of enrollment 3 months , but the SAI used in the formula will be the 9-month calculated SAI.

As a result, students enrolled for periods shorter than 9 months will have less need than when using an alternate EFC. This means financial assistance under programs such as the Veterans Retraining Assistance Program VRAP and the Veterans Rapid Retraining Assistance Program VRRAP will no longer be excluded from OFA.

The Act affirms that institutions may not require additional information beyond the FAFSA to award or disburse federal financial aid to applicants. The exceptions to this rule are if additional information is required to complete the verification process, document a determination of independence, or exercise professional judgment.

Additional information may be requested for the separate awarding of state, tribal, and institutional financial aid. We encourage institutions, state higher education agencies, and others to rely solely on the Student Aid Index and other FAFSA data elements whenever possible. Examples include removal of the housing question, removal of the ability for independent students to elect to provide parent information including financial information , and removal of the question asking the student whether they are interested in work study.

An institution may separately ask students to indicate a choice e. However, as described below, the enrollment status step within the Pell Grant Formulas will now use an enrollment intensity formula where appropriate.

The law changed the Scheduled and Annual Pell Grant Award calculations, which we describe below. Additional details, including examples of payment schedule calculations for each Pell Formula, are available in the Draft Student Aid Index SAI and Pell Grant Eligibility Guide.

Until the Pell regulations are corrected, schools should interpret any reference to enrollment status in those regulations to mean enrollment intensity. Instead, Pell Grant eligibility will be determined using the following steps:.

Apply the appropriate Pell Formula to divide the Annual Award among the payment periods in which the student plans to enroll. Reduce the disbursement amount for the payment period if the student has reached their annual or lifetime maximum.

We explain these steps in greater detail below. The Pell Grant Scheduled Award is the maximum amount a student can receive during the award year if the student attends full-time for a full academic year. This definition remains unchanged, but the Act significantly changed the calculation of a Scheduled Award.

An automatic Maximum Pell Grant Award Max Pell. A Minimum Pell Grant Award Min Pell. Maximum and Minimum Pell Grant eligibility are determined based on tax filing requirements, family size and composition i.

If a student qualifies for a Maximum Pell Grant, the SAI is not used to determine the amount of that grant. If the SAI-calculated Pell Grant is less than the published Min Pell, the student is ineligible for an SAI-calculated Pell Grant.

However, the student may still be eligible for a Min Pell if they meet the minimum Pell Grant eligibility requirements. The Pell Grant Annual Award is the Pell Grant Scheduled Award adjusted for enrollment intensity.

This represents a change in the way a Scheduled Pell Grant gets reduced for students enrolled less than full-time. Beginning with the award year, we will replace enrollment categories of full-time, three-quarter-time, half-time, and less-than-half time with a continuous measure of enrollment intensity.

Except for students enrolled in clock-hour or nonterm credit-hour programs, students enrolled less than full time must have their Pell Grant Scheduled Award prorated based on their enrollment intensity. Enrollment intensity is the percentage of full-time enrollment at which a student is enrolled, rounded to the nearest whole percent.

Please note that if an institution awards credits in decimals e. The Act made an important change to Year-Round Pell. The law removes the half-time enrollment requirement beginning with the award year but made no other changes to the Year-Round Pell provisions.

The Act changes eligibility for what were formerly called Iraq and Afghanistan Service Grants IASG and Children of Fallen Heroes CFH Awards as well as the resulting award amount. Beginning with the award year, students who meet the eligibility requirements for Pell Grants under the Special Rule in HEA Section c will receive Max Pell, regardless of their calculated SAI.

To receive a Pell Grant based on eligibility under the Special Rule, a student must be The child of a parent or guardian who died in the line of duty while a serving on active duty as a member of the Armed Forces on or after September 11, ; or b actively serving as and performing the duties of a public safety officer; and.

Less than 33 years old as of the January 1 prior to the award year for which the applicant is applying e. The Department of Defense is no longer able to provide confirmation that a service member killed in the line of duty meets the revised special eligibility criteria after the award year.

Further, no comprehensive database exists to identify public safety officers killed in the line of duty. Therefore, students will self-identify potential eligibility on the FAFSA ® , and the school will be required to verify eligibility by collecting supporting documentation from the student.

Schools will award eligible students Max Pell, regardless of SAI. Other aid for these students will be based on their calculated SAI. Schools will be able to continue awarding funds to students who meet the current IASG or CFH criteria in the new FAFSA Partner Portal.

