Loan repayment schedule

You might discover you need to adjust your down payment to keep your monthly payments affordable. You can also see the loan amortization schedule, or how your debt is reduced over time with monthly principal and interest payments.

If you want to pay off a mortgage before the loan term is over, you can use the calculator to figure out how much more you must pay each month to achieve your goal.

Other mortgage calculators can answer a variety of questions: What is your DTI, or debt-to-income ratio? Should you take out a year mortgage or a year? Fixed interest rate or variable?

If you fail to make the monthly payments, the lender can foreclose and take your home. Home equity loans, sometimes called second mortgages, are for homeowners who want to borrow some of their equity to pay for home improvements, a dream vacation, college tuition or some other expense.

A home equity loan is a one-time, lump-sum loan, repaid at a fixed rate, usually over five to 20 years. A HELOC is a home equity loan that works more like a credit card. You are given a line of credit that can be reused as you repay the loan. The interest rate is usually variable and tied to an index such as the prime rate.

Our home equity calculators can answer a variety of questions, such as:. Should you borrow from home equity? If so, how much could you comfortably borrow?

Are you better off taking out a lump-sum equity loan or a HELOC? The first is the systematic repayment of a loan over time. The second is used in the context of business accounting and is the act of spreading the cost of an expensive and long-lived item over many periods. The two are explained in more detail in the sections below.

When a borrower takes out a mortgage, car loan, or personal loan, they usually make monthly payments to the lender; these are some of the most common uses of amortization.

A part of the payment covers the interest due on the loan, and the remainder of the payment goes toward reducing the principal amount owed. Interest is computed on the current amount owed and thus will become progressively smaller as the principal decreases. It is possible to see this in action on the amortization table.

Credit cards, on the other hand, are generally not amortized. They are an example of revolving debt, where the outstanding balance can be carried month-to-month, and the amount repaid each month can be varied. Please use our Credit Card Calculator for more information or to do calculations involving credit cards, or our Credit Cards Payoff Calculator to schedule a financially feasible way to pay off multiple credit cards.

Examples of other loans that aren't amortized include interest-only loans and balloon loans. The former includes an interest-only period of payment, and the latter has a large principal payment at loan maturity. An amortization schedule sometimes called an amortization table is a table detailing each periodic payment on an amortizing loan.

Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. Each repayment for an amortized loan will contain both an interest payment and payment towards the principal balance, which varies for each pay period.

An amortization schedule helps indicate the specific amount that will be paid towards each, along with the interest and principal paid to date, and the remaining principal balance after each pay period. Basic amortization schedules do not account for extra payments, but this doesn't mean that borrowers can't pay extra towards their loans.

Once cards or other revolving credit lines are issued, basic monthly principal payments and interest depend on the terms and conditions contained within your individual cardholder agreement.

While interest rates are tied to indicators like the prime rate, each card carries its own terms. Good credit stems for several factors, each outlined on your most recent credit report. The numbers of cards you use regularly, as well as those which remain mostly idle, are considered alongside average balances and missed-payment histories.

Mortgages, car loans and other personal loans are also considered when determining your credit score. Installment credit represents borrowing usually associated with the two major purchases concerning consumers: Homes and vehicles.

Repayment terms vary, according to lender terms and how much money is borrowed, but monthly payments always contain interest obligations. Each installment also contains a contribution toward repaying principal, which is based on loan size and amortization schedule.

From the moment you initiate your installment loan, it is possible to look at a comprehensive payment schedule, outlining your repayment obligations over the course of the loan's life. If your financing is structured using fixed rates then the schedule only changes if you pay ahead, which is allowed under some installment contracts.

In other words, there are no surprises for consumers, who know exactly what their monthly home mortgage payments and vehicle loan obligations will be. Revolving credit is a more open-ended arrangement, allowing purchases to be made on an ongoing basis. Credit cards are the most widely used form of revolving credit, providing grace periods for customers to pay back money borrowed, without interest.

After a certain period of time, interest begins to accumulate and principal balances roll over into subsequent billing periods. Unlike installment payments, monthly revolving credit is based on spending activity occurring during the billing cycle.

Basic interest calculator helps track monthly interest payments, clearly illustrating which portion of your revolving credit payment is applied toward reducing your principal balance.

