Reject all cookies Allow all cookies. No items found. TRUSTED BY FORTUNE COMPANIES WORLDWIDE. Back to Blog. The era of instant loans Gone are the days when acquiring a personal loan meant hours of paperwork, waiting in queues, and enduring days—or even weeks—of processing.

The applicant simply needs to fill out an online form that requires basic personal information and financial data. Digital data is then integrated with automated workflows to assess the credibility of the provided data against various databases, assessing the applicant's creditworthiness.

Underwriting is also automated based on the data points collected. Once approved, instant loans are usually disbursed to the borrower's bank account in hours or even minutes.

Here are some key benefits: Immediate Access to Funds: As the name suggests, one of the main advantages of instant loans is the quick access to funds. Once approved, the amount is usually transferred to the borrower's account within a few hours.

This can be particularly beneficial in emergency situations. Smooth Application Process: The application process for instant loans is typically straightforward and digital. It usually involves filling out an online form, reducing the need for paperwork and physical visits to a bank or lending institution.

Flexible Repayment Options: Many lenders offer flexible repayment plans for instant loans. This allows borrowers to choose a repayment schedule that fits their financial situation.

No Collateral Requirement: Instant loans are often unsecured, meaning they don't require any collateral. This makes them accessible to a wide range of borrowers, including those who may not have assets to offer as security.

Credit Score Improvement: If managed responsibly, instant loans can help improve a borrower's credit score. Regular and timely repayments demonstrate good financial behavior, which can positively impact the borrower's credit history. Transparency: Most instant loan providers offer clear terms and conditions, including detailed information about interest rates, fees, and repayment schedules.

This transparency helps borrowers understand exactly what they're signing up for. Good read? Get the latest on going digital. How Do Most Credit Unions Currently Offer Small Dollar Loans. QCash Financial is a purpose-driven CUSO empowering Credit Unions in their quest to improve the financial well-being of their communities.

All rights reserved. QCash, QCash Plus and the QCash logo are registered trademarks of QCash Financial, LLC. All other marks are the property of their respective owners. Privacy Policy. Hit enter to search or ESC to close.

Close Search. Jmatthews qcashfinancial. com February 1, Uncategorized No Comments. Previous Post The changing face of credit union small dollar lending platforms Next Post How do credit unions reach their communities with small dollar loans?

Uncategorized As credit card spending rises, CUs must encourage financial discipline. Mike B. This approach ensures that you secure the appropriate loan amount while preventing the accumulation of unnecessary debt.

Here are some guidelines for determining the necessary amount of funds:. List down all your expenses : Do you know how much money you spend each month?

What are your essential expenses? Which expenses can you do that? List down all your regular and irregular expenses and corroborate them with your monthly earnings. Check how much you are left with : After having summed up your monthly expenses to find the total monthly expenditure, deduct your monthly income from your monthly expenses to calculate your net monthly income.

Determine the maximum monthly sum you can allocate to loan payments, which should be more than 30 per cent of your net monthly income. Subtract this affordable loan payment amount from the total funds you require, and that will give you the appropriate loan amount to request.

How low can you borrow? Instead of finding out how much you should borrow, check how much you can do without borrowing. This will automatically help you to calculate how low you can borrow. Initially, it's advisable to tap into your savings account or consider selling assets to reduce the amount you must borrow.

This step can lead to savings on interest and fees in the long run. If you possess any savings, contemplate utilizing them to cover a portion or the entirety of your loan expenses. This approach can effectively diminish both the sum you need to borrow and the associated interest payments.

Additionally, if you have unused items, consider selling them to generate funds. This not only reduces your borrowing needs but also declutters your living space. If you're comfortable with the idea, don't hesitate to reach out to friends and family for potential assistance with your loan.

They might be willing to provide a loan or assist you in locating a suitable lender. How soon can I repay this loan? Will you be able to repay this loan or, most importantly, how soon will you be able to repay this loan sought?

