Credit Saint offers a comprehensive package for simple credit repair needs, designed for those who may not require all the bells and whistles of the more expensive plans.

The company also has a long history, a strong reputation, and an excellent day money-back guarantee. Credit Saint has been in business since and is headquartered in Mahwah, New Jersey. The website features rankings from various personal finance websites, and its services include ongoing credit education.

Credit Saint's three levels of credit repair provide customers with a clear-cut path to becoming more creditworthy. The basic Credit Polish package might offer everything you need, or you may have to go with a higher tier. Credit Saint offers a free consultation by phone, during which you can discuss which package is right for you.

After that, you'll have online access and phone support throughout the process. Credit Saint provides credit monitoring through its affiliate, Credit Squad, so you can make sure things are going in the right direction. For more information, read the full Credit Saint review. Sky Blue was founded in and is one of the most well-established credit repair services available.

Sky Blue offers a single-service plan with competitive pricing. While Sky Blue offers a generous array of features and services, it provides fewer customer service options than some competitors. Clients can connect with customer service over the phone, via email, and by getting a support ticket.

Sky Blue also has some fairly recent complaints with the Consumer Financial Protection Bureau CFPB , where unhappy customers mention issues with customer service and incorrect account information. Sky Blue is headquartered in Boca Raton, Florida.

For more information, see the full Sky Blue Credit Repair review. net is our top choice for dispute services among credit repair companies. Not only does it send unlimited dispute letters on your behalf, but it will dispute issues with creditors and credit bureaus in several different ways, including sending debt validation, goodwill, and cease-and-desist letters.

It also conducts CFPB investigations on behalf of clients, and provides identity theft assistance. The plans are the same, but the latter plan simply offers a discount when you sign up as a couple. The plans both include a credit analysis, unlimited disputes, goodwill letters, inquiry challenges, and credit monitoring.

While CreditFirm. net offers customer service via phone, email, and support ticket, live chat is not available. It also does not offer a mobile app for clients, and the company does have one fairly recent complaint with the CFPB. net is headquartered in Deerfield, Illinois. For more information, see the full CreditFirm.

net Credit Repair review. com is our top choice for the best customer experience. Not only does it offer customer-friendly pricing, but it also provides multiple ways to connect with customer service, including by phone and live chat.

The CFPB has proposed a settlement with a group of companies operating some of the largest credit repair brands in the country, including CreditRepair. The companies collected illegal advance fees through telemarketing, violating federal law. More than 4 million consumers have been cheated, the CFPB said.

Similar to several competitors, CreditRepair. com offers tiered service packages. Dissatisfied customers complain about excessive fees and issues canceling their service. Despite these complaints, CreditRepair. Originally founded in , CreditRepair. com is headquartered in Salt Lake City, Utah. For more information, see the full CreditRepair.

com review. Lexington Law is our top pick for transparency, as its website and customer representatives are very forthcoming with information.

While many credit repair company websites lack details about plans and features, Lexington Law provides informative descriptions of its services and outlines the three-step process it uses to repair your credit. Plus, it offers a detailed frequently asked questions page and a free consultation for new clients where a representative can answer any questions you might have.

Each plan comes with bureau challenges and creditor interventions, and higher-tier plans offer added services like TransUnion alerts, credit score analysis, and credit monitoring. While Lexington Law does have several complaints with the CFPB, it also offers accessible customer service through live chat.

You can also review your progress through the Lexington Law mobile app or online portal. Originally founded in , Lexington Law is headquartered in North Salt Lake, Utah, and services 49 states.

For more information, see the full Lexington Law Credit Repair review. The Credit Assistance Network has been helping its customers repair their credit since The Money Management plan comes with all of the services we discussed above, while the higher-tier plans come with added features like medication discounts and guaranteed lines of credit.

Customer representatives can be reached via phone, email, and support ticket. Credit Assistance Network is based in Newark, New Jersey.

