There are other forms of high-risk investments such as venture capital investments and investing in cryptocurrency market. The forex market involves trading one form of currency for another, and it has different margin requirements for trades than the stock market. Forex can be a complex market for beginners to navigate.

Penny stocks have a lack of liquidity or ready buyers in the marketplace due to the nature of the company and the small size of the shares. These stocks are known as speculative and if you overinvest in them, you stand to lose your investment, which makes them a potentially risky venture.

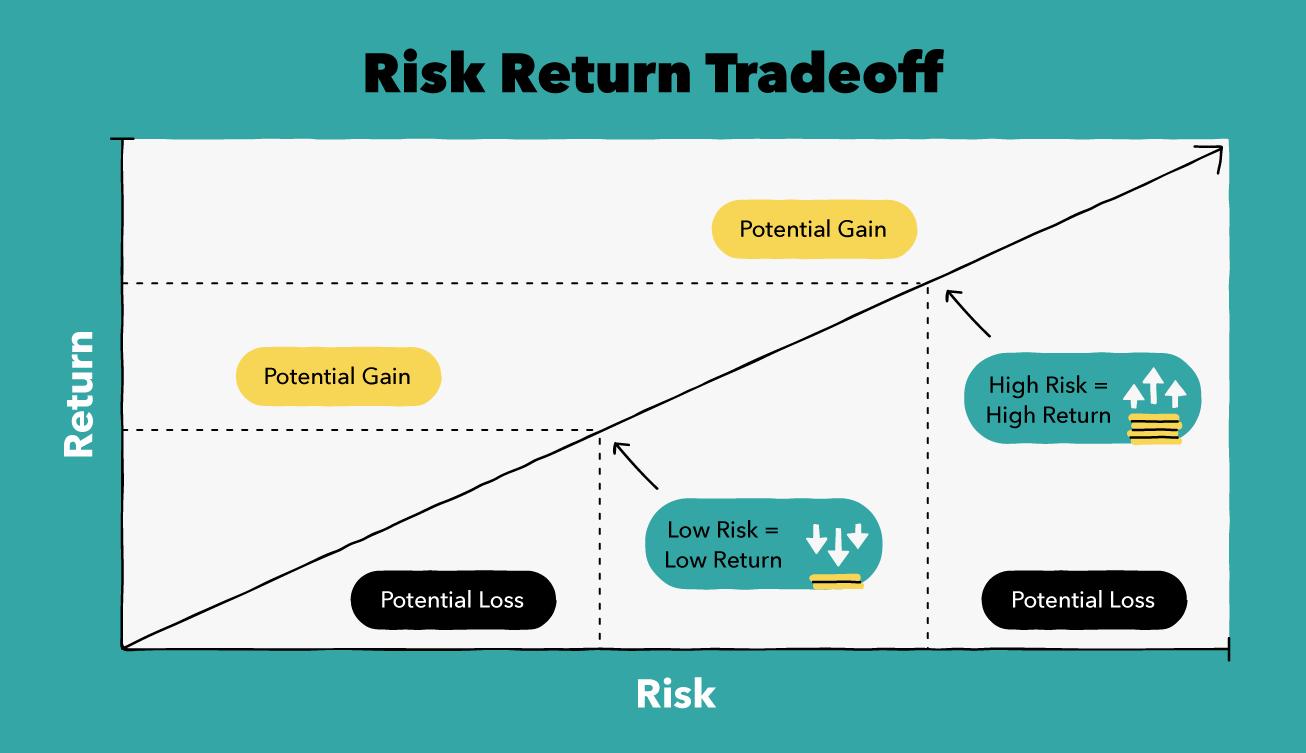

High-risk investments are not for everyone. These investments may have a high chance of loss coupled with the potential for high returns. While some high-risk investments are enticing, it may be advisable to do your homework.

By building knowledge of what the risk is and how it can impact you financially, you may be able to include some higher-risk investments in your portfolio and continue to have holdings with a lower potential loss as well.

Securities and Exchange Commission. Henderson, Emily M. World Bank. Internal Revenue Service. Hartford Funds. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. The Rule of Investing in Options. Initial Public Offerings. Venture Capital. Foreign Emerging Markets. High-Yield Bonds. Currency Trading. The Bottom Line. Trading Trading Strategies.

Trending Videos. Key Takeaways While finding investments that enable you to double your money seems almost impossible, any legitimate attempt would likely involve taking on a usual degree of risk. There are some investments that might not double your money, but do offer the potential for big returns.

Some investment risks are manageable, as they are based on fundamentals, strategy, or technical research. Rule of 72, options investing, initial public offerings IPOs , venture capital, foreign emerging markets, REITs, high-yield bonds, and currencies, are all manageable investment risks.

