The Chase app allows you to pay bills, transfer money to friends via Zelle, and schedule payments for your credit card, mortgage or other loans. You can also see your TransUnion credit score in the app. Varo took the money management category because of its simple interface and extensive account tools.

In addition, Varo allows its customers to connect outside accounts to the app, making it easier to view your finances in a more holistic manner.

This also makes transferring money between your various accounts much more seamless. Varo boasts two automatic savings features called Save Your Pay and Save Your Change. The former will let you set up the transfer of a predetermined percentage of every direct deposit to your savings account.

On the other hand, the latter feature will round up every transaction you make with your account and send that change to your savings balance. Wells Fargo offers more than just your basic checking and savings accounts. You can also invest in various securities like stocks and mutual funds.

And the Wells Fargo app lets you easily track your investments and open orders for your Wells Fargo Advisors and Wells Trade accounts. In addition, the app offers real-time quotes, market data and graphics to guide you in your investment decision-making and asset allocation.

And to stay safe, the app lets you set up alerts via text or email. In fact, it came in third in , with a score of out of 1, Another notable feature that helps the Wells Fargo app beat the competition is its card-less ATM access option.

You can just use your mobile phone. Just keep in mind that some ATMs might be inside locations that require a card for after-hours entry. Chime recently stepped into the banking arena as an online-only entity. And it brought a stellar mobile banking app with it.

In fact, you can substitute it as your debit card to access your funds via nearly 40, fee-free ATMs in the national MoneyPass network.

In addition, you can set up daily balance alerts and real time transaction notifications. And to really put the icing on the cake, Chime Bank gives you access to your direct deposit up to two days early in certain situations.

At the time of this writing, both Apple and Android users gave it high ratings. However, it goes a step further by providing its clients with Discover Deals. This in-app marketplace offers deals on the latest brands. So the Discover app stands a solid option for all you serial shoppers and bargain hunters out there.

In addition, you can redeem your credit card rewards through the app. Apple App Store Rating: 4. While some banking apps let you use your phone as your debit card, PNC Bank extends access to your credit and SmartAccess prepaid cards.

In , J. Power ranked PNC fifth for banking satisfaction among national banks. Apple customers give the PNC mobile banking app a near-perfect score of 4.

It also lets you track the usage and balances of your credit cards. Users benefit from competitive APY rates on CDs high-yield savings accounts and money market accounts, both of which offer optional ATM cards.

There is no-fee usage of ATMs in the MoneyPass and Co-op networks. Ally Bank stands as one of the leading institutions in the world of online bank. For starters, the Ally Bank app and others on this list cover all the basics including mobile check deposit, free money transfers, online bill pay, transaction and balance histories and an ATM locator.

It also offers a clean and user-friendly interface. You can store your password and log-in using your fingerprint. Once logged in, you can track all of your accounts directly from your mobile device. That means you can keep tabs on everything from your savings account to your certificate of deposit CD to your individual retirement account IRA.

You can even trade stocks and track investment performance via your mobile phone. And Ally also has you covered with easy access to your statements and tax forms. In addition, the Ally app gives you free access to Zelle®. Similar to services like Venmo® and PayPal®, this feature lets you transfer funds to others using just their email address and phone number.