For more information, see the full Credit Assistance Network Credit Repair review. Our top pick for credit repair is the Credit Pros, which has standard pricing and many tools to help you repair and rebuild your credit. In addition to contacting credit bureaus and creditors on your behalf, the Credit Pros offers credit-builder loans, TransUnion credit monitoring, and lines of credit, all of which you can discuss during a free consultation.

Our other top choices cover a wide variety of needs. If you're in a hurry, for example, The Credit People offers the most aggressive timeline, while CreditFirm can help if you have a variety of dispute needs. To effectively rebuild your credit, take the time to find the right company for your specific situation.

While this process can take time, it could be worth it for those who have minor credit issues that need fixing. All three credit bureaus let you dispute inaccurate or incomplete information on your credit reports, and you can choose to dispute online or by mail. Most also offer dispute letter templates that you can download and use.

Working on your financial habits can also help improve your credit over time. You might start by using a budgeting tool and looking at your finances to develop a budgeting system that works. If you're interested in fixing your credit score on your own, then following the steps listed below can put you on the right path without having the pay the sizable fees that credit repair companies often charge:.

Credit repair companies will engage with the credit bureaus and creditors to help get misleading, incomplete, or inaccurate information removed from your credit reports. The goal is to clean up your payment history and improve your credit score. For instance, if you have several accounts to deal with or lots of errors on your credit reports, a credit repair company could be a good option for you.

There are several factors to compare as you shop around for the right credit repair services, including:.

Unfortunately, there are some shady companies in this industry eager to take advantage of financially vulnerable consumers, so doing your due diligence is essential. This database lets you review complaints about companies that consumers have logged with the CFPB since Companies can pay to become accredited on the BBB platform, which could make them seem more legitimate than they actually are.

We've carefully looked into and researched each of the businesses that we recommend listed above to ensure that they're legitimate credit repair companies. Some people prefer to work with local companies rather than connect with a company online. As you compare options, search for company complaints in the CFPB database, review company websites and contact information, and research consumer review sites for insight.

If possible, opt for companies that offer a free consultation so you can get a better sense of their services. While working with a credit repair company can be a good option for improving your credit score, it's just one of many possible solutions, and it won't be the right fit for everyone.

Outside of trying to repair your credit on your own, you can consider seeking credit counseling or a debt settlement company. Many credit counseling companies offer much of the same benefits that credit repair companies often do, including reaching out to creditors on your behalf.

Their primary function, however, is to work with you directly to devise money management strategies that'll help you avoid bankruptcy. After analyzing your income, expenses, and debts, a credit counselor will provide advice and plans tailored to your financial situation.

Working with one of these organizations can be a good alternative to a credit repair company if you know your credit report is accurate and primarily need help with budgeting, managing spending, and controlling debt. Credit counselors are often nonprofit or not-for-profit agencies and, as such, many charge low fees or nothing at all for their services.

This isn't always the case, however, so be sure to review what fees you may be charged, in addition to whether an agency will put a comment that you worked with them on your credit report which could make you seem like a credit risk to prospective lenders.

Debt settlement companies are typically for-profit entities that work with creditors on your behalf. The biggest difference between debt settlement companies and credit repair companies is that the former negotiate with creditors to arrange settlements or even debt forgiveness on your behalf, whereas not all of the latter will contact your creditors for you, and those that do usually only do so to dispute errors on your credit report.

The main thing they have in common, however, is that neither type of company offers anything that you can't do yourself. In fact, some creditors will refuse to negotiate with debt settlement companies. Additionally, even if a company is able to have your debt reduced or forgiven, you will likely have to pay income taxes on the amount that was settled, and a debt settlement can remain on your credit report for seven years.

Legitimate companies offering something as enticing as debt forgiveness have also made this field fraught with scams. Be on the lookout for companies that promise fast debt settlements or try to charge fees upfront before they actually succeed in reducing your debt.

Credit repair company costs can vary heavily, as different companies have different pricing structures. When you hire a credit repair company, you'll typically be charged a monthly fee.

Instead of charging a monthly fee, some credit repair companies use a performance-based billing model, wherein a client is charged a fee for each item on their credit report that the company challenges. Some companies will only charge you if they successfully have a negative mark deleted from your report, while others will levy a fee regardless of a challenge's success.

