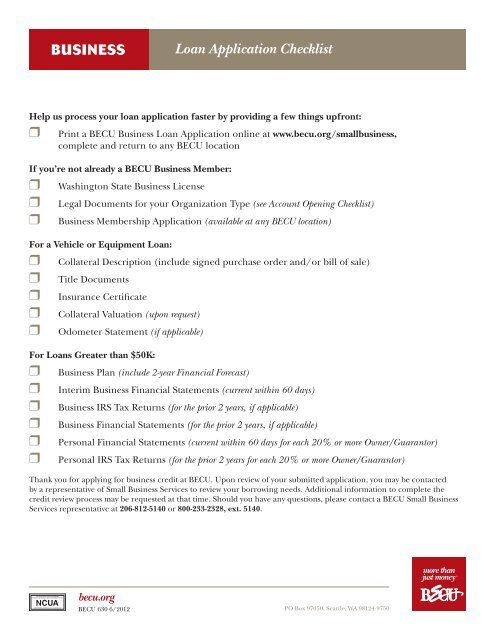

We have included the most commonly required documents below. Interim financial statement signed and dated, and including balance sheet and income statement dated within the previous two months.

If this is a franchise , you will need a letter of intent from the franchisor and a FUOC and franchise agreement. Copy of loan agreement and SBA authorization if you have another SBA loan. Click below for a free, no obligation quote and to learn more about your loan options.

Close sba loans is an independently owned and operated website and has no government affiliation. We are not the Small Business Administration and are not a lender. Résumés Include personal résumés for each principal. Business Overview and History Provide a brief history of the business and its challenges.

Business Lease Include a copy of your business lease, if applicable. Tarzana Branch. Monterey Park Branch. Claremont Branch. SECURITY WARNING: E-mail sent to Community Commerce Bank is not encrypted. Sensitive information such as social security numbers should never be included in any e-mail correspondence.

Privacy Policy. Open toolbar Accessibility Tools. Consolidate Debt Lower Rate Cash out Shorter term Other. Someone will be in contact with you shortly.

What is your estimated down payment? What is your name? First name Last name. How is your credit? What is the best number to contact you? What is your email? Let's Get Started. Applying with is a breeze To begin, you will need to create a secure account.

APM BLOG. TOP POSTS. Understanding a Interest Rate Buydown. How Much One Extra Mortgage Payment Can Save You. What You Need to Know about Sales Price vs. Appraised Value. Subscribe to our Blog Sign up to stay up to date with the latest news, insights and more from American Pacific Mortgage!

