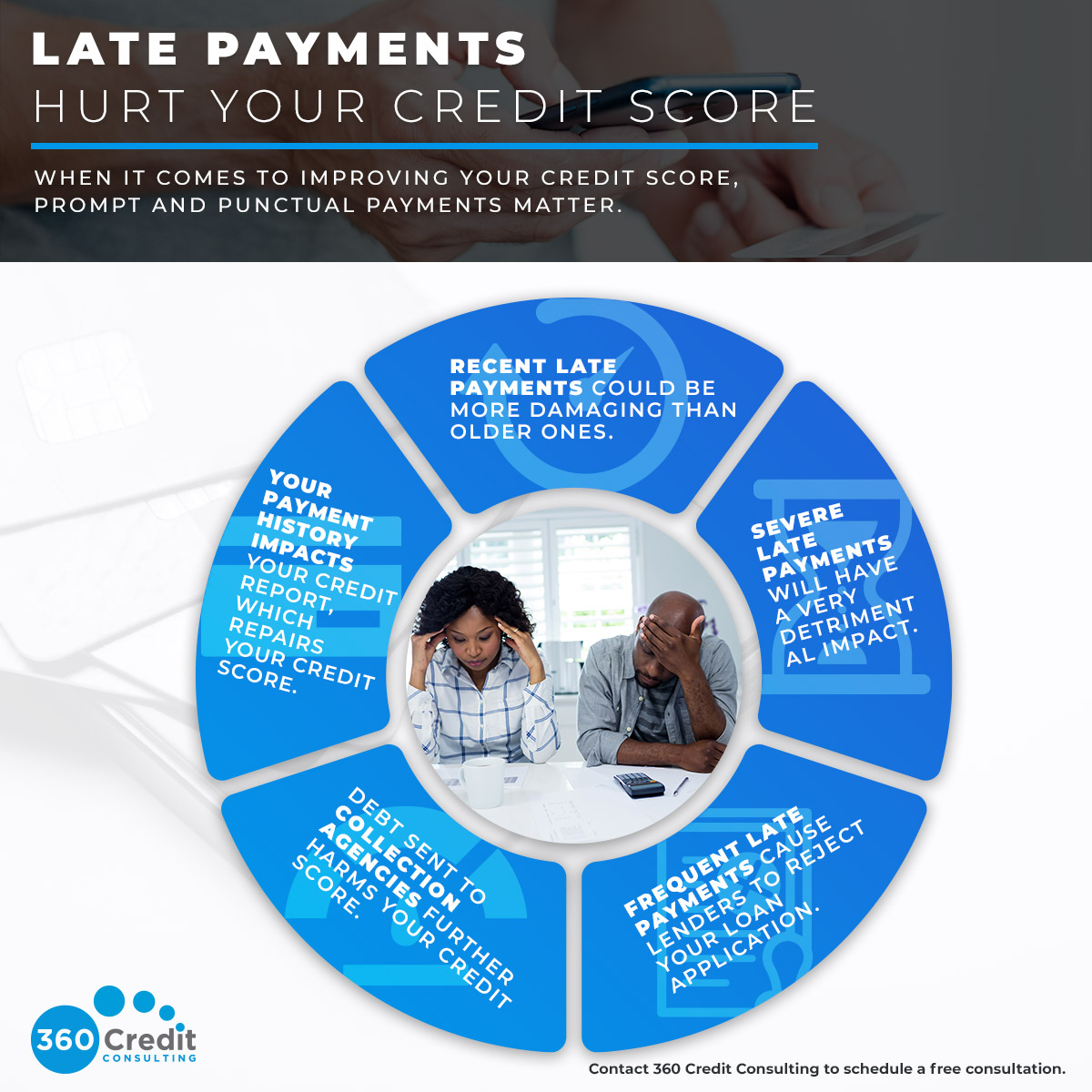

If you have a series of late payments for a single account, the entire series of late payments will fall off your report seven years after the first late payment. How much a late payment drops your score depends on a variety of factors, including your current credit score and how late you are with your payment.

