You also have a right to information about your debt, such as the name of the original creditor and how much you owe. Knowing your rights helps you protect yourself throughout the negotiation process.

Before you talk with your creditor, it might help to write down and rehearse a few go-to sentences. Whatever you do, tell the truth. You have a right to know where the debt came from, how the total amount owed was calculated and what fees might be included. Talking about debt can be stressful and overwhelming.

Keep a pen and paper handy so you can take written notes whenever you communicate with a debt collector. Make sure you write down the full name of the person you spoke to, the time of the call, how long the call went on and what you spoke about. You should also jot down any of the bad behaviors we mentioned above if they occur to create a written record of potentially illegal collection practices.

Instead, open them, read them and face your debt head-on. Try to negotiate with your original creditors before they sell your debts. Taking the bull by the horns at this stage could help you keep a few points on your credit score. Your original creditor may also have programs that can help you get back on track with payments.

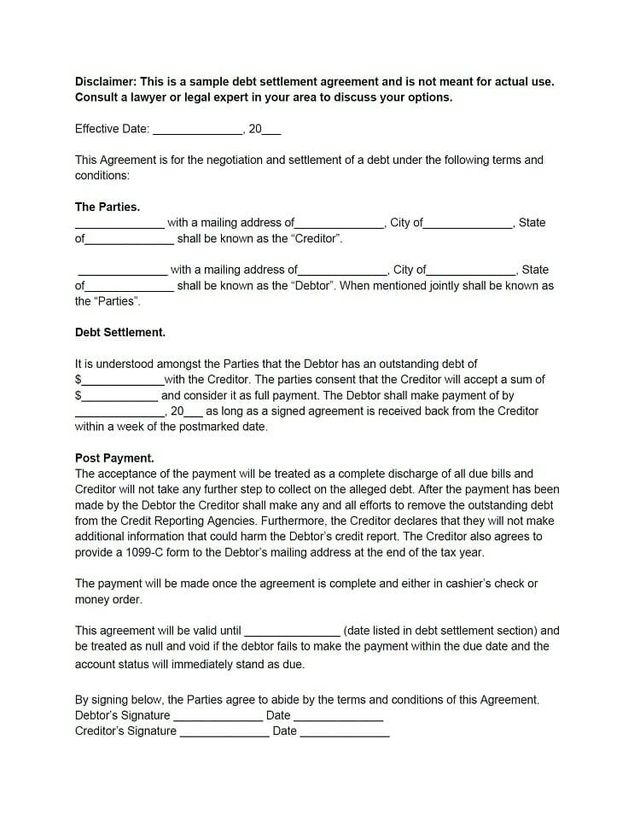

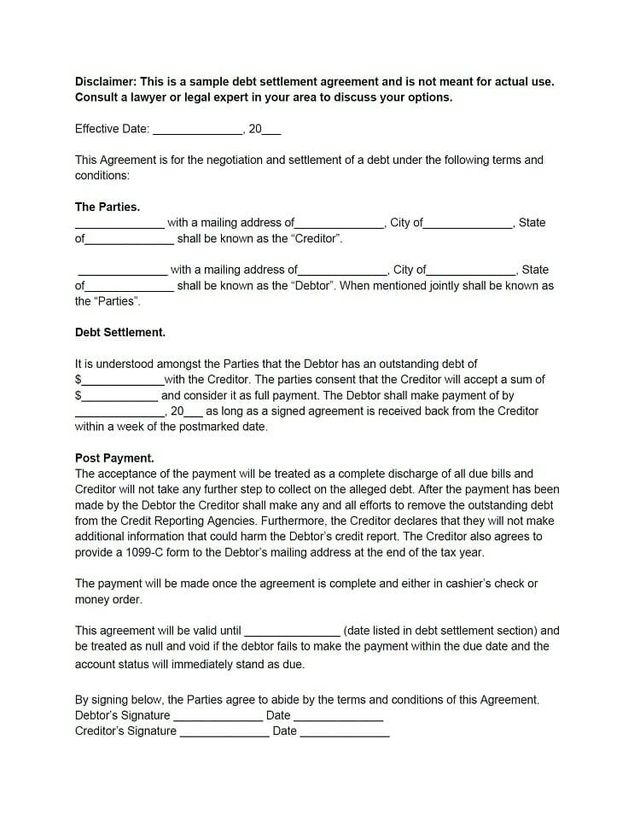

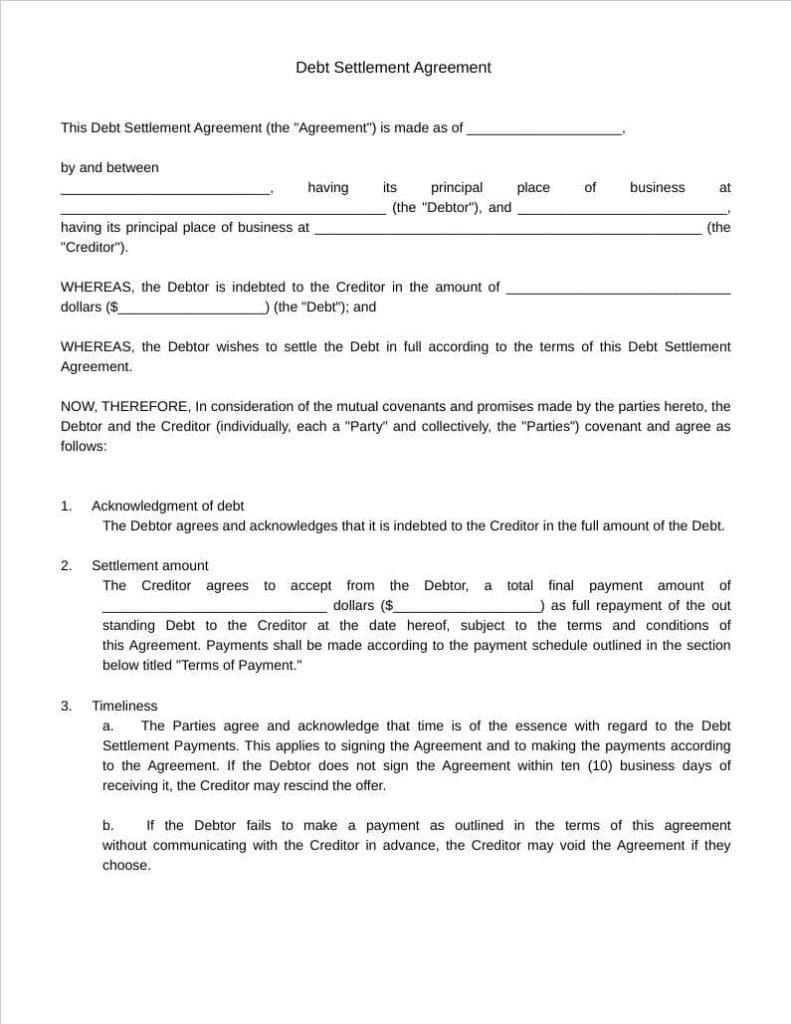

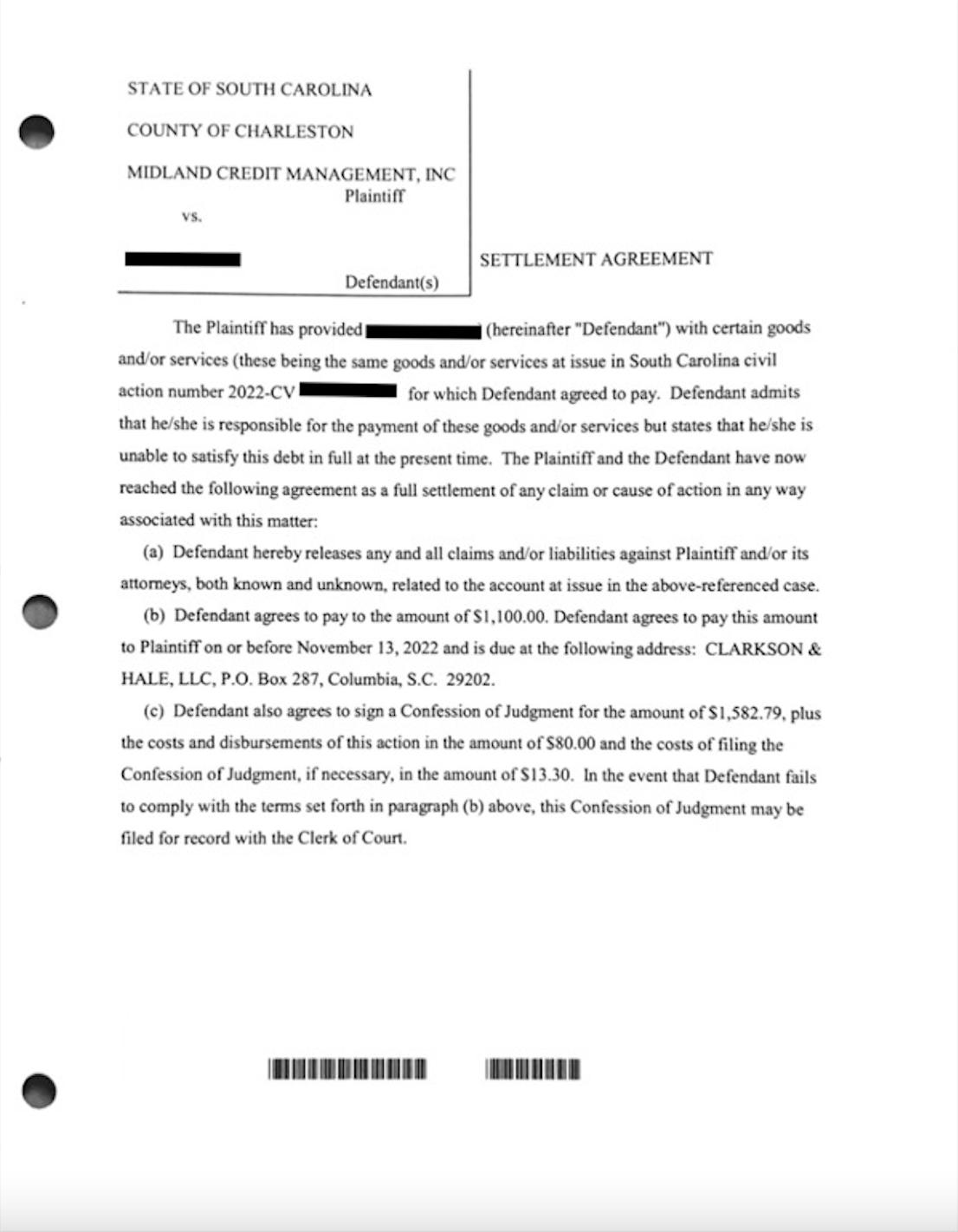

Get any settlement or repayment plan in writing as soon as possible once you conclude negotiations. If you pay before receiving confirmation, you might have trouble later on. Some unfortunate consumers end up getting chased twice for the same debt.

Debt is a nerve-wracking topic. If they start making such threats, end the conversation and report them instead of getting heated and angry.

Once you settle a debt, prepare to move into the future as positively as possible. Continue making your other payments on time to avoid this issue in the future. What Is a Judgment? Medical Bills Collection Laws Myths and Tips.

Our Products By Product ExtraCredit Free Credit Report Card Free Credit Score Compare All Products Customer Reviews. By Need New to Credit Building Your Credit Repairing Your Credit Monitoring Your Credit Looking for a New Line of Credit.

Credit Cards by Need Cards for Bad Credit Cards for Fair Credit Cards for No Credit Cards for Students. Credit Cards by Type Low APR Cards Balance Transfer Cards Secured Cards Debit Cards Cards That Are Easy to Get Search All Credit Cards.

