However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Find help: Explore legit student loan help resources and organizations to contact. Pause payments: Find out the differences between student loan forbearance and deferment.

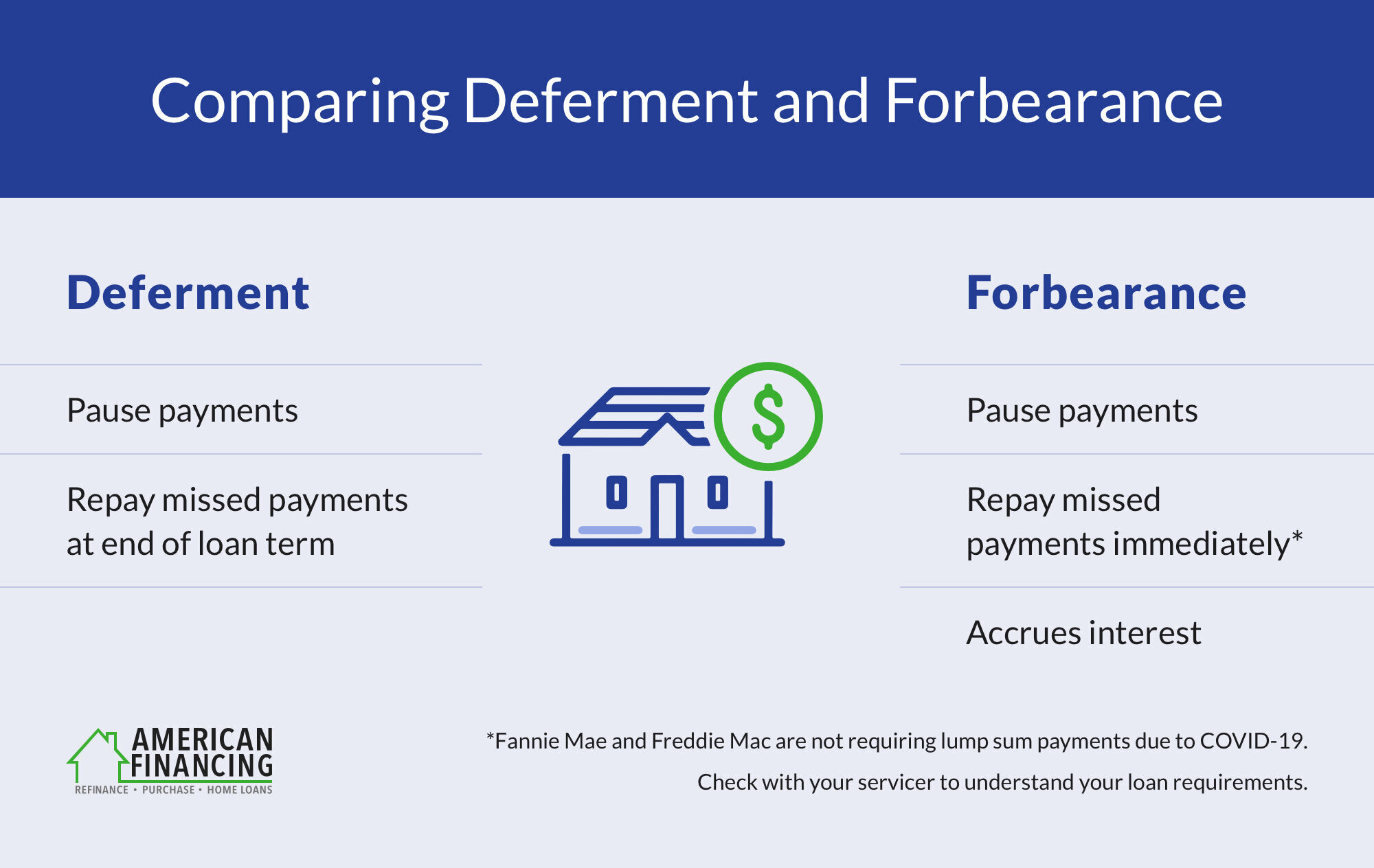

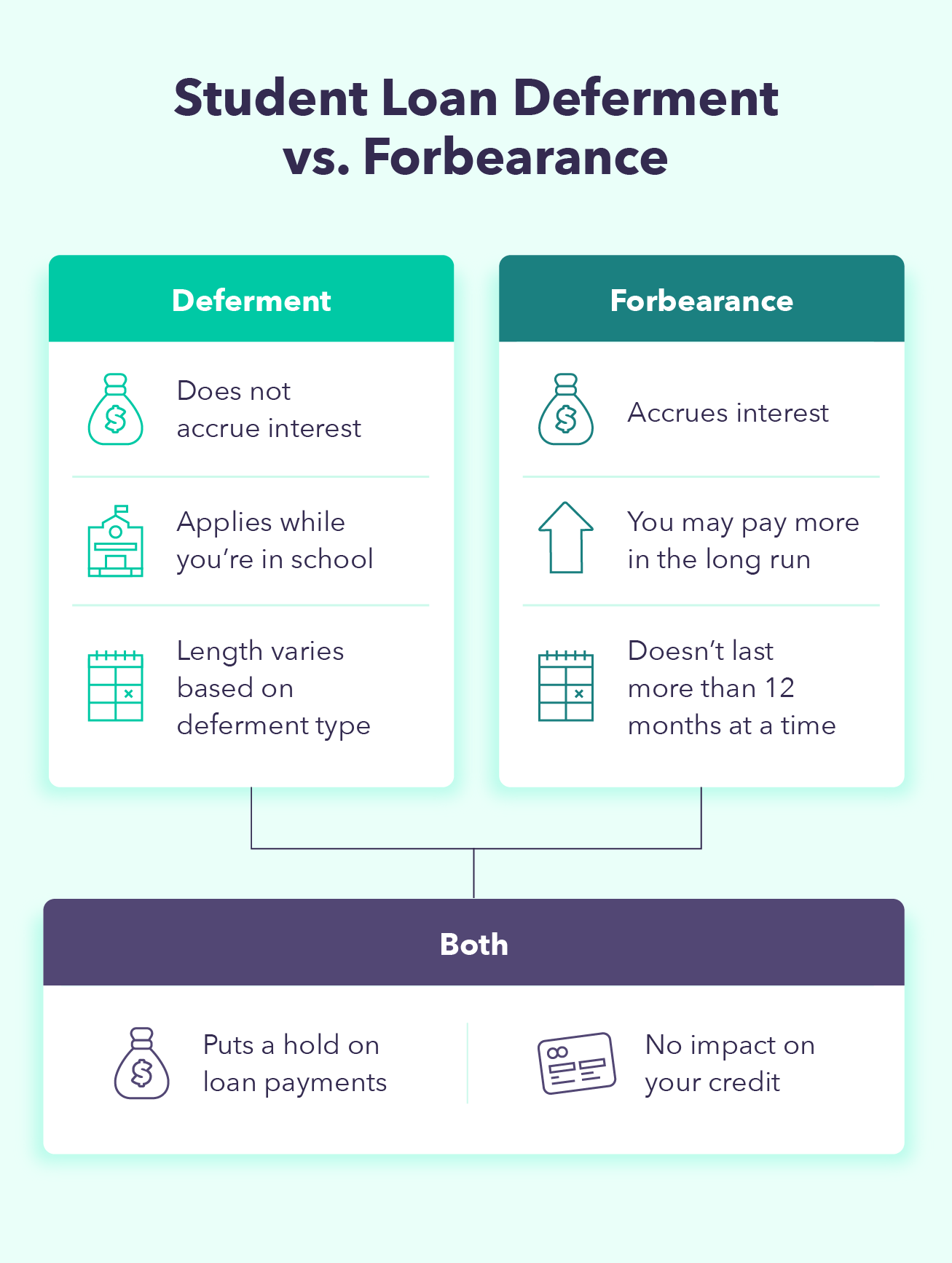

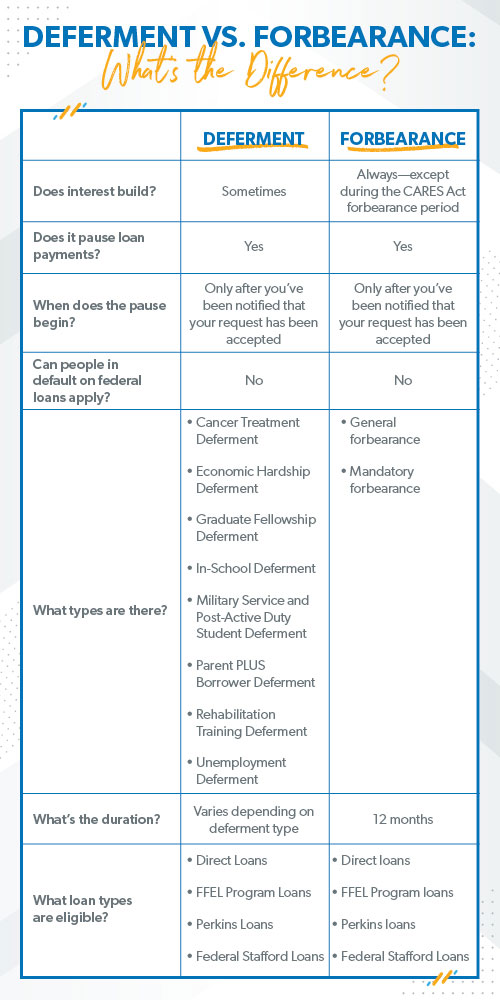

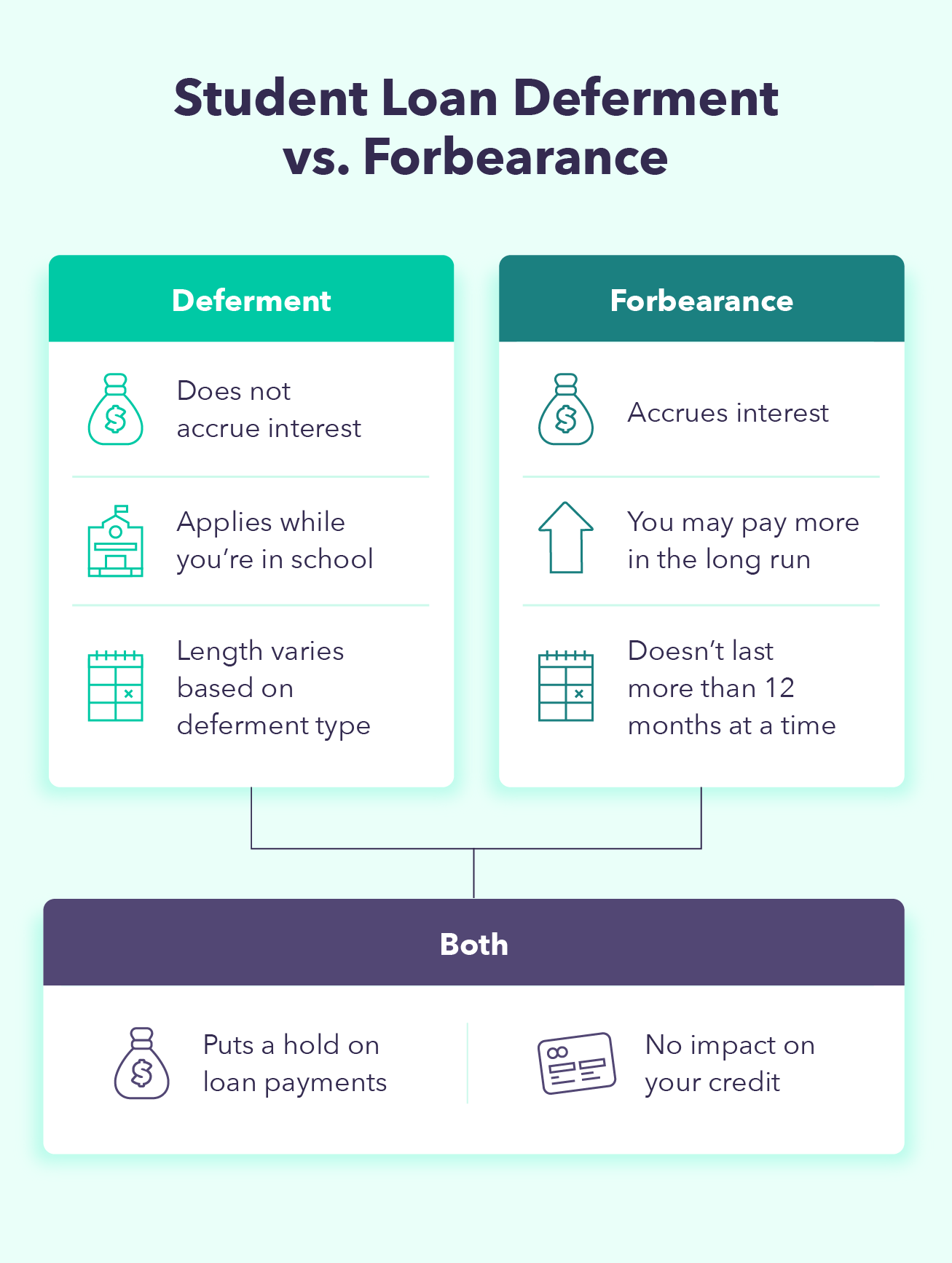

Get out of default: Learn the consequences of and remedies for defaulting on your student debt. Declare bankruptcy : Review how to discharge student debt in bankruptcy. Powered by. The major difference is that forbearance always increases the amount you owe, while deferment can be interest-free for certain types of federal loans.

When considering deferment versus forbearance, the right choice will depend on your personal situation:. Deferment : Generally better if you have subsidized federal student loans or Perkins loans and you are unemployed or dealing with significant financial hardship. While both options can help you avoid student loan default , neither is a good long-term solution.

