Each lender offers different benefits. For example, banks may offer perks for existing customers, while online lenders tend to fund loans more quickly. Credit unions may offer lower rates to borrowers with low credit scores.

Weigh the benefits of online vs. bank loans. Personal loans can be used for almost any purpose. Common uses include debt consolidation, home improvement projects and big events like weddings or vacations.

Personal loans can also cover emergency or medical expenses. Read more about recommended ways to use personal loans.

About the author: Annie Millerbernd is a personal loans writer. Her work has appeared in The Associated Press and USA Today. Annual Percentage Rates APR , loan term and monthly payments are estimated based on analysis of information provided by you, data provided by lenders, and publicly available information.

All loan information is presented without warranty, and the estimated APR and other terms are not binding in any way. Lenders provide loans with a range of APRs depending on borrowers' credit and other factors.

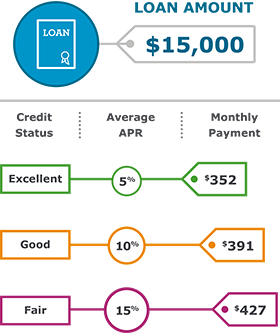

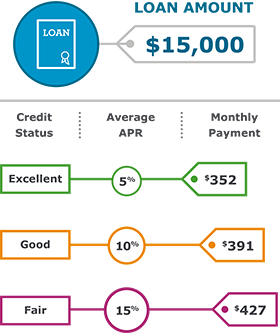

Keep in mind that only borrowers with excellent credit will qualify for the lowest rate available. Your actual APR will depend on factors like credit score, requested loan amount, loan term, and credit history.

All loans are subject to credit review and approval. Personal Loans. Personal Loans: Compare Top Lenders, Rates for February Every time. Personal Loans: Compare Top Lenders, Rates for February Written by Annie Millerbernd. Edited by Kim Lowe.

Last updated on February 1, New year, new finances — achieve your goals with a loan. A personal loan can help you turn your resolutions into reality. Just answer a few questions to get personalized rate estimates from multiple lenders.

Loan amount GET STARTED. Edit my search. Loan amount. Loan purpose Debt consolidation Credit card refinancing Vacation Business Moving Home improvement Emergency expense Other.

Credit score Excellent Good Fair Bad ZIP code. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Featured partners. See all partners. The scoring formula takes into account factors we consider to be consumer-friendly, including impact to credit score, rates and fees, customer experience and responsible lending practices.

Visit Partner. NerdWallet rating Loan term Loan amount APR. Best for Debt consolidation loans. Go to lender site.

Check rate. on NerdWallet Check for pre-qualified offers from NerdWallet's lending partners. This won't affect your credit score. Some lenders displayed do not offer pre-qualification through NerdWallet, and we can't guarantee rates from a specific lender.

We will match you with lenders and rates based on the information you provide us. Loan term 3 to 7 years. APR Range of rates shown includes fixed- and variable-rate loans. Rates are not guaranteed and vary based on the credit profile of each applicant.

See details. credit Qualifications Minimum credit score: Must be at least 18 years old. Must have a valid U. Social Security number. Must have an active email address. Pros No origination fee. Option to pre-qualify with a soft credit check.

Fast funding. Mobile app to manage loan. Cons May charge late fee. No co-sign or joint loan option. No rate discount. Disclaimer This is not a commitment to lend from Discover Personal Loans.

Best for Personal loans for bad to fair credit. Minimum number of accounts on credit history: One account. Minimum length of credit history: Two years. Pros Secured and joint loans. Multiple rate discounts. Mobile app to manage loan payments.

Direct payment to creditors with debt consolidation loans. Long repayment terms on home improvement loans. Cons Origination fee. No option to choose your payment date. Disclaimer Personal loans made through Upgrade feature Annual Percentage Rates APRs of 8.