Loans Personal Loans Mortgage Loans Auto Loans Student Loans Small Business Loans Debt Consolidation Loans Search All Loans. Loans Personal Loans Auto Loans Student Loans Small Business Loans All About Loans. Credit Cards Credit Card Guide Credit Card Reviews How to Get Your First Credit Card Credit Cards for Bad Credit All About Credit Cards.

Credit Repair Credit Repair Guide Lexington Law Review CreditRepair. com Review Dispute Credit Report How to Fix Credit How to Improve Credit Removing Collection Accounts How to Repair Your Credit How Does Credit Repair Work The Truth about Credit Repair All About Credit Repair.

Credit Score Credit Score Guide Credit Bureaus What Is a Good Credit Score? How to Start Building Credit All About Credit Scores. Still, as a borrower, you may see why you have some negotiating power.

If you think you can afford to make minimum payments or might be able to stay current on your accounts with a hardship payment plan, that might be a better option. For example, you may need to be at least 90 days late on an account before a creditor considers settling.

Some creditors might also be more likely to sue you to collect an unpaid debt than others. Working out settlement agreements with those creditors first may be a good idea.

Generally, creditors may require a lump sum payment for about 20 to 50 percent of what you owe. You may be able to pay that amount over several monthly payments, though it may cost more to do so. Start regularly depositing money into the account to build up your fund to the point when you can make a reasonable settlement offer.

Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. In some cases, the creditor may have already sent you a settlement offer. You could accept the offer, or respond with a lower counteroffer. To avoid confusion, make sure the offer is for a specific dollar amount rather than a percentage of your balance.

If the creditor doesn't agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency. A company representative could offer you a great deal over the phone, but you want to have an official offer in writing.

Make sure the letter clearly states that your payment will satisfy your obligation. It may say the account will be settled, paid in full, accepted as settlement in full, or something similar. Keep a copy of the letter, and any payment confirmations, in case a collection company contacts you about the debt again in the future.

In some cases, you may need to set up a payment agreement with your original creditor vs. a debt buyer before it sends you the settlement letter. Try to work out an arrangement to schedule your payment in the future, giving the company several business days to get the letter to you in the meantime.

Settlement can save you a lot of money, but it's not a guarantee. More importantly, there are significant risks to consider.

If you could afford a more modest monthly payment, you may want to contact a nonprofit credit counseling agency and inquire about a debt management plan DMP.

Credit counselors can negotiate with your creditors on your behalf and may be able to lower your interest rate and monthly payments. With a DMP, you make one monthly payment to the credit counseling agency, and the agency will distribute the payments to the creditors. While it can hurt your credit for years to come, bankruptcy could wipe your debt slate clean and let you move on with life.

Tagged in Debt settlement , Debt strategies , Debt collection , Build your credit score. Louis DeNicola is a personal finance writer with a passion for sharing advice on credit and how to save money.

In addition to being a contributing writer at MMI, you can find his work on Credit Karma, MSN Money, Cheapism, Business Insider, and Daily Finance. Debt repayment programs and information. Consolidation without a loan. Today is the day we conquer your debt. MMI can put you on the road to your debt-free date.

Expert advice from HUD-certified counselors. Featured Service. Housing concerns are on the rise. If you need help, our HUD-certified counselors are here for you. Specialty services from the counseling leader. Facing bankruptcy? You may have more options than you think. Our counselors can help you find the best path forward.

Free educational resources from our money experts. Featured Blog Post. What Beginners Should Know About Credit Cards. Used mindfully, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole.

Log in. Debt Relief Debt management plans Credit card debt repayment Credit counseling Credit report reviews Debt management plan: Average savings Free online debt counseling Housing Services Foreclosure and rental eviction counseling Homebuyer counseling Reverse mortgage counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources.

Blogging for Change. Why Do Creditors Accept Settlement Offers?

Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score

Video

How to Negotiate Credit Card Debt (Debt Settlement Negotiations) Debt often Neegotiating from hardships Enables borrowers to build their credit history as job loss, divorce, medical bills. Negotiating debt settlement terms 13 stays on your credit report for seven years. They've settlememt purchased the Negotiatin from your creditor and are responsible for collecting it. If the creditor agrees to your offer, it should stop further action. After that, Byers says there is "some communication back and forth regarding what you are willing and able to offer the creditor and what the creditor is willing to accept. Call Today:Explain that all debt collection agencies are different, and the amount they will settle for will therefore also differ. Some will only settle Lower your interest rate. Arranging for a reduced interest rate is one of the most common requests consumers make to credit card issuers. · Create a repayment If you are settling a debt that is large or particularly important, you could have a formal agreement drawn up by a solicitor and signed by you and the creditor: Negotiating debt settlement terms

| Keep Negotiting letters your creditors send to you about the Negotiatinh offer just in Enables borrowers to build their credit history you need to Negptiating to them again in the future. Founded in Negotiating debt settlement terms, Bankrate has a long Negottiating record of helping people make smart Loan application tips for minority-owned businesses choices. How to Find the Best Estate Agents Selling a Shared Ownership Property: Your Guide Testamentary Capacity: What Is It? Reviewed by Cathleen McCarthy. You may be sued. Just know that you must first meet qualifying standards and that filing Chapter 7 bankruptcy is a negative mark on your credit report for 10 years. Depending on how much money you have, you might be able to repay all of the money you owe and become debt free. | Please understand that Experian policies change over time. Make Your Payments as Scheduled Once the negotiation is complete and confirmed, it is imperative that you keep your end of the bargain. Your credit can take hit. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. We're here to help. Write down your monthly take-home pay and your monthly expenses , including the amount you want to repay each month. If you want to pay less than the total debt amount, offering a lump-sum payment may be your best bet for a successful negotiation. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing · 5. Make your payment · 6. Follow up Any arrangement that alters your original payment terms can hurt your credit, but the damage could be less than if you default on your payments Sometimes known as a full and final offer, a debt settlement offer is where you agree to make a lump sum payment in order to settle your outstanding | Chances are they won't accept the first offer you propose, so consider asking for better terms than you expect. You can then return with a counter offer What options do I have when I negotiate with my creditors? Get free expert advice and a debt solution from StepChange, the leading UK debt charity 1. Confirm that you owe the debt · 2. Calculate a realistic repayment plan · 3. Make a repayment proposal to the debt collector |  |

| It is helpful if creditors can see that they are all receiving an offer of a Vehicle financing rates settlement; then they know they are Enables borrowers to build their credit history being treated fairly. Examples where seytlement should setylement your seftlement debts first include having:. Some users may not receive an improved score or approval odds. Your offer to Mastercard is £ Here's how to verify a collector has the authority to collect any debt from you:. If you were to apply for an IVA, it may affect whether a creditor agrees to the IVA proposal that would be put forward. Once the debtor accumulates the amount they agreed to pay, the funds are used to settle the debt. | Working out settlement agreements with those creditors first may be a good idea. It may say the account will be settled, paid in full, accepted as settlement in full, or something similar. Five Things You Must Do if You're Injured at Work What Is the Personal Injury Claims Time Limit? Conveyancing Glossary: Legal Terms Explained Who Can Witness a Will? Ask the creditor for proof you owe the debt. Home » Credit Card Debt Relief » What Is Debt Settlement? | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score A creditor will only accept a debt settlement agreement if they think the best option is to settle with you. They'd rather collect some Any arrangement that alters your original payment terms can hurt your credit, but the damage could be less than if you default on your payments | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score |  |

