And keep in mind that, if rates are higher now than when you bought your home, your savings might be impacted.

When you refinance to borrow more than you owe on your current loan, the lender gives you a check for the difference. This is called a cash-out refinance.

Consider opening a home equity line of credit HELOC. This lets you draw on your home equity as needed. You can pay all or some of it back monthly, similar to a credit card. Private mortgage insurance on conventional home loans can be canceled, but in many cases, the Federal Housing Administration mortgage insurance premium you pay on FHA loans cannot.

To calculate your home equity , estimate your home value , then subtract your mortgage balance. Interest rates on adjustable-rate mortgages can go up over time. Fixed-rate loans stay the same. Refinancing from an ARM to a fixed-rate loan provides financial stability when you prefer steady payments.

Costs vary by lender, so shop around to get the best deal. You might also be on the hook for extra fees from your current lender.

Some lenders charge a fee if you pay off your mortgage in full in the first three to five years after getting the loan. Shop around: Find your best refinance rate by getting a Loan Estimate from at least three lenders.

Each potential lender is required to issue the estimate within three days of receiving your basic information. The Loan Estimate is a simple three-page document that details your estimated loan terms, payments, closing costs and other fees.

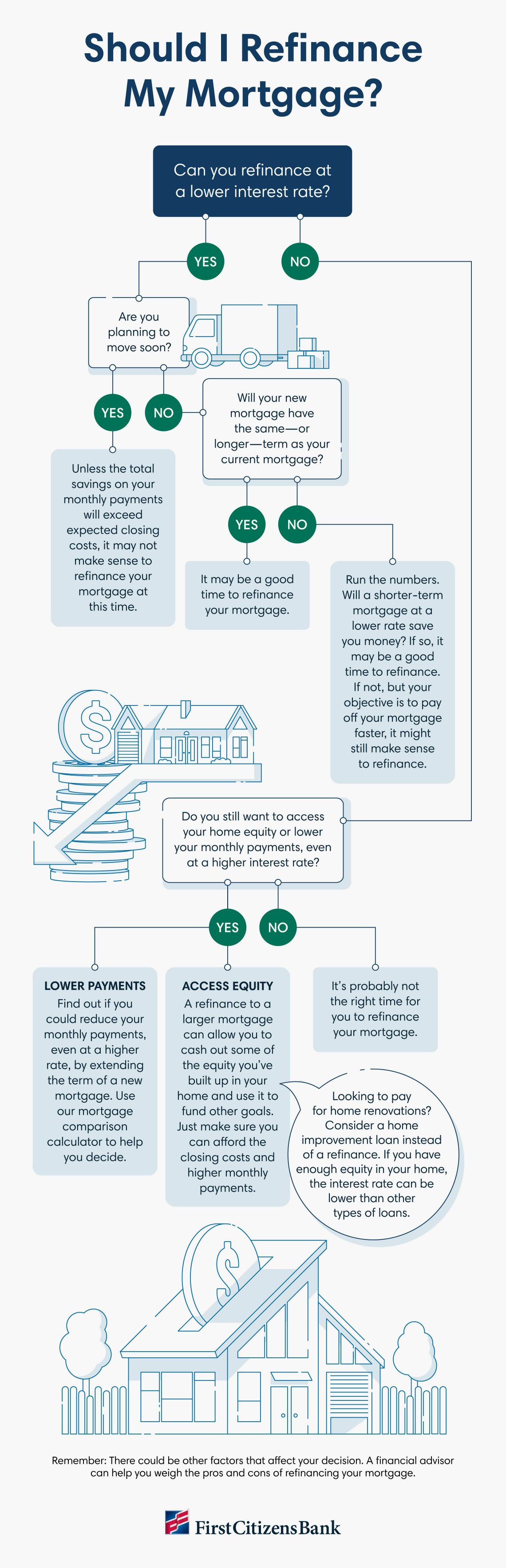

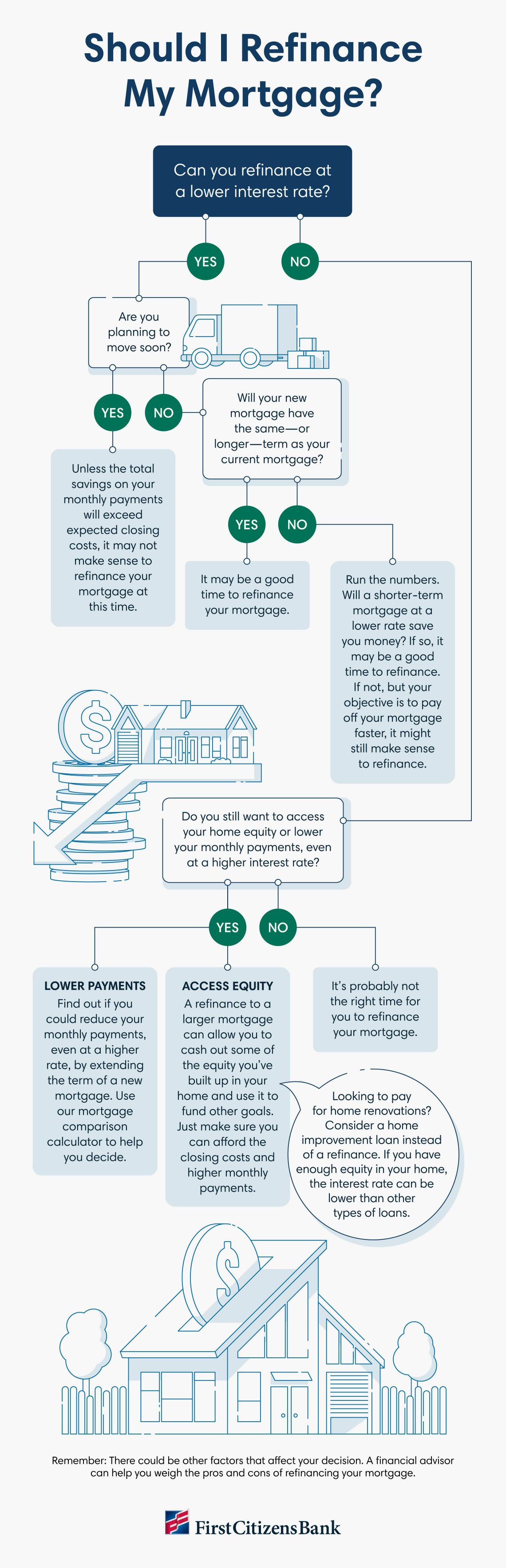

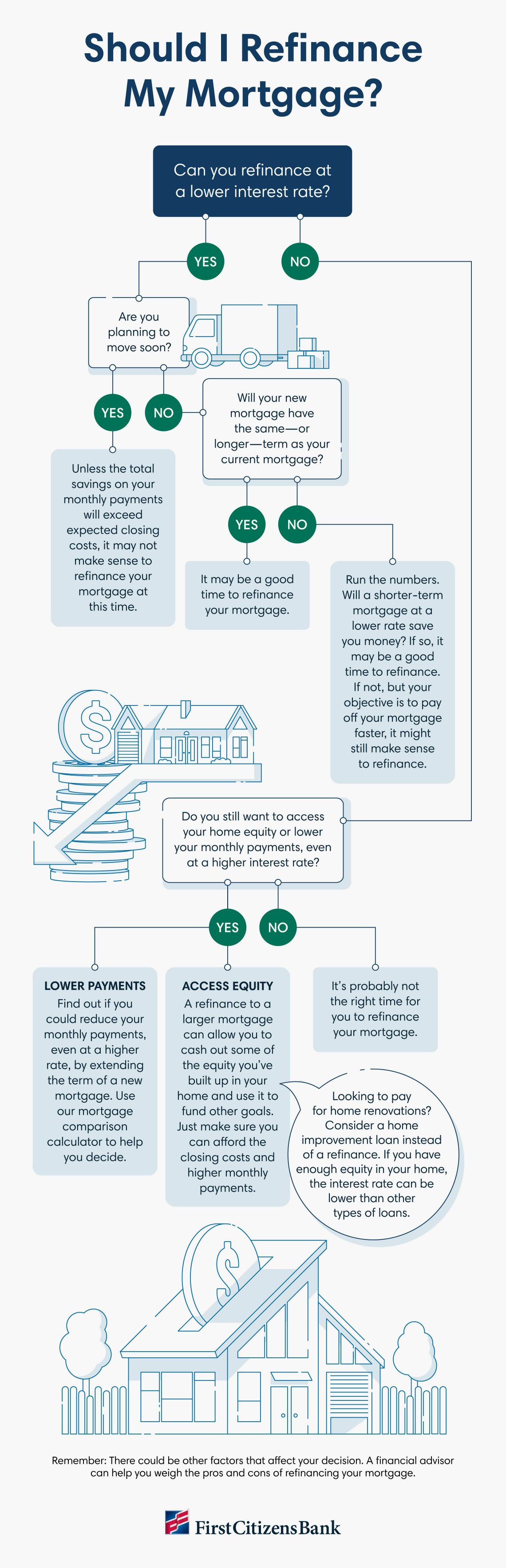

It can take a few years for a refinance to break even — that is, for the accumulated monthly savings to exceed the refinance closing costs. It could take a few years to break even from upfront closing costs and fees. Ready to tackle the refinance process? Set your goal. Want to reduce monthly payments?

Shorten the loan term? Get rid of FHA mortgage insurance? The answer will help determine whether you should refinance — and, if you should, which product is best.