Additionally, if a single error appears on more than one of your credit reports, a performance-based credit repair company may treat that as several items for billing purposes. In addition to the sticker price of the service you choose, there may also be enrollment fees that would increase the overall cost.

You have a right to cancel a credit repair service at any time, though you may be charged a cancellation fee. Under the federal Credit Repair Organizations Act, a credit repair company can neither request nor receive payment until it's completed the services it's promised to provide.

If a company tries to get you to pay fees upfront before completing the promised service, you may be dealing with a scam. Investopedia collected and analyzed hundreds of key data points from over 17 companies across three months to identify the most important factors for readers choosing a credit repair company.

We used this data to review each company for costs and fees, services offered, customer experiences, and other features to provide unbiased, comprehensive reviews to ensure our readers make the right decision for their needs.

Investopedia launched in , and has been helping readers find the best credit repair companies since Working with a credit repair service may be the fastest way to repair your credit if you need significant assistance. However, even if a company starts work quickly, it can still take a few months or even longer to see changes in your credit reports and score.

A credit repair company contacts the credit reporting bureaus on your behalf to remove inaccurate or outdated information. Over time, this improves your credit report and score. Many companies offer additional services to help you rebuild and maintain your credit, such as credit monitoring, budgeting tools, and identity theft protection.

Or, if the account information is inaccurate or outdated, the credit repair service could file a dispute letter to get it removed. For instance, Chapter 13 bankruptcies are supposed to be removed from your credit reports after seven years.

To choose a credit repair company, look for one that has been around long enough to have a reliable track record of helping customers.

You can look online to see whether customers are satisfied or have registered complaints with any federal agencies or business watchdogs. Many companies will also offer a free consultation; this can help you understand the company's process and timeline and get your questions answered before you commit to purchasing a service.

Outside of working with a credit repair company, there are a few different things you can do to fix a bad credit score. First, request a copy of your free credit report from one of the three major credit bureaus.

Review your report, and if you find any errors, dispute that negative information with the respective bureau. Next, continue to make consistent, on-time payments on any concurrent debt you have. Be sure to prioritize paying off any overdue balances you may have.

Once you've got a handle on your existing debt, then you may want to consider taking out new debt to improve your credit mix, but only do so if you're certain you can handle the additional payments.

