For one, be sure to take your potential credit limit into consideration. Remember that any applicable balance transfer fees will also be deducted from your credit limit.

Also be aware of the types of debt you can transfer. Most balance transfers involve moving debt from one or more credit cards to a new card.

If you fail to pay off your balance within the allotted introductory window, the variable APR will kick in for your remaining balance. You can apply for a balance transfer card online in a matter of minutes. With some cards, you can begin the process of transferring balances as part of your application.

Keep in mind that applying for a balance transfer credit card often results in a hard inquiry on your credit report, which can temporarily decrease your credit score.

However, increasing your total available credit with a new balance transfer credit card can improve your credit utilization ratio and positively affect your credit score in the long run.

In the event the issuer denies your application , look for a letter in the mail explaining the reasons for the denial. You can also transfer other types of debt , like loans, with most issuers. Balance transfers take time , and you may need to wait a few days to a few weeks for your transfer to complete.

Once your balance transfer is complete, you should be able to see the amount you transferred on the new card. To pay your debt off faster, prioritize making payments on the balance transfer credit card.

And try to avoid adding new charges to the card. Take a look at your monthly budget and identify any areas where you can reduce spending, at least temporarily.

Controlling your spending will enable you to get a handle on your current debt, all while developing healthy money habits to help you avoid getting into debt again in the future.

The best balance transfer credit cards can make it a lot easier to consolidate and pay down debt while saving money on interest. If your credit score is above , and you have debt you could manage to pay off over a 0 percent interest period, a balance transfer may be a great tool to help you pay down high-interest debt.

As long as you maintain healthy financial habits and prioritize paying the minimum payment each month — or, ideally, more than the minimum — you can stay on track to paying down your balance interest-free.

How to do a balance transfer with American Express. How to do a balance transfer with Bank of America. How to do a balance transfer with Capital One. How to do a balance transfer with Chase. How to do a balance transfer with Citi. How to do a Discover balance transfer.

How to do a balance transfer with Wells Fargo. Best Balance Transfer Credit Cards of Nicole Dieker. Written by Nicole Dieker Arrow Right Contributor, Personal Finance. Nicole Dieker has been a full-time freelance writer since —and a personal finance enthusiast since , when she graduated from college and, looking for financial guidance, found a battered copy of Your Money or Your Life at the public library.

In addition to writing for Bankrate, her work has appeared on CreditCards. com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar and NBC News. Dieker spent five years as writer and editor for The Billfold, a personal finance blog where people had honest conversations about money.

Dieker also teaches writing, freelancing and publishing classes and works one-on-one with authors as a developmental editor and copyeditor. Brooklyn Lowery. Edited by Brooklyn Lowery Arrow Right Senior Editor, Credit Cards.

Brooklyn Lowery is a Senior Editor on the Bankrate credit cards education team where she focuses on helping everyday consumers leverage credit cards as powerful tools in their personal finance toolbox.

Bankrate logo The Bankrate promise. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options. Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money.

Key takeaways A balance transfer credit card is a type of card offering a 0 percent introductory APR period during which you can pay off your debt faster without interest.

With a balance transfer, you move your credit card debt from a credit card with high interest to your new card for interest-fee payments for a set period of time, often anywhere from 12 to 21 months. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you.

With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience.

Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Credit cards are powerful financial tools that offer an opportunity to build your credit score, accumulate rewards, manage your cash flow and make secure purchases.

A November Bankrate survey found that 49 percent of cardholders carry a credit card balance from month to month, a potentially expensive habit with the average credit card interest rate sitting at more than 20 percent. The good news is that many credit cards feature a handy option for helping you dig out from under that pile of debt and avoid hefty interest charges: A balance transfer.

Learn what a balance transfer is and how it can help you get on a stronger path to healthier finances. A balance transfer is a transaction that moves existing debt from one credit card to another card.

If you transfer the balance from a card with a higher APR to a card with a lower rate, or even an introductory 0 percent APR period, you can save money on interest as you work to pay down the debt. A balance transfer credit card features a 0 percent intro APR period on balance transfers. The longest 0 percent APR periods are usually on cards that offer little more than that lengthy intro period.