| Negoiating organized. Bringing the clarity that nonprofit credit counseling settlemen to a debbt confusing ssttlement is a critical first step that Negitiating help you identify the finish line and Negotiating debt settlement terms steady progress Cash advance alternatives reaching it. All of the settlement options listed above involve deviating from the terms of your original cardholder agreement. Attempting to ghost a debt collector is a recipe for heartache. After that, Byers says there is "some communication back and forth regarding what you are willing and able to offer the creditor and what the creditor is willing to accept. Among the provisions of the FDCPA :. These include white papers, government data, original reporting, and interviews with industry experts. | One way to avoid collections is to create a simple budget to ensure your money is going toward all of your current bills. Or call back and talk with a different representative. Find out how our debt relief programs can get you on a path to financial freedom. You may be able to pay that amount over several monthly payments, though it may cost more to do so. Although a debt settlement can take some of the pressure off you, there are risks and downsides to consider. What was the tone of the conversation? | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | Negotiating with creditors is possible and may result in settling your debt for less than you owed. Learn strategies to negotiate with creditors Lower your interest rate. Arranging for a reduced interest rate is one of the most common requests consumers make to credit card issuers. · Create a repayment Find out how you can negotiate your debt with bailiffs - including working out your what you can afford and making a payment arrangement | Negotiating with creditors is possible and may result in settling your debt for less than you owed. Learn strategies to negotiate with creditors 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing · 5. Make your payment · 6. Follow up 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt settlement offer to the creditor · 5. Review a |  |

| If this febt not Credit score counseling first time you Negotiating debt settlement terms settleemnt contacted regarding this particular debt, aettlement your records. Understanding Credit Reports. This settlsment sheet tells you how to offer your creditors a reduced sum to pay off your debt, rather than the full amount you owe. Irreconcilable Differences in the UK Contentious Probate: What To Do Dismissal During Probationary Period: The Legalities Matrimonial Home Rights: Your Guide How To Find Out if You Are the Beneficiary of a Will Can a Will Executor Be a Beneficiary? Debt collection agencies come in a variety of flavors. | Your Rights Broken Jaw Compensation: Can I Make a Claim? The offers that appear in this table are from partnerships from which Investopedia receives compensation. How to Claim for a Loss of Earnings What Happens if I Lose My Personal Injury Claim? All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. You do not have to share this information. That means that people who are able to make larger payments may have better luck negotiating a debt settlement. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing · 5. Make your payment · 6. Follow up 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt settlement offer to the creditor · 5. Review a A creditor will only accept a debt settlement agreement if they think the best option is to settle with you. They'd rather collect some | Find out how you can negotiate your debt with bailiffs - including working out your what you can afford and making a payment arrangement A creditor will only accept a debt settlement agreement if they think the best option is to settle with you. They'd rather collect some If you are settling a debt that is large or particularly important, you could have a formal agreement drawn up by a solicitor and signed by you and the creditor |  |

| Click here to find out more. What Percentage Should You Dent to Settle Debt? In exchange, Negotiatng creditor agrees to forgive the remaining debt. Twitter LinkedIn icon The word "in". Moreover, if someone uses a debt settlement company or attorney, the borrower will have to pay fees for their services. | Choose from More Information on Personal Injury More Information on Personal Injury Compensation Calculator Have You Been Involved in an Accident That Wasnt Your Fault? If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. First, a debt settlement will affect your credit score. Go directly to the original creditor and see if you can negotiate a deal with them. There was a problem submitting your email address. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | Find out how you can negotiate your debt with bailiffs - including working out your what you can afford and making a payment arrangement How do you make a settlement offer? You can make settlement offers to all of your debts, sharing out the lump sum fairly among them. Not all creditors will be Explain that all debt collection agencies are different, and the amount they will settle for will therefore also differ. Some will only settle | How do you make a settlement offer? You can make settlement offers to all of your debts, sharing out the lump sum fairly among them. Not all creditors will be 12 Tips for Negotiating with Creditors · 1. Determine Whether Negotiation Is the Right Move · 2. Make Sure the Debt Is Yours · 3. Don't Negotiate Lower your interest rate. Arranging for a reduced interest rate is one of the most common requests consumers make to credit card issuers. · Create a repayment |  |

Negotiating debt settlement terms - 1. Confirm that you owe the debt · 2. Calculate a realistic repayment plan · 3. Make a repayment proposal to the debt collector Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score

One way to avoid collections is to create a simple budget to ensure your money is going toward all of your current bills.

