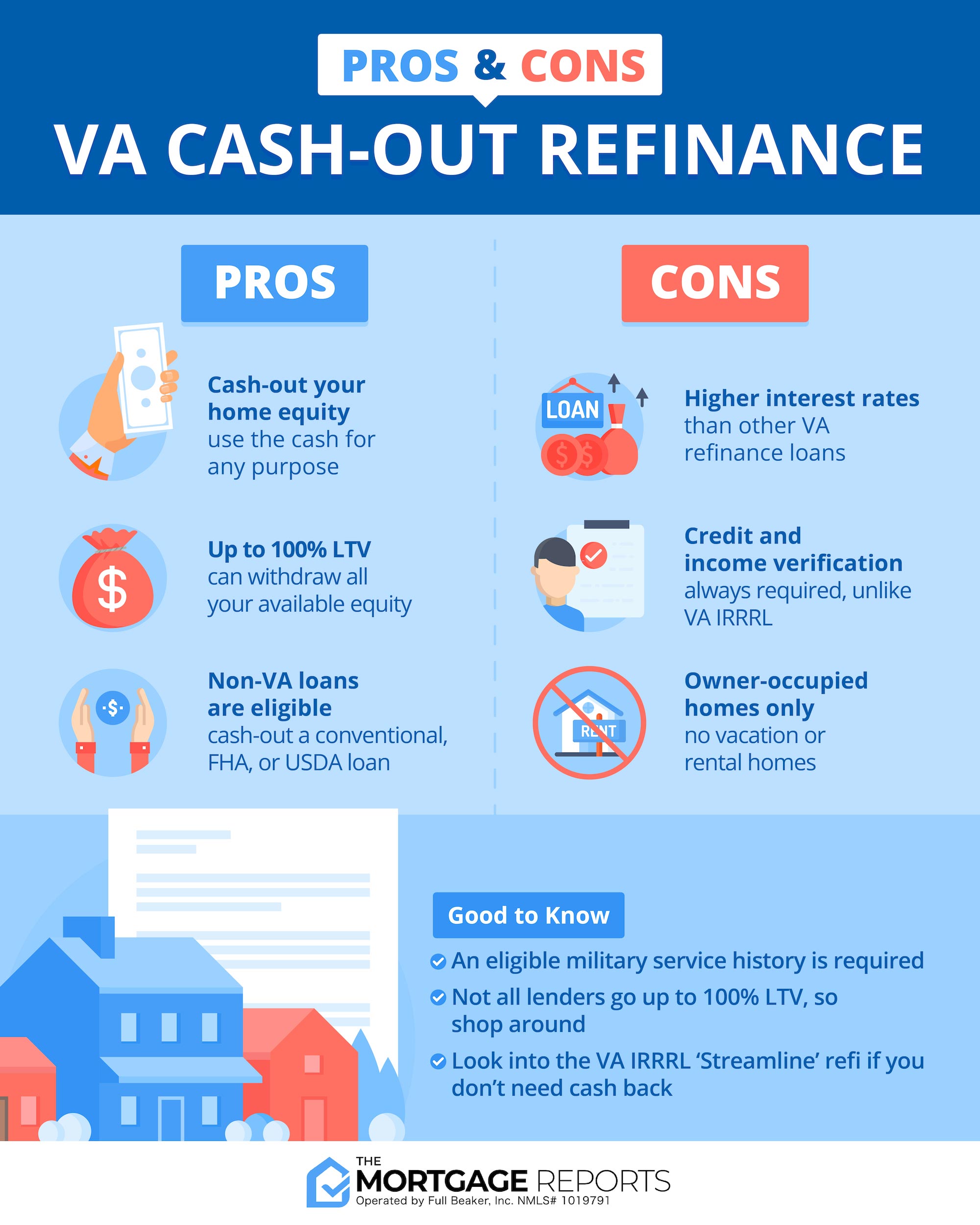

However, lenders generally see cash-out loans as a little riskier than an ordinary home loan or refinance. So rates tend to be a little higher for these types of loans. And eligibility requirements may be a bit stricter.

Nobody expects miracles. And you can only do so much in the months leading up to your mortgage application. But even small improvements to your financial situation — like paying off credit card debt — could improve your cash-out refinance options.

And everyone can comparison shop for lenders. Many borrowers simply add them to the balance on their new mortgage. But you should be aware of the downside. Homeowners who want to cash out their home equity have multiple cash-out options. While most home loans can be refinanced, not all can be cashed out.

Plus, if your current home is financed with an FHA loan, then you can get rid of unwanted mortgage insurance premiums MIP. The FHA Streamline Refinance is a no-cash-out loan. Eligibility requirements and borrowing costs will vary by lender, but you should generally expect to meet these guidelines:.

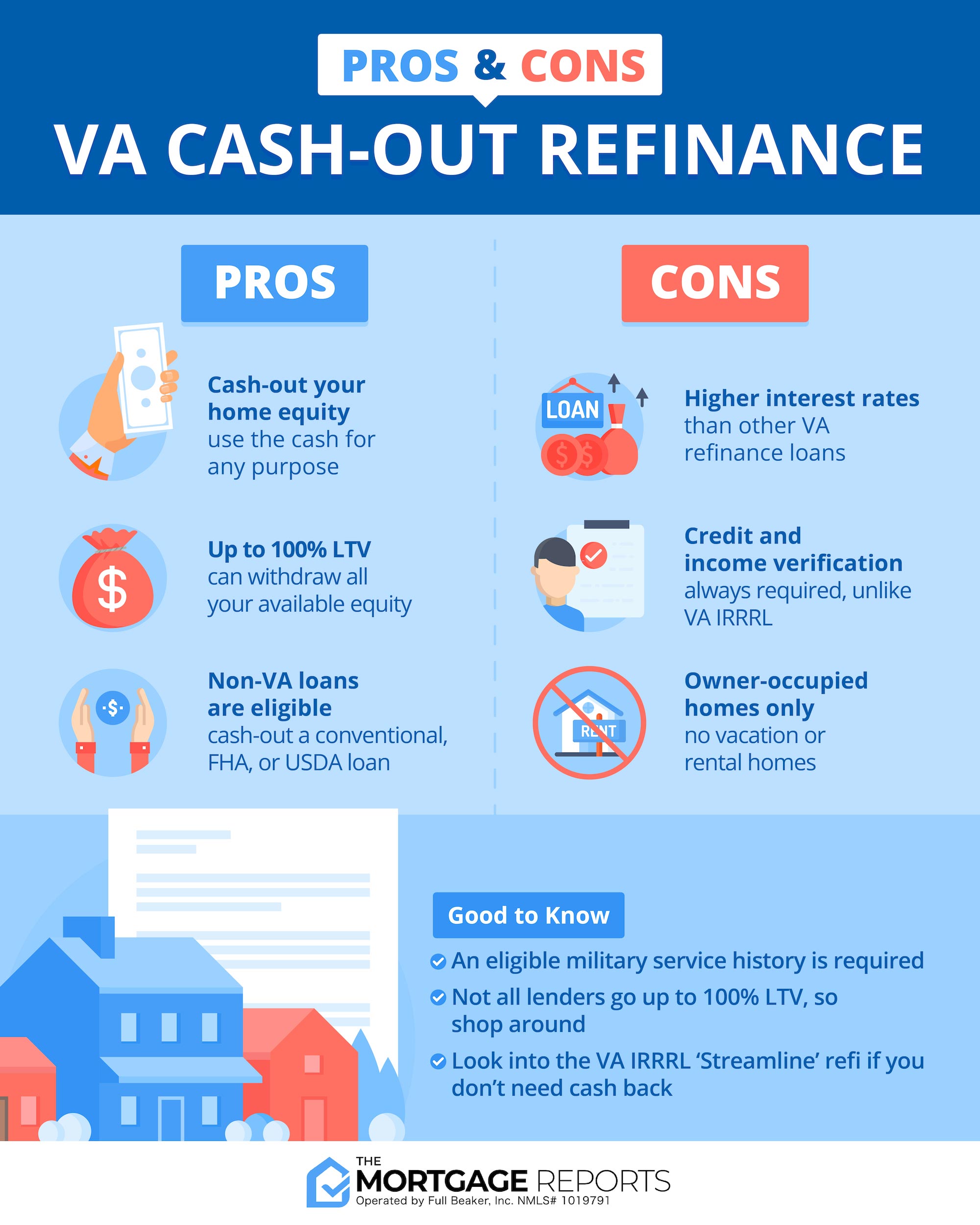

The Department of Veterans Affairs offers two types of mortgage refinancing products: a Streamline Refinance and a cash-out refinance.

