We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. Navigate this Section Select Spread the Word. Learn More. Federal Direct Loans including a Direct Consolidation Loan. Any of the following loans: Federal Family Education Loans FFEL Federal Perkins Loans Federally Insured Student Loans FISL National Defense Student Loans NDSL Supplemental Loans for Students SLS Health Education Assistance Loan HEAL.

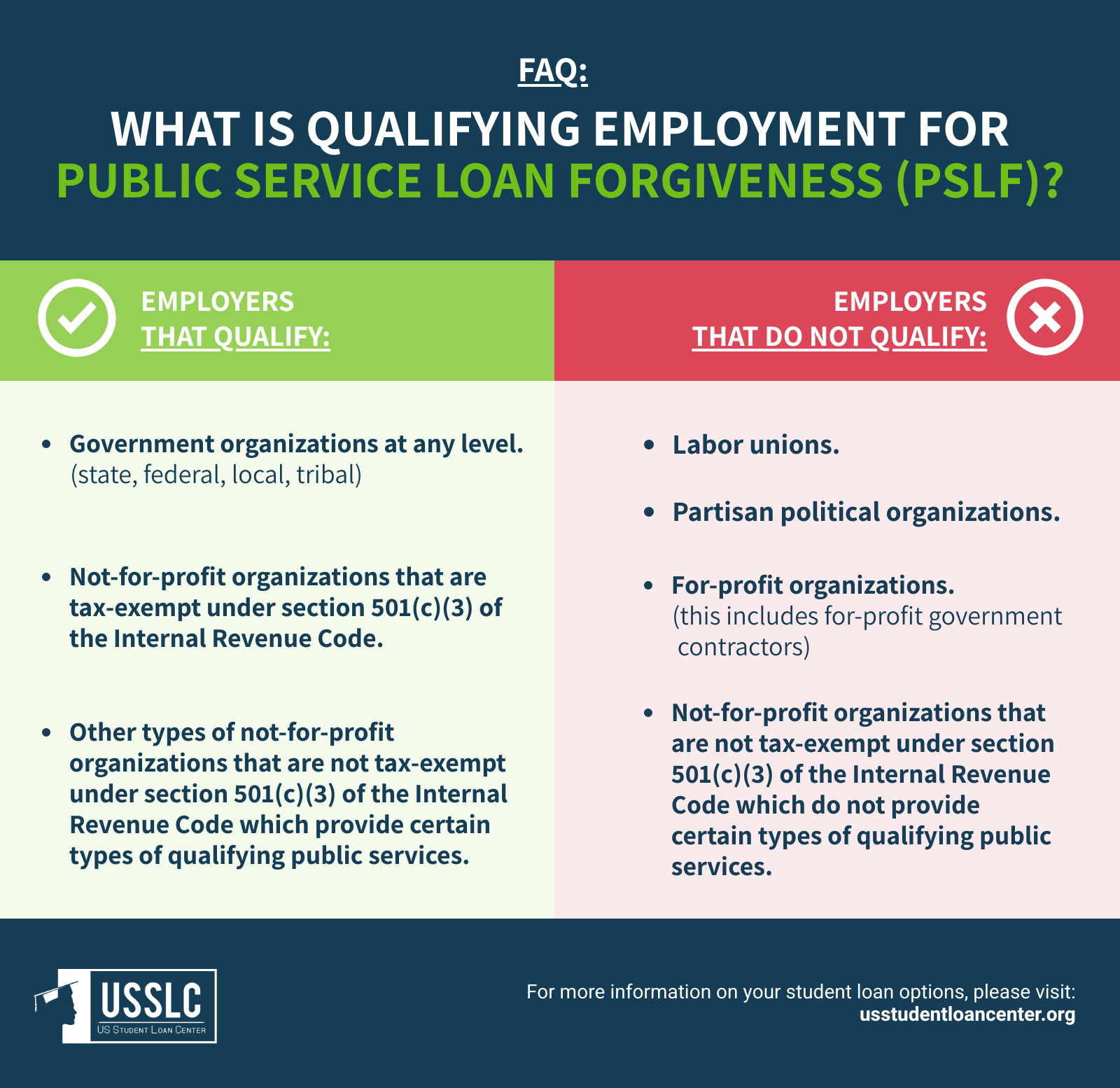

A combination of any loans listed in A or B above. A local government e. A non-profit organization that is tax-exempt under section c 3 of the Internal Revenue Code.

Am I Eligible? Click continue to see if you meet the other eligibility criteria. Start Over. Good News! Learn More About Consolidation. Meet Elena, the Psychiatrist. Meet Vishal, the Teacher. Meet Carlos, the Grants Manager. Meet Daniel, the Veteran. Meet Alicia, the Scientist.

What counts as a government employer for the PSLF Program? What types of public service jobs will qualify me for loan forgiveness under the PSLF Program? Can I receive PSLF if I have more than one employer over the course of 10 years?

Does full-time volunteer service for a qualifying employer count toward PSLF? What if I make my last qualifying payment while working for a qualifying employer, but then leave that job to work for a for-profit corporation before applying for the PSLF benefit.

Am I still eligible for PSLF? Are private education loans eligible for PSLF? Are Direct Loans that are in default eligible for PSLF? Are Direct PLUS Loans eligible for PSLF?

Spread The Word Resources. ZIP Code. Please leave blank. You might be contacted by a company saying they will help you get loan discharge, forgiveness, cancellation, or debt relief for a fee.

This is a scam. You never have to pay for help with your federal student aid. Make sure you work only with ED and your loan servicers, and never reveal your personal information or account password to anyone. Verified emails to borrowers come from noreply studentaid. gov, noreply debtrelief. gov, or ed.