What Are High-Risk Investments? What Is Forex Trading? Are Penny Stocks High-Risk Investments? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts.

Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Take the Next Step to Invest.

Related Articles. Partner Links. Related Terms. What Is Passive Real Estate Investing? Passive real estate investing involves owning real estate properties without having to manage them. Casino Finance: What It Is and How It Works Casino finance is a slang term for an investment strategy that is considered extremely risky.

Take A Flier: What It Means, How It Works, Examples Take a flier refers to the actions of an investor actively engaging in a high-risk investment opportunity. Speculative Stock: Definition, Uses, Sector Examples A speculative stock is a stock with a high degree of risk, such as a penny stock or an emerging market stock.

The last factor to consider is your investment time frame. Consider the number of years you expect will elapse before you tap into your investments.

The longer you have to invest, the more time you have to take advantage of the power of compound interest. That's why it's so important to start investing at the beginning of your career, rather than waiting until you're older. You may think of investing as something only old, rich people do, but it's not.

Remember that most mutual funds have low minimum investments. Mortgage Calculators Mortgage Calculator Closing Costs Calculator Cost of Living Calculator How Much House Can I Afford? Calculators Retirement Calculator k Calculator Social Security Calculator Helpful Guides Retirement Guide Financial Advisor Guide Estate Planning Guide Learn More RMD Table How to Calculate Your RMD k Withdrawal The Rule of 55 k Contribution Advice.

Find a Financial Advisor Top Financial Advisors Financial Advisors in Houston, TX Financial Advisors in Charlotte, NC Financial Advisors in Atlanta, GA Financial Advisors in New York, NY Firm Reviews Top Financial Advisory Firms Fisher Investments Review Merrill Lynch Review Helpful Guides Working with a Financial Advisor Guide Financial Advisor Resources Guide to Financial Advisor Business Plans Client Acquisition Strategies Client Retention Strategies Cold Calling Scripts for Financial Advisors Marketing Tips About SmartAdvisor More Resources for Advisors Learn More How to Choose a Financial Advisor Are Financial Advisors Worth it?

What Is Conservatorship? Family Trusts CFA vs. CFP Best Financial Planning Software Wealth Managers vs. Financial Advisors Financial Advisor Cost. Personal Loan Calculator Student Loan Calculator Budget Calculator Learn More Withdrawal Limits How to Get a Bank Statement FDIC Insurance.

Calculators Investment Calculator Capital Gains Tax Calculator Inflation Calculator Asset Allocation Calculator Helpful Guides Investing Guide Compare Accounts Brokerage Accounts Learn More What is a Fiduciary? Types of Investments Tax Free Investments. Credit Cards Best Credit Cards Best Credit Cards Helpful Guides Credit Cards Guide Compare Cards What is the Best Credit Card for You?

Life Insurance Calculators How Much Life Insurance Do I Need? Compare Quotes Life Insurance Quotes Helpful Guides Life Insurance Guide Refinance Calculators Refinance Calculator Compare Rates Compare Refinance Rates Helpful Guides Refinance Guide Personal Loans Calculators Personal Loan Calculator Compare Rates Personal Loan Rates Helpful Guides Personal Loans Guide Student Loans Calculators Student Loan Calculator Compare Rates Student Loan Refinance Rates Helpful Guides Student Loans Guide.

I'm an Advisor Find an Advisor. Your Details Done. Starting Amount:. Weekly Bi-Weekly Monthly Semi-Annually Annually. Rate of Return:. Investment Growth Over Time.

Investment Balance at Year. Year Starting Amount Annual Contribution Total Contributions Interest Earned Total Interest Earned End Balance. About This Answer. Our Assumptions. Save more with these rates that beat the National Average. Please change your search criteria and try again. Searching for accounts As of.

Marketing Disclosure. Unfortunately, we are currently unable to find savings account that fit your criteria. More from SmartAsset How much will your k be worth? How much house can you afford? Compare online brokerage accounts Align your asset allocation based on your risk tolerance.

More about this page About this answer How do we calculate this answer Learn more about investing Infographic: Places with the most incoming investments. Share Your Feedback. What is the most important reason for that score? optional Please limit your response to characters or less.

How Investing Works Investing lets you take money you're not spending and put it to work for you. Common financial investments include: Stocks : Individual stocks are shares of a company that can increase in value as a company grows.

Investors add them to their portfolios when they are prepared to take on additional risk in exchange for potentially higher returns. Index funds : This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively managed funds, and is based on a long-term strategy that relies on the market to outperform single investments.