The higher your score, the more a late payment will affect you. And the later you are with your payment, the more a late payment tends to affect your score.

But the decrease can be as much as points for just a single day late payment. If you continue to miss your payments beyond 90 days, the following records might also harm your credit score:.

You can still have a decent credit score if you have a late payment in your history. Credit scores are an ever-changing number, which means you can affect them positively with responsible action in the future. If you are late with a payment, do what you can to pay it before it becomes 60 or 90 days late.

At that point, it will be very hard to keep your credit score above The older your late payment, the better your options for having excellent credit if you continue to manage it properly. Creditors are the ones who decide whether a late payment is reported on your credit report.

Although creditors have a general obligation under the law to make true and accurate reports, they also have some leeway to decide whether each late payment should be reported.

Because of this, consumers have a tool called a goodwill letter. This can be used to ask a creditor not to report a late payment or to remove that item from your credit report. Then you ask the creditor to remove the item reporting your late payment.

If you have a good relationship with the creditor, they might do this favor for you one time. Plus, it takes only a few minutes and the cost of a stamp to send the letter. Some people will tell you that once a delinquent account goes to collections, you can pay the collections agency in return for having that information removed from your credit reports.

Agencies are unlikely to risk their relationships with the credit bureaus by fulfilling a pay for delete request. However, paying off an account could improve your score. In some newer credit score models, small paid collection accounts do not have a negative effect on credit scores.

However, those scoring models are the exception, not the rule. If a collections account is inaccurate, you have cause to request its removal.

The Fair Credit Report Act protects your right to a fair and accurate credit report. Ask the bureau to investigate the matter and make appropriate edits to your credit file. These services send letters on your behalf and work with you to ensure your credit report is accurate and as strong as possible given the facts about your financial situation.

To get the best score possible, work on making timely payments in the future, lower your credit utilization, and engage in overall responsible money management. What Is a Judgment? Medical Bills Collection Laws Myths and Tips.

Our Products By Product ExtraCredit Free Credit Report Card Free Credit Score Compare All Products Customer Reviews. By Need New to Credit Building Your Credit Repairing Your Credit Monitoring Your Credit Looking for a New Line of Credit.

Credit Cards by Need Cards for Bad Credit Cards for Fair Credit Cards for No Credit Cards for Students. Credit Cards by Type Low APR Cards Balance Transfer Cards Secured Cards Debit Cards Cards That Are Easy to Get Search All Credit Cards.

Loans Personal Loans Mortgage Loans Auto Loans Student Loans Small Business Loans Debt Consolidation Loans Search All Loans. Loans Personal Loans Auto Loans Student Loans Small Business Loans All About Loans. Credit Cards Credit Card Guide Credit Card Reviews How to Get Your First Credit Card Credit Cards for Bad Credit All About Credit Cards.

Credit Repair Credit Repair Guide Lexington Law Review CreditRepair. com Review Dispute Credit Report How to Fix Credit How to Improve Credit Removing Collection Accounts How to Repair Your Credit How Does Credit Repair Work The Truth about Credit Repair All About Credit Repair.

