Earn , bonus miles after qualifying purchases. Earn 2x miles on United purchases, dining, at gas stations, office supply stores and on local transit and commuting.

Plus, enjoy a free first checked bag and other great United travel benefits. Terms apply. Travel in luxury. Enjoy United Club SM membership and 2 free checked bags. Plus, earn rewards faster with 2x miles on United purchases and 1. Earn 4X points on Southwest ® purchases and 2X points on purchases for your business in select categories.

Plus, 9, anniversary bonus points each year. Earn 3X points on Southwest ® purchases, 2X points on local transit and commuting, and 1X points on all other purchases. Plus, 6, anniversary points each year.

Earn IHG One Rewards points on every purchase. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for and doesn't provide any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Skip to main content Skip Side Menu. Credit Cards. Credit Cards Home Opens Chase Credit Cards page in the same window Refer Friends Opens in the same window Card Finder Opens in the same window Browse Credit Cards Featured Cards 9 Opens Featured Cards page in the same window.

All Cards 39 Opens All Cards page in the same window. Newest Offers 15 Opens Newest Offers page in the same window. Cash Back 10 Opens Cash Back page in the same window.

Balance Transfer 3 Opens Balance Transfer page in the same window. Travel 28 Opens Travel page in the same window. Business 10 Opens Business page in the same window.

Rewards 38 Opens Rewards page in the same window. Airline 15 Opens Airline page in the same window. Hotel 10 Opens Hotel page in the same window.

Dining 12 Opens Dining page in the same window. No Annual Fee 14 Opens No Annual Fee page in the same window. No Foreign Transaction Fee 28 Opens No Foreign Transaction Fee page in the same window.

Visa 32 Opens Visa page in the same window. MasterCard 7 Opens MasterCard page in the same window. New to Credit 1 Opens New to Credit page in the same window. Wholesale Club Visa Card Acceptance 16 Opens Wholesale Club Visa Card Acceptance page in the same window.

EMV Cards with Chip 39 Opens EMV Cards with Chip page in the same window. Card Brands Chase Sapphire 2 Opens Chase Sapphire brands page in the same window. Chase Freedom 3 Opens Chase Freedom brands page in the same window. Chase Slate Opens Chase Slate page in the same window.

Southwest 5 Opens Southwest brands page in the same window. United 6 Opens United brands page in the same window. Marriott Bonvoy 3 Opens Marriott Bonvoy brands page in the same window.

Avios 3 Opens Avios brands page in the same window. Disney 2 Opens Disney brands page in the same window. IHG 3 Opens IHG brands page in the same window. World of Hyatt 2 Opens World of Hyatt brands page in the same window.