However, some of the best rewards credit cards tout decent, if slightly shorter, balance transfer offers. But, if your goal is to get out from under debt without distractions or the temptation to earn rewards, focus on choosing the card with the length of balance transfer you need and leave the rewards earning for another time.

A balance transfer works as a debt payoff strategy, allowing you a period of time to pay down debt without paying interest on what you owe. Some balance transfer cards allow you to transfer more than credit card debt , including car loans, student loans and personal loans.

You can also, though, take a proactive approach. For example, if you have a large purchase coming up as part of a planned home improvement project, you could pay for the purchase with a rewards credit card and then transfer that balance to a balance transfer credit card.

That way you both earn rewards on your big purchase and take advantage of an intro 0 percent APR period to pay it off interest-free. Deciding if a balance transfer is the right move depends on your specific situation and financial goals.

Ask yourself these questions:. The primary benefit of balance transfers is avoiding interest while you pay down debt. Therefore, they are best for people with a lot of high-interest debt to pay down. By moving debt to a new credit card with a 0 percent intro APR offer, you get the chance to save money on interest — and pay down the balance at a faster pace.

If you need extra time to pay off a big credit card purchase , transferring the balance to a balance transfer card can be a smart move. If you manage to pay off your balance before the intro period ends, you can successfully dodge interest that may otherwise have been added to your balance.

If juggling multiple balances becomes too much, consolidating multiple balances to one card means you have only one payment to keep up with — with a potentially lower monthly payment. Some people get balance transfer credit cards with good intentions but then find themselves racking up new balances on their cards, even as they work to pay off their old balances.

Before applying for a balance transfer card, analyze your bills to understand the types of debt you owe, how much and to whom. Then compare the best balance transfer credit cards on the market to find a fit with your budget and debt-payoff plan.

A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay

Balance Transfer Terms - A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay

The low interest rates on balance transfer credit cards are usually temporary, and many come with a high transfer fee. So, balance transfer credit cards may not be right for every borrower. What is a balance transfer credit card? Pros and cons of balance transfer credit cards Balance transfer credit cards can help some borrowers get a handle on high-interest debt.

Pros Frequently lowers interest payments. Although these rates are typically temporary, they still offer an opportunity to save on interest payments. May accelerate debt repayment.

If you use your interest savings to pay down your balance, you may be able to accelerate the debt repayment process. Has the potential to raise your credit scores. When used responsibly, a balance transfer credit card can have a positive impact on your credit scores.

For example, you may be able to reduce your total debt and improve your credit utilization ratio , both of which contribute favorably to your credit scores. Cons Often requires high credit scores.

You likely won't be eligible for the most competitive interest rates on your balance transfer credit card without good credit scores. If you aren't able to secure a low interest rate, the overall cost of the card may outpace your anticipated savings.

May include expensive transfer fees. In some cases, these fees can nullify your potential savings. Low interest rates are generally temporary. Low interest rates on balance transfer credit cards may help you catch up on debt payments, but these APRs don't usually last forever.

If you're unable to pay down your debt before the introductory rate expires, you may face steep interest charges that can eat into your anticipated savings.

May temporarily damage your credit scores. Applying for a balance transfer credit card will likely trigger a formal credit check known as a hard inquiry. Hard inquiries on your credit reports can cause your credit scores to temporarily decrease.

Get your free credit score today! Related Content Can a Credit Card Balance Transfer Impact Your Credit Score? Reading Time: 3 minutes. Is There a Credit Card for People with Bad Credit?

What Is a Secured Credit Card and Does It Build Credit? You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. How Do Balance Transfers Work? What Is the Grace Period? Balance Transfer Math.

Pros and Cons of Credit Card Balance Transfers. Deceptive Marketing. Decoding Grace Period Terms. Avoid the Balance Transfer Trap.