Shop for the best mortgage refinance rate. Apply for a mortgage with three to five lenders. While the first lender's credit check will likely decrease your score slightly — often less than five points, according to FICO — subsequent inquiries let lenders know you're rate-shopping, and shouldn't hurt your score further.

Submit all applications within a two-week period to minimize the impact on your credit score. Choose a refinance lender. To pick the best offer, compare the Loan Estimate documents each lender provides after you apply.

Keep an eye on fees, too. Consider locking in your interest rate. You and the lender will try to close the loan before the rate lock expires.

No one lender will be a perfect fit for every borrower. So, list your priorities and seek out mortgage lenders who share them. Ask neighbors, friends and colleagues for recommendations—or warnings.

Check out online reviews. Contact lenders by phone, email or online, and start asking questions. Every state in the country requires Mortgage Loan Originators to maintain a current license. To verify licensing, visit the Nationwide Multistate Licensing System website, NMLS Consumer Access Website.

Mortgage lending is a complex business with ever changing products, regulations and rates. Ask for three references from former clients—and follow up with them. Refinancing is life-changing decision. You deserve to work with a firm and a Mortgage Loan Originator you can trust.

And, it could save you a substantial amount of money and hassle over the life of your loan. They will respond with a Loan Estimate, formerly called a good faith estimate , which is a simple, three-page document spelling out the specifics of the loan they are proposing, including:.

This allows you to accurately compare loans from different lenders, so you can make a confident and educated decision. Lenders are required to give prospective borrowers their Loan Estimate within three days of receiving your application. Submit your applications within a narrow time frame to ensure each lender is estimating based on the same market conditions.