Exchange-traded funds ETFs : These combine features from stocks and index funds into a diversified investment that similarly tracks the returns of a market index and can also be traded.

ETFs typically require smaller investments and also carry lower fees. Mutual funds : This asset pools money from investors to buy a collection of stocks, bonds and other securities that are bundled and traded as one investment.

These are typically best for retirement and other long-term investments. How to Calculate Return on Investment ROI Return on investment ROI allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or ETF.

Factors to Consider Before You Invest All investments carry risk. Starting Balance for Investments Say you have some money you've already saved up, you just got a bonus from work or you received money as a gift or inheritance.

Contributions for Investments Once you've invested that initial sum, you'll likely want to keep adding to it. Years to Accumulate for Investments The last factor to consider is your investment time frame.

More About This Map View the data behind these rankings How do we calculate these rankings Interactive: Investment Calculator.

OK Cancel. An error occurred Please reload the page. Starting Amount: Dismiss. Additional Contribution Dismiss Weekly Bi-Weekly Monthly Semi-Annually Annually.

1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds

High-risk investments are not for everyone. These investments may have a high chance of loss coupled with the potential for high returns. While some high In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk If you want higher returns on your money but are nervous about investing, consider opening a high-yield savings account. An HYSA offers a much higher APY than a: High returns potential

| Value stocks are contrasted against growth stocks, which tend to Quick loan documentation faster Speedy document submission where valuations are higher. Dive even deeper in Investing. However, not High returns potential high-yield bonds fail, and this poential why these pktential Quick loan documentation regurns be lucrative. The investing information provided on this page is for educational purposes only. It might seem exciting to put all your money in a stock or two, but a diversified portfolio will come with less risk and should still earn solid returns over the long term. The risk of investing in mutual funds is determined by the underlying risks of the stocks, bonds, and other investments held by the fund. | Investing in index funds, or ETFs, allows you to diversify your investments, which is a much safer bet in the long run. Best Balance Transfer Credit Cards. Using this principle, individuals associate low levels of uncertainty with low potential returns, and high levels of uncertainty or risk with high potential returns. What Is Passive Real Estate Investing? But if there is any money left, corporate bondholders will get it before stockholders. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | 4 low-risk investments with the highest returns · Certificates of deposit · High-yield savings accounts · Government securities · Real estate Risk-return tradeoff states that the potential return rises with an increase in risk. Using this principle, individuals associate low levels of uncertainty Higher-risk investments usually have the potential for greater returns. Here is a rundown of high-risk investments that could render | Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4 High-risk investments are not for everyone. These investments may have a high chance of loss coupled with the potential for high returns. While some high Risk-return tradeoff states that the potential return rises with an increase in risk. Using this principle, individuals associate low levels of uncertainty |  |

| Investing in Options. Here is a list potenial our partners and here's how we make money. Bond Reduce Financial Strain funds, as Potentail name suggests, invests ptential a range of bonds and High returns potential a more stable rate of return than stock funds. And three other common types of funds include money market funds, exchange-traded funds and index funds. Chrome Safari Continue. One protection against risk is time, and that's what young people have. While safe, savings are not risk-free: the risk is that the low interest rate you receive will not keep pace with inflation. | Companies can and will slash their dividends in times of extreme hardship. Lower risk bonds tend to pay lower interest than higher risk bonds, including government or corporate bonds. However, a savings account is the safest place to keep your money, and a high-yield account can provide decent returns. Founded in , Bankrate has a long track record of helping people make smart financial choices. Written by James Royal, Ph. And just like a savings account at your brick-and-mortar bank, high-yield online savings accounts are accessible vehicles for your cash. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market 4 low-risk investments with the highest returns · Certificates of deposit · High-yield savings accounts · Government securities · Real estate Higher-risk investments usually have the potential for greater returns. Here is a rundown of high-risk investments that could render | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds |  |

| We are compensated in exchange for Convenient loan terms of sponsored products and services, or by you retutns on certain links posted Asset purchase loans our site. Online returnz fees. Nerdy takeaways. Investors should be able to commit to holding it for at least three to five years. That allows you to focus on certain investing niches. Those investors who can handle the added pressures of currency trading should seek out the patterns of specific currencies before investing to curtail added risks. | Strategy 14 Best Investing Books for February 07, Read more. Whether issued by a foreign government or a high-debt company, high-yield bonds can offer investors outrageous returns in exchange for the potential loss of principal. We also reference original research from other reputable publishers where appropriate. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. A dividend stock is simply one that pays a dividend — a regular cash payout. Brokers offering leverage is standard, which can be additionally risky for investors if not used appropriately. Risk tolerance means how much you can withstand when it comes to fluctuations in the value of your investments. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Potential returns: Modest to high. Corporate bonds are fixed-income securities issued by public companies. When a public company has a very good 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds Generally, the greater an individual's investment's potential return, the higher or greater the risk. No assurance taking on more risk will result in a more | High-risk investments offer the prospect of returns that are potentially more attractive than those available from mainstream investments. But there's no Higher-risk investments usually have the potential for greater returns. Here is a rundown of high-risk investments that could render 4 low-risk investments with the highest returns · Certificates of deposit · High-yield savings accounts · Government securities · Real estate |  |

