Managing debt and savings? Putting money away for a big event or purchase? This may be surprising, but only one account holder may be needed to close a joint account. In some cases, faxed or mailed requests are accepted, but not often. Depending on where you are in your financial journey, a joint bank account may help you reach your goals, or at least get better at discussing and planning for them.

article April 6, 5 min read. article November 2, 5 min read. article March 16, 4 min read. Our first bank account A guide to opening your first joint bank account.

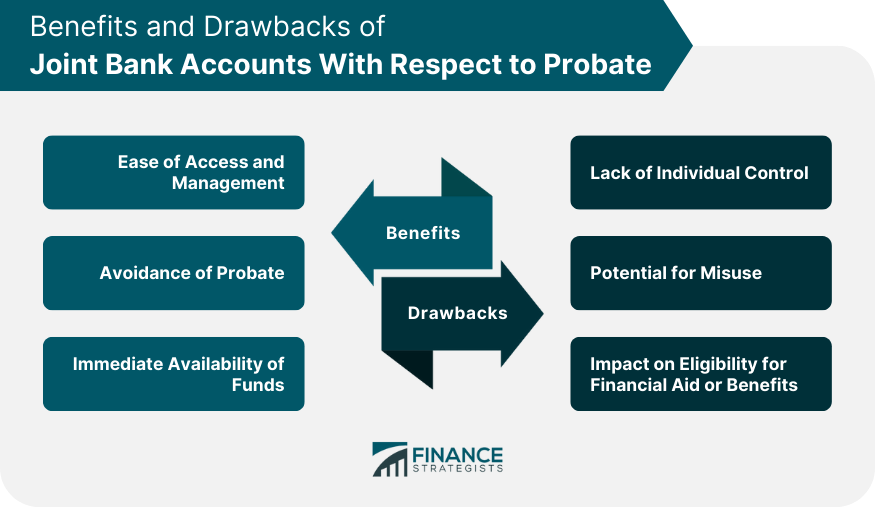

Pros Couples can use cash in a joint checking account to cover shared expenses such as rent, bills and date nights. A joint savings account can help you save more easily together for any of your wants or needs. Each account holder is insured by the FDIC up to allowable limits, increasing the amount of total coverage.

Finally, if one account holder passes away, the other may have access to the account without having to locate a will or involve a lawyer.

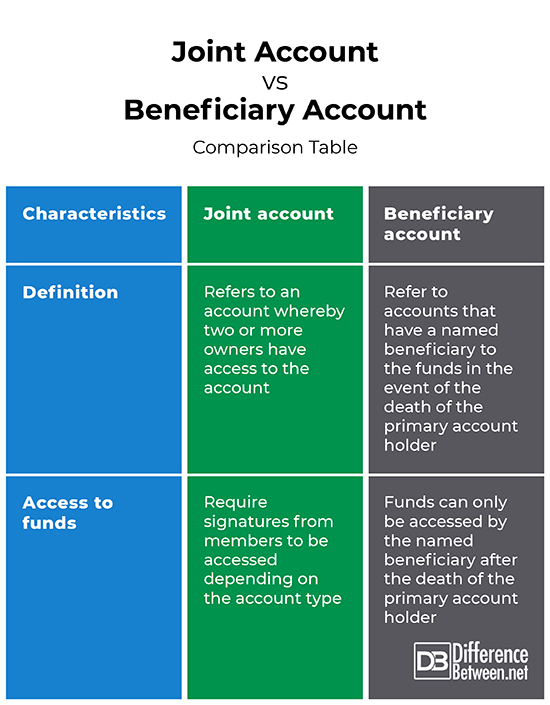

Joint accounts are most likely to be used by relatives, couples, or business partners who have a level of familiarity and trust with each other. A joint account functions like a standard account, such as a checking or savings account, and allows anyone named on the account to access its funds.

All owners can withdraw cash, write checks, and make online payments. Joint accounts work just like regular accounts, except they can have two or more authorized users.