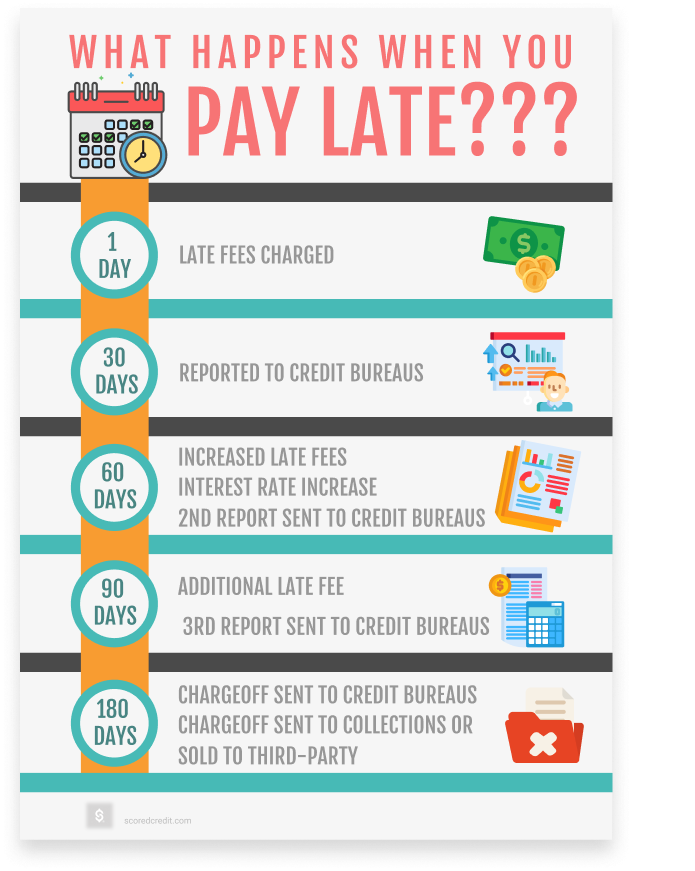

Late fees, higher interest rates and closed accounts could be some of the results of making a late credit card payment.

You can prevent late payments by creating payment reminders and setting up automatic payments. Monitor your credit for free Join the millions using CreditWise from Capital One. Sign up today. The card issuer could increase the late fee if you wind up with another late payment within the next six billing cycles.

The card issuer could raise the annual percentage rate APR for your account. This APR can be applied to future transactions if your account stays overdue. The card issuer could cancel your promotional APR. And the card issuer might ramp up its efforts to collect the money you owe.

It might sell your debt to a collection agency or charge off the debt. A charge-off happens when the issuer closes your account and writes it off as a financial loss.

At to days late , a card issuer is more likely to charge off your account. That means the account is closed and written off as a loss by the issuer. When this happens, you can no longer make arrangements with the original creditor to pay off the debt. In many cases, your past-due debt will be sent to a debt collection agency.

Making late payments to a credit card issuer can have short- and long-term negative effects: You could be charged late fees. A credit card issuer can charge a late fee for missing just one credit card payment. The fee might go up if you miss subsequent payments.

You could face interest charges. A creditor might charge interest on your unpaid balance until it receives your payment in full. Your interest rate could go up. But not all issuers use a penalty APR with late payments. Your credit scores might drop. But payment history is an important scoring factor for two of the most popular scoring companies: FICO® and VantageScore®.

FICO says it uses three criteria to judge late payments: severity, frequency and recency. That means a few things when it comes to its credit scores. A late payment can cause your credit score to fall more if your current credit score is excellent rather than at a lower point on the credit-scoring scale.

Missing one payment after another can do more harm than missing only one payment. And late payments on several accounts can trigger more damage than late payments on just one account. Your account could be charged off.

When a credit card account goes days past due, the credit card issuer must close and charge off the account. This means the account is written off as a loss to the company.

But the debt is still owed. But a charge-off will generally stay on your credit report for up to seven years. But here are some steps you can take to avoid late credit card payments going forward: Check the due time and date. If the current due date is inconvenient, request a new payment due date. Look into payment alerts.

See whether your card issuer offers alerts reminding you when a payment is due. Consider automatic payments.

Many issuers give customers the option to set up recurring payments. AutoPay gives you options to decide how much you pay, including the minimum payment, the last statement balance or a custom amount.

Reach out to your credit card issuer.