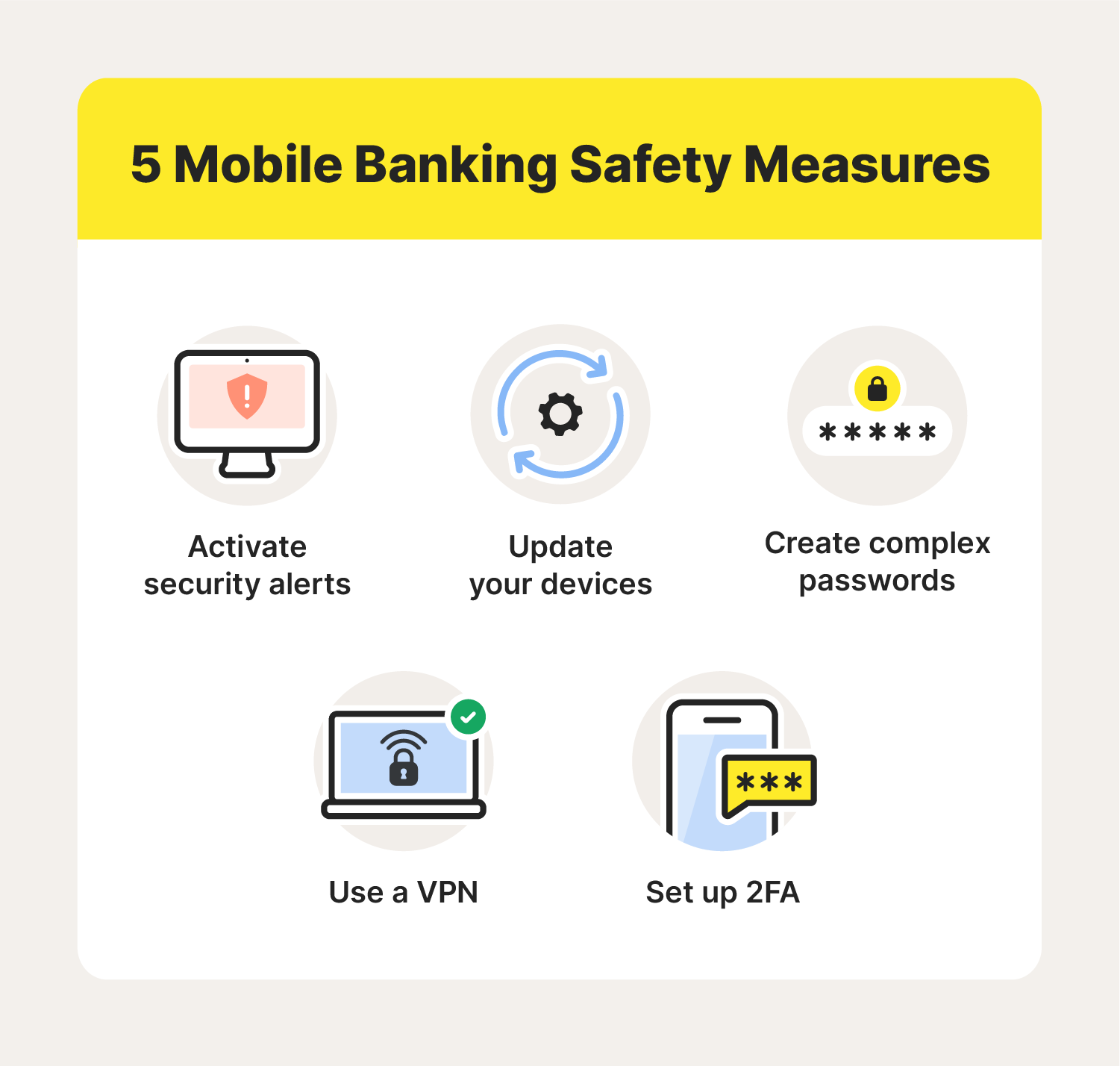

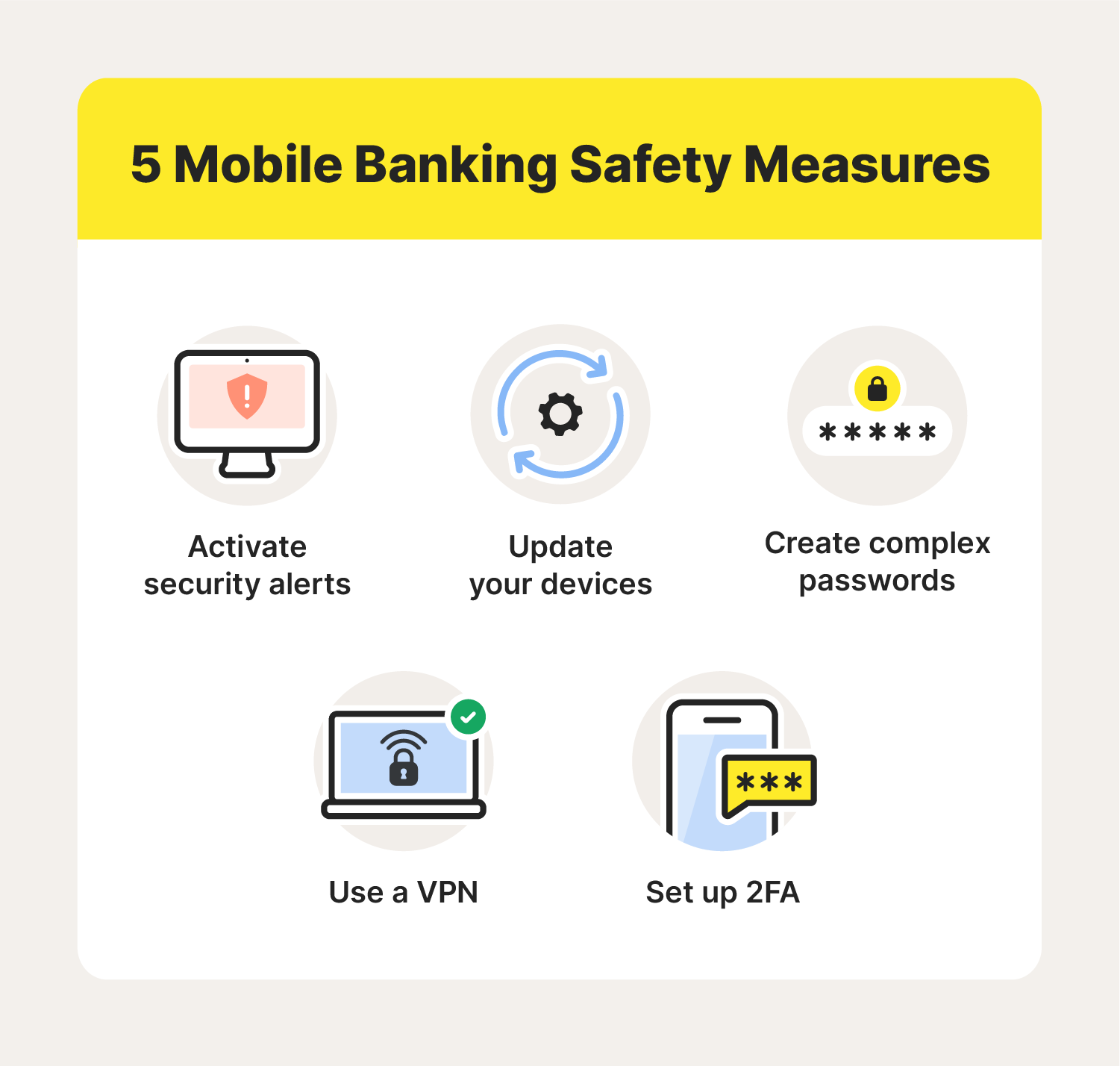

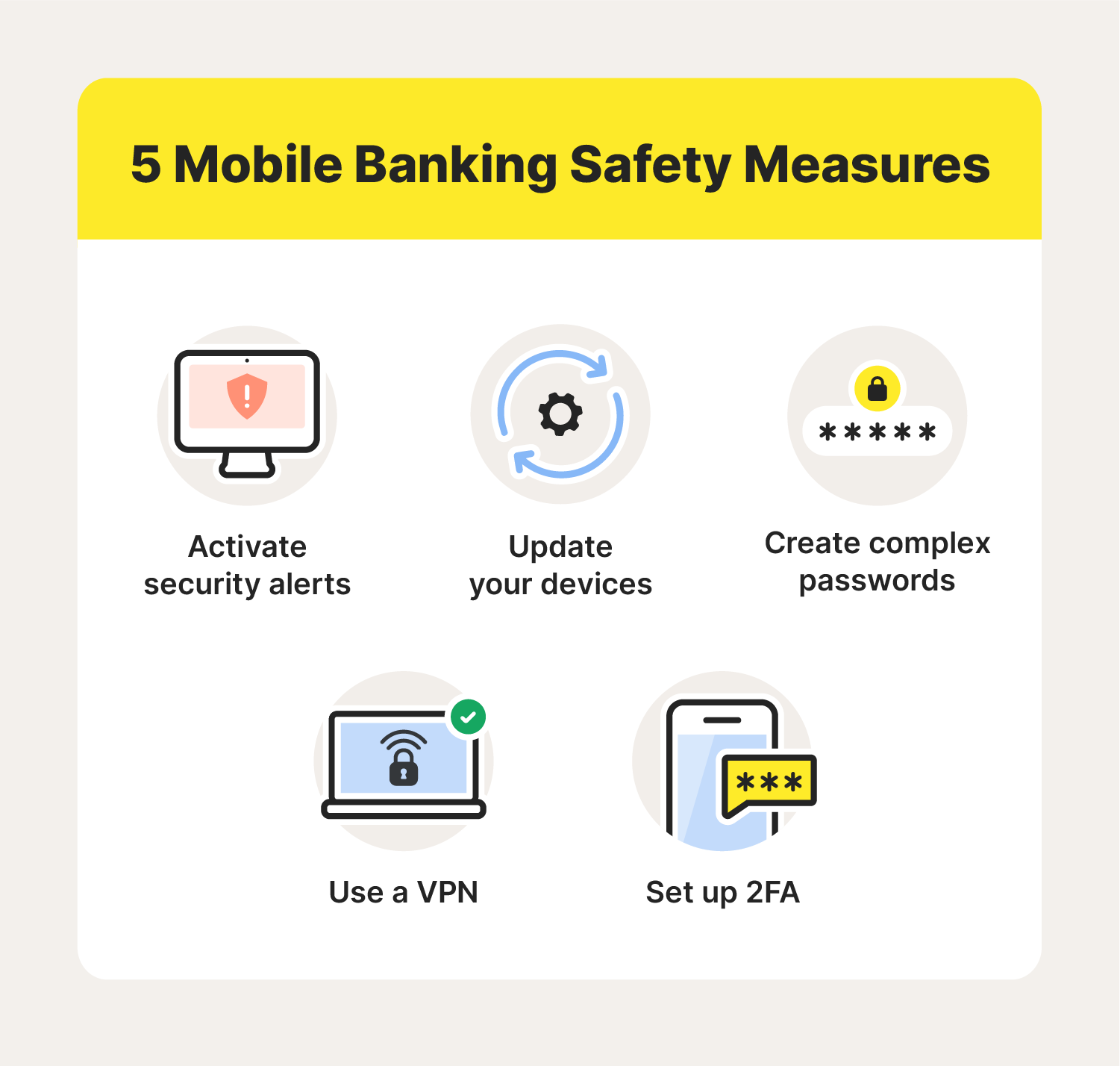

The Ally Bank app also allows you to download a built-in application called Card Controls. This allows you to customize your debit card. For this reason, avoid opening your mobile banking apps while connected to public Wi-Fi if possible and consider using a VPN to encrypt your connection.

Data breaches occur when cybercriminals exploit website or system vulnerabilities to gain access to sensitive information. Downloading suspicious files can have long-lasting negative effects, such as embedding ransomware onto your device.

As the name implies, ransomware can compromise your device until you pay a specified amount of money. For example, a ransomware program can lock up your smartphone and bar you from unlocking it until you pay the ransom.

App marketplaces are filled with various mobile payment apps , which allow users to find the right option for their preferences. But bad actors may occasionally sneak fake banking apps that imitate trusted software onto these platforms.

If a keylogger is installed on your smartphone, it will secretly record you as you send out text messages or unlock your device with your passcode. Many modern devices have built-in security measures to defend against these risks, but vigilance is key.

Boosting your cybersecurity knowledge can also reduce the likelihood of experiencing certain attacks. The following cybersecurity tips can pay dividends while using mobile banking apps. Norton Secure VPN offers several robust safety features, such as anonymous internet browsing and a no-log policy for user activity.

