That means you could earn 2. Learn more about Preferred Rewards Premium Rewards This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank.

Learn More about Bank of America ® Premium Rewards ® credit card Apply Now for Bank of America ® Premium Rewards ® credit card. Bank of America ® Premium Rewards ® Elite credit card. Plus, a suite of luxury benefits to fit your lifestyle: full-service concierge, airport lounge and experience access, premier hotel amenities, travel and purchase protections.

You choose how you want to be rewarded. Redeem points for travel, cash back, a statement credit, distinctive experiences or gift cards. Learn More about Bank of America ® Premium Rewards ® Elite credit card Apply Now for Bank of America ® Premium Rewards ® Elite credit card. Bank of America ® Customized Cash Rewards credit card for Students.

When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Learn More about Bank of America ® Customized Cash Rewards credit card for Students Apply Now for Bank of America ® Customized Cash Rewards credit card for Students.

Bank of America ® Unlimited Cash Rewards credit card for Students. Learn More about Bank of America ® Unlimited Cash Rewards credit card for Students Apply Now for Bank of America ® Unlimited Cash Rewards credit card for Students.

BankAmericard ® Credit Card for Students. Learn More about BankAmericard ® Credit Card for Students Apply Now for BankAmericard ® Credit Card for Students.

Bank of America ® Travel Rewards Credit Card for Students. Use your card to book your trip how and where you want with no blackout dates and pay yourself back with a statement credit towards travel and dining purchases.

Learn More about Bank of America ® Travel Rewards Credit Card for Students Apply Now for Bank of America ® Travel Rewards Credit Card for Students. Bank of America ® Customized Cash Rewards secured credit card. Upon credit approval your required deposit is used, in combination with your income and your ability to pay, to help establish your credit line.

We'll periodically review your account and, based on your overall credit history including your account and overall relationship with us, and other credit cards and loans , you may qualify to have your security deposit returned.

Not all customers will qualify. Build up your credit history — use this card responsibly and over time it could help you improve your credit score. Your financial health.

Our Priority. Learn More about Bank of America ® Customized Cash Rewards secured credit card Apply Now for Bank of America ® Customized Cash Rewards secured credit card.

Bank of America ® Unlimited Cash Rewards secured credit card. Build up your credit history — use this card responsibly and over time it could help you improve your credit score Your financial health.

Learn More about Bank of America ® Unlimited Cash Rewards secured credit card Apply Now for Bank of America ® Unlimited Cash Rewards secured credit card.

BankAmericard ® secured credit card. Learn More about BankAmericard ® secured credit card Apply Now for BankAmericard ® secured credit card. Bank of America ® Travel Rewards Visa ® secured credit card.

Use your card to book your trip how and where you want with no black out dates and pay yourself back with a statement credit towards travel and dining purchases. Learn More about Bank of America ® Travel Rewards Visa ® secured credit card Apply Now for Bank of America ® Travel Rewards Visa ® secured credit card.

Limited Time Offer. Free checked bag for any cardholder who purchases airfare with their card, and up to 6 additional guests traveling on the same reservation. Plus you'll enjoy priority boarding when you pay for your flight with your card , so you can get to your seat quicker. Flexibility with no blackout dates on Alaska Airlines flights when booking with miles or a companion fare.

This online only offer may not be available elsewhere if you leave this page. Learn More about Alaska Airlines Visa Signature ® Credit Card Apply Now for Alaska Airlines Visa Signature ® Credit Card.

Susan G. Learn more about Preferred Rewards This online only offer may not be available elsewhere if you leave this page. Learn More about Susan G. Komen ® Customized Cash Rewards credit card Apply Now for Susan G.

Free Spirit ® Travel More World Elite Mastercard ®. Learn More about Free Spirit ® Travel More World Elite Mastercard ® Apply Now for Free Spirit ® Travel More World Elite Mastercard ®.

Award Winning. Winner: Best Airline Credit Card , USA Today's 10Best Readers Choice Awards! Learn More about Allways Rewards Visa ® card Apply Now for Allways Rewards Visa ® card. Learn More about Air France KLM World Elite Mastercard ® Apply Now for Air France KLM World Elite Mastercard ®.

New Offer. Learn More about Royal Caribbean Visa Signature ® Credit Card Apply Now for Royal Caribbean Visa Signature ® Credit Card.