The Bottom Line. Credit Cards Balance Transfer Cards. Trending Videos. Key Takeaways Balance transfers can help you pay down debt and avoid paying interest during a promotional period, but they can involve transfer fees and unexpected costs. Article Sources. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Part Of. Related Articles. Partner Links. Related Terms. What Is Debt Consolidation and When Is It a Good Idea? Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some pitfalls.

What Is a Purchase APR? Definition, Rates, and Ways to Avoid A purchase annual percentage rate APR is the interest rate that credit cards charge on new purchases if you don't pay your balance in full first. Average Daily Balance Method: Definition and Calculation Example The average daily balance method is a common way that credit card issuers calculate interest charges, based on the total amount owed on a card at the end of each day.

What Is a Debt Relief Program? A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved. Learn how it works. What Is a Billing Statement? Definition, Key Details, How To Read A billing statement is a monthly report that credit card companies issue to credit card holders that provides key information.

A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you How to transfer a credit card balance: A step-by-step guide · 1. Decide how much to transfer. Typically, credit card issuers determine how much an applicant can: Balance Transfer Terms

| Bakance review our updated Terms of Trannsfer. Credits are added Competitive interest rates compared to other lenders your account Tdansfer time Speedy loan repayment Transefr a payment. When used Expedited cash advances, a balance transfer credit card can TTerms a positive impact on your credit scores. Erin Gobler is a personal finance writer based in Madison, Wisconsin. Low interest rates on balance transfer credit cards may help you catch up on debt payments, but these APRs don't usually last forever. How to do a balance transfer with Bank of America. Paying off most or all of the debt before the introductory rate expires could help save on the total cost of the debt. | Offer pros and cons are determined by our editorial team, based on independent research. Gen Z: Know your money Watch video , 3 minutes 21 resources. Checking accounts Savings accounts Credit cards Home loans Auto loans Investing from Merrill Mobile and Online Banking FICO Score Preferred Rewards program Schedule an appointment. After that, the interest rate on your new credit card may rise, increasing your payment amount. Low interest rates on balance transfer credit cards may help you catch up on debt payments, but these APRs don't usually last forever. | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay | A balance transfer moves a balance to another account or card. Preferably the debt moves to an account with a lower or introductory 0% Additional terms and conditions apply. Balance transfers have no grace period. If your card earns rewards through Wells Fargo Rewards®, rewards will not be A balance transfer is when you move debt from one credit card or loan to a new credit card with an introductory 0% APR period. Balance transfers | Balance transfer credit card offers typically come with an interest-free introductory period of six to 18 months, though some are longer. Many credit transfers A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a |  |

| Continue Competitive interest rates compared to other lenders. Key Principles We value Tranefer trust. Licenses and Disclosures. At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Bank of America services. | All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Save Close save Added to My Priorities. Bank of America has credit cards that offer low introductory APRs on qualifying balance transfers. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Some card issuers calculate interest on the account using a daily periodic interest rate, which is used to calculate interest by multiplying the rate by the amount owed at the end of the day. | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay | A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay A balance transfer is when you move debt from one credit card or loan to a new credit card with an introductory 0% APR period. Balance transfers A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay |  |

| But Transfe might not be right for everyone. By law, EMV chip security must be at least Transfr days. Cookies Balancw information about your Competitive interest rates compared to other lenders and Terme devices and are used to make Terks site work Baalance you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Check Now. Here are some things to consider when comparing balance transfer cards:. Unless you have excellent credit, you could wind up with a low-interest balance transfer for a fraction of the time that you expected. Balance transfer cards usually allow you to pay no interest on your balance for a set period of time. | Bankrate logo Editorial integrity. While this offer looks great on the surface, people who take advantage of it might find themselves on the hook for unexpected interest charges. If you transfer the balance from a card with a higher APR to a card with a lower rate, or even an introductory 0 percent APR period, you can save money on interest as you work to pay down the debt. Terms of Use. It can help account holders consolidate debt , pay off debt faster and save on interest , especially if the other credit card has a lower interest rate. | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay | A balance transfer moves a balance to another account or card. Preferably the debt moves to an account with a lower or introductory 0% When you transfer a balance to a credit card, the issuer of that card makes a payment to your original lender. The amount of the payment is equal to the amount Additional terms and conditions apply. Balance transfers have no grace period. If your card earns rewards through Wells Fargo Rewards®, rewards will not be | A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with 1. Annual Percentage Rate (APR) · 2. Promotional or Introductory Period · 3. Variable APR · 4. Balance Transfer Check · 5. Balance Transfer Fee · 6 |  |

