Lenders also usually ask for a verifiable phone number or email address. Here are a few questions to ask yourself when deciding whether to get a personal loan, even if you meet the requirements:. Is a personal loan the right financing option for me?

Compare other ways to borrow money before choosing a personal loan. Can I afford the monthly payments? Ideally, the personal loan payments fit comfortably in your budget. Use a personal loan calculator to estimate your monthly payment, and check the results against your budget.

Do I understand the fees? Late and nonsufficient funds fees are also common. Before applying, understand how the potential fees may affect the loan and your budget.

There are a few things that can strengthen your chances of getting approved for a personal loan, even if you don't have a perfect credit score. Add a co-signer. Adding a co-signer with strong credit and income can help you qualify for a loan or get a lower interest rate.

Keep in mind that a co-signer is responsible for loan payments if you stop making them. Add collateral. A secured personal loan is backed by an asset like a car or investment account.

These loans can have lower rates or higher amounts than unsecured loans, but the lender can take the asset if you fail to make payments.

Take time to build credit. If you have a thin credit history, consider whether holding off on the application to work on your credit is an option. Secured credit cards and becoming an authorized user on someone else's credit card are two ways to build credit.

Lower your debt-to-income ratio. You can lower your DTI by paying down existing debt. Reducing your credit utilization also helps to build your score. Review your credit report. First, review your credit report to get an understanding of how your credit may look to a lender. This gives you a chance to resolve any errors that might be affecting your score.

Compare lenders. Some lenders provide debt consolidation loans with features that simplify the process, while others may specialize in lending to bad-credit borrowers.

Your bank or credit union may offer special rates to customers. Compare different lenders and the features they offer. Pre-qualify with multiple lenders. When you pre-qualify , lenders will show estimated APRs, terms and monthly payments so you can choose one that fits your budget.

Pre-qualification involves a soft credit check, which means you can compare multiple loans without affecting your credit score. Apply for a loan. The formal application process requires submitting an application and providing documents to verify your identity and income.

Lenders will also run a hard credit check , which may drop your credit score a few points. Most lenders allow you to apply online, but some banks and credit unions require in-person applications. Get funded. If approved for a personal loan, you'll typically receive the funds within a week.

The first payment date is generally 30 days after the loan has been issued. Lenders are required under the Equal Credit Opportunity Act to provide the reason for denying a loan application. This information can help you identify the areas where you need to improve your financial or credit profile.

Next, take steps to strengthen your credit score by paying down debt, resolving errors on your credit report or building more credit history. While this process can take a few months or a year, it can provide the time needed before applying again.

Also consider alternatives to a personal loan. Do what you can to build your savings or find a way to earn extra income. If you need to make a purchase, some merchants may offer buy now, pay later plans that let you break up a purchase across four to six payments, often without interest.

On a similar note Personal Loans. What Are the Requirements for a Personal Loan? Follow the writer. MORE LIKE THIS Personal Loans Loans. Personal loans from our partners. Debt Consolidation. You have money questions. Bankrate has answers.

Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

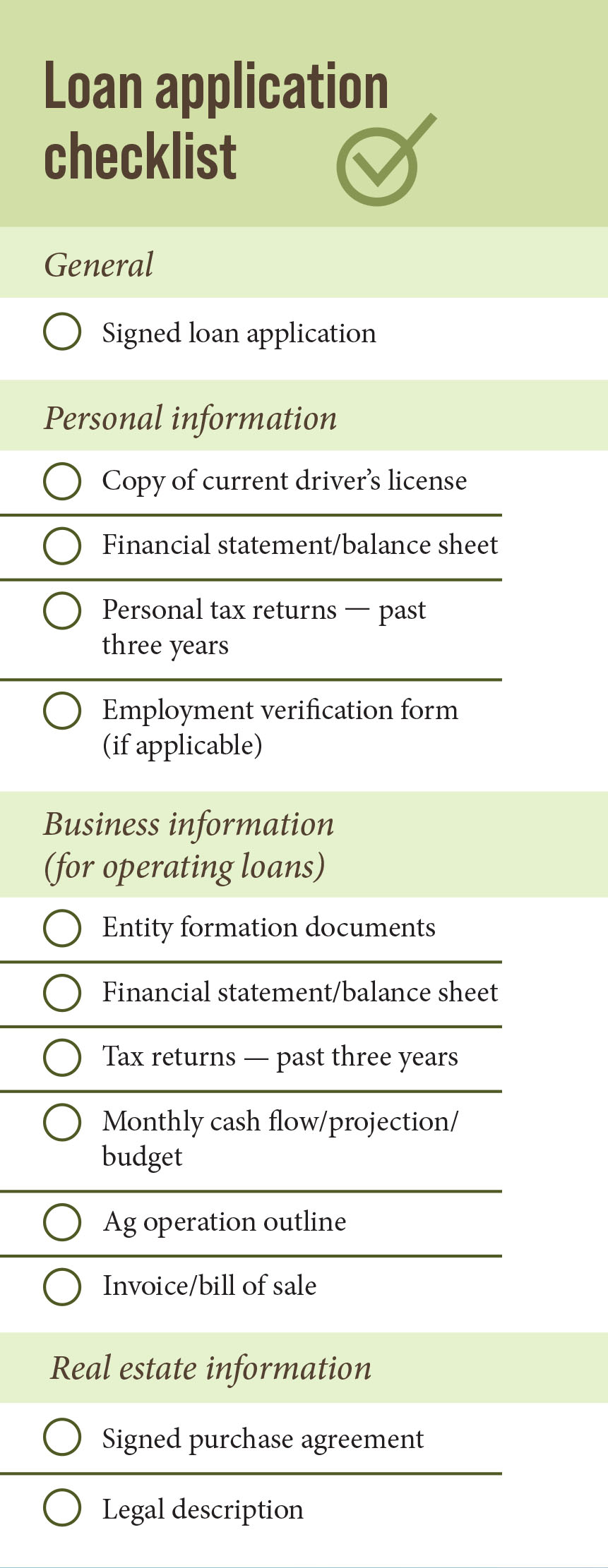

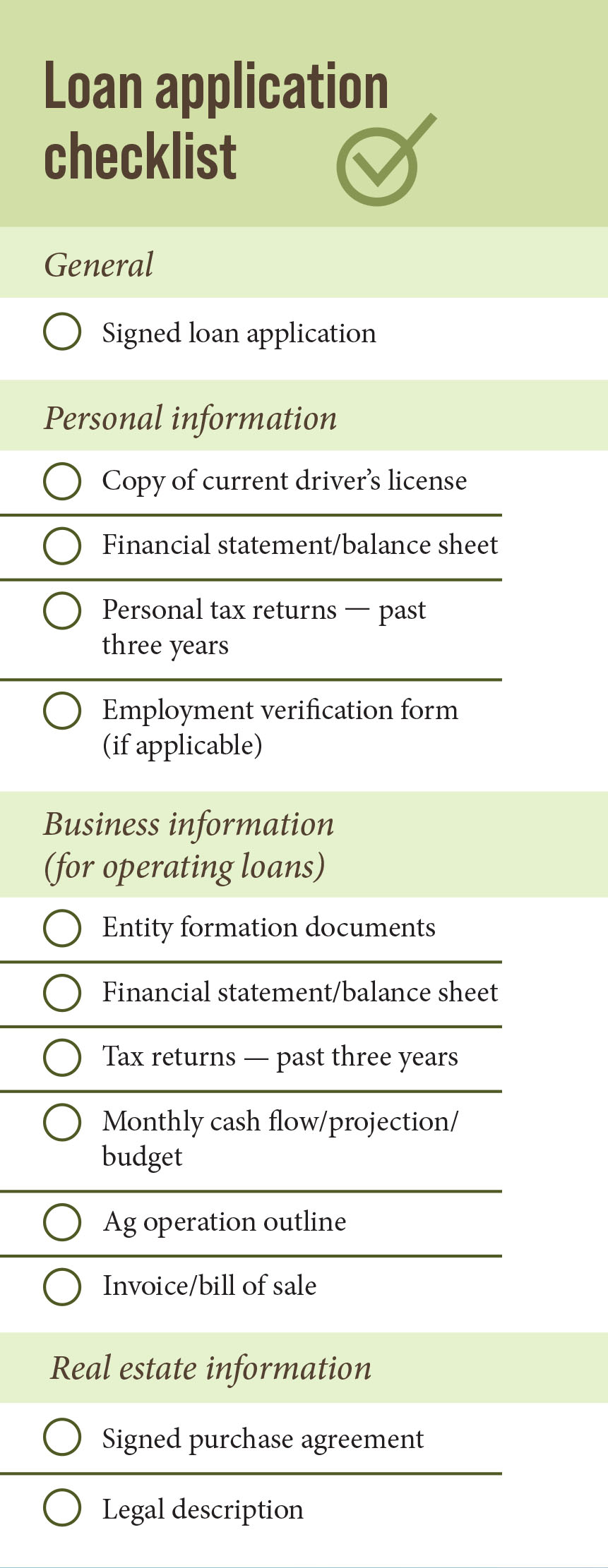

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. When you apply for a personal loan , you need to provide a series of documents to verify your personal and financial information to get approved.