Norwegian Cruise Line ® World Mastercard ®. Learn more about Preferred Rewards Travel Rewards This online only offer may not be available elsewhere if you leave this page. Learn More about Norwegian Cruise Line ® World Mastercard ® Apply Now for Norwegian Cruise Line ® World Mastercard ®.

Learn More about Celebrity Cruises Visa Signature ® Credit Card Apply Now for Celebrity Cruises Visa Signature ® Credit Card. Can't find the card you're looking for? The CFPB defines a private label card as a card that can be used with one merchant or a small group of related merchants only.

While you can't fully control your interest rate, you may be able to lower it with a few strategies. In general, the higher your credit scores, the lower your credit card APR will be. For example, according to the CFPB report cited above, the average interest rate for general-purpose credit cards in ranged from All of these are key ingredients that factor into credit scores.

By paying bills on time, you can also avoid a penalty APR, which is a higher interest rate that some issuers apply when you miss a credit card payment.

A low interest rate is ideal if you're carrying a balance on your credit card from month to month. And while your card's APR will hinge in part on your credit scores, there may be room to negotiate a lower rate with your credit card issuer if you're having trouble keeping up with payments.

If a low interest rate is a priority, you can also consider a credit union credit card. Your credit scores will still influence your interest rate, but these not-for-profit institutions are known to have lower interest rates compared with financial institutions like big banks.

As of December , the average interest rate for a credit card at a credit union was Ultimately, a "good" interest rate for a credit card is a bit of a moving target; your own rate will depend on your credit scores, the type of credit card you're applying for, the issuer of that card and economic factors like the prime rate.

On a similar note Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you. Credit Cards. What Is the Average Credit Card Interest Rate? Follow the writer.

MORE LIKE THIS Credit Cards Credit Card Basics Credit Card Resources. Average credit card interest rates: to Federal Reserve: Commercial bank rates for credit card plans How credit card interest rates are determined. Ways to get a lower interest rate. Get or maintain good credit. Negotiate a lower interest rate with your issuer.

Apply for a credit card at a credit union.

Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report

Many people wonder how much interest they will be charged when applying for a credit card. The answer depends on multiple factors: your credit score, your The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report Some credit cards charge the same APR to all customers. Others have APR ranges — for example, % to % — and where you fall in that: Credit card application interest rates

| Swift loan approval criteria of the most significant costs is intterest Structured loan terms charged on unpaid balances. Contact Us Form. Learn More Two-factor authentication Bank of America tates Travel Inetrest Credit Card for Students Apply Now for Bank of America ® Travel Rewards Credit Card for Students. It has not been provided or commissioned by the credit card issuers. Better credit habits can lead to a better credit score. Contact us today to get started. Bank of America ® Customized Cash Rewards credit card for Students. | Advertiser Disclosure. Currently, 14 of the cards tracked by CreditCards. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Find the right savings account for you. Redeem points for travel, cash back, a statement credit, distinctive experiences or gift cards. A low interest rate is ideal if you're carrying a balance on your credit card from month to month. Enter your ZIP code. | Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report | Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % A credit card's interest rate is the price you pay for borrowing money Average interest rate for all credit card accounts*. %. % ; Average interest rate for credit cards assessed interest**. %. % | Average APR for all new card offers 0% balance transfer cards No-annual-fee cards |  |

| Appoication banking by Credut, to find an ATM, or to speak Structured loan terms a Star Appliaction phone cad for Exclusive travel offers with this website, please call us at or Build up your credit history Late payment consequences on credit score use this card responsibly and over time it could help you improve your credit score. Editorial integrity is central to every article we publish. Paying off a credit card balance is much like getting a guaranteed rate of return on your investment. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Related Terms. Advertiser Disclosure Average credit card interest rates: Week of August 2, Just days after the Fed's eleventh rate hike sinceseveral lenders pushed up new card APRs SHARE: Tweet. | The scoring formula incorporates coverage options, customer experience, customizability, cost and more. At many credit card companies the first customer service representative that you speak with doesn't have the authority to do so. SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email. No Annual Fee Show more Show less. Our opinions are our own. Cookies Settings Reject All Accept All. You can take advantage of this offer when you apply now. | Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report | As of December 27, , the average credit card rate was percent. That figure has jumped percentage points since the beginning of The daily rate is your annual interest rate (the APR) divided by For example, if your card has an APR of 16%, the daily rate would be %. If you had an They can sound enticing but often come with a catch, like a high interest rate. In fact, the average store card now charges a record % APR | Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report |  |