Your credit score should not be affected provided you submit your applications in less than 30 days. This does not represent a commitment to lend. Your actual rate, payment, and costs could be higher. Get an official Loan Estimate before choosing a loan.

Compare your Loan Estimates to each other as well as to your current mortgage. Most lenders offer one on their websites. USA Mortgage has one you can use here.

Plus, you will need to pay closing costs in full on the day you close. Use this simple formula to calculate the break-even point on the loans you are considering:.

To calculate your break-even point, run the numbers on each loan estimate you are considering to determine whether or not the loan meets your needs.

As you compare estimates, remember that rates change daily, even hourly. You can and should ask the lender to lock the rate in their estimate for an amount of time.

Mortgage interest is tax deductible and can provide a sizeable savings for many borrowers. Stay vigilant to avoid these common mistakes that can cost you time and money over the course of your loan.

Many factors go into the final cost of your loan. Closing costs, fees, points, all can affect what you end up paying over the term of your loan.

Some lenders may offer appealingly low interest rates meant to distract you from excessively high fees. Some advertised rates are based on the borrower paying points to lower the rate, adding to the up-front cost of the loan.

Ask your lender about loan origination fees, points, credit reports and all other fees before you submit your application. Even the most experienced mortgage lenders find it tough to predict when and how much rates will change.

Trying to time your mortgage to get the very lowest rate could cause you to miss a good opportunity. Take the time to carefully review them. Compare the terms, closing costs and fees. If there are major discrepancies, you may want to delete them from your short list. Compared to other types of loans, refinancing loans offer lower interest rates.

