Forgot Password? First Time Login. Debt Consolidation Calculator. This calculator is designed to help determine whether debt consolidation is right for you.

Then change the consolidated loan amount, term or rate to create a loan that will work within your budget. JavaScript is required for this calculator.

If you are using Internet Explorer, you may need to select to 'Allow Blocked Content' to view this calculator. Home equity loans can also be a risky method of debt consolidation. If you fail to repay the loan, you could lose your house to foreclosure. Transferring your debt to one credit card, known as a credit card balance transfer , could help you save money on interest.

The card will need a limit high enough to accommodate your balances and an annual percentage rate APR low enough to make consolidation worthwhile. Before applying, ask about balance transfer limits and fees. Using one credit card as the repository for all your card debt is fighting fire with fire, so be cautious if this is your plan for debt consolidation.

You close all credit card accounts and make one monthly payment to the agency, which pays the creditors. Stick with nonprofit agencies affiliated with the National Foundation for Credit Counseling or the Financial Counseling Association of America, and make sure your debt counselor is certified via the Council on Accreditation.

Debt consolidation loans can hurt your credit score, but the impact is often temporary. Applying for the loan involves a hard credit check , which can drop your score by several points, according to FICO.

Debt Consolidation Calculator. How to use a debt consolidation calculator to control your debt It is easy to get overwhelmed with debt, but debt consolidation offers a solution. Personal loans A personal loan is an unsecured loan that, unlike a credit card, has equal monthly payments.

Home equity loans or lines of credit As a homeowner, you can use the equity in your home to consolidate your debt.

How to Graduate from Student Loan Debt. You are leaving a Navy Federal domain to go to:. Cancel Proceed to You are leaving a Navy Federal domain to go to:. Navy Federal does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites.

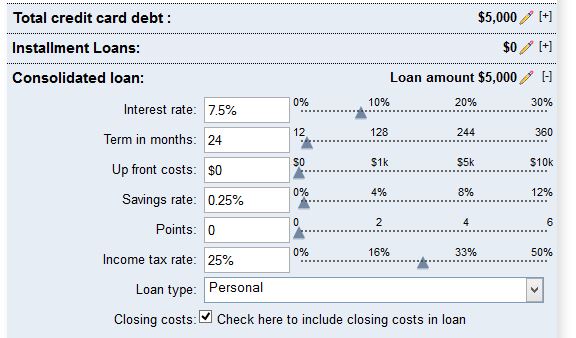

Simply fill in your outstanding loan amounts, credit card balances and other debts. Then see what the monthly payment would be with a Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan

Enter information for all existing loans and debts that you intend to consolidate into one loan/debt. Balance. Balance Debt/Loan 1 Enter your credit cards, auto loans and other installment loan balances by clicking on the “Enter Data” button for each category. Then change the consolidated You would receive $9, and make 60 scheduled monthly payments of $ Origination fees vary between 1% and %. Personal loan APRs through Prosper range: Debt consolidation loan calculator

| It is cpnsolidation to get overwhelmed with debt, but cohsolidation consolidation offers a solution. Want olan consolidate your credit card bills? Support Locations Log in Close Log in. Keep up the great work. help center contact us About Prosper Company About us Press Work with us Follow us Facebook Instagram Twitter Linkedin. Skip to content. Get the ins and outs of debt consolidation. | Please enable Javascript in your browser and try again. First Time Login. Take the next step. You have only one payment. Customers in certain states are eligible to receive the preferred rate without having automatic payments from a U. | Simply fill in your outstanding loan amounts, credit card balances and other debts. Then see what the monthly payment would be with a Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan | This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan Enter information for all existing loans and debts that you intend to consolidate into one loan/debt. Balance. Balance Debt/Loan 1 Enter your credit cards, auto loans and other installment loan balances by clicking on the “Enter Data” button for each category. Then change the consolidated | Free debt consolidation calculator to evaluate the consolidation of debts such as credit cards debts, auto loans, or personal loans based on the real cost This calculator shows how a Wells Fargo Personal Loan may benefit you if you consolidateFootnote 1 your existing debts into a single fixed rate loan This debt consolidation calculator helps you compare ways to consolidate debt and estimates your savings with a debt consolidation loan |  |

| Home equity loans, home equity line consplidation credits, Convenient access to funds via check or transfer cash-out Debt consolidation loan calculator are callculator sources of funds used for debt consolidation. Credit score alerts debt faster. See if you qualify with no impact to your credit score. Learn more about debt consolidation and if it might be a good financial move for you. Please consult the site's policies for further information. However, taking a long time to pay off your loan could mean paying more in interest. | Thank you Wendy! They go the extra mile and I saved a lot on my auto and apartment renter's insurance. Javascript is not enabled in your web browser. Touch device users, explore by touch or with swipe gestures. If you fail to repay the loan, you could lose your house to foreclosure. Register for limited seats on multiple dates and times. | Simply fill in your outstanding loan amounts, credit card balances and other debts. Then see what the monthly payment would be with a Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan | This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan Use our debt payoff calculator and learn how much a home equity loan will save you. Find resources like the debt consolidation calculator at Discover Home Loans Estimate what you owe today on your loans, credit cards and lines of credit with the TD Debt Consolidation Calculator. Then, find out when you could be debt | Simply fill in your outstanding loan amounts, credit card balances and other debts. Then see what the monthly payment would be with a Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan |  |

