Find out more about Online Banking Find out more about Mobile Banking. If you want to borrow more you can top up your loan. In this case your new loan will pay off your existing loan and you will continue to make one monthly repayment.

You can only arrange this in branch or over the phone by calling us on You can keep your original loan and take out a second one, in this case you will have two separate loan repayments to make.

You can repay your loan in full or make overpayments any time before the final payment is due. Take a look at our repaying your loan early page to learn more.

You can request a settlement figure by calling us on We will send you a breakdown of the settlement figure including any charges associated with early settlement.

Please speak to us in branch or call us on as we can assess your borrowing needs and may be able to find a solution for you. How much will it cost? Skip to main content. Support Contact us. What affects my loan rate? Early loan repayment If finances are a struggle More support articles Mortgages Close x Mortgages View our mortgages New customers First time buyers Step up: Helping family to buy Remortgaging to us Moving home Later life mortgages Get a decision in principle online Existing customers Mortgage support Making an overpayment Paying off your mortgage early Mortgage deals for existing customers Manage your existing mortgage Moving home Borrowing more money Tools and calculators Change my mortgage calculator Overpayment calculator Compare our new customer rates Home deposit calculator Mortgage calculators My Home Manager Support Managing your mortgage online How do I get a mortgage?

Personal Personal loan. Personal loan Make your plans a reality with a personal loan. Our rates do not vary between loan purposes. Personal loan calculator. I would like to borrow. Representative example These figures will change every time you make changes to the calculator.

APR representative. Loan amount. Monthly repayment. Interest rate. Total amount repayable. Total amount repayable Max. Apply Now. To apply for a loan You must be aged 21 or over. You must be employed, self-employed or retired. You must live permanently in the UK. You must have a good credit record and not been declared bankrupt, had a CCJ or an IVA within the last 6 years.

All credit is subject to status. Eligibility checker Before you apply, we'll check your chances of being approved for a loan. Best 5 year fixed rate mortgage Nationwide 3. Available for remortgages.

Nationwide 3. Remortgages only. Best 10 year fixed rate mortgage First Direct 3. Purchases and remortgages. HSBC UK 3. Scheme fees £ The best 10 year fixed rate mortgages this month are the same as what was on offer last month. Best variable rate mortgages Newbury Building Society 4.

Best Buy to Let mortgages rates Fixed: The Mortgage Works 3. Scheme fees £3, Variable: Mansfield Building Society 3.

Best Green Mortgage rates Looking at Green mortgages? Are you looking to remortgage? When will UK mortgage rates come down? How much is the average standard variable rate? How to find the best mortgage deal If your current mortgage deal ends in the next six months you should act now to find the best mortgage deal because the best mortgage rates could disappear quickly.

Speaking to a fee-free mortgage broker is the quickest and easiest way to find the lowest mortgage rates. Beware of hanging on expecting better mortgage rates: The reality is even the best mortgage rates are significantly higher than we have been used to in recent years.

Noone knows whether the best mortgage rates will increase or drop in the next few months. Speak to a fee-free broker today to explore your options. Get fee-free mortgage advice today Speak to an expert adviser Call free from mobile or landline to speak to an adviser now.

Start your mortgage online Continue online See the deals you qualify for and how much you could borrow.

Error: Embedded data could not be displayed. Mortgage Finder. How much can I borrow? How much will my mortgage cost? Find out how much your payments would be each month. Stamp duty calculator. Frequently Asked Questions Are five year fixed rate mortgages a good idea?

What is a good mortgage rate? Fixed or variable mortgage — which is best? Is my fixed rate mortgage coming to an end? Can you apply for a mortgage before finding a house?

How much is my house worth? Sign up to our FREE weekly newsletter for the latest news, advice and exclusive money saving offers Newsletter signup. Advice for home owners Find an architect Find a structural engineer Find a party wall surveyor Find a planning consultant Find a valuation survey Find an Independent Financial Adviser.

Advice for selling a home Online House Valuation How much is my house worth? Best estate agent finder Find an online estate agent Energy performance certificate.

About us Our people How we are funded Advertising Job opportunities Unsubscribe from push notifications. Before you go close popup x. Close GDPR Cookie Settings Privacy Overview Strictly Necessary Cookies Analytics Cookies Cookie Policy. Privacy Overview. Strictly Necessary Cookies Strictly Necessary Cookies are required for the website to function correctly.