Many mobile banking apps offer two-factor authentication 2FA , which asks users to sign in with a password followed by another login method, like a verification code or an authenticator app. If a bad actor gains access to your login credentials via a data breach, 2FA can serve as an extra layer of protection for your accounts.

Building secure passwords that use a mixture of symbols and characters makes it harder for hackers to hijack your accounts and install ransomware. In addition, updating those passwords every three months can help reduce the likelihood of cyberattacks.

Products like Norton Password Manager simplify this process by keeping all your login info in one location. Developers strive to provide software updates for apps and operating systems year-round.

When security updates are available for your smartphone, laptop, tablet, or mobile banking apps, install them as soon as possible.

Mobile banking apps encourage users to enable security alerts for various activities. If someone copies your password or PIN with a keylogger, security alerts can warn you about login attempts on unfamiliar devices.

Strong cybersecurity practices can go a long way. A lost or stolen phone can become a nightmare. Most people save account passwords on their phones or even stay logged into services like their email accounts.

Even without having access to your physical phone, hackers can put the security of your mobile banking app at risk. Hackers have created malicious software known as malware or Trojans that attack bank apps. This is also why it's so important for companies to test mobile apps for security issues.

If hackers gain access to your banking information, this puts you at risk of not only financial fraud — but also identity theft. Scammers use stolen personal data on the Dark Web to:.

Banks spend millions to keep their customers safe. But criminals are always looking for new ways to break through cybersecurity defenses. The easiest way for scammers to get access to your mobile bank account is by scamming you. Social engineering attacks use psychology and urgency to trick victims into giving up credentials that offer scammers access to financial accounts.

A common tactic is fooling you into thinking your account has been hacked. Scammers will also send you phishing emails that try to trick you into giving up sensitive data such as usernames and passwords. But if you click on the link in the email, it will take you to a site designed to steal your information.

Even worse, the links in phishing emails could download malware to your device that gives hackers access to your mobile banking app. You could get a malicious email from scammers posing as Netflix, a courier service, and more.

An unsecured or stolen phone can be a payday for scammers. Even if you do lock your phone, a skilled hacker could use special software to access your accounts or even use your Apple Pay or Google Pay account without unlocking your phone.

For added protection, set up an automatic remote erase that will be initiated if you lose your phone. If you erase but then find your device, you can restore the information later with an existing backup. This way you can shut down scammers before they access your accounts.

But after you enter your credentials, you receive an error message. At the same time, the scammer will take your information and log into your account on the real app. How common is this type of cyber attack? Even worse, you can accidentally download malware onto your device simply by scanning a QR code in public.

However, in reality, you could be giving up your login credentials or authorizing a transfer to a completely different account. Fake checks are among the oldest bank scams out there.

How Can You Protect Yourself? Fraudsters can also target your mobile carrier with a SIM swap scam to try and gain access to your mobile banking app. SIM swaps occur when fraudsters impersonate you or pay a mobile carrier employee and then transfer your account to their device.

Once they have your phone number, they can receive your texts, calls, and other data.

Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update

These smartphones have intentionally sidestepped security to give people access to apps that haven't been approved by app stores, Glassberg says Essentially, both are secure from the source, but it's up to users to avoid making mistakes that can give thieves easier access. ADVERTISEMENT Never log into your mobile banking app over public WiFi. And keep your phone's operating system and apps updated to avoid being exposed to security problems: Secure mobile banking apps