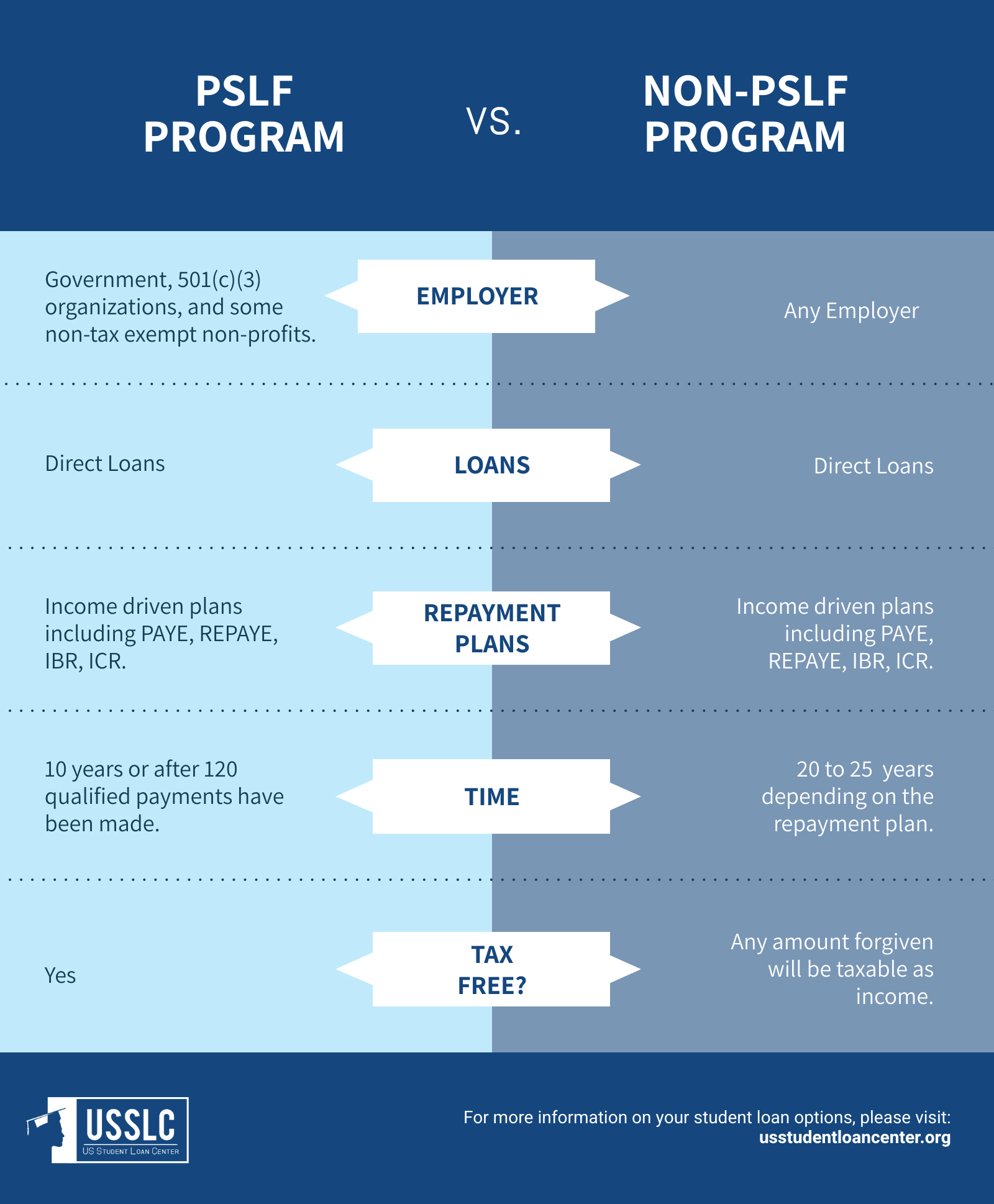

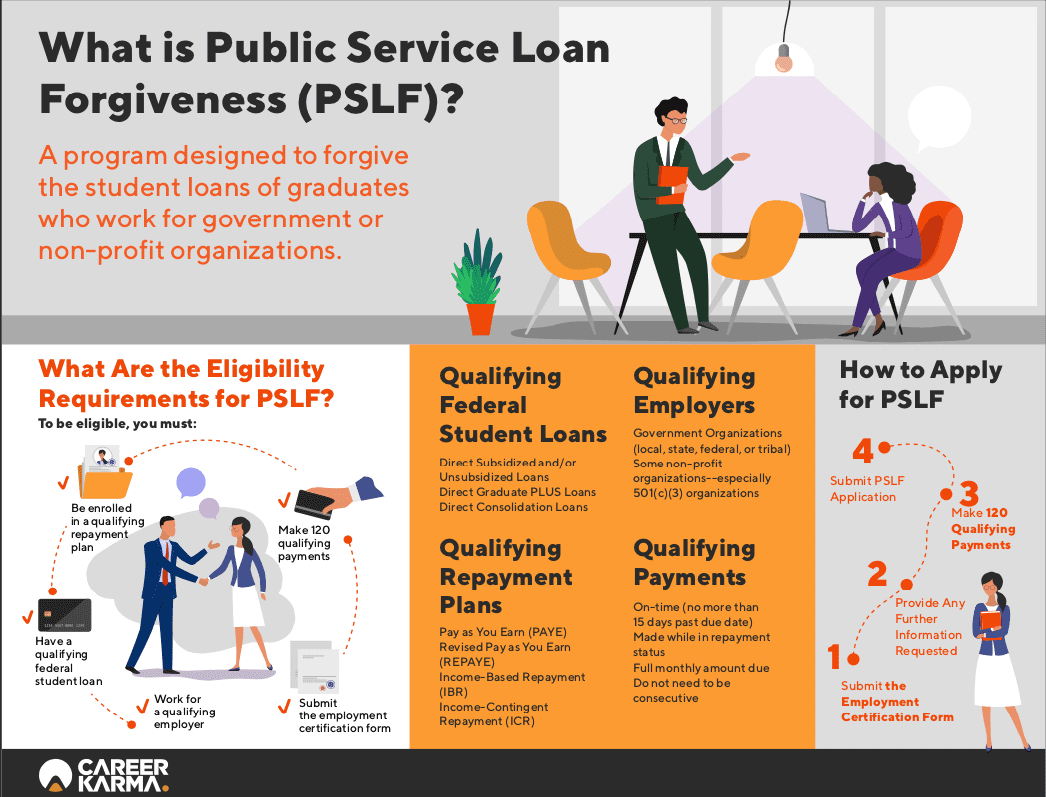

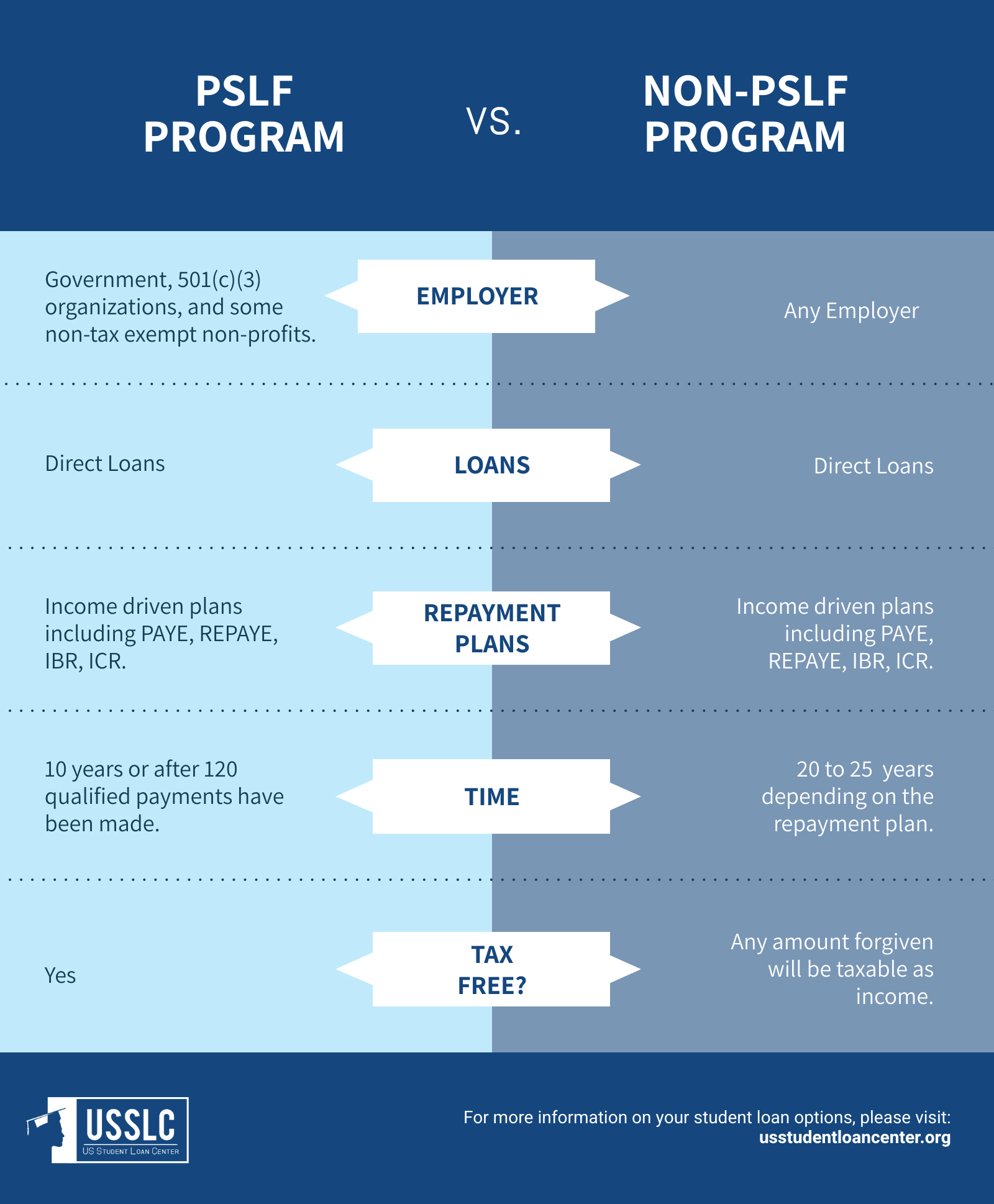

gov public. Here are some other warning signs that you may be dealing with a student loan cancellation scam and what to do if you are contacted by a scammer. PSLF allows qualifying federal student loans to be forgiven after qualifying payments 10 years , while working for a qualifying public service employer.