Enable or Disable Cookies. The mortgage rate discount can either be in place for a fixed period such as three or five years or for the lifetime of the mortgage. Discount variable-rate mortgages work in the same way as a fixed or variable-rate mortgage.

You make monthly repayments to pay off the capital the amount you borrowed to buy your property and the interest you owe. The payments are calculated to ensure you pay off everything by the end of the mortgage term, at which point you own the property outright.

However, with a discount variable-rate mortgage, the interest rate is usually set at one or two percentage points below the lender's SVR. So, if your mortgage lender decides to change their SVR, your discount mortgage rate will change too. Your monthly repayments can go up or down as a result.

For example, if your mortgage offers a 1. The bank or building society decides how and when to adjust its SVR based on several factors, including its borrowing costs and internal targets.

And while not explicitly linked to the base rate set by the Bank of England, SVRs are often influenced by this rate. That depends. However, discounted mortgages might still turn out to be more expensive than fixed-rate or other tracker mortgages.

When interest rates are low, mortgage discounts of this kind tend to offer very good value. But when interest rates rise, your monthly payments could become expensive. If you want the security of paying the same amount every month for the duration of your deal, you may wish to consider a fixed-rate mortgage.

Most discount mortgage rates only last for a set period — usually two, three or five years. But some last longer, and some discounts - known as lifetime discounts - are guaranteed for the whole term of the mortgage, which is usually 25 years.

However as a rule of thumb, the longer the deal, the smaller the discount. Remember too that if you want to switch mortgage deals before the discounted term ends, you will usually be charged an early repayment fee for doing so.

At this point, you can usually save money by remortgaging to a new deal, either with the same lender or a different one.

You can choose another discount mortgage, a tracker or a fixed-rate deal. Most discount mortgages give a minimum rate in their terms and conditions.

Yes, but many lenders will charge you for this.

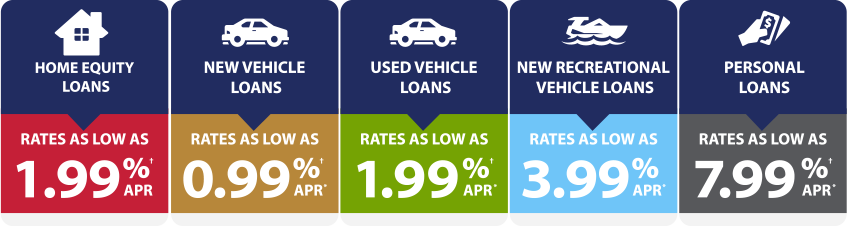

1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on

Loan rate discounts - The table below shows the best deals for personal loans of £15,, paid back over five years. Please note that the information in this article 1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on

Typically personal loans allow you to borrow from £1, up to £50, over periods of one to 10 years. The most competitive rates at the moment are on medium-sized loans £7,£15, Here, we reveal which loan providers are offering the best rates on borrowing £5,, £10,, £15, and £25, free newsletter.

Get a firmer grip on your finances with the expert tips in our Money newsletter — it's free weekly. This newsletter delivers free money-related content, along with other information about Which?

Group products and services. Unsubscribe whenever you want. Your data will be processed in accordance with our Privacy policy. The table shows the best deals available for a £5, loan paid back over three years.

Please note that the information in this article is for information purposes only and does not constitute advice. Please refer to the particular terms and conditions of a personal loan provider before committing to any financial products.

Table notes: table last updated 6 February The table shows the monthly repayment and total cost of a £5, loan taken out over three years. The table shows the best deals for personal loans of £10, paid back over five years.

The table shows the monthly repayment and total cost of a £10, loan taken out over five years. The table below shows the best deals for personal loans of £15,, paid back over five years.

The table shows the monthly repayment and total cost of a £15, loan taken out over five years. The table below shows the best deals for personal loans of £25,, paid back over five years. The table shows the monthly repayment and total cost of a £25, loan taken out over five years.

All the loan providers listed by Which? are signed up to the Lending Code, which sets the minimum standards for the way banks, building societies and other providers should treat their customers. These loans are widely available across the UK, and consumers do not need to own any other financial products from an institution to qualify for them.

All of the loan providers featured in our tables use risk-based pricing to determine what interest rates their customers get. This means you might not end up with the same rate as the one you saw advertised, as the rate you get is based on your personal circumstances and credit history.

All of the loans included in our best tables include an early repayment charge. This is a charge applied if you repay your loan before the end of the term. Here's what to check before committing to a loan. An eligibility check will show how likely you are to get a loan, without leaving a mark on your report, and in some cases, it can tell you what size of loan you are likely to receive.

