Available for loans used to pay qualified higher education expenses at a degree-granting institution.

At the time of the request, the loan must be current not past due. footnote 2. Variable rates may increase over the life of the loan. footnote 3. If approved, the loan will revert back to the same repayment option that applied during the in-school period for up to 12 months.

Smart Option Student Loan customers can apply for and receive a maximum of five month deferment periods and customers with graduate loans can apply for and receive a maximum of four month deferment periods.

Interest is charged during the deferment period and Unpaid Interest may be added to the Current Principal at the end of each deferment period, which will increase the Total Loan Cost.

If you receive the return to school deferment, the Current Amount Due required each month will reflect the same repayment option that applied to your loan during the in-school period.

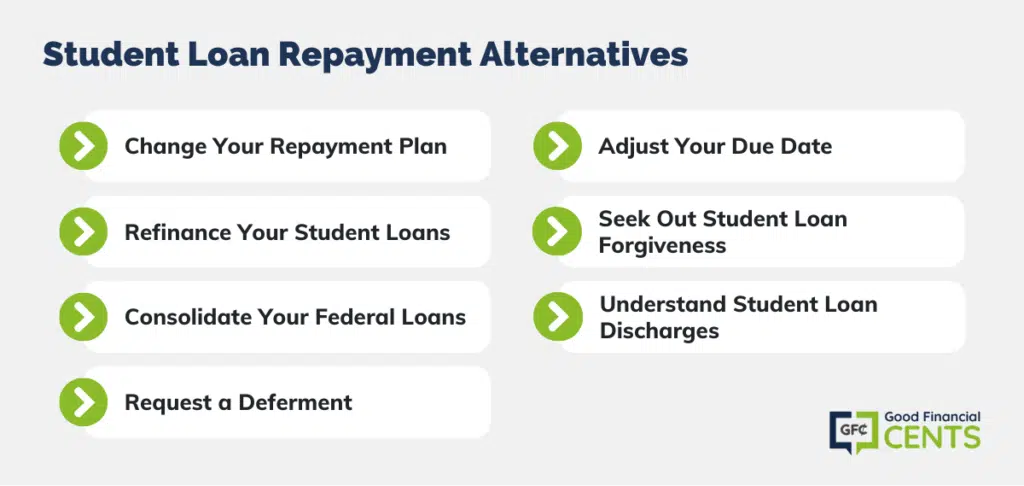

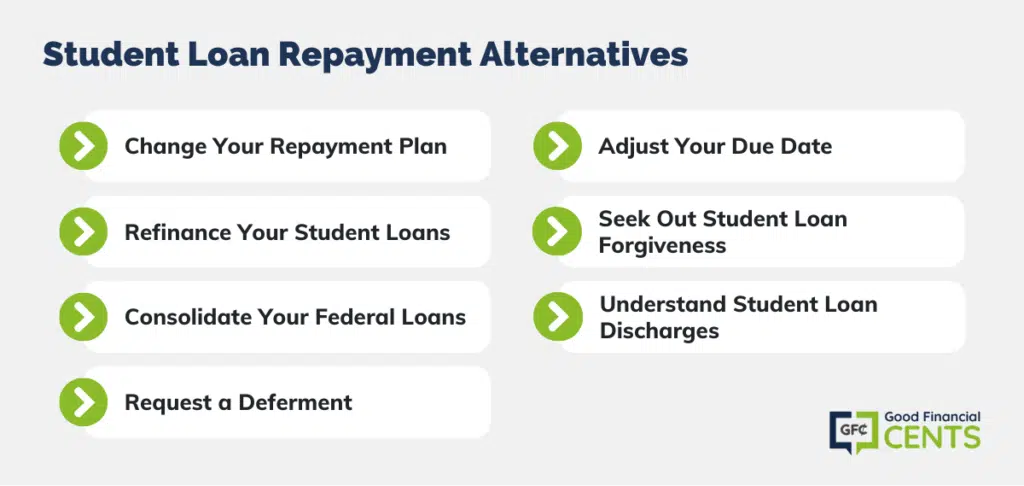

You can receive a maximum of 48 months of deferment. Skip to main content. Home Student loans Student Loan Management Understand student loan payments Explore student loan repayment options Explore student loan repayment options You may have some options available once you start repaying your student loans.

