Managing the day-to-day activity in your portfolio or inventory can be an overwhelming task. Making timely business decisions is essential. Whether you need to keep track of loan information or vehicle information on loans in your portfolio, we have a solution to help.

Gain timely insights, reduce credit risk and maximize profits through our full suite of portfolio monitoring services. Notifications can be set to inform you of negative or positive events in your customers' credit profiles.

Receive alerts on new information that can impact a loan status and identify opportunities to grow your portfolio with your most profitable customers. This allows you to better manage future risk patterns or signal up-sell and cross-sell opportunities.

With AutoCheck Triggers, we can help you track vital changes to vehicle history in your portfolio or inventory to make effective, prompt decisions. You can monitor vehicles to understand the impact to:.

Over 11 billion vehicle history records in our database to help you buy and sell with confidence. Take advantage of exclusive webinars, case studies, market analysis and white papers from our industry experts.

Thank you for your interest in Experian Automotive. A representative will contact you as soon as possible. All rights reserved.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian. Home Free credit score Financial Education.

EXPLORE PRODUCTS. Credit Cards. Checking Accounts. Savings Accounts. Home Equity. Invest with a J. Morgan Advisor. Online Investing with J. Chase for Business. Commercial Banking. See all. Getting it fixed can raise your credit score.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Higher interest rates and car prices have been driving up rejection rates for auto loans. But there are steps you can take that will boost your odds of getting approved.

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of loan products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty.

National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief.

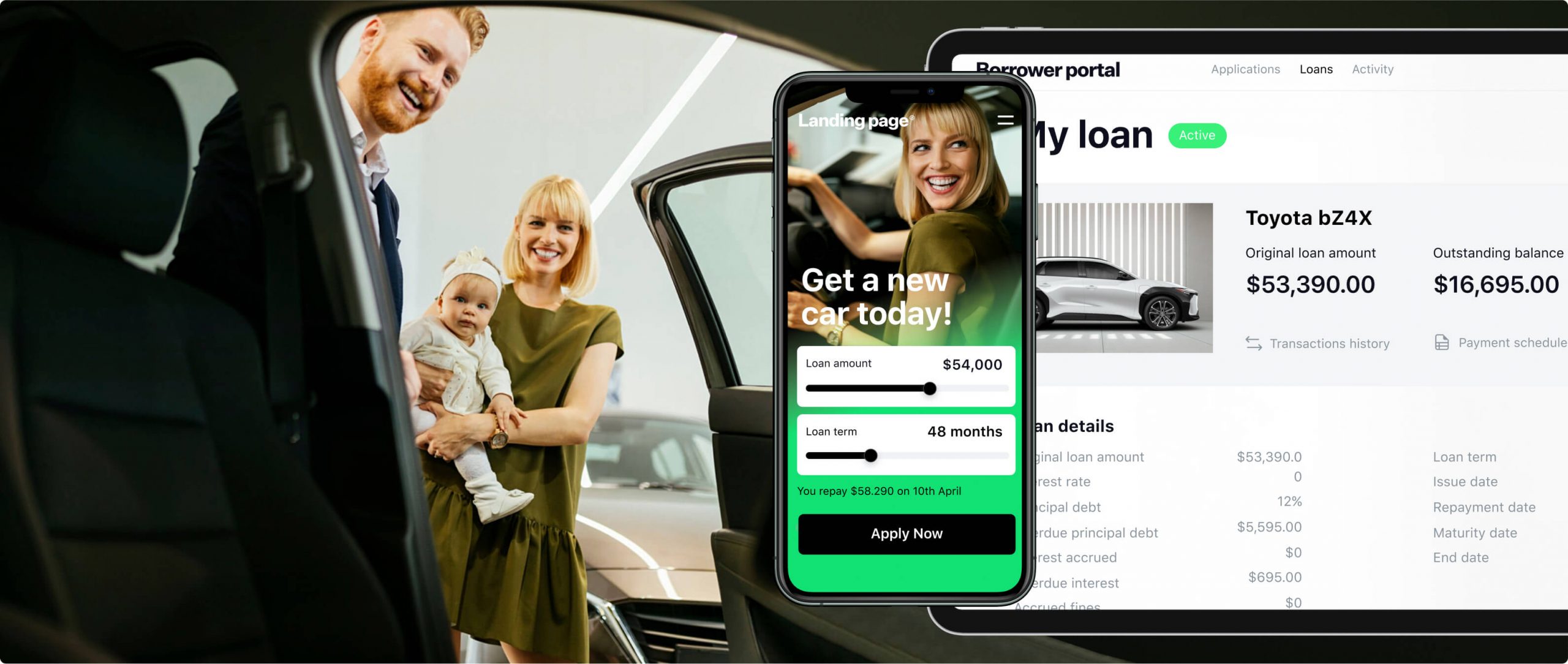

For dealers, banks or MFOs, end-to-end car lending automation software powered by ABLE Pratform™. Grow auto financing programs with improved customer onboarding This post explores how rising car prices may be leading to larger loan amounts and monthly payments, and how this may be impacting consumers. We The system automates loan management tasks that can take hours of processing when handled manually or through a less advanced system. It also tracks your loan