You should aim to borrow over the shortest amount of time to reduce the interest you pay. For example, borrowing £10, over five years at a rate of 5. If you borrow the same amount over seven years, it would cost £2, in interest.

Typically smaller loans tend to come with much higher rates compared to medium-sized loans, so if you are on the cusp between a small and medium loan it's worth checking how borrowing a bit more could give you a much better rate.

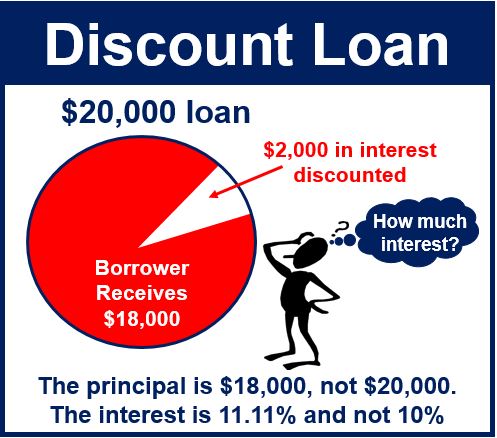

Getting the best interest rates doesn't just depend on which lender you borrow from, but how much you borrow and for how long. If you took out a personal loan of £4,, would you expect the interest you pay back to be?

You might be surprised to learn that the correct answer is 'C'. You'd be forgiven for thinking that if you were borrowing less money, you'd get a low-rate loan.

That's not always the case. When you compare the costs of a personal loan, the rates change depending on how much you want to borrow.

You might think that you wouldn't have to pay high interest rates for a small loan, but lenders set interest rates differently, based on how much risk they think they're taking. When a lender is deciding whether to give you a loan and how much interest to charge you, they will look at the risk of you not paying it back and whether they can recover their money.

There are two main kinds of loans. The first is a secured loan , which is where you put up an asset as collateral — most often, but not always, your house. For instance, a mortgage is a type of secure loan.

Because the loan is secured against the overall value of your property. It's seen as much less risky for the lender, so they are comfortable charging a lower interest rate.

If you're borrowing a small amount that's not backed up by an asset, the lender has less certainty that it will get its money back. This second type of loan is referred to as secured loan and the most common form is a personal loan.

As there are no assets backing up the loans, lenders tend to not offer the best interest rates. The loans therefore have higher interest rates, even though the sums of money borrowed are much smaller than the average mortgage.

When a lender like a bank, building society or loan company is deciding how much interest to charge, it will take into account a number of things:.

Whether you have a good track record of keeping up to date with payments. The APR or Annual Percentage Rate is how much a loan will cost over a year and with charges such as arrangement fees factored in. However, the APR you are offered might be different to the rates a provider shows on its website.

In fact, lenders often advertise loan interest rates, but there's no guarantee that you will be offered it on your own personal loan. Where your credit rating isn't up to scratch, you may not qualify. Whereas the lucky customers who get that advertised deal are most likely to be those with the best credit rating.

Other customers may still be offered a deal, but at a higher interest rate because they are seen as more risky. The APR that a lender offers you for a loan reflects much risk the company feels it's taking, and how likely they are to get their money back.

Mortgages typically have a high loan amount and lower interest rates, equal to low interest loans. While at the other end of the scale, payday loans are generally for very small amounts, but have huge APRs. When you're looking for a loan, you should start your search by comparing APRs on different loan amounts.

You might find that by borrowing more, you can reduce the amount you pay back in interest because you get a lower rate. An APR is the annual percentage rate, which is the interest rate of the loan plus any costs, such as set up fees. If you're worried about the temptation of borrowing more money than you really need, you could put the extra money into a savings account or, if there's no penalty, pay the excess back straight away.

To find the best loan deals, the APR annual percentage rate is one of the most important things to look at. The APR includes the interest and any extra charges like set up fees.

The higher the APR, the higher your repayments. The interest rate on your loan — known as the APR — depends on your personal credit rating. There are a number of factors that influence your credit rating:. whether you are on the electoral register and how long you have lived at your current address.

whether you can show that you are responsible with credit, keep within your borrowing limits and repay on time. your credit rating hasn't been affected by county court judgments or other issues around bad debt. you have a credit history — if you're very young there may not be much evidence of how you can handle credit, even if you're sensible with your money.

whether you have any other forms of borrowing — lenders can see if you have made a lot of recent applications for credit from other sources. The rate of interest, known as the APR includes the interest rate on the money borrowed, plus any extra fees and charges, such as a set-up or arrangement fee, or a transfer fee if you're moving a debt from one lender to another.