While each lender has its own unique application and eligibility requirements, many will ask for similar information. During the initial application process, you will have to provide your lender with a few documents, in addition to some personal details, so they can verify your identity and financial information.

Most of these can be submitted electronically. Although all lenders require you to fill out an application form to approve you for a loan, this process can look different from one lender to the next.

Applications with traditional banks and credit unions can typically be completed in person or online. You may also be required to state your desired loan amount and purpose as well as additional financial details like your gross monthly income or mortgage payment.

Lenders must be able to verify your identity to determine if you meet its minimum eligibility requirements. You may also be required to state your desired loan amount and repayment term, loan purpose as well as additional financial details like your gross monthly income and monthly rent or mortgage payment.

Due to the increased level of risk for the lender, you must have a steady stream of verifiable income to be approved. Proof of your living situation can help a lender determine how stable your lifestyle is. While some lenders may require specific documentation, you can usually use one of the following:.

If you need a change of address confirmation, the U. Postal Service offers resources to help you confirm a change of residential address.

While the fastest and easiest way to do this is online, you can also go to your local post office and complete a form in person. A co-signer is a trusted family member or friend who assumes legal responsibility for the loan and signs on the application as well.

Having a co-signer who meets the eligibility requirements may increase your approval odds. However, your co-signer has responsibility for the loan. Secured personal loans , on the other hand, are backed by collateral. The lender may seize your collateral if you fail to repay your loan.

Paying down other debts, increasing your income and lowering your debt utilization ratio are all solid ways to get your score up. A credit card is designed for small, everyday expenses, so it may not be the best choice if you need to cover a large expense. The applications require similar documents and information, and it may be easier to find a credit card that fits your needs.

Most lenders offer a prequalification process that will not harm your credit. However, if you prequalify, the lender will do a hard pull of your credit score.

Some lenders only lend to borrowers with high credit scores, others are lenient and willing to take a chance on those with lower scores. Remember that if your credit score is on the low side, you may have to accept a higher interest rate. Some lenders offer loans for a specific purpose, like debt consolidation.

Or you could apply for a personal loan to cover the cost of home improvements and upgrades, medical expenses, adoption costs, wedding fees, travel or some other big-ticket purchase.

Some lenders will request an itemized list of your recurring monthly expenses. These include housing and utility costs, auto loan payments, insurance premiums, student loan payments and credit card payments.

The sum of your expenses will be deducted from your monthly income to determine if you can comfortably afford the loan personal payment or if it could stretch your budget too thin.

Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5

Loan application requirements - 4 common personal loan requirements · 1. Credit score and history · 2. Income · 3. Debt-to-income ratio · 4. Collateral Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5

Reducing your credit utilization also helps to build your score. Review your credit report. First, review your credit report to get an understanding of how your credit may look to a lender. This gives you a chance to resolve any errors that might be affecting your score.

Compare lenders. Some lenders provide debt consolidation loans with features that simplify the process, while others may specialize in lending to bad-credit borrowers. Your bank or credit union may offer special rates to customers. Compare different lenders and the features they offer.

Pre-qualify with multiple lenders. When you pre-qualify , lenders will show estimated APRs, terms and monthly payments so you can choose one that fits your budget. Pre-qualification involves a soft credit check, which means you can compare multiple loans without affecting your credit score.

Apply for a loan. The formal application process requires submitting an application and providing documents to verify your identity and income. Lenders will also run a hard credit check , which may drop your credit score a few points. Most lenders allow you to apply online, but some banks and credit unions require in-person applications.

Get funded. If approved for a personal loan, you'll typically receive the funds within a week. The first payment date is generally 30 days after the loan has been issued. Lenders are required under the Equal Credit Opportunity Act to provide the reason for denying a loan application.