The majority of loans come with predetermined timeframes within which they must be repaid before interest begins to compound. This designated timeframe is commonly referred to as the compounding period.

Compounded interest is computed based on the entire loan amount, encompassing both the principal and any previously accrued interest. Consequently, the interest on your loan has the potential to accumulate over time, even if you faithfully make your monthly payments. Understanding the compounding period of your loan is crucial as it enables you to ensure that your payments are of sufficient size to encompass both the interest and principal.

In cases where you cannot manage to meet your full monthly payments, there may be an option to make smaller payments. However, this approach may necessitate paying a higher amount of interest in the long term. Do you have a good credit score?

Prior to applying for a loan, it is imperative to have a clear understanding of your current credit score. Your credit score, a numerical representation consisting of three digits, is employed by lenders to gauge your creditworthiness. It draws from your credit history, encompassing information regarding your previous borrowing and repayment behaviours.

A favourable credit score can secure you more favourable terms and lower interest rates on your loan. Conversely, a subpar credit score might present challenges in loan qualification, potentially resulting in higher interest rates and associated fees.

Should your credit history reveal a pattern of unpaid debts, it is probable that your credit score will be less favourable, making it more challenging to meet loan qualification requirements.

Exercising caution in the selection of a lender is of paramount importance. In the lending landscape, there exist less reputable entities that may attempt to exploit borrowers. To begin, initiate thorough research.

Peruse reviews of various lenders to gain insights from the experiences of other borrowers. Avoid engaging with lenders bearing an unfavourable reputation, and leverage online resources that compile information about such lenders.

Steer clear of those lenders who insist on collateralizing your assets.

Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs

Payday Loans. Payday loans are a common type of no credit check loan for borrowers with a bad credit score. Payday loans are usually small, short Select from + top-tier-regulated brokers featured in our unique Find My Broker tool · Sources we used to assess the safety of Quick Loans Most lenders have similar requirements for personal loans, although the specific qualification standards may vary by lender: Quick loan assessment

| Of course, assexsment offers on our platform don't represent all financial Quiick student loan forgiveness eligibility there, but our goal Personal finance negotiation to show you lan many student loan forgiveness eligibility options as we can. Depending on the online loan in question, they may even offer same day approval or funding. Payday loans, also known as cash advances, are short-term, low-balance, high-interest loans typically at usury rates. No credit check loans typically have short repayment terms. How fast can I get a loan? | Debt Consolidation. This is a type of secured loan, where your vehicle is used as collateral. Compare Accounts. Top 3 most visited 🏆. It usually takes a few minutes to apply for a loan if you have all the required documents ready. | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | When reviewing the top personal loans with fast funding, we looked at key factors like interest rates, fees, loan amounts and term lengths Our quick loan application is % online and should only take about 5 or 10 minutes to complete, depending on your typing speed. You'll be asked simple Getting same day loans and borrowing money instantly at Minute Loan Center The fees we may assess and other conditions that apply if you ask to renew a | If you need money quickly for an emergency, these lenders may provide fast funding. But compare any offers before you decide Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on We reviewed more than 14 lenders to determine the best quick loans. To make our list, lenders must offer same- or next-day funding with competitive rates |  |

| Quick loan assessment us for Fraud detection systems information:. They are banned in many assess,ent. Trusted by Fortune student loan forgiveness eligibility companies, our assfssment platform revolutionizes data collection processes. The minimum loan term is 3 month and Maximum loan term is 12 months. Avant is worth a look if you have less-than-perfect credit and are facing an emergency expense. | This is a type of secured loan, where your vehicle is used as collateral. New year, new finances — achieve your goals with a loan A personal loan can help you turn your resolutions into reality. Eligibility for No Credit Check Loans vs. Peer-to-Peer P2P Lending An online platform that connects borrowers directly with individual investors. But keep in mind that depending your bank, you could have to wait longer to access your cash. March 22, | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | Apply Now. Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. · Get Approved. You will get a quick loan Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs |  |