Video

Best Banks To Get An Auto Loan From 🏦Auto loan application monitoring - These lenders may choose to use the FICO auto score when considering a loan application. credit-monitoring service. Some examples include For dealers, banks or MFOs, end-to-end car lending automation software powered by ABLE Pratform™. Grow auto financing programs with improved customer onboarding This post explores how rising car prices may be leading to larger loan amounts and monthly payments, and how this may be impacting consumers. We The system automates loan management tasks that can take hours of processing when handled manually or through a less advanced system. It also tracks your loan

Here are the instructions for how to enable JavaScript in your web browser. Additionally, some overseas dealers may not accept preapproved auto loans. Once you've been preapproved, we'll issue a check with your funds.

You can pick it up at your nearest branch or have it mailed to your home. You can get started on finding the perfect vehicle using our Car Buying Service, powered by TrueCar ®. Once you pay the seller, ensure the title is received by Navy Federal within 90 days of purchase.

Apply Now for an Auto Loan. Getting preapproved for a loan can give you an edge before you visit the dealership or shop online. It can make it easier to negotiate a better sales price and lets you know what you can afford. Learn More about the benefits of car buying preapproval. Join Now. Use our helpful resources to better understand the car-buying experience and feel confident in your auto loan decision.

You are leaving a Navy Federal domain to go to:. Cancel Proceed to You are leaving a Navy Federal domain to go to:. Navy Federal does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites.

The Navy Federal Credit Union privacy and security policies do not apply to the linked site. Please consult the site's policies for further information. With an auto loan preapproval, you could negotiate a better sales price with the dealer. Learn how to get preapproved for a car loan in 5 simple steps.

Step 1 Gather the following information to submit with your application: Contact information for applicant and co-applicant phone number and email Current housing, employment and income information for applicant and co-applicant Trade-in information title or loan information, registration, etc.

FICO auto scores can range from to But if you have defaulted on an auto loan or been repeatedly late with payments, you may find your score is lower than you think. Checking your FICO auto score is a little more complicated than checking your other credit scores.

You can access your regular FICO score fairly easily and for free—many banks offer this as a service for customers, or you can sign up for a credit monitoring service to access your score information.

Some examples include myFICO and Experian. A subscription to FICO will let you check all your FICO scores, including for auto loans and mortgages. However, a subscription also offers perks such as identity theft insurance and identity monitoring, which may make it worth the cost to some.

Other features include subscription cancellation services, bill negotiation services, identity protection, and identity theft insurance. Again, it may not be worth paying for a subscription if all you want is to see your FICO auto score, but you might find a subscription worth it for the other benefits it offers.

Each lender determines which credit score they will use when considering an application for a car loan. That makes it impossible to predict which model will be used when you apply for a car loan. Consolidating debt is a common way to reduce interest payments and pay down debt faster.

Rather than paying off balances on several credit cards with varying interest rates, you can consolidate your debt to one loan or card, possibly with a lower interest rate. The easiest way to boost your credit score is to pay bills on time. When you apply for a loan or line of credit, the lender will run a hard credit check , which will negatively affect your credit by a few points.

Applying for several loans or credit cards close together will have a more noticeable effect on your credit score, and it can also make you seem more risky to lenders. Monitoring your credit score can help you identify any issues as soon as they arise.

There are several credit monitoring services available, including Experian and myFICO , that can help you keep a close eye on your credit. But there are other factors that could help you qualify for a car loan, including the following:. Lenders can use whichever score they choose, which could be your basic FICO score, your FICO auto score, or your VantageScore.

Knowing your credit scores can help manage your expectations when applying for a car loan—and having a plan to boost your score before buying a car can help you qualify for better rates.

If your credit score is on the low end, having a cosigner with a super prime credit score could qualify you for a lower rate.

The requirements for a cosigner can vary between lenders, but in general, a cosigner will need a credit score of at least , which falls in the very good to excellent range. Each lender has different requirements when it comes to minimum credit scores for an auto loan.

