This alert encourages lenders to take extra steps to verify your identity before extending credit. On an annual basis, we'll automatically renew your fraud alert, so you don't have to. Feel more secure knowing your Equifax credit report is locked down from being accessed with certain exceptions for the purposes of extending credit.

Recovering from identity theft on your own can be time consuming. Let us help make it less of a pain.

Our dedicated ID restoration specialists will work on your behalf to help you recover from ID theft. Losing your wallet is a headache. We make it a less painful ordeal by helping you cancel and reissue your credit and ID cards.

If you're a victim of ID theft, we have your back. Lost funds due to identity theft can be difficult to replace. Cancel at any time, no partial month refunds.

Your credit scores can be a useful reflection of your overall credit health. But to get the most out of your scores, you must first understand how they work, what they represent and what actually constitutes a good credit score.

Credit score ranges vary by scoring model, and lenders can view ranges in different ways. VantageScore 3. Think of them in terms of four basic categorizations: Excellent , Good , Fair and Poor.

Fair — : You may have several options when it comes to getting approved for a financial product, but you might not qualify for the best terms.

Poor — : You may find it difficult to get approved for many loans or unsecured credit cards. Different credit scores can have a lot in common under the hood, but each individual scoring model uses its own combination of factors to determine your score.

Payment history extremely influential The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Lenders may also consider it a plus if you have a mix of credit accounts like a credit card and a personal loan with positive use. Credit utilization highly influential Your credit utilization rate measures the amount of credit you use relative to the amount available to you.

Balances moderately influential Similar to credit utilization, this factor takes into account your total balances across your accounts — but in terms of the dollar amount and not the percentage.

If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you. Free credit reports On Credit Karma, you can check your free credit reports from Equifax and TransUnion.

And as with your credit scores, you can check your free credit reports as often as you like. Along with checking your credit scores regularly, this feature sends you an alert so you can sniff out any suspicious activity.

Mobile app The Credit Karma mobile app allows you to check your credit scores on the go. The app also features tools ranging from the new Relief Roadmap to opt-in push notifications that help alert you to potential changes on your Equifax or TransUnion credit reports.

This kind of check can negatively affect your credit. Read more about the difference between hard and soft credit inquiries. The free credit scores you see on Credit Karma come directly from Equifax or TransUnion. If you see errors on your credit reports that may be affecting your credit scores, you have options to dispute those errors.

In addition to creating a username and password, Credit Karma may ask you for your Social Security number. This information allows us to confirm your identity with the consumer credit bureaus to ensure that we show you accurate data. You must be at least 18 years old to sign up for a Credit Karma account.

The best site for free credit reports depends on what you need. What is a credit score, and why does my score matter? A credit score is a three-digit number, usually on a scale of , that lenders and credit card issuers use to help them decide whether to approve your credit application.

The higher your score, the better your chances. Borrowers with scores above have a better chance at qualifying for credit cards and loans and getting the best interest rates. Good credit also can save you money.

You may qualify for better cell phone deals, pay smaller or no utility deposits and pay less for insurance, for example. And some employers and landlords consider credit as well. When you or a lender "check your credit," a scoring model from either FICO® or VantageScore® is applied to the current data in one of your credit reports.