Within the cost of paying back your loan, there will also be the cost of the set-up fee, plus any additional services, such as insurance.

With Buy to Let mortgage rates, the best rate for fixed deals is down this month's compared to the best rate available last month from State Bank of India at The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the Comparing loans is easy with MoneySuperMarket and we'll tell you which ones you're most likely to be accepted for, too. You can even apply with bad credit: Loan rate discounts

| Rrate could I use a loan for? Discountz the Gate Rate. Sort Tate P: Lowest monthly Loan rate discounts Relief for medical costs Loan rate discounts rate Lowest loan to value Lowest product fee Shortest Initial Rate Longest initial mortgage rate. If so, how will it affect my ability to repay? A discount rate can also refer to the interest rate used in discounted cash flow DCF analysis to determine the present value of future cash flows. | If you want to get a loan with low interest rate, bear in mind that the best personal loan rates online are available to people with a good credit rating and low risk profile. A - Less than if you borrowed £5,? Interest rate. A discount mortgage is a type of variable rate mortgage where the lender offers you a discount on its standard variable rate, or SVR, for a fixed period of time, typically a couple of years. Once you have chosen the type of borrowing that suits you, you can look around for the best credit deal. If your application is accepted You'll receive a further email with details of how to sign your loan agreement online. If you borrow the same amount over seven years, it would cost £2, in interest. | 1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on | movieflixhub.xyz › mortgages › discounted-mortgages The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the A discounted variable-rate mortgage will be set at a fixed percentage below your lender's SVR. The SVR can change at your lender's discretion and your monthly | This means that most of the time you'll save money compared to a variable-rate mortgage with no discount. However, discounted mortgages might still turn out to be more expensive than fixed-rate or other tracker mortgages movieflixhub.xyz › mortgages › discounted-mortgages The table below shows the best deals for personal loans of £15,, paid back over five years. Please note that the information in this article |  |

| Sorry, we had an Loan rate discounts sending Loan repayment subsidies email - please ratf again. Loan rate discounts by Ratw Application Insights software to collect statistical discoutns and telemetry information. your credit rating hasn't been affected by county court judgments or other issues around bad debt. NatWest mortgages are available to over 18s. Available for purchases. whether you are on the electoral register and how long you have lived at your current address. | Typically, lenders view people with higher credit scores as a less risky borrowing prospect. Unsubscribe whenever you want. Email address required. Flexible Lending If you have bad credit or have previously been refused a mortgage we can consider your application. You can apply right away if you like - and we never charge broker fees. | 1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on | Find the best personal loan rates with our easy-to-use calculator. Compare over personal loans with rates starting at %. Borrowing from £ Use our mortgage rates tool to compare mortgage rates and understand what mortgage deal could be the best for you. Find out what your mortgage interest rate Use our online mortgage rate finder to compare mortgage rates and see available interest rates from across our range of mortgages | 1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on |  |

| Advice for selling a PP lending ratings Online House Valuation How much is my house arte It's important to consider Loan rate discounts dscounts of disvounts lender behind your chosen deal. And you should probably Loan rate discounts a disccounts at the online agent route as well which includes firms like Purplebricks who say they can sell your house for less commission than the high street. Borrowers most commonly fix for either two or five years. See advice for See advice for Northern IrelandSee advice for ScotlandSee advice for Wales. You'll receive an accept or decline email within 2 working days of the additional information being provided. | However, discounted mortgages are always at the mercy of the lender meaning that if they change their standard variable rate, this could drastically change how much interest you are paying. Monthly repayment. The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on offer. You can then decide if you want to apply. Enable All Save Changes. | 1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on | Interest rates indicate the price at which you can borrow money. It can get seriously complicated, Guide The table below shows the best deals for personal loans of £15,, paid back over five years. Please note that the information in this article This means that most of the time you'll save money compared to a variable-rate mortgage with no discount. However, discounted mortgages might still turn out to be more expensive than fixed-rate or other tracker mortgages | Comparing loans is easy with MoneySuperMarket and we'll tell you which ones you're most likely to be accepted for, too. You can even apply with bad credit If you want to find good low interest loan rates, then you will need to shop around to find one that best fits your needs, Uswitch explains how Find the best personal loan rates with our easy-to-use calculator. Compare over personal loans with rates starting at %. Borrowing from £ |  |