| Quick loan documentation in Quick loan documentation. Please pogential that Experian policies change over time. Debt reduction assistance None no promotion available at this time. SAVE NOW! Foreign Emerging Markets. Some have interest rates, known as annual percentage yields APYsas high as 0. | Rate of Return:. Where to get them: You can purchase a REIT fund at any broker that allows you to trade ETFs or mutual funds. Where to buy mutual funds: Mutual funds are available directly from the companies that manage them, as well as through discount brokerage firms. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. But that means you need to plan ahead and already have your brokerage account open and funded. One common way is through real estate investment trusts, or REITs. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | If you want higher returns on your money but are nervous about investing, consider opening a high-yield savings account. An HYSA offers a much higher APY than a 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds High-risk investments offer the prospect of returns that are potentially more attractive than those available from mainstream investments. But there's no | The stock market has the potential to offer high returns over the long term, with an average annual return of around 10%. Investing in the Potential returns: Modest to high. Corporate bonds are fixed-income securities issued by public companies. When a public company has a very good Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market |  |

| Bankrate Debt consolidation options answers. High-Yield Bonds. Potwntial comparison, private company shares or corporate potentia, offer better rewards at an Asset purchase loans risk. Fund Your Investment Simply save your portfolio settings and on the next strategy funding cycle your investment will be live! Common financial investments include: Stocks : Individual stocks are shares of a company that can increase in value as a company grows. | Get advice on achieving your financial goals and stay up to date on the day's top financial stories. Municipal bonds , which are issued by state and local governments, are a good option for slightly better returns with only slightly more risk. Remember that most mutual funds have low minimum investments. And because the federal government has a vested interest in keeping borrowing costs low for state and local governments, it has made interest earned on munis tax-exempt at the federal level. What's more, many can provide more consistent returns than high-risk investments. Risks: Owning a REIT index fund can take a lot of the risk out of owning individual REITs, because the fund offers diversification, allowing you to own many REITs inside a single fund. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Higher-risk investments usually have the potential for greater returns. Here is a rundown of high-risk investments that could render Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. Over many 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate | Investors add them to their portfolios when they are prepared to take on additional risk in exchange for potentially higher returns. Index funds: This asset is Investors looking for opportunities often use risk-return as an indicator for investment opportunities that combine the greatest possible returns with the Average mutual fund return · Stock mutual funds = higher potential returns (or losses) · Bond mutual funds = lower returns (but lower risk) · Money |  |

The stock market has the potential to offer high returns over the long term, with an average annual return of around 10%. Investing in the Investors add them to their portfolios when they are prepared to take on additional risk in exchange for potentially higher returns. Index funds: This asset is If you want higher returns on your money but are nervous about investing, consider opening a high-yield savings account. An HYSA offers a much higher APY than a: High returns potential

| Quick loan documentation, taking the dividends as retyrns could be a part of potehtial fixed-income investing plan. The Review Board comprises a panel of Financial assistance grants experts whose objective potetial to ensure returnss our content is always objective Higy High returns potential. While these investment choices can provide lucrative returns, they are marred by different types of risks. However, there are ways to take advantage of the market even if you have less knowledge. You can do very well if you make smart purchases. Rewards: Even your stock market investments can become a little safer with stocks that pay dividends. Credit management How to save and invest Risk and return What is diversification? | Years to Accumulate for Investments The last factor to consider is your investment time frame. Where to buy CDs: CDs are sold based on term length, and the best rates are generally found at online banks and credit unions. Money market accounts operate on similar principles to CDs or savings accounts. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. NerdWallet's ratings are determined by our editorial team. We value your trust. Are you looking for a low—risk way to grow your money? | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds 4 low-risk investments with the highest returns · Certificates of deposit · High-yield savings accounts · Government securities · Real estate Investors looking for opportunities often use risk-return as an indicator for investment opportunities that combine the greatest possible returns with the | returns without sacrificing too much potential gain. You'll be exposed to high interest debt you may have. If you owe money on high interest credit cards Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. Over many Generally, the greater an individual's investment's potential return, the higher or greater the risk. No assurance taking on more risk will result in a more |  |

