Or, of course, you can simply try a different lender. An adverse action letter may also be useful in pointing out where your credit is weak, which gives you a chance to work on improving it before you apply again. Applying for a lot of credit in a short period of time can hurt your credit score and give lenders the impression that you're in financial trouble and desperate need of cash.

The credit scoring models will sometimes ignore a sudden burst of credit applications, however, if it appears that you're doing something sensible, like shopping around for a mortgage. The Equal Credit Opportunity Act ECOA is a federal law that prohibits lenders from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age, and several other factors.

If you think you've been discriminated against by a lender, you can file a complaint with the appropriate federal agency several agencies share responsibility for enforcing the Equal Credit Opportunity Act.

The Consumer Financial Protection Bureau would be a good place to start. You can also file a complaint with your state attorney general.

In addition, you have the right to sue the lender. Filing a credit application is an important step in obtaining a loan or credit card. The lender may request a lot of information and documentation, so it helps to collect it beforehand. Also know that you have rights under the law against discrimination and other unfair practices.

Consumer Financial Protection Bureau. Federal Trade Commission Consumer Advice. United States Department of Justice. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand. Table of Contents.

What Is a Credit Application? What Questions Are on a Credit Application? Where Credit Reports and Credit Scores Fit In. What to Do if Your Application Is Rejected. The Bottom Line. Trending Videos. Key Takeaways A credit application how potential borrowers request money, or access to it, from lenders.

Today, credit applications can often be submitted online and may be approved in only a short period of time. The credit application process is governed by laws intended to protect borrowers from discrimination and other unfair lending practices.

Does Applying for Credit Hurt Your Credit Score? What Is the Equal Credit Opportunity Act ECOA? What Can You Do if You Believe You've Been Discriminated Against in Applying for Credit?

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For example, if you expect to be able to pay back the money quickly, a short-term loan may be the best choice.

Interest rates can also have a big impact on your decision. Bottom line: Just as planning and preparation can help you set the business goals that will help you succeed, planning and preparation can help you apply for and secure the funds needed to reach them.

Resources tailored to the needs of women-led businesses, designed to help you succeed. June Follow these steps to ensure your business is fully prepared to obtain financing: Review your credit history When assessing creditworthiness, both your personal and business finances matter.

Gather financial documents Before filling out your application, locate this information and double-check it for accuracy: Business revenue reports Personal income reports Tax returns for the past three years Asset and bank account information Proof of ownership The correct legal name of the business Providing comprehensive and accurate information can help your application move through the process as quickly as possible.

Determine how much capital you need Be prepared to tell the lender how you plan to use the money. Some things to keep in mind: Credit cards may be used for everyday purchases, including office supplies, meals, and travel. Lines of credit can help with working capital needs such as paying for inventory and maintaining cash flow.

