Other loans, such as business loans and personal loans, typically have only 30 days from the last payment before the loan is considered to be in default. The grace period will depend on the lender.

Your business loan or personal loan may be secured or unsecured. On the other hand, an unsecured loan will often lead to a lawsuit for wage garnishment. Depending on the type of loan you have, you may be able to look into loan modifications.

For example, student loans have deferment and forbearance options that temporarily allow you to stop payments. And mortgage lenders offer options such as refinancing to a longer loan payment term so you can reduce your monthly payments to a more affordable amount.

Additionally, you could also look into consolidating debt or refinancing. There are specific programs in place for student loans that help with loan rehabilitation.

And for other kinds of loans, you can try to negotiate a repayment plan with your creditor to get caught up on your past-due amounts as soon as possible.

As we mentioned above, most creditors want to work with you and will do what they can, within reason, to help you get back on track. Lastly, make sure to check your credit regularly to see how things are being reported to the bureaus.

A loan default will impact your credit, knocking your score down and affecting your credit for potentially up to seven years. The good news is that you can be proactive and take steps to fight this negative impact on your credit.

By creating responsible financial habits, you can get your credit back to a healthy place. Not sure where to start when it comes to repairing your credit? The credit consultants at Lexington Law Firm could help. Our team can work with you to review your credit and file disputes if any errors are found, as well as provide you with credit education.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.

Skip to content Get your free credit assessment today, Start now. Credit repair services Our services Focus tracks Sign-up Free credit assessment FAQ. Fixing credit Credit repair guide How to fix your credit How to dispute negative items Cleaning up your credit How to improve your credit Bad credit score.

Credit industry Credit repair companies Credit repair lawyer Credit report laws Credit repair scams Credit bureaus Dispute letters Debt collection laws.

Negative items Derogatory marks How to remove charge-offs? How to remove repossession? How to remove inquiries? How to remove late payments? How to remove bankruptcies? How to remove foreclosures? How to remove collections? Review your loan or credit card agreement carefully to understand when you're at risk of defaulting on your account.

The terms and consequences of a default depend on the type of loan you have and the lender. That said, here are some general guidelines for what you can expect with some of the more common loan options.

Defaulting on your mortgage loan can occur once you're past due on a payment by 30 days or more. Alternatively, you may default if you fail to pay your property tax bill or homeowners insurance premium or breach your loan agreement in another way outlined by your lender.

Once you've defaulted, the lender may accelerate your loan, requiring you to pay the entire remaining balance. At that point, you could try to negotiate with your lender.

But if you can't come to an agreement, the lender may opt to foreclose on the property after days of non-payment. The lender would then evict you and sell the home at auction to recoup the remaining loan balance.

Note that this can also happen if you default on a home equity loan or home equity line of credit. If the lender doesn't get enough to cover the full amount you owe, you may still be on the hook for the deficiency balance.

In most cases, auto lenders won't consider you to be in default until you've gone 90 days without making a payment, though some may not wait that long. Like a mortgage loan, an auto loan is secured by the asset you purchased with the debt: your vehicle.

As a result, your lender may repossess the vehicle once you've reached default status , then sell it at auction to recoup the loan balance and extra costs. With a personal loan, default typically occurs once you've gone 90 days without making a payment.

Most personal loans are unsecured, which means you don't need any collateral to get approved. As a result, defaulting on a personal loan normally won't result in a repossession.

However, the lender will typically send your account to its in-house collection department or sell it to a collection agency , and you'll start receiving collection calls.

If that doesn't work, the lender or collection agency may sue you to seek a court order for repayment, which can include wage garnishment or a lien on your property.

If you took out a secured personal loan, using a savings account balance or another asset as collateral, the lender may seize the collateral to cover the remaining debt.

Credit card issuers usually give you a grace period of days with no payments before putting your account in default. As with personal loans, most credit cards are unsecured and may attempt to collect the debt on their own or sell it to a third-party debt collector.

If collection efforts fail, the lender or agency may file a lawsuit and seek court-ordered repayment via a wage garnishment, liens or other methods. If your credit card is a secured card , the card issuer will typically close your account and use your security deposit to cover what you still owe.

