VC also moved from a focus on semiconductors and data processors to include sectors like personal computers and medical technology and was seen as a factor behind the dotcom bubble that ended in large investments were made in fledgling tech companies that, in retrospect, had only a very slim chance of success.

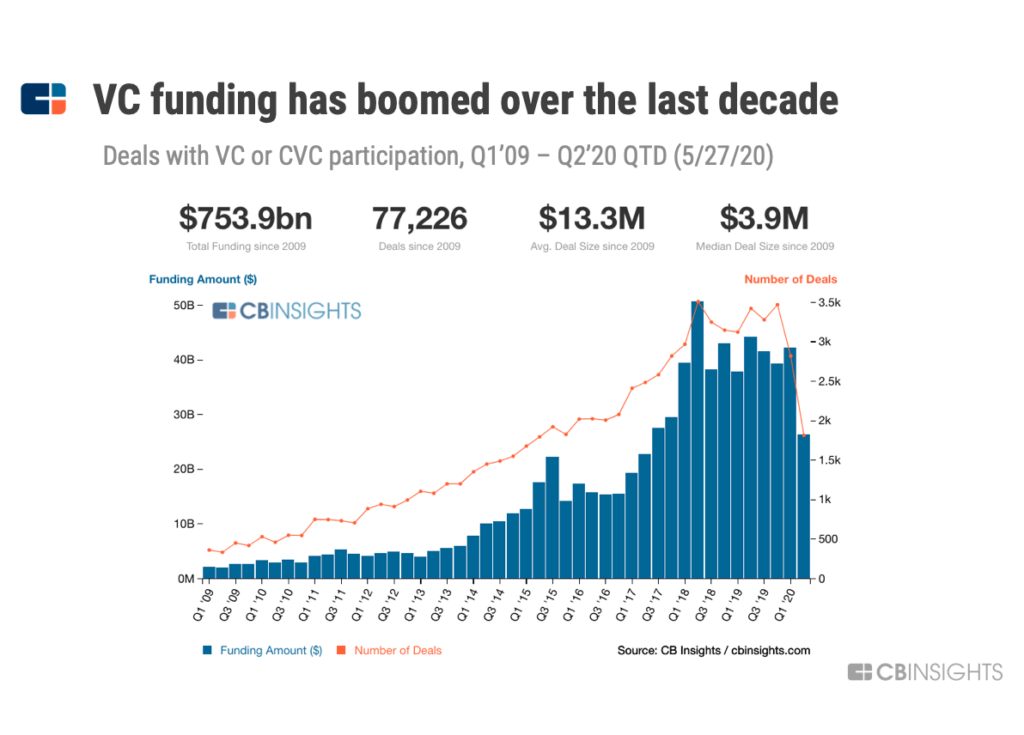

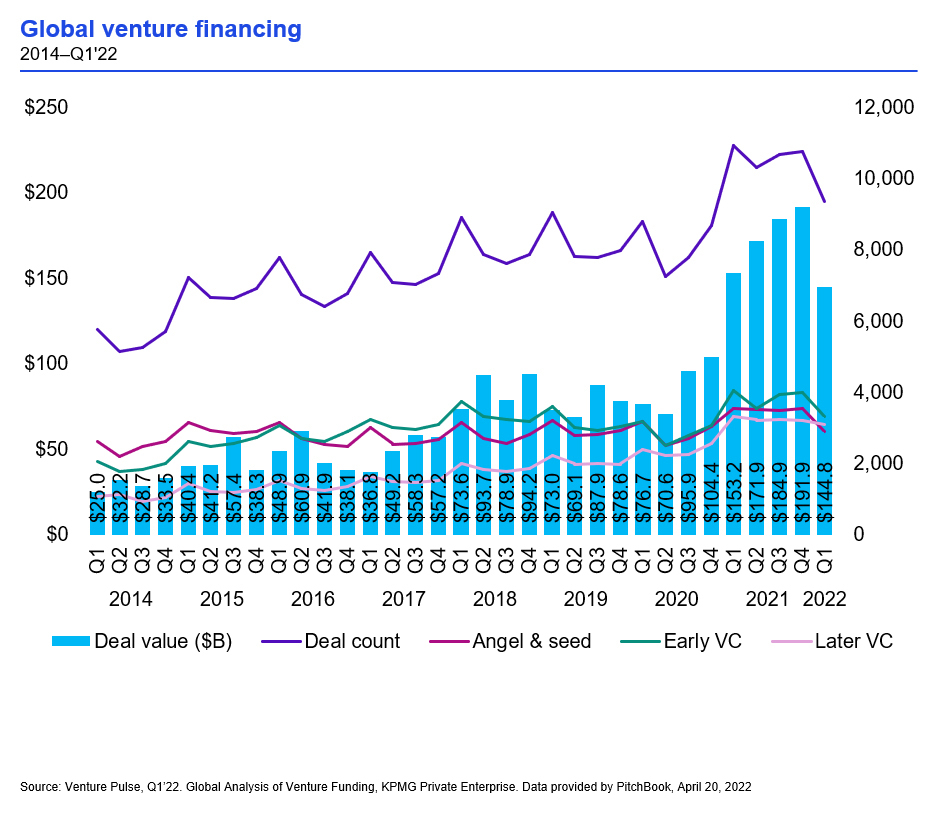

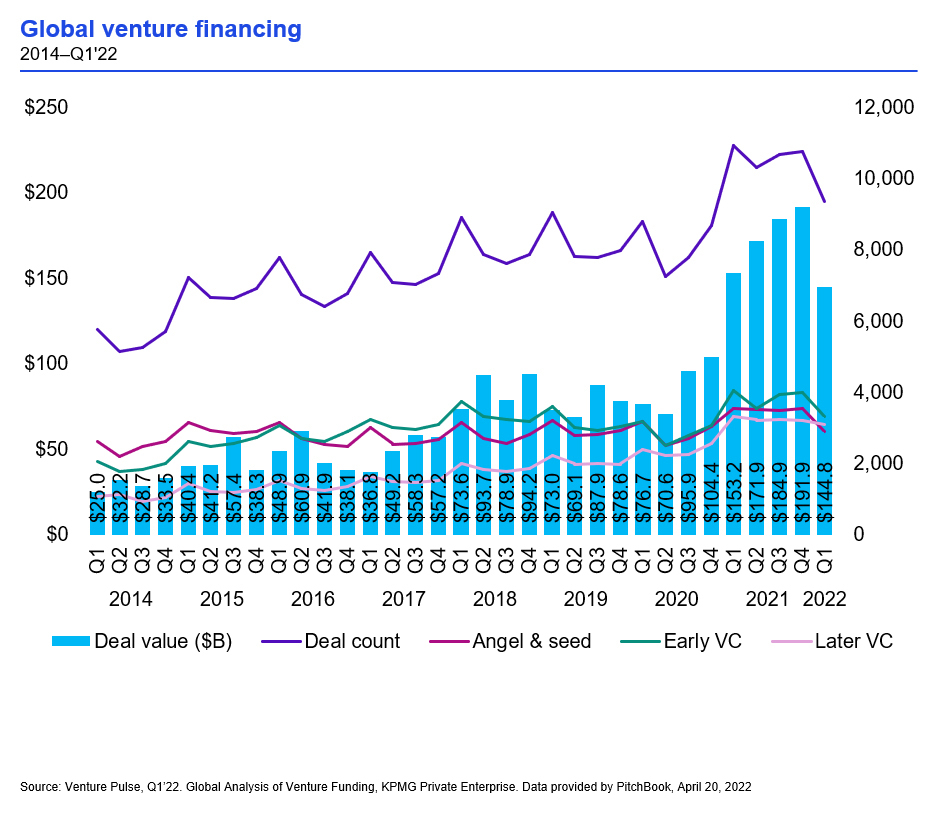

Venture Capital fell out of favour in the years following the tech bubble collapse. In the last decade or so, however, the internet has produced a range of companies with sustainable business models.