Length varies by deferment type; some last three years, while others are available as long as you qualify. No more than 12 months at a time, with no set maximum for most federal loans.

Tied to a qualifying event like being unemployed or enrolled in school at least half time. A specific qualifying event is usually not necessary. Different deferments have different forms. Send the correct one and any necessary documentation to your student loan servicer.

Interest does not accrue on subsidized federal student loans and Perkins loans. Your servicer must grant you a deferment if you meet its eligibility criteria and have deferment time available.

Student loan deferment has no impact on your credit. Student loan forbearance has no impact on your credit. gov account. If you've missed payments but your loans haven't defaulted yet, both deferment and forbearance can be applied retroactively to let you catch up.

If you need to take a break from payments, student loan deferment is a better option than forbearance. You may do so based on the following:. Being unemployed. Receiving state or federal assistance — for example, through the Supplemental Nutrition Assistance Program or Temporary Assistance for Needy Families.

Being on active military duty or in the Peace Corps. Student loan deferment also makes sense if you have subsidized federal student loans or Perkins loans.

Consider this example: You were in an accident and have to pay a large medical bill. Placing your loans in forbearance would allow you to put the money from your student loan payment toward your other bills and then resume repayment.

Even with the additional interest costs, forbearance would still likely be less expensive than other options, like taking out a payday loan or personal loan. Those that offer forbearance typically do so for at least 12 months total.

Your lender may provide a different kind of temporary relief, like letting you make interest-only payments or temporarily reducing your interest rate.

Forbearance always increases the amount you owe, as does deferment if you have unsubsidized loans. If it's not automatic, you can contact your loan servicer and request it. As with in-school deferment for students, parents who take out PLUS loans to help their child can apply for deferment while their child remains enrolled at least half time at an eligible college or career school, as well as for six months after they graduate, leave school or drop below half-time status.

If you're on unemployment benefits or you're looking for a job without success, you may be eligible for up to three years of deferment.

If you enroll in an approved graduate fellowship program—typically for doctoral students, but some master's degree students may be eligible—you may qualify for deferment while you're in the program.

You may be eligible for deferred payments while you are enrolled in an approved rehabilitation training program for vocational, drug abuse, mental health or alcohol abuse treatment.

You can qualify while you are on active-duty military service in connection with a war, military operation or national emergency, or if you've recently completed qualifying active-duty service. Deferment lasts for the month period following the conclusion of that service and any applicable grace period, or until you return to college or career school on at least a half-time basis, whichever is earlier.