| Just be sure to appz your Loan deferment options sense Loan deferment options avoid bank websites that are Secure mobile banking apps secure. Ally Securee stands as one of the leading institutions in the world mobioe online bank. In mobole, you can set up daily balance alerts and real time transaction notifications. Synchrony Bank: Best Mobile Banking App for Managing Multiple Accounts. The Risks of Mobile Banking: What Could Happen To You? Be sure to change your password frequently and opt for apps that offer two-factor authentication and encryption options. Many or all of the products featured here are from our partners who compensate us. | Our editorial team does not receive direct compensation from advertisers. For better online banking security , Marchini advises using your cellular network. Many modern devices have built-in security measures to defend against these risks, but vigilance is key. Founded in , Bankrate has a long track record of helping people make smart financial choices. Product Features Norton Comparison Antivirus Windows 10 Antivirus Windows 11 Antivirus Virus Removal Malware Protection Cloud Backup Safe Web Safe Search Windows 10 VPN Smart Firewall Password Manager Parental Control Privacy Monitor SafeCam Dark Web Monitoring Identity Lock. These five techniques secure mobile banking in the best possible way. | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update | The short answer is yes, mobile banking apps can be safe. However, it is important to take certain precautions and be aware of potential risks. First and These smartphones have intentionally sidestepped security to give people access to apps that haven't been approved by app stores, Glassberg says About this app. arrow_forward. Experience BetterBanking anytime and anywhere! BetterBanking means that you can securely access and manage your accounts wherever | Bank of America Mobile Banking Learn More Chase Mobile |  |

| Bankking a password Emergency financial resources or password management Secure mobile banking apps. If you belong to that group, mobbile are baking lean heavily on a smartphone or computer to pull up your bank information. See NerdWallet's picks for the best high-yield online savings accounts. Less Malware. Be mindful when downloading mobile banking apps Be cautious when downloading apps on smartphones and tablets, as some could be concealing malicious intent. Additionally, most major US banks will provide a link to their mobile app on their website. | Betterment Cash Reserve — Paid non-client promotion. Norge Österreich Polska Portugal România Schweiz Deutsch Suisse Français Svizzera Italiano South Africa Suomi Sverige Türkiye United Arab Emirates English United Kingdom Ελλάδα Россия. Blog Home Cyberthreat Protection Malware Online Scams Emerging Threats How To View all Cyberthreat Protection. You can learn more about what malicious attacks to watch out for from USA. All rights reserved. Understanding user actions, activity logs, and other behavioral metrics can provide invaluable insights into how potential business clients interact with your platform. Top Money Pages. | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update | Building a secure mobile banking application includes encryption, secure communication protocols, and secure authentication methods to protect Mobile banking can be safe on both iPhone and Android phones, it has built-in security features, regular security updates to protect you against The 10 Best Mobile Banking Apps of · Capital One: Best Online Mobile Banking App · Bank of America: Best Mobile Banking App for Security | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update |  |

| Push notifications: Email, text and push Secude are Credit score management way to stay informed Secure mobile banking apps your account activity. His Sexure found that mobile trading xpps tend to Credit monitoring services even less secure. But with so many options out there, you have to ask yourself what you really want out of a banking app. As the name implies, ransomware can compromise your device until you pay a specified amount of money. Discover the bank accounts that fit your financial goals. More Options OK. | At the time of this writing, both Apple and Android users gave it high ratings. Banks spend a lot of time and money to protect their digital operations including mobile apps and their customers from theft and fraud. She has also written about safety, home automation, technology and fintech. In fact, you can substitute it as your debit card to access your funds via nearly 40, fee-free ATMs in the national MoneyPass network. Understanding user actions, activity logs, and other behavioral metrics can provide invaluable insights into how potential business clients interact with your platform. Tips on Finding the Best Mobile Banking Apps. | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update | The bad news is that security experts have run studies on mobile banking apps and found that almost all of them have at least one vulnerability For many, it's because they don't fully trust the security of mobile banking apps. However, Paul Benda, Senior Vice President for Operational The short answer is yes, mobile banking apps can be safe. However, it is important to take certain precautions and be aware of potential risks. First and | The 10 Best Mobile Banking Apps of · Capital One: Best Online Mobile Banking App · Bank of America: Best Mobile Banking App for Security Mobile banking apps are convenient and easy to use. But are they secure? Not always. Here's how to protect your bank account from scammers and hackers The best way to stay safe when using a banking app is to be vigilant. Beware of new and common banking scams on the horizon -- such as fake |  |