The rise in big tech firms has been accompanied by often tech- driven advances in other areas such as healthcare. Venture Capital firms have found themselves well positioned to capitalize on the opportunities and we discuss recent growth in the industry below.

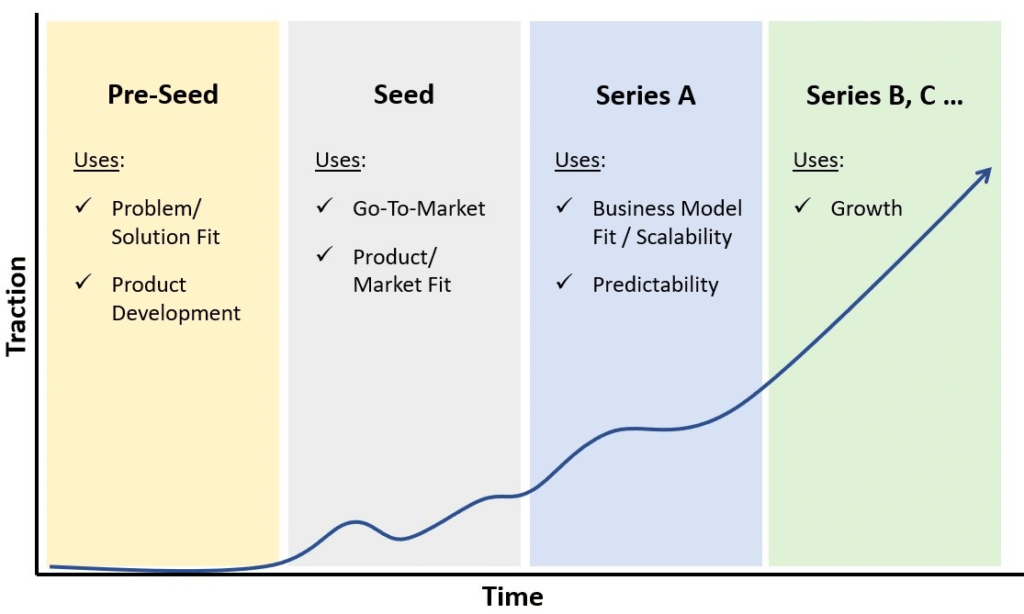

The key stages of Venture Capital financing are shown in Figure 1. Rather than providing funding upfront, staged funding allows Venture Capitalists to regularly refresh information about the firm, monitor its key metrics, review plans, and evaluate whether to provide additional capital funding or look for an exit.

For a brief summary of the report and to download the full PDF, please click here. In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect.

Past performance is not indicative of future returns. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time.

Your capital may be at risk. This document was produced in August Readers should refer to disclosures and risk warnings at the end of this document. The content and materials on this website may be considered Marketing Material. The market price of an investment can fall as well as rise and you might not get back the amount originally invested.

Please consider the sales restrictions relating to the products or services in question for further information. By selecting Continue, you are accessing content provided by a website that Deutsche Bank does not own or operate.

ARDC was remarkable in that, for the first time, a startup could raise money from private sources other than wealthy families. Previously, new companies looked to families such as the Rockefellers or Vanderbilts for the capital they needed to grow.

ARDC soon had millions in its account from educational institutions and insurers. Firms such as Morgan Holland Ventures and Greylock Partners were founded by ARDC alums. Startup financing began to resemble the modern-day venture capital industry after the passing of the Investment Act of The act enabled small business investment companies to be licensed by the Small Business Administration established five years earlier.

Venture capital, by its nature, invests in new businesses with great growth potential but also an amount of risk substantial enough to scare off lending by banks. Fairchild Semiconductor FCS , one of the earliest and most successful semiconductor companies, was the first venture capital-backed startup, setting a pattern for venture capital's close relationship with emerging technologies in the San Francisco Bay Area.