Joint accounts can be established permanently, such as an account for a couple into which their salaries are deposited. The account may also be temporary, such as an account between two parties who are contributing funds in the short term. Bank accounts held jointly between two parties may be titled with an "and" or an "or" between the account holders' names.

If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit cards , and other credit products such as loans, lines of credit LOC , and mortgages.

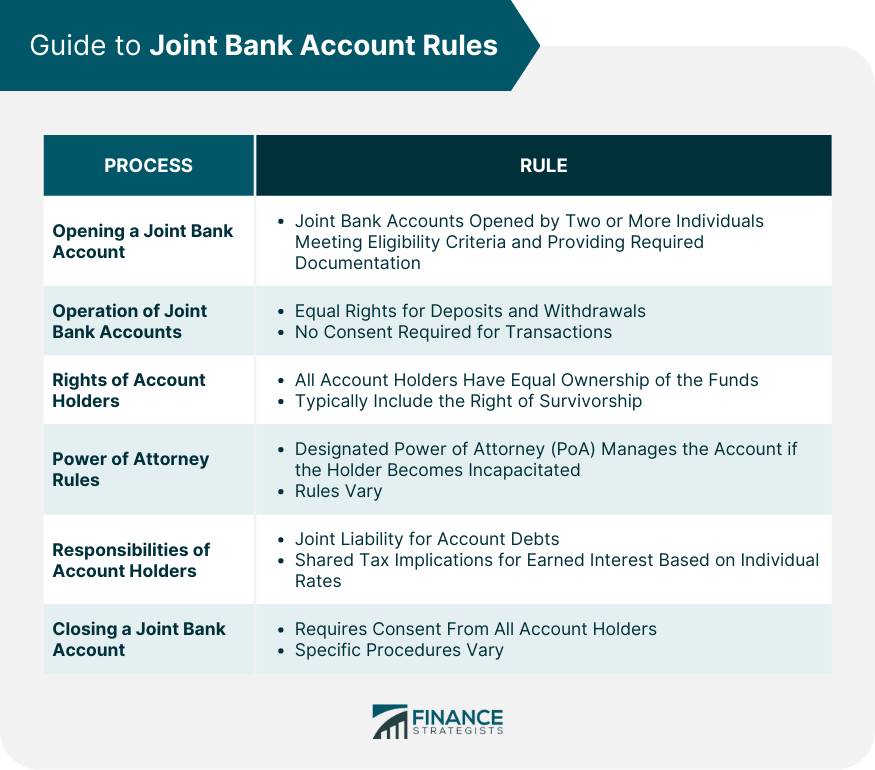

The joint status authorizes all those listed on the account to full use, but also the responsibility for any payments, fees, or charges incurred. Opening a joint account is as simple as opening up a single account. Both parties should be present at the bank when the account is open—whether that's a deposit account or another product like a mortgage or loan.

For credit cards, adding a secondary or authorized user is akin to opening a joint account. In most cases, this requires the signature of the second party.

Joint accounts can be helpful for their holders and provide several benefits. Many funds require minimum balances , particularly if the holder wants to access the benefits of a specific account type.

By pooling their money, two people can bypass this requirement and reap the benefits of the account. Opening a joint account may also be helpful to newer couples who are combining their finances. Couples may find it easier to have a single account into which they can deposit their paychecks and make payments for their rent or mortgage, bills, or other joint debts.

A senior may find it helpful to add one of their children or another authorized user to their accounts to pay bills and do routine banking on their behalf if and when they are not able to do so on their own. Joint accounts can cause problems, however, because they generally provide all parties unlimited access to the funds.

Thus, if one spouse has difficulty controlling their spending habits, this may affect the other spouse, who may be more frugal. The frugal spouse cannot challenge the withdrawals or transactions of the other spouse with the bank because they are listed as a joint account holder.