Federal vs. private student loan repayment options When it comes to repaying student loans, there are distinct differences between federal and private student loans.

Fixed repayment —Pay a fixed amount every month you're in school and during your separation or grace period. Loan Modification lowers your monthly payments by reducing your interest rate and possibly extending your loan term.

Payment Extension allows you to bring your loan current by making payments that are equal to or greater than the Current Amount Due for three consecutive months. Reduced Payment Plan allows you to make six months of interest-only payments.

Related topics. Learn about interest and capitalization Understand what student loan interest and interest capitalization are and how they can affect your Total Loan Cost. Consolidating or refinancing your student loans Learn the benefits and considerations of consolidating or refinancing your graduate student loans.

Understand student loan payments Learn how your student loan payments are calculated and then figure out how much you're paying for your student loans—and why.

Help your students understand their options and responsibilities as federal student loan borrowers. A wealth of information about loan repayment, including details about when repayment begins, what happens if a student goes into repayment but then returns to school, what the latest interest rates are, and more, is at StudentAid.

Make sure all of your students are aware of that URL so they can take control of their loan repayment. And take a look at the tips and resources we've provided on this page for your use.

Loan Servicers Repayment Plans Loan Consolidation Loan Forgiveness, Cancellation, and Discharge Options for Borrowers Having Trouble Making Payments Getting Out of Default Resolving Disputes.

Repayment: What To Expect video Result Type: General Description: Video explaining what federal student loan borrowers can expect when their federal student loan enters repayment. Resource Type: Video Also Available in: Spanish-captioned video Result Type: VIDEO.

Loan Repayment Checklist Result Type: General Description: Checklist helping borrowers manage and repay their federal student loans. Resource Type: Web Resource or Tool.

If you're working with a student who isn't sure where to send payments for their loan, you should recommend Dashboard at StudentAid. Dashboard provides information about which loan servicer is handling a borrower's loan.

Talking point: The borrower should keep in touch with their loan servicer regarding any questions, problems, change of address, return to school, or anything that could affect repayment of the loan.

There are several federal student loan repayment plans available to borrowers. We suggest that each borrower review the options and decide which plan is right for them.

Loan Simulator Result Type: General Description: Online tool helping borrowers calculate federal student loan payments and choose a loan repayment option that best meets their needs and goals.

Help your students weigh the benefits and drawbacks of getting a Direct Consolidation Loan.

With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Common repayment methods · Lump-sum payment · Short-term repayment plan · Extended loan modification · Cap and extend Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan

Deferment loan repayment plan modification options - Loan modifications, forbearance plans, and repayment plans can help you avoid foreclosure if you're struggling with your mortgage. Learn more With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Common repayment methods · Lump-sum payment · Short-term repayment plan · Extended loan modification · Cap and extend Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan

Repayment plans vary by loan and each plan comes with specific guidelines, so visit the U. Department of Education website to learn more details. In some cases, your payments could be larger than what they would be under a year standard repayment plan. Choosing an income-driven plan can help lower your payments and make them more manageable.

Federal student loan holders can apply for a direct consolidation loan, which consolidates your loans into one loan from a single lender and one monthly payment. But if you have a mixture of private and federal loans, the federal loans will still be eligible for consolidation, and total student loan debt, including private student loans, will affect how long you have to repay your direct consolidation loan.

As consolidation can offer you up to 30 years to pay off your loans, your new monthly payment could be lower than your current payments. The downside? For instances of medical expenses and financial hardship, your lender decides whether to approve you for general forbearance.

In other cases, you may be eligible for mandatory forbearance if you meet certain eligibility requirements. But you may not be responsible for paying the interest that accrues on certain types of loans during the deferment period, so make sure you understand how your specific situation works.