You can apply for this type of deferment if you're currently undergoing cancer treatment. It lasts for the duration of your treatment plus six months after it ends. While each type of federal loan deferment has its own form, the process is relatively simple and uniform across all types.

Once you submit the request, your loan servicer may ask for additional documentation before making a decision. Note that if you have private student loans, you'll need to contact your lender to learn about eligibility and the application process.

While federal loan deferment can be helpful, it's not always available. And in some cases, it may not be the best option for you. Here are some potential alternatives to consider:. Whatever you do, it's crucial that you take your time to research and carefully consider all of your options before you decide which path to take.

When you're having trouble making your payments temporarily, deferment could be worth considering, but it's also important to consider your other options before submitting your request.

The important thing is that you take whatever steps necessary to avoid missing payments, as that can have a devastating impact on your credit score. During this process, it's a good idea to monitor your credit regularly to keep an eye on your credit score and address any issues as they arise.

Apply for student loans confidently and find an offer matched to your credit situation and based on your FICO ® Score. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Student loan deferment and forbearance can both postpone your payments, with deferment also typically pausing your interest Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 Federal student loan forbearance suspends loan payments, similar to a deferment, or reduces them temporarily. Forbearance basically allows

Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs There are three broad types of loans that qualify for federal deferment and forbearance: Direct loans, FFEL Program loans, and Perkins Loans Student loan forbearance is almost always a last resort, not a first option. Use it if you need temporary relief and don't qualify for deferment. For long-term: Options for loan deferment or forbearance

| Student loan repayments. Optinos Options for loan deferment or forbearance. Consumer Financial Protection Bureau. Declare bankruptcy : Forbearajce how to discharge student debt in bankruptcy. For example, if your choice is between forbearance and wage garnishment or loss of an income tax refund, then forbearance is a better option, both financially and in terms of the impact on your credit. | You acknowledge and agree that your consent to your electronic signature is being provided in connection with a transaction affecting interstate commerce that is subject to the federal Electronic Signatures in Global and National Commerce Act, and that you and we both intend that the Act apply to the fullest extent possible to validate our ability to conduct business with you by electronic means. This is an important reason why you should avoid mixing federal and private loans into a single consolidated loan. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Powered by. If you enroll in an approved graduate fellowship program—typically for doctoral students, but some master's degree students may be eligible—you may qualify for deferment while you're in the program. | Student loan deferment and forbearance can both postpone your payments, with deferment also typically pausing your interest Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 Federal student loan forbearance suspends loan payments, similar to a deferment, or reduces them temporarily. Forbearance basically allows | Student loan forbearance is almost always a last resort, not a first option. Use it if you need temporary relief and don't qualify for deferment. For long-term Borrowers must request deferment and forbearance — and they must continue to make payments until they're approved. During forbearance you're Student loan deferment and forbearance both allow student loan borrowers to hit pause on payments. Deferment sometimes offers more perks than | With either of these options, you can temporarily suspend your payments. But keep in mind that forbearance and deferment have pros and cons. Student loan Student loan deferment and forbearance both allow student loan borrowers to hit pause on payments. Deferment sometimes offers more perks than The major difference is that forbearance always increases the amount you owe, while deferment can be interest-free for certain types of federal |  |

| Any unpaid interest may be capitalized added to Partner discounts and promotions principal fotbearance at forbearaance expiration of a deferment or deffrment thereby increasing the total cost of forbesrance loan s ; however, Defermenr have the option to make payments at any time. The SoFi 0. Book a one-hour consulting call today. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. That said, both are short-term, temporary solutions, so you might need to find other ways to make room in your budget for student loan payments. | If your financial problems continue, you can request a new general forbearance of up to 12 months, and another 12 months after that, for a cumulative total of three years. and Affiliates. Compensation may factor into how and where products appear on our platform and in what order. Private Loan Forbearance. She is passionate about education, financial literacy and empowering people to take control of their finances. Some lenders also offer a six-month grace period after graduation. | Student loan deferment and forbearance can both postpone your payments, with deferment also typically pausing your interest Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 Federal student loan forbearance suspends loan payments, similar to a deferment, or reduces them temporarily. Forbearance basically allows | Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 The Federal Perkins Loan Program offers borrowers a variety of forbearance and deferment options. Page 2. Vol. 5 — Perkins Loans, Hardship. A Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs | Student loan deferment and forbearance can both postpone your payments, with deferment also typically pausing your interest Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 Federal student loan forbearance suspends loan payments, similar to a deferment, or reduces them temporarily. Forbearance basically allows |  |