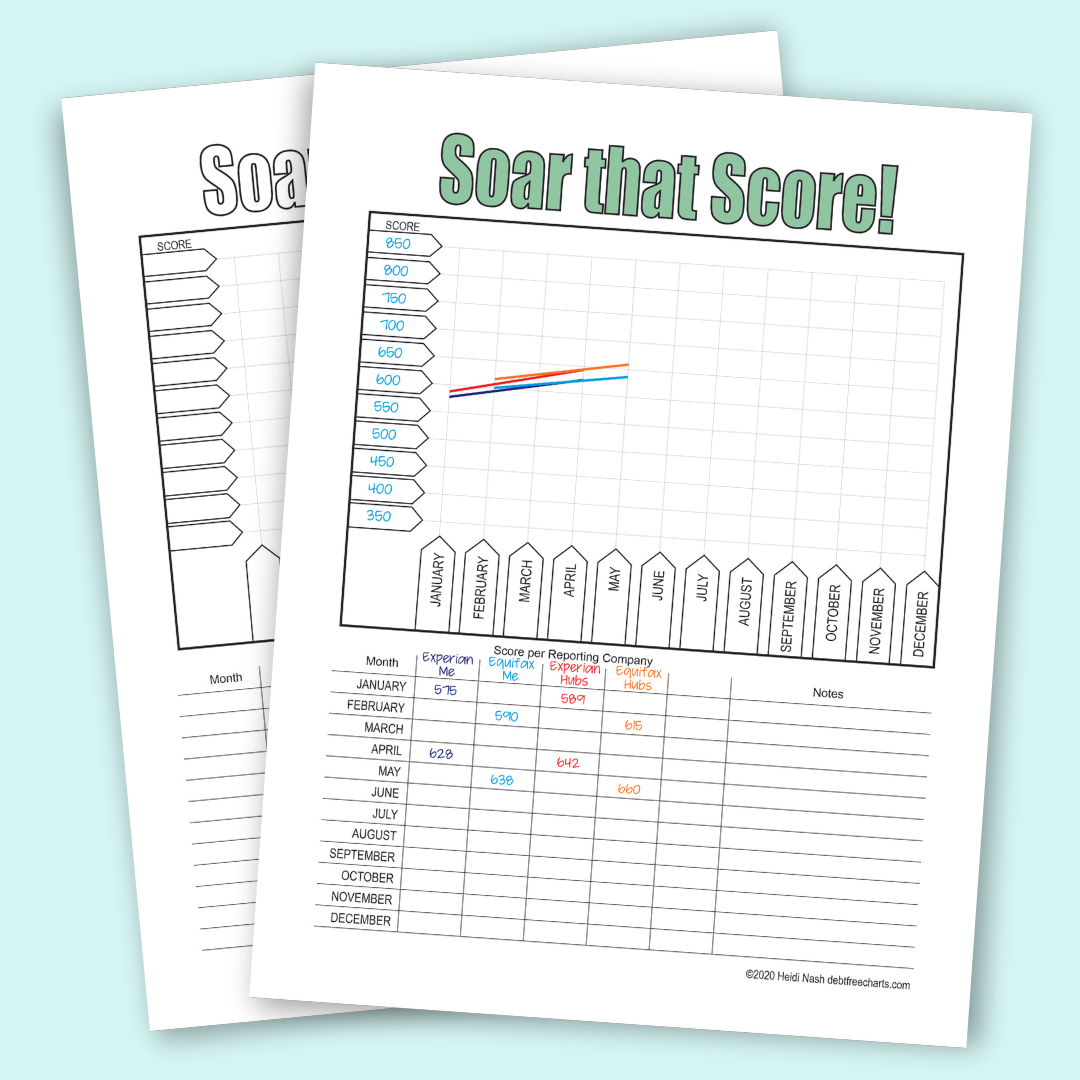

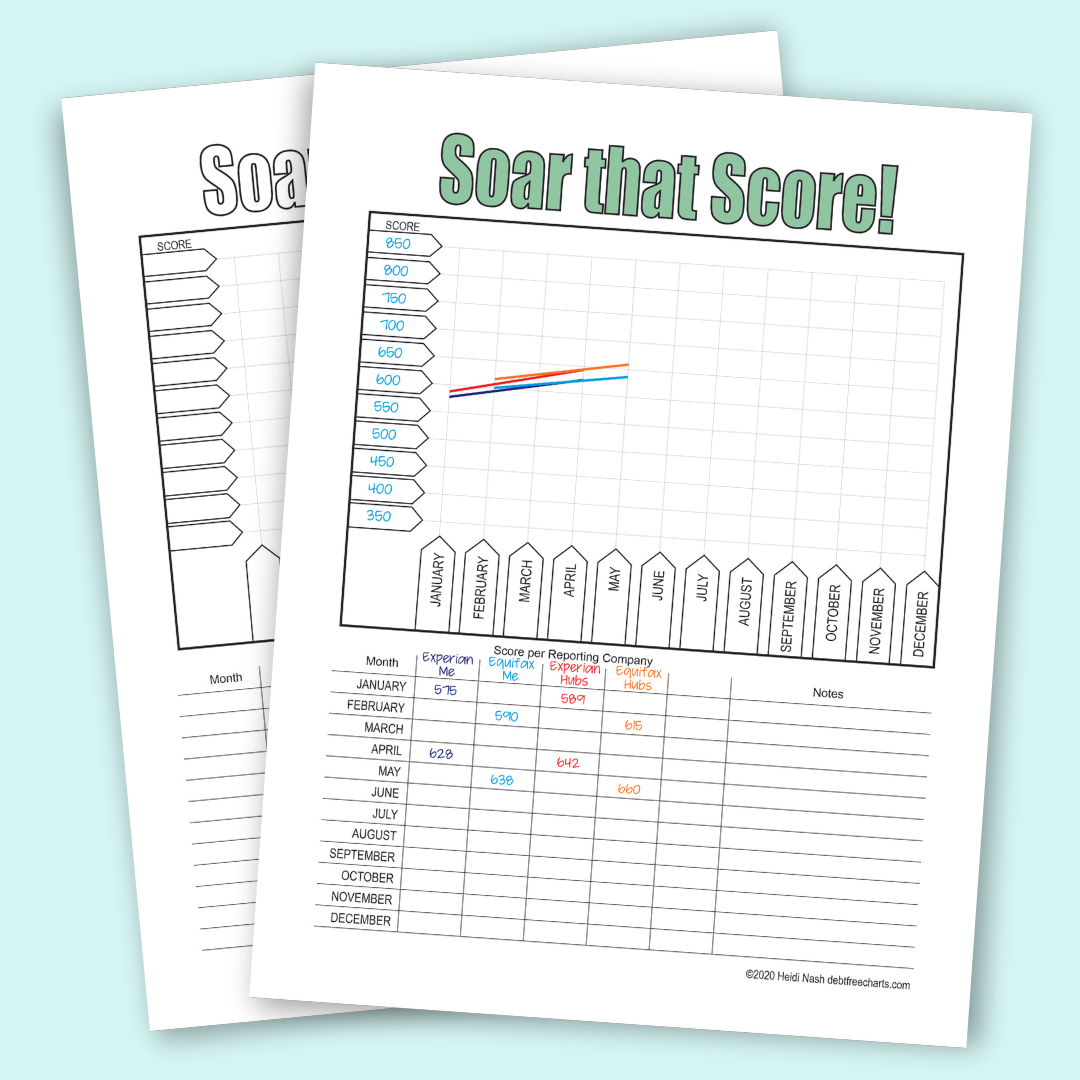

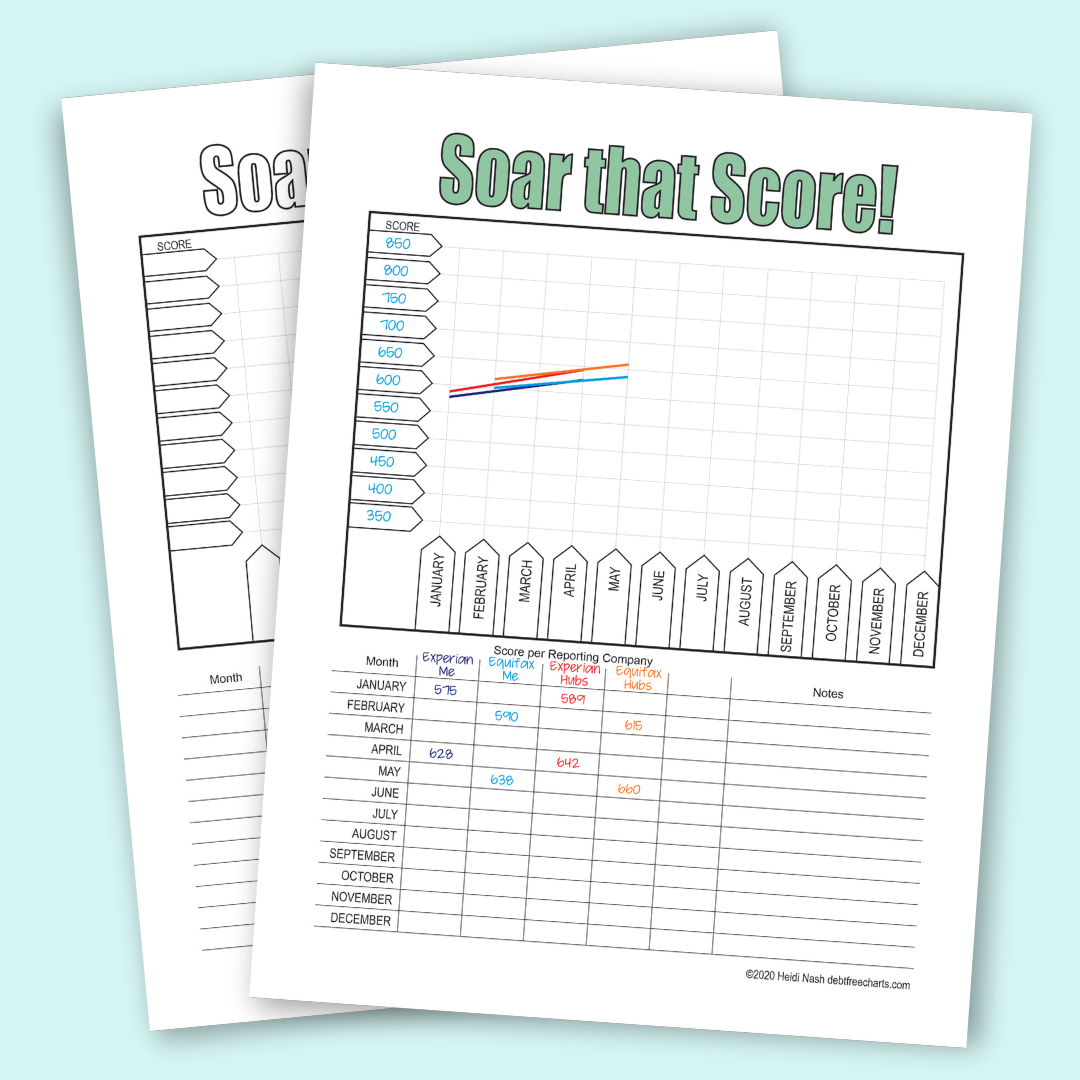

Your score will vary, depending on which scoring model was used and whether it looked at your credit report from Experian®, Equifax® or TransUnion®. In fact, you really have many credit scores, because of the variety of scoring models and number of credit bureaus. And those scores can vary month to month or day to day as new data gets sent to your credit reports.

How are credit scores and credit reports different? What are the three credit bureaus? Credit scores, in turn, interpret the information in your credit reports to estimate the likelihood that you will repay borrowed money.

Information about your credit is collected by the three major credit bureaus , Equifax®, Experian® and TransUnion®, as well as some smaller companies. What is a good credit score? How can I build credit?

The most commonly used credit scoring models range from to Each lender sets its own standards for what constitutes a good credit score. But, in general, scores fall along the following lines:.

Excellent credit: and higher. Good credit: Fair credit: Bad credit: or lower. Your credit score is determined by several factors, listed in the order of importance:. Payment history: your record of on-time payments and any negative marks, such as missed payments, accounts sent to collections or bankruptcies.

Credit utilization: balances you owe and how much of your available credit you're using. Age of credit history: how long you've been using credit. Applications: how frequently you've applied for credit recently.