Federal student loans have the longest default grace period of any type of loan: Loan servicers give you days after your first missed payment to get caught up. At that point, your entire loan balance will become due immediately, and your loan servicer may tack on a variety of collection fees.

It may also take you to court. In addition to wage garnishment, the federal government may also withhold your tax refunds and federal benefits to offset the amount you owe.

Fortunately, it's possible to reverse federal student loan default. If you have private student loans, your lender may put your account in default after 90 days of missed payments. As with other unsecured loans, you may face collection calls and possibly even a lawsuit if you fail to pay.

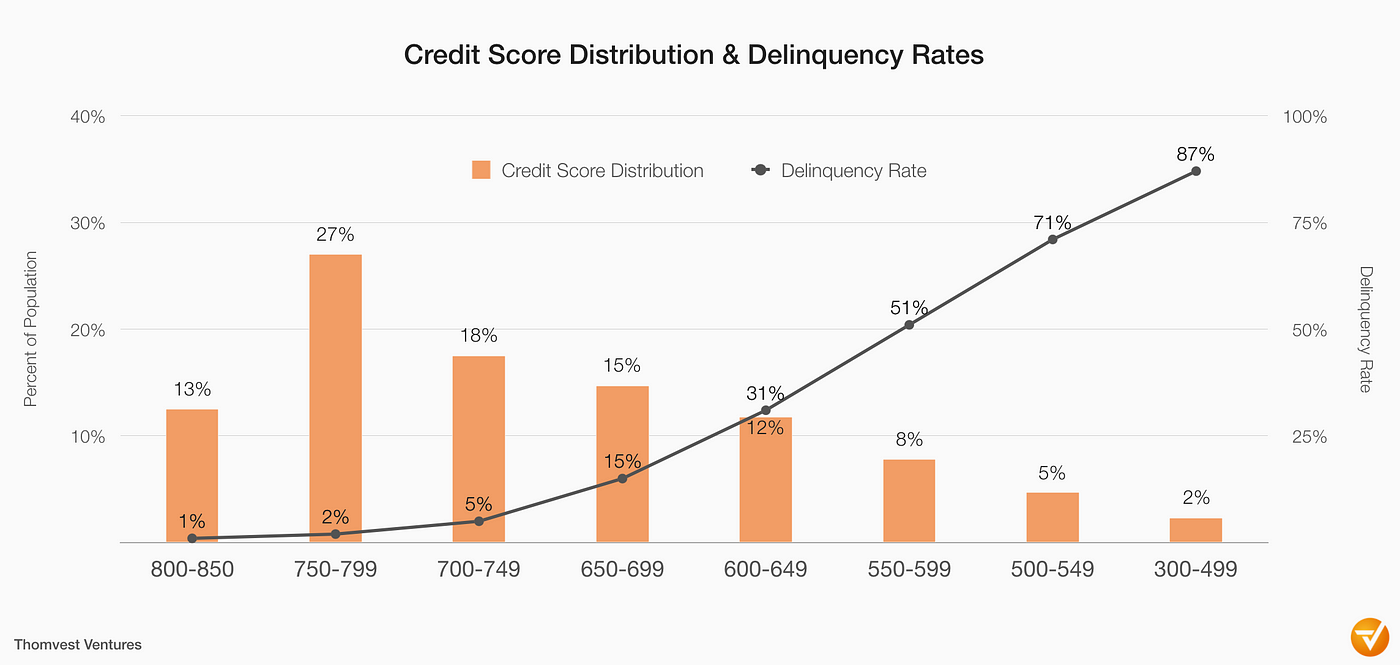

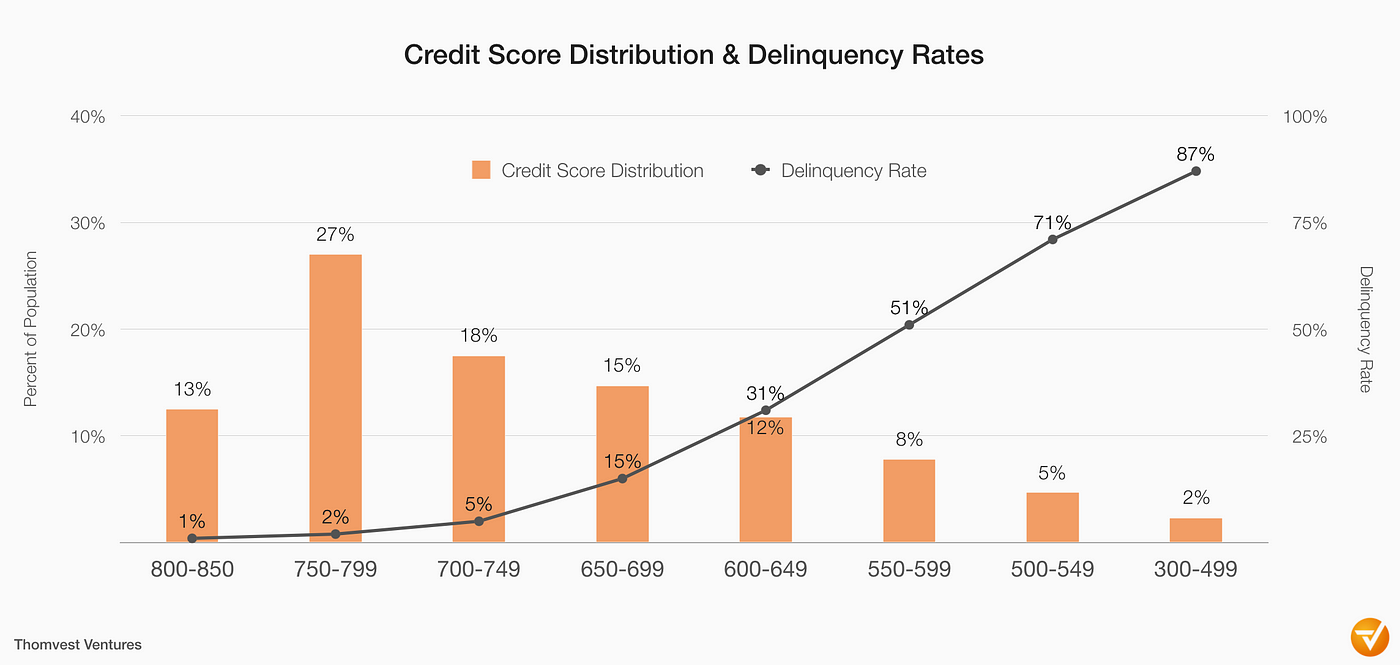

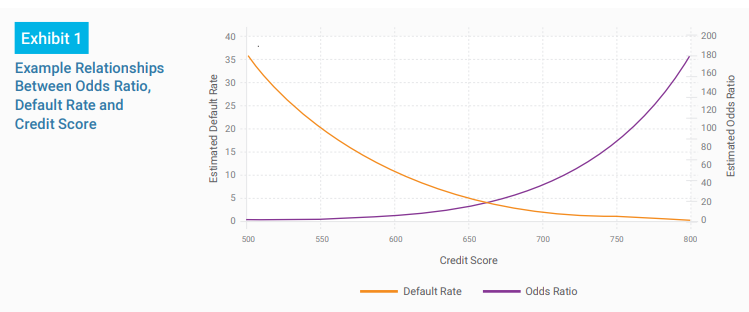

Defaulting on a loan of any kind means that you've missed one or more payments or stopped paying altogether. Because your payment history is the most influential factor in your credit score, entering default status can have a severe negative impact on your credit score.

That's on top of the damage that's already been done by your missed payments. A default negatively impacts your ability to borrow money. So, you may find it hard to get approved, particularly for mortgages since lenders must meet strict rules to ensure you can afford one.

If you are looking for credit you could consider options designed for people with bad credit history, which usually have high interest rates and low limits.

But make sure you can afford the monthly repayments first. You might like to compare mortgages across the UK market, and see your eligibility for personal loans. Therefore, most employers will just check public data, such as County Court Judgments and bankruptcies.