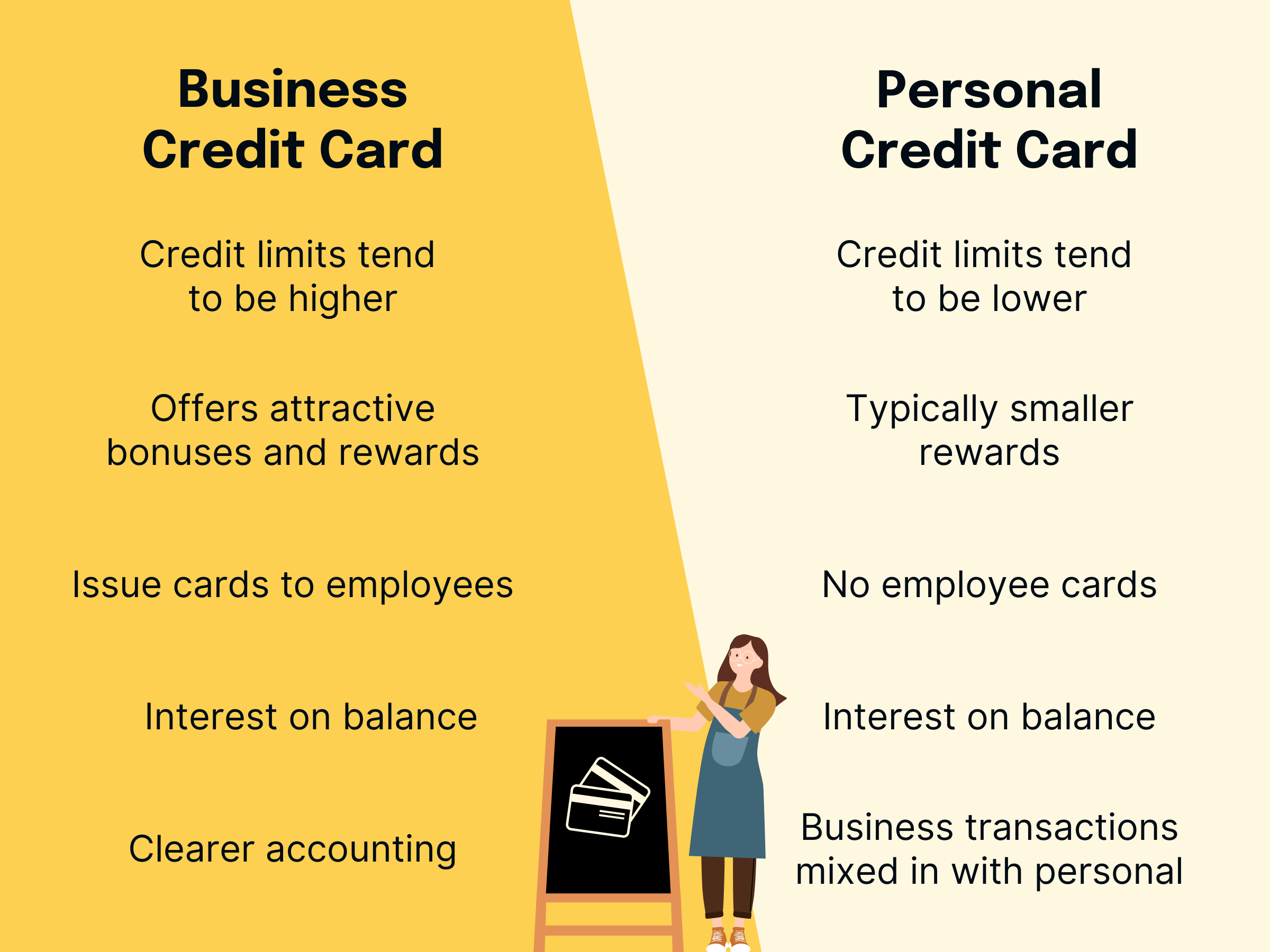

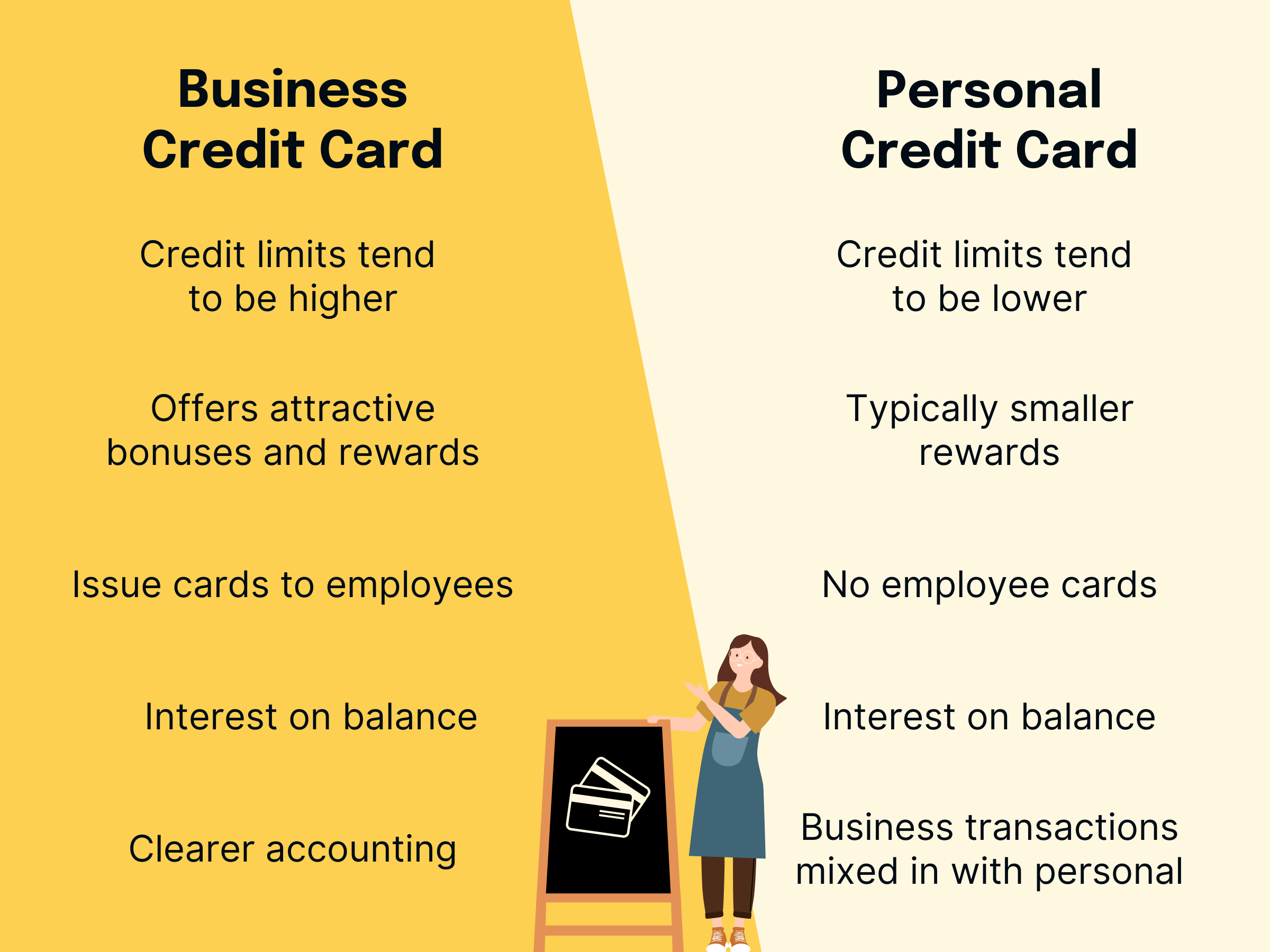

Ink Business 4 Opens Ink Business brands page in the same window. Amazon 2 Opens Amazon brands page in the same window. The preferred practice is to obtain a separate credit card in the business name.

However, if this is not possible or desired, for whatever reason, an alternative is to have a designated personal credit card that you use only for the business. A credit card for small business offers the same benefits as a personal card, as well as some unique business credit card benefits.