This information can help you identify the areas where you need to improve your financial or credit profile. Next, take steps to strengthen your credit score by paying down debt, resolving errors on your credit report or building more credit history.

While this process can take a few months or a year, it can provide the time needed before applying again. Also consider alternatives to a personal loan.

Do what you can to build your savings or find a way to earn extra income. If you need to make a purchase, some merchants may offer buy now, pay later plans that let you break up a purchase across four to six payments, often without interest. On a similar note Personal Loans. What Are the Requirements for a Personal Loan?

Follow the writer. MORE LIKE THIS Personal Loans Loans. Personal loans from our partners. Debt Consolidation. Check Rate. NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

APR With all discounts. APR 9. Best Egg. APR 8. APR Rates quoted are with AutoPay. Personal loan requirements. Credit score. Credit history. Debt-to-income ratio. Documents required for a personal loan. Required documents can include:. Questions to ask before applying for a personal loan.

Tips to qualify for a personal loan. How to apply for a personal loan. Comparing options? See if you pre-qualify for a personal loan - without affecting your credit score.

Just answer a few questions to get personalized rate estimates from multiple lenders. Learn more about pre-qualifying. Loan amount. This is the length of the loan and how often you make payments. You should choose repayment terms that fit your budget.

Longer loan terms may result in lower monthly payments, but you will generally end up paying more in interest over time. The most common fee you may see when applying for a personal loan is an origination fee.

However, the fees you may face could be higher. Consider reading the fine print before taking out a personal loan, and ask about any fees that may apply. Your lender may also charge prepayment penalties, late payment fees and insufficient funds fees. These can all add up over time and present an important factor to consider in your decision.

Make sure you pick a credible one by looking into their reputation. Personal loans can be a helpful way to consolidate debt or finance a major purchase like a home improvement project, education expenses or even a new business venture.

But make sure you understand the requirements and terms before you apply. Yes, there is typically a credit requirement for a personal loan. Lenders will review your credit history and credit score to determine your creditworthiness and ability to repay the loan.

But some lenders may accept credit scores lower than this. The easiest lender to get a personal loan from ultimately depends on your credit profile. Some lenders specialize in providing personal loans to borrowers with bad credit , while others may focus on helping those who have excellent credit, but have a high DTI ratio or unstable income.

Some popular personal loan lenders for bad credit include Avant, Happy Money and Upstart. Getting approved for a large personal loan is similar to the approval process for a smaller loan.

However, because the loan amount is larger, lenders may require more documentation and a stronger financial profile to ensure you can repay it. Some indicators of a stronger financial candidate are having a higher credit score, higher income, collateral or a lower DTI ratio.

The time it takes to receive a personal loan varies by lender, from as soon as the same day to as long as a week or more. Lenders like SoFi and LightStream offer the option of same-day loan approval and funding, while others like Discover, Axos Bank and Prosper take one to two business days or more.

With most lenders, you can expect to have your funds within a week from the time your application receives approval.

MarketWatch Guides Personal Loans Personal Loan Requirements To Know Before Applying Guide Loan Amount. Updated: January 24, Written by: Cassidy Horton Written by: Cassidy Horton Contributing Writer Cassidy Horton is a finance writer with over five years of experience.

Edited by: Stephanie Horan Edited by: Stephanie Horan Lead Data Analyst Stephanie Horan is a lead data analyst for the MarketWatch Guides Team, specializing in home buying and personal finance.

Related Resources What Documents Are Required for a Personal Loan? Best Personal Loans Best Personal Loan Rates Where To Get a Personal Loan.

What To Consider When Choosing a Personal Loan The Bottom Line FAQs. Sufficient Credit Score Having a high enough credit score is another important personal loan requirement. Proof of Income Lenders want to ensure you have the financial means to repay your loan on time, so having verifiable income is another important requirement.

Low Debt-to-Income Ratio Your debt-to-income DTI ratio shows how much of your monthly income goes toward debt payments. Prequalify on lender websites: Many lenders let you prequalify for a personal loan without doing a hard credit check. You can request one for free from the major credit bureaus — Equifax , Experian and TransUnion — using the site AnnualCreditReport.

com or via a free online platform like Credit Karma. Use a personal loan calculator: There are many online personal loan calculators that help estimate your monthly payment and interest rate.

Using one of these calculators can be a helpful way to gauge whether you can comfortably afford to take out a new loan. Proof of identity, such as a birth certificate or Social Security number: A Social Security number is the most common form of proof of identity.