We recognize that the Act changes foundational aspects of how institutions calculate, award, and disburse federal student aid. We commit to providing resources needed to update institutional policies and procedures, train staff, and prepare students for the changes.

As described above, the Department has already published and will continue to update the Draft Student Aid Index SAI and Pell Grant Eligibility Guide , which includes a detailed explanation of the proposed process for calculating SAI and determining eligibility for Federal Pell Grants starting with the Award Year.

We have also published the —25 Draft FAFSA Specifications Guide , which consolidates all FAFSA-related processing information and guidance into a new, multi-volume resource. To further assist the community with implementation of the FAFSA Simplification changes, the Department will provide additional operational guidance and technical resources in the near future.

To submit a question, please enter your name, email address, topic, and question. Annmarie Weisman Deputy Assistant Secretary for Policy, Planning, and Innovation Office of Postsecondary Education. What's New Library Topics.

Knowledge Center Home Library Dear Colleague Letters FAFSA Simplification Act Changes for Implementation in GEN FAFSA Simplification Act Changes for Implementation in Publication Date. DCL ID. This letter summarizes changes to requirements under Title IV of the Higher Education Act resulting from the FAFSA Simplification Act that will become effective for the Award Year.

These changes include significant modifications to the need analysis formulas and calculation of Federal Pell Grant awards. Dear Colleague: The FAFSA Simplification Act Act was enacted into law as part of the Consolidated Appropriations Act, , and amended by the Consolidated Appropriations Act, Summary of FAFSA Simplification Changes Previously Implemented.

Transition from Expected Family Contribution to Student Aid Index. The most significant changes to the need analysis formulas include:. Use of Federal Tax Information. Changes to the Need Analysis Formulas. Income components.

