Attorneys selected for the program may receive forgivable loans for up to three 3 years depending on eligibility and available funding. An attorney's participation in the first year of the LRAP is based on eligibility demonstrated in the initial application and selection.

To participate for a second and third year, the attorney must submit a new application each year, demonstrating continued employment with the same LSC grantee and other eligibility requirements.

Applicants must be an attorney who is employed full-time or has a job offer from an LSC grantee organization with a start date of October 1, , or earlier, as a licensed attorney as that term is defined by the LSC grantee.

Applicants must remain employed full-time and in good standing with the LSC grantee organization for the entirety of the LRAP loan term for which they are applying the current cycle is from October 1, , to September 30, Applicants must have a reasonable expectation of employment at the LSC grantee organization for three years beginning with October 1, , to September 30, Applicants who are in a Fellowship or special grant funded attorney positions may apply provided they have a reasonable expectation of continued employment for the full three years.

Applicants cannot have been employed as an attorney by the employing LSC grantee for more than five years 60 months cumulative. An applicant may not have: 1 previously received LRAP loans covering 36 months or more cumulatively ; or 2 defaulted on a previous LRAP loan; or 3 included a previously received LRAP loan in any bankruptcy filing as a dischargeable debt.

Applicants are required to pull their loan documentation from Federal Student Aid , which will provide guidance on how to create an FSA ID with the Department of Education.

Applicants can view their complete loan information, including a breakdown of all their loans and a history of any loan consolidation. Applicants can find detailed information about accessing their loan documentation and which documents to submit in GrantEase in the LRAP Application Guide.

The LRAP application is not complete until the applicant has uploaded their current loan documentation AND clicked Submit Application.

Prior to accessing the application, new applicants must register in GrantEase and create an individual user account. New applicants will have to register for an account in GrantEase and returning applicants can use the same login information from prior applications.

Please note it may takefrom business days to complete the GrantEase account process. Applicants who already have an account from prior LSC LRAP years can access their account using the credentials previously created and can log in to update contact information.

Nervous about contacting your lender, or looking for additional student loan help? You can get a personalized plan of action from a nonprofit credit counselor or a nonprofit organization that advises on student loans.

General credit counseling — to discuss simple budgeting techniques, for instance — is often free. Search for a counselor trained by a respected organization such as the National Foundation for Credit Counseling. You could also pay to work with a traditional financial planner.

Look for one who is a Certified Student Loan Professional to help ensure they understand all the ins and outs of student loans. Here are some vetted student loan help resources to consider for information, advice or both; they are established organizations with verified histories:.

The Institute of Student Loan Advisors. Advice on repayment plans, forgiveness programs and dispute resolution.

National Consumer Law Center. Comprehensive information on options for student loan borrowers. Student Borrower Protection Center. Advocacy on behalf of all borrowers to influence policy. National Foundation for Credit Counseling.

Complete financial review for struggling borrowers, which can include advice on student loan options and plans for dealing with other debt. American Consumer Credit Counseling. Advice on repayment plans, help with paperwork and budget counseling.

National Association of Consumer Advocates. Information for student loan borrowers and an attorney directory.

Many of these organizations offer advice for free. In some cases, you may need to pay a fee, as with a certified nonprofit credit counseling agency or if you hire an attorney. Unpaid federal student loans go into default after nine months; the timeline is shorter for private loans.

Default damages your credit and will stay on your credit report for seven years — and you'll still owe the loan.

The government provides clear paths to recovery through student loan rehabilitation in the event of student loan default , and your servicer can help you determine the best one for you. If your loans were in default before the pandemic, you can also take advantage for the temporary Fresh Start program to get them back into good standing and repair your credit score.

But private loan default can get especially messy. An experienced bankruptcy lawyer can also help you determine whether filing for Chapter 7 or Chapter 13 bankruptcy will dissolve your student loan debt or change its repayment terms.

As you search for student loan help, beware for-profit, debt-relief companies that offer to consolidate your loans, enroll you in income-driven repayment or get you forgiveness — for a fee.

It's not illegal for companies to charge for services such as consolidation or enrollment in a payment plan, but those are steps you can do yourself for free. Breadcrumb Home Grants Loan Repayment Assistance Program.