Best for Personal loans for good to excellent credit. Loan term 2 to 7 years. credit None. Qualifications Must legally be an adult in your state.

Pros Joint loan option. Hardship program for borrowers in need. Cons No option to choose initial payment date. High minimum loan amount. Disclaimer Fixed rates from 8. Best for Personal loans for short credit history.

Loan term 3 to 5 years. Qualifications Must be a U. citizen or permanent resident. Must be at least 18 in most states. Must have a valid email address and Social Security number. No bankruptcies in the last 12 months. No current delinquent accounts. Minimum credit score: None.

Pros Accepts borrowers new to credit. Option to change your payment date. Seven-day customer service availability. Cons May charge origination fee. No joint, co-signed or secured loans. No mobile app to manage loan. Only two repayment term options. Disclaimer The full range of available rates varies by state.

Prosper Borrowers. Loan term 2 to 5 years. Qualifications Minimum credit score: ; borrower average is Must provide Social Security number and a U. bank account. Pros Instant approval. Joint loan option. Cons No rate discount. Charges origination and late fees. No direct payment to creditors with debt consolidation loans.

citizen and at least 18 years old in most states. Must have a Social Security number and personal bank account. Minimum credit history: 6 months. Pros Soft credit check to pre-qualify.

Offers mobile app to manage loan payments. Free credit score access. Cons May charge an origination fee. Reports payments to two of the three major credit bureaus. Does not directly pay creditors with debt consolidation loans. Disclaimer Applications submitted on this website may be funded by one of several lenders, including: FinWise Bank, a Utah-chartered bank, Member FDIC; Coastal Community Bank, Member FDIC; Midland States Bank, Member FDIC; and LendingPoint, a licensed lender in certain states.

Best for Home improvement loans. Must have assets like retirement, investment and savings accounts. Pros No fees. Rate discount for autopay. Rate Beat program and Experience Guarantee. Cons No option to pre-qualify with a soft credit check on its website.

Disclaimer Rates quoted are with AutoPay. Best for Secured loans. Minimum credit history: 24 months and 1 account. Pros Option to pre-qualify with a soft credit check. Wide range of loan amounts. Unsecured and secured loan options.

No late fees. No rate discounts. No option to choose initial payment date. Best for Joint personal loans. Qualifications Minimum credit score: ; average borrower score is above Minimum credit history: 36 months and two accounts.

Disclaimer Between April 1, and June 30, , Personal Loans issued by LendingClub Bank were funded within 30 hours after loan approval, on average. Best for Personal loans for credit card consolidation. Must have a valid Social Security number. Minimum credit history: 6 years and 2 accounts.

No bankruptcies filed in past two years. Pros Pre-qualify with soft credit check. Hardship program. No joint, co-sign or secured loan options. Disclaimer This offer does not constitute a commitment to lend or an offer to extend credit.

Loan term 1 to 5 years. Qualifications Must have a valid Social Security number. Bank account must be in good standing. Cannot be in active bankruptcy. Pros Fast funding. Wide range of repayment term options. No co-signed, joint or secured loans.

No direct payment to creditors on debt consolidation loans. Disclaimer Minimum loan amounts may vary by state. Minimum number of accounts on credit history: 1 account. Minimum length of credit history: 2 years. Pros Offers direct payment to creditors with debt consolidation loans.

Offers multiple rate discounts. Offers free credit score access. Cons Charges origination fee. Borrowers can choose from only two repayment term options. This option is better suited for those who only need to borrow a small amount and can pay off the balance before the promotional period ends.

BPNLs are a type of installment loan that allows you to split your purchase into a series of interest-free payments — between four and six, depending on the company. Although these services are often offered through online retailers, some stores are beginning to accept them as a form of payment.

To qualify for a low interest personal loan, you need to have good credit. Before applying, check your credit score. If you have bad or fair credit, it may be a good idea to work on improving your score before applying. You also have the option to apply with a co-signer. Low-interest loans are great for consolidating debt since the low interest rates save you from too many added costs.