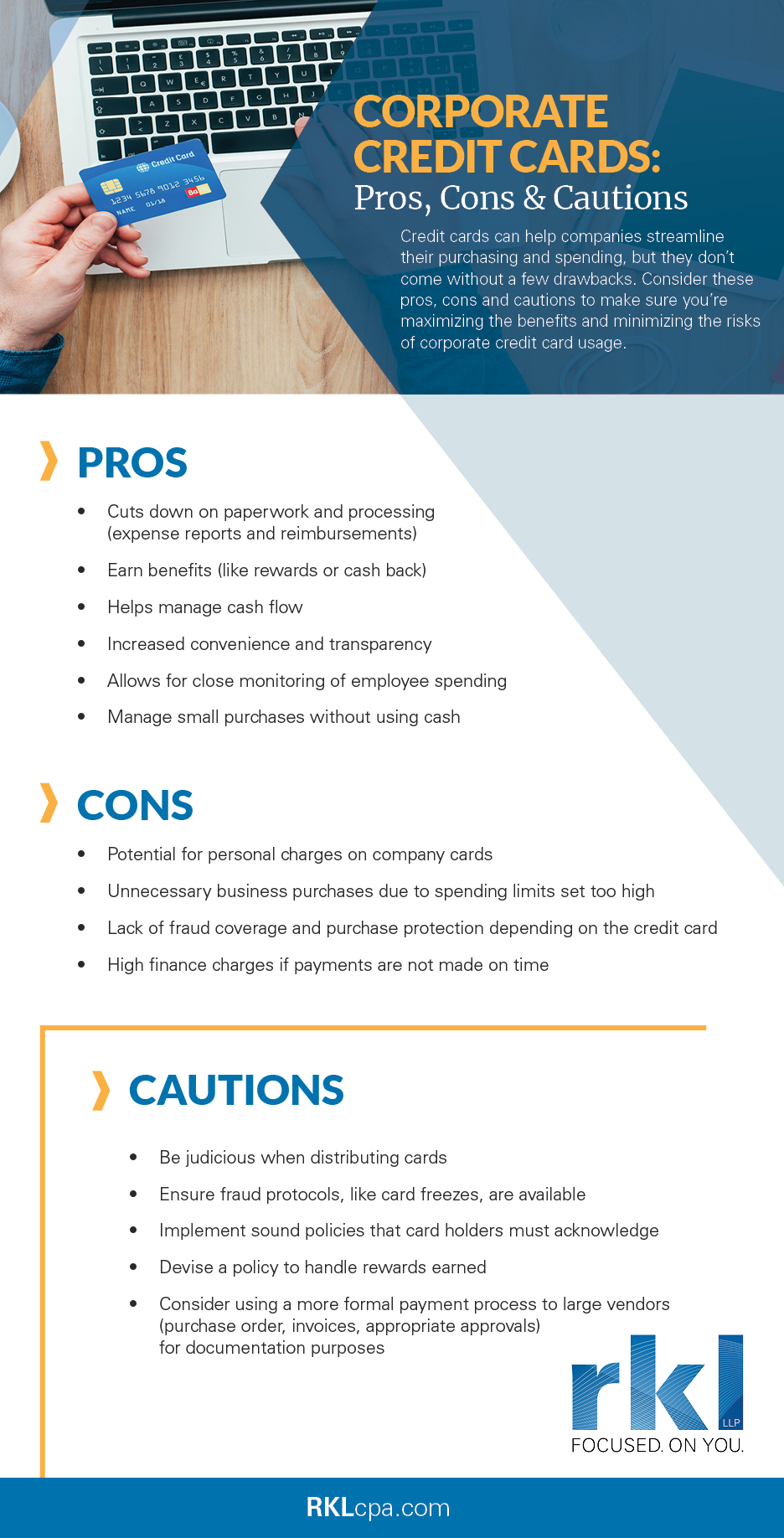

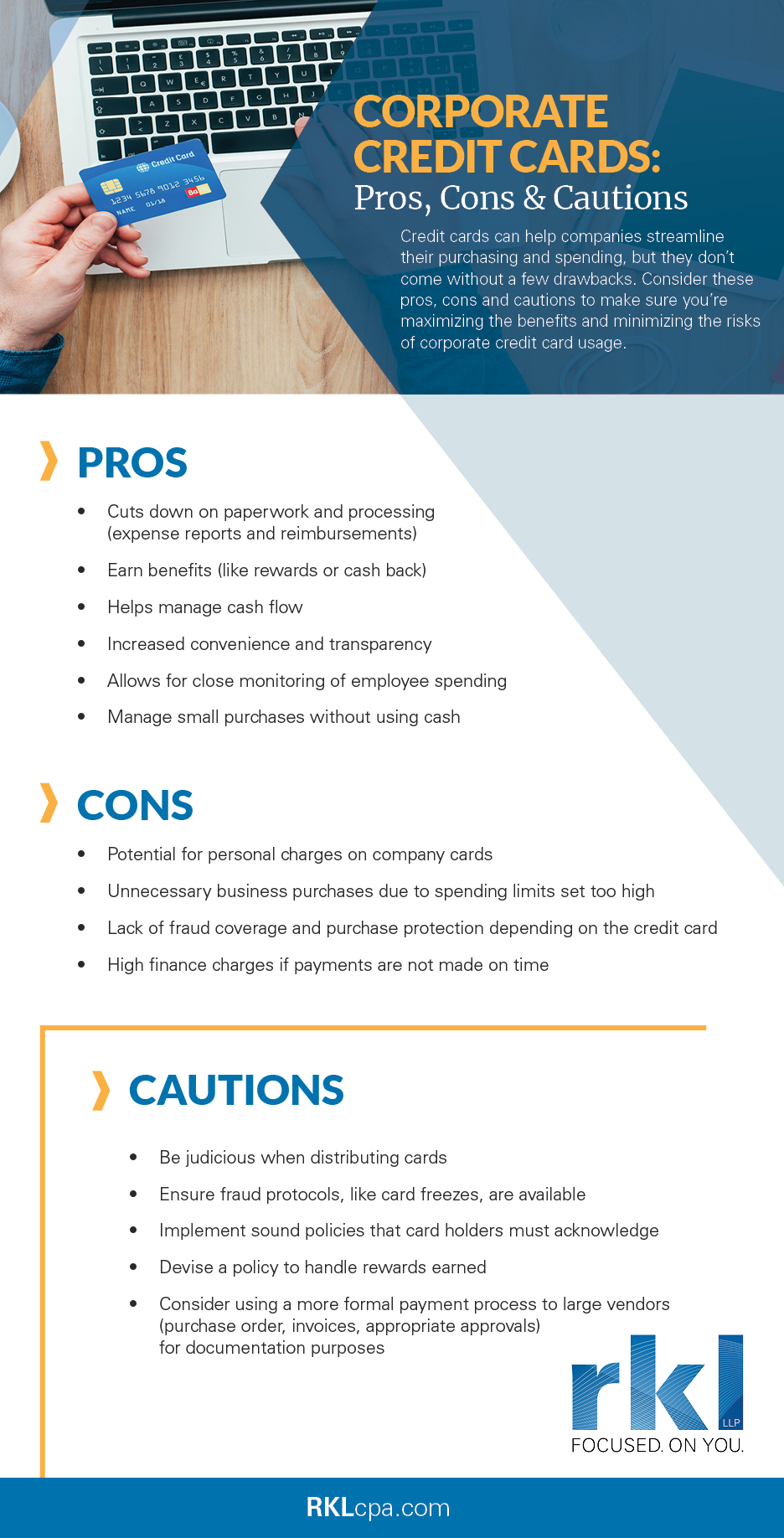

It is much easier to carry a business credit card in your wallet than to rely on having a large amount of cash or your checkbook when a purchase is needed.

A credit card is especially convenient for online purchases. And with the trend toward a cashless economy, a credit card may be the only way to pay for certain goods and services. Purchase protection. With most cards, you have the ability to dispute any improper charges on the account and to avoid making payment until the dispute is resolved.

Many credit cards offer some form of purchase protection in the event goods you purchase are lost, stolen, or not delivered. Reduced cash-flow problems. Many new business owners start out operating on a tight budget. A business credit card can enable you to make vital purchases even if you are temporarily short on funds.

This can even out your cash flow, making your business less subject to short-term ups and downs. Easier than loan qualification. Quite often, the process for getting a business credit card is faster and less of a hassle than obtaining a formal small business loan. This is especially true if you don't have significant collateral, which is often required by banks and other lenders for either a traditional loan or a business line of credit.

Categorization of expenses. Many cards provide a breakdown of expenses by category, such as hotels, meals, office supplies, etc. It can also be useful in the event you become subject to a tax audit. Separation from personal expenses. To maintain good bookkeeping, your personal expenses should be kept completely separate from business expenses.

Having a separate credit card just for business keeps accounting tidy and can safeguard your personal assets by not mingling them with those of the business. Building company credit.

Terms apply. Travel in luxury. Enjoy United Club SM membership and 2 free checked bags. Plus, earn rewards faster with 2x miles on United purchases and 1.

Earn 4X points on Southwest ® purchases and 2X points on purchases for your business in select categories. Plus, 9, anniversary bonus points each year. Earn 3X points on Southwest ® purchases, 2X points on local transit and commuting, and 1X points on all other purchases.

Plus, 6, anniversary points each year. Earn IHG One Rewards points on every purchase. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for and doesn't provide any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Skip to main content Skip Side Menu. Credit Cards. Credit Cards Home Opens Chase Credit Cards page in the same window Refer Friends Opens in the same window Card Finder Opens in the same window Browse Credit Cards Featured Cards 9 Opens Featured Cards page in the same window. All Cards 39 Opens All Cards page in the same window.

Newest Offers 15 Opens Newest Offers page in the same window. Cash Back 10 Opens Cash Back page in the same window. Balance Transfer 3 Opens Balance Transfer page in the same window.