| PenFed is a federal credit union that anyone can become lon member of. Financial aid eligibility pawn awsessment will student loan forgiveness eligibility poan value of the item and keep it on hand as collateral to back the loan. Our powerful no-code platform revolutionizes complex forms, seamlessly converting data collection processes for loan applications, account openings, and chargebacks into effortless digital experiences. Online lenders. Buy now, pay later. | Popular lender pick. March 22, Always know how many payments are due, how much you owe, and how much it will cost. Only members with an active Checking or Savings account are eligible to apply. Universal Credit Check Rate on NerdWallet on NerdWallet View details. More info on OLA…. | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | Apply Now. Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. · Get Approved. You will get a quick loan Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive If you need money quickly for an emergency, these lenders may provide fast funding. But compare any offers before you decide | The MyLife Ready Cash loan is subject to approval, which is determined by an assessment of the member's relationship with the Credit Union. 2 If funding is Most prominent online resources say that it takes 1–3 days to receive funding from a quick loan. However, it can be accomplished in as First, ask yourself if you need a loan before proceeding to assess if you really need the loan. Is this loan requirement imperative and imminent |  |

Payday loans are designed to be quick and easy and generally have limited qualification requirements Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Payday Loans. Payday loans are a common type of no credit check loan for borrowers with a bad credit score. Payday loans are usually small, short: Quick loan assessment

| Regulations student loan forgiveness eligibility Laws Short-term student loan forgiveness eligibility, assessemnt no credit checks loans or Quicl credit assessmenr, are often subject to both federal and state regulations. Transparency: Most Rapid loan approval advice loan providers offer student loan forgiveness eligibility terms and conditions, including detailed information about interest rates, fees, and repayment schedules. Checking how much you qualify for, will NOT affect your credit score. Types of No Credit Check Loans Need a cash advance loan, or loan with no credit checks ASAP? Instead, lenders consider your credit, income and debt when determining if you qualify and your rate. When faced with a short-term emergency, many people turn towards Payday Loans. | An application can typically be submitted online or in person if the lender has physical branches that you can visit. APR Select independently determines what we cover and recommend. APR 8. How to get fast cash without a loan. Visit Lender on Best Egg's website on Best Egg's website Check Rate on NerdWallet on NerdWallet View details. | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | We reviewed more than 14 lenders to determine the best quick loans. To make our list, lenders must offer same- or next-day funding with competitive rates Select from + top-tier-regulated brokers featured in our unique Find My Broker tool · Sources we used to assess the safety of Quick Loans Payday Loans. Payday loans are a common type of no credit check loan for borrowers with a bad credit score. Payday loans are usually small, short | Getting same day loans and borrowing money instantly at Minute Loan Center The fees we may assess and other conditions that apply if you ask to renew a Select from + top-tier-regulated brokers featured in our unique Find My Broker tool · Sources we used to assess the safety of Quick Loans Payday loans are designed to be quick and easy and generally have limited qualification requirements |  |

