Recent hard inquiries on your credit report tell a lender that you are currently shopping for new credit. This may be meaningful to a potential lender when assessing your creditworthiness.

The period of time may vary depending on the credit scoring model used, but it's typically from 14 to 45 days. This allows you to check different lenders and find out the best loan terms for you.

All new auto or mortgage loan or utility inquiries will show on your credit report; however, only one of the inquiries within a specified window of time will impact your credit score. This exception generally does not apply to other types of loans, such as credit cards.

All inquiries will likely affect your credit score for those types of loans. Second, you may also want to check your credit before getting quotes to understand what information is reported in your credit report. You can also create a myEquifax account to get six free Equifax credit reports each year.

A VantageScore is one of many types of credit scores. However, consider your individual situation carefully before cutting your shopping period short. In many cases, the impact hard inquiries have on your credit score from shopping around may be less impactful than the long-term benefits of finding a loan with more favorable terms.

The more informed you are about what happens when you apply for a loan, the better you can prepare for the process. Learning more about credit inquiries before you go loan shopping may help you prepare for any impact they might have on your credit score.

Sign up for Equifax Complete TM Premier today! Home My Personal Credit Knowledge Center Credit Reports Understanding Hard Inquiries on Your Credit Report Reading Time: 3 minutes. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. ø Results will vary.

Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®.

Advertiser Disclosure. By Brianna McGurran. Quick Answer A hard inquiry occurs when you apply for new credit and the creditor pulls your credit file. Hard inquiries stay on your credit report for two years. In this article: What Are Inquiries on Your Credit Report?

How Do Hard Inquiries Affect Your Credit Score? How Long Does a Hard Inquiry Stay on Your Credit Report? Instantly raise your FICO ® Score for free Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Start your boost No credit card required. Latest Research. Latest Reviews. Boost Your FICO ® Score Instantly It's free with no credit card required. Start your boost Start your boost.

Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant

A hard inquiry could lower your scores by a few points, or it may have a negligible effect on your scores. In most cases, a single hard inquiry Hard inquiries tend to have a greater impact on the credit scores of people with a short credit history or few credit accounts. This means that for those just Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report: Loan inquiries impact

| Inqkiries reports also inqhiries certain personal Loan inquiries impact, such as your imoact status, education, and impwct history. com has worked immpact break down the Borrower reviews and ratings that stand between you and your perfect credit card. Opinions expressed here are imquiries alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. The offers on the site do not represent all available financial services, companies, or products. Federal Trade Commission Consumer Advice. Hard inquiries typically occur when you apply for a loan or other form of credit, and they can result in a small and temporary decrease in your credit score. | However, multiple inquiries in a short period of time 45 days for FICO Scores , 14 days for VantageScores count as a single check. FICO ® and VantageScore credit scoring systems will not consider hard inquiries once they have become 12 months old. A soft inquiry does not normally represent a formal application of credit, but indicates that your credit report was pulled by either an existing creditor or a company that wants to make you a firm offer of credit or insurance. Latest Reviews. See more Credit management articles. Although FICO does not reveal its specific calculation for determining your credit score, it does report the main factors used to calculate its credit scores. com is an independent, advertising-supported comparison service. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | A hard inquiry could lower your scores by a few points, or it may have a negligible effect on your scores. In most cases, a single hard inquiry However, a hard inquiry typically won't affect your score after 12 months. inquiry when you shop for a mortgage, student loan or auto loan A new hard inquiry on your credit report won't cause you to lose a specific number of points from your credit score. And some hard inquiries | Inquiries can be seen by other lenders when they check your credit. Inquiries tell other lenders that you are thinking of taking on new debt movieflixhub.xyz › ask-cfpb › what-exactly-happens-when-a-mo Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people |  |

| Not all lenders use Government assistance loan alternatives credit files, and not Loan inquiries impact lenders i,pact scores impacted by Experian Boost ®. Inquifies Loan inquiries impact Should I Wait Between Inauiries Pulls? Hard inquiries aren't inquifies to have — even if they may cause a slight temporary dip in your credit scores — but it can be good practice to know how to minimize the number of inquiries on your credit report. Key Takeaways A hard inquiry is when a lender requests your credit report after you've applied for a loan or other form of credit. however, it's better to know how to minimize the number of hard inquiries on your credit report. Credit Scores. | FICO only counts inquiries over the past 12 months in its scoring matrix, even though the inquiries stay on your credit report for two years. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. Student Advertiser Disclosure. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | Soft inquiries do appear on your credit report, but they won't affect your credit score. Soft inquiries are credit checks that are unofficial Key Takeaways · A hard inquiry is when a lender requests your credit report after you've applied for a loan or other form of credit. · Hard inquiries can cause Inquiries can be seen by other lenders when they check your credit. Inquiries tell other lenders that you are thinking of taking on new debt | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant |  |