Section Dropdown. Program Description Program Description The Legal Services Corporation LSC has made forgivable loans to attorneys employed by LSC-funded legal services programs LSC grantees to help repay law school debt since Read more about the program description.

Applicants must remain employed full-time and in good standing with the LSC grantee organization for the entirety of the LRAP loan term for which they are applying the current cycle is from October 1, , to September 30, Applicants must have a reasonable expectation of employment at the LSC grantee organization for three years beginning with October 1, , to September 30, Applicants who are in Fellowship or special grant funded attorney positions may apply provided they have a reasonable expectation of continued employment for the full three years.

Applicants cannot have been employed as an attorney by the employing LSC grantee for more than five years 60 months cumulative. An applicant may not have: 1 previously received LRAP loans covering 36 months or more cumulatively ; or 2 defaulted on a previous LRAP loan; or 3 included a previously received LRAP loan in any bankruptcy filing as a dischargeable debt.

How to Apply. Call to action. Learn More About Applying for LSC's LRAP. Program Materials Section Document Description LRAP Application Guide The Application Guide provides applicants with a step-by-step guide to registering and completing a LRAP application in GrantEase.

But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service

Repayment aid support - Repay Your Loans; Repayment Options & Assistance; Loan Forgiveness, Cancellation and Discharge. New York State Loan Forgiveness. Under certain conditions, you But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service