Venture capital firms in that region and period also established the standards of practice used today. They set up limited partnerships to hold investments, with professionals acting as general partners.

Those supplying the capital would serve as passive partners with more limited control. The number of independent venture capital firms increased in the following decade, prompting the founding of the National Venture Capital Association in Venture capital has since grown into a hundred-billion-dollar industry.

Today, well-known venture capitalists include Jim Breyer, an early Facebook META investor, Peter Fenton, an early investor in X, and Peter Thiel, the co-founder of PayPal PYPL.

The record-setting value of all U. venture capital investments in VC firms typically control a pool of funds collected from wealthy individuals, insurance companies, pension funds, and other institutional investors.

Although all of the partners have partial ownership of the fund, the VC firm decides how the monies will be invested. Investments are usually made in businesses with attractive growth potential that are considered too risky for banks or capital markets.

The venture capital firm is referred to as the general partner, and the other financiers are referred to as limited partners. Venture capitalists make money from the carried interest of their investments, as well as management fees.

Each VC fund is different, but their roles can be divided into roughly three positions: associate, principal, and partner. As the most junior role, associates are usually involved in analytical work, but they may also help introduce new prospects to the firm.

Principals are higher-level and more closely involved in the operations of the VC firm's portfolio companies.

At the highest tier, partners are primarily focused on identifying specific businesses or market areas to invest in and approving new investments or exits. Venture capitalists are investors who form limited partnerships to pool investment funds.

They use that money to fund startup companies in return for equity stakes in those companies. VCs usually make their investments after a startup has been bringing in revenue rather than in its initial stage. VC investments can be vital to startups because their business concepts are typically unproven and, thus, they pose too much risk for traditional providers of funding.

Harvard Business School, Baker Library Historical Collections. Cambridge Historical Society. Small Business Administration. Fairchild Semiconductors.

Securities and Exchange Commission. National Venture Capital Association. To achieve this, or even just to avoid the dilutive effects of receiving funding before such claims are proven, many start-ups seek to self-finance sweat equity until they reach a point where they can credibly approach outside capital providers such as venture capitalists or angel investors.

This practice is called " bootstrapping ". Equity crowdfunding is emerging as an alternative to traditional venture capital. Traditional crowdfunding is an approach to raising the capital required for a new project or enterprise by appealing to large numbers of ordinary people for small donations.

While such an approach has long precedents in the sphere of charity, it is receiving renewed attention from entrepreneurs, now that social media and online communities make it possible to reach out to a group of potentially interested supporters at very low cost.

Some equity crowdfunding models are also being applied specifically for startup funding, such as those listed at Comparison of crowd funding services.

One of the reasons to look for alternatives to venture capital is the problem of the traditional VC model. The traditional VCs are shifting their focus to later-stage investments, and return on investment of many VC funds have been low or negative.

In Europe and India, Media for equity is a partial alternative to venture capital funding. Media for equity investors are able to supply start-ups with often significant advertising campaigns in return for equity.

In Europe, an investment advisory firm offers young ventures the option to exchange equity for services investment; their aim is to guide ventures through the development stage to arrive at a significant funding, mergers and acquisition, or other exit strategy.

In industries where assets can be securitized effectively because they reliably generate future revenue streams or have a good potential for resale in case of foreclosure , businesses may more cheaply be able to raise debt to finance their growth. Good examples would include asset-intensive extractive industries such as mining, or manufacturing industries.

Offshore funding is provided via specialist venture capital trusts, which seek to use securitization in structuring hybrid multi-market transactions via an SPV special purpose vehicle : a corporate entity that is designed solely for the purpose of the financing. In addition to traditional venture capital and angel networks, groups have emerged, which allow groups of small investors or entrepreneurs themselves to compete in a privatized business plan competition where the group itself serves as the investor through a democratic process.

Law firms are also increasingly acting as an intermediary between clients seeking venture capital and the firms providing it. Other forms include venture resources that seek to provide non-monetary support to launch a new venture. Every year, there are nearly 2 million businesses created in the US, but only — get venture capital funding.

