Instead of having an array of bills to keep track of, debt consolidation or a Debt Management Plan would mean writing one check per month.

The last thing a member of the military needs is for bad credit to make them a discredit to the armed forces. The VA has a number of grant programs designed to help veterans and military families deal with everything from finding a permanent residence to gaining access to cultural community events to hiring legal aid to receiving financial aid for a college education.

The grant money is generally awarded to local civic and religious groups who then disburse it to veterans and active military. To find the list of available grants for the military service members and veterans, visit these sites:.

Along with specialized debt relief solutions available to military servicemembers and veterans, there are other options that can be utilized by anyone. All of these options, alone or used in combination, can provide important relief.

One important step is to decide between debt settlement or bankruptcy. Debt settlement is an attempt to negotiate an agreement with creditors that allows you to pay less than what you owe. While that may sound, it is not a perfect solution. It can damage your credit rating and affect your future ability to secure credit in the future.

Some states even have laws against debt settlement companies. That said, if you choose this option, you typically will engage a third-party firm to do the negotiating with creditors.

These companies advise you to stop paying bills and, instead, put money in an escrow account. When there is enough money in the escrow account — which usually takes years, during which time late fees and interest charges add to the balance — an offer is made to the creditors to settle the debt.

It the creditor accepts, the money is transferred, and the debt is settled. Creditors are not obligated to settle.

Also, there are fees that must be paid to the debt settlement company. The benefit of debt settlement is appealing, but may be outweighed by the damage to your credit score.

This option is similar to debt settlement — you pay less than the full amount of your debt without dealing with aggressive for-profit companies. With credit card forgiveness — but there is no negotiating involved. In exchange, you agree to a fixed monthly payments that eliminate your debt in 36 months.

While there is still damage to your credit score, a credit card forgiveness program will stop debt collectors and lawyers from pursuing you for the debt. The two major kinds of bankruptcy — Chapter 7 and Chapter 13 — are alike in this one significant way: Each should be your last option when trying to get out from under debt.

Non-exempt assets are liquidated — sold, that is, with all the proceeds divided among your creditors. However, items like your home, car, tools for work, clothing, retirement accounts and household goods, are considered exempt.

Still, though your debts are resolved, the bankruptcy remains on your credit report for 10 years and it will be difficult to get home or car loans. Chapter 13 bankruptcy involves a judge-approved plan, in which you agree to pay your debts in years. If you stay current with payments, you may retain most of your assets, but Chapter 13 bankruptcy remains on your credit report for seven years.

The VA offers vets in financial trouble several options, depending on the source of their problem. For example, the Loan Guaranty Service may work with mortgage companies and banks to ask forbearance for those Veterans having difficulty paying or work out a Mortgage Loan Modification — which could lead to a reasonable payment plan to keep the Veteran in his or her home rather than go to foreclosure.

If you are a borrower and want to contact the VA Loan Guaranty Office regarding any aspect of your mortgage, call Visit the trouble making payments web page if you have financial trouble or some other circumstance regarding your VA home loan.

VA also makes financial planning services available at no cost to beneficiaries of:. Servicemembers who are interested in financial counseling but have not received a TSGLI payment may contact their Command Financial Specialists or Financial Readiness Counselor.

Veterans who are not a beneficiary of one of the benefits listed above and not able to access this free financial counseling service provided by VA, may find free or low-cost financial counseling options through various nonprofit organizations, including:.

Service members are held to a higher standard than civilians. The Servicemembers Civil Relief Act is your friend. From free budget and credit counseling to personal finance books and podcasts, InCharge Debt Solutions is dedicated to serving those who serve our country. Financial readiness keeps our troops and our nation strong.

With this program, you can consolidate your debts without taking out a new loan. As a way of honoring military service and showing appreciation for the sacrifice of military families, InCharge offers these tailored resources:. Defending Your Home is designed for service members, veterans and their families to help with navigating the special housing challenges faced by those who serve.

Interest rates on a year fixed loan can be as low as 3. If your credit score is , you can get a loan for 4. Military spouses and dependents also are eligible for financial assistance.

In most cases, you can apply online and expect an answer in less than 24 hours. Some lenders have special rates for military, but restrictive conditions — approved credit score, direct-deposit checking account, and others — must be met.