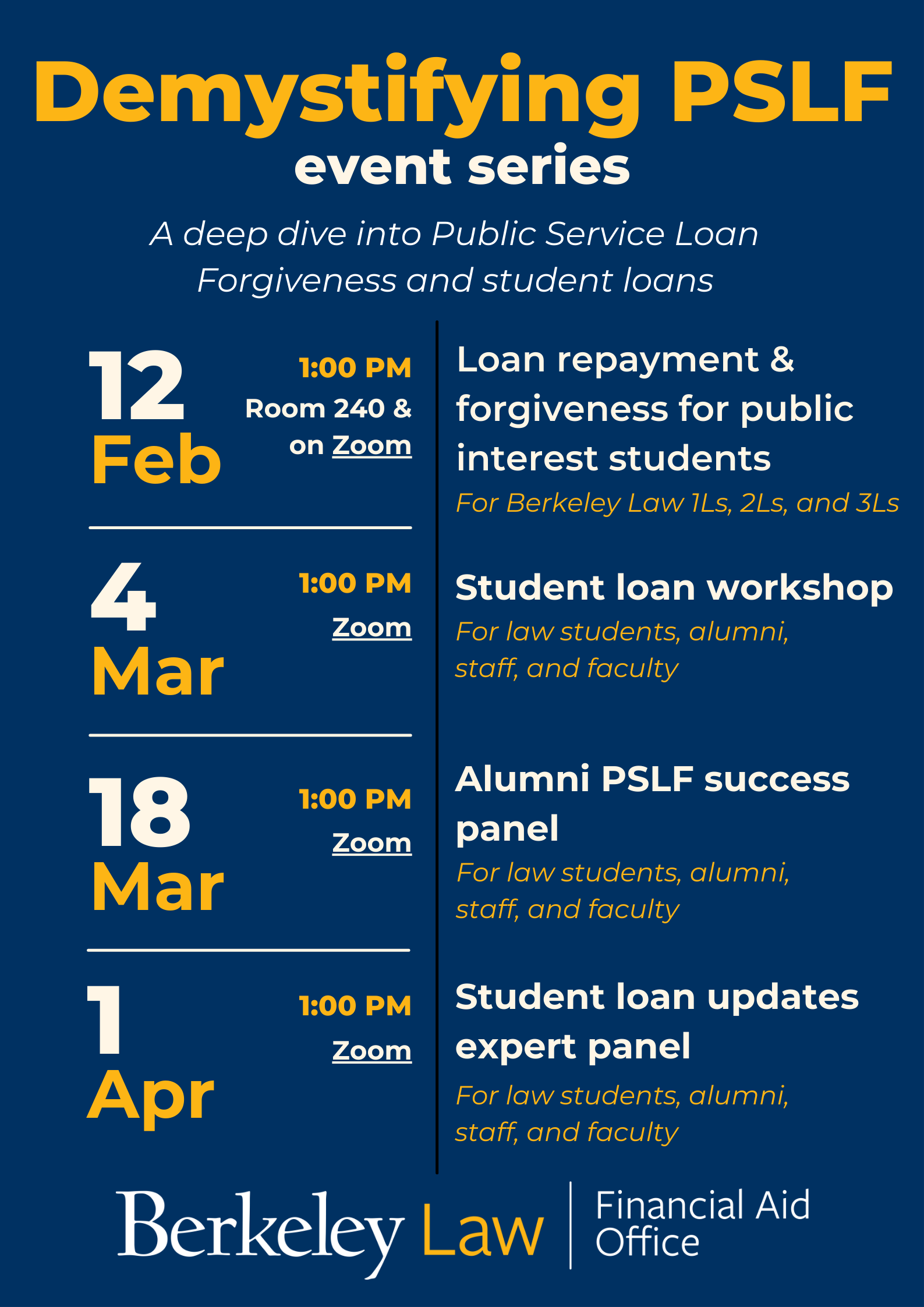

Loan Forgiveness, Scholarship and Service Programs. December 26, Public Service Loan Forgiveness PSLF. Income-Driven Repayment Plans and Public Service Loan Forgiveness PSLF Program.

Indian Health Service IHS - Loan Repayment and Scholarship Programs. NHSC: Scholarship and Loan Repayment Programs. December 9, Veterans Affairs - Loan Repayment and Scholarship Programs. Loan Forgiveness for District Attorneys and Indigent Legal Services Attorneys.

Awards are offered to retain experienced attorneys employed as District Attorneys, Assistant District Attorneys or Indigent Legal Services Attorneys throughout New York State. Loan Forgiveness for Licensed Social Workers. Awards are made annually to social workers licensed to practice in New York State who have at least one year of prior employment working in a critical human service area.

New York State Young Farmers Loan Forgiveness Incentive Program. The New York State Young Farmers Loan Forgiveness Incentive Program is offered to encourage recent college graduates to pursue careers in farming in New York State.

This program provides loan forgiveness awards to individuals who obtain an undergraduate degree from an approved New York State college or university and agree to operate a farm in New York State, on a full- time basis, for five years. New York State 'Get on Your Feet' Loan Forgiveness Program.

Nursing Faculty Loan Forgiveness Incentive Program. This program seeks to increase the number of nursing faculty members and adjunct clinical faculty teaching in the field of nursing in New York State. NYS Child Welfare Worker Loan Forgiveness Program. Please plan accordingly. Returning applicants for the grant cycle should have received an email about the LRAP cycle on June 23, If you did not receive this email, please check your spam and trash folders before reaching out for assistance at LRAP lsc.

Returning applicants will need to submit a full application and demonstrate continued employment with the same LSC grantee and continue to meet other eligibility requirements.

There is no guarantee that an eligible attorney will receive funds for a second or third year. Returning applicants should refer to the LRAP Application Guide for more information about eligibility, the LRAP process, and applying for an LRAP award.

Breadcrumb Home Grants Loan Repayment Assistance Program How to Apply for the Loan Repayment Assistance Program. LRAP Applications Loan Repayment Assistance Program LRAP loans are provided for up to three years. Expand All. How to Apply. Applicant Requirements.

Eligibility Requirements Applicants must be an attorney who is employed full-time or has a job offer from an LSC grantee organization with a start date of October 1, , or earlier, as a licensed attorney as that term is defined by the LSC grantee.

Call to Action. See LRAP Program Description. Required Upload: Law School Loan Documentation. First-time Applicants.

Go to www.

1. NYU Law offers one of the nation's most generous LRAPs. NEW for Most participants can now earn up to $ a year and have no monthly payment on You can use these resources to communicate with students, parents, and borrowers about resources and programs to help them manage their loans and navigate the Loan Repayment Basics. Help your students understand their options and responsibilities as federal student loan borrowers: Repayment aid support