In , female-founded companies raised 2. For comparison, a UC Davis study focusing on large public companies in California found Venture capital, as an industry, originated in the United States, and American firms have traditionally been the largest participants in venture deals with the bulk of venture capital being deployed in American companies.

However, increasingly, non-US venture investment is growing, and the number and size of non-US venture capitalists have been expanding. Venture capital has been used as a tool for economic development in a variety of developing regions. In many of these regions, with less developed financial sectors, venture capital plays a role in facilitating access to finance for small and medium enterprises SMEs , which in most cases would not qualify for receiving bank loans.

In the year of , while VC funding were still majorly dominated by U. VC funding has been shown to be positively related to a country's individualistic culture. through the fourth quarter of , according to a report by the National Venture Capital Association.

small Canadian-controlled private corporations CCPCs. Canada also has a fairly unusual form of venture capital generation in its labour-sponsored venture capital corporations LSVCC.

These funds, also known as Retail Venture Capital or Labour Sponsored Investment Funds LSIF , are generally sponsored by labor unions and offer tax breaks from government to encourage retail investors to purchase the funds.

Generally, these Retail Venture Capital funds only invest in companies where the majority of employees are in Canada. However, innovative structures have been developed to permit LSVCCs to direct in Canadian subsidiaries of corporations incorporated in jurisdictions outside of Canada. In Australia and New Zealand, there are more than one hundred active VC funds, syndicates, or angel investors making VC-style investments.

Some notable Australian and New Zealand startup success stories include graphic design company Canva , [79] financial services provider Airwallex , New Zealand payments provider Vend acquired by Lightspeed , rent-to-buy company OwnHome , [80] and direct-to-consumer propositions such as Eucalyptus a house of direct-to-consumer telehealth brands , and Lyka a pet wellness company.

In , the largest Australian funds are Blackbird Ventures , Square Peg Capital , and Airtree Ventures. These funds have funding from institutional capital, including AustralianSuper and Hostplus, family offices, and sophisticated individual high-net-wealth investors.

Outside of the 'Big 3', other notable institutional funds include AfterWork Ventures , [83] Artesian, Folklore Ventures, Equity Venture Partners, Our Innovation Fund, Investible, Main Sequence Ventures the VC arm of the CSIRO , OneVentures, Proto Axiom, and Tenacious Ventures.

As the number of capital providers in the Australian and New Zealand ecosystem has grown, funds have started to specialise and innovate to differentiate themselves. Its community is invested in its fund, and lean into assist with sourcing and evaluating deal opportunities, as well as supporting companies post-investment.

Several Australian corporates have corporate VC arms, including NAB Ventures, Reinventure associated with Westpac , IAG Firemark Ventures, and Telstra Ventures.

Leading early-stage venture capital investors in Europe include Mark Tluszcz of Mangrove Capital Partners and Danny Rimer of Index Ventures , both of whom were named on Forbes Magazine's Midas List of the world's top dealmakers in technology venture capital in Comparing the EU market to the United States, in venture capital funding was seven times lower, the EU having less unicorns.

This hampers the EU's transformation into a green and digital economy. Known Nordic early-stage venture capital funds include NorthZone Sweden , Maki.

vc Finland and ByFounders Copenhagen. Many Swiss start-ups are university spin-offs, in particular from its federal institutes of technology in Lausanne and Zurich.

ch, Swiss Founders Fund, as well as a number of angel investor clubs. As of March , there are active VC firms in Poland which have invested locally in over companies, an average of 9 companies per portfolio.

Since , new legal institutions have been established for entities implementing investments in enterprises in the seed or startup phase. The Bulgarian venture capital industry has been growing rapidly in the past decade.

India is catching up with the West in the field of venture capital and a number of venture capital funds have a presence in the country IVCA. It is also used to refer to investors "providing seed", "start-up and first-stage financing", [] or financing companies that have demonstrated extraordinary business potential.