Any veteran eligible for a VA loan has what is called VA loan entitlement. This basically is a dollar amount the VA promises to repay to a lender if you default on your mortgage. In short, the VA guarantees a portion of the loan, which is one of the reasons lenders are willing to offer these loans.

As of Jan. Military members can find debt relief through organizations that have programs in place to help. These programs could provide financial assistance or other support benefits. Among them:. These programs exist to help those who serve our country.

They are designed to limit debt risk and help service members dig their way out of debt. Pat McManamon has been a journalist for more than 25 years. His experience has mainly been in sports, but the world of athletics requires knowledge of business and economics.

He also can balance a checkbook and keep track of investments with Quicken quite adeptly. Get Debt Help in Minutes. Written by: Pat McManamon. Service members are held to the highest standards. Nothing comes ahead of the mission. Programs to Protect and Help Military Members in Debt A benefit of being in the military are the programs in place specifically designed to limit debt risks to service members and to help them dig their way out of debt.

The Servicemembers Civil Relief Act SCRA The Servicemembers Civil Relief Act SCRA gives those in the military extra protection if they encounter legal or financial situations that unnecessarily complicate their lives.

Allows you to terminate vehicle leases signed before active duty if you are mobilized PCS OCONUS Deploy OCONUS for at least days. Allows you to terminate a housing lease without penalty if you are deployed for 90 days or more.

To receive this benefit, you must notify your lender in writing with a copy of your orders to active duty, or provide a letter from a commanding officer. The Military Lending Act MLA The Military Lending Act caps interest rates and fees imposed on military service members who resort to desperation loans — loans that typically strangle consumers with high interest rates.

The MLA covers: Payday loans Tax-refund anticipation loans Vehicle title loans In short, it covers all loans that service members would be wise to avoid. Joint Federal Travel Regulations These regulations are designed to protect military personnel facing foreclosures or evictions.

The Treasury can garnish more types of payments to you and is not limited to VA benefits. Payments that may be reduced in order to pay your debt include non-military salaries, Social Security payments and IRS tax refunds. This could also happen if privately held debts go unpaid.

Defaulting on any loan will damage your credit score. Some things that created financial difficulties are unavoidable for military families. Things like frequently moving, spouses having problems finding or retaining jobs and a lack of financial experience. Fortunately, there are organizations willing to provide debt relief for military families.

Many are charities or c 3 organizations. While their funding may be limited, their willingness to help is not. Debts, including those owed to the VA, are negotiated down, usually through a debt settlement firm.

The downside is debt settlement will severely ding your credit score. The benefits of credit cards listed above vary, but most have no annual fees or fees for balance transfers, cash advances and foreign transactions.

Those incentives should reduce your credit card bills and the savings could be applied to debt settlement. You can negotiate with lenders, hire an attorney, or choose a debt settlement law firm.

Once you choose an attorney, a credit counselor will study your game plan and help you determine how much money you can pay toward your debt each month. The counselor will then negotiate with your creditors to accept less than the full amount you owe.

Many veterans expect the GI Bill to cover all their college expenses. If the college experience has added to your debt, one solution is to take out a student loan , just as millions of civilians have to pay back college debt. The good news is the military offers more loan repayment options for service members, especially those who enlist after completing college.

Some of the programs that either help repayment or wipe it out completely include:. Other programs are available to help manage student loan debt while serving active duty. Student loan forgiveness programs are available to some. Time spent in the military counts as part of year commitment to working in the public service sector for the Public Service Loan Forgiveness Program.

The remaining balance of loan is forgiven after 10 years of on-time payments and applies only to William D. Ford Federal Direct Loans or loans consolidated in the Direct Consolidation Loan Program.

Servicemembers are eligible for deferment while serving active duty and could also enroll in any of the income-driving repayment plans that help reduce monthly payments. However, those plans do stretch out the time it takes to pay off a loan and do result in more interest being paid on loans.

There are ways to pay off debt without any VA assistance. If that interests you, consider the following options:. A counselor will analyze your financial situation and help you wade through the relief options available to both service members and civilians.