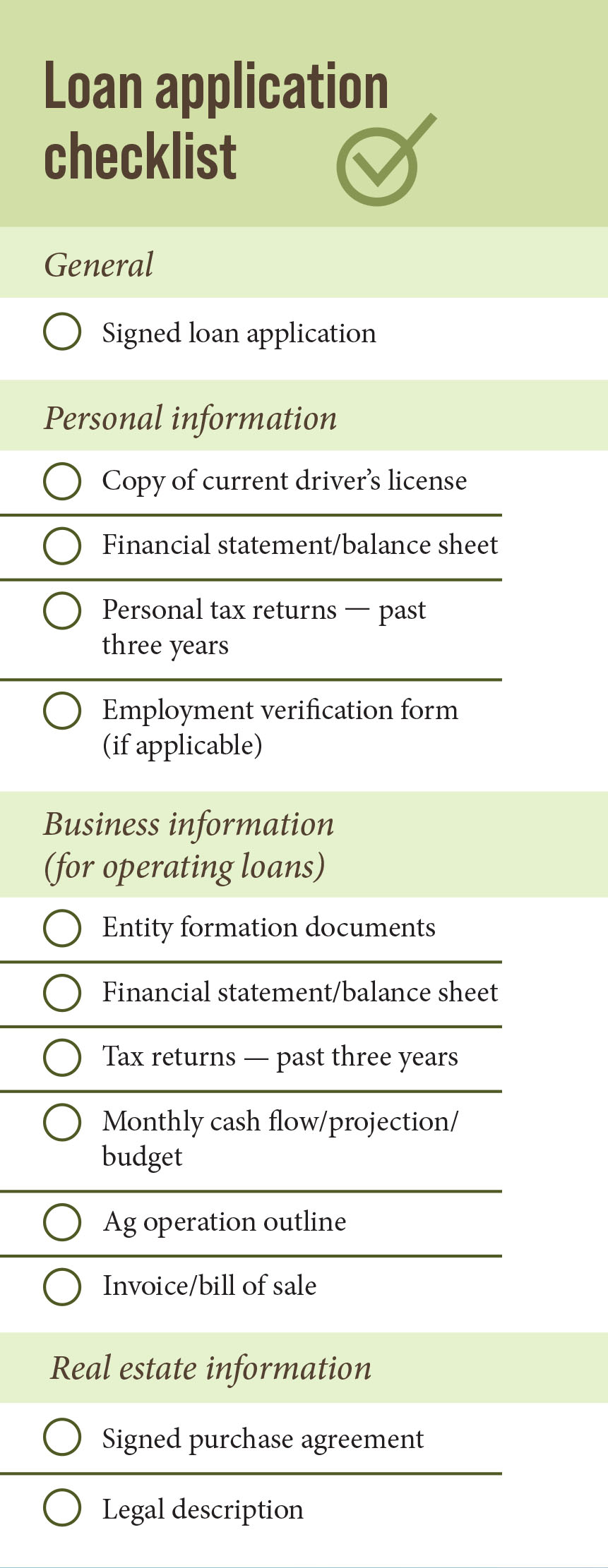

This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers?

Loan application requirements checklist - Signed and dated copies of your federal tax returns (complete) – most recent two years This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers?

Aug 26 at SBA Loans What Is SBA Form ? Get our latest updates:. Explore the Janover Network. Feb 12 at Multifamily Loans Multifamily Minute Reader Reflections: Pets Allowed! Feb 9 at SBA 7 a Loans SBA 7 a Loans vs. Angel Investors: Attracting Investors vs.

