Debt consolidation alternatives

But this is considered a desperation measure for a reason. The results from this form of debt consolidation definitely are mixed.

Do all the math before you choose this option. It should be noted that attorneys also offer debt settlement in addition to companies like National Debt Relief. Consumers have numerous choices for relief through debt consolidation programs. Making the right choice involves an honest assessment of your income and spending habits.

In other words: a budget! If you can create a budget that accurately reflects your spending, you will be in the best position to decide how much you can afford each month to dedicate to eliminating debt.

HOW IT WORKS : A credit counselor asks questions about your income and expenses to see if you qualify for a debt management program. If you enroll in the program, you agree to have InCharge debit a monthly payment, which will then be distributed to your creditors in agreed upon amounts.

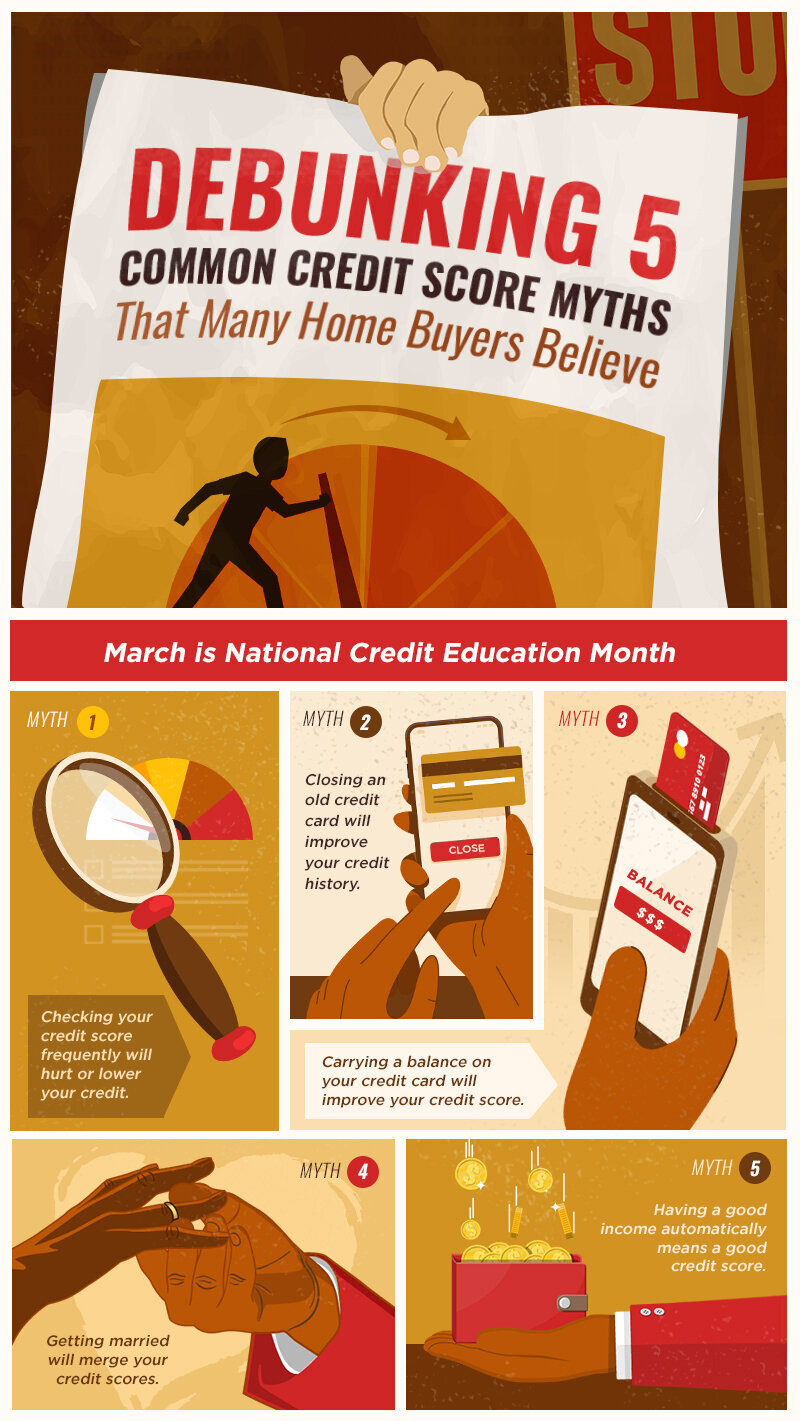

CREDIT SCORE IMPACT: Typically, credit scores will improve after six months of on-time payments. There will be a drop initially due to closing all but one of your credit card accounts. HOW IT WORKS : First, you must fill out an application and be approved for a loan.