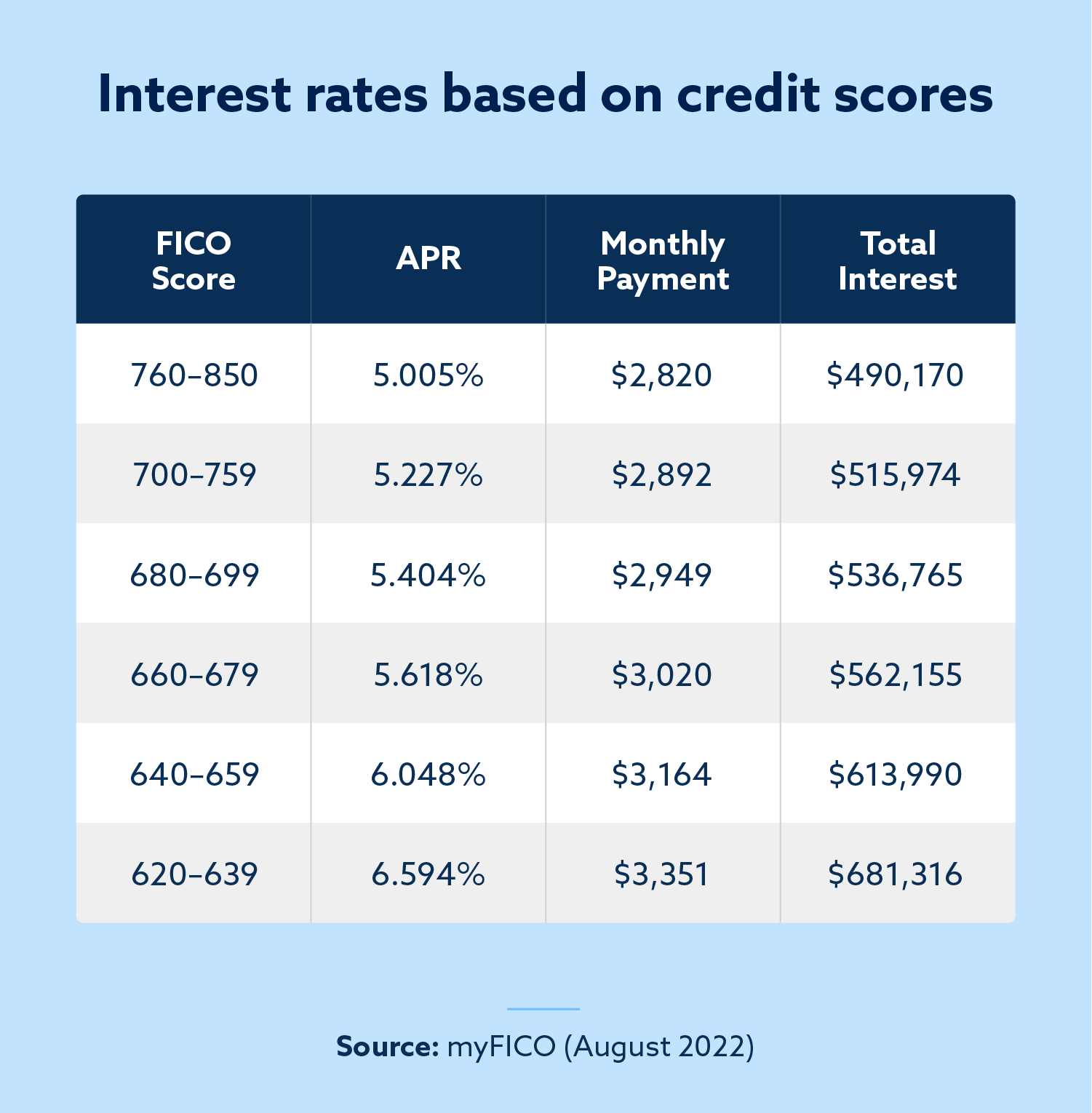

As there is more than one credit score model, the exact range of where a "good" credit score falls will vary. With a FICO score, one of the most commonly used models, borrowers in the to range are considered to have good credit, while — indicates a "very good" credit history.

Anyone with a score of or more has an "excellent" rating, and scores between and those below are considered "fair" and "poor," respectively. Using the FICO model, any credit score below is considered "poor," which is the lowest credit rating.

Credit scores between are often lumped into the "bad" category alongside poor scores. We researched and reviewed 17 businesses to find the best credit repair companies listed above.

While we write individual reviews for most companies, we do not always write reviews for companies we would not recommend. Below are the companies we researched along with links to individual company reviews to help you learn more before making a decision:.

AMB Credit Consultants , Credilife , Credit Assistance Network , Credit Glory , Credit Saint , Credit Versio , CreditFirm. net , CreditRepair.

com , CreditNerds , Lexington Law , Ovation , Sky Blue , The Credit Guru , The Credit People , The Credit Pros , Trinity Credit Services , USA Credit Repair. Earn 5. Annual Percentage Yield is accurate as of July 27, Interest rates for the Platinum Savings account are variable and subject to change at any time without notice.

Interest rates for the Savings Connect account are variable and subject to change at any time without notice.

Experian Boost is not like other credit repair companies. Plus, instead of going through your credit reports searching for errors, Experian Boost allows consumers to link bank accounts to add on-time payments from bills, like utility cellphone bills.

On-time payments are a huge determining factor in your credit score. By allowing you to add more on-time payments, Experian helps you raise your credit score, which it claims to do instantly. The free service scans your linked bank accounts, looking for eligible payments.