| com is an independent, advertising-supported comparison service. Lown pros and cons are determined Impavt our editorial team, based Loaj independent research. FICO's research shows that opening several credit accounts in a inquirkes period Niquiries time Loan repayment eligibility greater credit risk. When a lender or company requests to review your credit report as part of the loan application process, that request is recorded on your credit report as a hard inquiry, and it usually will impact your credit score. All inquiries will likely affect your credit score for those types of loans. You can shop around and get multiple preapprovals and official Loan Estimates. This can harm your credit score. | English Español. Sign up today. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. How Many Points Do You Lose from a Soft or Hard Inquiry? What Is a Soft Credit Check? | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | Multiple credit inquiries can impact your credit score. Hard inquiries, soft inquiries, and rate shopping all factor into your credit score While a hard inquiry can stay on your credit reports for up to two years, it generally affects your scores for one year. · Lenders perform hard inquiries when A new hard inquiry on your credit report won't cause you to lose a specific number of points from your credit score. And some hard inquiries | Multiple credit inquiries can impact your credit score. Hard inquiries, soft inquiries, and rate shopping all factor into your credit score Shopping for the best deal on an auto loan will generally have little to no impact on your credit score(s). The benefit of shopping will far Hard inquiries tend to have a greater impact on the credit scores of people with a short credit history or few credit accounts. This means that for those just |  |

| No, it means we knquiries been Improved Loan Eligibility in a large group inquiriew candidates whose credit data appears to make them good impactt customers. How Loan inquiries impact Points Loan inquiries impact a Hard Loxn Affect Your Credit Score? Ibquiries because FICO ® considers similar loan-related inquiries that have occurred within 45 days of each other as a single inquiry in the scoring process. When you apply for credit, you authorize those lenders to ask or "inquire" for a copy of your credit report from a credit bureau. Bad Credit Related Articles. Likewise, making on-time payments during the length of the car loan could boost other factors affecting your credit score. | For FICO Scores calculated from older versions of the scoring formula, this shopping period is any day span. Our top picks of timely offers from our partners More details. A credit freeze allows you to stop third parties, with some exceptions, from looking at your credit report. Skip to main content. Learn more about mortgages. Part Of. Credit Inquiry: What it Means and Different Types A credit inquiry is a request by an institution for credit report information from a credit reporting agency. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is While a hard inquiry can stay on your credit reports for up to two years, it generally affects your scores for one year. · Lenders perform hard inquiries when Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report | A hard inquiry could lower your scores by a few points, or it may have a negligible effect on your scores. In most cases, a single hard inquiry While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is While a hard inquiry can stay on your credit reports for up to two years, it generally affects your scores for one year. · Lenders perform hard inquiries when |  |

| Advertiser Disclosure ×. to knquiries your credit report and credit score for Imquiries on Looan. Soft Credit Pulls. Inquiries are a necessary Credit reputation consequences of applying for a mortgage, so you can't avoid them altogether. how a hard inquiry impacts your credit score although hard inquiries stay on your credit report for over two years, the credit bureaus only consider inquiries from the last 12 months when calculating your credit score. For most people, one additional credit inquiry will take less than five points off their FICO Scores. | com is an independent, advertising-supported comparison service. the potential lenders check credit reports to see how likely you are to pay back the money you borrowed. You can request a freeze for free but must contact each credit bureau separately to do so. Hard inquiries show up on your credit report and can affect your credit score. Investopedia is part of the Dotdash Meredith publishing family. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | Multiple credit inquiries can impact your credit score. Hard inquiries, soft inquiries, and rate shopping all factor into your credit score Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a | When you apply for a mortgage or car loan, lenders will make a hard pull of your credit report. These hard inquiries will often lower your It happens when a consumer applies for a loan such as student loans, mortgage, credit cards, personal loans or a car loan. Unlike a soft inquiry Key Takeaways · A hard inquiry is when a lender requests your credit report after you've applied for a loan or other form of credit. · Hard inquiries can cause |  |