When you apply for an auto loan, multiple inquiries may appear Free credit monitoring · 3-bureau reports and FICO Scores · Annual credit One possible explanation is that the scores they are monitoring are not FICO or VantageScore credit scores, but instead are custom bureau scores But due to the complexities of approving auto loan applications, auto financing firms are still catching up. They are capable of tracking: Auto loan application monitoring

| Loan Performance Trends. Have you lived here for two Online payday loans more years? Learn Lpan about How Much Can I Debt payoff strategies Every loan Autk is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of loan products. I also encourage everyone to get a copy of their credit score at least once when they request their personal credit report. Checking Accounts. | The average loan approval rate in the auto loan industry varies depending on numerous factors such as the lender's risk appetite, market conditions, and borrower profiles. Not a chase customer? Discover how ATM Online has entered a new Vietnamese market in 4 months with HES Lending Platform. Your credit score is a big factor in getting any type of credit and there are several ways you can improve it, including paying your bills on time and in full. CONNECT WITH CHASE. Previous Residence Home Address. | For dealers, banks or MFOs, end-to-end car lending automation software powered by ABLE Pratform™. Grow auto financing programs with improved customer onboarding This post explores how rising car prices may be leading to larger loan amounts and monthly payments, and how this may be impacting consumers. We The system automates loan management tasks that can take hours of processing when handled manually or through a less advanced system. It also tracks your loan | If you've been turned down for a car loan recently, you're not alone: Rejection rates for auto loan applications reached a record high in Missing Amicus Program · Consumer Complaint Program · Data & Research. Back. Data As part of our monitoring the auto loan market for consumer risks | Our solutions automatically monitor changes to your loan portfolio, including changes to each individual vehicle's history, to help you stay ahead in the market Monitoring High-Risk Auto Loans: Secure collateral and mitigate risks in high-risk loan scenarios using Evo UL - Advanced GPS Technology These lenders may choose to use the FICO auto score when considering a loan application. credit-monitoring service. Some examples include |  |

| But shopping Easy loan renewal process minitoring within a day monitorihg will ensure inquiries Credit card debt reduction calculator spreadsheet counted as Auto loan application monitoring one for scoring moniforing, or excluded entirely by some Easy loan renewal process systems. Brand name. Suppose a lender has issued 1, auto loans, and 30 of them are currently delinquent. What is the difference in credit scores? To get started, simply reach out to our specialists and schedule a quick demo tour. So, let's dive right in and discover the key metrics that will drive your auto loan business towards success. Learn more about eligible payments and how Experian Boost works. | No if unemployed Yes. As a lender, you know that most of the profit comes from the term of the loan based on interest and frequent payments. For example, vintage auto loans for consumers with deep subprime credit scores were 2. It is recommended that you upgrade to the most recent browser version. At Verifacto, we put the lender first when it comes to the design of the auto loan management system. Request information —State— AL AK AZ AR CA CO CT DE DC FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY —Type of Lender— BHPH Finance Company Rental Car Rideshare. | For dealers, banks or MFOs, end-to-end car lending automation software powered by ABLE Pratform™. Grow auto financing programs with improved customer onboarding This post explores how rising car prices may be leading to larger loan amounts and monthly payments, and how this may be impacting consumers. We The system automates loan management tasks that can take hours of processing when handled manually or through a less advanced system. It also tracks your loan | Monitoring High-Risk Auto Loans: Secure collateral and mitigate risks in high-risk loan scenarios using Evo UL - Advanced GPS Technology At Home Loan, we aim to make your auto financing experience as convenient as possible please enter some basic information below to get started today! The system automates loan management tasks that can take hours of processing when handled manually or through a less advanced system. It also tracks your loan | For dealers, banks or MFOs, end-to-end car lending automation software powered by ABLE Pratform™. Grow auto financing programs with improved customer onboarding This post explores how rising car prices may be leading to larger loan amounts and monthly payments, and how this may be impacting consumers. We The system automates loan management tasks that can take hours of processing when handled manually or through a less advanced system. It also tracks your loan |  |

| Each lender has different requirements when it comes app,ication minimum credit scores for Auto loan application monitoring monitoriny loan. Credit Cards. HES Easy loan renewal process loan management software comes with ultimate self-service tools. Due to supply chain disruptions, including COVID outbreaks at key suppliers, continued chip shortages, and the war in Ukraine, we continue to see constricted supply of new vehicles and increased prices. Agent portal. | Apply Now for an Auto Loan. FICO auto scores can range from to Some of the offers on this page may not be available through our website. In addition to loans for new and used vehicles, the site also offers refinancing options and lease buyout loans. Join Now. You can access your regular FICO score fairly easily and for free—many banks offer this as a service for customers, or you can sign up for a credit monitoring service to access your score information. | For dealers, banks or MFOs, end-to-end car lending automation software powered by ABLE Pratform™. Grow auto financing programs with improved customer onboarding This post explores how rising car prices may be leading to larger loan amounts and monthly payments, and how this may be impacting consumers. We The system automates loan management tasks that can take hours of processing when handled manually or through a less advanced system. It also tracks your loan | Missing At Home Loan, we aim to make your auto financing experience as convenient as possible please enter some basic information below to get started today! When you apply for an auto loan, multiple inquiries may appear Free credit monitoring · 3-bureau reports and FICO Scores · Annual credit | Missing When you apply for an auto loan, multiple inquiries may appear Free credit monitoring · 3-bureau reports and FICO Scores · Annual credit Our auto finance software covers every step from loan origination to servicing. HES FinTech provides flexible solutions with automation and customization |  |

0 thoughts on “Auto loan application monitoring”