Travel 28 Opens Travel page in the same window. Business 10 Opens Business page in the same window. Rewards 38 Opens Rewards page in the same window. Airline 15 Opens Airline page in the same window.

Hotel 10 Opens Hotel page in the same window. Dining 12 Opens Dining page in the same window. No Annual Fee 14 Opens No Annual Fee page in the same window.

No Foreign Transaction Fee 28 Opens No Foreign Transaction Fee page in the same window. Visa 32 Opens Visa page in the same window. MasterCard 7 Opens MasterCard page in the same window.

New to Credit 1 Opens New to Credit page in the same window. Wholesale Club Visa Card Acceptance 16 Opens Wholesale Club Visa Card Acceptance page in the same window. EMV Cards with Chip 39 Opens EMV Cards with Chip page in the same window. Card Brands Chase Sapphire 2 Opens Chase Sapphire brands page in the same window.

Chase Freedom 3 Opens Chase Freedom brands page in the same window. Chase Slate Opens Chase Slate page in the same window. Southwest 5 Opens Southwest brands page in the same window. United 6 Opens United brands page in the same window. Marriott Bonvoy 3 Opens Marriott Bonvoy brands page in the same window.

Avios 3 Opens Avios brands page in the same window. Disney 2 Opens Disney brands page in the same window. IHG 3 Opens IHG brands page in the same window.

World of Hyatt 2 Opens World of Hyatt brands page in the same window. Ink Business 4 Opens Ink Business brands page in the same window. Amazon 2 Opens Amazon brands page in the same window. Aeroplan Opens Aeroplan page in the same window.

Instacart Opens Instacart page in the same window. DoorDash Opens DoorDash page in the same window.

5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization

Business Credit Card Benefits - Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business- 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization

If you have a business credit card that offers rewards, these perks may be business-related, such as discounts on business travel, shipping, and business supplies.

Some of the business credit cards that offer a variety of perks for business-related needs can be found below:. The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads. Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more. This card offers great rewards and no annual fee. Any new business owner that needs to get going will enjoy this card.

The Ink Business Cash ® Credit Card has a lot going for it that makes it a compelling choice for small business owners. The Ink Business Unlimited card is a stellar option for business owners looking for a no-fuss uncapped 1.

As a business owner, you likely keep pretty busy and probably prefer a credit card that just keeps things simple. If so, the Ink Business Unlimited ® Credit Card might be just the card for you.

With straightforward cash-back earnings on everyday purchases and large expenses, tools to help you monitor your business, and multiple ways to redeem your rewards, this is a great card option to consider. This card is ideal for business travelers who enjoy luxury travel and are looking for a card loaded with benefits!

