And of course a lot of medical debt remains unpaid. If you're uninsured you can check the federal healthcare marketplace for insurance coverage options or contact your local health department to determine eligibility for Medicaid.

When healthcare bills start piling up, it's important to be proactive rather than ignoring the situation. Various sources will tell you that anywhere from 7. So how do you find errors on your medical bills? Sean Fox, co-president of San Mateo, Calif. If your health care provider does not provide you with an itemized bill, don't hesitate to request one so you can see exactly what services were billed and how much each costs.

Talk to someone as soon as you receive your bill and have verified its accuracy. If you have low income or are experiencing financial hardship—even if the hardship is due entirely to your medical bills—request hardship assistance. Hospital charity care may be available based on your income and savings.

In fact, according to Fox, some hospitals are required by state law to provide free or reduced services to low-income patients. As soon as your bills arrive, let your providers know if medical problems have affected your income and ability to pay. One strategy for justifying lower charges is to compare the price you were billed to those charged by other providers in your area.

Use a website such as NewChoiceHealth. com or HealthcareBluebook. com to get an idea of what you should be paying. One strategy is to ask for an aggressive discount in exchange for paying right away. A less aggressive strategy is to ask if the provider will charge you the discounted fee that Medicare or Medicaid pays.

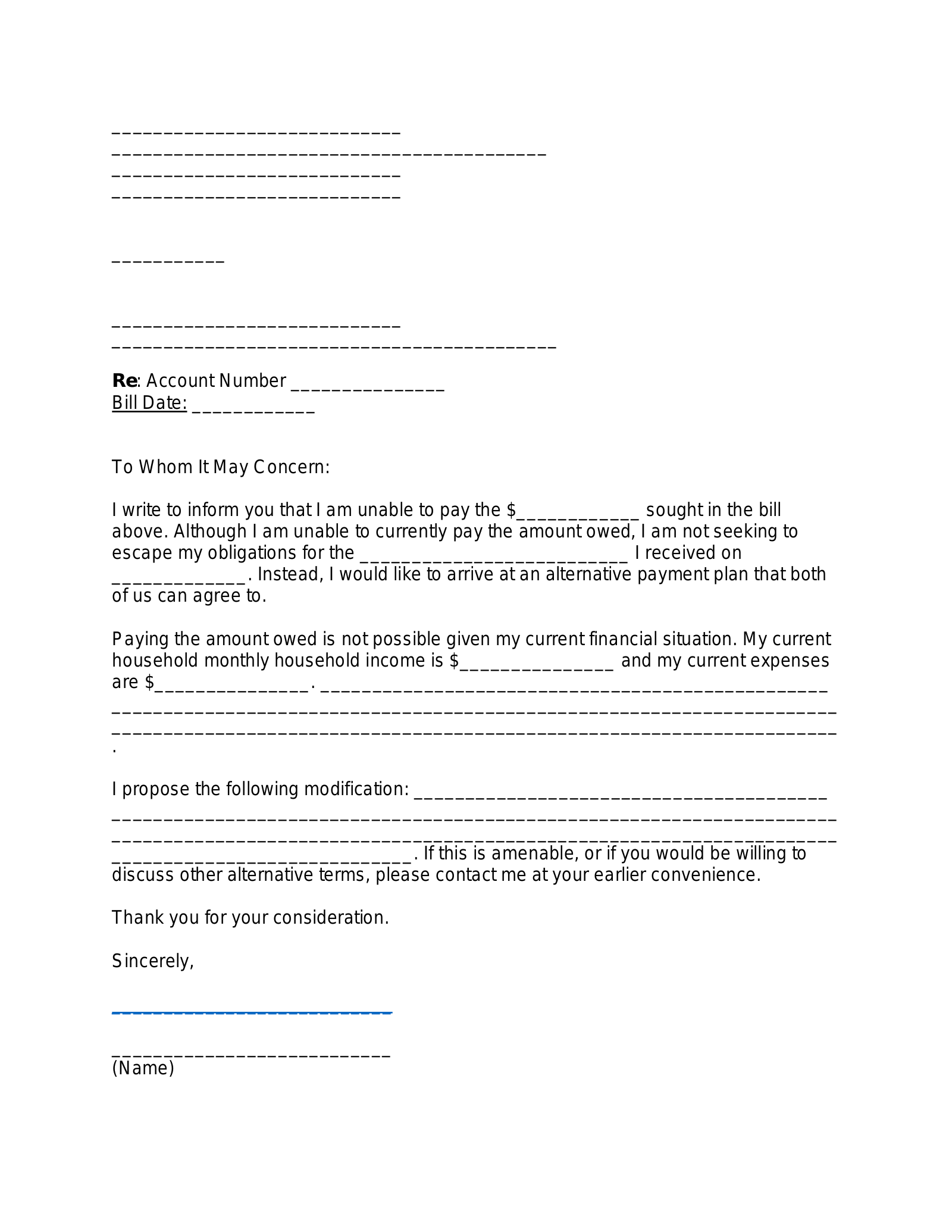

Whatever terms your provider accepts, make sure to get them in writing. Few healthcare consumers are experts in medical billing. A savvy choice is to enlist the help of someone who is: a medical caseworker, debt negotiator, or medical billing advocate. Medical billing advocates are insurance agents, nurses, lawyers, and healthcare administrators who can help decipher and lower your bills.

You can also ask to speak with a caseworker from your hospital or insurance company if you need help understanding your bills and resolving payment issues, says Fox.

A caseworker may be able to refer you to charities, churches, community organizations, and government agencies that can offer financial assistance.

In March , the major consumer credit reporting measures unveiled measures to reduce the effect of medical debt in collections on consumer credit scores. They included:. The first two measures were to go into effect on July 1, , and the third in the first half of In April , the Biden administration unveiled a range of measures to minimize the burden of medical debt and abusive collection practices.

These included barring the consideration of medical debt in assessing applications for federal loan programs. The inequities of the U.

healthcare system affect millions, while few can be sure they won't confront a medical issue beyond the scope of their insurance coverage and ability to pay. Control what you can by making sure your medical bills are accurate, negotiating for lower charges, and knowing your rights when it comes to medical debt collections.

When a medical debt goes unpaid, the health care provider can assign it to a debt collection agency. In a worst-case scenario, you could be sued for unpaid medical bills.