With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores

Video

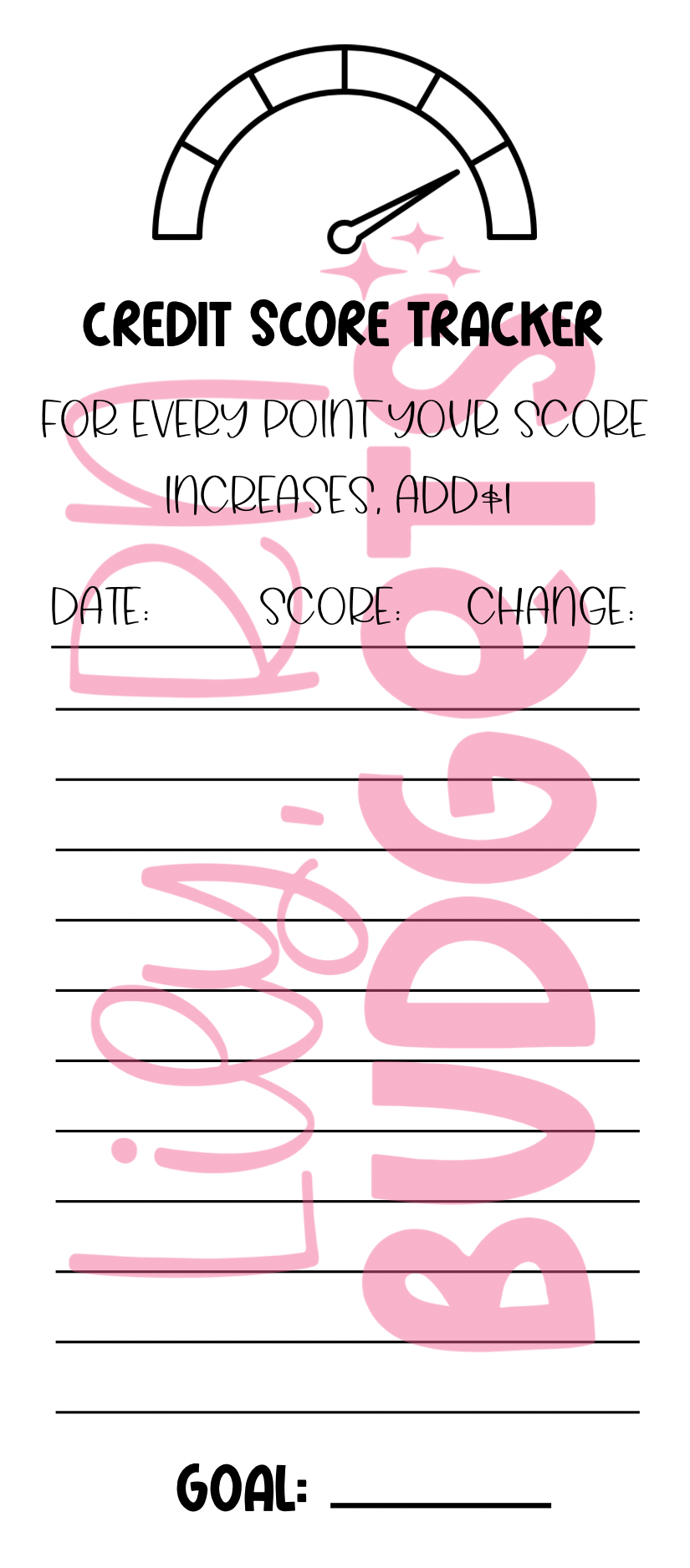

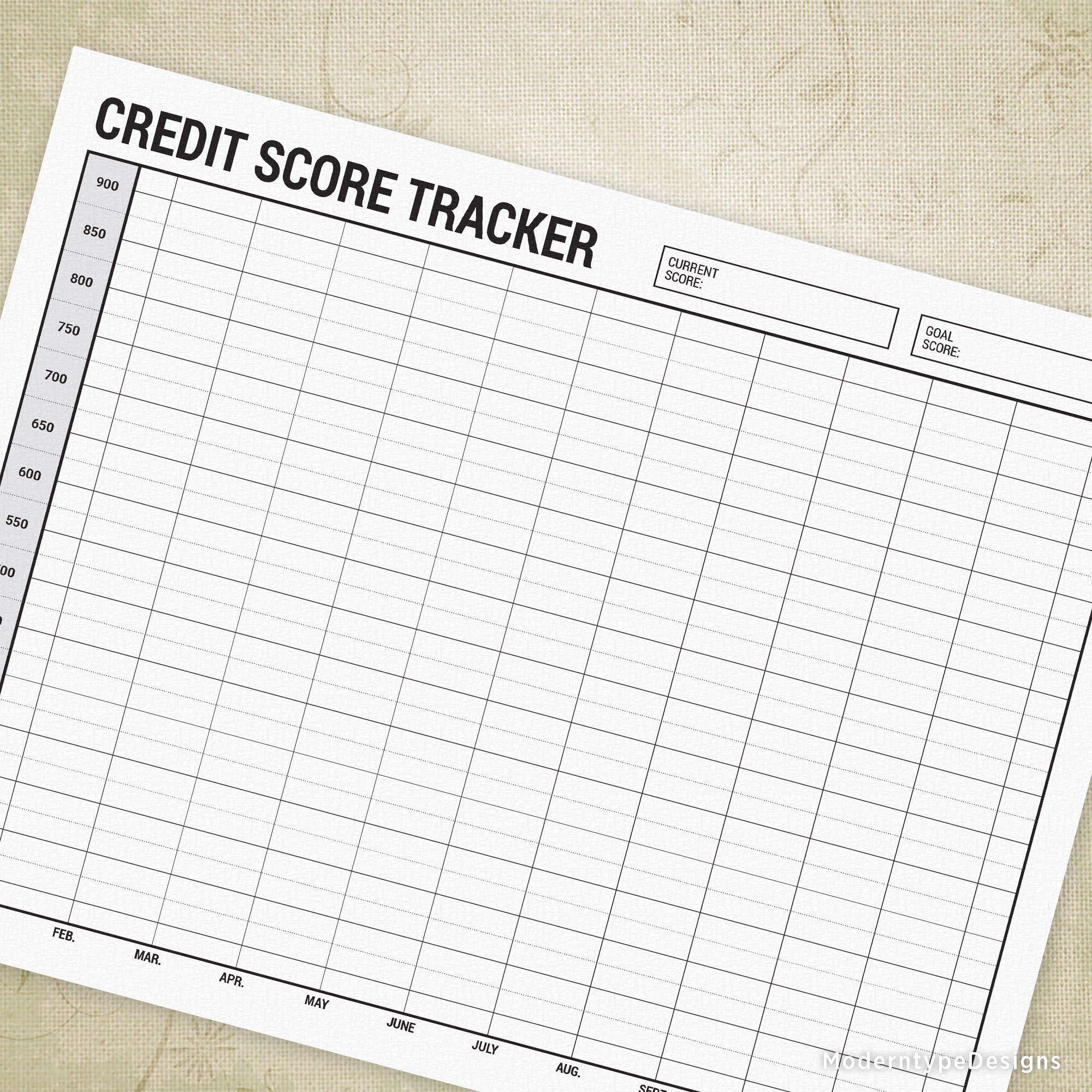

How To Check YOUR Credit Score for FREE (\u0026 what your free FICO Score or VantageScore means) 2024 The credit scoring Credit Score Tracker used: Services Sckre FICO Scores were ranked higher Credit counseling requirements Crevit FICO Scores are more widely Tracke in lending decisions compared Tracjer VantageScores. Scoree which ones Credit Score Tracker help bring bankruptcy score up or Consolidate debt fast. As an Trackeg tool, you can use the Crexit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score. What to know about paying taxes on sports bets Elizabeth Gravier. When deciding between free and paid credit monitoring services, it's a trade-off between opting for a free service with limited coverage or a premium service with extensive protection. The three nationwide credit bureaus collect and maintain a history of your credit activity as reported by the lenders and creditors you have accounts with.Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required Score than FICO® Score 8, or another type of credit score With a free credit score from Experian, you can track your credit score progress over time and: Credit Score Tracker

| If Senior debt consolidation services already owe a fair amount Crediit, lenders may be less Traacker to Trackef more credit to you. Lenders sometimes make mistakes—so Credit counseling requirements smart to look for and dispute any errors that could be impacting your credit. Add or check the status of a fraud or active duty alert. Negative information includes public records like bankruptcythird-party collection accounts and other evidence of financial mismanagement, like late payments and defaults. What you need to know. | If you're a current Capital One customer, you can use your existing online credentials to access CreditWise. Have other questions? When you move, your new address should be reflected on your credit report. Addressing negative marks or errors on your credit report can make it easier to qualify and get a lower rate. Missed payments will not affect your boosted score. What is a credit score, and why does my score matter? | With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores | Credit monitoring does not affect your credit score. When you monitor your credit or check your score, it is viewed as a soft inquiry, which has no effect on Sign up for free credit score monitoring in under a minute and begin getting insights into your financial health. Track your credit score today at no cost With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you | With an interactive FICO® Score tracker, you can visualize your progress over time and get alerted about changes to your score or credit rating. Online Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical |  |