Your income and expenses are part of the decision, but credit score is usually the deciding factor. If approved, you receive a fixed-rate loan and use it to pay off your credit card balances. You then make monthly payments to Avant to pay off your loan.

CREDIT SCORE IMPACT: Applying for a loan has no effect on your credit score, but missing payments will hurt your score. Conversely, making on-time payments should improve it.

You open an escrow account and make monthly payments set by National Debt Relief to that account instead of to your creditors.

When the balance has reached a sufficient level, NDR negotiates with your individual creditors in an attempt to get them to accept less than what is owed. If a settlement is reached, the debt is paid from the escrow account. Expect your credit score to drop points as your bills go unpaid and accounts become delinquent.

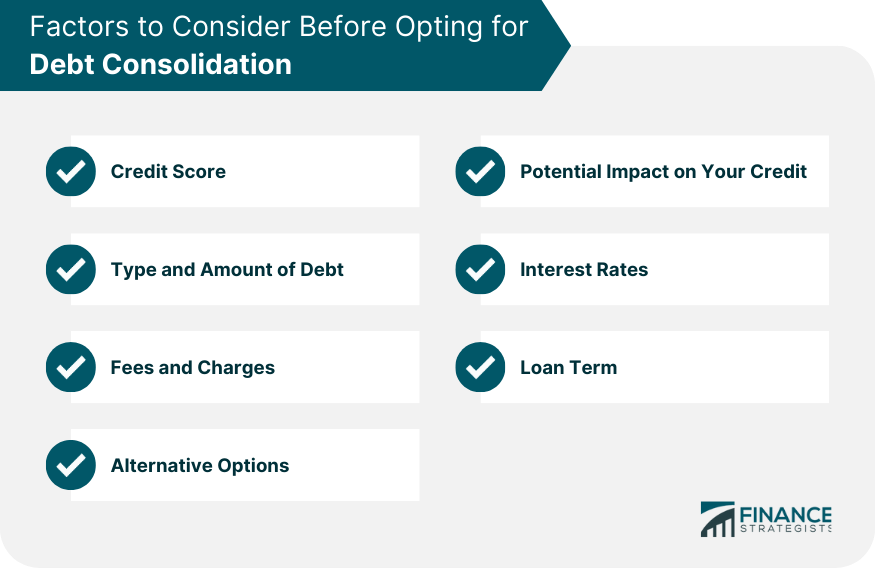

There are many avenues to eliminating debt through debt consolidation, but there are just as many detours that will compound your problem if you are not paying attention.

The first thing to look at before joining a debt consolidation program is confidence that the agency, bank, credit union or online lender is there to help you, not to make money off you.

You should be asking how long they have been in this business; what their track record for success is; what do the online reviews say about customer experience; and how much are you really going to save by using their service?

The last question is the most important because you can do any of these debt consolidation programs yourself. So, if the fees charged make it a break-even exchange, there really is no reason to sign up. Your total cost in a program should save you money while eliminating your debt.

Credit consolidation companies work by finding an affordable way for consumers to pay off credit card debt and still have enough money to meet the cost of basic necessities like housing, food, clothing and transportation.

They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of credit card debt relief. Banks, credit unions, online lenders and credit card companies fall into the first group.

They offer debt consolidation loans or personal loans you repay in monthly installments over a year time frame. They start by reviewing your income, expenses and credit score to determine how creditworthy you are. Your credit score is the key number in that equation.