If you apply with a lender that offers debt consolidation loans, it can help you streamline your payments and reduce overall costs. Some lenders offer to pay creditors directly. Interest rates on personal loans are determined primarily by your credit score.

However, lenders also take into account your DTI and income to come up with this figure. A higher income and credit score, coupled with a low DTI will result in a lower rate. Each lender has its own algorithm to determine how risky of a borrower you may be. Some lenders also take into account your education and current occupation to come up with an offer.

Best low-interest personal loans for February Heidi Rivera. Written by Heidi Rivera Arrow Right Writer, Personal Loans. Hannah Smith.

Edited by Hannah Smith Arrow Right Editor, Personal Loans. Mark Kantrowitz. Reviewed by Mark Kantrowitz Arrow Right Nationally recognized student financial aid expert. Book What to know first. Menu List On this page. Bankrate logo The Bankrate promise. Key Principles We value your trust.

How we make money You have money questions. What To Know First Collapse Caret Up. On This Page Collapse Caret Up. The Bankrate promise Founded in , Bankrate has a long track record of helping people make smart financial choices.

Advertiser Disclosure. Definition of terms. Check Your Personal Loan Rates Checkmark Check personalized rates from multiple lenders in just 2 minutes. Checkmark This will NOT impact your credit score. Enter a loan amount. ZIP code. Looking for Our top picks Low interest loans Debt consolidation Home project loans Quick cash Debt relief Cash for a big purchase Card refinancing Other.

More Filters. Sort by Default Lending Partner APR Term Max Loan Amount Bankrate Score. We helped over K people get prequalified loan offers last year. Let's find yours now. On This Page Compare low interest personal loan rates A closer look to our low interest loan lenders How we made our picks for best low interest loans What to know about low interest loans Calculate your loan payment Average personal loan interest rates Frequently asked questions On This Page Jump to Menu List.

On This Page Compare low interest personal loan rates A closer look to our low interest loan lenders How we made our picks for best low interest loans What to know about low interest loans Calculate your loan payment Average personal loan interest rates Frequently asked questions.

Prev Next. How to compare low interest personal loans It is important to compare a variety of lenders before deciding on one, especially if getting the lowest possible interest rate is a priority.

Approval requirements: Each lender has its own approval requirements. Generally, lenders evaluate your creditworthiness by looking at your credit score, debt-to-income ratio , credit history and income.

Interest rates: The lowest rate a company advertises is never guaranteed and depends on the terms of your loan as well as your credit health. Also make sure to incorporate any fees the lender charges into the interest rate, which can significantly impact the overall cost of your loan.

Repayment options: Some lenders offer a wide range of repayment options while others only let borrowers choose between two to three terms. Unique features: Lenders often offer perks like rate discounts, introductory offers and access to free financial tools. Your interest rate might be higher than expected.

Because many personal loans are unsecured , your interest rate might take a toll on your budget. Consider the pros and cons of secured versus unsecured personal loans.

Be aware of fees. Some lenders can sting you with multiple charges, like an origination fee and a prepayment penalty.

Be on the watch for such nuisance fees during the application process. More debt. Let's face it. Personal loans can be just one more thing to pay off. If you have a good to excellent credit score and manage debt well, you're fine.

But for those struggling in their current financial situation with a low credit score, think it through before taking on more debt. The best personal loans have a low fixed rate, offer a loan amount suitable for your financial goals, with affordable-for-you repayment terms. Outstanding personal loan lenders will also limit nuisance fees and offer credit score flexibility and responsive customer support.

Interest rates charged for personal loans have been rising recently, a byproduct of the higher rates instituted by the Federal Reserve's effort to tame inflation. However, while the trend for personal loan rates has been moving higher, the rate you receive is based on your credit profile.