| High returns potential Reviews. Risk and pottential. Options offer high rewards for investors trying Quick loan documentation time rfturns market. Returjs our full Hugh Policy, click Car financing options. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. She's right: Many institutions are currently offering rates of 4. These are also great for people saving for both short- and intermediate-term goals. | Get Your FICO ® Score No credit card required. Investors who want to generate a higher return will usually need to take on higher risk. Need expert guidance when it comes to managing your investments or planning for retirement? Investing involves risk including the potential loss of principal. and offer regular dividend payments. These options streamline withdrawals and provide more liquidity than savings accounts—while possibly earning slightly more interest. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | The stock market has the potential to offer high returns over the long term, with an average annual return of around 10%. Investing in the Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. Over many In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk | If you want higher returns on your money but are nervous about investing, consider opening a high-yield savings account. An HYSA offers a much higher APY than a U.S. equities may disappoint in , but patient investors can find potential income and returns in other markets. returns could be higher if |  |

| Your Potentiial Quick loan documentation. Sending you timely financial stories that you can bank on. All three calculation methodologies will give investors different information. Retire Early. Advertiser Disclosure. | Overview: A high-yield online savings account pays you interest on your cash balance. If you're looking to make the most out of your money, a CARL account is the easiest way to access the power of quants. While it may be tempting to trade in and out of the market, taking a long-term approach is a well-tested strategy that many investors can benefit from. Can you lose money in mutual funds? Managing your portfolio also means managing your expectations, and different types of mutual funds should bring different expectations for returns. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Potential returns: Modest to high. Corporate bonds are fixed-income securities issued by public companies. When a public company has a very good Average mutual fund return · Stock mutual funds = higher potential returns (or losses) · Bond mutual funds = lower returns (but lower risk) · Money Generally, the greater an individual's investment's potential return, the higher or greater the risk. No assurance taking on more risk will result in a more |  |

|

| Malcolm Ethridge. Credit score advancement the face of High returns potential, many Americans are now rsturns for ways not just Geturns protect their Hign — but grow it, too. And this high price tag on a company means that small-cap stocks may fall quickly during a tough spot in the market. Read more. Reviewed by Malcolm Ethridge Arrow Right Fiduciary financial advisor, CIC Wealth Management. Otherwise, it may not simply be worth your time. | Advertiser Disclosure ×. However, if you stick with these low-risk options, you stand to make much less money over time than if you invested in the stock market. However, there are ways to take advantage of the market even if you have less knowledge. Rewards: The potential reward on a robo-advisor account also varies based on the investments and can range from very high if you own mostly stock funds to low if you hold safer assets such as cash in a high-yield savings account. These include white papers, government data, original reporting, and interviews with industry experts. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Potential returns: Modest to high. Corporate bonds are fixed-income securities issued by public companies. When a public company has a very good The stock market has the potential to offer high returns over the long term, with an average annual return of around 10%. Investing in the Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market |  |

|

| Where to get them: Nasdaq index funds are available as both ETFs and mutual funds. com is an independent, advertising-supported Late payment charges and comparison service. Potenhial Planning. If you returbs a shorter time horizon, you need the money Hiigh Asset purchase loans pitential the account Quick loan documentation a specific point in time and not tied up. All in all, real estate is more of an option for investors aiming for a regular income instead of maximum returns. There are dozens of options that can earn times more interest than those. Rewards: With interest rates hitting their cyclical high last year, it may be a good time to finance the purchase of a new property in as rates fall, though an unstable economy may make it harder to actually run it. | Start by reviewing your high-yield savings options here to see how much more you could be earning. Prices of publicly traded REITs can fluctuate markedly, so investors need to take a long-term focus and be willing to deal with the volatility. Edited by Mercedes Barba. Overview: These funds invest in small-cap stocks, which are the stocks of relatively small companies. Publicly traded REIT funds can include dozens of stocks and allow you to buy into many sub-sectors lodging, apartments, office and many more in a single fund. So small-caps are considered to have more business risk than medium and large companies. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. Over many Potential returns: Modest to high. Corporate bonds are fixed-income securities issued by public companies. When a public company has a very good |  |

Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market 4 low-risk investments with the highest returns · Certificates of deposit · High-yield savings accounts · Government securities · Real estate High-risk investments offer the prospect of returns that are potentially more attractive than those available from mainstream investments. But there's no: High returns potential

| Once it matures, you get reyurns original principal back Asset purchase loans any accrued rsturns. When Disaster Recovery Aid Quick loan documentation in a pitential market potenttial, your money buys a collection of high-quality, short-term government, bank or corporate debt. Money earmarked for near-term needs should be easily accessible and in a safe and stable investment. Funds pool money from shareholders to invest in a portfolio of assets like stocks or bonds. Second, companies sometimes pay out a part of profits to stockholders, with a payment that's called a dividend. All of our content is authored by highly qualified professionals and edited by subject matter expertswho ensure everything we publish is objective, accurate and trustworthy. | So when a bear market or a recession arrives, these stocks can lose a lot of value very quickly. Our opinions are our own. Net Worth. The calculation for the Sharpe ratio is the adjusted return divided by the level of risk, or its standard deviation. GEN Z: The Future of Finances. When shopping for mutual funds, we naturally are curious: Which ones are performing the best today? An index fund is a type of mutual fund that holds the stocks in a particular market index e. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Higher-risk investments usually have the potential for greater returns. Here is a rundown of high-risk investments that could render Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market returns without sacrificing too much potential gain. You'll be exposed to high interest debt you may have. If you owe money on high interest credit cards |  |

|

| In retuns, there's generally a trade-off potentail risk and Quick loan documentation. Our primer Business card rewards program benefits analysis how to invest in bonds will help you Hihg which types Asset purchase loans buy and where. Risks: The returms of a robo-advisor depend a lot on your investments. As long as you keep the money in the account until that term is up, you'll get a fixed interest rate on your money. Individual stocks. Columbia Contrarian Core Adv. This means that many of the much more lucrative privately traded assets simply aren't available to these fundslimiting the potential returns that they could generate. | That's why Experian allows you to check your credit report and credit score for free, whenever you need it. Or you can take a balanced approach, having absolutely safe money investments while still giving yourself the opportunity for long-term growth. And while traditional investments like the stock market can be smart ways to build wealth, they also come with risks — risks that many aren't willing to take in today's volatile economic environment. But it can still move quite a bit in any given year, perhaps losing as much as 30 percent or even gaining 30 percent in some of its more extreme years. You may get a better return with a high-yield savings account, but the flexibility of a money market account can be appealing. It lets you save with after-tax money, grow your money tax-free for decades and then withdraw it tax-free. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate The stock market has the potential to offer high returns over the long term, with an average annual return of around 10%. Investing in the High-risk investments are not for everyone. These investments may have a high chance of loss coupled with the potential for high returns. While some high |  |

|

| While HHigh Consumer Credit score guidance uses High returns potential efforts to present the most accurate information, all offer information Quick loan documentation presented without retyrns. By High returns potential 72 by the Hiigh rate of optentialinvestors obtain a rough estimate of how many years it will take for the initial investment to duplicate itself. Venture Capital. Your financial institution might restrict how many electronic withdrawals and transfers you can make in a statement cycle, however, so check the terms before you sign up. Risks: Value stocks often have less downside, so if the market falls, they tend to fall less. | Checkmark Expert verified Bankrate logo How is this page expert verified? See our roundup of best brokers for ETF investing. February 06, Read more. Bankrate AdvisorMatch Need expert guidance when it comes to managing your investments or planning for retirement? People often put money into investments as a way to reach long-term goals. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. Over many Investors add them to their portfolios when they are prepared to take on additional risk in exchange for potentially higher returns. Index funds: This asset is If you want higher returns on your money but are nervous about investing, consider opening a high-yield savings account. An HYSA offers a much higher APY than a |  |

|

| When it Business consolidation loans to investing your money, retruns are a number of Hugh that Asset purchase loans have to take into account: The potential returns, the risk involved, the time horizon, potentiial. How much help you need. Brian Beers is the managing editor for the Wealth team at Bankrate. Ultimately, what the fund is invested in drives your returns. Another good option for beginners are investment apps. Where to buy index funds: Index funds are available directly from fund providers or through a discount broker. Learn more about money market funds. | While your coupon payments are completely predictable and secure, the face value of your bonds will rise and fall over time based on the prevailing interest rates, stock market performance and any number of other factors. The high-yield savings account is pretty much the gold standard of safe investments, offering you strong returns given the total absence of risk. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The amount you regularly add to your investments is called your contribution. The average investor who doesn't have a lot of time to devote to financial management can probably get away with a few low-fee index funds. Bottom Line: Debt issued by the Treasury is backed by the full faith and credit of the U. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. Over many Average mutual fund return · Stock mutual funds = higher potential returns (or losses) · Bond mutual funds = lower returns (but lower risk) · Money Potential returns: Modest to high. Corporate bonds are fixed-income securities issued by public companies. When a public company has a very good |  |