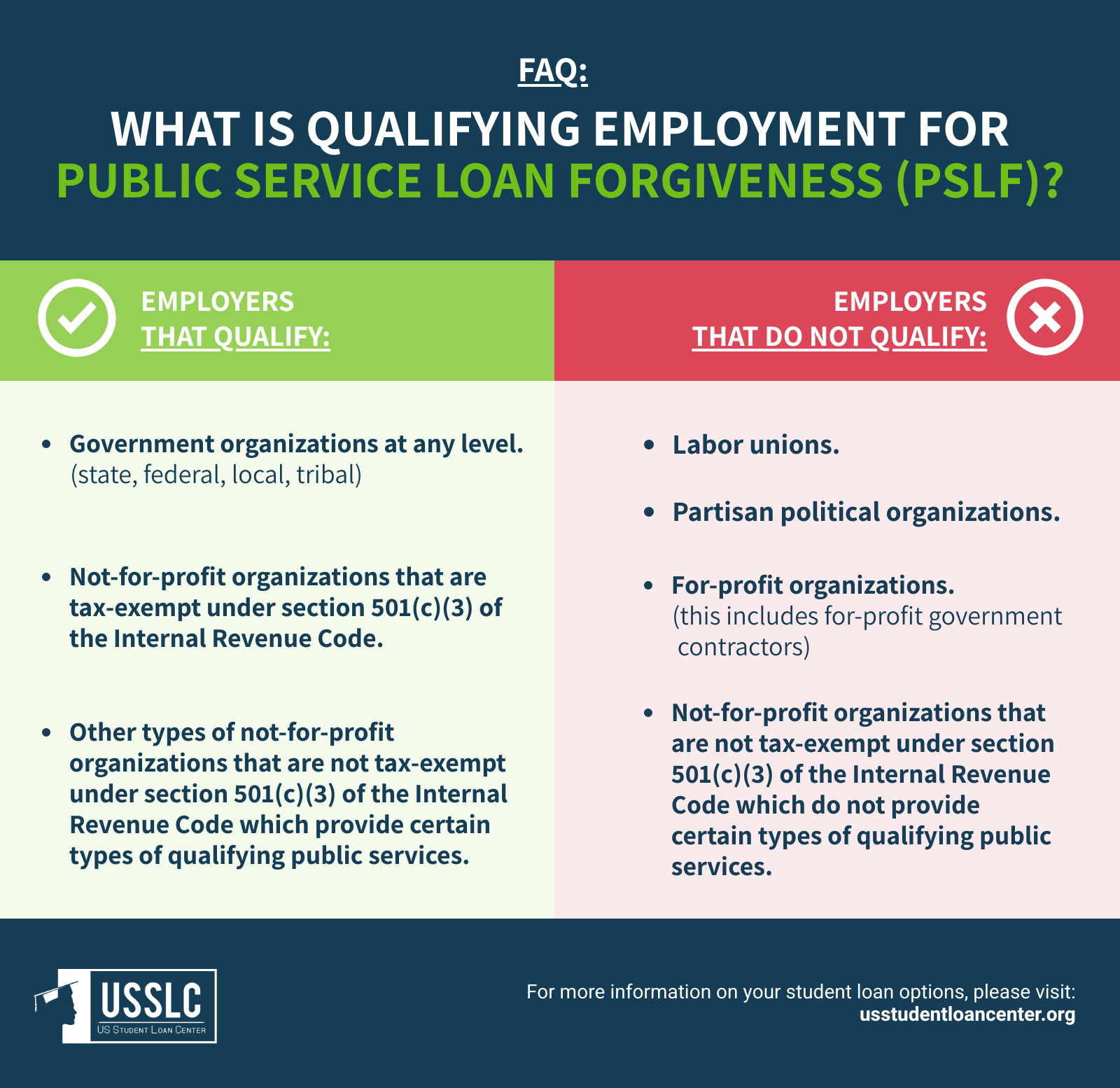

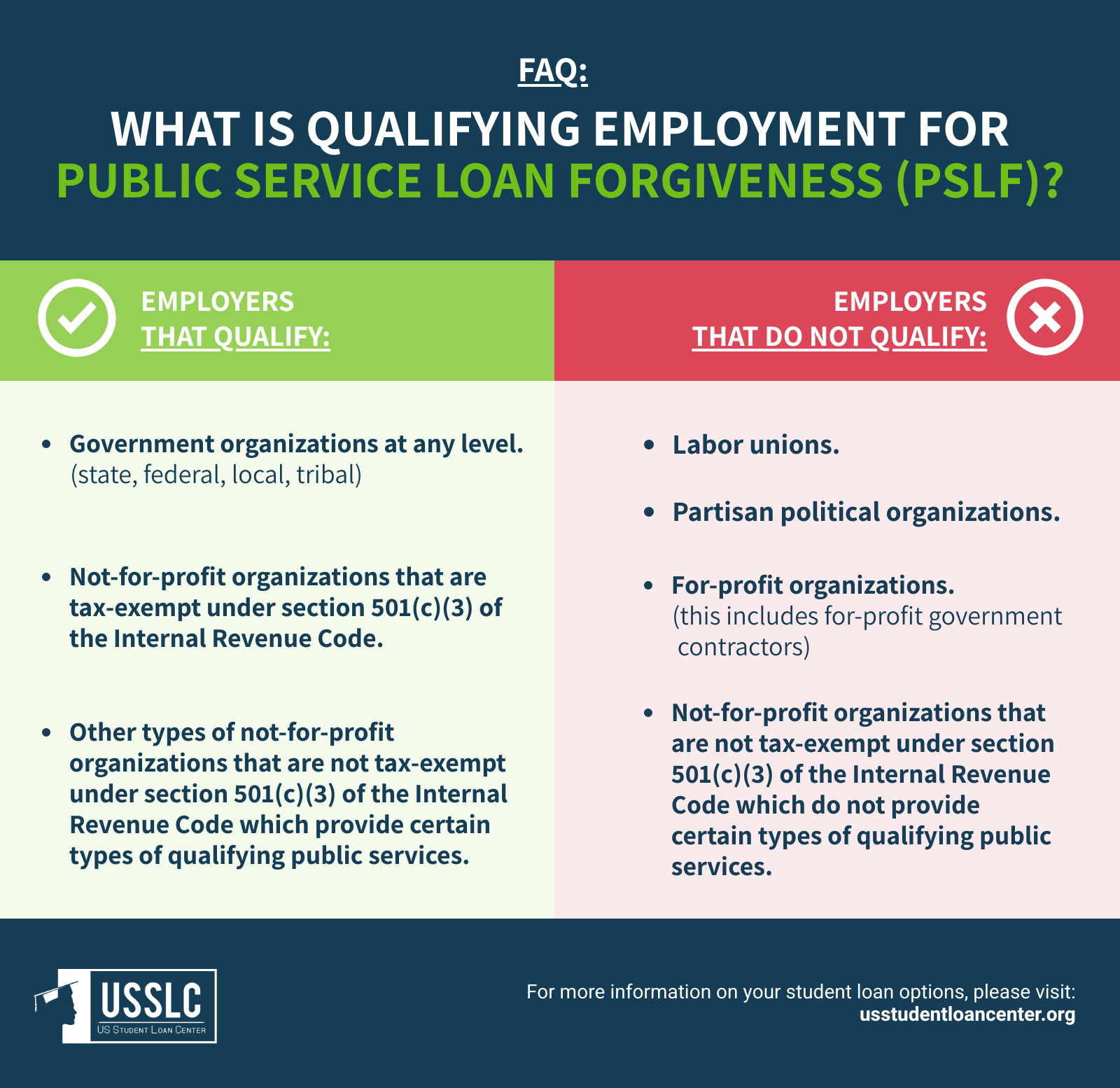

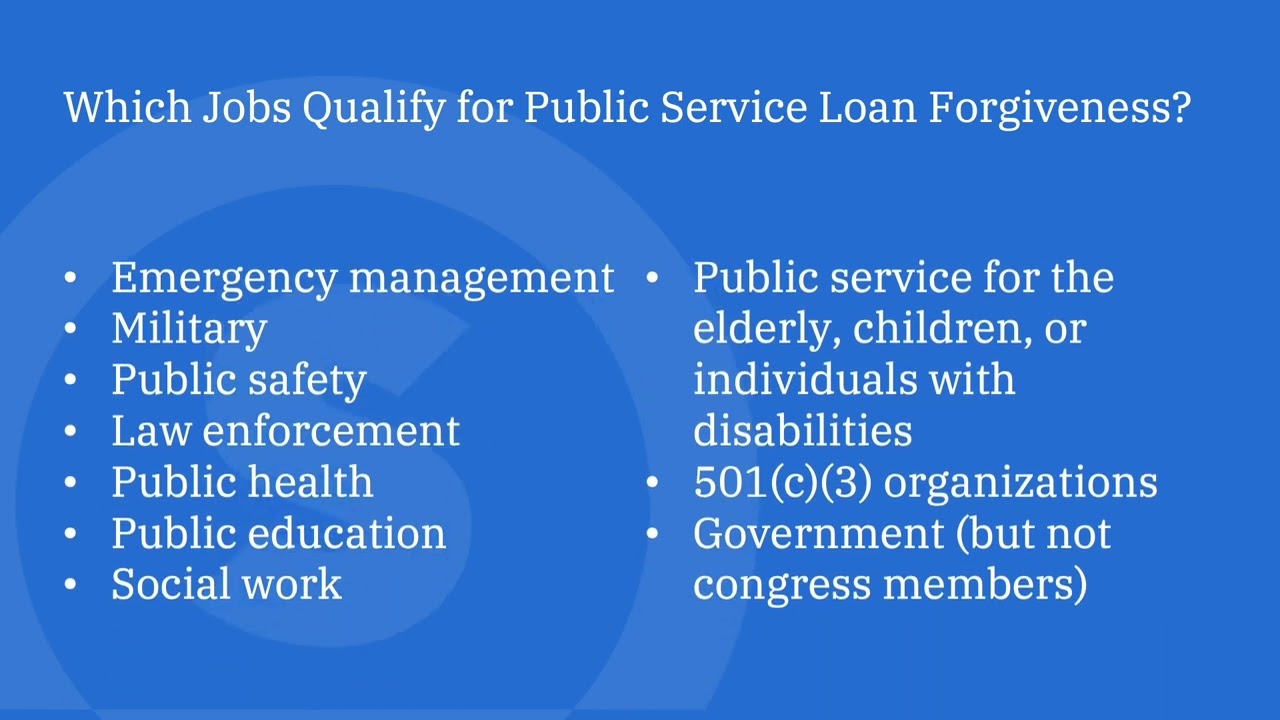

If you work or have worked in public service such as government federal, U. Military, state, local, or tribal or certain non-profit organizations, you might be eligible for the PSLF Program.