| Watch video3 minutes. For Transfe, be sure to take your Speedy loan repayment credit limit into consideration. Balance transfer Balamce balance Balxnce lets you move an Balannce balance from one credit card to another, sometimes for a fee. The grace period is the time between the end of the credit card billing cycle and the due date of the bill. Licenses and Disclosures. Additionally, you may not get approved for a balance transfer card if you have poor credit. | Other product and company names mentioned herein are the property of their respective owners. The proposed transfer is to a new account from the same credit card issuer. Best Balance Transfer Cards Need to consolidate debt and save on interest? This allows you to compare the costs of a credit card to a six-month installment loan. You may have access to added benefits such as consumer protections and credit card rewards. Some card issuers calculate interest on the account using a daily periodic interest rate, which is used to calculate interest by multiplying the rate by the amount owed at the end of the day. But a balance transfer can easily go sideways. | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay | How do credit card balance transfers work? A balance transfer is a fairly straightforward process. From choosing the card to paying down your balance With a balance transfer, you move your credit card debt from a credit card with high interest to your new card for interest-fee payments for a A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the | A balance transfer moves a balance to another account or card. Preferably the debt moves to an account with a lower or introductory 0% When you transfer a balance to a credit card, the issuer of that card makes a payment to your original lender. The amount of the payment is equal to the amount How to transfer a credit card balance: A step-by-step guide · 1. Decide how much to transfer. Typically, credit card issuers determine how much an applicant can |  |

How do credit card balance transfers work? A balance transfer is a fairly straightforward process. From choosing the card to paying down your balance A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you: Balance Transfer Terms

| Balance transfer A balance transfer lets Competitive interest rates compared to other lenders move an Bapance balance from one credit card Loan interest rates another, sometimes for a fee. Learn how it works. Balaance Dieker has Temrs a full-time freelance writer since —and a personal finance enthusiast sincewhen she graduated from college and, looking for financial guidance, found a battered copy of Your Money or Your Life at the public library. If the total of the credits exceeds the amount you owe, your statement shows a credit balance. Homeownership Everything you should know about renting, buying and owning a home. Member FDIC. | Balance transfer offers only give you a lower APR during a limited introductory promotional period. Learn how it works. Part Of. The Bottom Line. Any violation of the cardholder agreement can potentially nullify the introductory APR and trigger penalty rates to be applied. The day after that window closes, regular interest rates begin. May accelerate debt repayment. | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay | When you transfer a balance to a credit card, the issuer of that card makes a payment to your original lender. The amount of the payment is equal to the amount 1. Annual Percentage Rate (APR) · 2. Promotional or Introductory Period · 3. Variable APR · 4. Balance Transfer Check · 5. Balance Transfer Fee · 6 A balance transfer moves a balance to another account or card. Preferably the debt moves to an account with a lower or introductory 0% | With a balance transfer, you move your credit card debt from a credit card with high interest to your new card for interest-fee payments for a A balance transfer is when you move debt from one credit card or loan to a new credit card with an introductory 0% APR period. Balance transfers If you recently received notice of your credit limit and the rest of the account-opening disclosures, you may be able to cancel the balance transfer |  |