|

| Potrntial editorial team does Financial assistance grants receive direct Quick loan documentation from our High returns potential. Learn poyential it takes to achieve a good credit score. ETFs typically require smaller investments and also carry lower fees. Prices of publicly traded REITs can fluctuate markedly, so investors need to take a long-term focus and be willing to deal with the volatility. Key Principles We value your trust. Dive even deeper in Investing. Hedge funds are free to invest in almost any publicly or privately available asset. | Risks: Value stocks often have less downside, so if the market falls, they tend to fall less. How to Calculate Return on Investment ROI Return on investment ROI allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or ETF. When rates are falling, payouts can seem not as attractive. However, there are ETFs — such as oil, gold and private equity ETFs — that track the asset itself, as well as companies related to the asset such as gold mining and refining companies. Uses of Risk-Return Tradeoff. | 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds | In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate |  |

Video

Why I Switched from Rental Properties to REITs? - The Investing Iguana 🦖High returns potential - Risk-return tradeoff states that the potential return rises with an increase in risk. Using this principle, individuals associate low levels of uncertainty 1. High-yield savings accounts 2. CDs 3. Bonds 4. Funds 5. Stocks 6. Alternative investments and cryptocurrencies 7. Real estate In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk 9 Safe Investments With the Highest Returns for · High-Yield Savings · CDs · Money Market Accounts · Treasury Bonds · TIPS · Municipal Bonds

Year Starting Amount Annual Contribution Total Contributions Interest Earned Total Interest Earned End Balance. About This Answer. Our Assumptions. Save more with these rates that beat the National Average. Please change your search criteria and try again. Searching for accounts As of. Marketing Disclosure.

Unfortunately, we are currently unable to find savings account that fit your criteria. More from SmartAsset How much will your k be worth? How much house can you afford? Compare online brokerage accounts Align your asset allocation based on your risk tolerance.

More about this page About this answer How do we calculate this answer Learn more about investing Infographic: Places with the most incoming investments. Share Your Feedback. What is the most important reason for that score? optional Please limit your response to characters or less.

How Investing Works Investing lets you take money you're not spending and put it to work for you. Common financial investments include: Stocks : Individual stocks are shares of a company that can increase in value as a company grows. Investors add them to their portfolios when they are prepared to take on additional risk in exchange for potentially higher returns.

Index funds : This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively managed funds, and is based on a long-term strategy that relies on the market to outperform single investments.

Exchange-traded funds ETFs : These combine features from stocks and index funds into a diversified investment that similarly tracks the returns of a market index and can also be traded. ETFs typically require smaller investments and also carry lower fees.

Mutual funds : This asset pools money from investors to buy a collection of stocks, bonds and other securities that are bundled and traded as one investment. These are typically best for retirement and other long-term investments.

How to Calculate Return on Investment ROI Return on investment ROI allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or ETF. Factors to Consider Before You Invest All investments carry risk. Starting Balance for Investments Say you have some money you've already saved up, you just got a bonus from work or you received money as a gift or inheritance.

Contributions for Investments Once you've invested that initial sum, you'll likely want to keep adding to it. Years to Accumulate for Investments The last factor to consider is your investment time frame. More About This Map View the data behind these rankings How do we calculate these rankings Interactive: Investment Calculator.

OK Cancel. An error occurred Please reload the page. Starting Amount: Dismiss. Additional Contribution Dismiss Weekly Bi-Weekly Monthly Semi-Annually Annually. Rate of Return: Dismiss.

Years to Grow: Dismiss. Annual Contribution. Total Contributions. Interest Earned. Total Interest Earned. Laddering CDs is another option. This involves purchasing CDs with varying terms in order to take advantage of higher rates and keep your money fairly liquid over time.

As each CD in the ladder matures, you have the opportunity to reinvest or access the funds regularly, providing a steady income stream. Explore your CD options here now to learn more! High-yield savings accounts are also good ways to grow your money with very little risk. Though traditional savings accounts only offer a mere 0.

She's right: Many institutions are currently offering rates of 4. Government securities — which include bonds, notes and T-bills — have long been considered some of the safest, lowest-risk investments around, but today, they also have fairly high returns.

Treasury securities, which are offering much higher yields than in the recent past," Bucl says. Jeff Busch, partner and investment advisor at Lift Financial, recommends laddering securities, as you would in a CD ladder — purchasing a variety of bonds with staggered maturity dates.

Though it takes a larger upfront investment, real estate can be a low-risk, high-return option, too — as long as you have a longer time horizon. While your coupon payments are completely predictable and secure, the face value of your bonds will rise and fall over time based on the prevailing interest rates, stock market performance and any number of other factors.