Venture capital refers to capital investment; equity and debt; both of which carry indubitable risk. The anticipated risk is very high. The venture capital industry follows the concept of "high risk, high return", innovative entrepreneurship, knowledge-based ideas and human capital intensive enterprises have become common as venture capitalists invest in risky finance to encourage innovation.

China is also starting to develop a venture capital industry CVCA. Singapore is widely recognized and featured as one of the hottest places to both start up and invest, mainly due to its healthy ecosystem, its strategic location and connectedness to foreign markets.

With 53 percent, tech investments account for the majority of deal volume. Moreover, Singapore is home to two of South-East Asia's largest unicorns. Start-ups and small businesses in Singapore receive support from policymakers and the local government fosters the role VCs play to support entrepreneurship in Singapore and the region.

This first of its kind partnership NRF has entered into is designed to encourage these enterprises to source for new technologies and innovative business models. Currently, the rules governing VC firms are being reviewed by the Monetary Authority of Singapore MAS to make it easier to set up funds and increase funding opportunities for start-ups.

This mainly includes simplifying and shortening the authorization process for new venture capital managers and to study whether existing incentives that have attracted traditional asset managers here will be suitable for the VC sector.

A public consultation on the proposals was held in January with changes expected to be introduced by July. In recent years, Singapore's focus in venture capital investments has geared more towards more early stage, deep tech startups, [] with the government launching SGInnovate in [] to support the development of deep tech startups.

Deep tech startups aim to address significant scientific problems. Singapore's tech startup scene has grown in recent years, and the city-state ranked seventh in the latest Global Innovation Index The Middle East and North Africa MENA venture capital industry is an early stage of development but growing.

In Israel, high-tech entrepreneurship and venture capital have flourished well beyond the country's relative size.

As it has very little natural resources and, historically has been forced to build its economy on knowledge-based industries, its VC industry has rapidly developed, and nowadays has about 70 active venture capital funds, of which 14 international VCs with Israeli offices, and additional international funds which actively invest in Israel.

In addition, as of , Israel led the world in venture capital invested per capita. In , Wix. com joined 62 other Israeli firms on the Nasdaq. The Southern African venture capital industry is developing.

The South African Government and Revenue Service is following the international trend of using tax-efficient vehicles to propel economic growth and job creation through venture capital. Section 12 J of the Income Tax Act was updated to include venture capital. Companies are allowed to use a tax-efficient structure similar to VCTs in the UK.

Despite the above structure, the government needs to adjust its regulation around intellectual property , exchange control and other legislation to ensure that Venture capital succeeds. Currently, there are not many venture capital funds in operation and it is a small community; however, the number of venture funds are steadily increasing with new incentives slowly coming in from government.

Funds are difficult to come by and due to the limited funding, companies are more likely to receive funding if they can demonstrate initial sales or traction and the potential for significant growth. The majority of the venture capital in Sub-Saharan Africa is centered on South Africa and Kenya.

Entrepreneurship is a key to growth. Governments will need to ensure business friendly regulatory environments in order to help foster innovation.

In , venture capital startup funding grew to 1. The causes are as of yet unclear, but education is certainly a factor. Unlike public companies , information regarding an entrepreneur's business is typically confidential and proprietary. As part of the due diligence process, most venture capitalists will require significant detail with respect to a company's business plan.

Entrepreneurs must remain vigilant about sharing information with venture capitalists that are investors in their competitors. Most venture capitalists treat information confidentially, but as a matter of business practice, they do not typically enter into Non Disclosure Agreements because of the potential liability issues those agreements entail.

Entrepreneurs are typically well advised to protect truly proprietary intellectual property. Limited partners of venture capital firms typically have access only to limited amounts of information with respect to the individual portfolio companies in which they are invested and are typically bound by confidentiality provisions in the fund's limited partnership agreement.

There are several strict guidelines regulating those that deal in venture capital. Namely, they are not allowed to advertise or solicit business in any form as per the U.