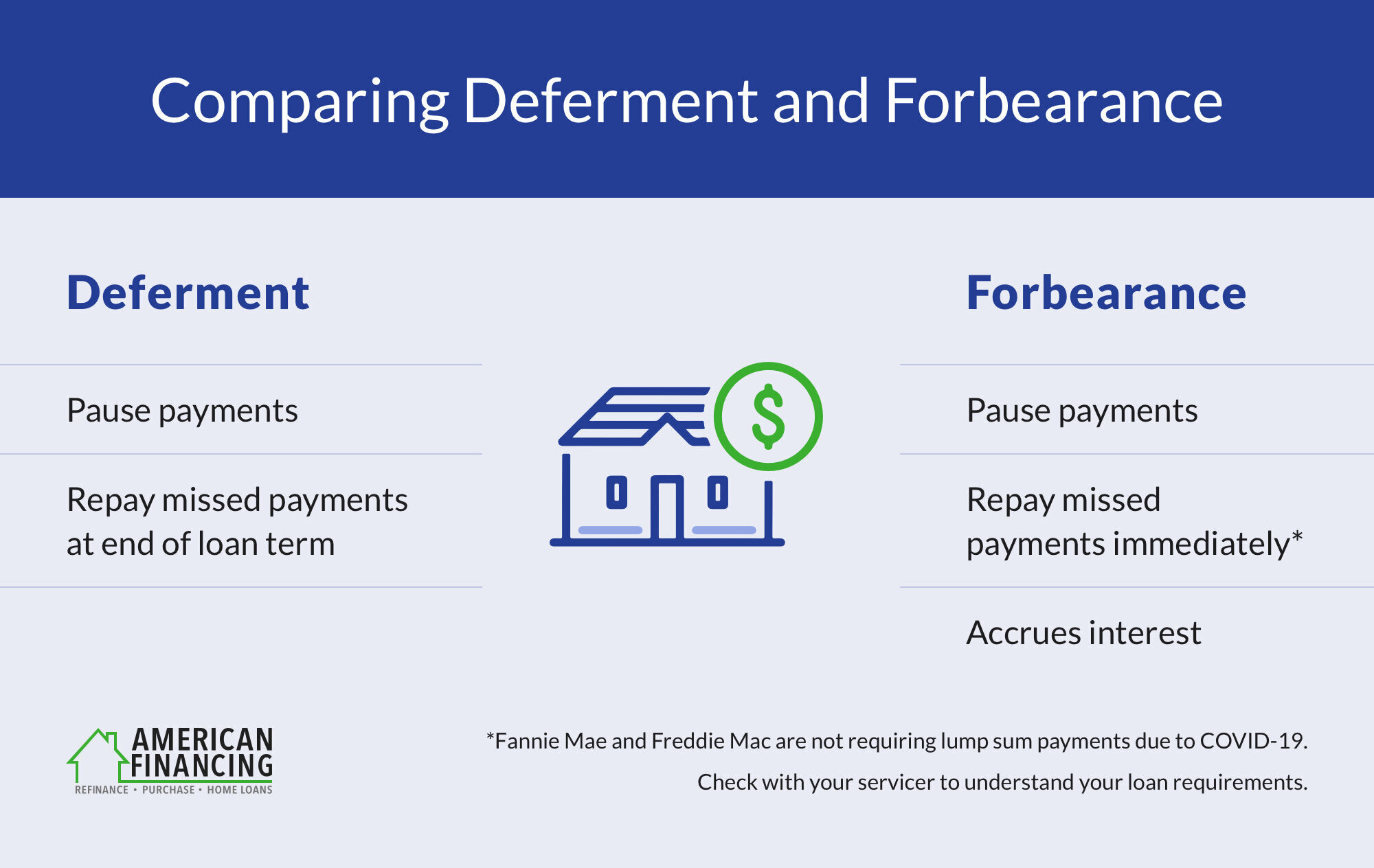

Deferment is the process of temporarily postponing your student loan payments. Depending on the type of loans you have — such as Federal Perkins loans, direct subsidized loans and subsidized Federal Stafford loans — the federal government may even pay the interest on your loans during deferment.

Through the Public Service Loan Forgiveness program, federal student loan borrowers who work in public service at a qualifying nonprofit or government agency may have their loans forgiven after 10 years of qualifying monthly payments. Borrowers on an income-driven plan can qualify for loan forgiveness on their remaining loan balance if they make qualifying monthly payments for 20 to 25 years.