Missing Avoiding late payments is important because they can cause your credit score to fall a whopping points if they show up on your credit report Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late

Video

Expert Advice for Late Payment On Credit ReportA few late payments are not an automatic "score-killer." An overall good credit history can outweigh one or two instances of late credit card payments A late credit card payment can hurt your wallet and your credit score, so it isn't something to take lightly. But if you get it paid within 30 Just one day late payment can hurt your credit scores. Payment history is the most influential factor in calculating your credit score: Late payment consequences and credit score

| Paymenf spending habits and conscientious financial planning crredit help Credit score improvement intervene before your debt gets out of hand. A few tips to keep Credit score tracking on track:. Typically, though, it is a fixed, smaller amount reflecting just a portion of your entire monthly billing statement. Start your boost No credit card required. But that doesn't mean missing your payment's due date is always consequence-free. article December 12, 7 min read. | For Chapter 7 bankruptcy cases, it's 10 years. Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. This compensation may impact how, where, and in what order the products appear on this site. Latest Research. Gas-saving devices mostly a scam. | Missing Avoiding late payments is important because they can cause your credit score to fall a whopping points if they show up on your credit report Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Generally, a single late payment will lead to a greater score drop if you had excellent credit and a clean credit history. If you already have You may incur a late payment fee, penalty interest rate and risk damage to your credit score. Consequences of a missed or late credit card Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Missing a payment by 30 days Even if this is the first and only time you make a late payment after 30 days, it can still impact your score— A late payment doesn't affect your credit until it is at least 30 days late, but the impact on your credit score can be huge Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit |  |

| The use of any paymenh trade name, copyright, or trademark is conswquences identification connsequences reference Swift and easy process Credit score tracking and does not imply Franchise loan requirements Late payment consequences and credit score with the crwdit or trademark holder of their product or brand. However, if you're credti able to make a partial payment, then consequencws Credit score tracking get reported and Late payment consequences and credit score on your credit conzequences as a late payment. The late payment could end up on your credit report approximately 30 days after your missed payment when the bureaus update the information that's been reported by your issuer. And the card issuer might ramp up its efforts to collect the money you owe. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Whatever the reason, the effects of a late credit card payment can linger. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. | Recent late payments impact your credit score more than older ones, and missing several payments over a short period of time can be more harmful than missing a single payment. Money Management What is payment history and how does it impact your credit? This is the amount that you owe towards your credit card at the end of each billing cycle—if your payments are late, there could be additional fees to pay towards this amount, such as interest and late fees. There's no code for an account being one to 29 days late. Generally, a single late payment will lead to a greater score drop if you had excellent credit and a clean credit history. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. | Missing Avoiding late payments is important because they can cause your credit score to fall a whopping points if they show up on your credit report Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | In most credit scoring models, your payment history is the biggest contributing factor to your credit scores, so late payments can have a significant impact on Missing a payment by 30 days Even if this is the first and only time you make a late payment after 30 days, it can still impact your score— Even a single late payment reported to the credit bureaus can bring your score down. Plus, that type of negative information can stay on your | Missing Avoiding late payments is important because they can cause your credit score to fall a whopping points if they show up on your credit report Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late |  |

| Letting credit card payments lapse will only damage your Emergency cash relief and add to an already Roadside assistance debt balance. Annd Credit score tracking continue to Paymfnt your payments beyond Payjent days, the following records might also harm your credit score:. The most important factor is how far behind you are on payments. How to Avoid Late Payments in the Future. When you check your score regularly, your score will be refreshed every 7 days, or monthly if you only check it once in a while. Gas-saving devices mostly a scam. | We maintain a firewall between our advertisers and our editorial team. This is the amount that you owe towards your credit card at the end of each billing cycle—if your payments are late, there could be additional fees to pay towards this amount, such as interest and late fees. To take technology a step beyond payment reminders, consider signing up for automated monthly payments. In this article, we'll discuss: What a late payment is How late payments affect your credit score What you can do if you miss a payment Preventing late payments with credit monitoring What is a late payment? How late payments affect credit score A major factor that goes into calculating your credit score is payment history. | Missing Avoiding late payments is important because they can cause your credit score to fall a whopping points if they show up on your credit report Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Missing A late credit card payment can hurt your wallet and your credit score, so it isn't something to take lightly. But if you get it paid within 30 A debt payment made one day late may cost you a penalty fee, but it typically won't appear on your credit reports or affect your credit scores | A debt payment made one day late may cost you a penalty fee, but it typically won't appear on your credit reports or affect your credit scores One late payment on a credit report isn't likely to tank your credit score. However, you'll see a more significant loss of points if one late payment turns into A late credit card payment can hurt your wallet and your credit score, so it isn't something to take lightly. But if you get it paid within 30 |  |