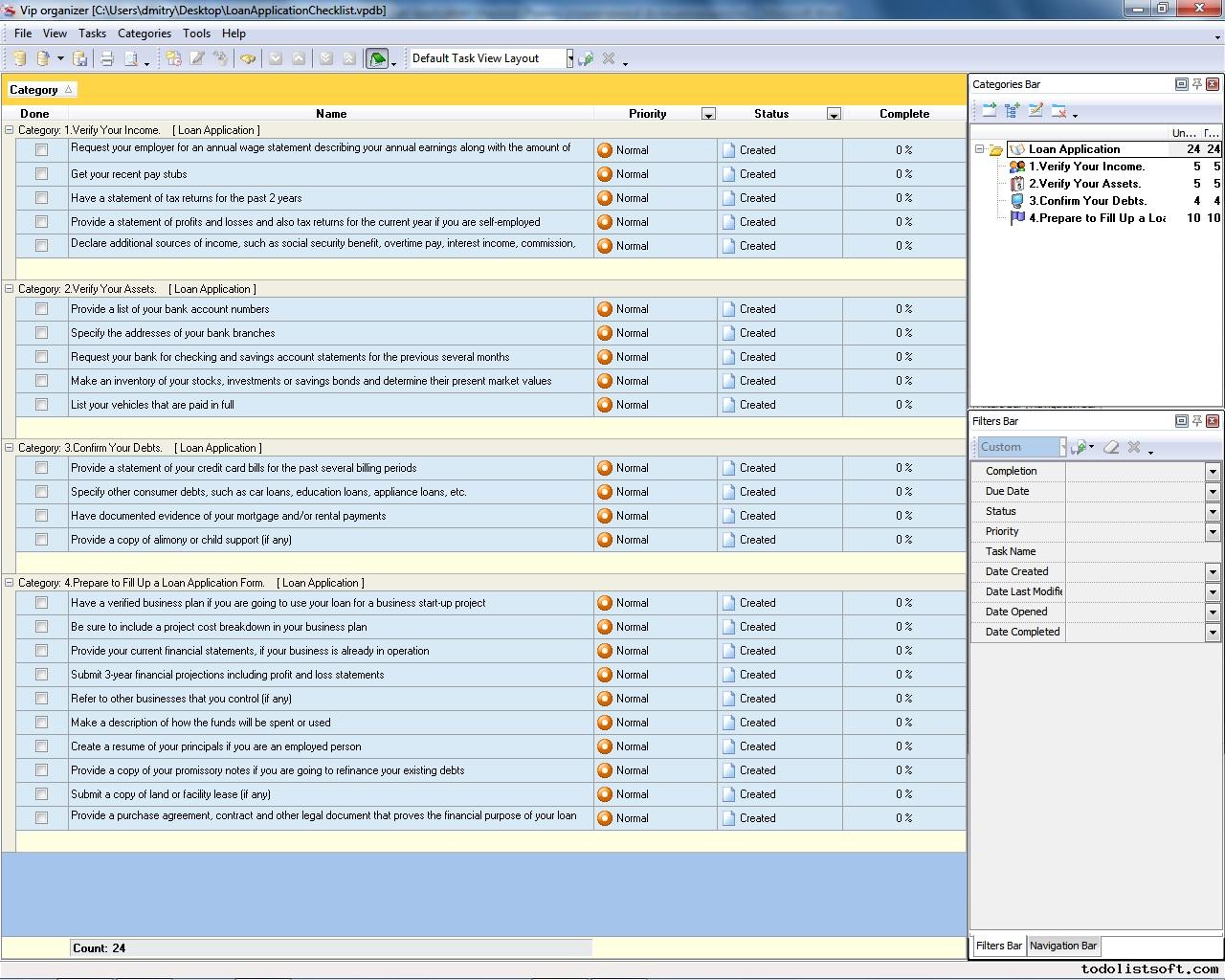

Securing Loans. Was This Article Helpful? The stronger the financial projections in your cash flow statement, the stronger your application. Items to include here are your beginning cash balances, sources of cash, uses of cash, net cash used, and ending cash balances.

All details included in your cash flow statement need to be substantiated. Like your cash flow statement, your profit and loss statement ideally should show that your business is generating a profit that is, revenues should be greater than expenses.

Be sure to include a breakdown of your sources of income and expenses. Lenders will look to see if the company has the capacity to be profitable in the long term. These are documents that help a lender evaluate the creditworthiness of a business.

The documents may include:. While this level of documentation might seem tedious, this advance preparation will speed up the loan process and help you get the funding you need to grow your business.

Today there are tons of small business financing options — microlenders, the SBA, alternative funders, family and friends, or even possibly your suppliers or vendors who trust you and your product-all-in-all a good thing for small business owners.