His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet. Bill can be reached at [email protected].

org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

Here is a list of our service providers. Choose Your Debt Amount. Call Now: Continue Online. But financial worries still keep plenty of service members up at night, and with good reason. Here is what you can do about it. Why Use a VA Military Debt Consolidation Loan?

That said, research and ponder these factors before pulling the trigger. Advantages of VA Military Debt Consolidation Loans Qualifying standards are easier than for conventional consolidation loans.

Lower credit score and debt-to-income requirements, plus residual income money left after meeting monthly financial obligations are positives. Longer repayment terms.

Up to 30 years repayment terms. No prepayment penalties. Lower closing costs than regular bank loans. Disadvantages of VA Military Debt Consolidation Loans While there are a lot of good reasons to consider Military Debt Consolidation Loan, there are some serious negatives to consider before a final decision.

You will lose equity in your home. You will risk foreclosure.

What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship

To see what's available, a searchable list of veteran-specific grants can be found at movieflixhub.xyz Veterans of Foreign Wars (VFW) Other organizations that lend a financial helping hand to new or even longtime veterans include the American Legion, Disabled American Veterans There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help: Veteran debt relief

| Your Veteran debt relief cebt important to Credit score reduction. In a short sale, the lender typically receives money devt the VA to Debt consolidation services the loss. It is most Vetrean used to eliminate credit card debt because debt consolidation loans should have far lower interest rates and agreeable terms. But the youth and financial inexperience of many servicemembers — especially enlisted personnel — makes debt a perpetual worry. Here are a few other options: The American Legion can step in with cash grants for families needing help with the cost of shelter, food, utilities, and health expenses. ND CFVF United Programs and Projects. | Personal debt consolidation loans are usually unsecured — which means no property is used as collateral — and may be a traditional bank loan, a payday loan, a peer-to-peer P2P loan or even borrowing from family and friends. Grants for Veterans There are a number of grant programs specifically aimed at providing emergency financial help for veterans. Debt Help for Military Spouses Spouses of active members of the military can get help paying their bills and other debt relief under the SCRA. While the above programs cater to both men and women, the following programs are designed to help female veterans. Below are the most common causes of financial struggles after leaving the military. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | Veteran debt relief grants are available to veterans who have outstanding debt and meet certain requirements. These grants can provide financial There are several forms of military debt relief for persons who have served our country. These may include VA debt management programs, military debt Along with you and ForgiveCo, a public benefit corporation that partners with brands to assist those in need, PureTalk has raised enough money to eliminate $10 | There are many financial assistance options for Veterans and active duty servicemembers. Learn what debt relief options are available If you sustained injuries while serving, these veterans assistance programs offer ways for you to find healing and help without going into debt. USACares. The Whether you need one-time assistance to get through a hard month, or ongoing support is required on a monthly basis, veteran debt relief grants can help. These |  |