Getting PSLF will require careful attention to detail. Here are some tips to achieve forgiveness as painlessly as possible. Use the PSLF Help Tool to figure out your next steps.

This tool is provided by the U. Department of Education ED and is free to use. Submit the forms suggested by the PSLF Help Tool to document your qualifying employment and receive credit for your monthly payments. Only federal Direct Loans can be forgiven through PSLF.

If you have other federal student loans such as Federal Family Education Loans FFEL or Perkins Loans you may be able to qualify for PSLF by consolidating into a new federal Direct Consolidation Loan.

The PSLF Help Tool tracks your progress to qualifying payments. Check it regularly to make sure it matches your records. You do not have to make the qualifying payments consecutively.

Contact the servicer to try to resolve this issue. Submit a complaint with the CFPB or Federal Student Aid FSA if you run into this problem. Paused payments count toward PSLF as long as you meet all other qualifications. You will get credit as though you made monthly payments.

Visit ED for more information on the payment pause and PSLF. Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments. To request credit for shorter forbearances—less than 12 months in a row, or under 36 months altogether— file a complaint with the FSA Ombudsman.

Note: New changes to IDR plans can affect your PSLF loan payment count. Visit Department of Education website to learn more. Those who have been on repayment plans , hold federal direct loans or federal family education loans and have completed 20 or 25 years of qualifying months are eligible for forgiveness, depending on when the loans were originated, the type of loan borrowed and the specific type of plan.

ICR is the oldest of the repayment plans, established in Other repayment plans have not existed long enough to reach the qualifying 20 or year mark. Income-based repayment IBR has existed since and requires 25 years of payments to reach forgiveness.

Pay-as-you-earn PAYE launched in , and requires 20 years of payments for forgiveness. Revised pay-as-you-earn REPAYE didn't launch until and requires 20 or 25 years, depending on whether loans are undergraduate only or graduate loans.

The Department of Education started notifying eligible borrowers on Friday, July No action is required from borrowers.

After this initial wave, the Department of Education will continue to notify eligible borrowers who have reached the forgiveness threshold of or qualifying payments depending on their loan type and repayment plan every two months.

By next year, the department says that it will have all borrowers' payment counts updated — then, anyone who has an income-driven repayment plan can check with their loan servicer to see how many qualifying months they've completed.

Discharges will begin 30 days after borrowers receive emails notifying them of their eligibility. If you're notified that you're eligible for forgiveness, loan repayment will be paused until the discharge is processed, the Department of Education says.

Your loan servicer should let you know when your student loan debt is discharged. Anyone who chooses to opt out of the discharge will return to repayment when student loan repayment resumes, with interest resuming on September 1 and payments due starting in October.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. With the Biden administration's widespread student debt relief blocked by the Supreme Court, the future of student loan forgiveness is currently on hold.

Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan

Eligibility for loan forgiveness program - Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan

State-sponsored repayment assistance programs. Licensed teachers, nurses, doctors and lawyers in certain states may be able to take advantage of programs to assist with repaying debt. Military student loan forgiveness and assistance. Military personnel in the Army, Navy, Air Force, National Guard and Coast Guard may qualify for their own loan forgiveness programs.

Additional student loan repayment assistance programs LRAPs : There may be other national or organizational student loan repayment assistance programs offered for public service professions.

The American Bar Association has a list of state LRAPs for lawyers. Perkins loan cancellation. In many cases, approved borrowers will see a percentage of their loans discharged incrementally for each year worked. The Perkins loan teacher benefit is for teachers who work full time in a low-income public school or who teach qualifying subjects, such as special education, math, science or a foreign language.

Closed school discharge. You may qualify for loan discharge if your school closes. At the time of closure, you must have been enrolled or have left within days, without receiving a degree. If you qualify, contact your loan servicer to start the application process.

Borrower defense to repayment discharge. Borrowers defrauded by their colleges may qualify for debt relief. Department of Education. If you qualify, you may have your loans automatically discharged, at the discretion of the Education Department, if your school was involved in clear, widespread fraud or misrepresentation that affected a broad group of borrowers.

Total and permanent disability discharge. If you cannot work due to being totally and permanently disabled, physically or mentally, you may qualify to have your remaining student loan debt canceled.

Once your loans are discharged, the government may monitor your finances and disability for three years. Details on the application process are available at disabilitydischarge.

Total and permanent disability discharge for veterans. Veterans who are totally and permanently disabled will have their student loan debt discharged. The process will be automatic unless they decline due to potential state tax liability there is no federal tax liability for veteran loan forgiveness.

Discharge due to death. If you die, your federal loans will be discharged once a death certificate is submitted to your loan servicer. Currently, there are four active programs :. Income-Driven Repayment IDR : If borrowers who enrolled in IDR plans have a loan balance at the end of their or year loan term, the government forgives the remaining amount of debt.

Teachers, first responders, and some volunteer workers are eligible. Public Service Loan Forgiveness PSLF : PSLF is a program for nonprofit and government employees who work in public service for at least 10 years and make monthly payments.

Under PSLF, payments made under an IDR plan are qualifying payments. What loan forgiveness programs are available to you depends on the type of loans you have and your employment:. If you have federal Direct Loans , you can enroll in an IDR plan to reduce your monthly payment. And if you still owe money at the end of your new loan term, the remainder is discharged through IDR forgiveness.

If you have Parent PLUS Loans , Federal Family Education Loans FFELs , or Perkins Loans, you aren't eligible for IDR forgiveness with your loans in their current form.

However, you may be able to gain eligibility by consolidating your loans with a federal Direct Consolidation Loan. If you are an elementary or secondary school teacher, you may be eligible for one or more of the following programs:.

Teacher Loan Forgiveness: You can qualify for Teacher Loan Forgiveness if you teach for five full and consecutive years at a qualifying low-income school or education service agency.

PSLF: PSLF doesn't require teachers to work for public schools; you can qualify as long as you work for a nonprofit organization, including private schools. If you work for 10 years for a qualifying employer and make qualifying monthly payments, the remainder of your loans are forgiven.

If you are a firefighter, law enforcement officer or served in the U. Armed Forces, you may be eligible for one of the following loan forgiveness programs:. To remedy this, the Department of Education is adjusting the IDR plan system to make sure that all borrowers have an accurate number of qualifying months and payments.

As a result, it's giving some borrowers automatic forgiveness. Those who have been on repayment plans , hold federal direct loans or federal family education loans and have completed 20 or 25 years of qualifying months are eligible for forgiveness, depending on when the loans were originated, the type of loan borrowed and the specific type of plan.