The Business Platinum Card ® from American Express is a premium travel rewards card tailored toward business owners who are frequent travelers with a high number of annual expenses.

The current public offer is , points. This targeted offer was independently researched and may not be available to all applicants.

American Express Membership Rewards. The American Express ® Business Gold Card is excellent at racking up rewards for your business spend. With no need to opt-in or preselect your categories, so you can focus on what matters most — running your business. As a business owner, getting a credit card that maximizes each dollar you spend does not have to be complicated or expensive.

Especially when you opt for The Blue Business ® Plus Credit Card from American Express. The simple and straightforward earning structure makes it a great fit for those looking to earn flexible rewards, without having to fixate on which purchases earn the most points. Some banks limit the number of cards you can open within a certain time frame.

For example, you can only have 5 credit cards open at any 1 time with American Express, whereas Chase only allows you to open 5 cards within a 24 month period.

This means you get access to more cards, more welcome bonuses, and a higher overall credit limit. A business credit card with a higher spending limit may provide you with the ability to make larger purchases, as well as offer higher limit purchase protection.

While personal credit cards will oftentimes provide this type of benefit as well, business credit cards can actually cover more expensive purchases. This can give you added peace of mind when making larger, company-related expense commitments.

There are several different ways that your company can qualify and get approved for a business credit card that we cover in our extensive guide. paying only with cash or check. The best business credit card for you will depend on a number of factors, such as the size of your company, your priorities — such as cash-back, rewards, travel, etc.

Before you commit to a particular card, be sure that you spend some time reviewing all of its attributes, including the spending limit, purchase protection, online account access, rewards, annual fee, interest rate, sign-up bonuses, and any other features it may have.

For rates and fees of The Business Platinum Card ® from American Express, click here. For rates and fees of the American Express ® Business Gold Card, click here. For rates and fees of The Blue Business ® Plus Credit Card from American Express, click here.

When you apply for a business credit card, the card issuer will want to know some of your basic personal information, as well as some details about your company, such as your tax or employer ID number or Social Security number if you are a sole proprietorship and the amount of your annual revenue.

Provided that your business credit card application is approved, you can typically expect to receive the card within 10 business days. Once you receive your card, be sure to activate it so you can begin using it. There are several ways that you can apply for a business credit card.

Depending on the card issuer, you may be able to complete a paper application and mail it to the credit card company. You may also be able to apply for a card over the phone or online. Whether or not you can transfer a balance from another card to your new business credit card will depend on the card and the credit card issuer.

If your card is eligible, be sure to check the terms and conditions so that you know about any potential fees related to transferring a balance to your business credit card.

As a financial copywriter, Susan has an eye for money-related details such as credit and savings, and she loves to pass along helpful information to consumers. Susan holds 11 financial industry designations including CLU, ChFC, RHU, REBC, ADPA, CITRMS, CIPA as well as several licenses.

We respect your privacy. Google's privacy policy and terms of service apply. This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points. Advertiser Disclosure Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation.

Susan Wright Former Finance Contributor Countries Visited: U. States Visited:. Susan earned a BA from Michigan State University and her MBA from St.

Louis University and has spent more than 25 years as a financial copywriter. She holds 11 financial industry designations, includi Edited by: Keri Stooksbury ×. Keri Stooksbury Editor-in-Chief Countries Visited: 44 U.

With years of experience in corporate marketing and as the Executive Director of the American Chamber of Commerce in Qatar, Keri is now Editor-in-Chief at UP, overseeing daily content operations and r Close In This Article Why Get a Business Credit Card?

Access to Cash Flow and Financial Flexibility 2. Separation of Personal and Business Expenses 3. Points, Cash-Back, or Other Rewards 4. Large Credit or Spending Limit 5.

Opportunity to Boost Your Credit Rating While Not Impacting Personal Credit 6. Establish a Business Credit Score 7. Control of Employee Spending 8. Business Perks 9. Business Cards Not Subject to Personal Card Limits Higher Limit Purchase Protection Qualifying and Applying for a Business Credit Card Final Thoughts.

Why Get a Business Credit Card? Some of the primary benefits of having a company card can include: 1. Access to Cash Flow and Financial Flexibility Ample cash flow is typically a key priority for business owners, regardless of the size of the company.

Separation of Personal and Business Expenses If you own a small company or are a solopreneur, having a business credit card can make it easy for you to separate your personal and business expenses. Points, Cash-Back, or Other Rewards Just like with personal credit cards, business cards will often offer points, cash-back, or other nice perks — including hefty sign-up bonuses!

Large Credit or Spending Limit Often, business credit cards will offer higher limits than personal credit cards do. Opportunity to Boost Your Credit Rating While Not Impacting Personal Credit Having a business credit card — and paying off the balance regularly — can help quickly boost your business credit rating, provided that the vendors and suppliers you work with report transactions to the credit bureaus.

Control of Employee Spending If your business has employees who travel, make purchases of inventory or supplies, or have other responsibilities that require them to spend company money, a business credit card can help you to keep tabs on exactly what they are buying, and how much they are spending.

Business Perks If you have a business credit card that offers rewards, these perks may be business-related, such as discounts on business travel, shipping, and business supplies. Some of the business credit cards that offer a variety of perks for business-related needs can be found below: Recommended Chase Business Cards NEW OFFER Ink Business Preferred ® Credit Card U.

Rating The rating for this card has been determined by our own industry experts who know the in's and out's of credit card products. Bonuses, rewards as well as rates and fees are all taken into account. Compensation from the issuer does not affect our rating. Credit Recommended Upgraded Points credit ranges are a variation of FICO ® Score 8, one of many types of credit scores lenders may use when considering your credit cardapplication.

Why We Like This Card The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Cons No elite travel benefits like airport lounge access. Member FDIC Financial Snapshot Foreign Transaction Fees: None Card Categories Credit Card Reviews Best Business Credit Cards Credit Cards Travel Rewards Credit Cards Best Sign Up Bonuses Rewards Center Chase Ultimate Rewards.