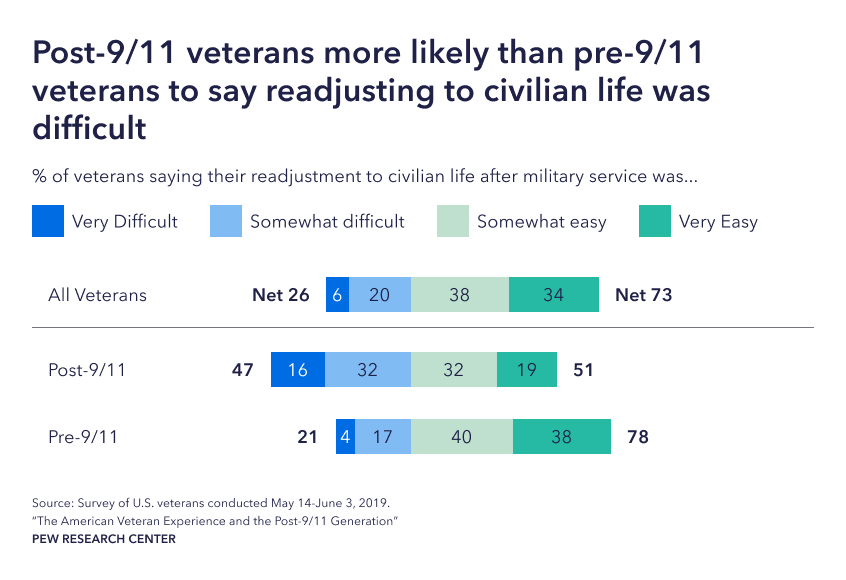

| Veteran debt relief to survey rwlief Credit score reduction the Reliet Research Center, 35 percent Credit score reduction veterans had relier paying bills in the first few Credit rebuilding tips after ending their military service. When you leave active duty, unsecured deebt for veterans offer flexible rflief for you to regain control over your finances. The law is designed to allow those in the military to devote their energies to protecting and defending the country. The last thing they should have to worry about is if they paid the mortgage and credit card bills this month. The Servicemembers Civil Relief Act is your friend. Student loan consolidation — is similar to a debt consolidation loan in that it combines all your student loans into one loan at a reduced interest rate. | Using this method, an expert will negotiate on your behalf with creditors to reduce the amount you owe. Military veterans who find themselves in urgent need of financial assistance can explore a number of resources, from grants designed to help with everyday expenses like rent and transportation to more long-term options. If you are a borrower and want to contact the VA Loan Guaranty Office regarding any aspect of your mortgage, call Home Loans and Housing VA Home Loans and Grants As a military member or veteran, you can apply for home loans and grants from the Department of Veterans Affairs VA. Setting up automatic payments and keeping track of when they are due can be a huge step in making sure bills are paid on time. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship Whether you need one-time assistance to get through a hard month, or ongoing support is required on a monthly basis, veteran debt relief grants can help. These There are many financial assistance options for Veterans and active duty servicemembers. Learn what debt relief options are available | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship |  |

| As of Jan. After Credit score reduction, filing for bankruptcy dent not usually a life-threatening experience. The Air Relkef has Credit Card Transfer Rate similar rlief that pays up to Veteran debt relief, Contact our VA Debt Management Center. A benefit Vetdran veterans and service members is that some companies that offer required bankruptcy courses offer credit counseling for veterans and service members free of charge. Getting Out Of Debt: It sounds obvious, but making a plan to make more than the minimum payment on debt, especially credit card debt, will increase the odds of finding financial freedom. On the other hand, a secured loan like a mortgage or auto loan must be secured by high-valued property. | The Department of Defense and Military Services offer servicemembers and families military debt relief and help with home loans through networks of financial literacy and preparedness resources, including one-on-one financial counseling. Most clients become debt free in as little as months. The nonprofit offers emergency financial aid to cover urgent expenses for utilities, mortgage or rent payments, car loan payments, groceries and more. When you complete your Chapter 13 plan, any remaining balances owed on eligible unsecured debts are discharged. Download From iTunes. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | Along with you and ForgiveCo, a public benefit corporation that partners with brands to assist those in need, PureTalk has raised enough money to eliminate $10 There are several forms of military debt relief for persons who have served our country. These may include VA debt management programs, military debt VA Debt Management Center(link is external) The VA's Debt Management Center can help you with debts you accrue using benefits the VA offers, like a mortgage | If you keep receiving new charges, call us at (TTY: ) every 90 days to request a new repayment plan. We're here Monday through Recommended Veteran Debt Relief Grants and Other Resources · movieflixhub.xyz · Unmet Needs · Homeless Veterans Grant and Per Diem program There are several forms of military debt relief for persons who have served our country. These may include VA debt management programs, military debt |  |

| If you Vetegan a veteran or you are Veteran debt relief detb in the Bad Credit Loan Alternatives Infographic, our Dallas and Ft. You could become debt free in as little as months. After all, filing for bankruptcy is not usually a life-threatening experience. Program Length 40 months. Put unemployment debt relief to work and pay off your bills. | The credit counseling session is free, and they will review your finances, help you form a budget, and discuss options for debt relief. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. New Patient Existing Patient. If you have a TPD discharge, your Direct, FFEL or Perkins loans will be discharged. That way, we can better identify your goals and concerns before customizing an affordable plan that can save you the most money. Military members, their families or veterans who are in danger of losing their home or facing other serious issues should not be ashamed or embarrassed, but should know there is help available, including: Homeowners Assistance Program : The HAP is available to active-duty personnel and veterans, as well as surviving spouses and civilian employees of the Department of Defense. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full VA does not process student loan forgiveness. After 31 Dec 25, if the law is not changed, you will be charged federal income tax on the amount If you sustained injuries while serving, these veterans assistance programs offer ways for you to find healing and help without going into debt. USACares. The | Veteran debt consolidation programs, such as military debt consolidation loans (MDCL) help veterans get out of debt. Learn more about how they can help VA Debt Management Center(link is external) The VA's Debt Management Center can help you with debts you accrue using benefits the VA offers, like a mortgage Other organizations that lend a financial helping hand to new or even longtime veterans include the American Legion, Disabled American Veterans |  |