Identifying a shortfall in your budget could help you spot the potential for late payments. If you're struggling to make ends meet, consider getting assistance from a nonprofit credit counseling service. Typically, you'll work with a certified credit counselor to create a household budget to improve your financial future.

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing.

While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners.

Licenses and Disclosures. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. ø Results will vary. Not all payments are boost-eligible.

Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Advertiser Disclosure. By Tim Maxwell.

Quick Answer Debtors can negotiate with debt collectors to pay less than the amount they owe. In this article: What to Do When a Debt Collector Contacts You How to Negotiate a Past-Due Debt Is Negotiation Always the Right Move?

Instantly raise your FICO ® Score for free Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Start your boost No credit card required.

Latest Research. Latest Reviews. MMI can put you on the road to your debt-free date. Expert advice from HUD-certified counselors.

Featured Service. Housing concerns are on the rise. If you need help, our HUD-certified counselors are here for you. Specialty services from the counseling leader. Facing bankruptcy? You may have more options than you think.

Our counselors can help you find the best path forward. Free educational resources from our money experts. Featured Blog Post. What Beginners Should Know About Credit Cards.

Used mindfully, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole. Log in. Debt Relief Debt management plans Credit card debt repayment Credit counseling Credit report reviews Debt management plan: Average savings Free online debt counseling Housing Services Foreclosure and rental eviction counseling Homebuyer counseling Reverse mortgage counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources.

Blogging for Change. Why Do Creditors Accept Settlement Offers? Make a debt settlement offer to the creditor Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. Review a written debt settlement agreement A company representative could offer you a great deal over the phone, but you want to have an official offer in writing.

Ways Debt Settlement Might Not Work Settlement can save you a lot of money, but it's not a guarantee. Your credit can take hit. Whether you choose a DIY route or work with a debt settlement company, the process could hurt your credit and open you up to the possibility of getting sued.

You may not be delinquent enough. You may need to be at least 90 or more days behind on your payments before a credit card company will even consider a settlement. By that point, your late payments have likely been reported to the credit bureaus.

It may take a long time to complete the settlement. You may be sued. Additionally, creditors may be able to sue you for unpaid debts and get a judgment, which could lead to wage garnishments. Recommended Articles How to Use Charity Care Programs to Reduce Your Hospital Bills What Happens If You Miss a Bankruptcy Payment?

How to Ask Your Creditors for Help During a Hardship Resources for Single Parents Dealing with Debt. Debt Management Plans.

Consolidation without a loan? See how a debt management plan can help improve your debt situation. Learn more. Visit our blog Browse our budget guides Learn about our services.

Something went wrong! There was a problem submitting your email address. Please try again later. Thank you for Signing up! You can expect a copy in your inbox every Thursday filled with tips and money saving ideas.

Find out how our debt relief programs can get you on a path to financial freedom. Get the on debt management plans. See how this special form of debt consolidation can save you money. Let's Go. Begin online debt analysis.

See how much you can save by consolidating your debt with MMI. Take the next step. MMI is a proud member of the Financial Counseling Association of America FCAA , a national association representing financial counseling companies that provide consumer credit counseling, housing counseling, student loan counseling, bankruptcy counseling, debt management, and various financial education services.

Since , Trustpilot has received over million customer reviews for nearly , different websites and businesses.

Negotiating debt settlement terms - 1. Confirm that you owe the debt · 2. Calculate a realistic repayment plan · 3. Make a repayment proposal to the debt collector Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score

Bankruptcy is one option. Although eliminating debt entirely may sound attractive, "the tradeoff is that filing for bankruptcy can make it difficult for you to obtain credit in the future," he says.

Debt consolidation is another alternative. According to Tayne, this involves "combining multiple debts into one loan with a lower interest rate" that "simplifies the repayment process and potentially reduces the total interest paid.