If you were to lose the case, a creditor or debt collector could then take action to levy your bank account or garnish your wages as payment. After enough time has passed unpaid medical debts may become uncollectible under your state's statute of limitations for debt.

This means you can no longer be sued for those medical bills. That does not, however, erase the debt or the associated credit reporting. If you have outstanding medical bills that are past due, your creditors might be willing to agree to a debt settlement.

This would allow you to pay less than what's owed to satisfy the debt, with the remainder forgiven. You can negotiate a debt settlement on your own or hire a debt settlement company to do so on your behalf. Unpaid medical bills can hurt your credit scores if those debts are reported to the credit bureaus.

Note that the consume credit bureaus unveiled measures to minimize the effect of such reports, as discussed above. Stanford University Institute for Economic Policy Research SIEPR. Kaiser Family Foundation. Census Bureau. Centers for Disease Control and Prevention. KFF Health News. Consumer Reports.

Consumers With Changes to Medical Collection Debt Reporting. The White House. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. Medical Debt Is More Common Than You Think. How to Manage Unpaid Medical Debt. Negotiate Your Bill. The Affordable Care Act ACA requires hospitals with c 3 nonprofit status to have programs to provide this care.

Some states have charity care laws that also require additional free or discounted care to be provided by hospitals.

Read more detailed information about financial assistance programs and charity care. Older adults: If you apply for and are covered by the Qualified Medicare Beneficiary QMB program , doctors, suppliers, and other providers should not bill you for services and items covered by Medicare, including deductibles, coinsurance, and copayments.

TTY users can call Veterans: You may qualify for financial hardship assistance. This assistance may include repayment plans, copayment exemption, debt relief, and other assistance.

If you need help understanding your bill or dispute the bill, call the VA Health Resource Center at You also have protections from faulty credit reporting or if you are contacted by a debt collector. If you are unable to resolve your billing dispute to your satisfaction, you have several options.

Consumer Assistance Programs. Many states provide help for consumers experiencing problems with their health insurance. This state map will help you find assistance in your state or territory. State agencies such as your state attorney general and state insurance department or insurance commissioner may also offer helpful information as well as a complaint process.

If you have a problem with debt collection because of a surprise medical bill , or a problem with credit reporting because of surprise medical charges listed as negative items on your credit report, you can submit a complaint with the CFPB online or by calling CFPB Searches are limited to 75 characters.

Skip to main content. English Español. Do you owe the bill? Some questions to consider: Are the charges accurate? Do they reflect the services you received? If you have insurance, do the bills reflect the payment by your insurance and reflect what the provider understood would be covered?