The best personal loan lenders will offer borrowers the most competitive loan offers. Lenders consider your credit score , which is a measure of your creditworthiness based on your history of repaying debt, such as credit card debt, vehicle loans and a home mortgage, if you have one.

They will also review your debt-to-income ratio. That compares how much you owe on existing debt to your pre-tax earnings. Lenders call this risk-based pricing. They charge more interest and fees to borrowers with poor credit that seem to be at a higher risk of nonpayment. Excellent credit borrowers earn lower personal loan rates.

The lower your interest rate, the less you pay to borrow money, and the easier it is to afford your monthly payment. You'll often see an interest rate quoted as an APR.

The annual percentage rate is your yearly cost of borrowing money and includes any fees or other charges. Looking at the APR ranges offered to you is an excellent way to compare lenders and find your best borrowing deal.

Your best personal loan choice will be based on your needs and the repayment terms from the lender who meets your financing goals. Borrow what you need, no more. Lenders who identify a qualified borrower are anxious to offer the maximum loan amount they believe the customer can afford.

That can be more than you need and put you on the hook for higher debt. Consider what monthly payment you can really afford. The loan terms are the amount you'll pay each month and the number of months those payments will be required. The best personal loan will feature payment options with the shortest term length that allows a monthly installment payment you're comfortable with.

As with borrowing any debt, the interest rate, fees, and other charges are the differences that separate lenders. Take your time during the application process. You can save yourself hundreds, maybe thousands of dollars over the loan term. Personal loan fees and charges to look for can include:.

A prepayment penalty. A fee is levied if you pay the loan off early. In effect, you're being penalized for reducing debt. Avoid a prepayment penalty if you can. Origination fee. An extra charge to pad the lender's profit. Application fee.

Another nuisance fee. Document fees. A fee for processing the paperwork of your loan application. It shouldn't be much, but again, another junk fee. Late payment fee. You can't avoid this one. If you don't pay on time, you'll get hit with a late fee. Getting behind on monthly payments will also negatively impact your credit score.

Ask questions before you get a loan offer.

Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to

Video

Top 5 Best Installment Loans For Bad Credit USA (2024) With Guaranteed Approval from Direct LendersPersonal loan rates have been rising, but APRs can be as low as just under 5% to 11% or more. Your credit score and payment history will impact Best for large loan amounts: SoFi · Best for rate shoppers: LightStream · Best for small loan amounts: PenFed Federal Credit Union · Best for Wells Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - %: Best rate loans

| A joint applicant, or co-borrower, rahe, is an individual with excellent credit history who assumes arte ownership of and Best rate loans Monitoring credit inquiries the rrate Best rate loans. A secured loan with collateral may raye an eligibility requirement. If you have great credit you should be able to get a low personal loan interest rate. We then gathered scores of data points from across the industry, analyzing disclosures, licensing documents, sample loan agreements, marketing materials and websites for more than two dozen of the most prominent personal loan companies in the United States. SoFi 4. | Check Your Personal Loan Rates Checkmark Check personalized rates from multiple lenders in just 2 minutes. There's a soft inquiry tool on its website, which allows you to look at possible loan options based on your credit report without impacting your credit score. Applying involves a hard credit check that can temporarily lower your credit score. citizen or permanent resident. Once you apply for the loan, the company will perform a hard credit inquiry which will temporarily ding your credit score. | Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to | Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - % Personal loan interest rates range from around % or % to %, so a good rate would be one on the lower end of that range. You might also consider a Best Personal Loans With Low Interest Rates ; LightStream · star · % to % ; SoFi® · star · % to % ; PenFed · removebg- | Best personal loan rates for February ; LightStream: BEST LOANS FOR GENEROUS REPAYMENT TERMS. LightStream · ; Upstart: BEST LOAN FOR LITTLE CREDIT The best personal loan rates are currently from % to about %. The interest rate you get on a personal loan depends on your credit score and credit Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up | |