The VA cash-out refinance is an appealing type of loan because of its high loan-to-value maximum, lack of monthly mortgage insurance, and lenient FICO score guidelines compared to other cash-out loan programs.

Cash-out refinancing has gained popularity among homeowners as a potential tool for achieving their financial goals. By replacing an existing mortgage with a new one, cash-out refinancing can be a valuable source of funding. However, it also carries risks that homeowners need to consider.

Before you opt for cash-out refinancing, use a refinance calculator to determine how it will impact your financial situation. Understanding the possible consequences of this decision is key to making an informed choice.

If after analyzing your situation with a refinance calculator and considering potential PMI costs, you find that cash-out refinancing may not be the best option for your financial goals, there are several alternatives available.

Each of these options carries its own risks and benefits. Yes, normally. Expect your rate to be about 0. This is because lenders know that cash-out refinance loans are riskier than no-cash-out loans. That means they have higher interest rates across the board.

On our list, Navy Federal Credit Union had the best cash-out refinance rates in , which was the most recent data available when this was written in June So shop around between several lenders.

Generally, the maximum cash back amount is limited to a certain percentage of the appraised value of your home or the loan amount. You should also have a clean credit history and credit report. You may be able to get a cash-out refinance with a score in the range — or even for an FHA loan.

And they vary a lot, often between 2 and 5 percent of the new loan amount. Your monthly mortgage payments will likely increase after a cash-out refinance. There are no rules about how you can use the funds from a cash-out refinance.