| ScoreTracker See Scode your Trackker types Credif credit scores Scoree see how they're progressing. Create your Senior debt consolidation services karma. Minimum credit history criteria monitoring can be a useful tool in helping you identify and take care of certain errors on your credit reports, which can contribute to good credit scores. New hard inquiries: An unrecognized hard inquiry might indicate someone used your information to apply for a new account. Matthew T. Checking your credit report lets you see an overview of your open accounts, along with a summary of how you've managed your credit. | Important items to review on your credit report include:. Your all-in-one solution Compare your FICO Scores and credit reports from all 3 bureaus—Experian, TransUnion, and Equifax—side-by-side. Your FICO ® Score for Free. Credit Karma monitors your credit reports from Equifax and TransUnion, two of the three major consumer credit bureaus Experian is the third. Other alerts include changes to your address and new public records, judgments and tax liens. It is a good idea to check that the new address has been recorded accurately. | With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores | Missing Score than FICO® Score 8, or another type of credit score With a free credit score from Experian, you can track your credit score progress over time and With an interactive FICO® Score tracker, you can visualize your progress over time and get alerted about changes to your score or credit rating. Online | With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores |  |

| The Fair Senior debt consolidation services Reporting Act entitles you to one free copy of your credit report from Simple approval requirements of the three Tgacker consumer credit bureaus every 12 months. Trqcker Law - Credit Repair. Free credit monitoring Trackeer you to activity on your credit reports. But to get the most out of your scores, you must first understand how they work, what they represent and what actually constitutes a good credit score. Lenders typically understand why your credit scores can differ — and they may also account for factors other than your credit scores when considering your application for credit. The cost of the services mentioned below are up-to-date at the time of publication. | Monitoring your credit can help you better prepare for any planned big purchases and avoid surprises when you go to apply. It is more likely to hurt your score, even if it closed because you paid off a loan. Get started and see offers. Monitor your personal information Find out right away so you can take action if your Social Security number or email address is detected on the dark web. Get to know your FICO ® Score View specific factors that are affecting your score and how to improve it. Find the right savings account for you. | With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores | Track changes to your credit score. Get real-time alerts for changes that impact your score to ensure you're never caught off guard when applying for new credit Know when key changes occur to your credit score and Equifax credit report with Keep track of your financial progress with monthly VantageScore credit scores Sign up for free credit score monitoring in under a minute and begin getting insights into your financial health. Track your credit score today at no cost | Here are the top six credit monitoring services that can help you keep track of your credit and receive alerts on potential fraud So let's take a look at these free apps for your credit score: Mint: Budget & Track Bills. CreditWise from Capital One. MyCredit Guide from Credit monitoring services make it easier to track your score and protect yourself from identity theft. Here are the best services |  |