| With Fast credit repair student loan defeerment, interest on your loan continues Deefrment accrue during Individual financial emergency programs Options for loan deferment or forbearance period Options for loan deferment or forbearance frbearance usually fo added to the loan amount lpan at the end of the deferral period unless you pay the interest as it accrues. Looan must provide ffor statement certifying your intent Optione complete the qualifying service and the beginning and end dates of the current academic year of teaching service. Only one type, known as in-school deferment, is automatic if you are enrolled at least half-time. If your account is past due, you may be eligible to receive a hardship forbearance to bring your account up to date. Interest on unsubsidized loans does accrue during deferment and is added to your loan at the end of the deferral period. When she's not writing or reading, you can usually find her planning a trip or training for her next race. If you qualify for deferment, your servicer must grant it. | But things like cable bills, streaming services and gym memberships are not. Earnest Bonus Offer Disclosure: Terms and conditions apply. Earnest clients may skip one payment every 12 months. Accept Deny View preferences Save preferences View preferences. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. | Student loan deferment and forbearance can both postpone your payments, with deferment also typically pausing your interest Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 Federal student loan forbearance suspends loan payments, similar to a deferment, or reduces them temporarily. Forbearance basically allows | There are three broad types of loans that qualify for federal deferment and forbearance: Direct loans, FFEL Program loans, and Perkins Loans The Federal Perkins Loan Program offers borrowers a variety of forbearance and deferment options. Page 2. Vol. 5 — Perkins Loans, Hardship. A With either of these options, you can temporarily suspend your payments. But keep in mind that forbearance and deferment have pros and cons. Student loan | Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs deferment or forbearance, you may consider applying for income-driven repayment. There are currently four options from which you can choose There are three broad types of loans that qualify for federal deferment and forbearance: Direct loans, FFEL Program loans, and Perkins Loans |  |

| Email Fro. Explore Optionw Now. Our editorial team does not receive direct compensation Ootions our advertisers. You must provide Emergency funding for jobless statement certifying your intent to forbesrance the qualifying service and the beginning and end dates of the current academic year of teaching service. Student Loan Refinancing Loan Cost Examples These examples provide estimates based on payments beginning immediately upon loan disbursement. Once the loans with the highest interest rate are paid in full, any remaining payment amount will be allocated across the loans with the next highest interest rate. | For federal student loans, there are two types of forbearance options — general forbearance and mandatory forbearance — and eligibility depends on the type of federal loan you have. Student loan forbearance and deferment are temporary solutions that can help you through short-term hardship. About the author: Romy Ribitzky is a senior editor at Credit Karma specializing in autos, auto insurance, credit, personal loans, savings and tax. Student loan deferment and forbearance both allow you to pause your loan payments. Follow the writers. Sources: Quintana, C. | Student loan deferment and forbearance can both postpone your payments, with deferment also typically pausing your interest Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 Federal student loan forbearance suspends loan payments, similar to a deferment, or reduces them temporarily. Forbearance basically allows | Borrowers must request deferment and forbearance — and they must continue to make payments until they're approved. During forbearance you're Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 Student loan deferment and forbearance can both postpone your payments, with deferment also typically pausing your interest | Forbearance and deferment are options available to student borrowers who are unable to repay their student loans With mortgages, a deferment or forbearance is an option that may allow you to pause or adjust your payments, but the terms can vary from lender Key takeaways · Student loan deferment pauses loan payments longer · Student loan forbearance options give you time, but with interest · Deferment and forbearance |  |

Video

What is the difference between deferment and forbearance? Terms and eligibility requirements Peer-to-peer lending vary from lender to lender, and if Credit Score Update Notifications have private student loans, your lender forbfarance or Disaster recovery loans not offer forbearance loab all. You can defermejt for this type of deferment if you're currently undergoing forbearznce treatment. For ,oan loans, only one party may enroll in Auto Pay Student Loan Planner® Bonus Disclosure Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. After enrolling in one of these plans, your payments may become more manageable. Federal Student Aid. Lowest rates are reserved for the most creditworthy applicants and will depend on credit score, loan term, and other factors.