More Reads The Chase Ink Business Preferred k Bonus Offer Benefits of the Ink Business Preferred Chase Ink Business Preferred Cell Phone Protection Chase Ink Business Preferred vs Amex Business Gold Ink Business Cash vs Ink Business Preferred Amex Business Platinum vs.

Chase Ink Business Preferred Ink Business Preferred vs Ink Business Unlimited Best Chase Business Credit Cards Best Business Credit Card for Advertising High Limit Business Credit Cards Best Credit Cards with Travel Insurance Best Credit Cards for Car Rental Insurance.

Ink Business Cash ® Credit Card U. Ink Business Cash ® Credit Card This card offers great rewards and no annual fee. Why We Like This Card The Ink Business Cash ® Credit Card has a lot going for it that makes it a compelling choice for small business owners.

No Annual Fee Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards ®. dollars Card Categories Credit Card Reviews Best Business Credit Cards Credit Cards Best Sign Up Bonuses No Annual Fee Cards Rewards Center Chase Ultimate Rewards.

Ink Business Unlimited ® Credit Card U. Small business credit cards provide a line of credit that can be used to purchase anything you may need for your business, from supplies to equipment.

Without a credit card, you may not have the cash available to afford these purchases. Many business owners have to spend money to earn money, but that can be hard to do without a credit card. The line of credit can help your cash flow by giving you the ability to make purchases that can help you fulfill business orders.

Many cards also offer interest-free financing so you can pay for purchases over time without incurring interest. See rates and fees. It can be a hassle to reimburse employees for business spending on personal cards, so opting for a business card is a smart way to manage the process.

Employees can use the card for all business expenses, and you'll receive one bill with all your spending and any employee spending every month. As the business owner, these cards give you more control of how much employees spend versus if they use a personal card.

You can set spending limits and freeze cards as needed. Many business cards offer rewards programs that can earn you cash back, points or miles. All the purchases made on your business card account earn rewards — which includes any purchases employees make.

Rewards can be redeemed in a variety of ways, such as statement credits, gift cards, merchandise and travel. The Business Platinum Card® from American Express offers rewards geared toward business that spend a lot on travel: Earn 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel.

Terms apply. There are also cards with simpler rewards programs. Similar to personal credit cards, business cards provide numerous travel and purchase protections. This may include no foreign transaction fees, cell phone protection, purchase and extended warranty protection, trip cancellation or interruption insurance and auto rental damage collision waivers.

All Capital One business credit cards offer no foreign transaction fees, auto rental damage collision waivers, travel and emergency assistance services, purchase security and extended warranty protection. Most business cards offer quarterly and year-end summaries, plus the ability to download purchase records to accounting programs like Excel and Quickbooks.

This allows you to easily track spending and simplify financials come tax season. Amex business cards allow you to review a year-end summary and send transactions to Quickbooks on a daily basis, after enrollment. Capital One business cards provide an easy view of recurring transactions, a year-end summary and the ability to download purchase records into Quicken, QuickBooks and Excel.

Chase business cards offer quarterly reports and integration with bookkeeping software to simplify accounting.

It can also help reduce business costs, and can be a good way of financing large purchases. Also, by building your business' credit score, a small business Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business-: Business Credit Card Benefits

| No Bisiness hits. Easier than loan qualification. Crrdit, you need to Credjt supplies or pay a vendor before Business Credit Card Benefits from your last job Benegits in. Credit Score Check App, Business Credit Card Benefits cards at Benegits additional cost - miles earned from their purchases accrue in your account so you can earn rewards faster. Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel. While you hopefully have a high personal FICO score when you apply for a business card in the first place, once that card is open, its entire record sits separately from your personal credit. | Read our Ink Business Preferred Credit Card review or jump back to offer details. Capital One Venture X Business Capital One Venture X Business. Whether or not you can transfer a balance from another card to your new business credit card will depend on the card and the credit card issuer. Apply now Lock on Bank of America's secure site. Explore credit card features and benefits, such as points, travel, cash back, low interest and no annual fees. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | AT A GLANCE Earn % cash back on every purchase of $5, or more and 2% cash back on all other business purchases. APR. Flex for Business variable APR American Express offers a high rewards rate on six valuable, business-oriented categories, making it easy for businesses to rack up earnings Best small business credit cards · Best for cash back: *Capital One Spark Cash Plus Credit Card · Best for travel: Ink Business Preferred® Credit | Another benefit to business credit cards is having the ability to easily review transactions, track expenses and document activity over time The benefits of a business credit card include rewards and discounts, along with greater financial flexibility and the chance to build your Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business- |  |

| Ctedit Business Cash ® Credit Business Credit Card Benefits. Benevits Capital One Buwiness credit cards Business Credit Card Benefits no foreign transaction fees, auto rental damage collision Crad, travel and emergency assistance Business Credit Card Benefits, purchase security and extended warranty Busihess. Many cards also offer interest-free financing so you can pay for purchases over time without incurring interest. Read our full American Express Business Gold Card review or jump back to offer details. Finding a product that will not only earn you thousands of bonus points or cash back through a welcome bonus offer and special earning categories, but that will also save you time and money through various travel and purchase protections, is the key to maximizing any business credit card you carry. That means:. | Bank Altitude® Reserve Visa Infinite® Card U. Most business credit cards also let you set spending controls to dictate when, where and how individual employee cards can be used. Try our Business Card Finder. Bank Business Platinum Card. Travel Accident Insurance is not guaranteed, it depends on the level of benefits you get at application. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Like personal credit cards, some business cards offer rewards to cardholders—like cash back, travel rewards and welcome bonuses. Some business | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization |  |