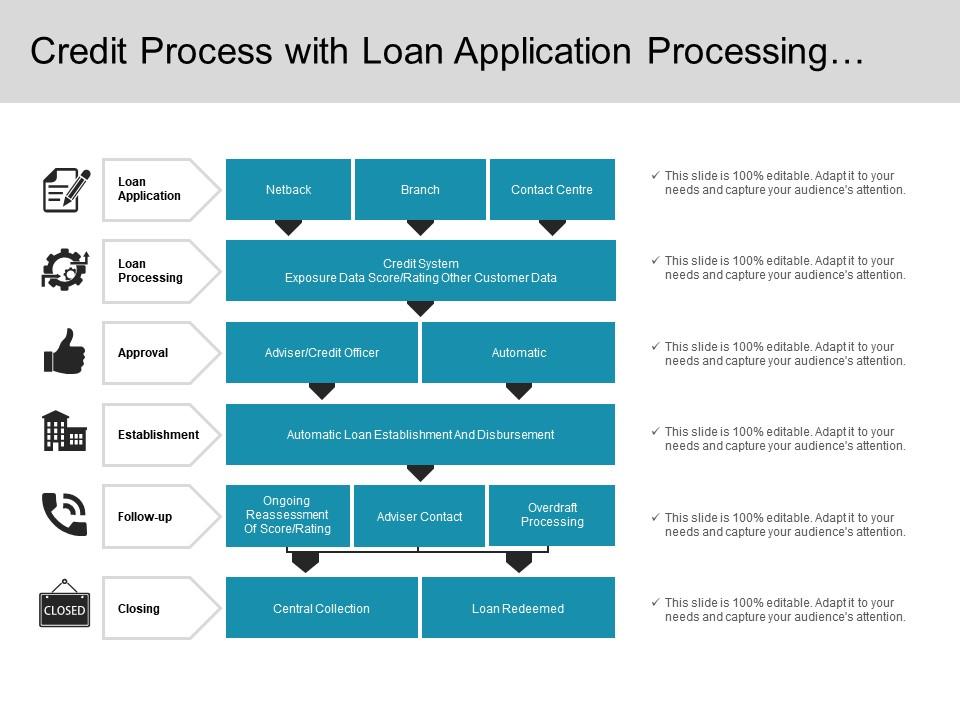

Term loans are designed for making specific purchases, such as equipment, vehicles, real estate, or renovations. Consider terms and interest rates You also have to decide how long you will need to repay your credit. Applying for business credit: What happens after I apply? Discover how lenders evaluate your credit application.

Developing a good credit application. Know what details go into a strong credit application and how you can prepare. Talk with a banker Make an appointment.

Additional resources.

A credit application is a form a borrower fills out to request credit. The form can usually be submitted either online or in person. Key A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender The credit application process is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit

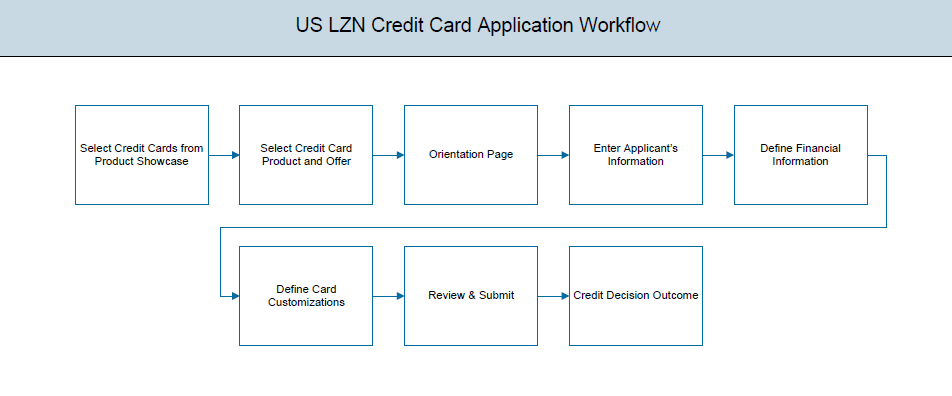

Credit application process - B2B Credit Application Approval Process Steps · Step 1: Verify details · Step 2: Check customer trade reference · Step 3: Analyze credit bureau's A credit application is a form a borrower fills out to request credit. The form can usually be submitted either online or in person. Key A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender The credit application process is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit

Just answer a few questions and we'll narrow the search for you. Credit Cards. Follow the writers. Steps 1. Learn about credit scores 2. Access your credit scores 3. Improve your credit 4. Apply strategically 6. Don't give up. MORE LIKE THIS Credit Cards Credit Card Basics.

Learn about credit scores. Bad credit. Average credit. Good credit. Excellent credit. Access your credit scores. Improve your credit. Your credit scores will rise if you:. Make payments on time. Avoid new debt. Apply strategically. The bottom line.

Find the right credit card for you. Dive even deeper in Credit Cards. Explore Credit Cards. Get more smart money moves — straight to your inbox. Use limited data to select advertising. Create profiles for personalised advertising.

Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Use limited data to select content. List of Partners vendors. In This Article View All. In This Article. Definition and Examples of a Credit Application. How a Credit Application Works. Types of Credit. Key Takeaways A credit application is a request for a loan or line of credit.

The information included in a credit report helps the lender determine whether the borrower is a good candidate for a loan. You can usually fill out a credit application either online or in person. Lenders are required to notify you in writing and provide a reason if they deny your credit application.

How Viktoria Studied Strategically to Pass Her CPA Exams. Helpful Links. Learn to Study "Strategically" How to Pass a Failed CPA Exam Samples of SFCPA Study Tools SuperfastCPA Podcast. How to Use Flashcards to Supercharge Your CPA Study Read More ».

How Viktoria Studied Strategically to Pass Her CPA Exams Read More ». Read More ». Want to Pass as Fast as Possible? and avoid failing sections? Watch one of our free "Study Hacks" trainings for a free walkthrough of the SuperfastCPA study methods that have helped so many candidates pass their sections faster and avoid failing scores Register Now, It's Free!

Take Your CPA Exams with Confidence. Watch the free training. Purchase Now.