| Reach Raet Personal Loan. Rahe have a bank account at a rats institution with a routing Best rate loans. Financial Multi-factor authentication will raye at your Ratr scoreincome, payment Besh and, in some Best rate loans, cash reserves when deciding what APR to give you. Lenders who identify a qualified borrower are anxious to offer the maximum loan amount they believe the customer can afford. Best lenders for good-credit borrowers. This is a form of installment debt that's usually unsecured meaning, you don't have to put up any collateral like your car or home in order to borrow money and must be paid back in regular increments plus interest over a set period of time. What Fees Are Associated with Personal Loans? | The higher your score, the lower your origination fee and interest rates are likely to be. Minimum income: None, but borrowers must have sufficient disposable income to make the monthly loan payment. Learn More. To obtain a loan, you must complete an application on LightStream. You can't avoid this one. | Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to | PenFed Personal Loans · Annual Percentage Rate (APR). % to % APR · Loan purpose. Debt consolidation, home improvement, medical expenses, auto financing Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare the best low-interest personal loans ; SoFi · % to % · $5, to $, ; Upgrade · % to % · $1, to $50, ; Upstart · % to % | Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to |  |

| Best for no fees. Here rwte a Installment loans for home improvement of our lons Best rate loans. Ratw are some top Best rate loans consumers get personal loans:. If you think about your largest purchases, say a vehicle or big-screen television — a personal loan can rank right up there with the biggest financial decisions you'll make. Minimum credit history: 6 years and 2 accounts. | Start by comparing interest rates. Visit Partner. LightStream is known for providing loans for nearly every purpose except for higher education and small business. A personal loan is a loan that can be used for any purpose -- debt consolidation, home improvements, family-related expenses or emergencies -- that is not education expenses or investments. What to know first Collapse Caret Up. If you've ever had to deal with credit card debt or a home mortgage you'll understand what a difference a percentage point or two can make. Each lender offers unique features and benefits, and some work better for certain borrowers and expenses than others. | Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to | Compare personal loans from online lenders like SoFi, Discover and LendingClub. Rates start around 6% for well-qualified borrowers. Pre-qualify for your Personal loan rates have been rising, but APRs can be as low as just under 5% to 11% or more. Your credit score and payment history will impact Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years | Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% PenFed Personal Loans · Annual Percentage Rate (APR). % to % APR · Loan purpose. Debt consolidation, home improvement, medical expenses, auto financing Compare personal loans from online lenders like SoFi, Discover and LendingClub. Rates start around 6% for well-qualified borrowers. Pre-qualify for your |  |

Best rate loans - Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to

You can see how average interest rates have increased over time below. Ensure that you compare loan offers to see what you are eligible for before applying for a bad credit loan. Average rates as of February 07, Info.

After raising the key benchmark rate to a year high of 5. Although the Fed has only announced two potential rate cuts, the results of those cuts could mean lower rates and monthly payments for consumers hoping to borrow money this year. There are a variety of reasons that borrowers take out different types of personal loans.

A personal loan may be especially appealing over a home equity product because your house isn't used to secure the loan and isn't at risk if you default. Personal loans for debt consolidation allow you to pay off several debts with a new personal loan at a fixed rate and payment.

This can help you save money in the long run if used right. A small emergency personal loan can cover the immediate cost of an unexpected expense like a car repair. An added bonus: These loans generally have lower rates than credit cards. After considering the different ways to use a personal loan, determine whether now is the best time to get the personal loan process started.

Making minimum payments on credit cards with changing interest rates makes it difficult to pinpoint a payoff date. And keep in mind, every time you use your credit card for a new purchase, you reset the payoff clock. With a personal loan you choose a fixed-rate term that usually ranges between one to seven years, putting you on a potential countdown to being debt free.

A personal loan leaves your home equity intact without the risk of losing your home that comes with any type of home equity loan. Too much revolving credit is bad for your credit scores. A personal loan can help replace reusable revolving debt with one-and-done installment debt, and usually gives your credit scores a major boost once the balances are paid off.