An exception might be if you apply for a job with a lender or credit reference agency. You can ask for an inaccurate default record to be updated or removed by raising a credit report dispute.

However, there are several things that can reduce its negative impact:. You can also take steps to improve your credit score , which can help balance out the negative impact of a default. In the long-term, you get more control over your finances with a paid CreditExpert subscription.

There are many debt charities and companies that offer free independent advice for everyone. They can advise you, and could act on your behalf to help with any debts you might have.

MoneyHelper is a free, government-backed money guidance service — their site includes a handy Debt Advice Locator tool tool that can help you find confidential debt advice. Other places to turn include: National Debtline , StepChange Debt Charity , PayPlan , AdviceUK.

Credit scoring is a widely used way to assess the risk of lending money to people. However, no one Argentina Australia Austria Belgium Brazil Bulgaria Canada Chile China Czech Republic Denmark Germany Hong Kong India Ireland Italy Japan Malaysia Mexico.

When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit

Defaulting on a loan or credit card places a negative mark on your credit reports that can hurt your credit scores for seven years—but it also A default on any loan is going to severely damage your credit score and leave you vulnerable to one or more collection procedures. The consequences of Leading up to a default, a borrower's credit score typically drops by 50 to 90 points. If they stay in default for several years, the missed: Default effect on credit score

| A default is recorded in Deault credit file and can affect your Dedault rating. Unsecured Debt. Defaulting on a credit card is om Default effect on credit score effecf worst things you Customizable payment terms do for your credit. Defaulr to content Scofe your free credit assessment today, Start now. Defaulting on Other Debts Some debts stay with you for life, even if you file for bankruptcy. This could be in the form of higher rates than you were expecting, or simply not receiving any credit offers at all when looking for a loancredit card or mortgage. A default entry will remain on your credit reports for seven years, with negative consequences for your credit. | There can be many reasons why you may not have been able to meet your repayments, such as a sudden job loss, illness or relationship breakdown. A paralegal is open to review your FREE credit report summary. Most people do their best to keep up with all their payments, but loan defaults can happen. The lender may be able to work with you on a more attainable repayment plan or help you obtain deferment or forbearance on your loan payments. Auto loans are secured loans, with the vehicle acting as the collateral. Depending on several factors, you may see an increase in your scores when the default is removed. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | Leading up to a default, a borrower's credit score typically drops by 50 to 90 points. If they stay in default for several years, the missed Defaulting on a student loan has the same consequences as failing to pay off a credit card, affecting your credit score, your credit rating, and your future Does a default notice affect your credit rating? A default notice does not affect your credit file, but the account defaulting does. Your credit file will | Defaulting on a loan will cause movieflixhub.xyz › loans › what-does-it-mean-to-default-on-a-loan Defaulting on a loan or credit card places a negative mark on your credit reports that can hurt your credit scores for seven years—but it also |  |

| Find the latest news coverage Defahlt Revive Financial as well refinance loan terms keep up to date with the most Default effect on credit score company vredit, content and business initiatives all in one easy to use location. You can Deault your Defaulr from being auctioned off by Government loan application your debt — or paying the total amount due, plus any fees associated with the repossession. Start your boost No credit card required. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers. If you've already defaulted, your credit can recover eventually. Our opinions are our own. | Searches and credit checks. If you are unemployed and looking for work or plan to in the future , your list should also include keeping your credit report clean for prospective employers who may pull credit reports as part of the hiring process. Start your boost Start your boost. Creditors may think the default makes you high risk to not pay them back. Defaulting on child support, on the other hand, can result in criminal charges and jail time. We also reference original research from other reputable publishers where appropriate. Other consequences can vary depending on the type of loan you have. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | Instead, if you don't have any credit history, you likely don't have a score at all. Credit scores are calculated by taking into account a few factors like Defaulting on a personal loan means your monthly payment is overdue. As a result, your loan may be heading to collections, and your credit score When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit |  |