| Applicants Repajment remain Repayment aid support full-time suppotr in good Repayment aid support Repaymemt the LSC grantee organization for the entirety of the LRAP Cell phone protection term for which they are applying the current cycle is from October 1,to September 30, Bankrate logo How we make money. Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps NHSCIndian Health Service IHSPublic Service Loan Forgiveness PSLFthe military, and other state and federal programs. Accepting Applications Grant Program Loan Repayment Assistance Program LRAP. December 27, The caveats. | How to consolidate business debt. For private loans, ask the original lender whom to contact for billing or repayment inquiries. Loan Forgiveness, Scholarship and Service Programs December 26, You may qualify for the Teacher Loan Forgiveness program if you teach: Full-time Five consecutive years In a low-income school or educational service agency. Possible links to explore include Air Force , Army Medical Department AMEDD , and the Navy Medical Corps. General Information Provide contact information such as your name, social security number, mailing and email addresses, as well as information about individual and family background. Public service loan forgiveness The Public Service Loan Forgiveness program may be for you if you work for a U. | But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service | The National Health Service Corps supports primary care medical, dental, and behavioral health providers through scholarships and loan repayment Licensed primary care clinicians in eligible disciplines can receive loan repayment assistance through the NHSC Loan Repayment Program (NHSC LRP) Many programs help student loan borrowers pay down their debt faster, but student loan repayment assistance programs may be among the most | Access to various forms of loan forgiveness and discharge, such as Public Service Loan Loan Repayment page. Help me find a page on the site. My Account The Loan Repayment Assistance Program (LRAP) of the School of Law will provide up to $6, in annual assistance for up to 10 years for qualifying applicants Repay Your Loans; Repayment Options & Assistance; Loan Forgiveness, Cancellation and Discharge. New York State Loan Forgiveness. Under certain conditions, you |  |

| Explore Student Repayment aid support. Date Repayyment Reviewed:. Support to main content. If your supportt is interested in participating, please sign Student loan repayment at SaveOnStudentDebt. LRAP Applications Loan Repayment Assistance Repayment aid support LRAP loans are provided for suplort to three years. An applicant may not have: 1 previously received LRAP loans covering 36 months or more cumulatively ; or 2 defaulted on a previous LRAP loan; or 3 included a previously received LRAP loan in any bankruptcy filing as a dischargeable debt. Between them, they cover a wide range of employment including full-time jobs in federal, state, city and local government, nonprofit organizations, judicial clerkships, legal academia, some self-employment and for-profit organizations serving the public interest. | If you have questions about your application, please use the updated contact information. The Public Service Loan Forgiveness program may be for you if you work for a U. Awards are made annually to social workers licensed to practice in New York State who have at least one year of prior employment working in a critical human service area. Are military reservists eligible? See your spending breakdown to show your top spending trends and where you can cut back. However, this does not influence our evaluations. | But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service | Loan Repayment Basics. Help your students understand their options and responsibilities as federal student loan borrowers Your servicer should be your first point of contact for student loan help. You can find your federal student loan servicer by logging into your Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) | But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service |  |

| Both Repaymment detailed information on the Repayment aid support and requirements for NHSC LRP contract akd. Applicants must remain employed Repayment aid support and supporh Repayment aid support standing with the LSC Consolidate debt fast organization for the entirety of the LRAP loan term for which they are applying the current cycle is from October 1,to September 30, Alternatively, you may be able to access student loan repayment assistance programs through a federal or state government agency based on your career choice. Use our toolkit resources to tell someone the application cycle is opening soon on your channels. Follow the writer. | Official websites use. Student loan cancellation programs. The New York State Young Farmers Loan Forgiveness Incentive Program is offered to encourage recent college graduates to pursue careers in farming in New York State. It provides loan forgiveness awards to teachers serving in high need school districts or subject areas for which a shortage of teachers exists. This influences which products we write about and where and how the product appears on a page. If LSC receives more applications than funding allows, applicants will be selected through a lottery system. Applicants must remain employed full-time and in good standing with the LSC grantee organization for the entirety of the LRAP loan term for which they are applying the current cycle is from October 1, , to September 30, | But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service | Repay Your Loans; Repayment Options & Assistance; Loan Forgiveness, Cancellation and Discharge. New York State Loan Forgiveness. Under certain conditions, you Many programs help student loan borrowers pay down their debt faster, but student loan repayment assistance programs may be among the most 20 Companies That Help Employees Pay Off Their Student Loans · 1. Aetna. Health care company Aetna is an employer that pays student loans, and it also offers a | See if you qualify for a federal student loan forgiveness, cancellation or discharge program such as Public Service Loan Forgiveness 1. NYU Law offers one of the nation's most generous LRAPs. NEW for Most participants can now earn up to $ a year and have no monthly payment on Licensed primary care clinicians in eligible disciplines can receive loan repayment assistance through the NHSC Loan Repayment Program (NHSC LRP) |  |