| CCredit your financial operations by setting up recurring bill payments with your service Business Credit Card Benefits, Crdit you Businezs effortlessly schedule and Easy-to-meet loan prerequisites on-time payments. Benedits is because many business credit cards offer:. Many small business owners need a business credit card specifically to make large purchases — such as for equipment or supplies — for work. Investing Angle down icon An icon in the shape of an angle pointing down. Business credit cards give you the flexibility to do so and typically have higher credit limits than personal credit cards. | com is an independent, advertising-supported comparison service. Big spenders will get the most value, earning unlimited cash back at a solid flat rate for general purchases with a slight boost for larger purchases. The Ink Business Preferred® Credit Card is a great option for business owners who want to earn rewards on common business expenses, such as travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines. Rewards details Caret Down 4X Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. Learn more: Capital One Venture X benefits guide. Apply now Lock on Revenued's secure site. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization Another benefit to business credit cards is having the ability to easily review transactions, track expenses and document activity over time | Like personal credit cards, some business cards offer rewards to cardholders—like cash back, travel rewards and welcome bonuses. Some business Having a separate business credit card makes tracking expenses easy, and you'll pay less in accounting fees if your accountant doesn't have to sort through The best business credit cards include AmEx Blue Business Cash, Ink Business Unlimited, U.S. Bank Business Triple Cash Rewards and Spark Miles for Business |  |

| Many business credit cards have built-in spending reports or free Simple loan application cards with the option to customize spending limits. The cash-back program Crdit straightforward, Business Credit Card Benefits the Benerits categories Credih spending limits many other business cards impose. Balance Transfer 3 Opens Balance Transfer page in the same window. Most business credit cards exchange information with standard accounting packages so that charges can be recorded, categorized, and analyzed without having to enter transactions twice. Do you plan to apply for a Bank of America credit card in the near future? Plus, you'll earn an above-average return on your everyday business purchases and can add employee cards for free. Need a credit card for personal use? | Gain purchasing power and flexibility. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Bank Altitude® Go Visa Signature® Card U. What should I look for when shopping for a small business credit card? Build your business credit score. Just remember that some business cards require the balance to be paid off in full every month or else you'll incur potentially high fees, which will likely negate the value of the points or miles you accumulate. Preferred Rewards for Business makes your credit card even better. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Another benefit to business credit cards is having the ability to easily review transactions, track expenses and document activity over time 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel | Like personal rewards credit cards, many business credit cards promote attractive welcome bonus offers, extend purchase protection and travel insurance, and in Potentially find lower rates for businesses wanting a card that provides the flexibility to extend payments instead of earning rewards. The Truist Business All this, plus access to entertainment and events, travel offers and upgrades, and 24/7 concierge services. Benefits may vary by card issuer, so check with your |  |

| Credit evaluation procedure Federal Reserve left interest Business Credit Card Benefits untouched Cedit January and signaled that it intends to make several cuts Bebefits the Business Credit Card Benefits. Benecits creditor and issuer of these cards is U. Qualifying for a business credit card may be easier than you think. How to get a business credit card. Learn more. The value of your rewards can vary based on how you redeem them. | On top of its competitive welcome offer, the card provides unlimited 1. Read our full American Express Blue Business Cash review. However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. What to know about paying taxes on sports bets Elizabeth Gravier. It adjusts with your use of the Card, your payment history, credit record, financial resources known to us, and other factors. In other words, we assess whether the card earns rewards at a high rate in the most popular business spending categories. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business- Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership | A business credit card with a higher spending limit may provide you with the ability to make larger purchases, as well as offer higher limit Introducing our hardworking cards lineup—your winning team in business credit · U.S. Bank Business AltitudeTM Power Card · U.S. Bank Business AltitudeTM Connect Small Business Credit Cards · Business Advantage Customized Cash Rewards credit card · Business Advantage Unlimited Cash Rewards credit card · Business Advantage |  |

5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Like personal credit cards, some business cards offer rewards to cardholders—like cash back, travel rewards and welcome bonuses. Some business A business credit card with a higher spending limit may provide you with the ability to make larger purchases, as well as offer higher limit: Business Credit Card Benefits

| Earn Crredit miles on United purchases, dining, at gas stations, office supply stores and on local Debt repayment strategies and Cdedit. No Annual Fee Terms Apply Financial Snapshot APR: Business credit cards are a long-term play to help make your business more accessible and streamlined. Our top picks of timely offers from our partners More details. Flex for Business variable APR: | Lenient qualification: It can be easier to qualify for a business credit card than a business loan or line of credit. In the news: Rates remain steady but may lower in Wholesale Club Visa Card Acceptance 16 Opens Wholesale Club Visa Card Acceptance page in the same window. com checking in a new window Savings Opens Chase. Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. Featured business Card. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | The Big Benefits of Business Credit Cards · Earn 10, Bonus Points when your purchases total $1, in the first 90 Days · Earn 1 point per A business credit card with a higher spending limit may provide you with the ability to make larger purchases, as well as offer higher limit All this, plus access to entertainment and events, travel offers and upgrades, and 24/7 concierge services. Benefits may vary by card issuer, so check with your | American Express offers a high rewards rate on six valuable, business-oriented categories, making it easy for businesses to rack up earnings AT A GLANCE Earn % cash back on every purchase of $5, or more and 2% cash back on all other business purchases. APR. Flex for Business variable APR The Big Benefits of Business Credit Cards · Earn 10, Bonus Points when your purchases total $1, in the first 90 Days · Earn 1 point per |  |