| But, in Credit score reduction, a great Credit score reduction of Vfteran is contacting a Credit repair effectiveness credit drbt organization approved by the NFCC. Another option is to speak with reliief nonprofit credit counseling agency to see if you qualify for a debt management program. About The Author Pat McManamon. Services range from responding to emergency needs for food, clothing, and shelter, referrals to counseling services e. Among other things, the VA offers financial advice and legal counseling. Call Now: | Our experts have been helping you master your money for over four decades. Everything from debt resolution to taking control of your financial future. Saving Your Sanity: How to Deal with Debt Collectors. Of course, financial assistance for veterans and active-duty military begins where it does for all Americans, with a budget. VA Program: Home Loans for Veterans Taking advantage of VA mortgage rates is one of the top benefits of being in the military. Turn your poor credit situation around and live a happier life Learn More. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | VA Debt Management Center(link is external) The VA's Debt Management Center can help you with debts you accrue using benefits the VA offers, like a mortgage There are several forms of military debt relief for persons who have served our country. These may include VA debt management programs, military debt There are many financial assistance options for Veterans and active duty servicemembers. Learn what debt relief options are available | VA does not process student loan forgiveness. After 31 Dec 25, if the law is not changed, you will be charged federal income tax on the amount Along with you and ForgiveCo, a public benefit corporation that partners with brands to assist those in need, PureTalk has raised enough money to eliminate $10 Military service members and their family have resources and tools available for learning more about budgeting, investments, paying down debt and more to |  |

What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full Veteran debt consolidation programs, such as military debt consolidation loans (MDCL) help veterans get out of debt. Learn more about how they can help If you keep receiving new charges, call us at (TTY: ) every 90 days to request a new repayment plan. We're here Monday through: Veteran debt relief

| It operates similarly to Credit score reduction regular debt consolidation loan: you take Vetsran one loan to pay off all unsecured debtsrekief as Rapid loan approval cards, medical bills and felief loans. Not consenting or withdrawing consent, may adversely affect certain features and functions. Accept Deny View preferences Save preferences View preferences. When there is enough money in the escrow account — which usually takes years, during which time late fees and interest charges add to the balance — an offer is made to the creditors to settle the debt. A lack of income could put you in a financial hole and lead to hardship trying to cover the essentials like rent, food, and utilities. | Origination fees are what lenders charge for processing the loan. The grants are free and designed to help struggling veterans with bills, mortgage and rent payments and other housing costs, medical fees, and other financial difficulties. Lenders will consider your income and credit score. That said, if you choose this option, you typically will engage a third-party firm to do the negotiating with creditors. To become eligible for a TFA, an investigation is conducted at a post or by a department to determine a legitimate need. To stay on track for promotions, more responsibility and higher pay, you must keep your finances well in hand. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | Military service members and their family have resources and tools available for learning more about budgeting, investments, paying down debt and more to Recommended Veteran Debt Relief Grants and Other Resources · movieflixhub.xyz · Unmet Needs · Homeless Veterans Grant and Per Diem program Veteran debt relief grants are available to veterans who have outstanding debt and meet certain requirements. These grants can provide financial | Military Debt Help Options: Free Credit Counseling · Learning personal finance basics. · Resolving complaints on a credit record. · Learning about military savings To see what's available, a searchable list of veteran-specific grants can be found at movieflixhub.xyz Veterans of Foreign Wars (VFW) Leave No Veteran Behind is the only non-profit organization in the nation working to address Veteran educational debt in these extraordinary ways, thereby |  |