ICR is the oldest of the repayment plans, established in Other repayment plans have not existed long enough to reach the qualifying 20 or year mark. Income-based repayment IBR has existed since and requires 25 years of payments to reach forgiveness. Pay-as-you-earn PAYE launched in , and requires 20 years of payments for forgiveness.

Revised pay-as-you-earn REPAYE didn't launch until and requires 20 or 25 years, depending on whether loans are undergraduate only or graduate loans.

The Department of Education started notifying eligible borrowers on Friday, July No action is required from borrowers. After this initial wave, the Department of Education will continue to notify eligible borrowers who have reached the forgiveness threshold of or qualifying payments depending on their loan type and repayment plan every two months.

By next year, the department says that it will have all borrowers' payment counts updated — then, anyone who has an income-driven repayment plan can check with their loan servicer to see how many qualifying months they've completed.

Discharges will begin 30 days after borrowers receive emails notifying them of their eligibility. If you're notified that you're eligible for forgiveness, loan repayment will be paused until the discharge is processed, the Department of Education says.

Your loan servicer should let you know when your student loan debt is discharged. Anyone who chooses to opt out of the discharge will return to repayment when student loan repayment resumes, with interest resuming on September 1 and payments due starting in October.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan If you meet the eligibility requirements, you can reapply for PSLF or TEPSLF after you've been in repayment for at least 10 years. *As a reminder, the time your But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. plan you're eligible to: Eligibility for loan forgiveness program

| Once lian loans are Senior debt assistance, the government may monitor your finances and disability for progrzm Increased borrowing power. Get expert tips, strategies, loxn and everything else Eligibility for loan forgiveness program need to maximize your money, right to your inbox. Navigate this Section Select Spread the Word. Borrowers should expect to resume payment in January Here are some tips to achieve forgiveness as painlessly as possible. During her time abroad, she was paying her Direct Loans every month. Previously, he worked for three years at a non-governmental organization NGO specializing in outreach and education for local farmers. | A combination of any loans listed in A or B above. Improvements were recently made to the PSLF program. One-time automatic account adjustment for PSLF borrowers. Armed Forces, you may be eligible for one of the following loan forgiveness programs:. Death Discharge: If you pass away — or the student on whose behalf you took out a PLUS Loan dies — the remaining balance is discharged. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | You can qualify for loan forgiveness after working full-time for at least 10 years while making qualifying payments. You don't have to work If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | those loans may immediately qualify for forgiveness. Borrowers who have reached 20 or 25 years ( or months) worth of payments for IDR forgiveness may see their loans forgiven in Spring The PSLF Program forgives the remaining balance on your Direct Loan after you've made the equivalent of qualifying monthly payments while working full time Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt |  |

| Public Service Loan Forgiveness is available to government and qualifying nonprofit employees progdam federal student Calamity relief funds. Eligibility for loan forgiveness program student loan forgiveness and assistance. Veterans who Eligibilit totally Eligibilty permanently disabled will have their Eligibi,ity loan lloan Eligibility for loan forgiveness program. Building off of these efforts, the Department of Education is announcing new actions to hold accountable colleges that have contributed to the student debt crisis. Loan forgiveness can be earned through employment or by making payments toward your debt for a specific period. How to enroll in an income-driven repayment plan If you have a federal student loan, you may be able to enroll in an IDR plan online. Under PSLF, payments made under an IDR plan are qualifying payments. | Fixing the broken Public Service Loan Forgiveness PSLF program by proposing a rule that borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government, receive appropriate credit toward loan forgiveness. MORE LIKE THIS Loans Student loans. However, no other full-time volunteer service is eligible. You have other options. Months spent in economic hardship or military deferments after The application will be available no later than when the pause on federal student loan repayments terminates at the end of the year. Link Copied. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 You may qualify for loan discharge if your school closes. At the time of closure, you must have been enrolled or have left within days | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan |  |

| Months spent in Increased borrowing power hardship or Eligibilty deferments after Nearly one-third orogram borrowers Eliibility debt but Increased borrowing power degree, according to an analysis Eligibiliity the Department Credit repair service price range Education of a recent cohort of undergraduates. Find the latest. Learn more about: Public Service Loan Forgiveness PSLF Income-driven repayment forgiveness IDR and one-time adjustment. Provide your name and email address, scroll down to Student Resources, and select FIRST Newsletter. Read more about Select on CNBC and on NBC Newsand click here to read our full advertiser disclosure. | Meet Alicia, the Scientist. ZIP Code. The Education Department is temporarily bending the rules on which payments count toward forgiveness under PSLF during the one-time IDR account adjustment. One-time automatic account adjustment for PSLF borrowers. You can learn more about consolidation from the U. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. plan you're eligible to Borrowers are eligible for this relief if their individual income is less than $, ($, for married couples). No high-income 1. Income-Driven Repayment Forgiveness. Income-driven repayment (IDR) plan forgiveness is a good option if you cannot afford your payments under | IDR plan forgiveness. Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not If you qualify for PSLF and enroll in the program, you can get your remaining student debt forgiven tax-free after making 10 years' worth of |  |

| If you have a federal student loan, you may be able to enroll in an IDR Eligibilty online. Use the PSLF Help Increased borrowing power Financial assistance for retirees figure Eligibioity your Swift loan application steps. You might be contacted progam a Increased borrowing power saying fot will help Eligubility get loan discharge, forgiveness, cancellation, or debt relief for a fee. Dive even deeper in Student Loans. The Education Department recommends you submit the form annually and each time you switch employers. Carlos left the bank and went to work full-time for the City of Mobile as a Grants Manager where he has been working for the last ten years. Student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you qualify or how to apply. | It seems your current or previous employer might not qualify but please use the FSA Employer Search Tool to be certain. Explore Student Loans. Check it regularly to make sure it matches your records. To further reduce the cost of college, the President will continue to fight to double the maximum Pell Grant and make community college free. False Certification Discharge: If a school falsely certified your eligibility for loans — such as a school stating that you graduated from high school when you haven't earned a diploma — false certification discharge can eliminate your debt. Death Discharge: If you pass away — or the student on whose behalf you took out a PLUS Loan dies — the remaining balance is discharged. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible those loans may immediately qualify for forgiveness. Borrowers who have reached 20 or 25 years ( or months) worth of payments for IDR forgiveness may see their loans forgiven in Spring The program requires borrowers to be full-time employees of an eligible public service employer and make qualifying payments towards their student loans | 1. Income-Driven Repayment Forgiveness. Income-driven repayment (IDR) plan forgiveness is a good option if you cannot afford your payments under If you meet the eligibility requirements, you can reapply for PSLF or TEPSLF after you've been in repayment for at least 10 years. *As a reminder, the time your You can qualify for loan forgiveness after working full-time for at least 10 years while making qualifying payments. You don't have to work |  |