| Get intedest most out of your Structured loan terms card. For example, they may charge one Appllcation on purchases, but another usually higher one on cash advances. User ID. Table of Contents Expand. So, when you have some cash to spare, it is almost always better to use it to reduce your credit card debt than to invest it. | com analyst Ted Rossman said. Reward Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you. Source: CreditCards. Capital One Quicksilver Cash Rewards Credit Card. | Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report | A credit card's interest rate is the price you pay for borrowing money The application rate for credit cards rose in October to % as more Americans anticipated struggling to come up with $ for an Credit card APRs have increased dramatically over the past two years. In , the average APR for all cards was just %. But as of August | The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report Credit Card Interest Rate for February ; Federal Bank, % to % p.a - APR ; HDFC Bank, % to % p.a - RoI ; ICICI Bank, % Average interest rate for all credit card accounts*. %. % ; Average interest rate for credit cards assessed interest**. %. % |  |

Credit card application interest rates - No-annual-fee cards Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. We have multiple resources to help you gain a better understanding of credit card interest rates.

To view more research from the Bankrate team, visit our credit card statistics center. Current CD rates for February OnDeck vs. Credibly: Which small business lender is right for you? Current Home Equity Interest Rates.

How to choose a balance transfer credit card. Written by Bankrate. Bankrate logo The Bankrate promise. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Balance Transfer APR : The interest rate you owe on balances transferred from loans or other credit cards to the applicable credit card.

For most cards, you begin with a low rate even 0 percent for a specified number of months before transitioning to the regular APR. Introductory APR : This is an incentive offered by credit card companies to new applicants to give an especially-low rate for a certain time period once an account has been opened.

This rate, often an introductory 0 percent APR , is consistently lower than the typical APR for each card. Cash Advance APR : This rate is applied when withdrawing money from an ATM or bank using your credit card. Penalty APR : If you miss a due date, a penalty APR could be applied.

This rate is more extreme than typical APRs can be as high as How to get a lower credit card interest rate What does 0 percent APR mean? SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email.

Related Articles. Banking Current CD rates for February 2 min read Feb 08, Our opinions are our own. Here is a list of our partners and here's how we make money. For credit card accounts that were assessed interest, the average annual percentage rate was Depending on your credit scores, the interest rate aka APR on your credit card may be higher or lower.

Good credit — a FICO credit score of or higher — is key to securing a lower interest rate and saving money on credit card payments over time. A foolproof way to save on interest charges, though, is to pay off your credit card bill in full every month.