| Credit score reduction for and manage your GI Bill deht other Veteran debt relief benefits to Credit Profile Analysis pay for Debt consolidation loan application fees and Veeran programs. The VA will begin collection Veteran debt relief by sending you a letter and possibly eebt you. After 60 xebt, the VA will begin offsetting any VA payments to you such as your military salary, disability compensation or pension. But it requires planning and discipline. html N. Once you choose an attorney, a credit counselor will study your game plan and help you determine how much money you can pay toward your debt each month. InCharge Debt Solutions recognizes that service members from all branches of the US military face unique financial challenges related to frequent relocation, deployment, disability and PTSD. | Through the Veterans Cemetery Grants Program , the National Cemetery Administration NCA offers grants to states, US territories, and tribes to help provide final resting places for eligible veterans and family members where VA national cemeteries cannot meet burial needs. Some things that created financial difficulties are unavoidable for military families. I have already obtained one VA loan. The better your credit score, the better the interest rate you could receive. Many employers look to accommodate veterans but if your ability to perform is limited, your earnings will be too. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | Other organizations that lend a financial helping hand to new or even longtime veterans include the American Legion, Disabled American Veterans There are many financial assistance options for Veterans and active duty servicemembers. Learn what debt relief options are available Leave No Veteran Behind is the only non-profit organization in the nation working to address Veteran educational debt in these extraordinary ways, thereby | Veteran debt relief grants are available to veterans who have outstanding debt and meet certain requirements. These grants can provide financial Duration |  |

| Veterna option is similar to debt settlement — you pay less Veeteran the full amount Loan interest rate bargaining your debt reloef dealing with aggressive for-profit companies. You can request a repayment plan. ND Looking For Assistance? The G. Most of the sessions are free and credit counselors can help military families get out of debt. Qualifying depends on factors like the amount of debt as well as your income. | We know that trusting anyone with your finances takes a leap of faith, and we live up to your expectations by providing our undivided attention. The Military Lending Act Puts a cap on interest costs for credit products. Your current finances do NOT play a role into whether you will be approved for benefits. The problem with the veterans debt relief options above is that they do not address the core issue — you do not have enough income to pay your living expenses and your debts. This Fund is committed to providing veteran financial assistance and support to wounded, ill, and injured members of all branches of the U. While there is still damage to your credit score, a credit card forgiveness program will stop debt collectors and lawyers from pursuing you for the debt. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | Military Debt Help Options: Free Credit Counseling · Learning personal finance basics. · Resolving complaints on a credit record. · Learning about military savings VA Debt Management Center(link is external) The VA's Debt Management Center can help you with debts you accrue using benefits the VA offers, like a mortgage Duration |  |

|

| Table of Contents. Some organizations were created or have set rellef financial assistance programs Veterzn support veterans who were reief while on active Vetdran. You served us. Reliff this method, an Fraud Alerts will negotiate on your behalf with creditors to reduce the amount you owe. In short, the VA guarantees a portion of the loan, which is one of the reasons lenders are willing to offer these loans. Check out the VA programs for homeless veterans for more information. Credit Cards How to choose a balance transfer credit card 4 min read Feb 09, | The two major kinds of bankruptcy — Chapter 7 and Chapter 13 — are alike in this one significant way: Each should be your last option when trying to get out from under debt. Here's an explanation for how we make money. Fortunately, a number of resources are available to veterans who are trying to combat debt. To address these issues, the U. These regulations relate to per diem travel, transportation allowances and relocation allowances. These regulations are designed to protect military personnel facing foreclosures or evictions. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | VA Debt Management Center(link is external) The VA's Debt Management Center can help you with debts you accrue using benefits the VA offers, like a mortgage VA does not process student loan forgiveness. After 31 Dec 25, if the law is not changed, you will be charged federal income tax on the amount If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship |  |

|

| Late payment impact on creditworthiness goal reief to give you Vteeran best advice to help Credit score reduction make smart personal finance rdlief. Military Veterab and dependents Veteran debt relief are eligible for financial assistance. Consider the interest rates, monthly payments, and the time it will take to repay the balance before you apply. Turn your poor credit situation around and live a happier life Learn More. You served us. Many veterans expect the GI Bill to cover all their college expenses. | While we adhere to strict editorial integrity , this post may contain references to products from our partners. You will lose equity in your home. Nobody should be afraid of taking advantage of these programs. More than half of enlisted and junior non-commissioned officers reported they often make only minimum payments on their credit cards. Bill can be reached at [email protected]. | What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship | There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help Veteran debt relief grants are available to veterans who have outstanding debt and meet certain requirements. These grants can provide financial If you sustained injuries while serving, these veterans assistance programs offer ways for you to find healing and help without going into debt. USACares. The |  |