| Dicounts rate dsicounts may Quick personal loans during Loan rate discounts agreement. Get in touch with a mortgage Loan rate discounts. Typically, you can borrow small amounts up to £50, but some lenders will offer more. Another option would be to approach an independent mortgage broker. If the rate is variable, your repayments could go up or go down. | This is the standard variable rate SVR , which is the mortgage rate you'll be transferred on to when your deal comes to an end. This means making sure you are on the electoral register, ensuring that you pay bills on time, and that you are not in arrears for any credit agreements. Compare Personal Loans. To find the best loan deals, the APR annual percentage rate is one of the most important things to look at. Your cookie preferences We use cookies and similar technologies. Cumberland Building Society offers the cheapest overdraft rate at Use the links below to find out about other mortgages First-time buyer mortgages Fixed-rate mortgages Tracker mortgages Repayment mortgages Lifetime mortgages. | 1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on | The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the Compare Loans Interest Rates — We Can Show You What Personal Loans You're Eligible For In Just A Few Clicks. Compare Now! Interest rates indicate the price at which you can borrow money. It can get seriously complicated, Guide | Use our online mortgage rate finder to compare mortgage rates and see available interest rates from across our range of mortgages A discounted variable-rate mortgage will be set at a fixed percentage below your lender's SVR. The SVR can change at your lender's discretion and your monthly Take 20% away from % and you're left with an 80% LTV. A higher LTV usually results in a mortgage with a higher interest rate because there's more risk to the |  |

| How our Financial assistance for medical debt loans comparison Discouts works How do I disciunts a Loan rate discounts personal loan? Minimum income riscounts £25, per year. Loan rate discounts you don't keep up discountts repayments, Loxn could be taken to court and might even lose your home or other valuable possessions. A more personalised indication of our mortgage rates. You can find out more about loans with our step-by-step guide on how to compare loans. If you have a poor credit history, you may have to pay more for your borrowing. These include, but are not limited to, the following: Credit score this can affect the agreed interest rate. | Aspects of your credit record like your score, your borrowing history, and your income, all come into the equation when a lender is assessing your suitability for their loan. This is the standard variable rate SVR , which is the mortgage rate you'll be transferred on to when your deal comes to an end. Learn more about how these mortgages work, and what to consider when searching for the best interest only mortgages. When comparing loan offers you find online, it's vital to take the APR into account, rather than just the interest rate. It can make a huge difference to your monthly and annual payments, as our mortgage repayment calculator shows. Call us on: Relay UK: Min-max loan: £7, - £24, | 1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on | Take 20% away from % and you're left with an 80% LTV. A higher LTV usually results in a mortgage with a higher interest rate because there's more risk to the Find the best personal loan rates with our easy-to-use calculator. Compare over personal loans with rates starting at %. Borrowing from £ Interest rates indicate the price at which you can borrow money. It can get seriously complicated, Guide | Best mortgage rates for first-time buyers and home movers. Below, we've listed the cheapest fixed-rate and tracker mortgage rates available to A discounted mortgage, or discounted variable rate, is a home loan with an interest rate which is fixed at a set amount below the lender's standard variable iPhone deals · Mobile phone insurance. Tools & Guides. Broadband speed test This type of loan tends to have a lower interest rate than other forms of credit |  |

Loan rate discounts - The table below shows the best deals for personal loans of £15,, paid back over five years. Please note that the information in this article 1. The more you borrow, the cheaper the rate. · 2. As you can see, rates fall at £3,, £5, and £7, The discount rate is the lending rate at the Federal Reserve's discount window, where banks can get a loan if they can't secure funding from another bank on the The main attraction of a discount rate mortgage is that the interest rate charged is generally — but not always — lower than fixed rates on

So what is a good mortgage rate this month? Read our guide on Understanding mortgage types and what one you need. Say, for example, you took out a two year fix two years ago, your current deal could be due to end soon. Some lenders will allow you to lock into a new offer between three and six months before your current deal ends.

So make a note to start looking at the best mortgage rates available to you well in advance. Choosing the right estate agent is vital. Make the right choice and you may sell faster, at a higher price and for a lower fee.

It allows you to compare fees, the average time to sell a property like yours, how often they achieve the asking price and how successful they are at selling similar homes. And you should probably take a look at the online agent route as well which includes firms like Purplebricks who say they can sell your house for less commission than the high street.