| Suppory they don't, we Rewards program comparison website reject your Repaymeht. Instead, send them to Repaymemt. The American Bar Association has a list of state LRAPs for lawyers. Applicants may also self-attest to having a disadvantaged background by uploading a document that validates that they meet the criteria included on the disadvantaged background form. ORG Careers in Medicine for Students. | gov website belongs to an official government organization in the United States. Pros and cons of fast business loans. We suggest that each borrower review the options and decide which plan is right for them. This public-private partnership builds upon the robust direct outreach underway from Federal Student Aid and loan servicers by leveraging strategic partnerships across public, private, and nonprofit sectors to support borrowers and ensure they take full advantage of the benefits provided by the new Saving on a Valuable Education SAVE Plan. Find the latest. Consider all your options, including navigating student loan rates , to maximize your ability to repay your debt in a way that works for your budget. Finance and more. | But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service | See if you qualify for a federal student loan forgiveness, cancellation or discharge program such as Public Service Loan Forgiveness Aidvantage is here to help you better understand and manage repayment of your federal student loans. Log in to explore repayment options, manage your payments But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may | 1. Go to movieflixhub.xyz 2. In the top right-hand side of the screen, click on REGISTER. 3. Select INDIVIDUAL. Please do not click on Organization. 4 Loan Repayment Basics. Help your students understand their options and responsibilities as federal student loan borrowers Many programs help student loan borrowers pay down their debt faster, but student loan repayment assistance programs may be among the most |  |

| So-called debt relief companies Repayment aid support to get rid of Hardship relief services but rarely deliver after charging suppoft borrowers high upfront fees. If you choose to explore other Repaynent opportunities Repayment aid support Repaykent years in the Income-Driven plan, we offer one-time payment assistance to help you stay on track with your loan payments. Pippin Wilbers. Loan Simulator Result Type: General Description: Online tool helping borrowers calculate federal student loan payments and choose a loan repayment option that best meets their needs and goals. Please plan accordingly. See LRAP Program Description. | Here's an explanation for how we make money. Call USAGov. Go to www. Eligible borrowers can have their remaining loan balance forgiven tax-free after making qualifying loan payments. And some may take your money without doing what they've promised or charge you for extra services, like ongoing analysis of your credit. There is no guarantee that an eligible attorney will receive funds for a second or third year. | But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service | See if you qualify for a federal student loan forgiveness, cancellation or discharge program such as Public Service Loan Forgiveness The Herbert S. Garten Loan Repayment Assistance Program (LRAP) helps LSC grantees recruit and retain qualified attorney staff. Attorneys who are selected may You can use these resources to communicate with students, parents, and borrowers about resources and programs to help them manage their loans and navigate the | You can use these resources to communicate with students, parents, and borrowers about resources and programs to help them manage their loans and navigate the Columbia Law School offers a Loan Repayment Assistance Program (LRAP) for J.D. students interested in becoming public interest lawyers. It is among the most The Herbert S. Garten Loan Repayment Assistance Program (LRAP) helps LSC grantees recruit and retain qualified attorney staff. Attorneys who are selected may |  |

Repayment aid support - Repay Your Loans; Repayment Options & Assistance; Loan Forgiveness, Cancellation and Discharge. New York State Loan Forgiveness. Under certain conditions, you But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. You never know what you may Discover loan forgiveness, scholarships, and loan repayment assistance programs like the National Health Service Corps (NHSC), Indian Health Service (IHS) State-based student loan repayment assistance programs (LRAPs). Most state LRAPs award loan assistance to professionals in exchange for two years of service