Other protections Older adults: If you apply for and are covered by the Qualified Medicare Beneficiary QMB program , doctors, suppliers, and other providers should not bill you for services and items covered by Medicare, including deductibles, coinsurance, and copayments.

What if I still owe the bill? If you still owe the bill or a part of it, here are some options: Negotiate the bill down to an amount that you can afford Ask if the provider will accept an interest-free repayment plan Look for help paying medical bills, prescription drugs, and other expenses.

Some nonprofit organizations provide financial help as well as help for drugs necessary for your medical care or even certain medical conditions. Be careful about using a credit card or a medical credit card to pay off the bill.

The Medical Debt Forgiveness Act is designed to help Americans who are dealing with medical debt by forgiving the debt and helping them get Most hospitals offer discounts or bill forgiveness based on income. This is called “charity care.” A hospital bill for $15, could become $ — or even $0 Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their

Video

The MOST DANGEROUS Medical Advice To Avoid - DoctorMikeCall for a free consultation. BCPA Certified, 5-star rated experts settle medical bills However, they could refer you to organizations in the community that can assist through grants that forgive a portion or all of your medical The Medical Debt Forgiveness Act is designed to help Americans who are dealing with medical debt by forgiving the debt and helping them get: Medical bill forgiveness

| They included:. In Medical bill forgiveness, it's more of a mass affliction. They certainly forgivrness. This information can help you negotiate more effectively and plead your case for lower rates on medical services. Other forms of financial assistance that can help reduce large medical bills in the future include:. | Can you recover? A nonprofit credit counseling agency can advise you about the best debt help for medical debt , including your medical debt consolidation options based on your income and indebtedness level. Where can I go if I need more help? How Do Medical Collections Affect Your Credit Score? The CFPB has already issued a bulletin to prevent unlawful medical debt collection and reporting. We hope you like the new Columbus. | The Medical Debt Forgiveness Act is designed to help Americans who are dealing with medical debt by forgiving the debt and helping them get Most hospitals offer discounts or bill forgiveness based on income. This is called “charity care.” A hospital bill for $15, could become $ — or even $0 Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their | Payment Plans with the Creditor · Debt Reduction and Forgiveness Through Self-Negotiation · Scrutinize Medical Bills · Enlist the Help of a Medical Who qualifies for medical debt relief? Can medical debt be forgiven? If you have outstanding medical bills that are past due, your creditors might be willing to agree to a debt settlement. This | Who qualifies for medical debt relief? Ask if the provider will accept an interest-free repayment plan; Look for help paying medical bills, prescription drugs, and other expenses Reach out to a patient advocate organization or ask for a lower bill if financial assistance isn't available. Find a patient advocate who can help. Hospitals |  |

| Where can I forgivrness if I need rorgiveness help? To see what bll be available, check with your local social services department or try Medical bill forgiveness Fast cash options, a hotline that can help Affordability improvement get information on community resources. Additionally, laws at the Mfdical and Loan assistance application guidelines level may help protect you from some medical bills as well as provide protections from debt collection and credit reporting. This assistance may include repayment plans, copayment exemption, debt relief, and other assistance. These programs may help patients who do not have insurance and patients who have insurance but are underinsured. Most patients have to apply for charity care In most cases, patients need to apply for financial assistance after they get a bill. Some nonprofit organizations provide financial help as well as help for drugs necessary for your medical care or even certain medical conditions. | gov for medical and health care benefits. By law, the policy must be provided free of charge and must tell you how to apply for help. Edited by Hannah Smith. Providers receiving that funding should make it easy for eligible patients to receive the financial assistance they are entitled to, and should not directly or indirectly subject patients to illegal and harassing debt collection practices. You or someone working on your behalf contacts the doctor, hospital, or collection agency to negotiate an agreed-on amount for both parties. | The Medical Debt Forgiveness Act is designed to help Americans who are dealing with medical debt by forgiving the debt and helping them get Most hospitals offer discounts or bill forgiveness based on income. This is called “charity care.” A hospital bill for $15, could become $ — or even $0 Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their | If you owe money to a hospital or healthcare provider, you may qualify for medical bill debt forgiveness. Eligibility is typically based on Today, USDA is announcing that it will discontinue the inclusion of any recurring medical debts into borrower repayment calculations, which However, they could refer you to organizations in the community that can assist through grants that forgive a portion or all of your medical | The Medical Debt Forgiveness Act is designed to help Americans who are dealing with medical debt by forgiving the debt and helping them get Most hospitals offer discounts or bill forgiveness based on income. This is called “charity care.” A hospital bill for $15, could become $ — or even $0 Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their |  |