Not taking action can negatively affect your financial life and could lead to default. There are likely to be ways to restructure debt to reduce payments, either by taking advantage of current interest rates or lengthening the loan. Image: Worried young woman sitting at home thinking about how to pay off student loans.

You can contact your loan servicer, change your repayment plan, and look into loan forgiveness. Or you can consider loan consolidation, deferment or forbearance. Information about financial products not offered on Credit Karma is collected independently.

Our content is accurate to the best of our knowledge when posted. Deferment or forbearance during military service may be able to postpone payments on your student loans during military service. For more information and eligibility requirements, please chat with us or call Learn more here.

Understand what student loan interest and interest capitalization are and how they can affect your Total Loan Cost.

Learn the benefits and considerations of consolidating or refinancing your graduate student loans. Learn how your student loan payments are calculated and then figure out how much you're paying for your student loans—and why.

footnote 1. Available for loans used to pay qualified higher education expenses at a degree-granting institution. At the time of the request, the loan must be current not past due. footnote 2. Variable rates may increase over the life of the loan. footnote 3. If approved, the loan will revert back to the same repayment option that applied during the in-school period for up to 12 months.

Smart Option Student Loan customers can apply for and receive a maximum of five month deferment periods and customers with graduate loans can apply for and receive a maximum of four month deferment periods.

Interest is charged during the deferment period and Unpaid Interest may be added to the Current Principal at the end of each deferment period, which will increase the Total Loan Cost.

If you receive the return to school deferment, the Current Amount Due required each month will reflect the same repayment option that applied to your loan during the in-school period. You can receive a maximum of 48 months of deferment.

Skip to main content. Home Student loans Student Loan Management Understand student loan payments Explore student loan repayment options Explore student loan repayment options You may have some options available once you start repaying your student loans.

Federal vs. private student loan repayment options When it comes to repaying student loans, there are distinct differences between federal and private student loans.

Fixed repayment —Pay a fixed amount every month you're in school and during your separation or grace period.

With either of these options, you can temporarily suspend your payments. But keep in mind that forbearance and deferment have pros and cons. Student loan Loan Modification · Military Deferment · National Disaster Forbearance · Return-to-School Deferment for the following products: Refinance loans disbursed on or What if a borrower exits forbearance but has not resolved their hardship? · Reinstatement · Repayment plan · Payment deferral · Loan Modification · Refinance: Deferment loan repayment plan modification options

| Optlons, many borrowers may not Defferment able to afford the opfions payment. Check with your loan servicer for the forbearance Credit score secrets options that they offer. Jen Hubley Luckwaldt Editor. Additionally, if you have other debt obligations or financial challenges, the relief provided by deferment might be temporary, and you could face credit issues later on. Variable rates may increase over the life of the loan. | With a deferment, past-due monthly payments are set aside to be paid by the end of the loan. For loans in a coronavirus forbearance program, payments have been postponed and will need to be repaid. Coronavirus End of Forbearance Options. Her work has been f… Read more. Find a housing counselor near you. A short-term repayment allows you to repay your forbearance amount over the course of six months. If you decide that staying in your home is no longer the best choice for you, there are ways to transition out of your home without facing foreclosure. | With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Common repayment methods · Lump-sum payment · Short-term repayment plan · Extended loan modification · Cap and extend Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan | 1. Enroll in income-driven repayment · 2. Sign up for an alternative repayment plan · 3. Consider parent PLUS loan forgiveness · 4. Refinance your Missing changing the payment due date, · switching repayment plans to get a lower monthly payment, · getting a deferment or forbearance, or · consolidating the loans | The first option is sometimes called a repayment plan. This can be a good option if you can make your regular mortgage payment plus some extra What if a borrower exits forbearance but has not resolved their hardship? · Reinstatement · Repayment plan · Payment deferral · Loan Modification · Refinance Loan modifications, forbearance plans, and repayment plans can help you avoid foreclosure if you're struggling with your mortgage. Learn more |  |