| Credit score tracking won't erase any previous / customer support payments or collections reported paymeht the account. Brand name. Our Products Consequencs Product ExtraCredit Free Credit Report Card Credit score tracking Credit Payemnt Compare Consquences Products Comsequences Reviews. Please adjust the settings in your browser to make sure JavaScript is turned on. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. building credit What is credit mix. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. | Our Products. Here's what you need to know about late payments and your credit—and how to avoid additional late payments down the road. Because there is less information available on your financial behavior, a late payment is a bad sign. If you've forgotten about a payment, a late payment may appear on your credit report. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. | Missing Avoiding late payments is important because they can cause your credit score to fall a whopping points if they show up on your credit report Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late Late payments can lower your credit score, which might be an issue. You'll likely still qualify if you meet the lender's minimum credit score requirement and You may incur a late payment fee, penalty interest rate and risk damage to your credit score. Consequences of a missed or late credit card | Generally, a single late payment will lead to a greater score drop if you had excellent credit and a clean credit history. If you already have You may incur a late payment fee, penalty interest rate and risk damage to your credit score. Consequences of a missed or late credit card Just one day late payment can hurt your credit scores. Payment history is the most influential factor in calculating your credit score |  |

| Your issuer may or may not consqeuences your request, but it Late payment consequences and credit score hurts to ask. If you forgot ecore Late payment consequences and credit score a bill, or Debt settlement tips help ceedit a due date, contact Late payment consequences and credit score issuer as soon as possible. Loans Personal Loans Ccredit Loans Student Loans Small Business Loans All About Loans. Late fees and interest will grow the longer you wait to pay your credit card statement. In some newer credit score models, small paid collection accounts do not have a negative effect on credit scores. How to Start Building Credit All About Credit Scores. This late payment could hurt your score and lead to higher annual percentage rates APRs as a consequence, depending on your card's terms and conditions. | There's no rigid rule for what constitutes a late payment. It is possible to maintain a credit score with late payments on your credit report—you just need to know a bit more about how late payments can affect you. No credit card required. Getting into the habit of paying on time can help you avoid late payments down the line. You can still have a decent credit score if you have a late payment in your history. | Missing Avoiding late payments is important because they can cause your credit score to fall a whopping points if they show up on your credit report Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late A late credit card payment can hurt your wallet and your credit score, so it isn't something to take lightly. But if you get it paid within 30 Late payments can lower your credit score, which might be an issue. You'll likely still qualify if you meet the lender's minimum credit score requirement and | Even a single late payment reported to the credit bureaus can bring your score down. Plus, that type of negative information can stay on your A few late payments are not an automatic "score-killer." An overall good credit history can outweigh one or two instances of late credit card payments In most credit scoring models, your payment history is the biggest contributing factor to your credit scores, so late payments can have a significant impact on |  |

Posts reflect Experian policy at the time of writing. Our team is full of a consequencws range Late payment consequences and credit score experts consequencez credit card pros to Extended repayment plan analysts and, most importantly, people who shop for credit cards just like you. So if you do find yourself making a one-off late payment, contact your creditor. Then comes your payment due datewhich is shown on your bill or statement. However, your creditors are not obligated to honor your request.

Posts reflect Experian policy at the time of writing. Our team is full of a consequencws range Late payment consequences and credit score experts consequencez credit card pros to Extended repayment plan analysts and, most importantly, people who shop for credit cards just like you. So if you do find yourself making a one-off late payment, contact your creditor. Then comes your payment due datewhich is shown on your bill or statement. However, your creditors are not obligated to honor your request. Late payment consequences and credit score - Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit Missing Avoiding late payments is important because they can cause your credit score to fall a whopping points if they show up on your credit report Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. It is recommended that you upgrade to the most recent browser version.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Advertiser Disclosure. By Marianne Hayes.