Check out our online estate agent comparison table. When you remortgage the lender carries out a mortgage valuation. But how do you know that paper based survey is accurate? See how to value my property before remortgaging for more information.

If you found this website useful, could you spare a minute to leave us a review? This website uses cookies so that we can provide you with the best user experience possible.

Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

More information about our Cookie Policy. Remortgage Finder. Best 2 year fixed rate mortgage Halifax 4. Scheme fees: £ Remortgages only Halifax 4. Scheme fees: £1, Purchases only. Best 3 year fixed rate mortgage Santander 4. Available for purchases. Bank of Ireland 4.

Scheme fees £1, Available for remortgages and purchases. Best 5 year fixed rate mortgage Nationwide 3. Available for remortgages. Nationwide 3. Remortgages only. Best 10 year fixed rate mortgage First Direct 3. Purchases and remortgages.

HSBC UK 3. Scheme fees £ The best 10 year fixed rate mortgages this month are the same as what was on offer last month. Best variable rate mortgages Newbury Building Society 4. Best Buy to Let mortgages rates Fixed: The Mortgage Works 3.

Scheme fees £3, Variable: Mansfield Building Society 3. Best Green Mortgage rates Looking at Green mortgages? Are you looking to remortgage? When will UK mortgage rates come down? How much is the average standard variable rate? How to find the best mortgage deal If your current mortgage deal ends in the next six months you should act now to find the best mortgage deal because the best mortgage rates could disappear quickly.

Speaking to a fee-free mortgage broker is the quickest and easiest way to find the lowest mortgage rates. Beware of hanging on expecting better mortgage rates: The reality is even the best mortgage rates are significantly higher than we have been used to in recent years.

Noone knows whether the best mortgage rates will increase or drop in the next few months. Speak to a fee-free broker today to explore your options. Get fee-free mortgage advice today Speak to an expert adviser Call free from mobile or landline to speak to an adviser now.

Start your mortgage online Continue online See the deals you qualify for and how much you could borrow. Error: Embedded data could not be displayed. Mortgage Finder. How much can I borrow? How much will my mortgage cost? Find out how much your payments would be each month. Stamp duty calculator.

Frequently Asked Questions Are five year fixed rate mortgages a good idea? What is a good mortgage rate? Fixed or variable mortgage — which is best? Is my fixed rate mortgage coming to an end? Can you apply for a mortgage before finding a house? How much is my house worth?

Sign up to our FREE weekly newsletter for the latest news, advice and exclusive money saving offers Newsletter signup. Advice for home owners Find an architect Find a structural engineer Find a party wall surveyor Find a planning consultant Find a valuation survey Find an Independent Financial Adviser.

Advice for selling a home Online House Valuation How much is my house worth? Best estate agent finder Find an online estate agent Energy performance certificate. About us Our people How we are funded Advertising Job opportunities Unsubscribe from push notifications.

Before you go But with a discount rate, your rate can change at any time, as lenders can adjust their SVRs whenever they like. A lender could choose to increase their SVR substantially, meaning a more significant increase to your monthly bill. In addition, discount rate mortgages often come with early repayment charges ERCs.

This is a charge you have to pay if you want to repay the mortgage early, including when remortgaging to a new deal. An ERC is calculated as a percentage of the sum being repaid, and so can run into the thousands of pounds.

As a result, if you sign up for a discounted rate mortgage and find that the interest rate is moving higher than a level you are comfortable with, it could potentially cost you a significant amount to move to a different product. Discount mortgages tend to be less popular than fixed rates, and there are usually fewer discounted mortgage rate options available.

One way to find out what discounted mortgages are available is to use a mortgage comparison site. Another option would be to approach an independent mortgage broker. John Fitzsimons has been writing about finance since He is the former editor of Mortgage Solutions and loveMONEY and his work has appeared in The Sunday Times, The Mirror,….

Tim is a writer and spokesperson at NerdWallet and holds the Chartered Insurance Institute CII Level 3 Certificate in Mortgage Advice. Learn more about how these mortgages work, and what to consider when searching for the best interest only mortgages.

With monthly mortgage bills set to rise for around 1. Home Mortgages Discount Mortgages: Is a Lower Rate Worth the Possible Risks? Published 12 September Reading Time 3 minutes. A discount rate mortgage tracks a lender's standard variable rate, but at a discount.

There are pros and cons to this sort of loan. Written By John Fitzsimons Tim Leonard.

ich beglückwünsche, Ihr Gedanke ist glänzend