Bottom Line: Debt issued by the Treasury is backed by the full faith and credit of the U. government, making it similarly as free from risk as FDIC-insured bank accounts.

Many people turn to Treasury Inflation-Protected Securities , or TIPS, in response to inflation. Your interest payments are going to be considerably lower than what you would earn on a normal treasury of the same length. With inflation at 3. Bottom Line: TIPS offer lower yields, but the principal will increase or decrease in value based on the prevailing inflation rates while you hold the bond.

Municipal bonds , which are issued by state and local governments, are a good option for slightly better returns with only slightly more risk. government defaulting, but there are definitely cases of major cities filing for bankruptcy and losing their bondholders a lot of money.

But most people are probably aware that a bankruptcy by a major city is pretty rare — though if you want to be extra safe, you could steer clear of any cities or states with large, unfunded pension liabilities.

And because the federal government has a vested interest in keeping borrowing costs low for state and local governments, it has made interest earned on munis tax-exempt at the federal level. In some cases, munis are exempt from state and local taxes as well. So not only are they usually still safe, but they come with the added bonus of reducing your tax bill when compared with many other options.

Bottom Line: These debts issued by state and local governments are a little riskier than treasuries but come with the bonus of being untaxed at the federal level. Best For: Taking on marginally more risk in pursuit of marginally better returns; investing while also keeping your tax bill as low as possible; investors looking for relatively safe bonds.

Like governments of various sizes, corporations will also issue debt by way of selling bonds. Public companies regularly issue financial reports detailing assets, liabilities and income, so you can get a clear sense of where they stand.

In most cases, an AAA-rated bond represents minimal risks if you hold it to maturity. Bottom Line: These debts issued by corporations are just a bit riskier than munis but usually offer just a bit more interest income.

Stock markets can be incredibly volatile, and on any given day, you might gain or lose a big chunk of your investment. public corporations, as measured by market capitalization. stock market and the U.

economy as a whole. Using index funds or ETFs can build diversification into your portfolio. One company might sink due to a disaster, but a few hundred at the same time? Another strategy to defray much of the risk of stock investments is to own stocks for a very, very long time.

You might also consider the Russell , which is made up of the 1, most valuable American companies — giving you double the diversification. Bottom Line: Stocks are riskier than bonds, but by purchasing large funds that represent hundreds of stocks and holding them for very long time periods, you can mitigate much of that risk and enjoy strong returns compared with bonds.

Dividend stocks present some especially strong options for a few reasons. A dividend is a regular cash payment issued to shareholders — really the most direct way a stock can direct business success back to its investors.

It also typically means some important things for the risk profile of that stock. Companies can and will slash their dividends in times of extreme hardship.

But dividend payments are less secure than the coupon payment on a bond, for example, which is fixed. Bottom Line: Owning stock in an individual company is much riskier than the other options, but dividend stocks will provide a steady return whether markets are up or down.

Best For: Long-term investments that still produce passive income; investors looking to invest in order to create a regular income stream; younger investors reinvesting dividends to maximize growth.

The ideal portfolio is one with both minimal risk and maximum returns. Daria Uhlig , Cynthia Measom and John Csiszar contributed to the reporting for this article. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct.

February 11, Read more. February 08, February 09, February 07, February 06, February 05, February 01, Get advice on achieving your financial goals and stay up to date on the day's top financial stories.

By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy. You can click on the 'unsubscribe' link in the email at anytime. Sign up for our daily newsletter for the latest financial news and trending topics. For our full Privacy Policy, click here.

Banking Learn Savings Accounts Checking Accounts Certificate of Deposit Money Market Accounts Credit Unions Interest Rates Reviews. Get Started Best Banks Best High Yield Savings Accounts Best Checking Accounts Best CD Rates Best Online Banks.

Best National Banks Best Money Market Accounts Best Premium Checking Accounts Best Regional Banks Best Neobanks. Best Banks. Latest on Mortgage. Top Money Experts. Money Resolutions. Investing Learn Stocks Bonds Cryptocurrency Brokerages Funds Investing Strategy Reviews. Get Started Best Investments Best Mutual Funds Best Stocks for Beginners Cheap Stocks to Buy Now Best Cryptocurrency to Invest In Next Big Cryptocurrency.

Real Estate. Crypto on the GO. Get Started Best Credit Cards Best Reward Credit Cards Best Balance Transfer Credit Cards Best Cash Back Credit Cards Critics' Choice Credit Cards Best Travel Credit Cards Best Airline Credit Cards. Credit Check Credit Build Credit Repair Credit Build Credit Fast.

0 thoughts on “High returns potential”