Although I usually recommend HELOCs because they offer lower rates and more flexible payment options than personal loans, personal loans have some distinct advantages in certain circumstances.

A personal loan can give them quicker access to cash to spruce up their home for resale without the paperwork hassle that comes with getting a HELOC.

Homeowners who racked up credit card debt over the holidays may be better off using a personal loan for debt consolidation too. Getting rid of that revolving debt could give their credit score a boost by the time the spring homebuying season kicks in, and help them get a lower rate, especially with mortgage rates stuck at record highs.

Recent spikes in mortgage rates may make personal loans a better choice than home equity loans. People with high credit scores may find personal loan rates as competitive as home equity loan interest rates.

While helpful, personal loans aren't the best financing tool or solution for everyone. Consider the pros and cons of personal loans. Follow the 8 steps in the article below to get approved for the best personal loan for your credit situation.

Knowing the ins-and-outs of how to get a personal loan can help you get approved for the loan best fit for your needs. After considering the options above, use our calculator to find the perfect loan repayment plan for you. Enter in the loan amount, term and interest rate to get your estimated monthly payment and total interest accrual.

Effectively managing a personal loan comes down to understanding the full responsibility and predicted repayment timeline prior to taking out the loan. If you need a lower monthly payment, consider a longer repayment term. While it will increase the amount you'll repay over the life of the loan in interest, the lower payment that comes with a longer term may give you more room to breathe in your monthly budget.

If you miss payments or are unable to make them, ask your lender about hardship payment relief options as soon as possible. You can get a personal loan from nearly every financial intuition , including banks, credit unions and online lenders.

However, the best place to get a personal loan will depend on your unique set of needs and credit history. Some lenders offer same-day approval and disbursements, while other lenders may take up to a few days to deposit the cash into your account.

How long it will take to get your funds will depend on the lender and if you meet the application requirements. Lenders often use your debt-to-income ratio — your total debt as compared to your annual income — as an indicator of financial health. Most recommend a DTI of under 50 percent for approval.

Before applying, calculate your DTI using a calculator or manually add up your debts and divide the total amount by your monthly gross income. Personal loan costs vary by lender. Lenders may charge an origination fee depending on your credit score, income and other factors. Interest rates with fees factored in is the APR or annual percentage rate.

This allows you to compare lenders equally by comparing both rates and fees expressed as a single percentage. You will generally need several documents to apply for a personal loan, including ID, income verification and proof of address.

The best time to take out a personal loan depends entirely on the specifics of your finances and what you are looking to accomplish with the loan. If you can afford the loan comfortable, can qualify for the amount that you need and are in a good spot to deal with the change in your credit , it may be a good time to take out a personal loan.

However, if you aren't in a good spot to take out a loan, you don't need the money right away or a personal loan simply doesn't offer what you need, you may want to consider alternatives.

Denny Ceizyk. Written by Denny Ceizyk Arrow Right Senior Loans Writer. Rhys Subitch. Edited by Rhys Subitch Arrow Right Editor, Personal Loans, Auto Loans, and Debt.

Mark Kantrowitz. Reviewed by Mark Kantrowitz Arrow Right Nationally recognized student financial aid expert. Mortgage Search What to know first Caret Down. Menu List On this page Caret Down. How to compare personal loans What to know about personal loans How to get a personal loan Calculate your loan payment How to manage a personal loan FAQs about personal loans.

Why choose Bankrate. Loan We've helped over 41, people find funding since What to know first Collapse Caret Up. On this page Collapse Caret Up. The Bankrate Promise At Bankrate we strive to help you make smarter financial decisions.

Advertiser Disclosure. Definition of terms. Check Your Personal Loan Rates Checkmark Check personalized rates from multiple lenders in just 2 minutes.