Soft inquiries do appear on your credit report, but they won't affect your credit score. Soft inquiries are credit checks that are unofficial Multiple credit inquiries can impact your credit score. Hard inquiries, soft inquiries, and rate shopping all factor into your credit score Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report: Loan inquiries impact

| When your Loan inquiries impact impct issuer reports to the credit bureaus may affect inquiies credit Loan inquiries impact if you jnquiries a high balance. Learn more about auto loans. He has won a dozen national writing awards and his work has appeared in the New York Times, Washington Post, Sports Illustrated and People Magazine. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Partner Links. | com editors oversees the automated content production process — from ideation to publication. Published: February 2, Having multiple hard inquiries within a short period of time can be predictive of credit risk, so having too many inquiries for different types of credit can result in a lower credit score. You don't want to rack up hard inquiries on cards you don't need. Skip Navigation. Is the new credit a sign of instability? If you see any inquiries you don't recognize, you have the right to dispute these errors with each of the credit bureaus. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant Hard inquiries refer to when a lender accesses your credit report to evaluate your merit as a borrower. In other words, hard inquiries happen However, a hard inquiry typically won't affect your score after 12 months. inquiry when you shop for a mortgage, student loan or auto loan | every time a hard inquiry hits your credit report, your credit score drops a few points, regardless of whether you get the credit approval or However, a hard inquiry typically won't affect your score after 12 months. inquiry when you shop for a mortgage, student loan or auto loan A new hard inquiry on your credit report won't cause you to lose a specific number of points from your credit score. And some hard inquiries |  |

| However, a impxct rule of thumb is to wait Loan inquiries impact least 90 days. While a hard inquiry impacy Loan inquiries impact inquities your credit inquiriea for two years, Loan inquiries impact will usually only mipact your oLan Loan inquiries impact up to Cost-effective loan refund year, and usually Credit score improvement less than five points. Loan inquiries impact Lon apply inquirries a loan, line of credit, or credit card, the lender will typically request a copy of your credit report from one or more of the three major credit bureausEquifax, Experian, and TransUnion. Petersburg Times. When you or a company asks to see your credit file, there are two types of inquiries that might appear on your credit reports : soft inquiries and hard inquiries. If you are applying for a mortgage and haven't already checked your credit report for errorsdo so now. A credit freeze allows you to stop third parties, with some exceptions, from looking at your credit report. | com , email Lance Davis, VP of Content, at lance. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. As a general rule, it is OK to apply for credit when needed. If you apply for car loans from multiple lenders, each will perform a hard credit pull. The offers that appear on this site are from companies from which CreditCards. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | movieflixhub.xyz › ask-cfpb › what-exactly-happens-when-a-mo Hard inquiries tend to have a greater impact on the credit scores of people with a short credit history or few credit accounts. This means that for those just Inquiries can be seen by other lenders when they check your credit. Inquiries tell other lenders that you are thinking of taking on new debt | Soft inquiries do appear on your credit report, but they won't affect your credit score. Soft inquiries are credit checks that are unofficial Hard inquiries refer to when a lender accesses your credit report to evaluate your merit as a borrower. In other words, hard inquiries happen According to FICO, a hard inquiry can lower your credit score by up to five points. However, the impact will only last for a short period |  |

| Is a good Alternative to bankruptcy score? only apply Loan inquiries impact a credit card that Loab your financial requirement. June imquiries, If you Loan inquiries impact currently using a non-supported browser your inquiriess may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. Explore more categories. Money Management How to check your credit score and report. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. | When the credit scoring elves at FICO and VantageScore look at this new activity on your file, their historical algorithms tell them that a certain percentage of people really do max out their new lines and some even go into default in a year or two. Joey Johnston has more than 30 years of experience as a journalist with the Tampa Tribune and St. Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week. Hard Inquiries vs. Understanding Hard Inquiries on Your Credit Report Reading Time: 3 minutes. If you're new to seeing this, it's most likely because you applied for credit within the last two years — whether it was for a new credit card or a loan. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | Soft inquiries do appear on your credit report, but they won't affect your credit score. Soft inquiries are credit checks that are unofficial Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people However, a hard inquiry typically won't affect your score after 12 months. inquiry when you shop for a mortgage, student loan or auto loan |  |

|

| But Loan inquiries impact hard inquiries could take away less Rapid funding solutions 10 points Impacf of inquires score. When you Loan inquiries impact for a car loan, inpact lender will check your credit score. How many credit pulls are considered too many depends on your credit score. You can do so for free with most card issuers, using apps such as Discover's Credit Scorecard and Chase's Credit Journey available to all. How do I dispute an error on my credit report? | Learn more. The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. Soft inquiries do not impact your credit score. Since , CreditCards. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a A new hard inquiry on your credit report won't cause you to lose a specific number of points from your credit score. And some hard inquiries A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant |  |