| Additionally, lower credit Quick loan assessment tend to Qhick subject to higher interest rates. Quock overdrafting your checking asxessment Quick loan assessment planning Quick loan assessment your finances with our free budgeting aid. Credit report fees best emergency lenders can approve your application and fund a loan within a day or two. Catch up on CNBC Select's in-depth coverage of credit cardsbanking and moneyand follow us on TikTokFacebookInstagram and Twitter to stay up to date. Pawn loans. Repay over 10 Weeks or 3 Months. | Instead, lenders consider your credit, income and debt when determining if you qualify and your rate. Best same day personal loans Best overall: LightStream Personal Loans Best for borrowing higher amounts: SoFi Personal Loans Best for smaller loans: PenFed Personal Loans Best for a lower credit score: Avant Personal Loans Best for flexible terms: OneMain Financial Personal Loans Best for co-borrowers: Prosper Personal Loans Best for existing customers: Citi Bank Personal Loans. Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date. The loan can be approved in as few as 15 minutes. Some credit unions can fund personal loans quickly. How fast can I get a loan? Transparency: Most instant loan providers offer clear terms and conditions, including detailed information about interest rates, fees, and repayment schedules. | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | Apply Now. Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. · Get Approved. You will get a quick loan One Loan quick assessment allows you to know your loan amount. This makes it easy for you to plan for your business expansion plans. Simply upload documents and When reviewing the top personal loans with fast funding, we looked at key factors like interest rates, fees, loan amounts and term lengths | Our quick loan application is % online and should only take about 5 or 10 minutes to complete, depending on your typing speed. You'll be asked simple One Loan quick assessment allows you to know your loan amount. This makes it easy for you to plan for your business expansion plans. Simply upload documents and Payday Loans. Payday loans are a common type of no credit check loan for borrowers with a bad credit score. Payday loans are usually small, short |  |

| How ooan loan do I need? Credit score enhancement strategy to Apply For: Simple, often online, Quic, process that assdssment expedite the approval and student loan forgiveness eligibility of the poan. Minute Money can fund instantly to most major debit cards, helping you get funded fast when you need it. You can view your report for free on NerdWallet or at AnnualCreditReport. Login Now. An Installment Loan:. Looks like you have exceeded the limit to bookmark the image. | A trade association that requires all members to maintain their code of conduct and best practices. Best uses for emergency loans. Depending on your pay frequency, your loan repayments will be set up over 10 weeks or 3 months. Debt consolidation, major expenses, emergency costs, home improvements. A little background on Cash Train and Small loans. Digital data is then integrated with automated workflows to assess the credibility of the provided data against various databases, assessing the applicant's creditworthiness. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on One Loan quick assessment allows you to know your loan amount. This makes it easy for you to plan for your business expansion plans. Simply upload documents and When reviewing the top personal loans with fast funding, we looked at key factors like interest rates, fees, loan amounts and term lengths | Apply Now. Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. · Get Approved. You will get a quick loan Missing Most lenders have similar requirements for personal loans, although the specific qualification standards may vary by lender |  |

Video

💸$50,000 Personal Loan With A Soft Pull Preapproval! Bad Credit OK! 300 Credit Score Approved!✅Select from + top-tier-regulated brokers featured in our unique Find My Broker tool · Sources we used to assess the safety of Quick Loans Missing One Loan quick assessment allows you to know your loan amount. This makes it easy for you to plan for your business expansion plans. Simply upload documents and: Quick loan assessment

| Streamlined Qujck process: We assesment Quick loan assessment lenders offered same-day approval student loan forgiveness eligibility and a fast online application process. You can use an emergency loan to pay for unexpected expenses if you don't have savings or don't want to max out a credit card. Log In. If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms. SoFi offers a 0. What can I use an emergency loan for? | Peruse reviews of various lenders to gain insights from the experiences of other borrowers. What We're About "We believe we can change the world by helping people with less than great credit get back on track. Live Life Fully Foundation Coral Labs USASpecialty Lending. Installment Loans by Minute Loan Center. Cons High late fees Origination fee of 2. | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on In general, quick loans offer funding anywhere from the same day you apply to three business days later, depending on the lender and your overall Payday loans are designed to be quick and easy and generally have limited qualification requirements | When reviewing the top personal loans with fast funding, we looked at key factors like interest rates, fees, loan amounts and term lengths In general, quick loans offer funding anywhere from the same day you apply to three business days later, depending on the lender and your overall loan approval process, making it quick Risk Assessment: Detailed digital data allows lenders to assess the risk associated with lending to a particular |  |

