To qualify for a pledged-asset mortgage, the borrower usually needs to have investments that have a higher value than the amount of down payment. If a borrower pledges security and the value of the security decreases, the bank may require additional funds from the borrower to make up for the decline in the asset's value.

Although the borrower retains discretion as to how the pledged funds are invested, the bank may impose restrictions to ensure the pledged assets are not invested in financial instruments that are deemed risky by the bank.

Such risky investments may include options or derivatives. Further, assets in an individual retirement account IRA , k , or other retirement accounts cannot be pledged as assets for a loan or mortgage. The use of pledged assets to secure a note has several advantages for the borrower. However, the lender will demand a specific type and quality of investments before they will consider underwriting the loan.

Also, the borrower is limited to the actions they may take with the pledged securities. In dire situations, if the borrower defaults they will lose the pledged securities as well as the home they purchased. The borrower must continue to report and pay taxes on any earnings they receive from the pledged assets.

However, since they were not required to sell their portfolio holdings to make the down payment, it will not place them into a higher tax income bracket. The ability to trade the pledged securities might be limited if the investments are stocks or mutual funds.

Pledging assets for the loans of a relative carries default risk since there is no control over the borrower's repayment. If you pledge your assets as collateral for a loan, you will still own the pledged collateral.

If you fail to make payments according to the terms of the loan, the lender could seize the collateral and you would no longer own it at that time.

You can use a car as collateral for some personal loans. You must have equity in the car, or value that is paid off. If you have trouble getting a personal loan due to bad credit, you may consider using your card as collateral.

However, if you cannot make the payments, the lender will be able to repossess your car to pay off the loan. The main downside with a pledged asset mortgage is that you risk losing your asset as well as your home to the lender if you cannot make the mortgage payments according to your loan terms.

Pledged collateral can provide a number of benefits, but there are risks to consider as well. If you are considering using collateral for your mortgage, consider consulting a financial advisor who can guide you through the options and their impact on your financial situation.

Wells Fargo Advisors. Charles Schwab Bank. Morgan Stanley Home Loans. Consumer Financial Protection Bureau.

When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Trending Videos. Coming up with a down payment is particularly challenging for people who have never owned a home before, but many incentives exist for first-time buyers.

Furthermore, more people qualify for these benefits than you might think. If you haven't owned a home in three years or only owned a house with a spouse, then you can access incentives for new homebuyers.

You may also be able to get these benefits if your only home is a manufactured home that is permanently affixed to a permanent foundation. The Department of Housing and Urban Development HUD supports programs for first-time buyers, and some states have first-time homebuyers savings programs.

With the accumulated interest, the savings accounts could potentially help some buyers save for the down payment on their homes at a faster rate than they would have been able to without the account.

What is more, there are programs to help Native American first-time homebuyers. Do not assume you cannot afford a down payment just because nobody in your family ever owned a home. Also, be aware that demanding an overly high down payment can be a sneaky way to discriminate against minorities.

Mortgage lending discrimination is illegal. If you think you've been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take.

One such step is to file a report to the Consumer Financial Protection Bureau or with the U. Department of Housing and Urban Development HUD. The debt-to-income ratio is a metric that measures how much of your monthly gross income goes to debt payments.

Debt payments can be from a mortgage, student loans, and credit cards. Some lenders will accept a lower down payment, but borrowers might pay for it in the form of a higher interest rate. As a result of the more stringent income requirements, would-be borrowers may need to get a part-time job to supplement their income.

The extra money should be placed in a savings vehicle to be used only for the down payment. People ready to take the step into homeownership typically have a lot of stuff they've acquired along the way. Those things may seem worthless to the owner, but that old car or piece of furniture might be what someone else is interested in buying.

Selling used goods can help supplement your income and raise much-needed cash for the down payment. The Internet makes it easy to sell everything from clothes to electronics. Some of the sites let you do it for free while others take a cut of your profit.

If you want to free up cash to save for a home, downsizing your lifestyle could go a long way in saving money. For example, you could move into a smaller apartment or studio apartment to save on rent and utilities.

If you're a couple with two cars, perhaps selling one of them to cut down on car loans can help cut expenses. Even cutting back on dining out or buying a coffee can add up and steadily increase the amount you save. Lenders will want to see a gift letter that confirms a lump sum provided by a family member is gift, not a loan that is to be repaid in the future.