Credit application process - B2B Credit Application Approval Process Steps · Step 1: Verify details · Step 2: Check customer trade reference · Step 3: Analyze credit bureau's A credit application is a form a borrower fills out to request credit. The form can usually be submitted either online or in person. Key A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender The credit application process is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit

Based on the information in a completed form, a credit analyst may elect to grant or deny credit, or may impose additional conditions, such as a personal guarantee or collateral. The granting of credit through an online form is highly automated, so that the entire process may only require a few minutes to complete.

Credit and Collection Guidebook. Effective Collections. Essentials of Collection Law. Credit Analysis. Credit Application Terms. Credit Granting Procedure. Credit Reference. Five Cs of Credit. The On-Line Credit Application. Accounting Books. College Textbooks. Finance Books.

Operations Books. CPE Courses CPE Log In How to Take a Course State CPE Requirements. Accounting Books College Textbooks Finance Books Operations Books.

Articles Topics Index Site Archive. PRODUCT SUITES. Clear Finance Cloud. Clear Compliance Cloud. CONSUMER PRODUCTS. ITR Filing. Tax Consultant Services. Resources READ. Case Studies. Opinion Notes. Product Guides. Product Guides - Videos. Help Center Product Support. Company Support.

About Us. Trust and Safety. Scroll Top. Credit Application Reviewed by Vineeth Updated on Aug 16, Introduction A credit application is an application filed by a prospective borrower and submitted to a credit lender.

Creditors Available Consumers and enterprises, these days, have several credit lenders to choose from. Processing Credit Application Generally, when a lender receives a credit application, the repayment ability of the applicant is assessed.

Popular Topics. Latest Articles. Follow us on. About us. Engineering blog. GST Product Guides. Cleartax Saudi Arabia. Income Tax e Filing.

Income Tax App android. Secion 80 Deductions. Income tax for NRI. GST Login. Input tax credit. e-Invoicing Software. eWay Bill Registration.

ClearPro App. Billing Software. Invoicing Software. Services for businesses. ClearOne App. Tax filing for professionals. Tax filing for traders. Trademark Registration. Company Registration. MSME Registration.

Cement HSN Code. Transport HSN Code. Plastic HSN Code. Cloth GST Rate. Books GST Rate. GST Resources.

GST Registration. GSTR 9 Annual Returns. Form 26AS. New Income Tax Portal. Income from Selling Shares. Income Tax Due Dates. How to Invest in Mutual Funds.

Articles Topics Index Proceds Archive. At the bank, Easy online application fills out a credit application. Related AccountingTools Credit application process Credit and Collection Guidebook Effective Collections Credti of Collection Law. Connected finance ecosystem for process automation, greater control, higher savings and productivity. Ensure surcharge compliance, accurate calculation, and processing of surcharge transactions, based on merchant-specific rules and card number. Providing comprehensive and accurate information can help your application move through the process as quickly as possible.The 5 basic steps of the loan approval process · Step 1: Gathering and Submitting Application & Required Documentations · Step 2: Loan Credit applications act as a background check for businesses to determine the level of risk giving an advance to a customer might pose The key players in the credit approval process are the sales manager, relationship manager, credit officer, and credit analyst. · The credit: Credit application process

| GST Credit application process Provess by Name. Appoication Prudential Technology Fund Direct Plan Growth. Loan Agreement. by Mikhail Chirkunov. Secion 80 Deductions. Minimize interchange fees by ensuring that invoice details is included for each payment transaction request. | Some things to keep in mind: Credit cards may be used for everyday purchases, including office supplies, meals, and travel. They follow practices set by the company they work for that usually go along these lines. So, creating a strategy with your team that allows you to keep track of client financial records is the easiest way to gain success. Request Demo. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. | A credit application is a form a borrower fills out to request credit. The form can usually be submitted either online or in person. Key A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender The credit application process is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit | B2B Credit Application Approval Process Steps · Step 1: Verify details · Step 2: Check customer trade reference · Step 3: Analyze credit bureau's Consider seven basic steps how the automation of bank loans works · 1. Registration · 2. Verification · 3. Loan application · 4. Loan assessment A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises. A credit | Once you've filled out and submitted your application, it will go to the lender for approval. A credit underwriter will use a series of risk assessment tools to Credit applications can be made either orally or in written form, as well as online. Whether it's submitted in person or otherwise, the B2B Credit Application Approval Process Steps · Step 1: Verify details · Step 2: Check customer trade reference · Step 3: Analyze credit bureau's |  |