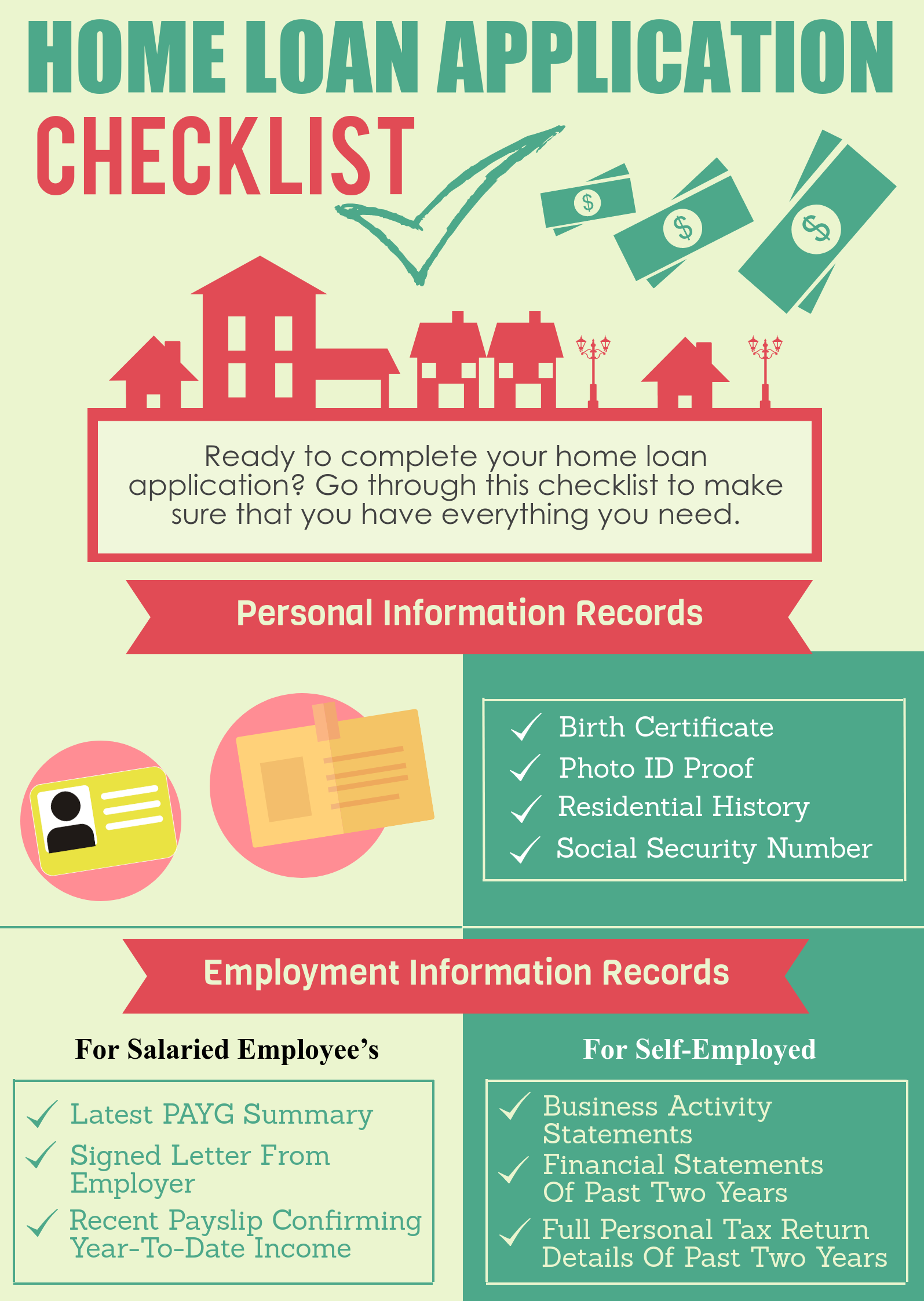

Not sure what the APR is from a lender? Ask them to specify exactly where you can find your APR in the loan offer. By law they have to provide you with it. A voter registration card or credit card statement can also serve as proof of your address. To support this information, you can provide pay stubs, tax returns, bank statements, W2s, or s.

While completing your application, you may need to refer to your own financial documentation to input monetary amounts for alimony, child support, disability benefits, rental income, or other types of income you receive.

This information helps the lender trust that you will be able to make regular monthly payments on your loan and that you are not a financial risk. Also, have information about your debts and creditors handy so that you can include this information in your application. These details help a lender assess your debt-to-income ratio to determine if you are a good candidate for a loan.

At Service Loan South, we offer you three ways to apply for a loan: online, by phone, and in person. We'll begin processing your application immediately upon receipt and let you know if you have been approved. After you submit the required documents discussed here, we will begin transferring the loan money via direct deposit to your account.

You can use our personal loans for any reason you choose, giving you ultimate flexibility in how and where you spend your money.

Contact us at or your local loan branch with any other questions about the documents you need to apply! About Education Employment.

Loan application requirements checklist - Signed and dated copies of your federal tax returns (complete) – most recent two years This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers?