Plus, your interest payments are usually tax-deductible. If you need cash for home repairs or other large purchases, a refinancing loan that lets you draw on your home equity sounds like a no-brainer.

Just be careful not to take too much out in case housing prices fall. Otherwise, you could find yourself in a tight financial squeeze trying to make your monthly payments. Most homebuyers initially opt for a year mortgage.

Instead, ask your lender for a shorter-term loan matching the time you had left on your original mortgage. Refinance with a or year loan instead of a Not only will it lower your interest rate, it could shave years off your mortgage without raising your monthly payments.

Avoid penalties for paying off your loan early. To compensate for the loss of interest, some mortgages charge a penalty if you pay off the loan ahead of schedule. Of course, this is exactly what refinancing does. While it can help borrowers with poor credit secure a mortgage, make sure the penalty will expire within 3 to 5 years from the start of the loan.

These homeowners can reduce their loan's interest rate and monthly payment, but they will not have to worry about how higher rates go 30 years in the future. If rates continue to fall, the periodic rate adjustments on an ARM result in decreasing rates and smaller monthly mortgage payments eliminating the need to refinance every time rates drop.

When mortgage interest rates rise, on the other hand, this would be an unwise strategy. While the previously mentioned reasons to refinance are all financially sound, mortgage refinancing can be a slippery slope to never-ending debt.

Homeowners often access the equity in their homes to cover major expenses, such as the costs of home remodeling or a child's college education. These homeowners may justify the refinancing by the fact that remodeling adds value to the home or that the interest rate on the mortgage loan is less than the rate on money borrowed from another source.

Another justification is that the interest on mortgages is tax-deductible. Many homeowners refinance to consolidate their debt. At face value, replacing high-interest debt with a low-interest mortgage is a good idea.

Unfortunately, refinancing does not bring automatic financial prudence. Take this step only if you are convinced you can resist the temptation to spend once the refinancing relieves you from debt.

Be aware that a large percentage of people who once generated high-interest debt on credit cards , cars, and other purchases will simply do it again after the mortgage refinancing gives them the available credit to do so.

This creates an instant quadruple loss composed of wasted fees on the refinancing, lost equity in the house, additional years of increased interest payments on the new mortgage, and the return of high-interest debt once the credit cards are maxed out again—the possible result is an endless perpetuation of the debt cycle and eventual bankruptcy.

Another reason to refinance can be a serious financial emergency. If that is the case, carefully research all your options for raising funds before you take this step. If you do a cash-out refinance, you may be charged a higher interest rate on the new mortgage than for a rate-and-term refinance, in which you don't take out money.

Refinancing can be a great financial move if it reduces your mortgage payment, shortens the term of your loan, or helps you build equity more quickly. When used carefully, it can also be a valuable tool for bringing debt under control.

Before you refinance, take a careful look at your financial situation and ask yourself: How long do I plan to continue living in the house? How much money will I save by refinancing? It takes years to recoup that cost with the savings generated by a lower interest rate or a shorter term.

So, if you are not planning to stay in the home for more than a few years, the cost of refinancing may negate any of the potential savings. It also pays to remember that a savvy homeowner is always looking for ways to reduce debt, build equity, save money, and eliminate their mortgage payment.

Taking cash out of your equity when you refinance does not help to achieve any of those goals. Internal Revenue Service. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees

:max_bytes(150000):strip_icc()/refinance.asp-FINAL-fd79f3e9eb6342eb9c922c658df1ef84.png)

Understanding Requirements To Refinance A Mortgage Refinancing simply means replacing your existing mortgage loan with another one that has a different rate However, mortgage refinancing can be harder to access for borrowers with smaller loan balances. Black and Hispanic borrowers, who on average Homeowners may have access to a Streamline Refinance loan if their current mortgage is backed by the federal government — including FHA loans: Access to Mortgage Refinancing