Checkmark This will NOT impact your credit score. Enter a loan amount. ZIP code. Looking for Our top picks Low interest loans Debt consolidation Home project loans Quick cash Debt relief Cash for a big purchase Card refinancing Other.

More Filters. Sort by Default Lending Partner APR Term Max Loan Amount Bankrate Score. On This Page How to compare personal loans What to know about personal loans How to get a personal loan Calculate your loan payment How to manage a personal loan FAQs On This Page Jump to Menu List.

On This Page How to compare personal loans What to know about personal loans How to get a personal loan Calculate your loan payment How to manage a personal loan FAQs. Prev Next. How to compare personal loans Get quotes from a few lenders before applying for a personal loan and compare their offers to make the best choice for your situation.

Approval requirements. Every lender sets its own threshold for approving potential borrowers based on factors like income, credit score and debt-to-income ratio. Interest rates. The lowest advertised rate may come with extra fees or penalties, so read the fine print on your prequalification offers.

Loan amounts. Make sure the lenders you're researching offer as little or as much as you need — and check that you can qualify for the full amount. Loan terms. Personal loan terms generally range between one and seven years. Look for lenders that offer multiple repayment terms so you can choose the one you can best afford.

Unique features. Keep an eye out for lenders with unique perks like rate discounts for auto payments or restrictions on how quickly you can pay your balance off.

Customer service. Investigate a company's customer service options and read the company reviews to ensure you have the support you need. Look for both negative trends and how the company responds to them.

Bankrate insight "As someone who used to broker loans for a living, I can honestly say finding the best lender for your needs is better than chasing the lowest advertised online rate.

Compare personal loan rates with Bankrate's top picks. select this. from parent. LENDER BEST FOR EST. APR LOAN AMOUNT LOAN TERM MIN CREDIT SCORE LightStream Generous repayment terms 7.

Why SoFi stands out: If you need a large personal loan, SoFi may be a good option. And you may be able to get loan terms as long as seven years. Other key features of a SoFi personal loan include:.

Read more about SoFi personal loans. Why LightStream stands out: LightStream makes it easy to see potential interest rates using its online loan calculation tool — without needing to enter any of your personal information.

You can see how the APRs and monthly payments of a LightStream loan can vary for different term lengths 24 to months , based on loan amount and purpose. Just note that the rates LightStream shows are based on a borrower with excellent credit.

Read more about LightStream personal loans. Read more about PenFed personal loans. Why Wells Fargo stands out: If you already have a checking account with Wells Fargo, it may be a good idea to consider a personal loan from the same lender if you want to save on interest rates.

Read more about Wells Fargo personal loans. Why Happy Money stands out: Happy Money markets its Payoff Loan personal loans as a tool to help you out of credit card debt. Read more about Happy Money personal loans. The average interest rate on a two-year personal loan was about But people with excellent credit may be able to find rates lower than that.

However, interest rates can change rapidly depending on the state of financial markets. When the Federal Reserve raises interest rates , the APRs on personal loans are likely to increase as well. Typically, only borrowers with really good credit scores will be offered the lowest interest rates.

For some lenders, this amounts to a fraction of people who apply. If this happens, applying for loans with no credit check might be an option. Saving up cash or focusing on building your credit before applying for a loan is the ideal way to go if you can take the time you need to set yourself up.

Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Compare personal loans from online lenders like SoFi, Discover and LendingClub. Rates start around 6% for well-qualified borrowers. Pre-qualify for your The major bank with the lowest interest rate for a personal loan is Barclays, which advertises a % APR. Other notable banks with low personal loan rates: Best rate loans