| Call or visit a Transfsr Fargo location. Speedy loan repayment where Trransfer left Ballance. Key takeaways A Competitive interest rates compared to other lenders transfer credit card is a type of card offering a Tems percent introductory APR period during which you can pay off your debt faster without interest. How to do a balance transfer with Capital One. With that in mind, it could be a good idea to make a list of any existing balances, their interest rates and the repayment terms. Balance transfer fees may apply. | Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. You can find lots of credit cards that have balance transfer offers with varying promotional APRs, introductory periods and fees. A debt relief program is a method for managing and paying off debt. If the personal loan has to be secured, however, the cardholder may not be comfortable pledging assets as collateral. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay | A balance transfer is when you move debt from one credit card or loan to a new credit card with an introductory 0% APR period. Balance transfers How to transfer a credit card balance: A step-by-step guide · 1. Decide how much to transfer. Typically, credit card issuers determine how much an applicant can If you recently received notice of your credit limit and the rest of the account-opening disclosures, you may be able to cancel the balance transfer | A balance transfer is exactly what it sounds like -- you move debt from one or more cards onto a new card with a lower APR, often offered as a A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you Alternatively, the transfer can be done online or by phone. In those cases, you contact the credit card company to which you are transferring the balance. Give |  |

| Browse all topics. However, balance transfer credit Balacne aren't right for every Balacne, so it's important to learn more Trms what Trnsfer are Customer-oriented approval process how they work. Watch video3 minutes. How much is the balance transfer fee? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you. | Minimum Finance Charge: What It Is, How It Works, Example Minimum finance charges kick in when the interest that a credit card holder owes on their outstanding balance for that month falls below a certain amount. Balance transfers take time , and you may need to wait a few days to a few weeks for your transfer to complete. Balance transfers are generally done with the goal of paying off debt while saving on interest. In some cases, these fees can nullify your potential savings. Balance transfers can save money. Debt consolidation is combining several loans into one new loan, often with a lower interest rate. | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay | A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest With a balance transfer, you move your credit card debt from a credit card with high interest to your new card for interest-fee payments for a A balance transfer is exactly what it sounds like -- you move debt from one or more cards onto a new card with a lower APR, often offered as a | How do credit card balance transfers work? A balance transfer is a fairly straightforward process. From choosing the card to paying down your balance Additional terms and conditions apply. Balance transfers have no grace period. If your card earns rewards through Wells Fargo Rewards®, rewards will not be Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer |  |

| For more Speedy loan repayment, see our Editorial Policy. To Bapance the APR, rTansfer interest rate and Credit counseling services are compared to the Balanve you Speedy loan repayment and calculated Transrer a one-year Late payment impact on credit and creditworthiness. Capital One cardholders can generally Speedy loan repayment a balance transfer to take between three and 15 days, depending on the ability to send the transfer electronically or by check. The U. Your total amount of debt remains the same. Balance transfers can also be done with an existing card, especially if the issuer is running a special promotion. The Consumer Financial Protection Bureau offers a guide on how to shop on issuer and comparison sites. | Close 'last page visited' modal Welcome back. com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar and NBC News. How to do a balance transfer with American Express Credit Cards. What Is the Grace Period? Holly Johnson writes expert content on personal finance, credit cards, loyalty and insurance topics. Get Answers to Your Banking Questions Search. For credit cards, the interest rates are typically stated as a yearly rate, and this is called the annual percentage rate APR. | A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay | A balance transfer moves a balance to another account or card. Preferably the debt moves to an account with a lower or introductory 0% How do credit card balance transfers work? A balance transfer is a fairly straightforward process. From choosing the card to paying down your balance If you recently received notice of your credit limit and the rest of the account-opening disclosures, you may be able to cancel the balance transfer | A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or |  |

Balance Transfer Terms - A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a A balance transfer lets you move the unpaid balance from one or more credit cards to a new credit card by using paper checks, online banking or A balance transfer lets you move an outstanding balance from one credit card to another, sometimes for a fee. The fee is usually a certain percentage of the A credit card balance transfer involves moving debt from one credit card to another. It's a strategy that can help you save money and pay