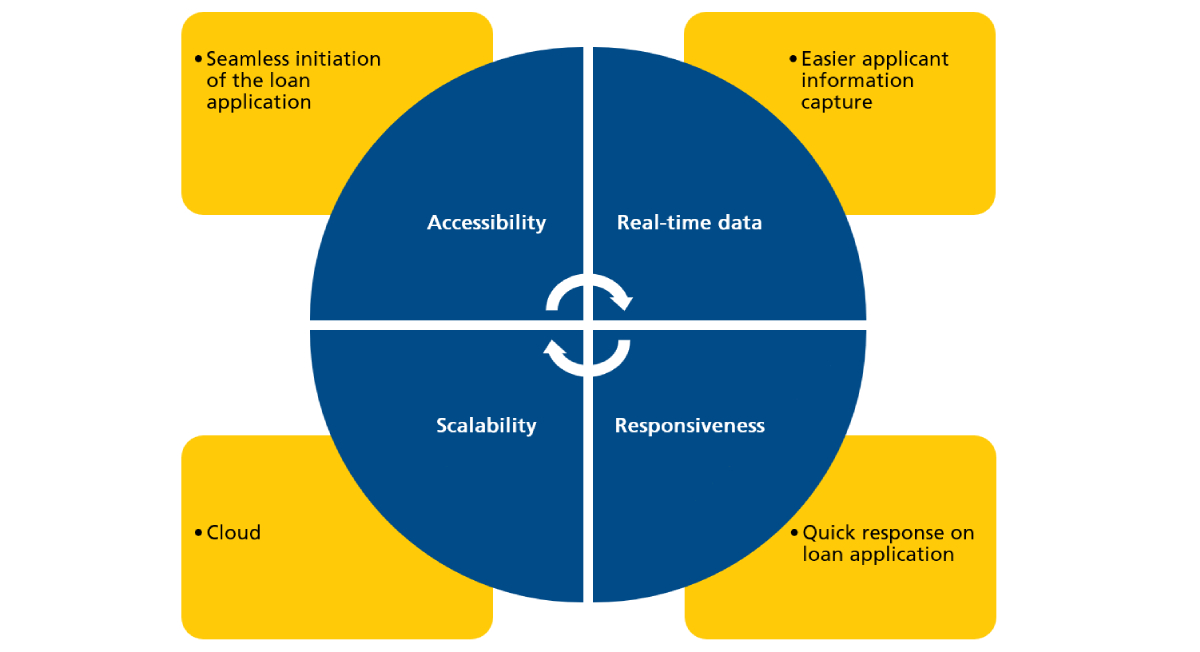

Application can be a bit time-consuming, which is why it is important to prepare all of the necessary documents beforehand to speed up the approval process.

Some kinds of loans such as mortgages and auto loans are secured by the title on the property. The length of the approval process will depend on the lender type. For credit unions and banks, the approval process can take anywhere between a few days to a few weeks.

Banks normally have stricter loan processes and higher approval standards than nonbank lenders. If applicants opt to lend from peer-to-peer lenders, loans can get approved within a few minutes up to a few business days.

Approvals tend to be faster if the applicant has already prepared all of the needed documents and other information beforehand. Repeat borrowers are likely to be approved quickly if they repaid on time during previous loans.

Online direct lenders tend to have the fastest processing periods. The application process usually takes a few minutes, and if applicants submit all of the needed documents, financing can be approved almost immediately. If we compare the average interest rate of personal loans to other forms of financing, we can see they have rates below that of a credit card, though charge a bit more than most secured forms of financing.

The big benefits of personal loans for those who take them is they are unsecured and the approval type is typically faster than other forms of financing. Credit score ratings may vary depending on the standard and the industry since there are industry-specific scores and several standard scores utilized across different markets.

The most popular scores are FICO® Scores and VantageScore. According to FICO® Scores, a credit rating above is tagged as Excellent, credit scores are Very Good, scores are Good, is Fair, is Poor, and is Very Bad. If an applicant has a poor score , then the applicant will either receive a loan rejection from the lender or be required to pay an upfront fee or a significantly higher rate to qualify for financing.

Applicants whose score falls below Fair are usually considered as subprime borrowers by lending institutions. Credit scores under the Good category are generally safe from rejections, while individuals with a rating of Very Good usually receive lower loan rates from lenders. Lastly, applicants that fall under the Exceptional category receive the best borrowing rates.

VantageScore ratings use almost the same ratings as FICO® Scores albeit with minor differences in the scoring range.

Simply put, an amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Amortization Loan Simulator helps you estimate monthly student loan payments and choose a loan repayment option that best meets your needs and goals How to create an amortization schedule in Excel · 1. Create column A labels · 2. Enter loan information in column B · 3. Calculate payments in cell