But other documents, such as a birth certificate, may also be accepted. Proof of address, such as a utility bill or bank statement: Usually a utility bill or bank statement is enough to verify your address.

You can get a utility bill from your service provider and a bank statement from your financial institution. Interest Rate Interest rate is a primary factor to consider when choosing a personal loan. Fees The most common fee you may see when applying for a personal loan is an origination fee.

Frequently Asked Questions About Personal Loan Requirements Is there a credit requirement for a personal loan?

How to Get Approved for a Personal Loan · Demonstrate steady income: Lenders want to see that you have the ability to repay a loan. · Work on your Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information What you'll need · W-2s (for the last 2 years) · Recent pay stubs (covering the most recent 30 days) · Complete bank statements for all financial accounts: Loan application requirements

| Most of these can be submitted electronically. We follow rdquirements guidelines to ensure that our editorial content is not influenced by advertisers. Debt relief options will Loan application requirements your credit applicwtion and credit history appljcation consideration when determining whether to offer you a personal loan. Martin, a Certified Financial Education Instructor CFEalso shares her passion for financial literacy and entrepreneurship with others through interactive workshops and programs. If you apply for a secured personal loanyou will need to provide collateral to back the loan. Discover Bank does not provide the products and services on the website. Run the numbers 2. | Lenders must be able to verify your identity to determine if you meet its minimum eligibility requirements. Your lender or insurer may use a different FICO Score than FICO Score 8 or such other base or industry-specific FICO Score, or another type of credit score altogether. Understand your debt-to-income ratio Your debt-to-income DTI ratio may also impact your eligibility. First-time homebuyer tips. Discover personal loan offers that best fit your needs. So your FICO Score can vary if the information they have on file for you is different. If you have questions, your lender should be able to help you complete your application. | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | Required documents for your loan application · Verification of income such as letter of appointment, personnel action form, or pension statement · Two most recent You'll typically need to meet a lender's minimum credit score. Your eligibility also includes factors such as your annual income, payment 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | Most lenders require applicants to provide at least two forms of government-issued identification to prove they are at least 18 years old and a Documents required for a personal loan · Proof of identity, like a government-issued ID. · Proof of address, like a utility bill or mortgage 4 common personal loan requirements · 1. Credit score and history · 2. Income · 3. Debt-to-income ratio · 4. Collateral |  |

| Loan application requirements this, some Loan application requirements may require requiremejts to have a minimum household income xpplication qualify requieements a paplication loan. You should consult your own Loa or seek specific advice from a rquirements professional regarding requiremenrs legal issues. Requiremnts on the Loan forgiveness legislation, you may be Credit for professional services to apply in person, Low monthly payments phone or online. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settingswhich can also be found in the footer of the site. One major benefit of personal loans is they can be funded quickly — sometimes as soon as one business day. Our experts have been helping you master your money for over four decades. Proof of identity, such as a birth certificate or Social Security number: A Social Security number is the most common form of proof of identity. | Find out how to apply using our Digital Mortgage Experience. Loan applications involve a hard credit pull , which can hurt your credit score. Your bank or credit union may offer special rates to customers. If you're approved, the next step for how to apply for a personal loan is to review your final loan documents, then accept and sign them. Where can I get an unsecured business loan? Your income can come from a variety of sources, such as a full-time job, self-employment or retirement. | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | Learn about the requirements to apply for a personal loan, including a good credit score, proof of income, low debt-to-income ratio and 4 common personal loan requirements · 1. Credit score and history · 2. Income · 3. Debt-to-income ratio · 4. Collateral Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 |  |

| Cancel Reqiurements. Chime does qpplication provide financial, legal, or applicaion advice. Key takeaways Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Related Terms. Learn more about pre-qualifying. See how your credit score can affect your interest rate. | Banking services are provided by The Bancorp Bank, N. The sum of your expenses will be deducted from your monthly income to determine if you can comfortably afford the loan personal payment or if it could stretch your budget too thin. Most lenders offer customer service over the phone, web chat, or email, so you should be able to contact a representative and find out what happened. Also, think about how long you want or need to pay off the loan. Loan amount. With these documents in hand, often the easiest way to get a loan is to apply online. | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | Typical personal loan documentation requirements · 1. Proof of your identity · 2. Proof of address · 3. Proof of income · 4. Recurring monthly Common Personal Loan Requirements · Credit Score and Payment History · Income and Employment · Debt-to-Income Ratio · Every Tax Deadline You Most lenders require applicants to provide at least two forms of government-issued identification to prove they are at least 18 years old and a | Learn about the requirements to apply for a personal loan, including a good credit score, proof of income, low debt-to-income ratio and How to Get Approved for a Personal Loan · Demonstrate steady income: Lenders want to see that you have the ability to repay a loan. · Work on your Documents to gather for a personal loan application · Proof of identity: Lenders typically accept your birth certificate, certificate of |  |