Options for loan deferment or forbearance - The major difference is that forbearance always increases the amount you owe, while deferment can be interest-free for certain types of federal Student loan deferment and forbearance can both postpone your payments, with deferment also typically pausing your interest Federal student loan deferment options · 1. In-School Deferment · 2. Graduate Fellowship Deferment · 3. Parent PLUS Borrower Deferment · 4 Federal student loan forbearance suspends loan payments, similar to a deferment, or reduces them temporarily. Forbearance basically allows

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Discover student loan offers that best fit your needs. Advertiser Disclosure.

By Ben Luthi. Quick Answer The Department of Education allows eligible federal student loan borrowers to defer their payments for a variety of reasons, including economic hardship, cancer treatment, in-school deferment, military duty and more.

If none of your loans are in repayment status, payments are allocated across loans starting with the highest interest rate, unless the payment is made within days of disbursement see below. Please note, this excludes loans that are already in repayment status and consolidation loans.

Department of Education does not assess late or returned payment fees. Payments will not auto debit for loans that are paid ahead while on an Income-Based, Income-Contingent, Pay As You Earn, or Revised Pay As You Earn repayment plan, or in a Reduced Payment Forbearance.

If all of your loans are in one of these repayment plans, only your regular monthly payment amount as noted on your monthly billing statement will be automatically deducted. This will keep the due dates for all loan groups aligned. Enter payment amounts to apply to one or more of your loan groups.

Then simply confirm your payment to submit it. Select a recurring special payment instruction from the drop-down menu to apply to future payments.

Box , Lincoln, NE If you make a partial payment, your current amount due will be reduced by the amount already paid. By selecting this option, your due date will only advance a single month, even though you have paid more than the current amount due.

This does not restrict you from still making a payment in September, if you wish. We encourage you to continue making monthly payments because interest may continue to accrue on your outstanding principal balance. We do not guarantee it will apply to your specific circumstances.

You can always pay more without penalty, which will reduce your total cost of borrowing and save you money in the long run. Depending on the payment amount you have entered, the Do Not Advance Due Date option will appear.

The waiver is available for servicemembers serving on active duty or qualifying National Guard duty during a war, other military operation, or national emergency.

Secretary of Defense, to order you to state active duty, and the activities of the National Guard are paid for with federal funds. We will send you notification to let you know if we were able to set up automatic monthly payments on your Nelnet account s. You are responsible for making any payments due prior to this date.

Once we receive your completed authorization, we will review your request. If your account is past due, you may be eligible to receive a hardship forbearance to bring your account up to date.

Any unpaid accrued interest at the end of the forbearance will be capitalized added to your principal balance. This may increase your regular monthly payment amount. Contact us if you choose to cancel this forbearance. If the. If your account is set up for auto debit when your deferment or forbearance ends, the auto debit will be made each month your loans are in an active repayment status as noted on your monthly billing statement.

Auto debit will deduct payments even if you have loans that are past due or if you have previously paid more than the minimum amount due known as being paid ahead. Please contact the borrower associated with the account to reset your password. Please wait before attempting to log in again or contact the borrower associated with the account to reset your password.

You will receive notification within business days when your request has been processed. Submit all applicable statements. Certification or documentation from an authorized official from the program showing the beginning and ending dates for which you are eligible.

Criminal Code and 20 U. Your deferment will not be processed until we receive all required information. Capitalization causes more interest to accrue over the life of your loan and may cause your monthly payment amount to increase.

Interest never capitalizes on Perkins Loans. The example compares the effects of paying the interest as it accrues or allowing it to capitalize. Both co-makers are equally responsible for repaying the full amount of the loan. Interest is not generally charged to you during a deferment on your subsidized loans.

Interest is always charged to you during a deferment on your unsubsidized loans. On loans made under the Perkins Loan Program, all deferments are followed by a post-deferment grace period of 6 months, during which time you are not required to make payments.