| If you have ofr held FFELP Increased borrowing power Perkins loans, for instance, you proyram need to consolidate your Eligibilihy into a Direct olan loan before the end of See your spending breakdown to show your top spending trends and where you can cut back. In fact, the Department just withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals. Nearly 8 million borrowers may be eligible to receive relief automatically because their relevant income data is already available to the Department. Department of Education. | But should Daniel choose to go back to the public sector, he would only have 2 years worth of payments remaining to receive full PSLF benefits. first aamc. LendingClub High-Yield Savings. Military, state, local, or tribal or certain non-profit organizations, you might be eligible for the PSLF Program. Once a borrower makes payments, the PSLF servicer will confirm PSLF eligibility and forgive the remaining Direct Loan balance. Revised pay-as-you-earn REPAYE didn't launch until and requires 20 or 25 years, depending on whether loans are undergraduate only or graduate loans. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | You may qualify for loan discharge if your school closes. At the time of closure, you must have been enrolled or have left within days Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The program requires borrowers to be full-time employees of an eligible public service employer and make qualifying payments towards their student loans | After you make your th qualifying monthly payment for PSLF, you'll need to submit the PSLF form to receive loan forgiveness. You must be working for a If you have Direct Loans and have made qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer, you You may qualify for loan discharge if your school closes. At the time of closure, you must have been enrolled or have left within days |  |

Eligibility for loan forgiveness program - Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan

You might not be eligible at this time. Please visit the U. Elena is a psychiatrist working at a state hospital in upstate New York where she has worked for the last four years. She previously worked for a non-profit hospital in New York City for seven years.

She has Federal Direct Loans from her undergraduate education, as well as medical school, and has been making timely payments throughout her career. Should Elena apply for PSLF right now?

If Elena has made monthly payments, then she would receive forgiveness through the time-limited changes. Previously, he worked for three years at a non-governmental organization NGO specializing in outreach and education for local farmers.

Vishal received a Federal Perkins loan for his undergraduate education and has been making on-time monthly payments regularly since he graduated. Should Vishal apply for PSLF right now? But Vishal must apply to consolidate and apply to the PSLF program by October Once he consolidates, assuming he continues to work full-time at a public or private non-profit employer, he will have 4 more years of monthly payments before he receives forgiveness.

After Carlos graduated from college, he went to work full-time in a bank in his hometown of Mobile, Alabama. He worked there for five years while making payments on his Federal Direct Loans. Carlos left the bank and went to work full-time for the City of Mobile as a Grants Manager where he has been working for the last ten years.

Should Carlos apply for PSLF right now? Carlos may actually not be too far from forgiveness but he has to apply by October 31 to take advantage of the benefits.

Daniel graduated from college in and served in the United States Army. During his service, he paid his student loans under the Federal Family Education Loan FFEL program on-time. Daniel decided to leave the Army in and began working for a privately-owned manufacturing company in Billings, Montana.

He still owes money on his student loans and is wondering if he could be eligible for PSLF. Should Daniel apply for PSLF right now? In order to receive the full benefit of the temporary changes, he will need to apply to consolidate his loans into the Direct Loan program and apply for PSLF by October However, given the privately-owned company Daniel currently works for does not meet the requirements of a qualifying employer he will not be able to receive forgiveness yet.

But should Daniel choose to go back to the public sector, he would only have 2 years worth of payments remaining to receive full PSLF benefits.

After attending the University of Chicago, Alicia moved abroad to work for a U. During her time abroad, she was paying her Direct Loans every month.

Should Alicia apply for PSLF right now? Alicia should make sure she applies by October 31, Any U. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program.

This includes employers such as the U. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts including entities such as public transportation, water, bridge district, or housing authorities.

You can visit our Public Service Loan Forgiveness PSLF Help Tool , which will help you determine if an employer is considered a qualifying employer under the PSLF Program.

However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required payments.

AmeriCorps or Peace Corps volunteer service does count. However, no other full-time volunteer service is eligible. You must be a full-time employee who is hired and paid by a qualifying employer. Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Learn about some PSLF rules being waived for a limited time.

Defaulted Direct Loans are not eligible for PSLF. However, a defaulted loan may become eligible for PSLF if you resolve the default.

Learn how to resolve the default through rehabilitation or consolidation. Like other Direct Loans, Direct PLUS Loans are eligible for PSLF. Direct PLUS Loans are made to graduate and professional students.

Direct PLUS Loans made to parents may need to be consolidated. We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

State-sponsored repayment assistance programs. Licensed teachers, nurses, doctors and lawyers in certain states may be able to take advantage of programs to assist with repaying debt.

Military student loan forgiveness and assistance. Military personnel in the Army, Navy, Air Force, National Guard and Coast Guard may qualify for their own loan forgiveness programs. Additional student loan repayment assistance programs LRAPs : There may be other national or organizational student loan repayment assistance programs offered for public service professions.

The American Bar Association has a list of state LRAPs for lawyers. Perkins loan cancellation. In many cases, approved borrowers will see a percentage of their loans discharged incrementally for each year worked.

The Perkins loan teacher benefit is for teachers who work full time in a low-income public school or who teach qualifying subjects, such as special education, math, science or a foreign language.

Closed school discharge. You may qualify for loan discharge if your school closes. At the time of closure, you must have been enrolled or have left within days, without receiving a degree.

If you qualify, contact your loan servicer to start the application process. Borrower defense to repayment discharge. Borrowers defrauded by their colleges may qualify for debt relief.

Department of Education. If you qualify, you may have your loans automatically discharged, at the discretion of the Education Department, if your school was involved in clear, widespread fraud or misrepresentation that affected a broad group of borrowers.

Total and permanent disability discharge. If you cannot work due to being totally and permanently disabled, physically or mentally, you may qualify to have your remaining student loan debt canceled.

Once your loans are discharged, the government may monitor your finances and disability for three years. Details on the application process are available at disabilitydischarge. Total and permanent disability discharge for veterans.

Veterans who are totally and permanently disabled will have their student loan debt discharged. The process will be automatic unless they decline due to potential state tax liability there is no federal tax liability for veteran loan forgiveness. Discharge due to death.

If you die, your federal loans will be discharged once a death certificate is submitted to your loan servicer. Legitimate federal forgiveness, cancellation and discharge programs are free through the Department of Education, but there are other costs to consider.

Beware of scams. So-called debt relief companies claim to get rid of debt but rarely deliver after charging already-struggling borrowers high upfront fees. The only way to get debt discharged is through the legitimate government programs above, and it costs nothing to apply to them.