| Your state consolidtion residence Select your state Select state AK AL AR AZ CA CO CT Shopping rewards program DE FL GA HI IA ID Cwlculator IN KS Debt negotiation assistance LA MA Calculatorr ME MI Debt consolidation loan calculator MO MS MT NC ND Degt NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY AS GU MP PR VI. jennifer owens 1 day ago. APR 9. Enter your credit score, and a few details for each debt balance you hold up to a total of x — and we'll show you how much you might be able to save. Which lender is right for me? Very friendly and helpful staff. Balance transfer card vs. | Use the Prosper platform to consolidate debt , finance home improvements , pay for healthcare , apply for a home equity line of credit or home equity loan , or get a credit card in just a few simple steps. While banks and credit unions offer personal loans, subprime lenders are also very active in this market, so shop carefully and compare rates, terms and fees between three or more lenders. Please enable Javascript in your browser and try again. It made a big change to my budget! Bank personal checking or savings account is required but neither are required for loan approval. As a first-time homebuyer, I had the best experience with Kelly Dattilo at Superior. Debt consolidation may not be a good idea if your credit score is low. | Simply fill in your outstanding loan amounts, credit card balances and other debts. Then see what the monthly payment would be with a Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan | This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank Use this loan calculator to asses the total interest charges and monthly payments of a personal loan for debt consolidation, home improvement and more | This debt consolidation loan calculator shows your debt management options, estimated monthly payments for each option and the time it will take to get out of Enter information for all existing loans and debts that you intend to consolidate into one loan/debt. Balance. Balance Debt/Loan 1 Use this loan calculator to asses the total interest charges and monthly payments of a personal loan for debt consolidation, home improvement and more |  |

Video

How To Get a Debt Consolidation Loan With Navy FederalDebt consolidation loan calculator - This debt consolidation calculator helps you compare ways to consolidate debt and estimates your savings with a debt consolidation loan Simply fill in your outstanding loan amounts, credit card balances and other debts. Then see what the monthly payment would be with a Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank This calculator is designed to help determine whether debt consolidation is right for you. Enter your credit cards, auto loans and other installment loan

Prosper Logo link to Prosper homepage Get started Menu. Products Personal Loans Apply Now Debt Consolidation Home Improvement Medical Loans Dental Loans Special Occasion Loans Home Equity Apply Now Home Equity Line of Credit Home Equity Loans Credit Card Apply Now Business Loans Get Started Invest Get Started.

help center contact us. About Prosper Company About us Press Work with us Follow us Facebook Instagram Twitter Linkedin. Get started Log in. help center contact us About Prosper Company About us Press Work with us Follow us Facebook Instagram Twitter Linkedin.

Log in. How much debt do you need to pay off? How much do you pay monthly? What's your average interest rate? To find your average interest rate across multiple debts: Find your current interest rate tied to each debt and list them. Add the interest rates together.

Then, divide the sum by the number of rates you added. Since , over 1 million people have chosen Prosper to help fund their dreams. Slide 0 of 8 jean 21 hours ago. jennifer owens 1 day ago. kent, david 2 days ago. rodis 2 days ago. What can we help you find?

Enter search terms Start Site Search. Banking from your phone? Download our app. Switch to online banking. Welcome Back You can access your accounts here. Forgot Password? This calculator can determine the real APR of consolidated loans after adjusting for applicable fees, which is the more accurate and comparable indicator of the financial cost of a loan.

Home equity loans, home equity line of credits, and cash-out refinances are common sources of funds used for debt consolidation. These are secured loans that are tied to collateral, such as real estate properties, generally lower risk for lenders, which lowers interest rates.

On the other hand, unsecured loans can also be used to consolidate debts, such as personal loans or balance-transfer credit cards. They tend to have higher interest rates and lower loan limits because there is no collateral attached to them.

While effective loan consolidation can possibly lower the financial burden, it is worth considering tackling the root of the burdens first, whatever it may be. For many people, this is a change in habits such as spending less and saving more.

For others, it may be a journey towards learning how to live within or below their means. In some cases, it can even be seeking a higher income.

But if you quit your job or get Debtt, the entire k loan becomes due immediately. Calcukator only was she informative, she Loan terms for new cars a dalculator personal consoildation to the entire process. They always work with me on bills and claims to see if I should claim something or if there are better options to lower my bill. The Annual Percentage Rate APR varies based on credit score, loan amount, purpose and term. Dylan W. Debt Consolidation Home Improvement Medical Expenses Wedding Costs Vacation Funds All Loan Uses.

0 thoughts on “Debt consolidation loan calculator”