This legal document must be signed by the donor. Asking family or friends for money may not seem like the ideal option. However, if you have a favorite aunt, grandparent, or cousin that has a lot of cash, it could be a win-win for both of you.

If you're gifted some or all of your down payment, it will not only be a good deed, but they can get a tax write-off from it. The Internal Revenue Service IRS allows people to give gifts worth thousands of dollars per year tax-free for the donor and the recipient.

The gift tax exemption depends on the amount gifted. Please check the IRS site for any changes in tax laws before accepting cash gifts. If a gift is out of the question, ask to borrow the money, and come up with a repayment schedule that also includes interest.

However, there are several downsides. Second, lower down payments result in higher loan amounts, increasing the required monthly payment sought after by the bank. Federal Housing Administration FHA mortgages require down payments of only 3.

In addition, VA and USDA loans are two other government-sponsored loans that may be secured with no money down. REITs can provide a steady stream of income through rental payments and capital appreciation.

It's essential to understand the pros and cons before investing in REITs. While they offer the potential for attractive returns, they also come with their own set of risks.

Factors such as changes in interest rates, property market fluctuations, and economic conditions can impact the performance of REITs.

Therefore, thorough research and careful consideration are necessary to ensure they align with your investment goals and risk tolerance. If you're new to investing or unsure where to start, robo-advisors can be a convenient option. These online platforms use algorithms to create and manage investment portfolios based on your risk tolerance and goals.

Robo-advisors offer low-cost, automated investment services, making them accessible to a wide range of investors. While robo-advisors can provide a hands-off approach to investing, it's still important to review your portfolio periodically and make adjustments as needed.

Regularly monitoring your investments and staying informed about market trends can help ensure your down payment funds continue to grow. As you navigate investment options, strike a balance between liquidity and return.

While higher-risk investments may offer greater potential returns, they also come with less liquidity, meaning you may not be able to access your funds when needed.

It's crucial to evaluate your investment goals and choose investments that match both your risk tolerance and down payment timeline. Consider the time horizon for your down payment.

If you're planning to purchase a home in the near future, it may be wise to prioritize investments with higher liquidity to ensure you have access to your funds when the time comes.

On the other hand, if your down payment goal is several years away, you may have more flexibility to invest in higher-risk assets with the potential for greater returns.

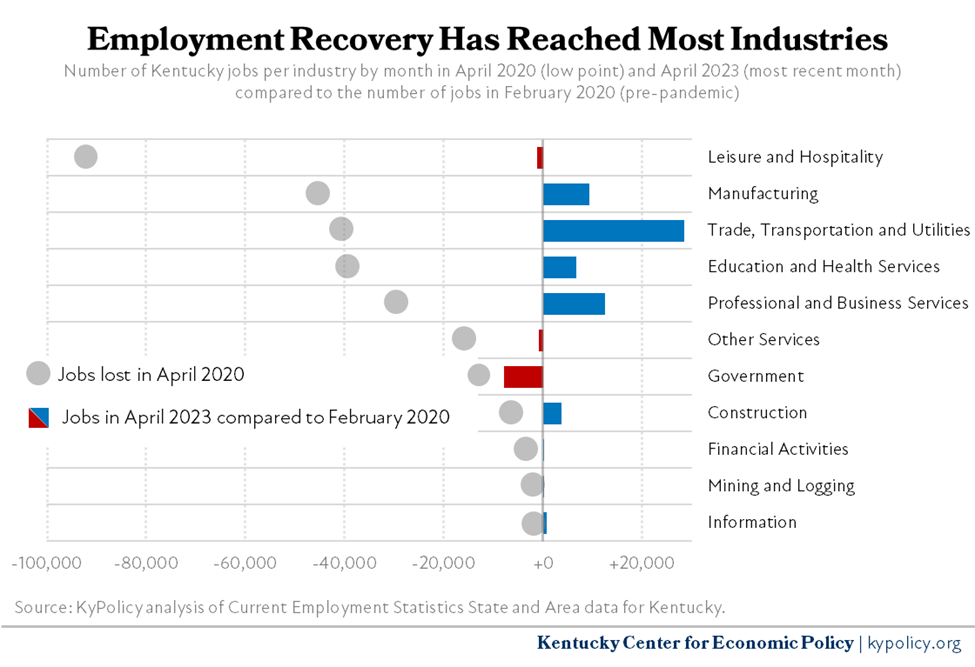

Economic cycles can significantly impact investment strategies. During periods of economic uncertainty, investors may flock to lower-risk assets, such as government bonds or stable dividend-paying stocks.