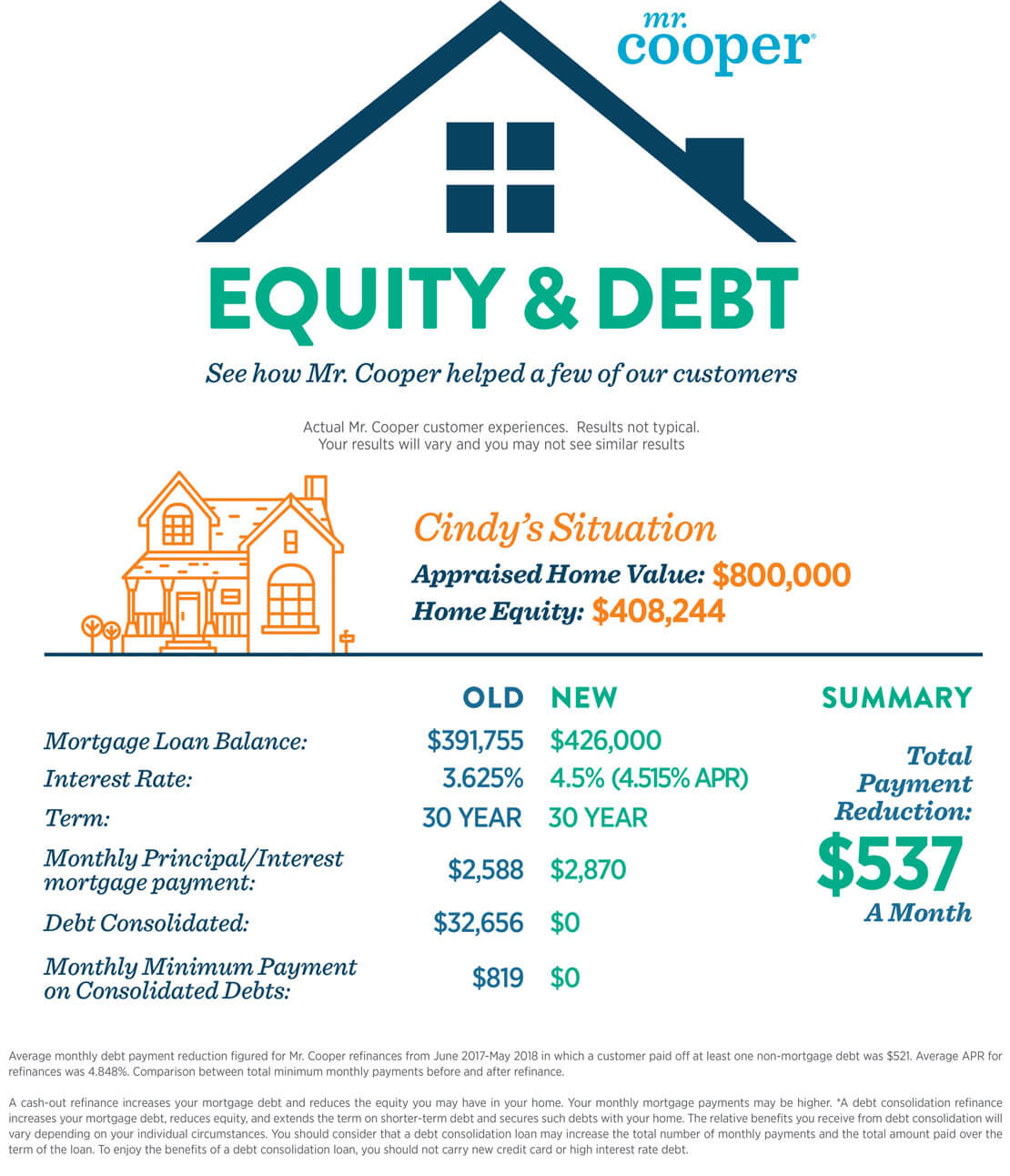

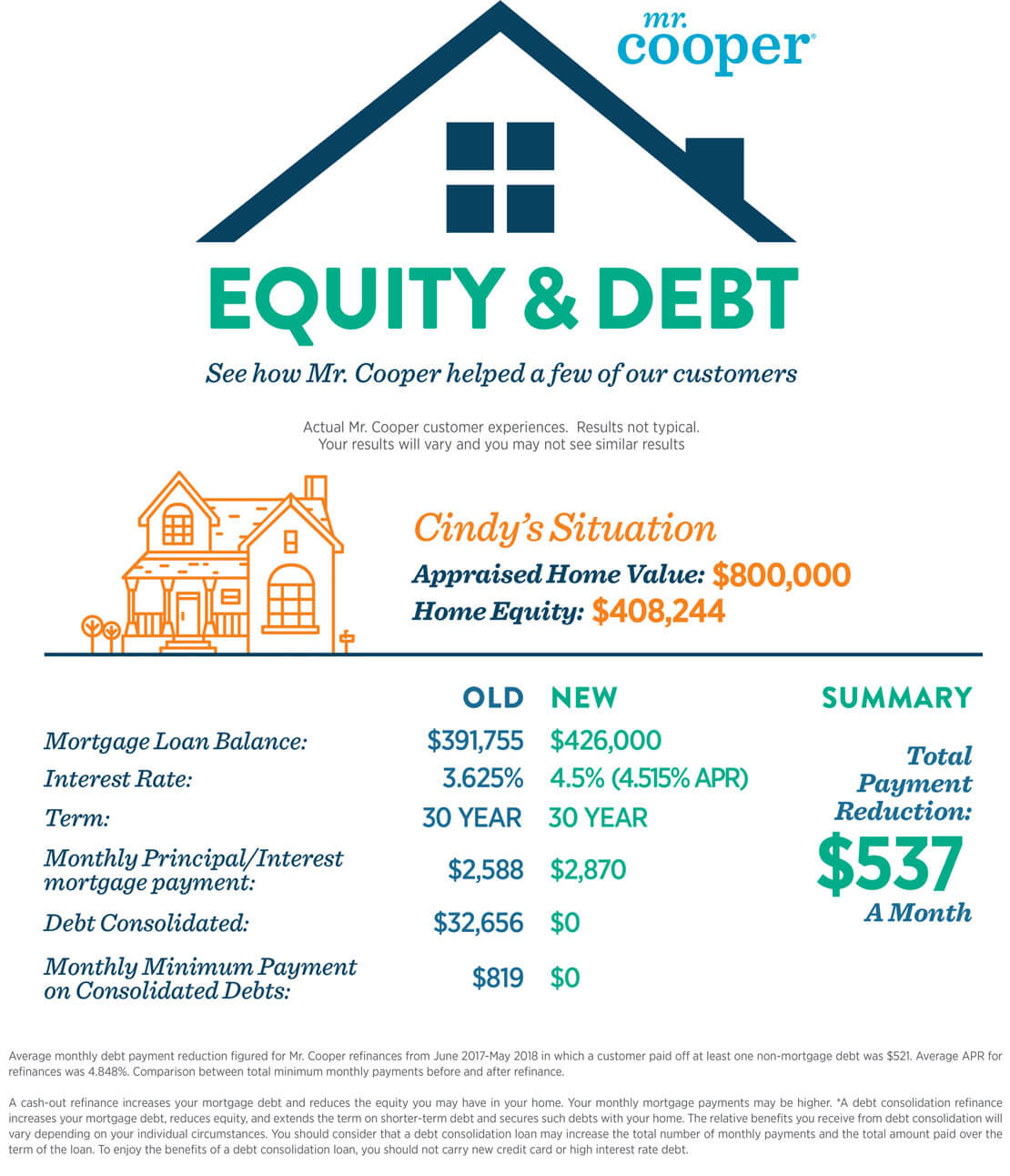

Popular uses for cash-out refinancing include paying for home improvements or renovations, debt consolidation, paying off high-interest debt like credit cards, student loans, or personal loans, and investing in a business, real estate, or college tuition.

However, the FHA insists you retain 80 percent of your equity. Typically, only those with credit scores in the range need an FHA cash-out refinance.

Because many lenders allow you to refinance up to percent of your property value with a VA loan, which means you can take all your available equity as cash back. From the first quarter of to the first quarter of , cash-out refinances tended to have smaller loan amounts, lower borrower incomes, and lower borrower credit scores compared to non-cash-out refinances, but other loan characteristics, such as loan-to-value and debt-to-income ratios, were similar.

We then showed that two-year delinquency rates were similar between both types of refinances, with only a noticeable increase for lower credit-score borrowers taking out cash-out refinances in Prior research has focused on cash-out refinances as one of the mechanisms that exacerbated the financial crisis.

However, mortgage originations from to are fundamentally different from mortgage underwriting before the financial crisis. As we have shown above, most cash-out refinances now have loan-to-value ratios below 80 percent, requiring a 20 percent or more drop in house prices to be underwater.

Although cash-out refinances gained popularity from to due to record-low interest rates , the amount of equity extracted was lower than during the pre boom, despite home prices having increased substantially.

These characteristics of cash-out refinances over the past decade suggest that cash-out refinances are now a smaller source of systemic risk than before the financial crisis. Beyond the potential systemic risk of equity extraction contributing to a new financial crisis, cash-out refinances present at least two other concerns for borrowers.

First, research from the JPMorgan Chase Institute showed that a typical cash-out refinance in their data had a longer loan term and larger monthly payment compared to the paid-off mortgage. This suggests that cash-out borrowers are more likely to still be paying off their mortgage and less likely to own their home free and clear in retirement, potentially exposing these borrowers to more future financial shocks while the mortgage is outstanding.

Second, a cash-out refinance with a higher interest rate than the prior paid-off mortgage could effectively lead to much higher borrowing costs, relative to the original mortgage or to other sources of credit, like home equity loans or home equity lines of credit, that do not raise the interest rate on the existing first-lien loan balance.

Join the conversation. Follow CFPB on Twitter and Facebook. Skip to main content. We find that: Cash-out refinances were a larger share of all refinances during periods of rising interest rates.

Borrowers of cash-out refinances had lower credit scores, lower incomes, and smaller loan amounts compared to non-cash-out refinance borrowers. Loan-to-value and debt-to-income ratios were similar for cash-out and non-cash-out refinances.

Cash-out refinances had larger shares of older, female, Black, and Hispanic borrowers, compared to non-cash-out refinances. Serious delinquencies were rare for borrowers with higher credit scores, regardless of whether the refinance was cash-out or not.

For borrowers with lower credit scores, both cash-out and non-cash-out refinance borrowers have similar two-year delinquency rates, except for a relative increase in delinquencies among cash-out refinance borrowers in —a year marked by rising interest rates.