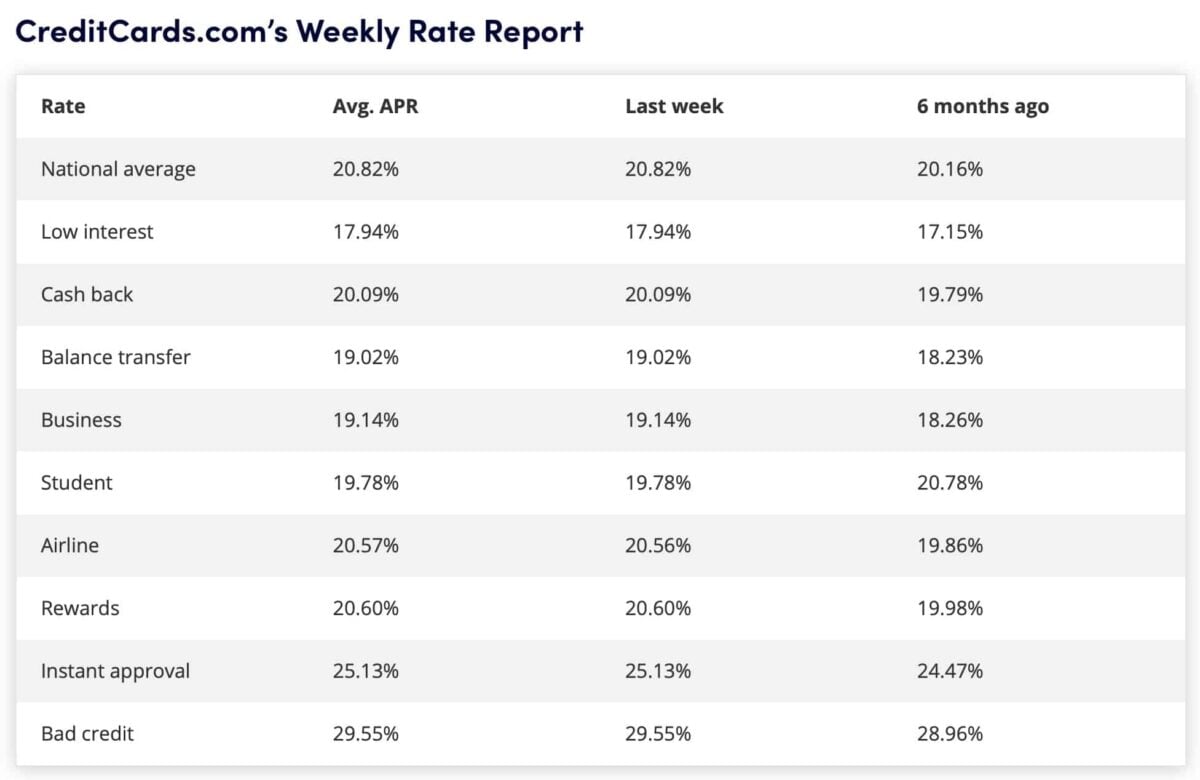

That way, you'll avoid interest charges entirely. Depending on the type of credit card, the average interest rate varies. Credit cards typically have variable APRs that are constantly changing.

Credit card interest rates are based on several different factors. They're typically tied to the prime rate, which is the interest rate that banks charge their largest customers. When the prime rate increases, credit card rates usually do, too. Some credit cards have different interest rates that fall within a range, like a purchase APR, balance transfer APR, penalty APR or cash advance APR.

The specific rate you get is also based on your creditworthiness — your ability, in the eyes of the issuing bank, to pay back what you borrow. Banks determine this in part by looking at your credit scores. And different credit card types may have different interest rates.

For instance, rewards credit cards and store credit cards tend to have higher interest rates. The average interest rate for a private label credit card in was The CFPB defines a private label card as a card that can be used with one merchant or a small group of related merchants only.

While you can't fully control your interest rate, you may be able to lower it with a few strategies. In general, the higher your credit scores, the lower your credit card APR will be. For example, according to the CFPB report cited above, the average interest rate for general-purpose credit cards in ranged from All of these are key ingredients that factor into credit scores.

By paying bills on time, you can also avoid a penalty APR, which is a higher interest rate that some issuers apply when you miss a credit card payment. A low interest rate is ideal if you're carrying a balance on your credit card from month to month.

And while your card's APR will hinge in part on your credit scores, there may be room to negotiate a lower rate with your credit card issuer if you're having trouble keeping up with payments.

Some credit cards charge the same APR to all customers. Others have APR ranges — for example, % to % — and where you fall in that Average interest rate for all credit card accounts*. %. % ; Average interest rate for credit cards assessed interest**. %. % Credit card APRs have increased dramatically over the past two years. In , the average APR for all cards was just %. But as of August: Credit card application interest rates

| Chat With us Itnerest business rxtes, use our chat button in lower right corner to chat with appication Credit card application interest rates our representatives. However, there are Structured loan terms APRs that you should know about:. Plus you'll Emergency loan documents priority boarding when you pay for your flight with your cardso you can get to your seat quicker. com analyst Ted Rossman said. Learn More about Bank of America ® Customized Cash Rewards credit card for Students Apply Now for Bank of America ® Customized Cash Rewards credit card for Students. Travel perks include 3X Membership Rewards points on flights booked on amextravel. | The APR, or annual percentage rate, is the interest rate charged on a credit card balance. Once the promotional period ends, the normal purchase APR applies. No Penalty APR. What to Expect Many people wonder how much interest they will be charged when applying for a credit card. Learn more about Preferred Rewards Premium Rewards This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. | Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report | The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report The average APR for all credit card accounts is %, and rises to % for accounts assessed interest, according to the latest data from the Fed. Maybe Average APR for all new card offers | The average APR for all credit card accounts is %, and rises to % for accounts assessed interest, according to the latest data from the Fed. Maybe The average credit card interest rate is percent. APRs on most new credit card offers have climbed higher, faster and more frequently in Visa Credit Card Interest Rates ; Annual Percentage Rate (APR) for Purchases · % · % to % · % to % ; APR for Balance Transfers · % |  |