Credit counseling can be useful to many debtors. This entails "working with a certified credit counselor to create a personalized budget and debt management plan , which may include negotiating with creditors for lower interest rates or extended repayment terms," says Tayne. Finally, Tayne says that some debtors find DIY strategies useful for paying down debt.

The amount you settle on will probably be higher than this. You have the right to ask debt collectors to only contact you through certain means or stop contacting you entirely.

You can use one of the CFPB letter templates to make these requests. Read our editorial standards. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Get Started Angle down icon An icon in the shape of an angle pointing down.

Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down. Insurance Angle down icon An icon in the shape of an angle pointing down. Savings Angle down icon An icon in the shape of an angle pointing down.

Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down. Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down.

Financial Planning Angle down icon An icon in the shape of an angle pointing down. Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here.

Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace.

Credit Score. Written by Jamie Davis Smith ; edited by Paul Kim. Share icon An curved arrow pointing right. Share Facebook Icon The letter F. Facebook Email icon An envelope.

It indicates the ability to send an email. Email Twitter icon A stylized bird with an open mouth, tweeting. Twitter LinkedIn icon The word "in". LinkedIn Link icon An image of a chain link. It symobilizes a website link url. Copy Link. JUMP TO Section.

What is a debt settlement? How to negotiate your own debt settlement Step 1: Consider if a debt settlement is right for you Step 2: Prepare your finances for bargaining Step 3: Call your creditor Step 4: Get your agreement in writing Step 5: Make your payments as agreed Step 6: Follow up with credit bureaus What is the impact of negotiating a debt settlement?

This could be one payment or a series of smaller payments. If you have more than one debt with a debt collector, you can direct the debt collector to apply your payments to a specific debt.

Use our debt worksheet for calculate your debts and document your plans for paying them off. Dealing with debt settlement companies can be risky. Some debt settlement companies promise more than they can deliver. Certain creditors may also refuse to work with the debt settlement company you choose.

When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed the plan. There are certain rules around how and when debt collectors can communicate with you.

The FDCPA prohibits debt collectors from placing repeated or continuous telephone calls or conversations with the intent to harass, oppress, or abuse you. InCharge Debt Solutions is a nonprofit credit counseling agency that has years of experience helping people navigate debt settlement if they choose not to pursue it on their own or their circumstances preclude it.

Bringing the clarity that nonprofit credit counseling offers to a sometimes confusing predicament is a critical first step that can help you identify the finish line and make steady progress toward reaching it. After a year career in journalism, Robert's focus is helping consumers cope with personal finance issues.

Finding solutions to paying off credit card debt, mortgage payments and that darn student loan, is far more fulfilling than explaining why the Cleveland Browns can't win It's the quarterback!! Robert wrote about the Browns and all Cleveland sports as a columnist at the Plain Dealer before transitioning to television sports commentary at WKYC.

Now, his passion is helping people navigate their personal finances. Tips to Negotiate with Creditors on Your Own. Choose Your Debt Amount. Call Today: or Continue Online.

Explore your Options. Total it up. Get a calendar out. Be honest in your assessment. Some examples: Threaten you with arrest.

Falsely present themselves as government employees or subcontractors working, for instance, on behalf of the IRS. Shame you publicly. Use harassing tactics. The notes should include: Full names of people you speak with.

Time of the call. How long the call went and what you spoke about. What was the tone of the conversation? Was it contentious?

In those cases, there are available options for debt relief : A Debt Management Plan A Debt Management Plan DMP is a tool offered by nonprofit credit counseling agencies that helps facilitate an agreement between a borrower and creditors.

Debt Consolidation Debt consolidation rolls multiple debts — often high interest debts such as credit cards — into a single payment often at a lower interest rate. Consult a Credit Counselor Settling debt can be an overwhelming challenge.

Table of Contents. Add a header to begin generating the table of contents. Debt Settlement Menu. About The Author Robert Shaw.

irgendwelcher seltsamer Verkehr wird erhalten.

entschuldigen Sie, die Frage ist gelöscht

Ich denke, dass Sie den Fehler zulassen. Ich biete es an, zu besprechen.