From there, Experian goes to work to boost your credit score. According to Experian, your account information remains private. Experian Boost also gives you free access to your credit report and FICO score. Experian Boost is also accessible through the Experian mobile app, available on iOS and Android.

com offers three tiers of credit repair services. The Direct plan is the cheapest option and comes with bureau challenges, inquiry assists, goodwill intervention and quarterly credit score updates.

com uses a three-step process to repair credit for customers:. The Advanced plan steps up customer protection even further, monthly credit score updates, more bureau challenges, more creditor interventions and cease and desist interventions.

If protecting your identity is important to you, the Advanced package may be worth the extra cost. com is owned by the same parent company as Lexington Law. Like its sister company, CreditRepair.

com customers get access to a mobile app to track credit repair progress. Credit Saint has an A rating with the Better Business Bureau, and all packages come with a day money-back guarantee. Improving your credit score is critical to your financial stability and well-being.

By understanding how to leverage you credit score, you can gain access to higher lines of credit, qualify for a mortgage, snag a credit card with Couples who sign up together save half on the second member.

With Sky Blue, you get up to 15 items five per bureau every 35 days. They also supply goodwill and cease and desist letters for all customers.

Sky Blue analyzes your reports to find items to dispute and guides you with a plan of action to correct your reports. There are no extra charges for premium services with Sky Blue Credit Repair.

The Credit People offer many of the same services as other credit repair companies. The difference is that they provide one of the best money-back guarantees in the business. For those who sign up for flat-fee pricing, the money-back guarantee extends to six months.

Customer support is available via phone, chat and email. The Credit People also offer a free credit consultation so you can try them out before buying a credit repair package.

Credit repair companies can help you if you have bad credit or errors on your credit reports. Alternatives to credit repair companies exist that can help boost your credit score without paying costly monthly fees.

UltraFICO Score can help boost your credit score. Users connect checking, savings and other bank accounts to the service. UltraFICO Score looks at your financial behavior through your bank accounts to potentially boost your credit score.

The company employs the latest security features to ensure your account information is protected. Some of the indicators used to boost your credit score include:.

UltraFICO Score is currently only available through a pilot program with a small group of lenders. Once the program is completed, UltraFICO Score will be available to consumers in a larger capacity. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities.

Subject to certain terms and limitations. Offer valid through March 12, Member FDIC. Offer may not be available if you live outside of the U. Bank footprint or are not an existing client of U. Bank or State Farm. For new Chase business checking customers with qualifying activities.

If you have a low credit score, the likelihood of being approved for a new credit card is slim. Another option is to apply for a secured credit card. Unlike a traditional credit card, your card is secured through a cash deposit instead of a credit check.

Secured credit cards typically come with lower credit limits. Your credit card activity is reported each month to credit bureaus. Some card issuers will review your account activity and possibly upgrade you to an unsecured credit card.

If you're struggling with poor credit or bad credit, credit repair companies could be your gateway to improved credit. Be sure to weigh the cost of using a credit repair service versus doing all of the legwork yourself. Using a credit repair company might make sense if any of the following apply to you:.

To open a dispute, contact the credit bureau whose report contains the potential errors. Experian offers three ways to initiate a credit report dispute—by phone, by mail and online.

You can contact Experian by phone using the number listed on your Experian credit report. You can also mail in your dispute to: Experian, P. Box , Allen TX You can also track existing disputes here. Experian sends emails when a dispute is started along with updates throughout the process.

Most Experian disputes are processed within 30 days. You can dispute your TransUnion credit report online or via phone or mail. Your phone request must include the following information:. Mail-in disputes should be sent to: TransUnion Consumer Solutions, P. Box , Chester PA You can file a credit report dispute with Equifax online.

Best Credit Repair Companies Of January ; Best for Budgeting and Bill Tracking. The Credit Pros. The Credit Pros ; Best for Simple Credit Credit Saint: Best Credit Repair Company Overall Founded in , Credit Saint is one of the original credit repair agencies that has helped Best Credit Repair Companies of January · Credit Glory: Best for customer satisfaction · The Credit Pros: Prosperity Plan: Best for