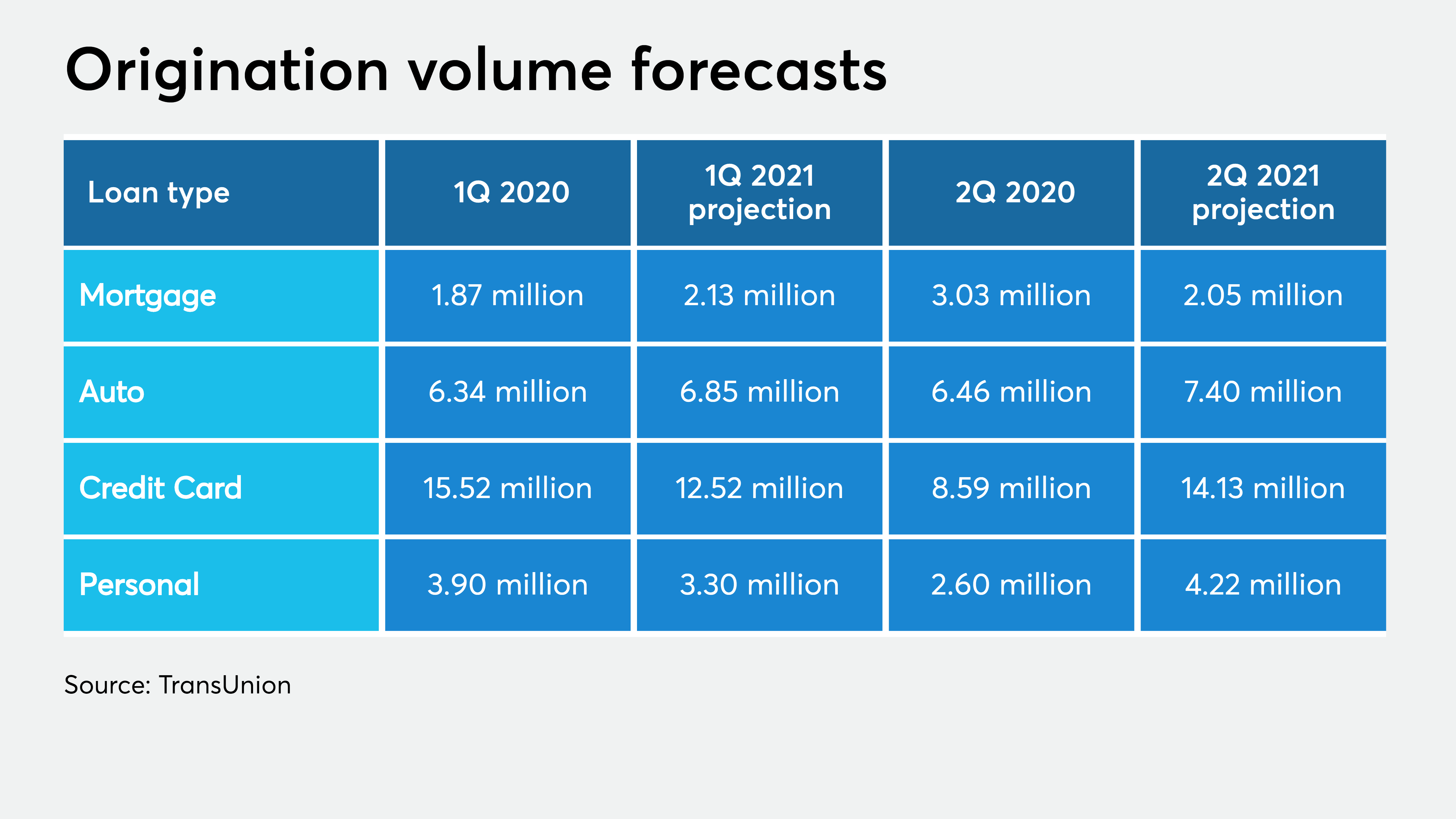

Loan and borrower characteristics of refinances We used refinance data in the National Mortgage Database to compare the loan characteristics and two-year delinquency status of cash-out refinances and non-cash-out refinances.

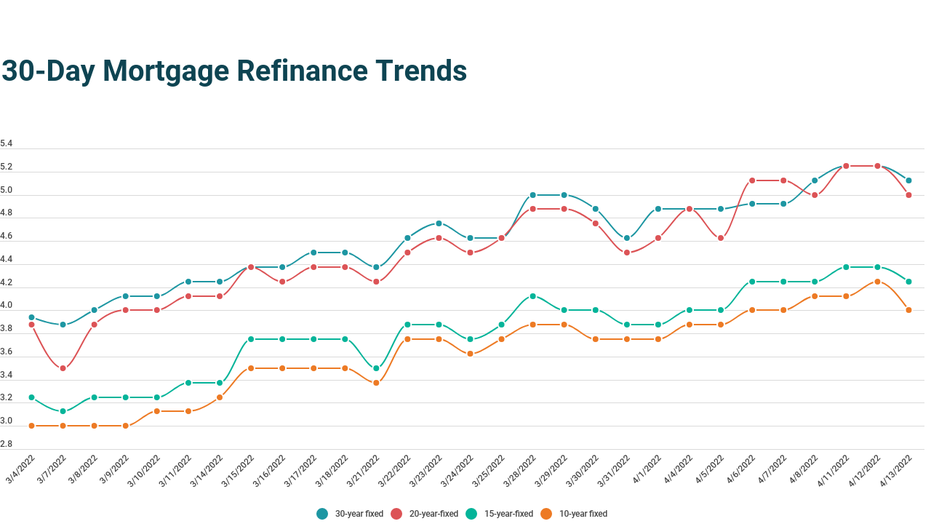

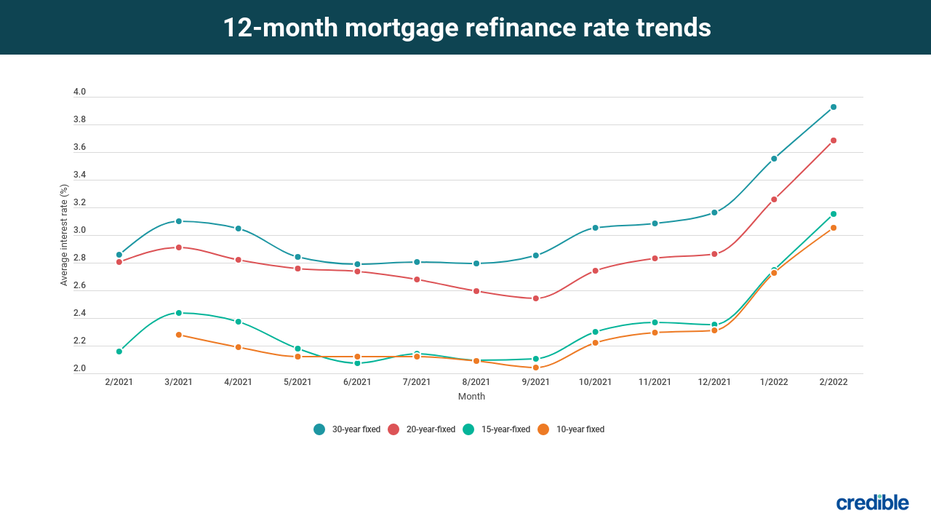

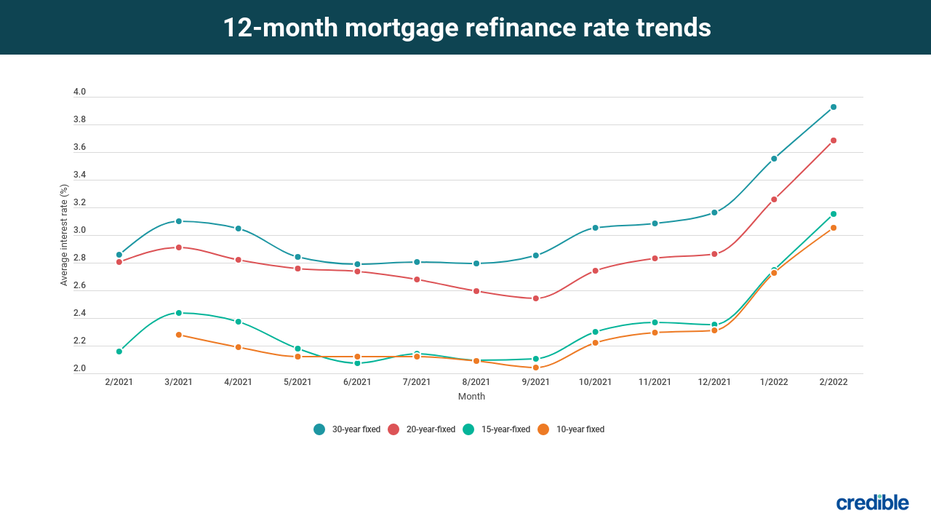

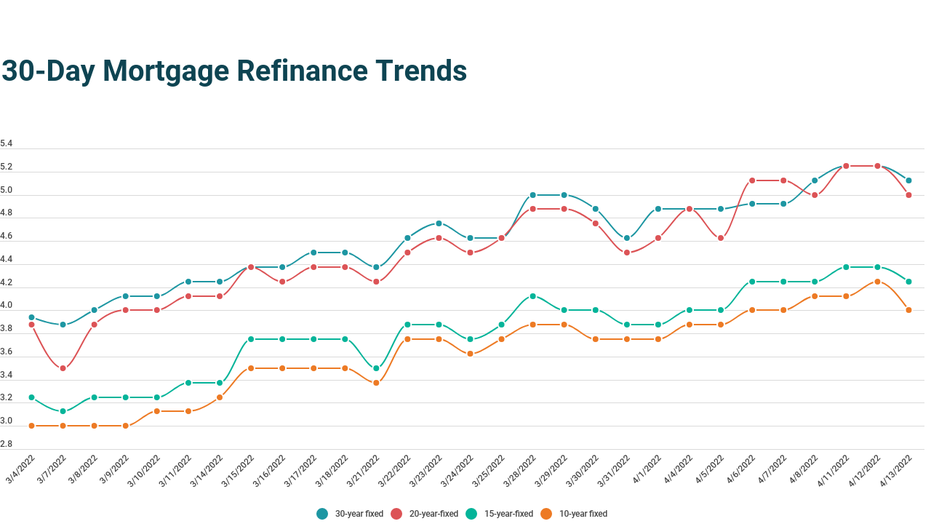

Figure 1: Quarterly volume of cash-out versus non-cash-out refinances, Figure 2: Median credit score at origination of cash-out versus non-cash-out refinances, Figure 3: Median combined loan-to-value ratio at origination of cash-out versus non-cash-out refinances, Table 1: Loan and borrower characteristics by cash-out versus non-cash-out refinances.