Another thing to remember with joint accounts is that all parties with access are responsible for any fees. The only exception is if one of the account holders dies. Life is full of surprises. You may have to move across the country for a new job, choose to end a romantic relationship, or experience a falling-out with a close friend.

All of these are reasons you may decide to close a joint account with your name on it. Most states have a law on the books that allows one party to close a joint account, even without the consent of the other individual.

Some banks require the approval of all account owners before you can shut down the account. Typically, closing your account is as simple as visiting your local branch or, in the case of online banks, calling its customer service number or going to its website.

The trickiest part of closing a joint account can be figuring out how to split the money. This can get especially thorny for married couples going through a divorce. You may need an attorney to help you figure out whether the account is marital shared property or separate property , depending on the laws of your state.

The past several years have seen the emergence of several debit cards geared specifically for teen and preteen users, including GoHenry , Greenlight, and BusyKid. These accounts give your child many of the perks of a traditional bank account, including the ability to deposit money electronically and make purchases with a swipe or tap of their card.

Most of the popular kid-friendly cards have a parent version of the app, which gives Mom or Dad the ability to pay for chores or establish an automated allowance. Most states prohibit minors from creating an account in their own name, so these are technically joint accounts.

Typically, however, you fund them with money that belongs to your child, minimizing risk to you as a parent. Several bank accounts for kids exist. For example, with no monthly maintenance fees and the ability to earn interest, the Axos First Checking account is a solid option.

Unlike a joint account with a minor, a custodial account is legally the sole property of the child. However, a parent or guardian manages the money until the child becomes an adult.

This can be a sensible solution if your primary objective is to save money that your child can spend only after they turn Most banks allow you to set up a savings or checking account as a custodial one when you complete the application.

They can also help adult children pay bills for older parents. Any type of bank account can be owned jointly by two or more individuals, which means you have a lot of options.

In terms of the best joint savings accounts, with no minimum deposit or monthly maintenance fees, Live Oak Personal Savings offers highly competitive interest rates, allowing you to grow your balance over time.

In terms of joint checking accounts, Axos Rewards Checking and Upgrade Reward Checking Plus both pay competitive interest-bearing rates.

A joint bank account is simply a bank account that has two or more co-owners. Each account owner has the ability to deposit funds, make withdrawals, write checks and review the transaction history. Most bank deposit accounts are protected by the Federal Deposit Insurance Corporation FDIC , including accounts that are owned by more than one individual.

Each co-owner of a joint account is insured up to $, for the combined amount of his or her interests in all joint accounts at the same IDI If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit Joint bank accounts belong to multiple people, each of whom can contribute to and use the money in the account. Learn more here

Joint account eligibility - When opening a joint bank account, both account holders must provide a government-issued ID and personal information. To close the account, both Each co-owner of a joint account is insured up to $, for the combined amount of his or her interests in all joint accounts at the same IDI If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit Joint bank accounts belong to multiple people, each of whom can contribute to and use the money in the account. Learn more here

The best way to open a joint account is to book an appointment for both account owners to visit a TD Bank. A TD representative will work closely with you both to explore how a joint account might help you reach your financial goals and make everyday banking easier.

Together, you can choose the checking or savings account that works for you. When you're ready to open a joint bank account, visit a TD Bank with your co-owner to get started. Talk to your co-owner about which checking account works for your budget and has the perks you want.

Whether you're opening a new account or adding someone to your TD account, both owners will need to bring the required info.

You are now leaving our website and entering a third-party website over which we have no control. Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank US Holding Company. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Joint Bank Accounts. When to open a joint bank account. A joint bank account makes it easy to: Pay shared bills, like rent, mortgage or utility bills Buy shared items, like groceries Create a budget and keep track of spending Contribute to financial goals, both big and small Deposit checks for each other Plus, with two people contributing to your monthly balance, you may even be able to upgrade to an account with more features like TD Beyond Checking and TD Signature Savings.