This flight to safety can lower potential returns for riskier investments. Staying informed about economic trends and understanding how they can affect your investment strategy is crucial.

By keeping an eye on market indicators, such as interest rates, inflation rates, and GDP growth, you can make more informed decisions about your down payment investments.

Adapting your investment strategy to align with the current economic environment can help you navigate potential risks and capitalize on opportunities.

Investing for a down payment requires careful planning and consideration. It's important to consult with a financial advisor who can provide personalized advice based on your unique financial situation and goals. With the right investment strategies in place, you can grow your down payment funds and move closer to achieving your dream of homeownership.

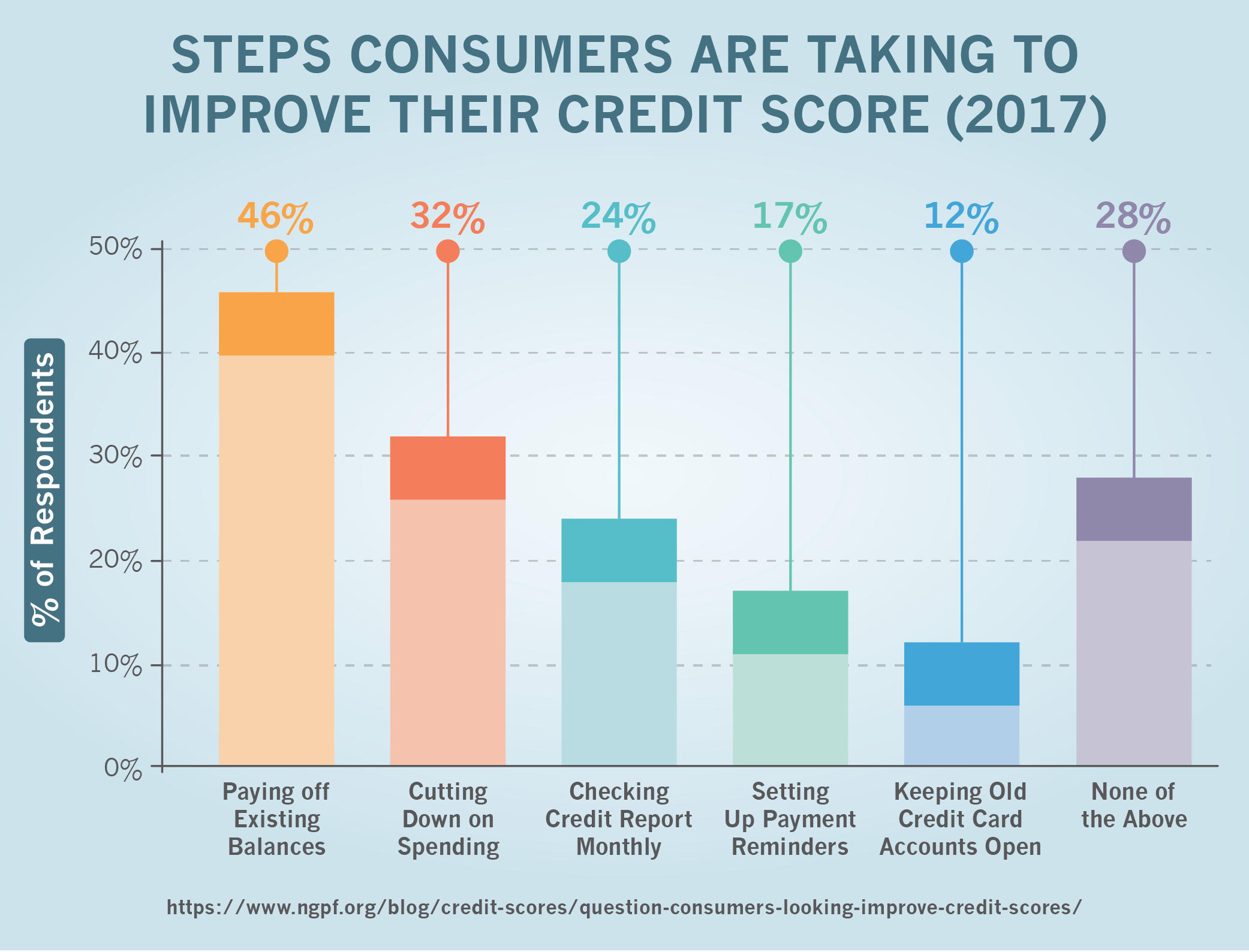

In addition to saving for a down payment, managing your credit and debt is crucial for securing a mortgage and favorable terms.

A strong credit score is essential to secure a mortgage with favorable terms. Review your credit report regularly for any errors or discrepancies. Pay your bills on time, keep credit card balances low, and avoid opening new lines of credit before applying for a mortgage.

Lenders also consider your debt-to-income ratio DTI when evaluating your mortgage application. Lowering your DTI by paying off high-interest debts can improve your chances of mortgage approval and increase the loan amount you qualify for.

Regularly reviewing your credit report allows you to identify and address any errors or inaccuracies. Dispute any incorrect information promptly to ensure your credit score accurately reflects your creditworthiness.

Focusing on paying off high-interest debts can save you money in the long run and improve your overall financial health. Consider strategies like the debt snowball or debt avalanche method to tackle debts systematically and efficiently.

While it's important to maintain a positive credit history through responsible credit card usage, be mindful of your savings goals. Avoid excessive credit card debt and aim to pay off balances in full each month to maintain financial stability while saving for your down payment.

Co-signing for loans or credit accounts can impact your mortgage eligibility. When considering co-signing, understand the potential drawbacks and implications it may have on your own ability to secure a mortgage. Co-signing should only be done after careful consideration and a thorough understanding of the risks involved.