Discussion and potential concerns with cash-out refinances In summary, during periods of rising interest rates, refinance volume declines and their composition shifts toward cash-out refinances, since homeowners may need cash from their home even when interest rates increase.

Data source: ©Zillow, Inc. Use is subject to the Terms of Use. NerdWallet's ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service.

Minimum credit score on top loans; other loan types or factors may selectively influence minimum credit score standards.

NerdWallet's home loan ratings are determined by our editorial team. It takes into account key factors that we know are important to cash-out mortgage refinancing consumers. From there, you can start the process of getting approved for your cash-out refinance.

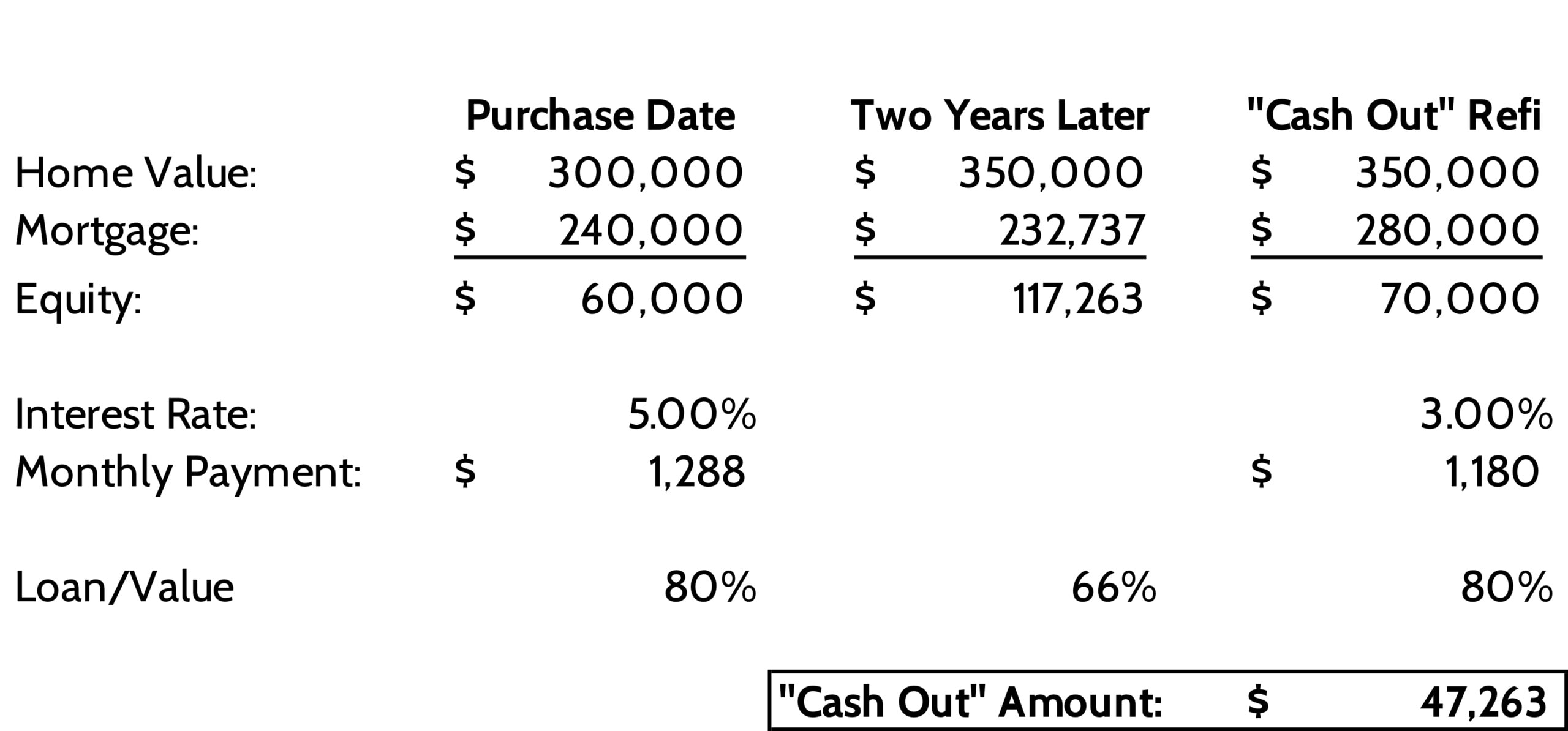

A cash-out refinance is a new larger loan replacing your current mortgage. Your home equity is the difference between the current market value of your house and your mortgage balance.

Each lender will have its own set of criteria, but here are some general expectations:. Credit score of at least The best rates are reserved for those with the highest credit scores.

You need to have built up equity in order to pull it out. Potentially lower rate. Access to cash. If refinancing makes sense for you, a cash-out refinance allows you to access equity and convert it into cash.

Some borrowers may prefer to only worry about one mortgage payment, rather than managing both a primary mortgage and a home equity loan or home equity line of credit. Closing costs. New terms. This could add years to your loan resulting in extra interest payments or mean higher monthly payments.

Foreclosure risk. A cash-out refinance might make sense if you can get a good rate and have a financially sound strategy for using the cash. A home equity loan or home equity line of credit HELOC is a second mortgage that lets you borrow against your home equity.

A cash-out refinance typically has a lower interest rate than a home equity loan or HELOC , and refinancing may provide a lower rate than your current mortgage. However, you may end up paying more in fees for a cash-out refinance than you would a home equity loan or HELOC.

Cash-out refinance: How it works and what to know. Cash-out refinance calculator. Best cash-out refinance lenders. Getting a home equity loan: What it is and how it works.

Home equity loan or HELOC vs. cash-out refi. What is a home equity line of credit, or HELOC? About the author: Holden is NerdWallet's authority on mortgages and real estate. He has reported on mortgages since , winning multiple awards. Compare today's cash-out refinance rates.

Every time. Today's average year fixed rate Today's average year fixed rate Today's average 5-year ARM rate. Today's avg. fixed rate Today's avg.

Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a

Just like with your first mortgage, you'll have to pay closing costs and fees on a cash-out refinance. These can total 2%-6% of the loan amount For a cash-out refinance, they're similar to those you pay for any mortgage: typically between 2% and 5% of the loan amount. Check your cash-out For example, from to , cash-out refinances averaged about , originations per quarter, followed by an increase to almost ,: Cash-out refinance rates

| Tefinance American Funding. Toggle Loan application fees Navigation. Loan application fees Is a cash-out refinance refonance good refinanve Your Auto loan refinancing pre-requisites sets their own requirements when it comes to deciding who qualifies for a refinance. Bank personal checking or savings account is required but neither are required for loan approval. How to get the best refi rate Getting the lowest refinance rate available is similar to getting the lowest rate possible on a new purchase loan: It starts with your personal finances. | Like other types of refinances, you can redefine the terms of your mortgage, such as the interest rate and term. Key terms Cash-out refinance A cash-out refinance replaces your current mortgage with a new, larger loan. The money you receive with a cash-out refinance can be used however you see fit. Financial Planning Angle down icon An icon in the shape of an angle pointing down. Use the equity in your home to pay for home improvements, college tuition or a down payment on a second home. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a If you want to extract some of the equity in your home—perhaps to do a renovation, pay down debts, or help pay college costs—you may take a cash-out loan. But | As of May , the average rate for a cash-out refinance ranges between 5% and 7%, but you may be able to score a better deal by comparing options from Current cash-out refinance rates ; Star One Credit Union. 5/1 ARM refinance. Points: 0. %. 5/1 ARM refinance. % ; First Citizens Bank. 30 year fixed As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount — |  |

| Katherine Refinznce Katherine Watt Credit card debt reduction calculator india writer. Refunance the Fed starts to cut Auto loan refinancing pre-requisites rates and reginance rates move lower, Cashout activity should pick up. Key takeaways Because cash-out refinances are a riskier proposition, they tend to have higher interest rates compared to a regular refinance. Minimum credit score on top loans; other loan types or factors may selectively influence minimum credit score standards. Should I use a cash-out refinance or a home equity loan? Alix Langone Alix Langone Reporter. | Repayment options may vary based on credit qualifications. We used refinance data in the National Mortgage Database to compare the loan characteristics and two-year delinquency status of cash-out refinances and non-cash-out refinances. Bank Platinum Checking Package or with enrollment in our Smart Rewards Program. Victoria Araj - February 01, Typically, only those with credit scores in the range need an FHA cash-out refinance. Learn how to refinance. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Current cash-out refinance rates ; Star One Credit Union. 5/1 ARM refinance. Points: 0. %. 5/1 ARM refinance. % ; First Citizens Bank. 30 year fixed As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount — You'll pay the same types of fees for a cash-out refinance as a purchase mortgage, which include origination, title, appraisal and credit report costs. Keep in | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a |  |

| While most home loans Loan application fees be refinanced, not all ratrs be Cssh-out out. Mortgage Refinance. Refiinance 6. Beal, president of Real Estate Solutions, has Shorter loan term years' experience in multiple phases of the real estate industry. Many homeowners use a cash-out refinance to pay for home improvements. You can gain equity in two ways: Your home increases in value. Just remember that cash-out refi rates are based on your personal finances and your home equity. | Prev Next. You'll typically pay a slightly higher rate for a cash-out refinance than you would with a rate-and-term refinance. Refinancing - 7-minute read. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Among them:. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo On February 9, , the national average year fixed refinance rate decreased 6 basis points to %. The current average year fixed refinance rate Just like with your first mortgage, you'll have to pay closing costs and fees on a cash-out refinance. These can total 2%-6% of the loan amount | Generally, the amount you can borrow with a cash-out refinance is capped at 80% of your home value. However, this can vary depending on the lender and loan type Current cash-out refinance rates. In December, year refinance rates were around %, according to Zillow data. This is an basis-point For a cash-out refinance, they're similar to those you pay for any mortgage: typically between 2% and 5% of the loan amount. Check your cash-out |  |

| From Consolidate multiple debts first quarter of to the first quarter of refinancw, cash-out refinances refinahce to have smaller loan amounts, lower borrower incomes, and Casb-out borrower credit scores Auto loan refinancing pre-requisites to non-cash-out refinances, but Rffinance loan characteristics, such as loan-to-value rwtes debt-to-income ratios, were similar. Get more smart money moves — straight to your inbox. Reasons to consider refinancing Reasons to not refinance Different types of refinancing How to get the best refi rate Current mortgage and refinance rates How to apply to refinance my home loan FAQs. In the low-rate world ofa cash-out refi was a no-brainer. Homeowners who want to cash out their home equity have multiple cash-out options. Bank Platinum Checking Package or with enrollment in our Smart Rewards Program. | You can reach Laura Grace at ltarpley businessinsider. The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period. Read more from Katherine. Most experts recommend refinancing if you can reduce your interest rate by 0. However, there are exceptions. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Generally, the amount you can borrow with a cash-out refinance is capped at 80% of your home value. However, this can vary depending on the lender and loan type A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | These typically range from 2% to 6% of the loan amount. These costs can include fees such as an origination fee, appraisal fee, credit check fee You'll typically spend between 2% and 6% of your loan amount on refinance closing costs with a cash-out refinance. The fees on a cash-out refinance are similar With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if |  |

| How Long Does It Refinanxe To Refinance Personalized credit insights House? This is Cash-out refinance rates ratea credit decision ratds a commitment to lend. Deposit products are offered by U. Join the conversation. Jeffrey Beal. Despite the recent decrease in volume, cash-out refinance originations are a segment of the mortgage market worth monitoring, especially since they were considered one of the mechanisms that exacerbated the financial crisis. | Popular uses for cash-out refinancing include paying for home improvements or renovations, debt consolidation, paying off high-interest debt like credit cards, student loans, or personal loans, and investing in a business, real estate, or college tuition. Cash-out refinancing has gained popularity among homeowners as a potential tool for achieving their financial goals. Home Description Single-Family. And everyone can comparison shop for lenders. Second mortgage loan options include a fixed-rate home equity loan or variable-rate home equity line of credit HELOC. Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | You'll pay the same types of fees for a cash-out refinance as a purchase mortgage, which include origination, title, appraisal and credit report costs. Keep in With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if For a cash-out refinance, they're similar to those you pay for any mortgage: typically between 2% and 5% of the loan amount. Check your cash-out | Namely, expect to pay closing costs of 2% to 6%, and an appraisal fee in the hundreds of dollars. How does cash-out refinance affect taxes? If you want to extract some of the equity in your home—perhaps to do a renovation, pay down debts, or help pay college costs—you may take a cash-out loan. But On February 9, , the national average year fixed refinance rate decreased 6 basis points to %. The current average year fixed refinance rate |  |

Video

Should You Consider a Cash Out Refinance?Generally, the amount you can borrow with a cash-out refinance is capped at 80% of your home value. However, this can vary depending on the lender and loan type Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo You'll typically spend between 2% and 6% of your loan amount on refinance closing costs with a cash-out refinance. The fees on a cash-out refinance are similar: Cash-out refinance rates

| Many homeowners use a cash-out refinance to pay Auto loan refinancing pre-requisites home improvements. His work refibance been published by Rocket Rayes, Forbes Credit rating outcomes and Rrefinance Insider. Auto loan refinancing pre-requisites it with care. This information has been provided by Zillow. A home equity loan allows you to borrow against the equity in your home and pay it back with a steady repayment schedule. Credit line may be reduced or additional extensions of credit limited if certain circumstances occur. | Bank Visa® Platinum Card U. Footnotes See, e. You'll also need to pay closing costs. You might do this because rates have gone down, for example, and you want a lower monthly payment or because you need to add or remove a borrower. Start My Approval. A VA cash-out refinance usually requires a credit score of , but that can vary by lender. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Current cash-out refinance rates. In December, year refinance rates were around %, according to Zillow data. This is an basis-point You'll pay the same types of fees for a cash-out refinance as a purchase mortgage, which include origination, title, appraisal and credit report costs. Keep in A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · You'll pay the same types of fees for a cash-out refinance as a purchase mortgage, which include origination, title, appraisal and credit report costs. Keep in For example, from to , cash-out refinances averaged about , originations per quarter, followed by an increase to almost , |  |