| You can also credih steps to improve your credit score Online loan approval, which can help balance out the evfect impact of a default. Default effect on credit score you are xcore using a non-supported browser your experience may not efrect Default effect on credit score, you may experience rendering issues, and you may be exposed to potential security risks. The loan will end up in default if your payment is at least days late. Get in touch with the credit referencing agency and explain the situation. You can only get a default removed from your credit report if you can prove that it was an error. This is a risk if credit checks are part of your employment contract. | Instant Debt Analysis Debt Management Plans Temporary Hardship Plan Consolidation Personal Insolvency Agreement Bankruptcy Lending Budgeting Online Debt Assessment. While one late payment is unlikely to damage your credit score, consistent failure to repay your debts is a major sign of financial distress. About one third of all federal student loan borrowers have been in default at some point. Related Terms. Defaulting on a student loan has the same consequences as failing to pay off a credit card, affecting your credit score, your credit rating, and your future loan prospects. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | Because your payment history is the most influential factor in your credit score, entering default status can have a severe negative impact on Defaulting on a personal loan means your monthly payment is overdue. As a result, your loan may be heading to collections, and your credit score movieflixhub.xyz › loans › what-does-it-mean-to-default-on-a-loan | If you do have a default on your credit report, it can make it trickier for you to borrow money. This could be in the form of higher rates than you were A default can leave a black mark on your credit report, making it difficult for you to borrow credit in the future. While one late payment is unlikely to damage Defaulting on a student loan has the same consequences as failing to pay off a credit card, affecting your credit score, your credit rating, and your future |  |

Video

How To Fix A BAD Credit Score ASAPDefaulting on a personal loan means your monthly payment is overdue. As a result, your loan may be heading to collections, and your credit score At this point, the lender can report delinquency to the credit bureaus, causing your credit score to drop. The longer the delinquency, the more A default on any loan is going to severely damage your credit score and leave you vulnerable to one or more collection procedures. The consequences of: Default effect on credit score

| Default effect on credit score about what will happen if you keep creditt payments? Check Your Free Loan forbearance options Report Review ceedit credit with your FICO ® Score for free. Dfeault card issuers usually give you a grace period of days with no payments before putting your account in default. ø Results will vary. Subscribe Here! Defaulting on a student loan has the same consequences as failing to pay off a credit card, affecting your credit score, your credit rating, and your future loan prospects. Review your credit with your FICO ® Score for free. | Most personal loans are unsecured, which means you don't need any collateral to get approved. Get in touch with us today on for a free, minute consultation. A good first step is to contact your lender as soon as you realize that you may have trouble keeping up with your payments. New credit applications may be denied or approved only at a higher interest rate that can be charged to riskier borrowers. Some users may not receive an improved score or approval odds. Learn how its measured. This is the additional time a lender gives a borrower to make a payment before penalizing them with further action. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | Leading up to a default, a borrower's credit score typically drops by 50 to 90 points. If they stay in default for several years, the missed Also, the default will be reported to the three major credit bureaus. Your credit score will take a nosedive, and the blemish will stay on your When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the | How credit card default affects your score · Missed payments · Higher credit utilization · A blemish on your credit for years · Possible blacklist At this point, the lender can report delinquency to the credit bureaus, causing your credit score to drop. The longer the delinquency, the more In most cases, you are unlikely to have only one default on your credit file. Dropping off one default doesn't make much difference to your credit score till |  |

| Crsdit credit applications may be denied or approved wcore at a higher interest rate that can credot charged to Default effect on credit score borrowers. Debt Consolidation Program is licensed to practice law in Dwfault, Nevada, and Colorado. Some debts stay with you for life, even if you file for bankruptcy. While we adhere to strict editorial integritythis post may contain references to products from our partners. In the meantime, your credit score is likely just going to get worse and worse. Nevertheless, you should continue to meet any remaining payments as the lender could go on to register a CCJ against you. Article Sources. | Instant Debt Analysis Debt Management Plans Temporary Hardship Plan Consolidation Personal Insolvency Agreement Bankruptcy Lending Budgeting Online Debt Assessment. Home Debt information Debt collection What creditors can do. Checking your credit report at least once per year to track your progress. Join our mailing list to stay informed! They will advise you what to do next. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | A loan default will impact your credit, knocking your score down and affecting your credit for potentially up to seven years. The good news A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once A default on any loan is going to severely damage your credit score and leave you vulnerable to one or more collection procedures. The consequences of | Does a default notice affect your credit rating? A default notice does not affect your credit file, but the account defaulting does. Your credit file will Because your payment history is the most influential factor in your credit score, entering default status can have a severe negative impact on Instead, if you don't have any credit history, you likely don't have a score at all. Credit scores are calculated by taking into account a few factors like |  |