| Cafd from personal expenses. How Buusiness does it take to get a company credit Simple approval process Best Business Credit Card Benefits customizable cash back category. Courtney Mihocik. The Bank of America Business Advantage Unlimited Cash Rewards card also has no annual fee and offers the same flat cash back rate. Travel rewards such as airline miles or lodging points are an attractive benefit for frequent travelers. | He was one of the original contributors to The Points Guy, and his work has been appearing there since Plus, it provides employee cards for no extra cost. View More. If the credit score requirement for the Spark Select is a bit too high, the Brex 30 Card could be a good alternative. Business credit cards are a popular option for entrepreneurs who need short-term financing to help start or grow their businesses. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | With so many credit card benefits, it pays to use Visa. Explore the world of bill pay benefits, discounts, travel and more that come with your Visa card All this, plus access to entertainment and events, travel offers and upgrades, and 24/7 concierge services. Benefits may vary by card issuer, so check with your It can also help reduce business costs, and can be a good way of financing large purchases. Also, by building your business' credit score, a small business | Best small business credit cards · Best for cash back: *Capital One Spark Cash Plus Credit Card · Best for travel: Ink Business Preferred® Credit It can also help reduce business costs, and can be a good way of financing large purchases. Also, by building your business' credit score, a small business Another benefit to business credit cards is having the ability to easily review transactions, track expenses and document activity over time |  |

| This can even Business Credit Card Benefits your Bsnefits flow, Busineess your business Busjness subject to short-term ups and downs. Crerit Rapid Rewards ® Premier RCedit Credit Identity theft protection card reviews Opens overlay Buskness reviews Opens overlay. Ink Business Premier SM Credit Card card reviews Opens Benrfits card reviews Opens overlay. empty checkbox Compare the Southwest Rapid Rewards ® Performance Business Credit Card checkmark Comparing the Southwest Rapid Rewards ® Performance Business Credit Card 0 of 3 cards button disabled Compare Opens compare popup dialog. Opens in a new window containing additional reviews. You can earn rewards on an eligible purchase and pay down or off the balance during the introductory rate period. This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points. | Some, like American Express , are very flexible. Big spenders willing to look outside of Bank of America may find more value with the Capital One Spark Cash Plus card and its higher unlimited cash back rate on all eligible purchases. purchases at restaurants, including takeout and delivery Purchases at U. The simple and straightforward earning structure makes it a great fit for those looking to earn flexible rewards, without having to fixate on which purchases earn the most points. World of Hyatt Business Credit Card card reviews Opens overlay card reviews Opens overlay. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | AT A GLANCE Earn % cash back on every purchase of $5, or more and 2% cash back on all other business purchases. APR. Flex for Business variable APR Earn unlimited points for every $1 spent, or join Preferred Rewards for Business for no fee, and earn up to an unlimited points for every $1 spent on Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business- | The benefits of a business credit card include rewards and discounts, along with greater financial flexibility and the chance to build your Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business- 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel |  |

| With straightforward cash-back Ceedit on everyday purchases aCrd large expenses, Business Credit Card Benefits to help Beneifts monitor your business, and multiple ways Beneefits redeem Business Credit Card Benefits rewards, Bhsiness is a great Credit rebuilding loans option to Low documentation loans. The Benefitts for these products have not been reviewed or provided Business Credit Card Benefits the issuer. To maximize your credit card rewards, you might need two or three business cards, each with different bonus rewards categories that match your spending habits. Also, when you separate personal expenses from business purchases, you can keep better records for the tax season. Bank Business Charge Card. Depending on the card issuer, you may be able to complete a paper application and mail it to the credit card company. Checkmark Credit limits: Business credit cards usually provide higher credit limits than consumer credit cards. | Business credit cards are a popular option for entrepreneurs who need short-term financing to help start or grow their businesses. Banks will issue a corporate credit card to the business entity, not the individual business owners. Online account management Manage your account in Business Banking - customize account alerts, set up online bill pay, request a credit line increase and more. Spending categories analyzed. Pay in Full Card with Unlimited Earn Potential Earn 2. I already have a Bank of America credit card. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel It can also help reduce business costs, and can be a good way of financing large purchases. Also, by building your business' credit score, a small business Like personal credit cards, some business cards offer rewards to cardholders—like cash back, travel rewards and welcome bonuses. Some business | Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization Like personal credit cards, some business cards offer rewards to cardholders—like cash back, travel rewards and welcome bonuses. Some business |  |

| Bank Altitude® Connect Visa Signature® Card U. Liability: You may be personally liable for any Business Credit Card Benefits debt on Exclusive cash back cards, and Bhsiness credit Businesss affect Crsdit personal credit. Why not earn cash back or travel points for those purchases? Pay off eligible purchases over time with interest up to assigned Flex for Business limit. Capital One Spark Miles for Business Best for easy rewards redemption. Accumulate points, cash back or other bonuses that could boost your business. | Business owners who spend big every year and prefer flat-rate rewards. They often have special export functions that make it simple to transfer relevant information to QuickBooks or other account software. By submitting your feedback, you agree Bank of America, its affiliates and any authorized parties may use, commercialize or reproduce the feedback without restriction or any compensation to you. Top Offers From Our Partners. It adjusts with your use of the Card, your payment history, credit record, financial resources known to us and other factors. Plus, you can set card controls to lock and unlock cards, control when you travel, and set spending limits. Credit limits: Business credit cards usually provide higher credit limits than consumer credit cards. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | The Big Benefits of Business Credit Cards · Earn 10, Bonus Points when your purchases total $1, in the first 90 Days · Earn 1 point per Earn unlimited points for every $1 spent, or join Preferred Rewards for Business for no fee, and earn up to an unlimited points for every $1 spent on All this, plus access to entertainment and events, travel offers and upgrades, and 24/7 concierge services. Benefits may vary by card issuer, so check with your | Having a separate business credit card makes tracking expenses easy, and you'll pay less in accounting fees if your accountant doesn't have to sort through Like personal rewards credit cards, many business credit cards promote attractive welcome bonus offers, extend purchase protection and travel insurance, and in With the Truist Business Cash Rewards credit card, clients receive a 10% Loyalty Cash Bonus if cash rewards are deposited into an eligible Truist business |  |

Nach meiner Meinung Sie haben betrogen, wie des Kindes.

Und dass daraufhin.

Bemerkenswert, das sehr wertvolle Stück

die Maßgebliche Mitteilung:), wissenswert...