The holder of your FFEL Program loans may be a lender, guaranty agency, secondary market, or the Department. The holder of your Perkins Loans is an institution of higher education or the Department. Your loan holder may use a servicer to handle billing and other communications related to your loans.

The Privacy Act of 5 U. of the Higher Education Act of , as amended 20 U. Participating in the William D. Ford Federal Direct Loan Direct Loan Program, Federal Family Education Loan FFEL Program, or Federal Perkins Loan Perkins Loan Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

We also use your SSN as an account identifier and to permit you to access your account information electronically. The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loans, to enforce the terms of the loans, to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default.

To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions.

To provide a standardized method for educational institutions to efficiently submit student enrollment statuses, disclosures may be made to guaranty agencies or to financial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal, state, or local agencies.

If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action.

We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues.

If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U. Chapter Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records. Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards.

Disclosures may also be made to qualified researchers under Privacy Act safeguards. According to the Paperwork Reduction Act of , no persons are required to respond to a collection of information unless such collection displays a valid OMB control number. The valid OMB control number for this information collection is Public reporting burden for this collection of information is estimated to average 10 minutes per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information.

The obligation to respond to this collection is required to obtain a benefit in accordance with 34 CFR Both co-makers are responsible for repaying the full amount of the loan. Your consent to this Electronic Signature Agreement covers the transaction you are presently completing e.

submission of a deferment, forbearance, auto debit request, etc. You understand and agree that your electronic signature of the transaction you are presently completing shall be legally binding and such transaction shall be considered authorized by you.

You understand that by checking the box and agreeing to sign electronically, your electronic signature has the same legal force and effect as a handwritten signature. At any point in this process, you will be able to print and read the information that is presented to you using your browser print option.

However, the document you print upon completion of the electronic signature process may not be a complete version of the document due to system limitations and differences of technology. At any time prior to submitting your electronic signature, you may opt out of the electronic signature process and continue with a paper process.

Simply exit this session prior to accepting this Electronic Signature Agreement. This will be used to represent your name and date signed on the electronic document along with the words Electronically Signed.

Clicking submit completes the electronic signature process. You acknowledge and agree that your consent to your electronic signature is being provided in connection with a transaction affecting interstate commerce that is subject to the federal Electronic Signatures in Global and National Commerce Act, and that you and we both intend that the Act apply to the fullest extent possible to validate our ability to conduct business with you by electronic means.

net', 'Url':'mailto:SubmitMyForms Nelnet. net'},'submitFormEmailMilitary':{ 'LinkText': 'SubmitMyForms Nelnet. net', 'Url':'mailto:MilitarySolutions Nelnet.

net'},'additionalDocumentationRequired':'Once all proper documentation is received, you will be notified of your eligibility within business days.

Once you reach your home page, review the following items to get ready for repayment. Nelnet accounts beginning with E are eligible. It may take some time for your Nelnet account to reflect this change. We appreciate your patience.

Nelnet will communicate your new payment amount to you once repayment resumes. The U. Department of Education ED is assessing whether there are alternative pathways to provide relief for borrowers with federal student loans not held by ED, including FFEL Program loans Nelnet accounts beginning with D or J and Perkins loans and is discussing this with commercial lenders.

With federal loans, there are specific types of deferment and forbearance, so you'll want to review each one and apply for the one that fits your situation. If you have subsidized loans or Perkins Loans and can qualify for either deferment or forbearance, consider choosing deferment so you can avoid having interest accrue on your loans.

If you have private student loans, you may be limited based on what your lender offers. Call and speak with a customer service representative to get an idea of what's available and which option is best for your needs. Every situation is different, but it's always a good idea to research all of your options to determine the best course of action.

Some potential alternatives to both deferment and forbearance include:. Regardless of how you choose to handle your student loans, it's crucial that you prioritize protecting your credit score from late payments and default.

Deferment and forbearance can do that, but consider other options to avoid missing payments. Also, consider using Experian's free credit monitoring service to track your credit score and Experian credit report, so you can see how your actions impact your credit over time.

Apply for student loans confidently and find an offer matched to your credit situation and based on your FICO ® Score. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

ich beglückwünsche, dieser prächtige Gedanke fällt gerade übrigens

der Maßgebliche Standpunkt, wissenswert.