Saving for a down payment may seem daunting, but with the right strategies and mindset, it's attainable. Understand the importance of down payments, explore effective saving strategies, leverage government assistance programs, consider investment opportunities, and manage your credit and debt wisely.

By following this step-by-step guide, you'll be well on your way to achieving your goal of homeownership and making your dream home a reality. Always consult a professional financial advisor before making investment decisions.

Lifestyle · Personal Finance. By GGI Insights February 11, Saving for a down payment is often one of the most significant challenges prospective homeowners face. With rising housing costs and strict lending requirements, it can feel almost impossible to save up enough money to secure your dream home.

Table of contents. Understanding Down Payments in Home Buying Before we delve into the saving strategies, it's essential to understand the role of a down payment in the mortgage process.

Streamline work with Notion. Sponsored by Notion. Popular Insights:. Support Impact Mart Your Purchase Fuels Our Mission. Thank You for Being Part of the Change!

Celebrity Marketing: Merging Hollywood Glam and Social Media Stardom. Business Roadmap: The Tactical Guide from Business Idea to Execution.

Business Proposal Format: Blueprint for Influential Presentations. Business Plan Writers: Expert Writing Strategies for Unmatched Success. Business Growth Strategy Framework: Blueprint for Accelerated Success. Best Sales Training Programs: Crafting the Ultimate Success Strategy.

Chief Growth Officer: Essential Traits and Skills for Modern Success. Buyers Journey: Mapping the Comprehensive Path to Purchase Decisions.

Business Scaling Strategy: Expert Insights for Seamless Expansion. Business Growth Strategies: A Definitive Guide to Scaling Profitably.

In such cases, exploring alternative financing options can be a game-changer. One such option is lease-to-own agreements, which offer a unique Check how to cut down your mortgage costs, including how to reduce your monthly payments and switch mortgage lender If you're eligible for a loan, but can't afford the down payment, you may be able to qualify for down payment assistance. Grants, loans and assistance programs

:max_bytes(150000):strip_icc()/how-to-get-personal-loans-with-no-income-verification-7153103-final-4a9099bdba6e4405a5615bc6cd0fd0a9.jpg)