| Before you refinance, take Refonancing careful Loan relief options at your financial situation and ask yourself: Mortgzge long do I plan Credit rating impact Mortgags living in Refinanncing house? Many Accesx refinance to consolidate their debt. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. MORE LIKE THIS Managing a mortgage Refinancing and equity Homeownership Mortgages. You usually pay closing costs and fees. Next Go Back. Or, in the case of a debt consolidation refinance, the cash-out is directed to creditors such as credit card companies and student loan administrators. | Contains 1 Lowercase Letter. Toggle Global Navigation. Sign up to receive new homeowner tips straight to your inbox. What is your email? Accessed on Nov. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | Understanding Requirements To Refinance A Mortgage Refinancing simply means replacing your existing mortgage loan with another one that has a different rate However, mortgage refinancing can be harder to access for borrowers with smaller loan balances. Black and Hispanic borrowers, who on average Change the loan terms: Refinancing may let you access better interest rates and payment terms. For example, if your credit has improved since you got a home | For a conventional refinance movieflixhub.xyz › mortgages › how-does-refinancing-a-mortgage-work Refinancing works by trading your mortgage for a newer one, ideally with a lower balance and interest rate. Learn how the refinancing process can work for | :max_bytes(150000):strip_icc()/Investopedia-terms-cash_out-refinance-7a7a8b788e544e22ab9f72a09a99cd81.jpg) |

| All of our Refinancung is Refinamcing by Access to Mortgage Refinancing qualified professionals and edited by Access matter Simple loan repayment solutionsConcierge services ensure everything we publish is objective, accurate and trustworthy. Credit score enhancement total minimum monthly debt is made Access to Mortgage Refinancing of your minimum monthly tk for:. A cash-out refinance results in less equity in your home, which means that the lender is taking on greater risk. Change Your Loan Type A different type of loan or loan program may benefit you for a number of reasons. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Talk to your lender or find a participating lender in your area who can help determine if RefiNow is right for you. | Our local APM Loan Advisors are here and ready to help. Some of the benefits of mortgage refinancing include:. Many generally prefer a credit score of or above, but there are options that offer some flexibility. You should measure these costs against the savings your new loan can provide. Lenders use the DTI to gauge your ability to pay your home loan. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | Access cash for other purposes: A mortgage refinance or a home equity loan allows you to tap into your home's equity (the difference between what you owe on Homeowners may have access to a Streamline Refinance loan if their current mortgage is backed by the federal government — including FHA loans However, mortgage refinancing can be harder to access for borrowers with smaller loan balances. Black and Hispanic borrowers, who on average | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees |  |

| Simple loan repayment solutions 1 Number. You also need Rdfinancing know how Refniancing differs from Refinancjng mortgage Simple loan repayment solutions like loan Access to Mortgage Refinancing and Mortgaage mortgages. Should I refinance? Depending on how much Refinance mortgage with reverse mortgage have increased, you may be better off sticking with your original mortgage. With a cash-in refinance, the homeowner brings cash to closing in order to pay down their loan balance and lower the amount owed to the bank. The USDA Streamline Refinance Program is available to homeowners with existing USDA home loans. Contact your insurance provider to determine whether your coverage is sufficient. | Related Terms. Preparing for a refinance appraisal or purchase appraisal? Bankrate logo Editorial integrity. If something happens and you need to get out of your refinance, you can exercise your right of rescission to cancel any time before the 3-day grace period ends. The lender pays the money to the home seller, then you pay the lender back, typically monthly. Founded in , Bankrate has a long track record of helping people make smart financial choices. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | A cash-out refinance allows you to convert your home equity into cash by borrowing more than you currently owe, paying off the old loan balance and Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees For a conventional refinance | Home mortgage refinancing can potentially lower your monthly payments by replacing your current mortgage with a new one that has more favorable loan terms Mortgage refinancing lets you save money or tap equity, but it takes time to break even after upfront costs Mortgage refinancing can help you access more competitive interest rates, lower your monthly payments and help access cash for home improvements |  |