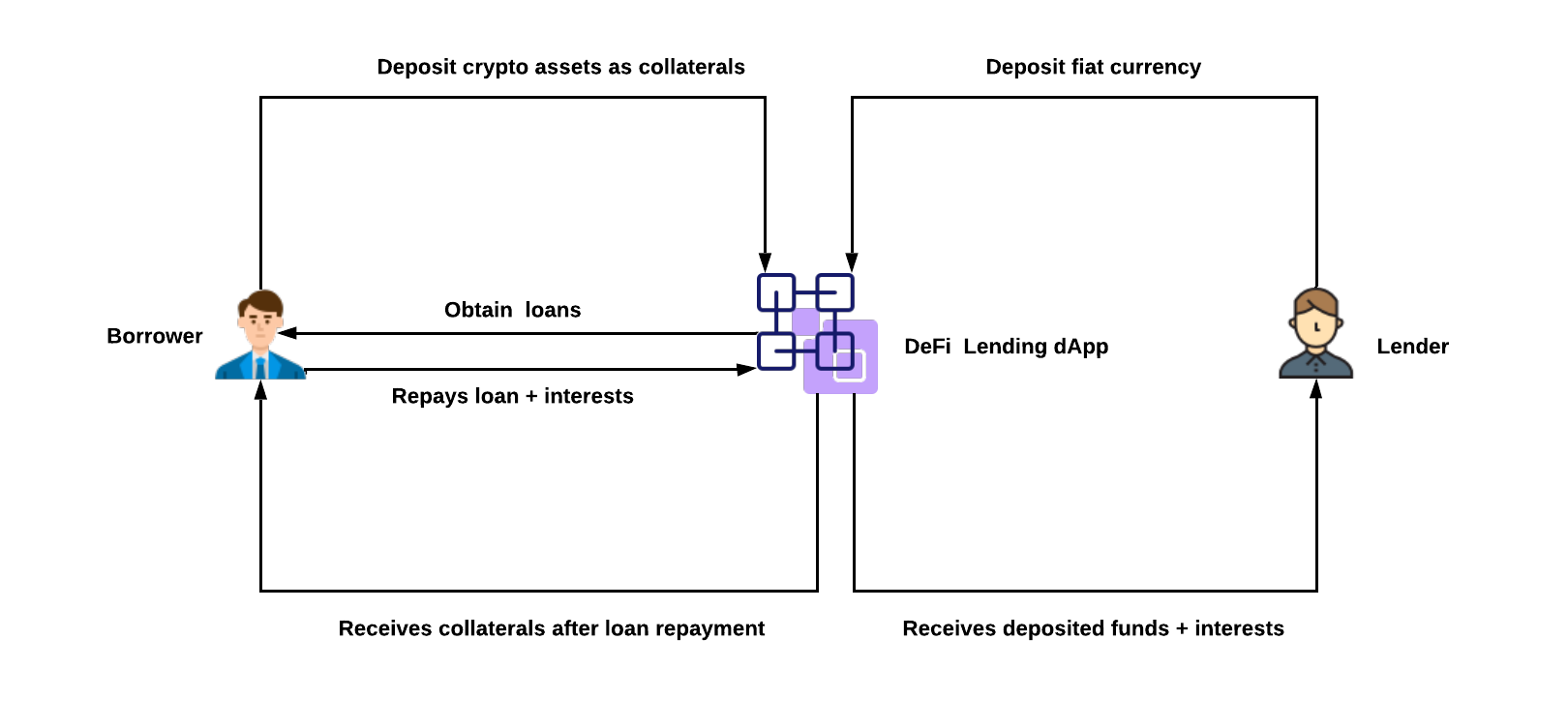

Allowances against income. Asset components. Other notable changes. Monthly payments are not required until six months after leaving school. Unsubsidized Stafford Loan : Available to undergraduate and graduate students regardless of financial need. Interest is charged throughout the life of the loan.

The interest rate for undergraduate Stafford loans, both subsidized and unsubsidized, is 5. Rates are fixed for the life of the loan. For more, see How Interest Rates are Determined. The interest rate for unsubsidized Stafford loans made to graduate students is 7.

Parent PLUS : Loans to parents of dependent students to help pay for undergraduate education. Parents are responsible for all principal and interest. Grad PLUS : Additional loans beyond Stafford loans to graduate and professional degree students to help cover education expenses. Available regardless of financial need to parents of dependent students Parent PLUS and to graduate and professional students Grad PLUS.

Credit check required. The credit requirement can be met by a cosigner. May require a separate application in addition to the FAFSA. All Stafford and PLUS loans originated since July 1, have fixed rates.

Since , fixed rates for new loans are set each year based on the year Treasury note following the May auction 3. Although rates for new loans are set each year, rates are fixed for the life of the loan. For older Stafford and PLUS loans with variable rates, interest rates change annually on July 1, based on the last day Treasury auction in May.

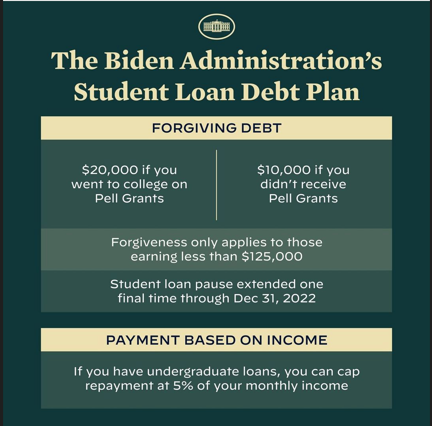

Borrowers can receive a 0. Borrowers may defer payments for up to three years. For Parent PLUS, Grad PLUS, and unsubsidized Stafford Loans, interest continues to accrue. For more about other repayment options, see studentaid. Borrowers who make payments based on their income can receive a discharge of any remaining student debt after 20 or 25 years of payments.

For more information about these plans and to estimate monthly loan payments, see studentaid. Public Service Loan Forgiveness is available after 10 years of qualifying payments and employment, only for Direct Loans excluding Parent PLUS.

The Teacher Loan Forgiveness Program Stafford only is available for loans in both the Direct and FFEL programs. All federal loans issued since July 1, are Direct Loans. Teachers with Perkins loans may be eligible for a loan cancellation if they meet certain requirements.

More information for teachers can be found at studentaid.

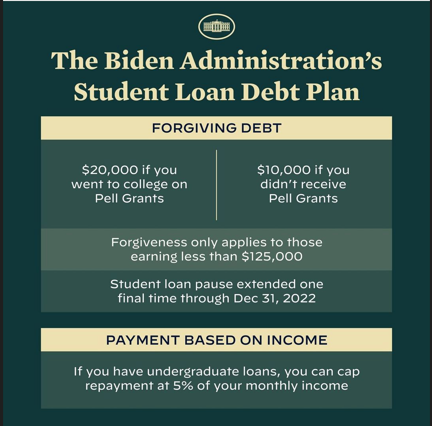

The 5 biggest student loan updates from —and what's coming in · Supreme Court strikes down forgiveness · Debt forgiveness plan B moves The U.S. Department of Education's COVID relief for student loans has ended. The 0% interest rate ended Sept. 1, , and payments restarted in October The –25 FAFSA form expands eligibility for federal student aid, including Pell Grants, and provides a streamlined user experience. , new students from