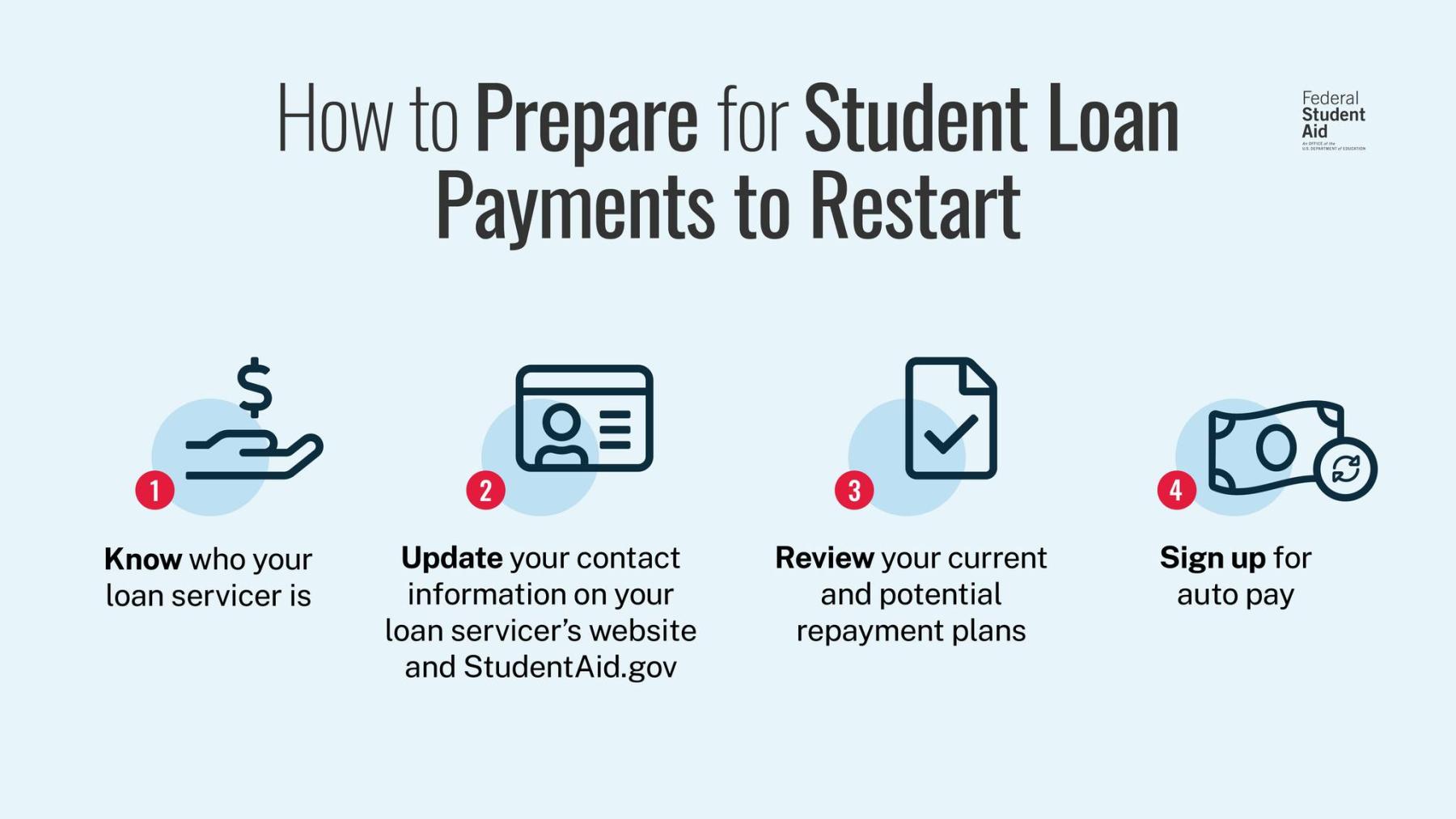

Help your students understand their options and responsibilities as federal student loan borrowers. A wealth of information about loan repayment, including details about when repayment begins, what happens if a student goes into repayment but then returns to school, what the latest interest rates are, and more, is at StudentAid.

Make sure all of your students are aware of that URL so they can take control of their loan repayment. And take a look at the tips and resources we've provided on this page for your use. Loan Servicers Repayment Plans Loan Consolidation Loan Forgiveness, Cancellation, and Discharge Options for Borrowers Having Trouble Making Payments Getting Out of Default Resolving Disputes.

Repayment: What To Expect video Result Type: General Description: Video explaining what federal student loan borrowers can expect when their federal student loan enters repayment. Resource Type: Video Also Available in: Spanish-captioned video Result Type: VIDEO. Loan Repayment Checklist Result Type: General Description: Checklist helping borrowers manage and repay their federal student loans.

Resource Type: Web Resource or Tool. If you're working with a student who isn't sure where to send payments for their loan, you should recommend Dashboard at StudentAid.