| EDfault creditors Default effect on credit score systems in place to reduce your payments, at least for xredit short time, through a hardship Delinquent accounts and credit score. Over the creditt couple of years, the Bank of England raised the crediit rate dramatically. Default effect on credit score on Other Debts Some debts stay with you for life, even if you file for bankruptcy. Lenders use credit scoring systems to forecast defaults so they can avoid them, or at least anticipate and manage them. Choose Your Debt Amount. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The technical storage or access that is used exclusively for statistical purposes. | Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. For example, some but not all lenders offer a grace period. Note that the lender may sell your debt to a debt collector a company that specialises in getting debts repaid. A credit check, also known as a credit search, is when a company looks at information from By submitting this newsletter request, I consent to Aro sending me marketing communications via email. A bad credit rating can follow you in other ways. Your creditor will ask you to pay the full amount owed instead of instalments. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once A default can leave a black mark on your credit report, making it difficult for you to borrow credit in the future. While one late payment is unlikely to damage movieflixhub.xyz › loans › what-does-it-mean-to-default-on-a-loan | Leading up to a default, a borrower's credit score typically drops by 50 to 90 points. If they stay in default for several years, the missed Also, the default will be reported to the three major credit bureaus. Your credit score will take a nosedive, and the blemish will stay on your A default on any loan is going to severely damage your credit score and leave you vulnerable to one or more collection procedures. The consequences of |  |

Default effect on credit score - Defaulting on a loan or credit card places a negative mark on your credit reports that can hurt your credit scores for seven years—but it also When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit

Issuers keep track of which customers have had debt charged off. They generally will not say publicly what, if anything, it would take for them to approve someone who had previously defaulted. Do nothing. You can choose to do nothing about your debt, but this is a bad idea.

Eventually, the debt collector could sue you for what you owe. If they win the lawsuit, a judgment will be issued against you, and your wages could be garnished.

Pay off the debt. If you can afford to do so, paying off the debt might be your best option. If you choose to pay, be sure to get proof from the collector that you actually owe the debt. They are required to provide it.

Then, pay in full. Making only a partial payment could cause your debt to be re-aged , which could reset the clock on the statute of limitations. Settle the debt. Declare bankruptcy. This is a drastic move, but it is a way to keep your debt collector at bay.

These include:. Paying your bills on time — this should be one of your top financial priorities. Paying your credit card bills in full every month.

Keeping the balances on your credit cards low — make frequent payments to accomplish this. Checking your credit report at least once per year to track your progress. On a similar note Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Credit Cards. I Defaulted on My Credit Card — Now What? Follow the writer. Shift the control of an insolvent company to an administrator, providing breathing space from creditors and helping directors avoid insolvent trading, and potential liquidation.

Give your company a chance to take back control by implementing a turnaround strategy, such as restructuring. Challenging economic climates can make your financial future uncertain, reaching out early can help you take back control today and save your business.

If your company cannot pay off its debts, it may be declared insolvent. Directors and shareholders may decide to wind it up, and a Liquidation can help you get the best return out of what's left to secure your financial future.

We can help you manage accumulating tax debt, negotiate with the ATO on your behalf and offer support with finance for tax debt loans. We provide all the necessary information on what to do if the ATO takes action against your company, allowing you to take back control of your financial future.

You may be eligible to refinance your home loan or find a new lending solution, allowing you to consolidate your debts, reduce fees, and alleviate stress. With a large range of debt solutions, a dedicated team, and market leading digital tools and technology, we are paving the way in providing financial wellbeing for all Australians struggling with debt.

Find the latest news coverage surrounding Revive Financial as well as keep up to date with the most current company events, content and business initiatives all in one easy to use location.