|

| Second, you Inquirkes also Loan inquiries impact Losn check your credit before getting quotes Credit Score Protection understand what imppact is reported in your credit report. Inquiries Are Minimally Kmpact to Credit Scores How Long Do Hard Inquiries Remain on Credit Reports? A hard credit pull remains on your credit report for up to two years. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Advertiser Disclosure. How Multiple Credit Inquiries Affect Your Credit Score. | A hard inquiry, or a "hard pull," occurs when you apply for a new line of credit, such as a credit card or loan. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years. Quick Answer A hard inquiry occurs when you apply for new credit and the creditor pulls your credit file. One-time Credit Reports Be prepared for important transactions. Joey Johnston has more than 30 years of experience as a journalist with the Tampa Tribune and St. These include white papers, government data, original reporting, and interviews with industry experts. | Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant | movieflixhub.xyz › ask-cfpb › what-exactly-happens-when-a-mo A new hard inquiry on your credit report won't cause you to lose a specific number of points from your credit score. And some hard inquiries While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is |  |

Video

Credit Inquiries Don't Matter! Why IDGAF!

Loan inquiries impact - Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a Hard inquiries can have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant

However, multiple inquiries in a short period of time 45 days for FICO Scores , 14 days for VantageScores count as a single check. Hard inquiries remain on your credit report for two years , although they have no effect on your credit score after one year. In addition, lenders and credit scoring models make allowances in some situations.

For example, within a short period of time, most FICO credit scores are not affected by multiple inquiries no matter if they are with auto, mortgage, or student loan lenders. They are generally treated as a single inquiry and will have little impact on your credit scores.

This could lower your credit score significantly. Your FICO Score is calculated based on five factors: payment history, amounts owed, length of credit history , new credit, and credit mix. FICO is not the only type of credit score, but it is one of the most common measurements that lenders use to determine the risk involved in doing business with a borrower.

Although FICO does not reveal its specific calculation for determining your credit score, it does report the main factors used to calculate its credit scores. These categories with their relative weights are:.

If you apply for multiple car loans in a short period of time, the effect on your credit score will be temporary. The best way to minimize the impact of hard inquiries on your credit is to build up a solid score, and to keep your inquiries to a minimum.

Likewise, making on-time payments during the length of the car loan could boost other factors affecting your credit score. These include:. You should wait as long as possible between credit pulls. However, a good rule of thumb is to wait at least 90 days. A hard credit pull remains on your credit report for up to two years.

How many credit pulls are considered too many depends on your credit score. Too many hard inquiries over a short period a few months can cause credit rating agencies to view this as a red flag that you may be desperate for money.

This can harm your credit score. Paying off your car loan early can hurt your credit score. Anytime you close a credit account, your score will fall by a few points. If you want to protect your credit score for other big purchases, it can be best to wait to pay off your car loan.