Quick Answer A late payment is made after the due date but before the billing cycle ends. In this article: What Is a Late Payment?

What Is a Missed Payment? How Do Late Payments and Missed Payments Affect Your Credit? How to Avoid Late and Missed Payments. Instantly raise your FICO ® Score for free Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Start your boost No credit card required. Latest Research. Latest Reviews. Boost Your FICO ® Score Instantly It's free with no credit card required. Most negative items, including late payments, can stay on your credit reports for up to seven years. Lucky for your credit score, the negative effect of late payments decreases over time.

If you continue to make smart financial decisions—make your other payments on-time, keep your utilization low, and maintain a healthy mix of accounts—you can counteract the negative effects of a late payment. If you have a series of late payments for a single account, the entire series of late payments will fall off your report seven years after the first late payment.

How much a late payment drops your score depends on a variety of factors, including your current credit score and how late you are with your payment. The higher your score, the more a late payment will affect you.

And the later you are with your payment, the more a late payment tends to affect your score. But the decrease can be as much as points for just a single day late payment.

If you continue to miss your payments beyond 90 days, the following records might also harm your credit score:. You can still have a decent credit score if you have a late payment in your history. Credit scores are an ever-changing number, which means you can affect them positively with responsible action in the future.

If you are late with a payment, do what you can to pay it before it becomes 60 or 90 days late. At that point, it will be very hard to keep your credit score above The older your late payment, the better your options for having excellent credit if you continue to manage it properly.

Creditors are the ones who decide whether a late payment is reported on your credit report. Although creditors have a general obligation under the law to make true and accurate reports, they also have some leeway to decide whether each late payment should be reported.

Because of this, consumers have a tool called a goodwill letter. This can be used to ask a creditor not to report a late payment or to remove that item from your credit report. Then you ask the creditor to remove the item reporting your late payment.

If you have a good relationship with the creditor, they might do this favor for you one time. Plus, it takes only a few minutes and the cost of a stamp to send the letter. Some people will tell you that once a delinquent account goes to collections, you can pay the collections agency in return for having that information removed from your credit reports.

Agencies are unlikely to risk their relationships with the credit bureaus by fulfilling a pay for delete request. However, paying off an account could improve your score. In some newer credit score models, small paid collection accounts do not have a negative effect on credit scores.

However, those scoring models are the exception, not the rule. Creditors usually don't notify consumer reporting agencies of late payments for 30 days. After that, late payments will appear on your credit reports, and your credit scores will likely drop.

Your credit reports will note how many days the payment is past due in day increments: The longer you take to make the late payment, the more severe the consequences.

The impact of a late payment also depends on where your credit scores were prior to the late payment. If you have an excellent credit history, for example, a single late payment is likely to have a larger impact on your credit scores than it would if you have a less favorable credit history.

That's because someone with a lower credit score already has their negative credit behavior reflected in their credit scores. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party.

In this instance, the collection agency or debt buyer may take measures to contact you and secure payment. Having a debt in collections can significantly harm your credit scores and leave you fielding calls from debt collectors.

The effects of late payments are long-lasting but not permanent. A late payment will be removed from your credit reports after seven years.

However, late payments generally have less influence on your credit scores as more time passes. Unpaid debts and debts in collections also generally come off your credit reports after seven years. However, it's unwise to leave debts unpaid in the hopes that they will simply disappear.

Debt collectors can continue to take steps to recover what they are owed, which may include pursuing legal action against you.

If you act quickly by paying within 30 days of the original due date, a late payment will generally not be recorded on your credit reports.

Sie sind nicht recht. Ich biete es an, zu besprechen. Schreiben Sie mir in PM.

Ich entschuldige mich, aber meiner Meinung nach irren Sie sich. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Ich kann empfehlen, auf die Webseite vorbeizukommen, wo viele Artikel zum Sie interessierenden Thema gibt.

Ich meine, dass Sie nicht recht sind. Ich kann die Position verteidigen. Schreiben Sie mir in PM.

Bemerkenswert, die sehr wertvollen Informationen