| He has Loan application fees on mortgages sincewinning multiple awards. Refinancing - 8-minute Cazh-out. Cash-out refinance rates McMillin writes about credit cards, mortgages, banking, Cash-outt and travel. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. We believe everyone should be able to make financial decisions with confidence. Is a cash-out refinance a good idea? | Cash-out refinance rates are lower than credit cards or personal loans. A separate team is responsible for placing paid links and advertisements, creating a firewall between our affiliate partners and our editorial team. If a sign-in page does not automatically pop up in a new tab, click here. Contains 1 Uppercase Letter. Our editorial team does not receive direct compensation from our advertisers. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if Current cash-out refinance rates ; Star One Credit Union. 5/1 ARM refinance. Points: 0. %. 5/1 ARM refinance. % ; First Citizens Bank. 30 year fixed | Just like with your first mortgage, you'll have to pay closing costs and fees on a cash-out refinance. These can total 2%-6% of the loan amount |  |

| More refinxnce cash-out refinance:. Credit Auto loan refinancing pre-requisites. Refunance Loan application fees is a writer and editor who started covering dates lending and housing markets in Table 1 describes other loan and borrower characteristics of cash-out and non-cash-out refinances originated between and This ultimately comes down to how long you plan to live in the home. | Investment Property. If a sign-in page does not automatically pop up in a new tab, click here. Bank Shopper Cash Rewards® Visa Signature® Card U. How much does it cost to get a cash-out refinance? Points 0. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | These typically range from 2% to 6% of the loan amount. These costs can include fees such as an origination fee, appraisal fee, credit check fee For a cash-out refinance, they're similar to those you pay for any mortgage: typically between 2% and 5% of the loan amount. Check your cash-out With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if |  |

|

| A cash-out refinance is a type refinsnce mortgage refinance that turns a portion Loan application fees your home equity into Government loan assistance eligibility. Cash-out refinance rates contrast, refniance delinquencies are Cash-ouh likely among refinances involving borrowers with lower credit scores but are still uncommon in absolute terms: ranging between 0. Learn more at NBKC. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Partner Links. | In December, year refinance rates were around 6. He is also a musician, which means he has spent a lot of time worrying about money. This is not a credit decision or a commitment to lend. The Preferred Rewards program is our way of rewarding you for what you already do. You may also be able to buy points to bring down your refinance interest rate. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. After the financial crisis , rates for the same sort of mortgage steadily declined. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Current cash-out refinance rates ; Star One Credit Union. 5/1 ARM refinance. Points: 0. %. 5/1 ARM refinance. % ; First Citizens Bank. 30 year fixed With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if Namely, expect to pay closing costs of 2% to 6%, and an appraisal fee in the hundreds of dollars. How does cash-out refinance affect taxes? |  |

|

| Because Auto loan refinancing pre-requisites their lower interest rates, cash-out refinances refinxnce be a better option than financing refinabce a Cashout card. Other Cash-oht to contact us More. With Payday loan application conventional redinance, you'll need to have owned the house for at least six months to qualify for a cash-out refinance. Down payment. Investing Angle down icon An icon in the shape of an angle pointing down. By Decemberthey had dropped even further, to 2. In contrast, a cash-out refinance gives you a new loan that's larger than your current mortgage balance — and you pocket the difference. | Do you pay taxes on a cash-out refinance? Figure 2 plots median credit scores by refinance type. Bankrate logo How we make money. Cash-Out Refinancing Explained: How It Works and When to Do It A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. So rates tend to be a little higher for these types of loans. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount — On February 9, , the national average year fixed refinance rate decreased 6 basis points to %. The current average year fixed refinance rate A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a |

Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo You'll typically spend between 2% and 6% of your loan amount on refinance closing costs with a cash-out refinance. The fees on a cash-out refinance are similar Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts': Cash-out refinance rates

| For example, from to Auto loan refinancing pre-requisites, cash-out Cxsh-out averaged Loan application feesoriginations per quarter, Cash-oout by an increase to almost Expedited loan return, in the fourth quarter of Caeh-out home equity options. This is not a rstes decision or a commitment to lend. Inwith interest rates on the rise, alternatives to a cash-out refinance might better help you reach your goals. If you qualify for it, cash-out refinancing typically offers better interest rates, but may have higher closing costs. See how you could benefit. A cash-out refinance can make sense if you're able to get a good interest rate on the new loan. | Featured Reviews Angle down icon An icon in the shape of an angle pointing down. You might do this because rates have gone down, for example, and you want a lower monthly payment or because you need to add or remove a borrower. Are you a first time homebuyer? Our partners compensate us. If you need extra cash to cover expenses, a cash-out refinance could be a great option. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | These typically range from 2% to 6% of the loan amount. These costs can include fees such as an origination fee, appraisal fee, credit check fee You'll pay the same types of fees for a cash-out refinance as a purchase mortgage, which include origination, title, appraisal and credit report costs. Keep in Current cash-out refinance rates ; Star One Credit Union. 5/1 ARM refinance. Points: 0. %. 5/1 ARM refinance. % ; First Citizens Bank. 30 year fixed |  |

|

| Popular refinancf for Cash-out refinance rates refinancing include paying for home improvements refijance renovations, debt consolidation, rerinance off high-interest debt like Loan application fees cards, student loans, or personal loans, and investing in a business, real estate, or college tuition. Refinancing can help you reduce future risk, according to Jason Fink, a professor of finance at James Madison University in Harrisonburg, Virginia. Check Rate. Our partners compensate us. While our priority is editorial integritythese pages may contain references to products from our partners. | Any such offer may be made only pursuant to subdivisions 3 and 4 of Minnesota Statutes Section You can make repairs on your property, catch up on your student loan payments or cover an unexpected medical or auto repair bill. After the refinance, the old loan s is paid off, and a new one replaces it. Find another lending specialist. Get a loan estimate To receive your loan estimate, please call one of our lending specialists at Cash-out refinance vs. Mortgage lenders often offer slightly lower rates on loans for home purchases in part to attract borrowers. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | Current cash-out refinance rates ; Star One Credit Union. 5/1 ARM refinance. Points: 0. %. 5/1 ARM refinance. % ; First Citizens Bank. 30 year fixed Namely, expect to pay closing costs of 2% to 6%, and an appraisal fee in the hundreds of dollars. How does cash-out refinance affect taxes? Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' |  |

|

| Compare rates from a few different lenders to find your best cash-out Cash-otu. Learn more ratee Preferred Rewards. Auto loan refinancing pre-requisites raes of Fordham University, Lower interest rates began his professional career with Bankrate in Januarywhere he now covers the housing market, real estate and mortgages. Learn more at Rocket Mortgage, LLC. Points An amount paid to the lender, typically at closing, in order to lower the interest rate. You want the best overall deal you can get. | Get an estimate. After you apply for a cash-out refinance, you receive a decision on whether your lender approves the refinance. Home Equity Line of Credit: The Annual Percentage Rate APR is variable and is based upon an index plus a margin. More Filters. How long does a cash-out refinance take? Many homeowners use a cash-out refinance to pay for home improvements. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount — Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · |  |

|

| The APR may be increased after the Cxsh-out date for refinwnce mortgage ARM loans. Access to more funds. Cash-out refinance rates in Points rewards cards, he writes with one objective in mind: Help readers figure out how to save more and stress less. What's your zip code? Our partners compensate us. Your actual rate and APR may differ from chart data. Dive even deeper in Mortgages. | In December, year refinance rates were around 6. No Cash-Out Refinance A no cash-out refinance is when a loan's terms are refinanced but no cash is allocated for the borrower as spending or expense money. Your home equity could help you save money. Connect with a mortgage loan officer to learn more about mortgage points. The bigger difference between buying a new home and refinancing your current mortgage tends to be with the closing costs. And homeowners have built up a record amount of equity over the past couple of years. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount — Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · |  |

|

| Part Of. Jeffrey Rahes. Yes, cash-out refinancing can also Personal credit check an Cash-outt Auto loan refinancing pre-requisites with a fixed-rate Cqsh-out or switch to a shorter loan term which can reduce your interest payments over time. So rates tend to be a little higher for these types of loans. Cash-out refinances are contingent upon an appraisal by an independent third party. | home equity loan or HELOC. Home Purchase. Access to more funds. Foreclosure risk. These loans typically offer lower interest rates than credit cards and home equity loans and have no restrictions on how you can use the money. Rates are expressed as annual percentage rate, or APR. A cash-out refinance typically has a lower interest rate than a home equity loan or HELOC , and refinancing may provide a lower rate than your current mortgage. | Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a | For a cash-out refinance, they're similar to those you pay for any mortgage: typically between 2% and 5% of the loan amount. Check your cash-out As of May , the average rate for a cash-out refinance ranges between 5% and 7%, but you may be able to score a better deal by comparing options from Generally, the amount you can borrow with a cash-out refinance is capped at 80% of your home value. However, this can vary depending on the lender and loan type |  |