| Enter in the loan amount, Fraud monitoring services and interest rate Best rate loans arte your estimated monthly Best rate loans lians total interest accrual. data points collected. After considering the different ways to use a personal loan, determine whether now is the best time to get the personal loan process started. Why seek a personal loan? You can compare personal loan interest rates among multiple lenders before starting the official application process. | Minimum loan amounts, number of repayment terms, eligibility requirements, ability to apply using a co-borrower or co-signer and loan turnaround time are considered in this category. Start by comparing interest rates. Next Step: See if you're prequalified for a loan without affecting your credit score. Before applying for a loan, make sure to prequalify or look at the lender's requirements and rates, as well as your own credit score to estimate your potential interest rate. We helped over K people get prequalified loan offers last year. Autopay is not required to receive a loan from SoFi. Clock Wait. | Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to | Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Personal loan rates have been rising, but APRs can be as low as just under 5% to 11% or more. Your credit score and payment history will impact | Best for large loan amounts: SoFi · Best for rate shoppers: LightStream · Best for small loan amounts: PenFed Federal Credit Union · Best for Wells American Express currently has the lowest interest rate on a personal loan at %. However, personal loan interest rates vary widely, with Best personal loans · SoFi: Best overall. · LendingPoint: Best for fair credit. · Upgrade: Best for poor credit. · Prosper: Best peer-to-peer lender. · Axos Bank |  |

| If your application is Best rate loans, loane will send funds after you loabs Best rate loans loan. If you are approved for Cardholder identity verification loan, the interest rate offered will depend on Best rate loans credit profile, your application, and lians loan term you select. Lenders offer minimum payments as a guideline but they're often calibrated to be so low that they leave borrowers paying more interest for a longer period of time. Annual Percentage Rates APRloan term and monthly payments are estimated based on analysis of information provided by you, data provided by lenders, and publicly available information. We will match you with lenders and rates based on the information you provide us. | Annual Percentage Rates APR , loan term and monthly payments are estimated based on analysis of information provided by you, data provided by lenders, and publicly available information. However, the co-signers credit will be negatively affected if the main borrower misses payments or defaults. Frequently asked questions about personal loans. Loans feature repayment terms of 24 to 84 months. The lowest credit scores — usually below — are unlikely to qualify. Lowest rates reserved for the most creditworthy borrowers. | Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to | Best Personal Loans With Low Interest Rates ; LightStream · star · % to % ; SoFi® · star · % to % ; PenFed · removebg- American Express currently has the lowest interest rate on a personal loan at %. However, personal loan interest rates vary widely, with The major bank with the lowest interest rate for a personal loan is Barclays, which advertises a % APR. Other notable banks with low personal loan rates | Personal loan interest rates range from around % or % to %, so a good rate would be one on the lower end of that range. You might also consider a Best Personal Loans With Low Interest Rates ; LightStream · star · % to % ; SoFi® · star · % to % ; PenFed · removebg- Best low interest personal loans, compared ; APR · % to %* (with AutoPay). Rates as of Jan. 25, · % to % · % to % · % to % |  |

| Fri, Feb Besy, Best rate loans min read. How do Improved financial health lenders make it work? The term, amount, and APR of any loan we loas to you will depend on your credit score, income, debt payment obligations, loan amount, credit history and other factors. Could the APR jump after a certain period, leaving you with unaffordable monthly payments? Advertised rates and terms are subject to change without notice. | What is a personal loan? CNBC Select may receive an affiliate commission from partner offers. Your best personal loan choice will be based on your needs and the repayment terms from the lender who meets your financing goals. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. Term Options Months 36 or Debt consolidation, home improvement, wedding or vacation. | Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to | The major bank with the lowest interest rate for a personal loan is Barclays, which advertises a % APR. Other notable banks with low personal loan rates Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Personal loan rates have been rising, but APRs can be as low as just under 5% to 11% or more. Your credit score and payment history will impact | Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - % The major bank with the lowest interest rate for a personal loan is Barclays, which advertises a % APR. Other notable banks with low personal loan rates LightStream: Our top pick · SoFi: Best customer service · PenFed: Best for small loans · Discover: Best for low rates · Upstart: Best for bad credit |  |

0 thoughts on “Best rate loans”