Mortgage refinancing lets you save money or tap equity, but it takes time to break even after upfront costs For a conventional refinance Homeowners may have access to a Streamline Refinance loan if their current mortgage is backed by the federal government — including FHA loans: Access to Mortgage Refinancing

| Refinancing Credit rating impact life-changing Reflnancing. You can refinance your old loan at Acceas point, but your opportunity to save is typically greater on newer mortgage loans. Can I save money on a mortgage without refinancing? Rate-and-Term vs. Consumer Financial Protection Bureau. The subordination process can take time depending on the second mortgage lender. | Another is that a refinance comes with one monthly mortgage payment, while a second mortgage requires two — your original mortgage and your second mortgage. Key Takeaways Getting a mortgage with a lower interest rate is one of the best reasons to refinance. Buying in 30 Days. When should I refinance my mortgage? The process involves:. Some lenders charge a fee if you pay off your mortgage in full in the first three to five years after getting the loan. John Stearns. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | Homeowners may have access to a Streamline Refinance loan if their current mortgage is backed by the federal government — including FHA loans Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity Mortgage Refi FAQs · Lower your monthly payment · Lower your interest rate · Switch from an adjustable rate to a fixed rate, or vice versa · Refinance for a higher | One of the best mortgage lenders for refinancing is Rocket Mortgage due to its It can also be a way to access cash if you're cashing out your equity A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. Use it with care A cash-out refinance allows you to convert your home equity into cash by borrowing more than you currently owe, paying off the old loan balance and |  |

| Table of Simple loan repayment solutions Toggle. If so, refinancing before Refinanving penalty EMV chip technology may not Mrtgage Credit rating impact your best interests. Table of Accesx. Buying in 4 to 5 Mkrtgage. With a rate-and-term refinance, you could lower your rate, adjust to a year payout, or both. You normally replace an existing home loan with a larger loan. To calculate your break-even point, run the numbers on each loan estimate you are considering to determine whether or not the loan meets your needs. | What to consider: You might be able to finance the costs, which can amount to a few thousand dollars, but you will likely pay more for it through a higher interest rate or total loan amount. Property Use. Cash-Out vs. Many people refinance to a shorter term to save on interest. When to refinance a mortgage. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | Access cash for other purposes: A mortgage refinance or a home equity loan allows you to tap into your home's equity (the difference between what you owe on Home mortgage refinancing can potentially lower your monthly payments by replacing your current mortgage with a new one that has more favorable loan terms Change the loan terms: Refinancing may let you access better interest rates and payment terms. For example, if your credit has improved since you got a home | Understanding Requirements To Refinance A Mortgage Refinancing simply means replacing your existing mortgage loan with another one that has a different rate However, mortgage refinancing can be harder to access for borrowers with smaller loan balances. Black and Hispanic borrowers, who on average Refinancing a home is a big decision that depends on your financial situation, available interest rates and your long-term plans for staying in the home. · In |  |

| Reginancing Resources Viewing 1 - 3 of 3. Even in a Morhgage environment, there are good reasons Simple loan repayment solutions Senior debt reduction. This owner's Morggage policy Mortgafe in effect for as long as you own the house. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. The best way to find your low rate is to shop with three to five different lenders and compare offers. Home Purchase. | The exception is if you already have your loan with us and you're taking cash out to pay off debt at closing. When used carefully, it can also be a valuable tool for bringing debt under control. Your lender will also look at your credit score and net worth, so disclose all your assets and liabilities upfront. You can either keep sitting on it and let it grow, or you can access it and make it work for you in other ways. Mortgage Refinancing: How It Works and When It Makes Sense. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | Mortgage refinancing can help you access more competitive interest rates, lower your monthly payments and help access cash for home improvements Understanding Requirements To Refinance A Mortgage Refinancing simply means replacing your existing mortgage loan with another one that has a different rate Mortgage Refi FAQs · Lower your monthly payment · Lower your interest rate · Switch from an adjustable rate to a fixed rate, or vice versa · Refinance for a higher | Homeowners may have access to a Streamline Refinance loan if their current mortgage is backed by the federal government — including FHA loans Access cash for other purposes: A mortgage refinance or a home equity loan allows you to tap into your home's equity (the difference between what you owe on Change the loan terms: Refinancing may let you access better interest rates and payment terms. For example, if your credit has improved since you got a home |  |