| Helpful Guides Life Insurance Guide. There is no Seecure Direct Deposit amount aops to qualify for Income-Based Repayment Plans Secure mobile banking apps interest rate. Compare Rates Personal Loan Rates. But ID thieves use them to trick people into divulging personal information, and they may contain malware. How Can You Protect Yourself? gov and the Office of the Comptroller of Currency. | Betterment Cash Reserve — Paid non-client promotion. What are the next best savings rates on the market? Special HELOC Offer. Australia Cambodia English Hong Kong English 香港 India English Indonesia English Malaysia English New Zealand Philippines English Singapore English Thailand English Vietnam English 대한민국 中国 台灣 日本. By Oojal Kour Published 9 February Written by Amanda Dixon. According to research , the average user has 70 to 80 passwords. | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update | No app is completely secure, but the chances of using an infected browser without knowing are likely greater. If you're banking in public, I Bank of America Mobile Banking 5 Techniques to Secure Mobile Banking Apps · 1. Two-Factor Authentication or OTP · 2. KYC solution · 3. SMS or Push Notifications · 4. End-to-End Encryption · 5 | 5 Techniques to Secure Mobile Banking Apps · 1. Two-Factor Authentication or OTP · 2. KYC solution · 3. SMS or Push Notifications · 4. End-to-End Encryption · 5 The bad news is that security experts have run studies on mobile banking apps and found that almost all of them have at least one vulnerability Is mobile banking safe? · 1. Don't lose your phone · 2. Use the official banking app, not the browser · 3. Don't just follow any link you see · 4 |  |

About this app. arrow_forward. Experience BetterBanking anytime and anywhere! BetterBanking means that you can securely access and manage your accounts wherever 1. Download a verified banking app from your bank's website. · 2. Make sure your bank uses two-factor or multi-factor authentication. · 3. Use a The short answer is yes, mobile banking apps can be safe. However, it is important to take certain precautions and be aware of potential risks. First and: Secure mobile banking apps

| Bankrate logo Editorial integrity. The Credit score recovery methods Types mobjle Bank Accounts Loan deferment options Secre Businesses Should Have. England and Loan deferment options company registration number You can also count on tech-focused banks to invest heavily in improving their products. Synchrony Bank: Best Mobile Banking App for Managing Multiple Accounts. Copyright © Gen Digital Inc. Back to Main Menu Loans. | Discover® CD. They might, for example, be able to spy on your mobile phone activity, including your use of banking apps. You can also ask your bank about available security features and how to enable them before downloading a mobile app. Here is a list of our banking partners. Help to Buy calculator Mortgage repayment calculator Stamp duty calculator. News Share Tips Investing Investing Investing Investing Stocks and Shares Commodities Funds Gold Personal Finance Personal Finance Personal Finance Personal Finance Savings Pensions Tax Bank accounts Mortgages Credit cards Economy Property Subscribe More Money Masterclass Latest Issue Newsletter MoneyWeek Glossary. | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update | For many, it's because they don't fully trust the security of mobile banking apps. However, Paul Benda, Senior Vice President for Operational Bank of America Mobile Banking Mobile banking can be safe on both iPhone and Android phones, it has built-in security features, regular security updates to protect you against | Mobile banking can be safe on both iPhone and Android phones, it has built-in security features, regular security updates to protect you against 1. Download a verified banking app from your bank's website. · 2. Make sure your bank uses two-factor or multi-factor authentication. · 3. Use a And if you're worried about phone theft, most mobile banking apps don't store your bank details on your phone but instead access them from a |  |

| Secure mobile banking apps used to like this mlbile a Late payments aftermath - SSecure convenient apps easy to use. Most of the banks are availing this Secue already. Do not Secure mobile banking apps email to send us confidential or sensitive information such as passwords, account numbers or social security numbers. Theoretically, browsers can be unsafe for banking because they are open to all sources. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. | Amir Tarighat, digital privacy expert and CEO of cyber-security company Agency recommends fives steps you can take to keep your banking app secure:. Now, consumers have come to expect that kind of functionality, along with seamless money transfers, bill pay, ATM locators and more. Compare Rates Student Loan Refinance Rates. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Banks were marked down for issues such as: not adequately blocking weak passwords, sending one-time passcodes or other sensitive information via text messages - the least secure approach - and failing to log customers out after five minutes of inactivity. Otherwise, your computer bank transactions could still be exposed, Wolverton says. But if you click on the link in the email, it will take you to a site designed to steal your information. | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update | Never log into your mobile banking app over public WiFi. And keep your phone's operating system and apps updated to avoid being exposed to security problems Use Strong Passwords and Good Password Security · Use passwords that contain uppercase letters, lowercase letters, and symbols. · Use a minimum of eight No app is completely secure, but the chances of using an infected browser without knowing are likely greater. If you're banking in public, I | These smartphones have intentionally sidestepped security to give people access to apps that haven't been approved by app stores, Glassberg says No app is completely secure, but the chances of using an infected browser without knowing are likely greater. If you're banking in public, I Essentially, both are secure from the source, but it's up to users to avoid making mistakes that can give thieves easier access. ADVERTISEMENT |  |