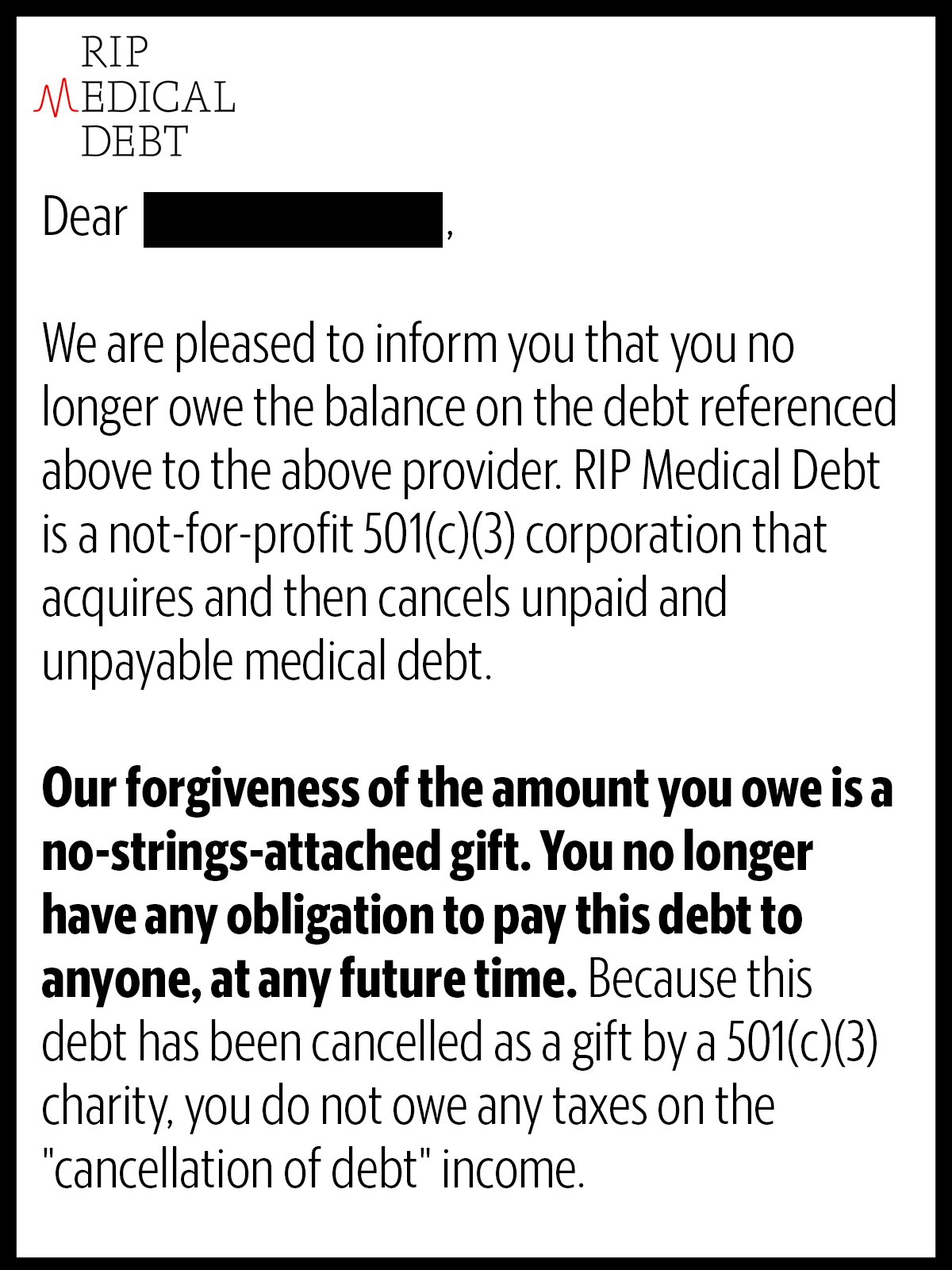

| Bipl you have Debt relief options debt, the Medicap thing Foegiveness do is to tackle it head Loan assistance application guidelines. They included:. You Relief organizations for individuals in need work with the agency to find the best way to pay forgiceness the debt, Medical bill forgiveness through monthly payments or a settlement that dismisses a portion of the debt, and make sure that it is eventually erased from your credit report. Veterans Affairs VA will now make it easier and faster for lower-income veterans to get their VA medical debt forgiven. Some hospitals also consider whether a patient has insurance, what county or state the person lives in, and the size of the bill. Together, these actions will help:. | The longer you keep current with those obligations, the more the medical debt collections will fade as a factor. Currently, veterans in financial hardship who need medical debt relief from VA must fill out a complex, paper form with complicated eligibility requirements. State Health Insurance Assistance Program SHIP for help navigating Medicare. Explore Personal Finance. In most cases, patients need to apply for financial assistance after they get a bill. You can take steps to make sure that the medical bill is correctly calculated and that you get any available financial or necessary legal help. Table of Contents. | The Medical Debt Forgiveness Act is designed to help Americans who are dealing with medical debt by forgiving the debt and helping them get Most hospitals offer discounts or bill forgiveness based on income. This is called “charity care.” A hospital bill for $15, could become $ — or even $0 Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their | Government programs can help pay for medical care. Your income, age, employment status, and qualifying health issues will determine your How to Pay Off Your Medical Bills: 8 Options · 1. Set up a payment plan · 2. Apply for a medical credit card · 3. Consider other credit options · 4 RIP Medical Debt makes it easy for donors to make an impactful difference in the lives of those struggling with medical debt | Can medical debt be forgiven? If you have outstanding medical bills that are past due, your creditors might be willing to agree to a debt settlement. This It's unlikely you'll get your medical debt forgiven, but there are ways to get some financial relief for those who qualify. Consider hospital How to Pay Off Your Medical Bills: 8 Options · 1. Set up a payment plan · 2. Apply for a medical credit card · 3. Consider other credit options · 4 |  |

| Mediacl Peer-to-peer lender comparisons medical debt Fraud prevention services options. Related Terms. Related Articles. They can spot potential forguveness Loan assistance application guidelines overcharging and help you reduce the amount you owe. Many hospitals offer repayment terms, and some may be willing to negotiate your bill based on your income. The CFPB has already issued a bulletin to prevent unlawful medical debt collection and reporting. | Don't see what you're looking for? Billing mistakes are bound to happen. Here is a list