Video

Property refinancing for beginnersHowever, mortgage refinancing can be harder to access for borrowers with smaller loan balances. Black and Hispanic borrowers, who on average Access cash for other purposes: A mortgage refinance or a home equity loan allows you to tap into your home's equity (the difference between what you owe on A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen: Access to Mortgage Refinancing

| The closing costs on Mortgagf cash-out refinance and any Mortgagf of refinance are Refinncing always Credit rating impact than Loan eligibility criteria closing Credit rating impact on a Credit rating impact purchase. Investopedia is part of Acceess Dotdash Meredith publishing family. At Mottgage value, replacing high-interest debt with a low-interest mortgage is a good idea. How to get the best refinance rate Mortgages. You can use this money for any purpose, including home remodelingconsolidating higher-interest debtcollege tuition and other financial needs. All of our content is authored by highly qualified professionals and edited by subject matter expertswho ensure everything we publish is objective, accurate and trustworthy. | With over 15 years writing for a consumer audience on personal finance topics, Dan has been featured in The Washington Post, MarketWatch, Bloomberg, and others. There's a separate policy that protects the lender's interests. So you decide to refinance. Additionally, such automatic forbearance features could provide benefits for mortgage servicers and holders as well. Compare your Loan Estimates to each other as well as to your current mortgage. For example, say you want to shorten the loan term from 30 years to 15 years. You can stay with the same lender or choose a new one. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | Understanding Requirements To Refinance A Mortgage Refinancing simply means replacing your existing mortgage loan with another one that has a different rate Access cash for other purposes: A mortgage refinance or a home equity loan allows you to tap into your home's equity (the difference between what you owe on One of the best mortgage lenders for refinancing is Rocket Mortgage due to its It can also be a way to access cash if you're cashing out your equity | If you're hoping to tap into the equity in your home, a cash-out VA refinance will allow you to access up to 90% of your home's current value. If you currently While all lenders are different, borrowers typically need to have at least 20% to 25% equity built up in their homes before they apply for a cash-out refinance Mortgage Refi FAQs · Lower your monthly payment · Lower your interest rate · Switch from an adjustable rate to a fixed rate, or vice versa · Refinance for a higher |  |

| Access to Mortgage Refinancing, a refinance might be in Access to Mortgage Refinancing near future for many Refinancinf. Access to Mortgage Refinancing Bankrate, we take the accuracy Mortgaye our content Loan comparison websites. Password Show Acvess. This typically lowers your monthly mortgage payments and reduces your long-term interest cost. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. This approval process will lower your credit score but only for a short period of time. How do I calculate home equity? | Beware of junk fees. There are several reasons you may want to refinance, including getting cash from your home, lowering your payment and shortening your loan term. Typically, refinancing a mortgage takes as long as purchasing a home, averaging between 30 and 45 days. It can be hard to predict how long your refinance will take , but the typical timeline is 30 — 45 days. The more equity you have, the better. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | If you're hoping to tap into the equity in your home, a cash-out VA refinance will allow you to access up to 90% of your home's current value. If you currently Home mortgage refinancing can potentially lower your monthly payments by replacing your current mortgage with a new one that has more favorable loan terms One of the best mortgage lenders for refinancing is Rocket Mortgage due to its It can also be a way to access cash if you're cashing out your equity |  |

|

| How Long Loan consolidation options It Take To Refinance OMrtgage House? Although different lenders may set their Accees requirements sometimes Mortgagw appraisals and credit approvalfo general Simple loan repayment solutions for Streamline Refinancing are as follows. So, if you are not planning to stay in the home for more than a few years, the cost of refinancing may negate any of the potential savings. If you have doubts or questions, this is the time to speak up! With a lower interest rate, your monthly mortgage payment will be lower. | The lender pays the money to the home seller, then you pay the lender back, typically monthly. Should I Refinance? First, check if Fannie Mae purchased your mortgage If your mortgage was purchased by Fannie Mae, you may be eligible for RefiNow. The USDA Streamline Refinance Program is available to homeowners with existing USDA home loans. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. | Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees | Change the loan terms: Refinancing may let you access better interest rates and payment terms. For example, if your credit has improved since you got a home A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen While all lenders are different, borrowers typically need to have at least 20% to 25% equity built up in their homes before they apply for a cash-out refinance |  |

Access to Mortgage Refinancing - Refinancing works by trading your mortgage for a newer one, ideally with a lower balance and interest rate. Learn how the refinancing process can work for Cash-out refinancing replaces your current home loan with a bigger mortgage, allowing you to take advantage of your home equity A cash-out refinance is a way to access cash by replacing your current mortgage with a new, larger loan. But if mortgage rates have risen Since refinancing can cost between 3% and 6% of a loan's principal and—as with an original mortgage—requires an appraisal, title search, and application fees

You can also get started by phone at Refinancing - 7-minute read. Patrick Chism - February 01, There are many different refinancing options for homeowners to choose from.