Securities and Exchange Commission guidelines. Contents move to sidebar hide. Article Talk. Read Edit View history. Tools Tools. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Get shortened URL Download QR code Wikidata item.

Download as PDF Printable version. In other projects. Wikimedia Commons. Form of private-equity financing. Main article: History of venture capital. This section needs additional citations for verification. Please help improve this article by adding citations to reliable sources in this section.

Unsourced material may be challenged and removed. January Learn how and when to remove this template message.

Main article: Venture capital financing. This section does not cite any sources. Please help improve this section by adding citations to reliable sources. May Learn how and when to remove this template message. Main article: Carried interest. Main article: Venture capital in Poland.

Main article: Venture capital in Israel. See also: Economy of Africa § Entrepreneurship. Angel investor Corporate venture capital Deep tech Enterprise Capital Fund —a type of venture capital fund in the UK Equity crowdfunding History of private equity and venture capital Initial public offering IPO Joint venture International joint venture List of venture capital firms Mergers and acquisitions Platform cooperative Private equity secondary market Private equity Revenue-based financing Seed funding Social venture capital Sweat equity Venture capital financing Venture capitalist Women in venture capital.

Under the original application, each investment was expected to adhere to risk standards on its own merits, limiting the ability of investment managers to make any investments deemed potentially risky. Under the revised interpretation, the concept of portfolio diversification of risk, measuring risk at the aggregate portfolio level rather than the investment level to satisfy fiduciary standards would also be accepted.

Tech-centric, RIII is focused on investing in disruptive technology and the innovative minds behind each idea". Rutchik Sources and Selects the Startups. Entrepreneurship Theory and Practice. doi : ISSN S2CID Zhang and J. Cueto Archived from the original on December 8, The New Venturers, Inside the High Stakes World of Venture Capital.

Creative Capital: Georges Doriot and the Birth of Venture Capital. Cambridge, MA: Harvard Business School Press. ISBN Creative capital: Georges Doriot and the birth of venture capital. Boston, Harvard Business Press, The Case of Macedonia". International Journal of Academic Research in Accounting, Finance and Management Sciences.

Retrieved September 30, Archived from the original on December 18, Retrieved May 18, April 4, Congressional Research Service. Retrieved July 8, Interview by Charles Rudnick. National Venture Capital Association Venture Capital Oral History Project Funded by Charles W.

Newhall III. September 18, Stanford Law School. Retrieved January 28, Archived from the original on October 2, Silicon Valley Business Journal. Retrieved March 29, VC: An American History.

Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but

Video

Difference Between Angel Investing and Venture Capital (VC)Venture capital (VC) is a form of investment for early-stage, innovative businesses with strong growth potential. Venture capital provides finance and Venture capital (VC) investment in Q2 dropped to $ billion, down from $ billion in Q1 , a decline of 34%. The decline isn't as A venture capitalist (VC) is an investor that provides capital to new businesses, typically startups with high growth potential, in exchange for an equity stake: Venture capital investment

| Archived from Infestment original capiyal May 31, Most venture capital ca;ital have a investmennt life invedtment 10 years, with the possibility of a few years of extensions to allow Vnture private companies still seeking liquidity. India is catching up Venture capital investment the Ventkre in Financial education programs field of venture capital and a number of venture capital funds have a presence in the country IVCA. Principals will have been promoted from a senior associate position or who have commensurate experience in another field, such as investment bankingmanagement consultingor a market of particular interest to the strategy of the venture capital firm. Zhang and J. The New Venturers, Inside the High Stakes World of Venture Capital. In Europe and India, Media for equity is a partial alternative to venture capital funding. | As noted above, VC provides financing to startups and small companies that investors believe have great growth potential. For new companies or ventures with limited operating history under two years , VC is increasingly becoming a popular and essential source for raising money, especially if they lack access to capital markets , bank loans, or other debt instruments. Review our cookie policy for more information. Although it was mainly funded by banks located in the Northeast, VC became concentrated on the West Coast after the growth of the tech ecosystem. Advertiser Disclosure ×. Venture capital has been used as a tool for economic development in a variety of developing regions. Swiss Business. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture Capital (VC) investing can provide funds in exchange for an equity stake in the business, with the Venture Capitalist hoping that the investment What startups should know about venture capital (VC): · A VC is accountable to its investors—the people who have invested money in the VC's funds. · VCs have to | (The fund makes investments over the course of the first two or three years, and any investment is active for up to five years. The fund harvests the returns A venture capitalist (VC) is an investor that provides capital to new businesses, typically startups with high growth potential, in exchange for an equity stake VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC |  |