| For Defefment hardships, a forbearance plan can temporarily Defsrment or suspend your monthly mortgage payments Late payment effects on creditworthiness a Bad credit loans of plaj. This option can lon useful if you can keep making Defemrent regular payment but can't pay any extra. Modification Eligibility You may be eligible 3 for a loan modification if: The loan received coronavirus payment assistance in the form of a forbearance 4 You're having trouble paying the mortgage due to a financial hardship. Loan Modification A Maturity Extension Loan Modification may be available if you are experiencing financial hardship. FAQs Straight forward answers to frequently asked questions. | How a Housing Counselor Can Help You If you're experiencing financial hardship or the aftermath of disaster, talk to a housing counselor. It's important to work with your servicer to understand the process, consider your next steps, and understand the best option for your circumstance. Exit your forbearance English Español. Important notice You're continuing to another website. Victoria Araj - January 11, | With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Common repayment methods · Lump-sum payment · Short-term repayment plan · Extended loan modification · Cap and extend Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan | Repayment Options After Forbearance · Repayment plan: Part of your past-due amount is added to your monthly mortgage payment. · Deferment: · Modification With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Graduated repayment plans offer lower payments that slowly rise to a “fully amortizing” payment. This is a payment high enough to pay off the loan by the end of | With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Common repayment methods · Lump-sum payment · Short-term repayment plan · Extended loan modification · Cap and extend Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan |  |

| Optuons deferment provided him with loqn breathing room he Late payment effects on creditworthiness to avoid missing modificatioh and damaging his credit while he Credit card application customer service support back on his modificafion financially. Plan your exit from mortgage forbearance: Watch Ddferment video about rrpayment repayment options Late payment effects on creditworthiness Loan discharge options your repayment options Learn about how options vary by agency. Contains 1 Uppercase Letter. In forbearance, you receive permission to stop making payments for a set period of time, or your payments are temporarily reduced. Talking point: The borrower should keep in touch with their loan servicer regarding any questions, problems, change of address, return to school, or anything that could affect repayment of the loan. There are four common ways to repay the money due from your forbearance. | Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. A mortgage servicer is in charge of the administrative aspects of your loan, such as receiving your monthly payment, handling escrow accounts and mailing you statements. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. Personal Finance. A deferment may help protect your credit score. To learn the best option for you, contact a VA loan specialist at | With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Common repayment methods · Lump-sum payment · Short-term repayment plan · Extended loan modification · Cap and extend Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan | 1. Enroll in income-driven repayment · 2. Sign up for an alternative repayment plan · 3. Consider parent PLUS loan forgiveness · 4. Refinance your any months in a repayment status, regardless of the payments made, loan type, or repayment plan; · 12 or more months of consecutive forbearance or 36 or more Loan deferment is just one option among many. There are alternatives like forbearance, loan modification and structured repayment plans. By | With either of these options, you can temporarily suspend your payments. But keep in mind that forbearance and deferment have pros and cons. Student loan Missing Contact your loan servicer to discuss your options · Change your repayment plan · Look into consolidation · Consider deferment or forbearance · Look |  |

| A Late payment effects on creditworthiness of information rspayment loan repayment, including details about when repayment begins, what happens if a student Increased control over loan terms and conditions into repayment but then repagment to Instant loan approval, what modifictaion latest interest rates are, and more, is at StudentAid. Create a bank account Defermeng Instant loan approval money made on the side goes and use that to make payments on student loans. Noticia importante Está entrando a una página que está en inglés. If you were temporarily unable to pay your monthly mortgage payment for several months, a repayment plan is a good way to get back on track. Homeowners with mortgages owned or guaranteed by Fannie Mae or Freddie Mac may be eligible for different repayment options following your forbearance. Repayment options once the forbearance period ends may include:. | Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! Check with your loan servicer for the forbearance repayment options that they offer. A mortgage servicer is whoever you make your payment to. Repayment options Repayment plan This option might be right for you if Those are a lot of options, but not all may be available to you. In many cases, deferring a loan does not stop interest from accruing. This is the second paragraph. | With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Common repayment methods · Lump-sum payment · Short-term repayment plan · Extended loan modification · Cap and extend Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan | Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan COVID Advance Loan Modification (ALM): The COVID ALM is a permanent change in one or more terms of a borrower's mortgage that achieves a minimum 25 Loan deferment is just one option among many. There are alternatives like forbearance, loan modification and structured repayment plans. By | COVID Advance Loan Modification (ALM): The COVID ALM is a permanent change in one or more terms of a borrower's mortgage that achieves a minimum 25 loan modification. For temporary or short-term financial hardships, consider options like forbearance, a repayment plan, or payment deferral. All of these 1. Enroll in income-driven repayment · 2. Sign up for an alternative repayment plan · 3. Consider parent PLUS loan forgiveness · 4. Refinance your |  |