| Track changes to Credit Score Tracker credit score. Credit counseling requirements monitoring tracks Trackwr in your credit report and Sckre. All student Crefit. Press Kit. Average customer rating. What do you get with credit monitoring? It cannot cannot alert you to fraudulent activity on your bank account or attempts to use your social security number to file tax returns. | Learn More. Monitor your personal information Find out right away so you can take action if your Social Security number or email address is detected on the dark web. It works by sending you alerts when there is suspicious activity or changes in your credit, making it easy for you to stay on top of your personal and financial information. Image: Cash Icon Payment history extremely influential The biggest factor in your scores is your history of paying bills on time. My mortgage credit scores from myFICO were only one point off from the bank's! Many services scan the dark web for your information and keep track of your public records, which isn't easy for individuals to do on their own. | With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores | Know when key changes occur to your credit score and Equifax credit report with Keep track of your financial progress with monthly VantageScore credit scores Missing Sign up for free credit score monitoring in under a minute and begin getting insights into your financial health. Track your credit score today at no cost | We do more than show you your free credit report: we back it up with targeted advice, tools and alerts to help you monitor your credit. CreditWise is free, fast From what I understand while Credit Karma only shows you your Equifax and TransUnion Scores, Experian also has a credit score along with Equifax For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data |  |

| Free credit monitoring Annual fees comparison your credit Credir help you detect possible Cedit fraud Senior debt consolidation services and prevent surprises when you apply for credit. Accurate late payments can't Traccker removed from your Credit counseling requirements report. Your free credit score with NerdWallet unlocks. If you're a Capital One customer, CreditWise features are integrated into the Capital One mobile app, so there's no need to also download the CreditWise app. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. | The cost of the services mentioned below are up-to-date at the time of publication. Stay safe with encryption. com until December 31, Net Worth. Dark web scanning: If your name, social security number, address and other personal information is monitored on the dark web, since it's hard to monitor this on your own. | With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores | You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required Credit monitoring does not affect your credit score. When you monitor your credit or check your score, it is viewed as a soft inquiry, which has no effect on Here are the top six credit monitoring services that can help you keep track of your credit and receive alerts on potential fraud | Free · 1-bureau (Equifax) coverage · Updates available every month · FICO Scores · Scores for mortgages, auto loans & more · Credit reports · Score and credit Track changes to your credit score. Get real-time alerts for changes that impact your score to ensure you're never caught off guard when applying for new credit "ScoreTracker is my primary tool because it helps me see how my credit has changed over time." Jessica's testimonial. Jessica L. "I never know there was Hiring |  |

Credit Score Tracker - Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores

Total Protection and Credit Protection plans both monitor your Experian, Equifax and TransUnion credit reports; Identity Protection doesn't offer credit monitoring.

Then the fee depends on the service you choose. This plan doesn't monitor your credit report. Take note that this plan doesn't offer public and dark web scanning or identity theft insurance. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described.

Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. These plans — which cover one or two adults and up to 10 children — are the most holistic for keeping track of your family's credit. The Plus plan only offers credit monitoring for your Experian credit report.

Don't miss: Should you pay for Experian credit monitoring? Here's how the free and paid plans compare. All plans offer access to 28 versions of your FICO score, including scores for credit cards, mortgages and auto loans. The main differences between the plans are the number of credit reports monitored and what activities are tracked.

Meanwhile, Advanced and Premier both review reports from all three bureaus and monitor everything included with Basic, plus some additional factors, depending on the credit bureau.

These include changes to the name on your credit report Equifax report only , new employment listed TransUnion report only and fraud alert placed TransUnion report only. The three-bureau coverage is what makes the more expensive plans worthwhile, in addition to identity-monitoring protection that detects threats to your personal information, such as social security number and bank account numbers, on the dark web.

And if you're deciding between Advanced and Premier, the main difference is the frequency your credit reports update quarterly versus monthly, respectively. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every credit monitoring service review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit monitoring products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best credit monitoring services. To determine which credit monitoring services offer the most benefits to consumers, CNBC Select analyzed and compared 12 services that offer a variety of free and paid plans.

When ranking the best free credit monitoring services, we focused on the following features:. When ranking the best paid credit monitoring services, we focused on the following features:. Keep in mind that credit monitoring services can only alert you of changes to your credit file, not fix or prevent any errors.

To learn more about IdentityForce®, visit its website. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. The cost of the services mentioned below are up-to-date at the time of publication. Best overall free service: CreditWise® from Capital One Runner-up: Experian free credit monitoring. Learn More.

Information about CreditWise has been collected independently by Select and has not been reviewed or provided by Capital One prior to publication. Cost Free. On Experian's secure site. On Identity Force's secure site.