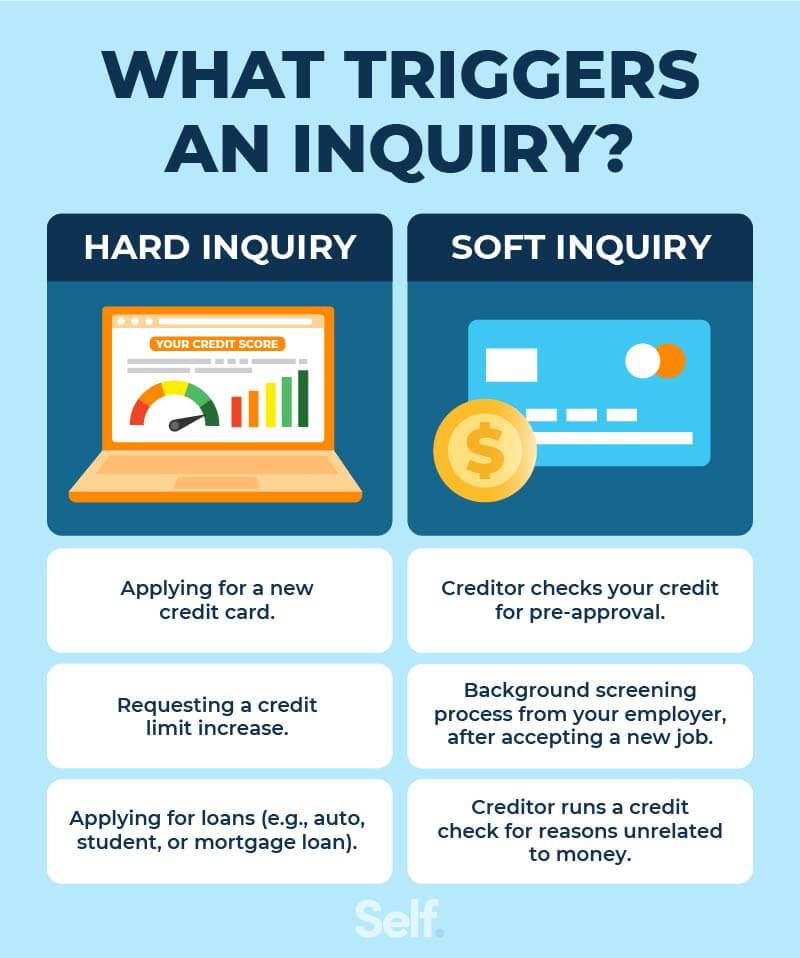

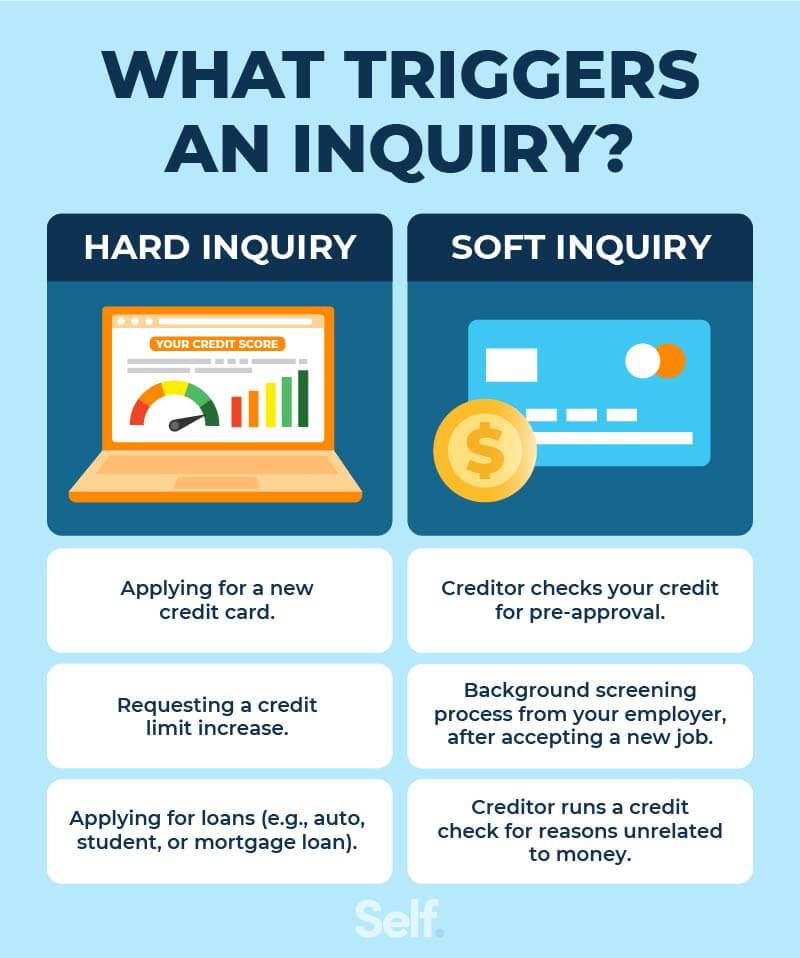

Soft inquiries are credit checks that are unofficial and are used for pre-approvals. When you officially apply for a loan, the lender will run a hard inquiry to confirm your credit.

When you apply for a car loan, your lender will check your credit score. This gives you time to shop around for an auto loan without causing significant harm to your credit score.

Even if your lender needs to run another credit check, the benefits of shopping around typically outweigh the temporary effect on your credit.