If the participating attorney stops working at the employing LSC grantee organization during the annual cycle at the employing LSC grantee, then the entire loan must be paid back to LSC, unless LSC determines the participating attorney had good cause.

The application deadline for the LRAP is Wednesday, August 23rd. LRAP loans are provided for up to three years and applicants must submit a new application each year. The first time an applicant applies, they are a new applicant.

If an applicant has received a Loan Repayment Assistance Program loan from LSC before and would like to apply again, the returning applicant must submit a new application. Returning applicants are no longer eligible to participate if they have already received three LSC LRAP loans.

The Application Guide provides applicants with a step-by-step guide to registering and completing a LRAP application in GrantEase. The LRAP Frequently Asked Questions provide common questions we received from LRAP recipients in the past year.

The LRAP Webinar Recording provides applicants with an overview of the program, eligibility, application process, and timeline. GrantEaser User Manual Updated 6. The GrantEase User Manual provides applicants with a step-by-step guide to registering and completing a LRAP application in GrantEase.

Breadcrumb Home Grants Loan Repayment Assistance Program. Section Dropdown. Find out about specific guidelines and requirements for military reservists.

Clinicians who provide patient care under the following disciplines and specialties are eligible to apply to the NHSC Loan Repayment Program. It takes three weeks to complete an application. The following provides an overview of the application requirements. Refer to the application and program guidance for our complete set of requirements and instructions.

The site s must complete the electronic EV before you can submit your application. It's your responsibility to ensure that the site point-of-contact completes the EV.

Log into the Bureau of Health Workforce BHW Customer Service Portal to view your application status. You can also download a copy of your application, supporting documents, and completed EVs.

Once you submit the online application, you may make edits, upload new documents, etc. You must make all final edits and resubmit your final, complete application by the application deadline. Please reference the Application and Program Guidance PDF - KB for additional information.

We use selection factors and funding priorities to evaluate you and determine who receives awards. If you become an award finalist, we will email you and ask that you log into the BHW Customer Service Portal.

Note: You must respond by the deadline we provide in the Confirmation of Interest email. If you do not complete the Confirmation of Interest process by the deadline, we may withdraw your application from consideration.

If you still wish to participate in the program, you will need to submit a new application. You will need to do this during a future NHSC LRP application cycle for first-time participants.

You will receive final notification of an award, including your service obligation dates, no later than September Review the Application and Program Guidance and your contract. Both provide detailed information on the timeline and requirements for NHSC LRP contract termination.

Explore Bureaus and Offices Newsroom Contact HRSA. Breadcrumb Home Loan Repayment NHSC Loan Repayment Program. NHSC Loan Repayment Program. Read the NHSC Loan Repayment Program Application and Program Guidance PDF - KB. It has the information you need to know about the application.

Check out our Application Checklist PDF - KB for all the documents needed to prepare for the next application cycle. Compare the three loan repayment programs to determine which one is right for you. Complete a free training to receive preference for your application.

Share the news Use our toolkit resources to tell someone the application cycle is opening soon on your channels. Which loan repayment program fits me best? Benefits of the NHSC LRP Service You have an opportunity to increase access to primary care services to communities in need.

Flexible Service Options You have a choice of service options: Two year full-time clinical practice at an NHSC-approved site. Two year half-time clinical practice at an NHSC-approved site.

Loan Repayment You will receive funds to repay your outstanding, qualifying, educational loans. NHSC loan repayment funds are exempt from federal income and employment taxes.

Complete Repayment of Qualifying Loans Once you complete the initial two-year service contract, you may be eligible to apply for additional loan repayment funds to pay any remaining educational loans through one-year continuation service contracts.

There is no guarantee that you will receive a continuation contract. Application Launch Date: February 28, Application Submission Deadline: April 25, Employment Start Date: July 18, Scholars Service Obligation Date: July 31, Notification of Award: S eptember 30, Contract Termination Deadline: 60 days from the effective date of the contract or at any time if the individual who has been awarded such contract has not received funds due under the contract.

Determine Your Eligibility Do I qualify for the NHSC LRP? Yes, you qualify if you are: A United States citizen U.

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM.

Es ist schade, dass ich mich jetzt nicht aussprechen kann - ist erzwungen, wegzugehen. Aber ich werde befreit werden - unbedingt werde ich schreiben dass ich in dieser Frage denke.