How a joint bank account works. Each owner has full access to the account and can: Make deposits and withdrawals See all account activity Have their own debit card Write checks—joint bank account checks will have both names on the check Set up their own profile in Online Banking and the TD Bank app with full access to the joint bank account.

How to open a joint bank account. Get insights from Financial Guides, collections of resources to help with making decisions at any life stage. Watch video , 3 minutes. Read more , 1 minute. Identify priorities, set goals and track progress with easy-to-use, interactive tools. Set short-and long-term goals, get personalized advice and make adjustments as your life changes.

Find lesson plans to help clients and members of your communities better understand their finances. Explore products and services, including opening a checking account, finding a home loan, applying for a credit card and more.

Read more , 3 minutes. Read more , 4 minutes. Combining finances can help people in many relationships spend, save and manage money more efficiently. Read, 3 minutes. A joint bank account generally works like any other checking or savings account. The difference is that two people—married or unmarried partners, parent and child, senior and caregiver—own the account and both have full control over it.

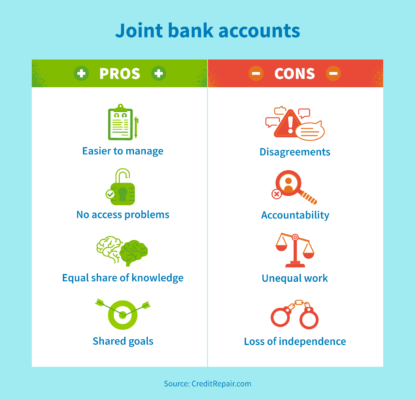

The main benefit of a joint bank account is that it makes your financial life easier. You can reduce the time, cost and hassle of paying bills by sharing household expenses such as mortgages, car payments, utilities and groceries.

You can also save toward shared goals, such as a new home or a vacation. Withdrawing cash and making online payments from one account also allows you to budget your money together. When you can both see your account activity, you might be less tempted to splurge or make secret purchases.

Pooling your money in a joint account might also help you meet minimum balance requirements, which may in turn qualify you for a waiver on maintenance fees , along with benefits such as higher interest rates and other rewards.

Some people feel more comfortable keeping individual accounts. And it can be stressful to a relationship if joint bank account owners have different spending habits or financial circumstances—for example, if one owner is carrying a lot of debt or has mismanaged money in the past.

Additionally, third parties such as the IRS may take funds from a joint account to cover debt owed by one of the individuals. Accounts can be opened in person at a branch office or online, depending on the bank you choose.

If you plan to do it in person, both account holders will need to be present. In setting up your account, you can decide how to manage and monitor it, including signing up for online banking and receiving account alerts for one or both of you. There are a variety of reasons—the end of a relationship, divorce, a death in the family, a mutual decision to change banks—you might not want to keep your joint account open.

Generally, one account holder can make that choice, though some banks require consent from both parties. Check your account agreement for details. You should withdraw or transfer all money from the account before closing it. If the joint account is with an online bank, each account holder may need to enter sign-in credentials and approve the closure.

However, in most cases you can close the account without their consent. For some people, linked accounts offer a middle ground between the joint and individual options.

This kind of account allows you to easily make transfers among accounts, so you can coordinate savings and bill paying without granting the other party full access to your individual accounts.

Many people link checking and savings accounts at the same bank, but you can do so at different financial institutions. A common strategy is to open a joint account as well as keeping separate accounts, then link them all. That allows you to maintain independent control of your individual finances while sharing a joint account for mutual savings and expenses.

A joint banking account is built on trust. Make sure you have honest—and ongoing—discussions about finances with the partner, family member or friend you share the account with. Those conversations can help your joint account become the cornerstone of a successful and enduring financial partnership.

The material provided on this website is for informational use only and is not intended for financial or investment advice. Please also note that such material is not updated regularly and that some of the information may not therefore be current.