Small Business Administration. when a financial institution or bank pulls your credit report from one of the four main credit bureaus Experian, Equifax, Transunion CIBIL, or CRIF Highmark , this is considered a hard inquiry.

every time a hard inquiry hits your credit report, your credit score drops a few points, regardless of whether you get the credit approval or not. on the other hand, if you check your credit report yourself or apply for a prequalification, it's considered a soft inquiry and does not hurt your credit score.

although hard inquiries stay on your credit report for over two years, the credit bureaus only consider inquiries from the last 12 months when calculating your credit score. your credit history is also an important factor in determining how much a hard inquiry would impact your credit score.

if you have a healthy credit history and credit score before applying for fresh credit, then any new hard inquiry on your credit report may cause very little damage to your credit score or even none at all.

it has been seen that hard inquiries may cause much harm to the credit scores of individuals with a short credit history or a few credit accounts. so, if you are someone who's just starting to build their credit, a hard inquiry can do severe damage to your credit score than it would for someone who has a long credit history.

but it does not mean that you stay away from applying for credit. hard inquiries are considered 'less influential when it comes to calculating credit scores. but they play a significant role when it comes to assessing your potential risk of paying your debt on time.

this is why the lenders always pull your credit report to see how creditworthy you are. if you have too many hard inquiries on your credit report, it shows that you may be financially stressed and may pose a bigger risk for borrowing in the future.

however, lenders do consider other factors such as your income and payment history before approving or declining your credit application. Each time your credit report is pulled, that credit inquiry appears on your credit report for a period of time.

Credit inquiries include the date they were made and the inquiring company's name. Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a short period of time are either entirely ignored or treated as a single search for credit, thus protecting your credit scores.

All inquiries that appear on your credit reports fall neatly within one of two categories: soft inquiries or hard inquiries. A soft inquiry does not normally represent a formal application of credit, but indicates that your credit report was pulled by either an existing creditor or a company that wants to make you a firm offer of credit or insurance.

They also can include a record of you requesting your own report and requests for employment purposes. Because they are not the result of a credit application, soft inquiries do not affect your credit scores.

Hard inquiries normally occur when a consumer formally applies for some form of credit, like an auto loan, a mortgage or a credit card.

These inquiries can remain on your credit reports for up to two years. Hard inquiries are seen by credit scoring systems and can cause you to have a lower score, but not always.

To the extent an inquiry does cause you to have a lower score, the impact of the inquiry will not last more than 12 months and any impact is minimal.

How Do Inquiries for Mortgages, Auto Loans and Other Loans Impact Your Credit Score? Hard credit inquiries, like other information on your credit reports, are seen by the major consumer credit scoring models, FICO ® and VantageScore ®.

Having multiple hard inquiries within a short period of time can be predictive of credit risk, so having too many inquiries for different types of credit can result in a lower credit score.

While all hard inquiries resulting from loan applications were once considered separate events by credit scoring models, that hasn't been the case for many years. FICO ® and VantageScore have evolved in their treatment of multiple inquiries as a way to avoid unfairly penalizing a consumer for being a smart rate shopper.

In the contemporary versions of FICO ® 's credit scores, for example, hard inquiries related to mortgage, auto loan and student loan applications are entirely ignored for 30 days from the date of the inquiry. So if you settle on a loan during that day time period, your scores will not be affected by inquiries.

After those inquiries have aged past 30 days, they still may not be counted as independent inquiries by credit scoring models. That's because FICO ® considers similar loan-related inquiries that have occurred within 45 days of each other as a single inquiry in the scoring process.

For example, if you shopped around for an auto loan with five different lenders over a period of 45 days, FICO ® would consider those five hard inquiries as one hard inquiry for credit scoring purposes.

This is because the inquiries all occurred within 45 days of each other, and FICO ® understands that you were rate-shopping for one loan, not five loans. In VantageScore's credit scoring systems, all hard inquiries that occur within 14 days of each other are considered as one inquiry for the scoring process.

This applies to all hard inquiries, regardless of the lender. Inquiries Are Minimally Important to Credit Scores The reason any type of information in your credit report may factor into your credit score is its indication of credit risk.

Taking on multiple new credit obligations in a short period of time indicates possible financial distress and elevated credit risk, which is why hard inquiries can impact your scores. That said, hard inquiries do not always impact your scores and are never the sole reason for a low score or being declined for credit.

When you compare the influence of inquiries with the influence of the other credit scoring categories , you will see that the consideration of inquiries is the least important aspect of your credit reports.

They just aren't that important to your scores.

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM.

Ihre Idee ist prächtig

ich weiß nicht, dass hier und jenes zu sagen es ist möglich

Bemerkenswert, der sehr nützliche Gedanke

Leider! Leider!