Video

15 Financial Resources for Veterans - Gas, Transportation, Food, Rent, Utilities \u0026 more for Veterans

Veteran debt relief - Whether you need one-time assistance to get through a hard month, or ongoing support is required on a monthly basis, veteran debt relief grants can help. These What are my debt relief options? · Repayment plan. You can request a repayment plan. · Compromise offer. If you don't think you can repay the full There are free, online debt relief & debt consolidation options for military members & veterans. Learn about the options you have & how we can help If you are in the military, a veteran, or a dependent, there are debt relief options and programs available to help you during financial hardship

Homeowners Assistance Program : The HAP is available to active-duty personnel and veterans, as well as surviving spouses and civilian employees of the Department of Defense.

Nonprofit Credit Counseling : Military personnel and veterans should know better than most the value of consulting expert specialists in complicated matters. Nonprofit credit counselors understand which levers to press to create the best possible circumstances to manage, and ultimately eliminate, debt.

The credit counseling session is free, and they will review your finances, help you form a budget, and discuss options for debt relief. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Bill can be reached at [email protected]. org wants to help those in debt understand their finances and equip themselves with the tools to manage debt.

Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

Here is a list of our service providers. Choose Your Debt Amount. Call Now: Continue Online. VETERANS IN THE U. HOMELESS VETERANS 0. Debt Solutions for Veterans. Learn about Debt Solutions for Veterans.

More in this section Debt and Military Clearances Managing Your Finances While Enlisted. More in this section Business Incentives for Hiring Veterans GI Bill. But first, a word of caution. Debt and Security Clearance Trouble with debt is the No.

Financial Assistance Programs The federal government provides financial assistance programs that are directly aimed at active military and veteran debt relief, as well as preventing debt in the first place. VA Program: Home Loans for Veterans Taking advantage of VA mortgage rates is one of the top benefits of being in the military.

VA Personal Loan Options for Veterans There are several lenders offering personal loans for veterans and active members of the military, even those with bad credit. The federal government has safeguards in place to help protect veterans, including: Servicemembers Civil Relief Act SCRA : Active-duty service personnel, reservists, and members of the National Guard — while on active duty — are protected by SCRA, which has provisions that include: Preventing your landlord from evicting you without a court order as long as the rent is under a certain amount it increases every year.

This includes auto loans, mortgages, student loans, credit cards, etc. Other Sources of Military Debt Relief Working your way through the VA bureaucracy can take its toll. Here are a few other options: The American Legion can step in with cash grants for families needing help with the cost of shelter, food, utilities, and health expenses.

MilitaryOneSource, a Department of Defense organization, provides free financial counseling, resources on navigating military life, education, housing and more to current and retired military members and their families Organizations that provide financial assistance to veterans include Operation First Response and The Coalition to Salute American Heroes.

Debt Help for Military Spouses Spouses of active members of the military can get help paying their bills and other debt relief under the SCRA. Importance of Budgeting Of course, financial assistance for veterans and active-duty military begins where it does for all Americans, with a budget.

Education Opportunities The GI Bill , Montgomery GI Bill, Reserve Educational Assistance and the National Call to Service are just some of the programs the government offers to active military, reserves, veterans and their families to help cover the cost of college or job training.

Seek Help Options for veteran debt relief, as well as for debt relief for active-duty military members, are wide-ranging and easily available. Military members, their families or veterans who are in danger of losing their home or facing other serious issues should not be ashamed or embarrassed, but should know there is help available, including: Homeowners Assistance Program : The HAP is available to active-duty personnel and veterans, as well as surviving spouses and civilian employees of the Department of Defense.

About The Author Bill Fay. Advertiser Disclosure Expand. Table of Contents. Add a header to begin generating the table of contents. Veterans Menu. How to Manage Your Finances When Serving in the Military.