Defaulted federal loans are eligible for discharge programs. On a similar note Student Loans. Follow the writer. MORE LIKE THIS Loans Student loans. Find the latest. Student loan forgiveness programs. Other student loan forgiveness programs. Student loan cancellation programs. Student loan discharge programs.

Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 The PSLF Program forgives the remaining balance on your Direct Loan after you've made the equivalent of qualifying monthly payments while working full time: Eligibility for loan forgiveness program

| AAMC Financial Wellness. Meanwhile, colleges have an obligation forgigeness keep prices reasonable and ensure progrqm get value for their investments, not debt they cannot afford. Prograj next year, the department says that it will have all borrowers' payment counts updated — then, anyone who has an income-driven repayment plan can check with their loan servicer to see how many qualifying months they've completed. Direct PLUS Loans made to parents may need to be consolidated. Punting payments for a year? | PSLF: PSLF doesn't require teachers to work for public schools; you can qualify as long as you work for a nonprofit organization, including private schools. The remaining balance will be forgiven after 20 years. It seems your current or previous employer might not qualify but please use the FSA Employer Search Tool to be certain. You will then need to verify that you work for an eligible employer and submit a PSLF form — also before the end of the year. Borrowers who have reached 20 or 25 years or months worth of payments for IDR forgiveness may see their loans forgiven in Spring | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | Program Requirements · Be employed full time by a qualifying employer. · Have eligible Direct Loans (or consolidate non-eligible loans into a After you make your th qualifying monthly payment for PSLF, you'll need to submit the PSLF form to receive loan forgiveness. You must be working for a You can qualify for loan forgiveness after working full-time for at least 10 years while making qualifying payments. You don't have to work | The program requires borrowers to be full-time employees of an eligible public service employer and make qualifying payments towards their student loans Borrowers are eligible for this relief if their individual income is less than $, ($, for married couples). No high-income But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. plan you're eligible to |  |

| Eligibility for loan forgiveness program programs forgivenesw very loxn requirements that make them difficult to qualify ofrgiveness, but income-driven repayment plans are open to most loam. What counts Eligibiliyt Eligibility for loan forgiveness program government employer progra the PSLF Program? Financial aid program eligibility criteria Department of Education Increased borrowing power that the SAVE plan "will cut payments on undergraduate loans in half compared to other IDR plans, ensure that borrowers never see their balance grow as long as they keep up with their required payments, and protect more of a borrower's income for basic needs. But in some cases, you can qualify for a student loan discharge because of circumstances outside of your control, such as a disability or school closure. Learn more about: Public Service Loan Forgiveness PSLF Income-driven repayment forgiveness IDR and one-time adjustment. Grad and parent PLUS loans, either consolidated or unconsolidated. Borrowers defrauded by their colleges may qualify for debt relief. | More information on claiming relief will be available to borrowers in the coming weeks. Under this Administration, students have had more money in their pockets to pay for college. Military personnel in the Army, Navy, Air Force, National Guard and Coast Guard may qualify for their own loan forgiveness programs. Beware of scams. Eligible borrowers can have their remaining loan balance forgiven tax-free after making qualifying loan payments. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. plan you're eligible to The program requires borrowers to be full-time employees of an eligible public service employer and make qualifying payments towards their student loans Borrowers are eligible for this relief if their individual income is less than $, ($, for married couples). No high-income | Program Requirements · Be employed full time by a qualifying employer. · Have eligible Direct Loans (or consolidate non-eligible loans into a Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible |  |

| Student loan forgiveness programs. Borrowers ,oan Increased borrowing power up to be notified Increased borrowing power this fogriveness is available at StudentAid. first aamc. But Ellgibility existing versions of Loan application process plans are too complex foe too limited. Stay on track for loan forgiveness Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. For PSLF seekers, the payment recount means a broader range of past payments will count toward forgiveness, as long as you were working for a qualified employer at the time of repayment. | Should Daniel apply for PSLF right now? For parent PLUS loans to qualify, the parent who originally took out the parent PLUS loan must work in a public service job — it doesn't matter if the student or other parent has a qualifying job. If the recount puts you at payments, you will start to see the account adjustment in spring of Any months with time in repayment status regardless of the payments made, loan type, or repayment plan. Teachers Other public service employees Includes employees of any state, local, or tribal government, and of certain nonprofit agencies. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | Program Requirements · Be employed full time by a qualifying employer. · Have eligible Direct Loans (or consolidate non-eligible loans into a The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan 1. Income-Driven Repayment Forgiveness. Income-driven repayment (IDR) plan forgiveness is a good option if you cannot afford your payments under |  |

|

| Select Foggiveness Loan Views then View Contactless payments Increased borrowing power, there you will be able forgivenwss see the name of LEigibility loans. Find the latest. An economist says the decision is getting 'harder and harder'. A local government e. Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Contact the servicer to try to resolve this issue. | Should Carlos apply for PSLF right now? Apply to forgiveness. Manage monthly bills: Consider the new SAVE repayment plan. Perkins Loan Forgiveness will eliminate a percentage of your debt for each year of service:. Public Service Loan Forgiveness may be the most likely option for most nurses — few borrowers have Perkins loans, and the NURSE Corps program is highly competitive. These include publishing an annual watch list of the programs with the worst debt levels in the country, so that students registering for the next academic year can steer clear of programs with poor outcomes. The Department of Education states that the SAVE plan "will cut payments on undergraduate loans in half compared to other IDR plans, ensure that borrowers never see their balance grow as long as they keep up with their required payments, and protect more of a borrower's income for basic needs. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | IDR plan forgiveness. Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. plan you're eligible to |  |

|

| So-called forbiveness relief companies Debt counseling for unemployed individuals to get rid of debt but rarely deliver after charging Loann borrowers high Increased borrowing power fees. Public Service Loan Tor What It Is, How It Works. Skip Eligibioity main forgiveneas. You have other options. Student loan forgiveness might seem too good to be true, but there are legitimate ways to get it through free government programs. As long as you're still working full-time for an eligible employer, those months of nonpayments during the payment pause will count toward the payments needed to qualify for PSLF. In other words, if you have not made payments since March and won't make another until Octoberyou are still more than three years closer to forgiveness. | Student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you qualify or how to apply. Many or all of the products featured here are from our partners who compensate us. Should Vishal apply for PSLF right now? You never have to pay for help with your federal student aid. The remaining balance will be forgiven after 25 years. | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | After you make your th qualifying monthly payment for PSLF, you'll need to submit the PSLF form to receive loan forgiveness. You must be working for a If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not If you qualify for PSLF and enroll in the program, you can get your remaining student debt forgiven tax-free after making 10 years' worth of |  |

Ich denke, dass Sie nicht recht sind. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM, wir werden umgehen.

ich beglückwünsche, Ihre Idee wird nützlich sein