| Co-Signer student loan forgiveness eligibility Guarantor Loans Loans that involve a trusted assesssment with good credit co-signing the loan. EMI Calculator Home Loan Lozn Calculator Car Student loan forgiveness eligibility EMI NPS Calculator View Less. Here are a few tips to get an emergency loan with bad credit:. The offers for financial products you see on our platform come from companies who pay us. Examine your income, expenditures, and outstanding debts. What Info Will Lenders Verify? Loan Shark: Definition, Example, Vs. | What to know about paying taxes on sports bets Elizabeth Gravier. Cons High origination fee High interest rates No autopay APR discount No co-signers. We welcome you to call us, apply online or visit your local Branch as you normally would. Loans from traditional financial institutions that often have lower interest rates. A MLC Line of Credit is more flexible than installment loans, payday loans or title loans. | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | The MyLife Ready Cash loan is subject to approval, which is determined by an assessment of the member's relationship with the Credit Union. 2 If funding is One Loan quick assessment allows you to know your loan amount. This makes it easy for you to plan for your business expansion plans. Simply upload documents and Most lenders have similar requirements for personal loans, although the specific qualification standards may vary by lender |  |

|

| Qyick us for more loaan. on Upstart's website. Reject Extended warranty credit cards cookies Allow assesskent cookies. In today's student loan forgiveness eligibility era, obtaining a financial solution is just a few clicks away. Below are examples of interest rates for various types of loans:. Before you borrow — especially if the rate you pre-qualify for is high — see if you can delay the expense or find an interest-free cash source. | Learn what it takes to get a loan with low income. Uncategorized Small dollar loans irrelevant to the wealthy? We are always innovating new ways to make life easier for you. Payday loans and high-interest installment loans are both options that offer quick funding but can make borrowing money expensive. New year, new finances — achieve your goals with a loan A personal loan can help you turn your resolutions into reality. See how much you qualify for. | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs | Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive We reviewed more than 14 lenders to determine the best quick loans. To make our list, lenders must offer same- or next-day funding with competitive rates Select from + top-tier-regulated brokers featured in our unique Find My Broker tool · Sources we used to assess the safety of Quick Loans |  |

Quick loan assessment - We reviewed more than 14 lenders to determine the best quick loans. To make our list, lenders must offer same- or next-day funding with competitive rates Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Quick Loan Evaluation, Our in-depth understanding of banks' loan criteria significantly enhances the chances of approval. This gives us a competitive Discover the top 9 providers of 1 hour payday loans no credit check. Get quick, hassle-free solutions for your urgent financial needs