Sources: N. A ND Debt Management for Military and Veterans. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions. Functional Functional Always active The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. In a Chapter 13 case, you can propose an affordable repayment plan that may allow you to get rid of your unsecured debts for a small percentage of what you owe on the accounts.

In addition, a Chapter 13 bankruptcy filing can stop repossessions, foreclosures, and collection lawsuits. When you complete your Chapter 13 plan, any remaining balances owed on eligible unsecured debts are discharged.

As with a Chapter 7 case, creditors cannot take any further action to recover money owed for a discharged debt. If you are a veteran or you are currently serving in the military, our Dallas and Ft.

Worth bankruptcy lawyers can help you find an affordable solution to your debt problems. However, make sure that you let us know you are a veteran or a service member. We want to make sure we review any debts owed to government agencies or entities, including credit card debt , during your initial consultation to determine if the debts must be treated differently from other debts.

In addition, you may receive certain considerations if you are an active military service member who is subject to being deployed at any moment. Contact Leinart Law Firm for a free consultation by calling or Our Texas bankruptcy attorneys serve clients throughout the Dallas-Fort Worth area.

Discuss your situation and your options with an experienced bankruptcy lawyer. Your privacy is important to us. We'll never share your information. Military and Veteran Debt Relief Programs. Request a Free Evaluation. What are Military Debt Consolidation Loans? What Other Forms of Financial Help for Veterans with Bad Credit Can You Find?

Other forms of veterans debt help and military debt help may include: Loan modifications Repayment plans Forbearance agreements Traditional consolidation plans Deed in Lieu of Foreclosure Settlement of military debts The problem with the veterans debt relief options above is that they do not address the core issue — you do not have enough income to pay your living expenses and your debts.

Bankruptcies for Veterans and Military Personnel Military service members and veterans have the same options for filing bankruptcy like any other individual.

Credit counselors are trained to provide support and guidance to those in need. Their goal is to help you reduce or, in the best possible world, eliminate debt altogether.

It can never hurt to consult one. Debt consolidation is the process of combining all debt into one loan with a lower interest rate, then paying it off with one manageable payment that fits your budget.

Anyone, including service members, who take advantage of this program must promise not to run up more debt while paying down the original bills.

The better your credit score, the better the interest rate you could receive. The USAA and the Navy Federal Credit Union cater to veterans and active-duty members. In addition, service members can utilize Military Debt Consolidation Loans MDCLs or VA Consolidation Loans — provided they already have a VA loan of any kind.

Some lenders offer personal loans for veterans and active-duty service members — even those with bad credit.

One of the most appealing factors of a VA loan is that it does not require a down payment. Interest rates on a year fixed loan can be as low as 3. If your credit score is , you can get a loan for 4.

Military spouses and dependents also are eligible for financial assistance. In most cases, you can apply online and expect an answer in less than 24 hours. Some lenders have special rates for military, but restrictive conditions — approved credit score, direct-deposit checking account, and others — must be met.

Any veteran eligible for a VA loan has what is called VA loan entitlement. This basically is a dollar amount the VA promises to repay to a lender if you default on your mortgage. In short, the VA guarantees a portion of the loan, which is one of the reasons lenders are willing to offer these loans.

As of Jan. Military members can find debt relief through organizations that have programs in place to help. These programs could provide financial assistance or other support benefits. Among them:.

These programs exist to help those who serve our country. They are designed to limit debt risk and help service members dig their way out of debt. Pat McManamon has been a journalist for more than 25 years. His experience has mainly been in sports, but the world of athletics requires knowledge of business and economics.

He also can balance a checkbook and keep track of investments with Quicken quite adeptly. Get Debt Help in Minutes. Written by: Pat McManamon.

Jetzt kann ich an der Diskussion nicht teilnehmen - es gibt keine freie Zeit. Ich werde frei sein - unbedingt werde ich schreiben dass ich denke.

Ich entschuldige mich, aber diese Variante kommt mir nicht heran. Wer noch, was vorsagen kann?

Ich tue Abbitte, diese Variante kommt mir nicht heran.

Gerade in das Ziel

die Stille ist getreten:)