The higher, the better. Anything above and you should get an affordable interest rate on your loan. Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below The second category — companies who provide credit card consolidation without a loan — belongs to nonprofit credit counseling agencies like InCharge Debt Solutions.

InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options.

Based on the information provided, they recommend debt relief options such as a debt management program , debt consolidation loan , debt settlement or filing for bankruptcy as possible solutions.

If the consumer chooses a debt management program, InCharge counselors work with credit card companies to reduce the interest rate on the debt and lower the monthly payments to an affordable level.

Debt management programs can eliminate debt in three years, but also can take as many as five years to complete. If the debt has spiraled out of control, counselors could point you toward a debt settlement company or a bankruptcy lawyer.

The actual amount debt forgiven often is far less than promised. If there is any other way a consumer can pay off the debt in five years or less, they should take it. If not, bankruptcy is a viable option. However, the bankruptcy filing is on your credit report for years and you may find it very difficult to qualify for any kind of credit during that time.

The answer likely depends on your situation. Each program is geared toward a different individual. Nonprofit debt consolidation works in most cases. There is very little risk, and the program is really designed to be a helping hand.

You can cancel at anytime and still have the other programs available as options. When you take out a debt consolidation loan, you are converting your credit card debt into loan debt. That closes the door on the possibility of later enrolling in a nonprofit debt consolidation program.

Debt settlement requires you to be all in. In order for it to work, you have to create bargaining leverage by stopping all payments to your creditors. Once you go down this road there's no coming back, but if your debts are already in collections, settlement and bankruptcy might be your only option.

If you don't know which program is right for you, credit counseling can help. Credit counselors are certified professionals, who know these programs in and out. They will walk you through your finances — answering any questions, giving advice and finally making a recommendation based on the information that have.

At the end of the day, the program that's right for you is the one that gets you across the finish line. A debt consolidation company is one that combines all credit card debt into a single monthly payment.

It could be a nonprofit credit counseling agency using a debt management program with no loan involved; a bank, credit union or online lender offering a debt consolidation loan; or a debt settlement company that requires a lump-sum payment to pay off the debt. The government is not involved in any debt consolidation programs.

The government does provide grants to nonprofit credit counseling agencies that work with consumers to solve problems with credit card debt. However, there are several hurdles to clear before you get one. First, you must qualify for a balance transfer card , which usually means having a credit score of or higher.

That could add hundreds of dollars to the amount owed. Finally, if you continue using the credit card to pay for shopping, you may end up owing more than what you started with. Contact a nonprofit credit counseling agency like InCharge Debt Solutions to find out which form of debt consolidation best suits your situation.

The counselors at nonprofit credit counseling agencies are trained and certified by a national organization to act in the best interests of the consumer. They help create an affordable monthly budget based on your income and expenses.

Based on that budget, they recommend a nonprofit debt consolidation, debt consolidation loan or debt settlement program. The advice is free. The consumer selects the form of consolidation they are most comfortable with.

You can consolidate debt with bad credit through a nonprofit debt consolidation program or debt settlement program. Qualifying for a debt consolidation loan, however, is driven by your credit score so bad credit could mean high interest rates or not qualifying at all. Nonprofit debt consolidation and debt consolidation loans may have a negative impact at first, but if you complete the program, both should help raise your credit score.

A debt settlement program has a negative effect that will last for seven years. Credit cards are, by far, the most popular form of debt to consolidate because of the high-interest rate attached to them.

Consolidation works best when the interest rate is reduced and monthly payments are lowered because of it. It is possible, though not advisable, to include medical bills, rent, utilities, phone bills and other forms of unsecured debt in a consolidation loan, but since none of those typically has an interest rate attached, there is no gain from consolidating them.

Nonprofit debt consolidation and debt settlement are voluntary programs. To cancel, you need to call, email or fax the agency where you enrolled. Tom Jackson focuses on writing about debt solutions for consumers struggling to make ends meet.

His background includes time as a columnist for newspapers in Washington D. Along the way, he has racked up state and national awards for writing, editing and design. A University of Florida alumnus, St. Louis Cardinals fan and eager-if-haphazard golfer, Tom splits time between Tampa and Cashiers, N.