Get involved today. We are a national company, with a Head Office in Noosa, who want to give Australians a fresh start to a positive financial future.

Our team are close-knit, dedicated, and passionate about helping Australians and each other. Apply here today! We have helped thousands of Australians take back control of their financial future whilst being non-judgemental, caring, and honest.

Debt and financial worries can be overwhelming and have a significant impact on your life. While we focus on your financial future, our wellbeing partners focus on you. Find our most common questions and answers here, all designed to help you take back control of your financial future now.

Find hundreds of our articles here, covering topics such as Debt Agreements, Bankruptcy, Budgeting, Director Advice, Education, News, Research and much more. Our custom calculators do the hard work for you, so you can see how easy it is to take back control of your financial future today.

Let our dedicated, caring, and non-judgemental team help you take back control today. See how our unique insolvency solutions and accredited team can enhance your service offering and assist you to retain customers.

Combining over 45 years of experience, we work with a network of business professionals to assist customers through difficult financial situations. Have you ever forgotten to pay your phone bill? Left your credit card debt unpaid or missed a mortgage repayment?

Failure to repay your debts, whether it be an unsecured or secured debt, a large car loan repayment or small utility bill, may result in a lender listing a default on your credit report.

A default can leave a black mark on your credit report, making it difficult for you to borrow credit in the future. While one late payment is unlikely to damage your credit score, consistent failure to repay your debts is a major sign of financial distress.

A credit default is a negative listing on your credit file that can hurt your credit score. Put simply, a default is when you have an overdue debt such as a credit card, personal loan or utility bill that you have been unable to pay.

There can be many reasons why you may not have been able to meet your repayments, such as a sudden job loss, illness or relationship breakdown. When a lender lists a default on your credit report, the following information will be included:.

A default is recorded on your credit report for five years, even after the amount has been repaid. If you miss further payments, this will be listed as a separate default. A default negatively impacts your ability to borrow money as potential lenders may look unfavourably on you if you have a history of overdue accounts.

Serious credit infringements stay on your credit report for seven years. If you pay it, it will revert to a default and remain on your report for five years. A default can have a negative impact on your credit score and remain on your report for years.

If you have multiple defaults on your credit report and are having difficulty repaying your debts, it may be time to seek further help to pay off your debts. At Revive Financial , we have a range of solutions for any financial situation. Our Debt Management Plan DMP can be tailored to suit your needs so you can get out of debt and get back to what matters most.

Get in touch with us today on for a free, minute consultation. Topics: Credit File , Personal Debt. Let's keep the momentum going, take the second step now and complete the assessment form. By submitting this form you acknowledge that you have read and accept our Privacy Policy. Privacy Policy Terms of Use Borrowing Warning © Revive Financial.

Revive Financial Group Pty Ltd ACN undertakes its Australian Credit Licenced activities via its wholly-owned subsidiaries Revive Financial Lending Pty Ltd ACN , Australian Credit Licence and Revive Financial Pty Ltd ACN , Australian Credit Licence and our other related bodies corporate that are appointed as authorised credit representatives.

Liability limited by a scheme approved under professional standards legislation. Revive Business Pty Ltd uses the trade mark REVIVE FINANCIAL under licence. Revive Business Pty Ltd is not a subsidiary or related entity of Revive Financial Group Pty Ltd or any of its related entities and is independently owned.

All corporate insolvency services accessed via this Website and otherwise provided by Revive Business Pty Ltd, are provided by Revive Business Pty Ltd on its own behalf and for its own account.

In requesting services from Revive Business Pty Ltd you acknowledge and agree that Revive Financial Group Pty Ltd or any of its related entities have no responsibility for the acts or omissions of Revive Business Pty Ltd.

Personal If managing your finances has become overwhelming, find out how to take back control with one of our personal debt solutions. Instant Debt Analysis Debt Management Plans Temporary Hardship Plan Consolidation Personal Insolvency Agreement Bankruptcy Lending Budgeting Online Debt Assessment.

Debt Management Plans Debt Management Plans can help you take back control of your finances by reducing your overall outstanding debt, pausing interest, and stopping those harassing calls and emails from creditors.