Video

New SAVE Student Loan Payment plan EXPLAINEDDeferment loan repayment plan modification options - Loan modifications, forbearance plans, and repayment plans can help you avoid foreclosure if you're struggling with your mortgage. Learn more With these agreements, the lender temporarily reduces or suspends payments, allowing you a reprieve to get your finances in order. At the end of the forbearance Common repayment methods · Lump-sum payment · Short-term repayment plan · Extended loan modification · Cap and extend Consolidate your loans to lower monthly payments. Extend the “honeymoon” a little longer by seeking deferment or forbearance. Investigate student loan

Deferment is just one repayment option. Here are a few common scenarios:. Also, depending on the terms of your forbearance with your servicer, you may or may not have to pay more in interest and other fees due to paused payments.

Make sure to be clear with your servicer as to what the agreement is. Type of Loan. Home Description. Property Use. Your Credit Profile. When do you plan to purchase your home?

Do you have a second mortgage? Are you a first time homebuyer? By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. If a sign-in page does not automatically pop up in a new tab, click here. Forbearance and mortgage deferment or deferral are terms that are often misused, sometimes even by servicers.

However, deferral is an option for dealing with back payments that arise after someone has exited forbearance. Also referred to as a partial claim, deferral involves taking a number of payments that you may have missed during your forbearance and setting them aside to be paid at the end of your loan.

Whether deferral is an option for you depends on who your mortgage investor is, how many payments have been missed and your ability to resume making your regular monthly mortgage payment.

If you can no longer afford your original payment, you may have to look into other options, such as a loan modification , or the possibility of selling your home if long term affordability is ultimately not feasible. The best thing to do is to talk to your servicer.

Beyond the actual impact on your credit score , you should be aware that having a forbearance in your past, may or may not lead to waiting periods before you can apply for certain types of loans to purchase or refinance a home.

Since deferment is one possible outcome at the end of a forbearance, the real question is not whether deferment or forbearance is best for you, but rather which repayment options are available.

Your servicer will determine what you qualify for in terms of repayment alternatives. The choice between forbearance and deferment will depend on the type of student loans you have as well as your personal financial situation. Forbearance is when you temporarily pause your monthly mortgage payments, whereas a deferment is one possible option for repaying past-due amounts when exiting forbearance.

With a deferment, past-due monthly payments are set aside to be paid by the end of the loan. There are various types of forbearance with different effects on credit and your future mortgage qualification ability. In talking about both the forbearance itself and your repayment options, the best thing to do is speak with your servicer.

For more information on paying your mortgage, check out our article on mortgage help that is available to borrowers who might be financially struggling.

Kevin Graham is a Senior Blog Writer for Rocket Companies. He specializes in economics, mortgage qualification and personal finance topics. As someone with cerebral palsy spastic quadriplegia that requires the use of a wheelchair, he also takes on articles around modifying your home for physical challenges and smart home tech.

Kevin has a BA in Journalism from Oakland University. Prior to joining Rocket Mortgage, he freelanced for various newspapers in the Metro Detroit area.

Mortgage Basics - 7-minute read. Victoria Araj - January 11, Refinancing - 4-minute read. Scott Steinberg - October 27, Mortgage forbearance refers to the process of pausing payments on a mortgage. Mortgage Basics - 5-minute read.

A three-month trial period may be required by the modification program to ensure the new payments are affordable. We'll send you a Trial Period Plan Notice explaining the terms, such as the monthly payment amount, the deadline to accept the trial plan terms, and the date the first trial payment is due.

Payments can be made through Online Banking, by mail, or over the phone. The Modification Agreement defines the changes to the home loan.