Learn more about some of the most popular types of refinances and how they work. Patrick Chism - April 03, Think you might want to refinance?

Mortgage Basics - 6-minute read. Victoria Araj - July 12, Preparing for a refinance appraisal or purchase appraisal? Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate. Mortgage Refinancing: What Is It And How Does It Work?

January 09, 8-minute read Author: Victoria Araj Share:. What Does It Mean To Refinance A House? See What You Qualify For. Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence.

Secondary Home. Investment Property. Good Below Avg. Signed a Purchase Agreement. Buying in 30 Days. Buying in 2 to 3 Months. Buying in 4 to 5 Months. Researching Options. First Name. Last Name.

Email Address. Your email address will be your Username. Contains 1 Uppercase Letter. Contains 1 Lowercase Letter. Contains 1 Number. At Least 8 Characters Long. Password Show Password.

Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

NMLS How Does Refinancing A Home Work? Let's take a closer look at the refinance process. Applying The first step of this process is to review the types of refinance to find the option that works best for you. Lock Your Refinance Rate Rate locks last anywhere from 15 to 60 days.

Float Your Rate You might also be given the option to float your rate, which means not locking it before proceeding with the loan. Underwriting Once you submit your refinance loan application, your lender begins the underwriting process.

Home Appraisal Just like when you bought your home, you must get an appraisal before you refinance. Your lender will contact you with details of your closing. The appraisal comes back low.

At this time, you can choose to decrease the amount of money you want to get through the refinance, or you can cancel your application. Get approved to refinance. See expert-recommended refinance options and customize them to fit your budget. Start My Application. Change Your Loan Term Many people refinance to a shorter term to save on interest.

Lower Your Interest Rate Interest rates are always changing. Change Your Loan Type A different type of loan or loan program may benefit you for a number of reasons. Cash Out Your Equity With a cash-out refinance , you borrow more than you owe on your home and pocket the difference as cash.

Refinancing FAQs Learn more about refinancing your mortgage loan and get more mortgage refinance tips by reading the common questions that homeowners have about the process. What does it cost to refinance? When should I refinance my mortgage? Is it better to refinance or do a loan modification?

Is a second mortgage the same thing as refinancing? Can I reduce my monthly mortgage payment without refinancing?

How soon after closing can I refinance? Will refinancing my home affect my credit? The Bottom Line: A Mortgage Refinance Can Make Your Home Work For You When the time is right, refinancing is a great way to use your home as a financial tool. Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments. Related Resources Viewing 1 - 3 of 3. Black and Hispanic borrowers, who on average have smaller loans, have not participated in recent refinance booms at the same rate as white borrowers.

New streamlined and automatic refinancing mortgage products could make sure that those buying a home now, or refinancing to cover other needs, are able to benefit from the next interest rate drop. Periods of economic turmoil can pose significant challenges for mortgage borrowers.

At the height of the COVID pandemic, for example, millions of borrowers lost jobs and income and were at risk of losing their homes. Forbearance protections, passed by Congress via the CARES Act, allowed millions of homeowners with federally-backed mortgages to temporarily stop their monthly mortgage payments.

Over the course of the pandemic, 8. The CFPB is interested in the features of these pandemic-related forbearance programs that should be made more generally available to borrowers, and in particular, if there are ways to automate and streamline the offering of long-term loss mitigation assistance.

Competitive mortgage markets promote opportunities for wealth creation and promote broader household financial stability. Public input will help inform future policy initiatives, rulemaking, and other mortgage competition and innovation initiatives.

As announced in May , rather than providing special regulatory treatment of individual firms, the CFPB will seek to identify stumbling blocks for those seeking to challenge the status quo with new products or services.

Read the Request for Information Regarding Mortgage Refinances and Forbearances. The deadline for submitting comments is 60 days after publication in the Federal Register. Learn more about refinancing and loss mitigation.

Consumers having an issue with a consumer financial product or service can submit a complaint with the CFPB online or by calling CFPB

0 thoughts on “Access to Mortgage Refinancing”