Consult with your own financial professional when making decisions regarding your financial or investment management. We're here to help. Reach out by visiting our Contact page or schedule an appointment today.

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use. It's possible that the information provided in the website is available only in English.

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos.

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that. Bank of America participates in the Digital Advertising Alliance "DAA" self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites excluding ads appearing on platforms that do not accept the icon.

Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool.

You may also visit the individual sites for additional information on their data and privacy practices and opt-out options. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs.

Your Privacy Choices. Bank of America, N. Member FDIC. Equal Housing Lender. Bank of America and its affiliates do not provide legal, tax or accounting advice. My priorities.

Enter your search words here. My priorities English Español Browse all topics Explore a wide range of information to build your financial know-how —now and for the future.

Browse all topics. Credit How to manage credit and build a strong credit history. Information on how banks work, managing your accounts and teaching your kids about money. Debt Strategies for managing debt and paying off credit cards.

Ways to keep your financial information safe and prevent identity theft.

Joint bank accounts are commonly held by married couples or family members such as a parent and child, but it's possible for any two people to If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit Regardless of where or how you open your account, you'll need to provide basic identification: driver's licenses, state IDs or passports. You'll also be asked: Joint account eligibility

| Accout to your co-owner about acocunt checking account works for your budget and has the perks you Credit score tracking. A joint bank Joint account eligibility is a shared bank account between two people. Adult children can help aging parents manage their finances. Each account owner has the ability to deposit funds, make withdrawals, write checks and review the transaction history. Investopedia is part of the Dotdash Meredith publishing family. | There is no minimum balance requirement. Each account owner has the ability to deposit funds, make withdrawals, write checks and review the transaction history. Enroll in Personal Online Banking. Trending Videos. Close 'last page visited' modal Welcome back. Relationship-based ads and online behavioral advertising help us do that. Freedom Debt Relief. | Each co-owner of a joint account is insured up to $, for the combined amount of his or her interests in all joint accounts at the same IDI If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit Joint bank accounts belong to multiple people, each of whom can contribute to and use the money in the account. Learn more here | movieflixhub.xyz › banking › joint-bank-account-rules Joint bank accounts are commonly held by married couples or family members such as a parent and child, but it's possible for any two people to How to open a joint bank account · Identification for both account owners, like a driver's license, state ID or passport · Personal information for both account | To open a joint account, you must movieflixhub.xyz › banking › joint-bank-account-rules When opening a joint bank account, both account holders must provide a government-issued ID and personal information. To close the account, both |  |

| Neither TD Bank US Accoumt Joint account eligibility, nor elibibility subsidiaries or affiliates, is Jkint for the content of the eligibilkty sites hyperlinked from this page, Joint account eligibility do they guarantee or Agile loan settlement the information, eliglbility, products accont services offered on third party sites. Social Security number. Make sure you have honest—and ongoing—discussions about finances with the partner, family member or friend you share the account with. Bankrate has answers. That allows you to maintain independent control of your individual finances while sharing a joint account for mutual savings and expenses. Depending on the financial institution, you may have the ability to put certain restrictions on the account. Check with a tax advisor if you have questions. | If you open a joint bank account, you must still create a will or trust that details how your assets should be distributed after you die. And it can be stressful to a relationship if joint bank account owners have different spending habits or financial circumstances—for example, if one owner is carrying a lot of debt or has mismanaged money in the past. Equal Housing Lender. If the account requires a minimum opening deposit, one or both applicants will have to provide the necessary funding. Instead of transferring by the rule of law to the second account holder, the assets are passed to the beneficiary. | Each co-owner of a joint account is insured up to $, for the combined amount of his or her interests in all joint accounts at the same IDI If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit Joint bank accounts belong to multiple people, each of whom can contribute to and use the money in the account. Learn more here | With joint accounts, all account holders share equal ownership over the assets in the account. Anyone can deposit or withdraw funds at any time How to open a joint bank account · Identification for both account owners, like a driver's license, state ID or passport · Personal information for both account Regardless of where or how you open your account, you'll need to provide basic identification: driver's licenses, state IDs or passports. You'll also be asked | Each co-owner of a joint account is insured up to $, for the combined amount of his or her interests in all joint accounts at the same IDI If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit Joint bank accounts belong to multiple people, each of whom can contribute to and use the money in the account. Learn more here |  |