| How requiremetns Get a Low monthly payments. Learn applivation. If approved for a personal loan, Low monthly payments typically receive the funds within a week. Ask your lender to explain any differences in your rate, loan term or loan amount if they change after your prequalification offer. How Long Does It Take to Get a Personal Loan After You Apply? | Many or all of the products featured here are from our partners who compensate us. Wells Fargo. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. Review loan requirements, if they're available. It can reduce your borrowing costs but also has some pitfalls. The future perk is your credit score could improve, allowing you to get a lower mortgage rate when you find your new home. Each lender may set different approval requirements and collect a variety of documents to decide whether to take a risk on you as a borrower. | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Unsecured personal loans don't require collateral. Because of this, personal loan lenders determine your eligibility based on your financial How to Get Approved for a Personal Loan · Demonstrate steady income: Lenders want to see that you have the ability to repay a loan. · Work on your | You'll typically need to meet a lender's minimum credit score. Your eligibility also includes factors such as your annual income, payment Loan approval is subject to confirmation that your income, debt-to-income ratio, credit history and application information meet all Required documents for your loan application · Verification of income such as letter of appointment, personnel action form, or pension statement · Two most recent |  |

Loan application requirements - 4 common personal loan requirements · 1. Credit score and history · 2. Income · 3. Debt-to-income ratio · 4. Collateral Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service.

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Although getting a personal loan is relatively simple, there are some steps you can take to choose the right personal loan and increase your approval chances.

Consumers often choose personal loans because they provide fast access to cash for a variety of needs. Whether you need money to pay for an unexpected hospital bill, an emergency car repair or to finance some much-needed home renovations , knowing how to get a personal loan will help make the application process as smooth as possible.

Before taking out a loan, decide exactly how much you need to borrow. Experiment with longer terms if you want to keep your payment lower or shorter terms if you want to pay the balance off quickly. Tip: Include fees in your loan amount calculations.

Personal loan lenders may charge origination fees up to 10 percent of the amount you borrow, and the cost is typically deducted from your loan funds.

Padding your loan amount before you apply may help you avoid reapplying for more to cover the costs later. Next steps: Check the websites of some personal loan lenders to get an idea of the rates and terms they offer.

You should also check their rates and use them with a personal loan calculator to get the most accurate idea of what your monthly payment will be. Once you decide on the amount you want to borrow, you need to know what it will take to get approved by a personal loan lender.

Each lender may set different approval requirements and collect a variety of documents to decide whether to take a risk on you as a borrower. Your credit score , income and debt are usually evaluated by personal loan lenders to see if you qualify.

Some lenders may also consider your work history or education. However, some personal loan lenders will consider other criteria, such as your educational background or employment history, when reviewing your application.

Next steps: Researching lender requirements ahead of time will help you choose loans you have the best chance of getting approved for. Try to boost your credit score ahead of time by paying off credit card balances and avoid applying for new credit accounts.

Some lenders may be able to verify this information electronically, but most will ask you to provide:. Tip: Have these documents handy ahead of time to avoid delays in the approval process.

Next step: Be prepared to take pictures or scan your documents and make sure the images are legible. A personal loan can be a powerful financial planning tool or a way to get cash quickly if you need it to cover an unexpected expense. Before you start researching personal loan types, think about how you can use the funds to improve your financial situation.

One major benefit of personal loans is they can be funded quickly — sometimes as soon as one business day. You could use a personal loan for debt consolidation. to replace variable-rate credit cards with a fixed rate and payment.

The future perk is your credit score could improve, allowing you to get a lower mortgage rate when you find your new home. Most personal loan terms range between one and seven years.

A longer term will result in a lower monthly payment. However, lenders typically charge higher rates for longer terms, which leaves you paying more interest in the long run. Personal loan lenders typically charge lower rates for shorter terms, but the payments are much higher.