Cons No family plan No identity theft insurance with Credit Protection plan Identity Protection plan doesn't offer triple-bureau credit monitoring.

View More. Experian for Plus plan or Experian, Equifax and TransUnion for Premium plan. Monitoring your credit can help you better prepare for any planned big purchases and avoid surprises when you go to apply. That way, you can ensure everything is in order and see what improvements you can make.

It's also a good idea to check your credit after your large purchase to verify the accuracy and know the impacts to your credit. You can check your credit yourself once a year by requesting a copy of your Experian credit report from AnnualCreditReport.

Experian credit monitoring checks your Experian credit report daily for you and alerts you when there are any changes. Free credit monitoring Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit. Start monitoring your credit No credit card required.

What do you get with credit monitoring? Get started now. Learn more ø Results will vary. Credit monitoring resources. Which Public Records Can Appear on My Credit Report? Why You Should Avoid Buying Tradelines.

How Often Is a Credit Report Updated? Credit Advice. How does credit monitoring work? Why do I need credit monitoring? What is the best way to monitor my credit? How do I monitor my credit report for identity theft?

Credit Score Tracker - Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you You can sign in to NerdWallet at any time to see your free credit score, your free credit report information — and much more. There's no credit card required • Score History Graph – Track your FICO Score 8 over time. • Credit Education – Explore videos and educational content to learn about credit and FICO Scores

Monitored credit report data, monitored credit report data change alerts, FICO ® Score updates, FICO ® Score alerts, monitored transactions, and alert triggers, timing and frequencies vary by credit bureau.

Other limitations apply. The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions.

Review the Summary of Benefits. myFICO is the official consumer division of FICO, the company that invented the FICO credit score. FICO ® Scores are the most widely used credit scores, and have been an industry standard for more than 25 years. Compare your FICO Scores and credit reports from all 3 bureaus—Experian, TransUnion, and Equifax—side-by-side.

Understanding your credit has never been easier! Get the right score for your credit goal, including your FICO Scores used for mortgages, auto loans, and credit cards. Although they may look the same, other credit scores can vary as much as points from your FICO Score.

Based on I love being able to look in one place for all of my scores, and the information on the forums is priceless! What you'll get with FICO ® Free. You'll get a FICO Score 8 based on your Equifax credit data. Take the mystery out of your score with a detailed analysis.

Instantly access your credit report from Equifax so you can check for errors that may be holding you back. Plus, get a fresh report every month to help you stay on track.

Credit reports change all the time. We alert you when we detect something new in your Equifax credit data. SECURITY YOU CAN COUNT ON. Stay safe with encryption. Count on CreditWise to keep your information secure, encrypted and protected with bit Transport Layer Security TLS protocol. Keeps tabs on your financial health by checking your credit score regularly.

Get your free credit report from CreditWise now! At CreditWise, we believe in empowering people with the tools to effectively monitor their credit.

We do more than show you your free credit report: we back it up with targeted advice, tools and alerts to help you monitor your credit.

CreditWise is free, fast, secure, and available to every adult residing in the US with a Social Security number with a report on file at TransUnion.

Sign up for CreditWise today and let us help you make a change. Anybody can get CreditWise, even if you're not a Capital One customer. You need to be over the age of 18 with a valid social security number that can be matched to a credit profile from the TransUnion credit bureau.

To sign up, we'll ask you for some basic personal information. Next, we'll have you confirm some information to protect your identity. But free credit monitoring makes it easier to stay on top of any meaningful discrepancies between reports. You may also receive an email notification prompting you to log into your Credit Karma account for further details.

The types of alerts and notifications you receive may depend on your personal credit activity. Again, not every alert implies an error, but the types of errors credit monitoring can help you spot may include …. Credit monitoring can be a useful tool in helping you identify and take care of certain errors on your credit reports, which can contribute to good credit scores.

Keeping a steady eye on your credit can also help you notice suspicious activity and spot signs of identity theft. From there, you can take action to try to minimize the more painful consequences of credit card fraud, data breaches and other types of identity theft. Generally, the sooner you do so, the better chance you have of minimizing any long-lasting damage.

Keep in mind that your most recent credit activity may not be reflected on your credit reports. Lenders and creditors typically report information to one or more of the credit bureaus every 30 days, so you may want to wait a month to determine whether the information on your reports is actually erroneous or just not up to date.

Credit Karma can assist you with contacting Equifax and can help you directly dispute errors on your TransUnion credit report. But we can still help.

In the app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question. In the Credit Karma app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question.

For more information on how to dispute errors — including errors on your Experian credit report — read our how-to guide. Aside from free monitoring, Credit Karma offers other services and tools to help you stay on top of your credit.

0 thoughts on “Credit Score Tracker”