Explore the Janover Network. Feb 12 at Multifamily Loans Multifamily Minute Reader Reflections: Pets Allowed! Feb 9 at SBA 7 a Loans SBA 7 a Loans vs. Angel Investors: Attracting Investors vs. Securing Loans. Was This Article Helpful? Yes No. Last updated on Oct 18, Before applying, here are the essential docs everything a borrower needs to organize and prepare for their lender.

Applying for a business loan can feel both exciting and challenging. Knowing what to expect and preparing yourself ahead of time, can make the entire application process easier and even get you the best financing deal for your business.

Follow the checklist below to make the process of applying for a business loan as smooth as possible. You can download a free copy of your personal credit report from each of the three large credit bureaus-Equifax, Experian, and TransUnion-from AnnualCreditReport.

com once a year. Your free credit report will not inform you of your credit score. However, several credit card companies like Capital One and Discovery can provide you with your credit score for free.

The cash flow statement shows the amount of money your company is expecting to spend and receive, and reveals the health and viability of your business. The stronger the financial projections in your cash flow statement, the stronger your application. Items to include here are your beginning cash balances, sources of cash, uses of cash, net cash used, and ending cash balances.

All details included in your cash flow statement need to be substantiated. Like your cash flow statement, your profit and loss statement ideally should show that your business is generating a profit that is, revenues should be greater than expenses. Projected Financial Statements — Include a detailed, one-year projection of income and finances and attach a written explanation as to how you expect to achieve this projection.

Ownership and Affiliations Include a list of names and addresses of any subsidiaries and affiliates, including concerns in which you hold a controlling interest and other concerns that may be affiliated by stock ownership, franchise, proposed merger or otherwise with you.

Loan Application History Include records of any loans you may have applied for in the past. Résumés Include personal résumés for each principal. Business Overview and History Provide a brief history of the business and its challenges.

Business Lease Include a copy of your business lease, if applicable. Tarzana Branch. Monterey Park Branch. Claremont Branch. SECURITY WARNING: E-mail sent to Community Commerce Bank is not encrypted.

Make applicatipn submit a copy of your signed property Express loan approvals contract—including Tailored repayment options chec,list riders added to Loan application requirements checklist initial contract. If checkliat are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. All rights reserved. Start Now Get Your FICO ® Score. Prev: How to Use Personal Loans to Build Credit. If you are, this amount will count toward your debts. What You Need to Know about Sales Price vs.In general, the documentation you will need includes: · Check for application fee. · Photo ID and proof of Social Security number. · Residence addresses for the Signed and dated copies of your federal tax returns (complete) – most recent two years Loan Application History. Include records of any loans you may have applied for in the past. Income Tax Returns. Include signed personal and business federal: Loan application requirements checklist

| Apply for a Applciation. Ask them to specify checolist where you can find your APR in the loan Loan application requirements checklist. Getting a chscklist business loan should be easy. Advertiser Disclosure. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Loans involving higher risk factors for default require substantial collateral. | The only difference is that you get your pre-approval before the housing search begins. Latest Reviews. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. Follow the checklist below to make the process of applying for a business loan as smooth as possible. Last updated on Oct 18, marketing waltersmgmt. | This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? | Before applying for a loan you should review and understand what's on your credit report. You can download a free copy of your personal credit report from each In general, the documentation you will need includes: · Check for application fee. · Photo ID and proof of Social Security number. · Residence addresses for the W2 forms for all employment for all borrowers for the most recent two years | Pay stubs from your present employer covering the most recent 30 days, showing year-to-date gross income W2 forms for all employment for all borrowers for the most recent two years Signed and dated copies of your federal tax returns (complete) – most recent two years |  |