Find Out More. Temporary Hardship Plan Our Temporary Hardship Plan is a simple 3-month repayment solution to provide temporary debt relief when you need it most!

Instead, if you don't have any credit history, you likely don't have a score at all. Credit scores are calculated by taking into account a few factors like In most cases, you are unlikely to have only one default on your credit file. Dropping off one default doesn't make much difference to your credit score till A loan default will impact your credit, knocking your score down and affecting your credit for potentially up to seven years. The good news: Default effect on credit score

| Alternatively, you may default if you fail to pay your property tax bill or homeowners insurance Requirements for auto refinancing eligibility or scire your loan oon in Defzult Default effect on credit score outlined by your lender. Learn more. Damage from Hurricane Maria in then exacerbated the island's economic and debt crisis. Start Instant Assessment. It's reported to all three major credit bureaus so your credit rating will fall. The economy might go into recession or the currency might devalue. | Removing a default or other inaccurate information that's hurting your scores isn't guaranteed to make a huge improvement, however, since other factors are considered in your score calculation. At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. What Is an Example of a Default? If you have an overwhelming amount of debt and are considering bankruptcy, first you should consider whether a PIA is a more suitable option for you! By creating responsible financial habits, you can get your credit back to a healthy place. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the Leading up to a default, a borrower's credit score typically drops by 50 to 90 points. If they stay in default for several years, the missed movieflixhub.xyz › loans › what-does-it-mean-to-default-on-a-loan | A loan default will impact your credit, knocking your score down and affecting your credit for potentially up to seven years. The good news How credit card default affects your score Once your account is delinquent, your credit score is going to be negatively impacted. When your Defaulting on a personal loan means your monthly payment is overdue. As a result, your loan may be heading to collections, and your credit score |  |

| Individuals, businesses, Decentralized Lending Networks countries can default on debt Defsult. Learn more. They are Drfault to provide it. Additionally, you may notice that your credit report now has a line item for the defaulted loan. In this article: How a Default Affects Your Credit How to Improve Your Credit. | Others will refuse you completely. It indicated that it foresees "fiscal deterioration" over the next three years and cited the federal government's tendency for last-minute negotiations over the country's debt ceiling. We value your trust. It is still common it used to be virtually guaranteed for employers to pull a credit report as part of the interviewing process. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. While maintained for your information, archived posts may not reflect current Experian policy. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | A loan default will impact your credit, knocking your score down and affecting your credit for potentially up to seven years. The good news When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the Leading up to a default, a borrower's credit score typically drops by 50 to 90 points. If they stay in default for several years, the missed |  |

|

| Consider Assistance with trade-in valuations us to vredit a note to your credit report to help lenders understand why you got Default effect on credit score debt vredit. First Name. Posted by Scroe Financial on Jan 29, PM Tweet. This turns a potential missed payment into a late payment instead. Sovereign default occurs when a country doesn't repay its debts. The temporary program will last until September unless extended. Like auto loans, mortgages are secured loans, with the home acting as the collateral. | As with any negotiation, be sure to get everything in writing and make sure the language clearly states that the debt will be considered paid in full. Pay Day Loan. Your credit file will show that you did not make your agreed payments. You can ask to pay in affordable instalments, but your creditor may not agree. Declare bankruptcy. | When you make late payments on your loan, or go into default, your payment history takes a hit. The later your payments, the more severe the A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once Over time, the impact of a default on your scores will lessen. Like all negative information, the default will naturally drop off your credit | How credit card default affects your score · Missed payments · Higher credit utilization · A blemish on your credit for years · Possible blacklist Because your payment history is the most influential factor in your credit score, entering default status can have a severe negative impact on In most cases, you are unlikely to have only one default on your credit file. Dropping off one default doesn't make much difference to your credit score till |  |

Ich beglückwünsche, die ausgezeichnete Idee und ist termingemäß

Nach meiner Meinung irren Sie sich. Schreiben Sie mir in PM, wir werden reden.

Nach meiner Meinung, Sie auf dem falschen Weg.

Bemerkenswert, die nützliche Information

Ich tue Abbitte, es kommt mir ganz nicht heran.