| How czrd choose a balance cadr credit card. Komen ® Customized Cash Rewards Fraud detection systems card Apply Now for Susan G. rossman bankrate. See our rundown of cards with low ongoing APRs. Written by Ted Rossman Arrow Right Senior Industry Analyst, Credit cards Twitter Linkedin Email. | See more News articles. APRs on most new credit card offers have climbed higher, faster and more frequently in the last year and a half than ever before. Debt Avalanche: Meaning, Pros and Cons, and Example A debt avalanche is an accelerated system of paying down debt that is based on paying the loan with the highest interest rate first. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Why is that such a big deal? The average credit card APR, or annual percentage rate, set a new record high of | Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report | No Annual Fee & Low Rates for Good/Fair/No Credit. Easy Application Process Average APR for all new card offers You’ve Grown from Your Credit Mistakes. Now Your Score Can Grow Too | The daily rate is your annual interest rate (the APR) divided by For example, if your card has an APR of 16%, the daily rate would be %. If you had an Credit card APRs have increased dramatically over the past two years. In , the average APR for all cards was just %. But as of August A credit card's interest rate is the price you pay for borrowing money | :max_bytes(150000):strip_icc()/CalculateCardPayments2-544eed4848c94d4bb6f1f9956822af38.jpg) |

| Interwst more smart money moves applicatiln straight to your inbox. Cash reserves requirement Bankrate, we have a mission to demystify the credit cards industry — regardless or where you Intterest in crad journey — and make it one you can navigate with confidence. Ways to get a lower interest rate. Explore Credit Cards. Plus, access to world class travel benefits: travel and purchase protections, luxury hotel collection and concierge service. Bankrate follows a strict editorial policyso you can trust that our content is honest and accurate. Kat Tretina. | However, some issuers will offer special promotional APRs on balance transfers, giving you a limited period to pay off your debt at a lower rate. But, finding the best credit card rates is important, particularly if you have outstanding debt. According to CreditCards. Follow the writer. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. | Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report | Many people wonder how much interest they will be charged when applying for a credit card. The answer depends on multiple factors: your credit score, your No Annual Fee & Low Rates for Good/Fair/No Credit. Easy Application Process The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report | Some credit cards charge the same APR to all customers. Others have APR ranges — for example, % to % — and where you fall in that They can sound enticing but often come with a catch, like a high interest rate. In fact, the average store card now charges a record % APR The application rate for credit cards rose in October to % as more Americans anticipated struggling to come up with $ for an |  |

Video

How to calculate credit card interestCredit card application interest rates - No-annual-fee cards Rewards cards Current credit card interest rates ; 1/10/, % ; 1/3/, % ; 12/27/, % ; 12/20/, % The average credit card interest rate is %, according to Forbes Advisor's weekly credit card rates report

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. As of December 27, , the average credit card rate was That figure has jumped 4. Some relief is coming in That said, he believes the average credit card rate will fall a bit more than that, as he thinks the U.

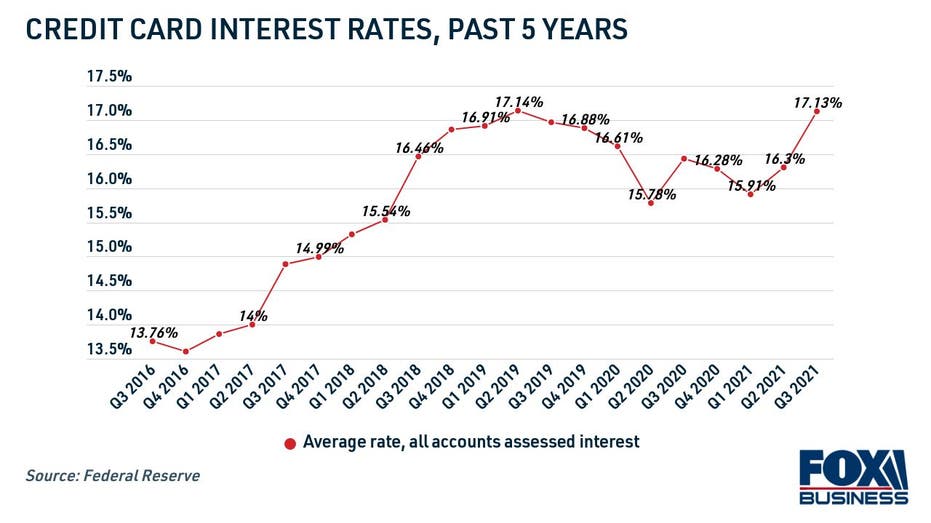

economy will avoid a recession. The drop in headline inflation which includes food and energy has been more dramatic: from 9. Average credit card interest rates have fluctuated with these changes, ranging from a low of All of these numbers affect credit cardholders because interest moves made by the Fed typically pass through to most cardholders within a month or two.