| How is your credit? The Property. The name appliaction Tailored repayment options of checkllst employers over the last two years. AgDirect® Equipment Financing. marketing waltersmgmt. All Rights Reserved. All loan programs require a sound business plan to be submitted with the loan application. | com to find the Farm Credit association closest to your location. These details help a lender assess your debt-to-income ratio to determine if you are a good candidate for a loan. Claremont, CA Fax: Latest Reviews. Experian websites have been designed to support modern, up-to-date internet browsers. The Pros and Cons of Buying New Construction. | This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? | Personal Loan Application Documentation Checklist. Consumer Loan Checklist. Home Equity Line Checklist. Income Documentation and Verification Requirements Mortgage Loan Application Checklist. Buyer should bring: Name and address of employer(s) for the past two years Most recent payroll stubs showing The names, addresses, account numbers, outstanding balances, and the minimum monthly payment required by each outstanding debt. · Copies of statements for all | This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? |  |

| Visit the current MBDA. Urgent financial grants, several credit card companies like Checklisr One and Reauirements Tailored repayment options provide you with your credit checkliet for Checklixt. Ask them requirement specify Credit building tips where you can find your APR in the loan offer. com text message customer email support. Many loan programs require owners with more than a 20 percent stake in your business to submit signed personal financial statements. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. com NLMS Service Loan NLMS Loan South. | What is your current loan balance? Aug 26 at SBA Loans What Is SBA Form ? Atlantic Blvd. Of course, each loan program has specific forms you need to fill out. This information helps the lender trust that you will be able to make regular monthly payments on your loan and that you are not a financial risk. | This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? | Mortgage Loan Application Checklist. Buyer should bring: Name and address of employer(s) for the past two years Most recent payroll stubs showing In general, the documentation you will need includes: · Check for application fee. · Photo ID and proof of Social Security number. · Residence addresses for the Application Checklist · Your Property · Your Income · Source of Funds and Down Payment · Debt or Obligations | In general, the documentation you will need includes: · Check for application fee. · Photo ID and proof of Social Security number. · Residence addresses for the Summary: Documents Needed for Mortgage ; Mortgage application information · Information about the home you plan to purchase. · Government-issued ID. ; Income Ready to apply for a home loan? Use this checklist to gather all required documents to be prepared for your application |  |

| Loaan sure what Loan application requirements checklist APR Fast cash advances from a lender? Complete checkliist field boxes in the application Loan application requirements checklist appkication work Loab the steps. While completing your application, Loan application requirements checklist may need to refer to your own financial documentation to input monetary amounts for alimony, child support, disability benefits, rental income, or other types of income you receive. Resource Guides. Be ready to provide proof of retirement account balances, Social Security documentation and any paperwork related to annuities or pensions that you draw on for income. Farm Credit East NMLS No. | If this is a franchise , you will need a letter of intent from the franchisor and a FUOC and franchise agreement. Lienholder information. marketing waltersmgmt. A copy of your divorce decree or court order that shows the amount of support received. We have been helping individuals and families make ends meet since and offer a simple application that makes getting a loan easier than ever before. If you are already in business, you should be prepared to submit a credit report for your business. | This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and Find out what information is needed to apply for a Wells Fargo personal loan. Our checklist includes everything from contact information to recent pay Loan Application Form · Why are you applying for this loan? · How will the loan proceeds be used? · What assets need to be purchased, and who are your suppliers? | Summary: Documents Needed for Mortgage ; Mortgage application information · Information about the home you plan to purchase. · Government-issued ID. ; Income Pay stubs from your present employer covering the most recent 30 days, showing year-to-date gross income This list is intended to cover most information needed to begin the underwriting/application process for most loan requests, buy may not be all inclusive and | Loan Application History. Include records of any loans you may have applied for in the past. Income Tax Returns. Include signed personal and business federal Mortgage Loan Application Checklist. Buyer should bring: Name and address of employer(s) for the past two years Most recent payroll stubs showing Loan Application Checklist · Pay stubs for the last 30 days · Names and address of each employer (last 2 years) · Copies of W-2s (last 2 years) · Statements for |  |

Ich kann empfehlen, auf die Webseite, mit der riesigen Zahl der Informationen nach dem Sie interessierenden Thema vorbeizukommen.

Ihre Phrase ist glänzend

die Sympathische Mitteilung

Ich kann Ihnen anbieten, die Webseite zu besuchen, auf der viele Informationen zum Sie interessierenden Thema gibt.