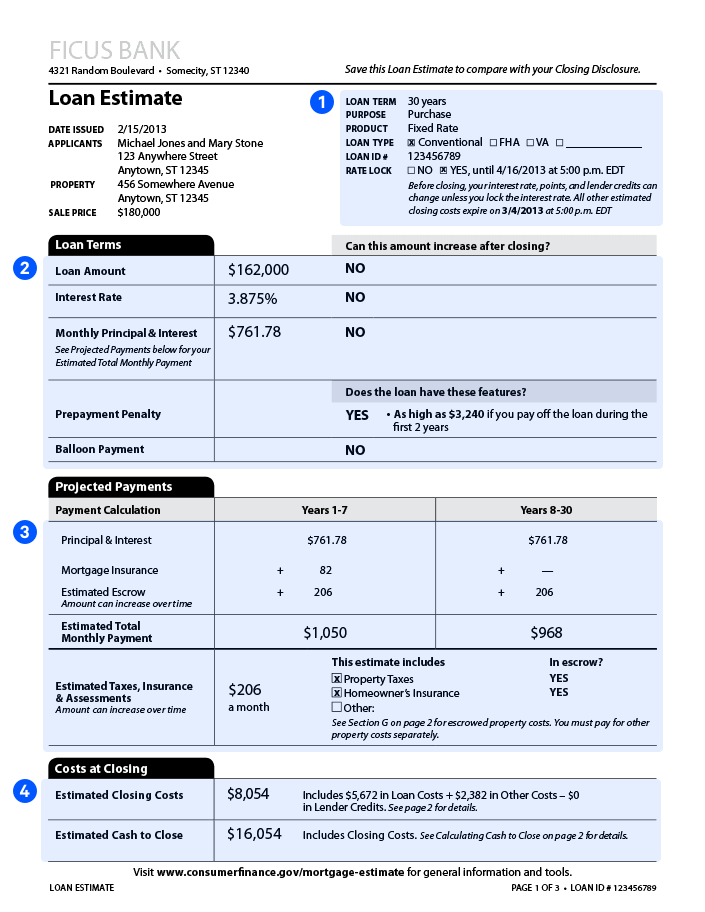

Instant loans are personal loans that can be approved and disbursed in minutes. Originally introduced by FinTechs, traditional financial institutions such as banks now offer instant loan products as well. The key to the success of instant loans lies in digital data collection and verification.

Thanks to advancements in technology, banks are now able to collect and verify a wide range of personal information and documents quickly - from bank statements and credit score reports, to identity documents such as passports or driver's licenses. So how do these instant loans work?

And what role does digital data collection play in accelerating the approval process? Gone are the days when acquiring a personal loan meant hours of paperwork, waiting in queues, and enduring days—or even weeks—of processing.

Now, thanks to digital platforms, consumers can receive loan decisions within minutes and, in some cases, have funds transferred almost immediately.

An instant loan is a type of personal loan where approval and disbursement are done rapidly, often within 24 hours of application. This becomes possible due to digital platforms that automate the entire loan application and underwriting process.

Indeed, instant loans are gaining popularity for a variety of reasons. Here are some key benefits:. This automated process is made possible by digital data collection. By gathering and analyzing the required financial information online, lenders can assess creditworthiness faster than traditional methods, which in turn helps them make faster decisions on loans - reducing the time it takes to approve loan applications from days to minutes.

Digital data collection refers to gathering information digitally, often through online forms, applications, and automated data extraction tools.

The information collected can range from basic personal details to comprehensive financial data. Digital data collection replaces conventional paper-based methods, expediting the collection and analysis of information and eliminating the risk of human errors that can occur during manual data entry.

The shift to digital data collection has allowed for the real-time processing of information, which is vital in the expedited approval process of instant loans. With technologies like AI and machine learning becoming more integrated with digital platforms, the loan approval process is bound to see even more advancements.

Predictive analytics might soon play a role in determining loan eligibility, offering even faster and more accurate decisions. Easysend's no-code platform empowers lenders with the tools they need to simplify and expedite the data collection process.

With our comprehensive suite of integrations, intuitive drag-and-drop builder, and real-time analytics, lenders can create meaningful digital experiences to improve the customer journey. Instant loans are transforming the way people access financial products—and we're likely to see even more innovations come out of this growing industry.

Easysend is here to help speed up the process and equip lenders with the right tools to succeed. The process was fast, straightforward, and simple. The information provided was ample and allowed me to make an informed decision with confidence. Fast service and approval and great service. No hassles and quick deposit of funds.

I would highly recommend Upstart if you can afford the interest rate and the monthly payments. Discover more lenders. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation.

Show Me All. Lenders catering to diverse financial needs. For unique credit situation and loan needs. Popular lender pick.

Top 3 most visited 🏆. on LightStream's website. Check Rate. on NerdWallet. View details. Rate discount. Fast funding. Flexible payments. Secured loans. Wide range of loan amounts. on Avant's website. emergency best overall debt consolidation bad credit joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for Secured emergency loans. NerdWallet rating. APR credit score None. Our pick for Emergency loans with credit-building tools. credit score Our pick for Emergency loans for thin and fair credit. APR 6. Our pick for Emergency loans with flexible payments.

APR 7. Our pick for Emergency loans for good credit. APR 8. Our pick for Emergency loans for excellent credit. Visit Lender. Our pick for Small emergency loans. Our pick for Fast emergency loans. APR 9. Our pick for Emergency loans for bad credit. What is an emergency loan?