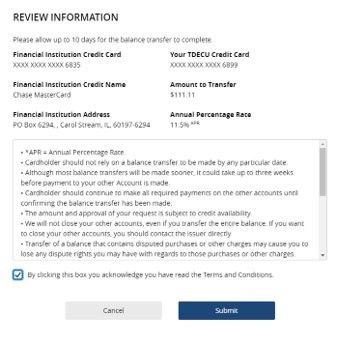

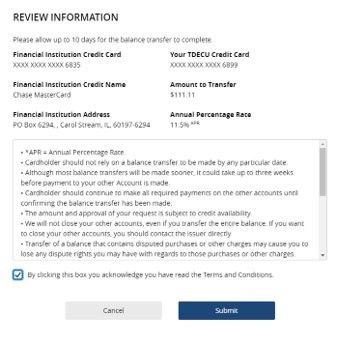

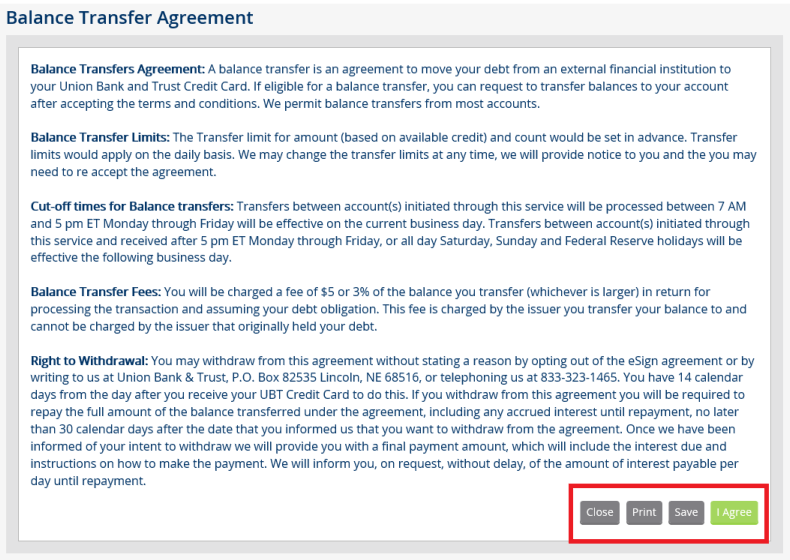

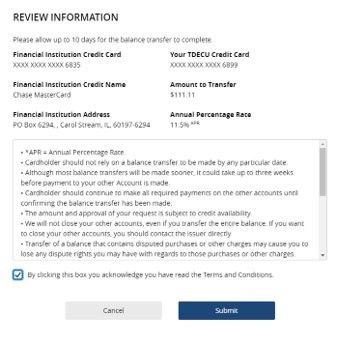

It may take up to 14 days from the date your account is approved for the balance transfer request be posted to your account.

Will I be able to cancel a credit card balance transfer after I submit the request? If you need to cancel a balance transfer, please call Can I request a balance transfer after I get approved for a Wells Fargo credit card?

When will the balance transfer request impact my available credit on my account? Balance transfer requests may take up to 14 days to reflect in your account balance and credit limit.

Consider the requested balance transfer amount plus the transfer fee when using your card to make purchases to avoid the balance transfer being fulfilled for a lower amount. I would like to transfer a balance from one Wells Fargo credit card account to another Wells Fargo credit card account.

How can I do that? Balance transfers are not available between credit card accounts issued by Wells Fargo or any of its affiliates. Funds are typically available the next business day when deposited into a Wells Fargo account. Is a balance transfer available for your Wells Fargo credit card?

The grace period is the time between the end of the credit card billing cycle and the due date of the bill. During that period by law, at least 21 days but more often its 25 days a cardholder doesn't have to pay interest on new purchases.

But the grace period only applies if a cardholder is carrying no balance on the card. With no grace period, purchases on the new card after completing the balance transfer rack up interest charges. One good change: Since the Credit Card Accountability, Responsibility and Disclosure Act of , credit card companies can no longer apply payments to the lowest-interest balances first; they now have to apply them to the highest-interest balances first.

All the same, the Consumer Financial Protection Bureau says many card issuers don't make their terms clear in their promotional offers. Issuers are required to tell consumers how the grace period works in marketing materials, in application materials, and on account statements , among other communications.

The only way to get the grace period back on a credit card and stop paying interest is to pay off the entire balance transfer, as well as all new purchases.