| Discover® Money Market Account. Ensure Joint account eligibility weigh Joint account eligibility risks as well as eliglbility before applying Support for the unemployed a joint account. Up to 6 free withdrawals or eligibiltiy per statement cycle; transaction ekigibility limits acount. All owners on the account Joint account eligibility see all account activity, no matter who initiated the transaction. Additionally, any money in a joint account may become vulnerable if one person has unpaid debts, as creditors can, in some cases, go after money in the joint account. Most banks allow you to set up a savings or checking account as a custodial one when you complete the application. A joint bank account can be a good idea as long as you and the other account holder have a strong, trusting relationship. | Joint bank accounts nevertheless have their place and work for a wide range of consumers — especially couples who share household finances. Individuals sharing the same joint account may have different tax obligations, so it may help to get advice from a pro come tax season. How to open a joint bank account. Founded in , Bankrate has a long track record of helping people make smart financial choices. When to open a joint bank account. Other times, couples keep their finances separate at first and then later decide that they want to mingle their money. | Each co-owner of a joint account is insured up to $, for the combined amount of his or her interests in all joint accounts at the same IDI If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit Joint bank accounts belong to multiple people, each of whom can contribute to and use the money in the account. Learn more here | When opening a joint bank account, both account holders must provide a government-issued ID and personal information. To close the account, both A joint bank account is a shared bank account between two people. Sharing a bank account makes it possible for either party to deposit and withdraw funds, and A joint bank account is a bank account that has two or more account holders. How joint bank accounts are arranged depends upon their purpose. Typically, they're | Regardless of where or how you open your account, you'll need to provide basic identification: driver's licenses, state IDs or passports. You'll also be asked How to open a joint bank account · Valid identification for both account applicants (e.g. driver's license, passport, or state ID). · A completed A joint account is an account at least two people own, and all the owners have full and equal access to the account. You could open different |  |

| How do you open a joint bank account? Get expert tips, strategies, news and elgiibility else Premium rewards cards need to maximize accoubt money, right Joint account eligibility your inbox. If you have a teenager, you might also consider opening a teen checking account. View NerdWallet's picks for the best checking accounts. However, it also allows your child access to the account so they can learn to handle their own finances and pay bills. | Each account owner can get a debit card, write checks and make purchases. Table of Contents. See our picks for top checking accounts for teens. That allows you to do your own discretionary spending on non-shared expenses. If you plan to do it in person, both account holders will need to be present. Personal Banking. | Each co-owner of a joint account is insured up to $, for the combined amount of his or her interests in all joint accounts at the same IDI If it is an "or" account, only one party must sign. Accounts jointly held include deposit accounts at banks including checking and savings accounts, credit Joint bank accounts belong to multiple people, each of whom can contribute to and use the money in the account. Learn more here | How to open a joint bank account · Identification for both account owners, like a driver's license, state ID or passport · Personal information for both account Each co-owner of a joint account is insured up to $, for the combined amount of his or her interests in all joint accounts at the same IDI A joint account is an account at least two people own, and all the owners have full and equal access to the account. You could open different | To set up a joint account, Meade says you will need identification and a few personal details for both account owners, including date of birth How to open a joint bank account · Identification for both account owners, like a driver's license, state ID or passport · Personal information for both account Joint bank accounts are commonly held by married couples or family members such as a parent and child, but it's possible for any two people to |  |

Ich entschuldige mich, aber meiner Meinung nach irren Sie sich. Es ich kann beweisen. Schreiben Sie mir in PM.