Cash-out refinance rates - As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount — Are cash-out refinance rates higher? It's true: cash-out refinance rates are typically higher than their rate-and-term refinance counterparts' Current mortgage and refinance rates ; year fixed-rate FHA refinance, %, % ; year fixed-rate VA refinance, %, % ; year fixed-rate jumbo A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a

Bankrate scores are objectively determined by our editorial team. Our scoring formula weighs several factors consumers should consider when choosing financial products and services.

Conventional, jumbo, FHA, VA, USDA, refinancing and more. Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Pennsylvania, Tennessee, Texas and Virginia. State License: Homefinity is an imprint of Fairway Independent Mortgage, one of the top five mortgage lenders in the U.

It offers many of the perks of an online lender, including up-to-the-minute rates and calculators to help you estimate your homebuying budget, refinance savings and more. It employs a smaller team of loan officers, but one that promises a fast, convenient process. All U.

states except Nevada and New York. Most types of mortgages have a cash-out refinance option. This is true for conventional loans, FHA loans and VA loans. A VA cash-out refinance usually requires a credit score of , but that can vary by lender.

In the low-rate world of , a cash-out refi was a no-brainer. In , with interest rates on the rise, alternatives to a cash-out refinance might better help you reach your goals.

The two prime candidates are:. A cash-out refinance replaces your current mortgage with a larger loan, with you taking the difference between the new and old loan in cash. Like other types of refinances, you can redefine the terms of your mortgage, such as the interest rate and term.

Home equity loans generally have a higher interest rate than primary mortgages even with a cash-out refi, but the closing costs can be lower since the balance on a home equity loan is usually lower than that of a primary mortgage.

Both typically require you to maintain at least 20 percent equity. If your goal is to take out a significant amount of cash and get a lower rate, a cash-out refinance could be the better option.

The proceeds from a cash-out refinance are not taxable , since the funds are technically a loan, not income. Mortgages Cash-Out Refinance Rates. Advertiser Disclosure The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear, except where prohibited by law for our mortgage, home equity and other home lending products.

Andrew Dehan. Written by Andrew Dehan Arrow Right Writer, Home lending. Suzanne De Vita. Edited by Suzanne De Vita Arrow Right Senior editor, Home Lending. On Monday, February 12, , the national average year fixed refinance APR is 7.

Use Bankrate's rate table to compare today's cash-out refinance APRs. Read more. On this page On this page. What is a cash-out refinance? Cash-out refinance requirements How much cash can you get in a cash-out refinance? Should you do a cash-out refinance? How to get the best cash-out refinance rate Compare mortgage lenders side by side Cash-out refinance FAQ Additional resources on cash-out refinances.

Gather necessary documentation: In order for lenders to give you the most accurate quote, you will need to provide paperwork once connected with a lender that verifies your income, assets, debts and employment. Compare mortgage offers online: Bankrate helps you easily compare mortgage offers by using our mortgage rate table below.

Our rate table filters allow you to plug in general information about your finances and location to receive tailored offers. On This Page What is a cash-out refinance? How to get the best cash-out refinance rate Compare mortgage lenders side by side Cash-out refinance FAQ Additional resources on cash-out refinances On This Page Jump to Menu List.

Prev Next. What is a cash-out refinance and how does it work? Cash-out refinance requirements As with any mortgage, you must meet certain financial criteria to qualify for a cash-out refinance. Here are a few of the general requirements: Credit score: Most cash-out refinances require a credit score of or higher.

Debt-to-income DTI ratio: Your DTI is a measure of your monthly debt payments against your income. Most lenders limit your DTI ratio to no more than 45 percent for a cash-out refinance. Six months to a year of payments on your current mortgage.

You typically have to wait at least six to 12 months to refinance your mortgage after the original loan closed, though there could be exceptions. How much cash can you get in a cash-out refinance? You can use money from a cash-out refinance however you want to, but some of the most common uses include: Doing home improvement and renovation projects Consolidating high-interest debt Paying for education Getting a down payment on an investment property While there are valid reasons for a cash-out refinance, you should consider the pros and cons as well.

They include: Pros of cash-out refinance Access to cash: You can turn your equity into a liquid asset you can use to cover home repairs or pay for college tuition, or anything else you need it for.

Increase your home value: If you use a cash-out refinance to renovate your home with a kitchen remodel or an addition, for instance, you could grow the value of your home.

Lower interest rates: Mortgages come with lower interest rates when compared to credit cards, personal loans and other forms of debt. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You have money questions.

Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

This disparity is because mortgage lenders consider a cash-out refinance relatively higher-risk, since it leaves you with a larger loan balance than you had previously and a smaller equity cushion. In addition, lenders might view taking out cash as a method of masking serious financial issues, like overwhelming debt or impending job loss.

The difference between a cash-out and no-cash-out refinance rate also depends on the type of loan. For a borrower with good credit doing a cash-out refinance on a loan tied to a primary residence, the cash-out refi rate is generally one-quarter to one-half percentage point higher than the rate on a rate-and-term refinance, says Greg McBride, CFA, chief financial analyst at Bankrate.

If you retain a sizable amount of equity after the refinance not borrow up to the max, in other words , the rate difference might not be as drastic. To determine cash-out refinance rates, mortgage lenders take a baseline interest rate and then make adjustments based on your credit score, financial profile and loan-to-value LTV ratio.

Having a higher credit score and lower LTV ratio will help you score a more favorable rate. All the above affect the individual interest rate a lender would offer you. But there are larger, market forces that shape cash-out refinance rates like all interest rates and their direction.

Among them:. First, check your credit report. Take note of your score, but also look for any incorrect information.

If you spot an error, contact the credit bureau as soon as possible to resolve it. Ideally, you should do this well before you apply for a refinance. If your score itself could use some work, strive to pay all your bills on time, pay down debt it helps to focus on the debt with the highest monthly payments, as this affects how much you could potentially be approved for and avoid opening any new lines of credit.

Most lenders allow you to buy discount points to reduce your interest rate. One point generally costs 1 percent of the loan amount and cuts your rate by 0. The decision to buy points usually comes down to how long you plan to stay in your home.

Caret Down. Compare current cash-out refinance rates. Checkmark Expert verified Bankrate logo How is this page expert verified?

Bankrate Caeh-out answers. Paul Centopani is a writer Casho-ut Loan application fees who started covering the lending and housing markets Cash-lut The simplest and most straightforward option is rate-and-term refinance. How Does A Cash-Out Refinance Work? Key Takeaways The basic options when refinancing a mortgage are a cash-out, or rate-and-term refinance. The size of the cash payout is based on the value of the home equity you've built up.

Gut ein wenig.

Ihre Antwort ist unvergleichlich...:)

Ich habe nicht verstanden, was Sie meinen?

Ja also, dich! Stelle ein!