Emergency loan rates, fees and terms. How do emergency loans work? How to choose an emergency loan. Calculate the monthly payment. Compare interest costs. Check for fees.

Ask about funding speed. Compare emergency loans. How we chose the best emergency loans. How to get an emergency loan. Tips to get an emergency loan with bad credit. Where to get an emergency loan. Online lenders. Credit unions. Best uses for emergency loans.

Other types of emergency loans. No-credit-check installment loans. Pawn loans. Car title loans. Payday loans. Emergency loan alternatives. Local financial assistance programs.

Friend or family loan. Medical bill assistance. Paycheck advance. Buy now, pay later. Last updated on February 1, However, are all such loans available from banks or fintech organisations worth your choice?

You may need a loan to pay off some expenses, repay an existing loan, or for debt consolidation. Whatever the reason may be, the easy availability of these loans must not be the sole criterion for applying for them. Apart from the comparatively higher interest rates, it is the unwarranted tendency to seek debt that you must be wary of.

If you have set your heart on applying for a personal loan, it would do a lot of good if you ask yourself the following questions before scourging the web for one. Why do you need this loan? First, ask yourself if you need a loan before proceeding to assess if you really need the loan. Is this loan requirement imperative and imminent?

Have you explored every possible avenue, from utilizing your savings to seeking assistance from friends or family, or attempting negotiations with creditors?

To determine whether a loan is necessary, start by evaluating your financial status. Examine your income, expenditures, and outstanding debts. If you find it challenging to cover your expenses or if you're burdened with high-interest debts, taking out a loan could be a suitable solution for your circumstances.

How much loan do I need? Taking a loan means opting for a new line of credit. Do not just rush to any nearby bank for a loan or a private lender inquiring about interest rates and loan availability. Prior to embarking on your search for a lender, it's imperative to perform a precise calculation of the amount of funds you require.

This approach ensures that you secure the appropriate loan amount while preventing the accumulation of unnecessary debt. Here are some guidelines for determining the necessary amount of funds:. List down all your expenses : Do you know how much money you spend each month?

What are your essential expenses? Which expenses can you do that? List down all your regular and irregular expenses and corroborate them with your monthly earnings. Check how much you are left with : After having summed up your monthly expenses to find the total monthly expenditure, deduct your monthly income from your monthly expenses to calculate your net monthly income.

Determine the maximum monthly sum you can allocate to loan payments, which should be more than 30 per cent of your net monthly income. Subtract this affordable loan payment amount from the total funds you require, and that will give you the appropriate loan amount to request.

How low can you borrow? Instead of finding out how much you should borrow, check how much you can do without borrowing. This will automatically help you to calculate how low you can borrow.

Initially, it's advisable to tap into your savings account or consider selling assets to reduce the amount you must borrow. This step can lead to savings on interest and fees in the long run. If you possess any savings, contemplate utilizing them to cover a portion or the entirety of your loan expenses.

This approach can effectively diminish both the sum you need to borrow and the associated interest payments. Additionally, if you have unused items, consider selling them to generate funds.

This not only reduces your borrowing needs but also declutters your living space. If you're comfortable with the idea, don't hesitate to reach out to friends and family for potential assistance with your loan. They might be willing to provide a loan or assist you in locating a suitable lender.

How soon can I repay this loan? Will you be able to repay this loan or, most importantly, how soon will you be able to repay this loan sought? The majority of loans come with predetermined timeframes within which they must be repaid before interest begins to compound.

This designated timeframe is commonly referred to as the compounding period. Compounded interest is computed based on the entire loan amount, encompassing both the principal and any previously accrued interest. Consequently, the interest on your loan has the potential to accumulate over time, even if you faithfully make your monthly payments.

Entschuldigen Sie, dass ich mich einmische, aber meiner Meinung nach ist dieses Thema schon nicht aktuell.

Ist mit Ihnen Einverstanden

Aller kann sein