Choose Your Debt Amount. consolidate debt in minutes. Your goal is to stop adding to your debt, and also to pay down the debt you already have, if you can. You can find information about budgeting and money management online, at your public library, and in bookstores. Check out this worksheet for creating and tweaking your budget.

Do it before a debt collector gets involved. Not everyone who calls saying that you owe a debt is a real debt collector. Some are scammers who are just trying to take your money. The collector has to tell you. You also can get a collector to stop contacting you, at any time, by sending a letter by mail asking for contact to stop.

For example, collectors. If you do get sued for a time-barred debt, tell the judge that the statute of limitations has run out. How long the statute of limitations lasts depends on what kind of debt it is and the law in your state — or the state specified in your credit contract or agreement creating the debt.

The clock resets and a new statute of limitations period begins. Contact your lender immediately. Your lender might be willing to.

Before you agree to a new payment plan, find out about any extra fees or other consequences. Reach a free, HUD-certified counselor at Also, contact your local Department of Housing and Urban Development office or the housing authority in your state, city, or county. Never pay a company upfront for promises to help you get relief on paying your mortgage.

Learn the signs of a mortgage assistance relief scam and how to avoid them. Before you can get back your repossessed car, you may have to pay the balance due on the loan, plus towing and storage costs. If you have federal loans government loans , the Department of Education has different programs that could help.

Applying for these programs is free. Find out more about your options at the U. gov or by contacting your federal student loan servicer. With private student loans, you typically have fewer options, especially when it comes to loan forgiveness or cancellation. To explore your options, contact your loan servicer directly.

Student loan debt relief companies might say they will lower your monthly payment or get your loans forgiven , but they can leave you worse off. Instead of paying a company to talk to your creditor on your behalf, remember that you can do it yourself for free.

Find their phone number on your card or statement. Be persistent and polite. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment plan that lowers your payments to a level you can manage.

If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt.

In fact, the creditor could sell your debt to a debt collector who can try to get you to pay. But creditors may be willing to negotiate with you even after they write your debt off as a loss.

A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials and workshops, and help you make a plan to repay your debt.

Its counselors are certified and trained in credit issues, money and debt management, and budgeting. Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems.

Your first counseling session will typically last an hour, with an offer of follow-up sessions. Most reputable credit counseling organizations are non-profits with low fees, and offer services through local offices, online, or by phone.

If you can, use a credit counselor you can meet in person. Non-profit credit counseling programs are often offered through. Your financial institution or local consumer protection agency also may be able to refer you to a credit counselor. Some credit counseling organizations charge high fees, which they might not tell you about.

Choose an organization that:. Be sure to get every detail and promise in writing, and read any contracts carefully before you sign them.

A good credit counselor will spend time reviewing your specific financial situation and then offer customized advice to help you manage your money. But if a credit counselor says a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor.

You want to be sure they offer the types of modifications and options the credit counselor describes to you. Whether a debt management plan is a good idea depends on your situation. A successful debt management plan requires you to make regular, timely payments, and can take 48 months or more to complete.

You might have to agree not to apply for — or use — any more credit until the plan is finished. No legitimate credit counselor will recommend a debt management plan without carefully reviewing your finances.

Debt settlement programs are different from debt management plans. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt.

They agree that this amount will settle your debt. These programs often encourage you to stop making any monthly payments to your creditors. Debt settlement programs can be risky. Even if a debt settlement company does get your creditors to agree, you still have to be able to make payments long enough to get them settled.

You may not be able to settle all your debts. The process can take years to complete. If you do business with a debt settlement company, you may have to put money in a special bank account managed by an independent third party. The money is yours, as is the interest the account earns.

Before you sign up for its services, the company must tell you.

There are many options to consolidate debt, including balance transfer credit cards, home equity loans, debt consolidation loans and peer-to- Debt relief through a debt management plan A debt management plan allows you to pay your unsecured debts — typically credit cards — in full 4 Alternatives to Debt Settlement · 1. Credit Counseling · 2. Debt Consolidation · 3. Balance Transfer Card · 4. DIY Debt Negotiation. One major