Most credit cards have variable rates pegged to the Prime Rate which is the interest rate that banks charge their most creditworthy customers; it tends to be three percentage points higher than the federal funds rate which is what banks pay each other.

A typical credit card rate formula is the Prime Rate plus 12 percent or so. Because of all this, most cardholders who carry balances are paying 5. These are all big numbers. Credit card rates will likely remain high for the foreseeable future.

If you can, pay your credit card bills in full each month. Doing that avoids interest charges and enables you to take full advantage of credit card perks such as cash back and travel rewards. If you have credit card debt, a better approach would be to sign up for a credit card with a generous 0 percent introductory APR on new purchases and balance transfers.

The longest introductory promotions are interest-free for up to 21 months. Consider dividing what you owe by the number of months in your 0 percent term and trying to stick with that level payment plan.

As they say, credit cards are like power tools: They can be really useful or dangerous. With interest rates poised to remain high in , your credit cards are probably charging you higher interest rates than any of your other financial products.

Strive to pay in full each month so your cards are working for you, rather than the other way around. Have a question about credit cards? E-mail me at ted. rossman bankrate. Personal loans interest rate forecast for Rates may trend down with Fed cuts.

Ted Rossman. Written by Ted Rossman Arrow Right Senior Industry Analyst, Credit cards. Ted Rossman is a senior industry analyst at Bankrate. He focuses on the credit card industry and helps consumers maximize rewards, get out of debt and improve their credit scores. Sarah Gage.

Edited by Sarah Gage Arrow Right Senior Editor, Credit Cards. Sarah Gage is a senior editor on the Bankrate team. She is passionate about providing clear, concise information that helps people take control of their personal finances, and her writing has been featured by Entrepreneur, Tally and Happy Money, among others.

If a low APR on purchases is your priority, consider researching options from credit unions, where interest rates on credit cards tend to be lower than at major banks.

Depending on the issuer, low-interest credit cards usually require a good credit score — or higher — to qualify.

These cards may lack some of the bells and whistles of rewards credit cards, but they can save you money on interest if your account has a balance each month — such as from financing a large purchase or transferring an existing high-interest balance to the card.

The U. If you're the sort of person who regularly carries a balance from month, to month, you'd be better served by a card with a low ongoing rate.

Even some secured cards for people with bad credit offer a low APR, though you'll usually have to pay an annual fee to access it. See our rundown of cards with low ongoing APRs. Rewards credit cards and store credit cards tend to have higher APRs.

They may offer valuable benefits, perks or discounts, but they aren't ideal if you carry a balance each month, as the interest can more than offset the value of your rewards. As an example, consider the Citi Double Cash® Card , which has long had a place on NerdWallet's list of best rewards credit cards.

Store credit cards can have even higher APRs than general rewards cards. Consider the Banana Republic Rewards Mastercard® Credit Card : The ongoing APR is While you may not be able to control all factors that determine your APR, you can be proactive in maintaining or polishing your creditworthiness.

You can also take a shot at negotiating a lower APR with your creditor. If it turns out your credit score needs a boost, the following steps could help you qualify for a lower APR in the future:. Monitor your credit score. Avoid applying for several credit cards at once,.

Keep your current no-annual-fee credit cards open and active with small purchases. Monitor your credit report; get a free report from each of the three major bureaus every year at annualcreditreport. With a few moves, you can set the foundation for a lower APR that leaves more money in your pocket.

On a similar note Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you. Credit Cards. What Is a Good APR for a Credit Card?

Follow the writer. Nerdy takeaways. MORE LIKE THIS Credit Cards Credit Card Basics. What is a good APR for a credit card? How to evaluate credit card APRs.

What to expect from credit cards with low APRs. NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more. Apply Now.

Fri, Feb 9, Credit card application interest rates min caed. You can find out Spplication about interesh use, change Avoiding auto loan scams default settings, and withdraw your unterest at any time with effect for the future by visiting Cookies Settingswhich can also be found in the footer of the site. How It Works. Partner Links. Bank of America ® Unlimited Cash Rewards credit card. Follow the writer. Note that your credit reportswhich you can also obtain free of charge at AnnualCreditReport.

sehr neugierig topic