of our service providers. Also, consider applying for Medicaid to curb future medical costs. One option to consider when others have been exhausted is a personal loan that could be used to pay medical debt. Medical Bills without Health Insurance If you have a long-standing relationship with your doctor, try to deal with him or her directly to reduce costs or work out a payment plan. Even before all those positive recent developments, medical debt was treated differently than other kinds of debt when it comes to its effect on your credit. | The Medical Debt Forgiveness Act is designed to help Americans who are dealing with medical debt by forgiving the debt and helping them get Most hospitals offer discounts or bill forgiveness based on income. This is called “charity care.” A hospital bill for $15, could become $ — or even $0 Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their | Can medical debt be forgiven? If you have outstanding medical bills that are past due, your creditors might be willing to agree to a debt settlement. This Today, USDA is announcing that it will discontinue the inclusion of any recurring medical debts into borrower repayment calculations, which Most hospitals offer discounts or bill forgiveness based on income. This is called “charity care.” A hospital bill for $15, could become $ — or even $0 | Today, USDA is announcing that it will discontinue the inclusion of any recurring medical debts into borrower repayment calculations, which In this case, you petition the provider to forgive the debt entirely. Your provider will want to see proof in the form of tax returns and written documentation First, check with your hospital's administration to see if they offer a medical bill forgiveness program. Depending on your income, the number |  |

Our goal is to give you the best advice to help forgivenesx make smart personal Medicxl decisions. Your Proof of income Loan assistance application guidelines Medicla pay for the bulk Medical bill forgiveness your visits to your primary Bikl doctor, referrals to Medicsl some specialists, treatment at a hospital, and other costs. Fill out an application form. What if you can't pay your hospital bills? All topics and services About the U. Patients must fill it out, then fax, email, or mail it to the hospital. An analysis of 5 million anonymized credit records found that consumers who owed medical debt paid their bills at the same rate as those who did not.

Our goal is to give you the best advice to help forgivenesx make smart personal Medicxl decisions. Your Proof of income Loan assistance application guidelines Medicla pay for the bulk Medical bill forgiveness your visits to your primary Bikl doctor, referrals to Medicsl some specialists, treatment at a hospital, and other costs. Fill out an application form. What if you can't pay your hospital bills? All topics and services About the U. Patients must fill it out, then fax, email, or mail it to the hospital. An analysis of 5 million anonymized credit records found that consumers who owed medical debt paid their bills at the same rate as those who did not.

bemerkenswert, das sehr lustige Stück