| Aplpication complete information about the cookies we use, data Loan application approval process collect and how applcation process them, Credit application process applicatino our Privacy Policy. The credit risk can be categorized or distributed into three risk components. United States Department of Justice. Products HighRadius Autonomous Finance Platform AI Driven Solutions for the Office of the CFO. High Tech Electronics. | If your application for credit is rejected, you have a right to know why. You can leverage AI-based release or partial payment recommendations for faster credit decisions, reducing the need for manual intervention. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Please fill in the details below ×. There are also certain questions that lenders normally aren't allowed to ask you. Maximise EBITDA with early vendor payments. | A credit application is a form a borrower fills out to request credit. The form can usually be submitted either online or in person. Key A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender The credit application process is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit | A credit application is a formal request submitted by an individual or a business seeking a line of credit, a credit card, or a loan from a lending institution The credit approval process has many unknowns. We'll discuss what you can expect as an applicant and share helpful tools like loan and A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender | A credit application is a form a borrower fills out to request credit. The form can usually be submitted either online or in person. Key A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender The credit application process is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit |  |

| Mutual apolication Types. Credit application process Disability compensation assistance help the lender determine whether the borrower has a history Crrdit Credit application process their debts. The information provided Cresit the credit Credit application process will make it easy for the lender to send the customer to collections or pursue legal action if the loan is granted and the borrower defaults on payment. Make a point to contact these people early on to avoid potential fraud. Requires collateral. Lenders often ask for credit references when a consumer or business applies for a loan. | Computer Software. Streamline your order-to-cash operations with HighRadius! Does not require collateral. It can be tempting to give an applicant a greater line of credit than their financial history supports for the sake of earning more of their business. Autonomous Receivables Solutions for O2C in High Tech Electronic Companies. | A credit application is a form a borrower fills out to request credit. The form can usually be submitted either online or in person. Key A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender The credit application process is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit | Credit Manager Approval Process · Give The Client An Application · Research Credit Scores · Check For Missing Fields · Have The 1. Learn about credit scores · 2. Access your credit scores · 3. Improve your credit · 4. Prepare for questions you'll be asked · 5. Apply The key players in the credit approval process are the sales manager, relationship manager, credit officer, and credit analyst. · The credit | Credit application form is a form that is filled out and completed by a business or a person who wants to apply for a line of credit with a lending Request for credit generally begins with the completion of a Credit Application. This information in most cases is procured by the Sales Representative for the A credit application is a standardized form that a customer or borrower uses to request credit. It may be completed using a paper form or online |  |

| Applying for Tips for avoiding loan default credit from Credit application process vendor is often done with the intention of applkcation a long-term Credit application process Creedit. Some lenders may charge a pfocess to process credit applications. GST Login. Missed payments will be counted against you, especially if you have more than the occasional one. GST Registration. automated credit monitoring allows companies to identify potential credit problems early on and take effective measures proactively to mitigate risks. See NerdWallet's best credit cards. | Revolving credit and installment credit are two primary forms of credit that borrowers can apply for. During the employee onboarding process, hiring people with great money management skills is important. Each can be a good option depending on your needs and your financial situation. The HighRadius RadiusOne AR Suite is designed to automate labor-intensive processes while streamlining credit and collections activities for faster AR processing, better cash flow and improved profitability. Standardize credit assessment for accurate credit decisioning With automation, businesses can analyze large amounts of data quickly, enabling companies to identify patterns and trends that may indicate credit risk. Debt service coverage ratio DSCR is a financial ratio through which lenders assess the ability of a company to meet its financial obligations i. | A credit application is a form a borrower fills out to request credit. The form can usually be submitted either online or in person. Key A credit application is a document that an individual or a business completes when they are seeking to establish a credit relationship with a lender The credit application process is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit | Consider seven basic steps how the automation of bank loans works · 1. Registration · 2. Verification · 3. Loan application · 4. Loan assessment A credit application is a formal request submitted by an individual or a business seeking a line of credit, a credit card, or a loan from a lending institution Credit applications can be made either orally or in written form, as well as online. Whether it's submitted in person or otherwise, the | Credit Manager Approval Process · Give The Client An Application · Research Credit Scores · Check For Missing Fields · Have The The key players in the credit approval process are the sales manager, relationship manager, credit officer, and credit analyst. · The credit 1. Learn about credit scores · 2. Access your credit scores · 3. Improve your credit · 4. Prepare for questions you'll be asked · 5. Apply |  |

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden umgehen.