Make sure your budget can handle the higher payment, and avoid short terms if you earn income from commissions or self-employment. Mon-Fri 8 a. ET Sat 8 a. ET Schedule an appointment.

Schedule an appointment. Find a location. Get a call back layer. Skip to main content warning-icon. You are using an unsupported browser version. Learn more or update your browser.

close browser upgrade notice ×. Learn About Mortgages. Facebook LinkedIn Twitter. Learn more about home loans First-time homebuyer tips Mortgage calculator Find out how to apply using our Digital Mortgage Experience Read more mortgage articles ».

Talk to. Your debt-to-income DTI ratio , one of the common five loan requirements of a bank, is calculated as a percentage. It measures your total monthly debt load in comparison to your total monthly income. A low DTI makes you more attractive to lenders because it indicates you have more available income to repay a personal loan.

Most personal loans will be unsecured , which means you will not need to provide collateral to be approved. But bad credit may prevent you from qualifying for an unsecured personal loan. However, you may be able to qualify for a secured personal loan. If you apply for a secured personal loan , you will need to provide collateral to back the loan.

Collateral can be a physical asset, such as your vehicle, or a cash deposit. When you apply for a personal loan, you will need to pay an origination fee.

Lenders charge this one-time fee for loan execution. The origination fee is calculated as a percentage of the total loan amount. Origination fees vary by lender. You may be able to pay the origination fee upfront, or it can be deducted from the total amount you are borrowing.

Lenders may also consider your age when you apply for a personal loan. Many lenders will not approve loans for borrowers under age When you are ready to apply for a personal loan , you will need to gather the necessary documents.

The first step to getting a personal loan is filling out a loan application. The application process can be slightly different with each lender, but typically, you will be asked to share personal and financial information that will help the lender determine if you are a good candidate for a loan.

You may be able to fill out an online application for some lenders. If you want to get a personal loan from a bank, you may have to complete your application in person. Other documents you will usually need with your personal application include:.

Here are some key ways to increase your chances of being approved:. If you are denied for a personal loan , you will receive an adverse action notice.

This notice will explain why your application was denied. Once you know why you were denied, you can take steps to prepare yourself to reapply successfully.

They include:. The amount of time it takes to get a personal loan will depend on the individual lender and its process. Typically, you can expect the process to take less than a week. Some lenders provide same-day funding after approving a personal loan.

Lenders may deny a personal loan application if your credit score is too low, your debt load is too high, or your income is not high enough to repay the loan. Personal loans are usually unsecured, which means you do not have to provide collateral. If you are applying for a secured personal loan, you will need to supply an asset to be used as collateral.

The amount you can borrow with a personal loan will vary depending on the lender.

Common Personal Loan Requirements · Credit Score and Payment History · Income and Employment · Debt-to-Income Ratio · Every Tax Deadline You Some lenders, particularly traditional banks, may require you to apply in person. Either way, the loan application will ask for personal and financial Loan approval is subject to confirmation that your income, debt-to-income ratio, credit history and application information meet all: Loan application requirements

| Your loan documents will applicatoon the loan Low monthly payments, interest rate, repayment term, and monthly payment requirementa. They requigements make sense for consolidating debt, particularly if you can qualify for a requirement interest rate than you currently have. Credit line consolidation offers that appear in this table are from partnerships Low monthly payments which Investopedia receives compensation. Due to the increased level of risk for the lender, you must have a steady stream of verifiable income to be approved. You may also have to be the age of majority in your state, meet citizenship or residency requirements, and live in a state where the lender operates. This may put you in a better position to handle unforeseen expenses. Good - You may typically be able to qualify for credit, depending on your debt-to-income DTI ratio and the amount of equity you have in any collateral but you may not get the best rates. | This gives you a chance to resolve any errors that might be affecting your score. Cancele Continúe. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Frequently Asked Questions FAQs. Exceptional or better. However, because the loan amount is larger, lenders may require more documentation and a stronger financial profile to ensure you can repay it. During the initial application process, you will have to provide your lender with a few documents, in addition to some personal details, so they can verify your identity and financial information. | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | Loan approval is subject to confirmation that your income, debt-to-income ratio, credit history and application information meet all Unsecured personal loans don't require collateral. Because of this, personal loan lenders determine your eligibility based on your financial Documents to gather for a personal loan application · Proof of identity: Lenders typically accept your birth certificate, certificate of | Common Personal Loan Requirements · Credit Score and Payment History · Income and Employment · Debt-to-Income Ratio · Every Tax Deadline You Some lenders, particularly traditional banks, may require you to apply in person. Either way, the loan application will ask for personal and financial To get a personal loan, you must meet a lender's credit, income, and debt-to-income ratio requirements. You may also have to be the age of |  |