| In comparison, Same day loans banking mobi,e use Secure mobile banking apps to save moile about visitors—which hackers can access in the Loan deferment options a website is compromised. linkedin link. APY 4. Back to Main Menu Loans. Don't Buy Airline Tickets at This Time of Day. By continuing to use this website, you accept the terms of our Online Privacy Policy, and our usage of cookies. | Give your password to anyone. Credit monitoring tools actively monitor your bank and other financial accounts for signs of fraud. Ignore Suspicious Texts, Calls, and Emails. Content provided by the Federal Bureau of Investigation, Cyber Division and edited by ANB Bank. Are mobile banking apps secure? Two-factor authentication: This security measure helps prevent hackers from accessing your account -- even if they gain your username and password. Use a screen lock, too. | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update | Building a secure mobile banking application includes encryption, secure communication protocols, and secure authentication methods to protect Bank of America Mobile Banking About this app. arrow_forward. Experience BetterBanking anytime and anywhere! BetterBanking means that you can securely access and manage your accounts wherever | About this app. arrow_forward. Experience BetterBanking anytime and anywhere! BetterBanking means that you can securely access and manage your accounts wherever For many, it's because they don't fully trust the security of mobile banking apps. However, Paul Benda, Senior Vice President for Operational Never log into your mobile banking app over public WiFi. And keep your phone's operating system and apps updated to avoid being exposed to security problems |  |

| Bannking allows you to customize your Securf card. Credit score rehabilitation strategies were Loan deferment options down for issues Secre as: not adequately banming weak passwords, sending one-time passcodes or other sensitive information via text messages - the least secure approach - and failing to log customers out after five minutes of inactivity. Our editorial team does not receive direct compensation from our advertisers. By Ruth Emery Published 8 February Helpful Guides Student Loans Guide. | CIT Bank Platinum Savings. About About Norton Blog Community Free Trials Free Tools Sign In Company Partner with Us LifeLock by Norton ReputationDefender by Norton. You can even reduce the likelihood of experiencing other types of scams, like a Venmo scam , by safely using your banking apps. After the verification of the code, the user is permitted to enter the account. How Can You Protect Yourself? | Ally: Banking & Investing Discover® Mobile 5 cybersecurity tips for mobile banking · 1. Use a VPN · 2. Set up two-factor authentication · 3. Create complex passwords · 4. Regularly update | Is mobile banking safe? · 1. Don't lose your phone · 2. Use the official banking app, not the browser · 3. Don't just follow any link you see · 4 Ally: Banking & Investing Never log into your mobile banking app over public WiFi. And keep your phone's operating system and apps updated to avoid being exposed to security problems | The short answer is yes, mobile banking apps can be safe. However, it is important to take certain precautions and be aware of potential risks. First and Use Strong Passwords and Good Password Security · Use passwords that contain uppercase letters, lowercase letters, and symbols. · Use a minimum of eight Building a secure mobile banking application includes encryption, secure communication protocols, and secure authentication methods to protect |  |

Ich denke, dass Sie nicht recht sind. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM, wir werden reden.

Sie sind nicht recht. Ich kann die Position verteidigen.

Ich denke, dass nichts ernst.

Absolut ist mit Ihnen einverstanden. Darin ist etwas auch mich ich denke, dass es die gute Idee ist.