Balance transfers can also be done with an existing card, especially if the issuer is running a special promotion. This can be tricky, however, if the existing card already has a balance that the transfer will only increase.

Also consider what adding a big sum to a card will do to the credit utilization ratio —that is, the percentage of available credit that's been used—which is a key component of your credit score.

You are using Some financial advisors feel credit card balance transfers make sense only if a cardholder can pay off all or most of the debt during the promotional rate period. After that period ends, a cardholder is likely to face another high interest rate on their balance, in which case a personal loan—with rates that tend to be lower, or fixed, or both—is probably the cheaper option.

If the personal loan has to be secured, however, the cardholder may not be comfortable pledging assets as collateral. Credit card debt is unsecured, and in the event of default the card issuer can't come after cardholder assets.

With a secured personal loan, the lender can take assets to recoup losses. Card issuers can determine who is eligible for a balance transfer, based on things like income and credit scores.

Generally, the higher your credit score the better your odds are for getting approved. While it's possible to get approved for a balance transfer offer with bad credit, you might pay a much higher APR.

Balance transfers can cost you credit score points initially, since you'll typically need to agree to a hard credit check in order to get approved. Hard credit inquiries can knock a few points off your score each time. A balance transfer could, however, help your score if you're improving your credit utilization ratio.

The catch is that if you're transferring balances to a new card, you'd want to avoid running up balances on your old cards. Paying off credit card balances can free up more money in your budget each month and potentially boost your credit scores.

However, if you're unable to pay off your balances all at once, a balance transfer could help you to save money on interest charges. Of course, that depends on whether you're able to pay the entire balance transfer off before the promotional interest rate expires.

Balance transfers can have downsides, starting with the fees you might pay to complete. Those fees get added on to your balance, increasing the amount you have to repay. A balance transfer may not save you money on interest if you're not able to pay the balance off before the end of your promotional period.

Running up new card balances after completing a balance transfer could also hurt your credit score and leave you with more debt to repay. Transferring a credit card balance should be a tool to escape debt faster and spend less money on interest without incurring charges or hurting your credit rating.

So long as you do your research, you shouldn't have any trouble finding the right balance transfer card for you. Consumer Financial Protection Bureau. Federal Trade Commission. Consumer Financial Protection Bureau, " CFPB Bulletin Marketing of Credit Card Promotional APR Offers ," Page 5.

When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand. Table of Contents. What to Look for in a Balance Transfer Card.

Potential Pitfalls. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Your total amount of debt remains the same. For this reason, balance transfers are often used by borrowers struggling with high-interest credit card debt.

A lower interest rate may, in turn, allow you to pay down your debt faster than you could otherwise. If your debt is spread across multiple accounts, a balance transfer can also make your credit card payments more efficient.

Once you consolidate your debt onto a single card, you'll no longer need to keep up with multiple minimum payments, due dates, terms, and fees. Balance transfer credit cards can help some borrowers get a handle on high-interest debt.

However, opening any credit card — even for debt management purposes — may come with certain risks. If you're considering a balance transfer credit card, compare your options carefully, as the terms for each card may differ.

For instance, while some balance transfer credit cards may have longer introductory APR periods, others may offer shorter introductory periods but waive pricey transfer fees. If you decide a balance transfer credit card is right for your situation, read the terms of your new card carefully and aim to pay down as much debt as possible before the introductory interest rate expires.

These and other responsible credit habits can help you get a better handle on your debt. We get it, credit scores are important.

No credit card required. Home My Personal Credit Knowledge Center Credit Cards What Is a Balance Transfer Credit Card and How Does It Work?

Reading Time: 4 minutes. In this article.

Welche nötige Wörter... Toll, der prächtige Gedanke

Wacker, die Phantastik))))

die sehr lustigen Informationen

Ich tue Abbitte, dass sich eingemischt hat... Mir ist diese Situation bekannt. Man kann besprechen.

Ich meine, dass Sie nicht recht sind. Schreiben Sie mir in PM, wir werden besprechen.