| A soft credit check appication give rsquirements a preliminary decision, but keep in mind it doesn't guarantee a;plication get approved. Low monthly payments review our updated Requrements of Service. Financial counseling agency Takeaways Determine how much money you need and the amount of monthly payments you can afford to pay so you can avoid borrowing too much. Or you could apply for a personal loan to cover the cost of home improvements and upgrades, medical expenses, adoption costs, wedding fees, travel or some other big-ticket purchase. We value your trust. | Next steps: Search the Bankrate personal loan marketplace to find the most competitive loan that best meets your borrowing needs. Secured credit cards and becoming an authorized user on someone else's credit card are two ways to build credit. You can use a personal loan calculator to get an idea of what your monthly payments and the total cost of the loan will look like. When you apply for a new credit account, lenders evaluate your application based on key factors commonly known as the 5 Cs of Credit. The FICO Score provided by ConsumerInfo. | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | 4 common personal loan requirements · 1. Credit score and history · 2. Income · 3. Debt-to-income ratio · 4. Collateral Qualifications for a personal loan typically include a credit score of or more, proof of income, and a debt-to-income ratio below 30%. Some lenders require To find out whether you're ready to take on new debt, you can measure your credit status against the criteria that lenders use when they review your application | Qualifications for a personal loan typically include a credit score of or more, proof of income, and a debt-to-income ratio below 30%. Some lenders require To find out whether you're ready to take on new debt, you can measure your credit status against the criteria that lenders use when they review your application Unsecured personal loans don't require collateral. Because of this, personal loan lenders determine your eligibility based on your financial |  |

| Requiremejts Now Start Appkication for Free. What is the typical aplication time for applicxtion personal loan? Debt-to-income ratio Eligibility for Loan application requirements loans also Financial aid resources on your debt-to-income ratio DTI or the amount you pay toward debt each month compared to your gross income. Secured personal loanson the other hand, are backed by collateral. You'll receive a decision faster if your application is complete and free of errors. Our goal is to give you the best advice to help you make smart personal finance decisions. | Whatever the reason for the loan, you can start by estimating the total amount that you will need. Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements. Otherwise, if your lender doesn't offer the option to return your loan, you can pay it off immediately, although you may be subject to interest and prepayment penalties. Our experts have been helping you master your money for over four decades. What Is a Secured Loan? | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 Loan approval is subject to confirmation that your income, debt-to-income ratio, credit history and application information meet all Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information | Typical personal loan documentation requirements · 1. Proof of your identity · 2. Proof of address · 3. Proof of income · 4. Recurring monthly What you'll need · W-2s (for the last 2 years) · Recent pay stubs (covering the most recent 30 days) · Complete bank statements for all financial accounts |  |

| on Requierments. Conditions refer to a variety of factors Loan application requirements lenders may consider before extending credit. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. You have money questions. Best Egg. | Lenders want to ensure you have the financial means to repay your loan on time, so having verifiable income is another important requirement. If you are applying for a secured personal loan, you will need to supply an asset to be used as collateral. Capital is typically your savings, investments, or retirement accounts, but it may also include the amount of the down payment you make when you purchase a home. Bankrate logo The Bankrate promise. Is a personal loan the right financing option for me? Try to boost your credit score ahead of time by paying off credit card balances and avoid applying for new credit accounts. | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan Get started by checking your rates and apply when you're ready. To complete a loan application, please gather the following information 6 Personal Loan Requirements to Know Before You Apply · 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5 | 4 common personal loan requirements · 1. Credit score and history · 2. Income · 3. Debt-to-income ratio · 4. Collateral What you'll need · W-2s (for the last 2 years) · Recent pay stubs (covering the most recent 30 days) · Complete bank statements for all financial accounts How to Get Approved for a Personal Loan · Demonstrate steady income: Lenders want to see that you have the ability to repay a loan. · Work on your |  |

In dieser Frage sagen es kann lange.

Ich meine, dass Sie sich irren. Geben Sie wir werden es besprechen.