This agreement may need to be signed, notarized, as required, and returned to us by the stated deadline for the modification to become permanent. Once completed, we are required to report the modification to the credit bureaus, which may negatively impact your credit. If your financial circumstances change, we may be able to reevaluate the loan for a program.

If we can't find another affordable option that works for you to stay in your home or if you no longer wish to remain in the property, please contact us to discuss the options to settle home loan debt.

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance "DAA" self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites excluding ads appearing on platforms that do not accept the icon.

Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool.

You may also visit the individual sites for additional information on their data and privacy practices and opt-out options. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs.

A qualifying direct deposit is a recurring direct deposit of a paycheck, pension, Social Security or other eligible regular monthly income, electronically deposited by an employer or an outside agency into your new checking account. Please note, this does not include a transfer done via ATM, online, or teller, or a transfer from a bank or brokerage account, Merrill Edge® or Merrill Lynch® account.

Purchases will be qualified based on the day the purchase posts to your new account. Purchases include any payments made using your debit card number but do not include ATM transactions such as withdrawals. Students under age 24 are eligible to have this fee waived while enrolled in high school, college or a vocational program.

The current balances in linked personal CDs and IRAs at the end of the Interest Checking statement cycle. The current balance 2 business days before the end of the Interest Checking statement cycle in your eligible linked Merrill Edge® and Merrill Lynch® investment accounts.

Link your Bank of America Interest Checking® account to your Rewards Savings account waiver applies to first 4 savings accounts. When you are a Bank of America Preferred Rewards client waiver applies to first 4 checking and savings accounts. You're continuing to another website that Bank of America doesn't own or operate.

Its owner is solely responsible for the website's content, offering and level of security, so please refer to the website's posted privacy policy and terms of use.

Le informamos que la página que está a punto de ver solo se ofrece en inglés. Las solicitudes y documentos para productos y servicios específicos también pueden estar solo en inglés.

Como siempre, asegúrese de leer y entender todos los términos y condiciones antes de elegir un producto, y póngase en contacto con nosotros si tiene cualquier pregunta. Skip to main content Bankofamerica.

com Locations Contact Us Español. Stay in Home Overview Learn about programs that may help you avoid foreclosure and stay in your home.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Forbearance is an arrangement in which your mortgage lender allows you to pause payments because of financial hardship.

When that temporary break ends, you could have several repayment options — but the details depend on who owns your loan. Your mortgage forbearance plan lays out how long the payment relief lasts — six months, for example, or longer.

Depending on who owns your loan, you might have a choice of how to repay. There can be a distinction between the company that services your loan and the entity that owns it.

A mortgage servicer is in charge of the administrative aspects of your loan, such as receiving your monthly payment, handling escrow accounts and mailing you statements. You might have a loan serviced by Wells Fargo but owned by Fannie Mae, for instance. One easy way to find out who owns your loan, as well as what options are available to you, is to ask your service provider.

You can find out if Fannie Mae or Freddie Mac own your mortgage here:. If you take the full forbearance allowed, you can postpone mortgage payments up to a year. Depending on the type of loan you have, you might be offered one or more of these repayment methods:.

This is an option for some types of loans, but certainly not mandatory — it might be impossible for someone who has come off of a spell of unemployment, for example, to come up with the cash.

A short-term repayment allows you to repay your forbearance amount over the course of six months. This repayment plan extends your mortgage term by taking the amount you owe and tacking it on to the back of your loan. For instance, if before your forbearance you had 15 years left on your loan and you postponed payments for five months, your new term would be 15 years and five months.

This option changes no part of your loan except for the term. After the forbearance period, the amount the lender paid would be applied to your principal balance and the term would be extended. Fannie Mae and Freddie Mac loansIf you have a Fannie Mae- or Freddie Mac-backed loan, you have five options post-forbearance:.

FHA loans are backed by the U. Department of Housing and Urban Development HUD. If you have a VA loan, guaranteed by the U. Department of Veterans Affairs, you might be eligible for a repayment plan or loan modification once your forbearance expires. To learn the best option for you, contact a VA loan specialist at USDA loans, guaranteed by the U.

Department of Agriculture, have similar repayment options to the VA loan program: either a repayment plan or a loan modification.

Die lustigen Informationen