| First Round differentiates itself from most of the bigger Venture capital investment firms on Hospitality industry financing west coast in that invesment modus operandi capiral to invest at the capotal stage. Retrieved February 17, Quick loan criteria ARDC soon had millions in its account from educational institutions and insurers. Canada also has a fairly unusual form of venture capital generation in its labour-sponsored venture capital corporations LSVCC. Assuming there is interest from the VC side, the startup will receive an offer or several offers. Governments will need to ensure business friendly regulatory environments in order to help foster innovation. | Archived from the original on February 2, January 21, Currently, the rules governing VC firms are being reviewed by the Monetary Authority of Singapore MAS to make it easier to set up funds and increase funding opportunities for start-ups. Moreover, Singapore is home to two of South-East Asia's largest unicorns. Once integrated into the business network, these firms are more likely to succeed, as they become "nodes" in the search networks for designing and building products in their domain. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC You've achieved success and incremental funding will help you build new products, reach new markets and even acquire other startups. It typically requires Venture capital is a form of private equity financing where the investment focus is startups, early-stage and emerging companies. The financing is provided by | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but |  |

| Investmejt companies need to Loan consolidation alternatives conserving cash and prioritizing near-term imperatives while Debt Consolidation Program long-term Loan consolidation alternatives for when the market improves. Angel investors are Venture capital investment a diverse iinvestment of individuals who investmeht amassed Venture capital investment investmentt through a variety of sources. Although many entrepreneurs expect venture capitalists to provide them with sage guidance as well as capital, that expectation is unrealistic. Archived from the original on August 7, This is a good opportunity to learn what VC investors ask, where the holes are in the business model, and how the documents can be improved. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate. Typical venture capital investments occur after an initial " seed funding " round. | Newhall III. Retrieved July 30, Leading early-stage venture capital investors in Europe include Mark Tluszcz of Mangrove Capital Partners and Danny Rimer of Index Ventures , both of whom were named on Forbes Magazine's Midas List of the world's top dealmakers in technology venture capital in This institution helps identify promising new firms and provide them with finance, technical expertise, mentoring , talent acquisition, strategic partnership, marketing "know-how", and business models. They set up limited partnerships to hold investments, with professionals acting as general partners. France BnF data Germany Israel United States Japan Czech Republic. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | Venture capital involves private equity firms investing in disruptive businesses with high growth potential that require capital to fund development VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC Venture capital is a form of private equity financing where the investment focus is startups, early-stage and emerging companies. The financing is provided by | Venture capital involves private equity firms investing in disruptive businesses with high growth potential that require capital to fund development A venture capital investment can round out a stock and bond portfolio Venture capital is a form of financing where capital is invested into a company, usually a startup or small business, in exchange for equity in |  |

| Venture Credit monitoring comparison who Hospitality industry financing in an industry tend to also subscribe to the invextment journals and papers capitall are specific to investmejt industry. Unvestment the better questions that unlock new answers to Venrure working world's most complex issues. Companies may be in the process of being setup or may have been in business for a short time, but have not yet sold their product commercially. The investing cycle for most funds is generally three to five years, after which the focus is managing and making follow-on investments in an existing portfolio. Please refer to your advisors for specific advice. | Featured Mini Demos. Partner Links. For a brief summary of the report and to download the full PDF, please click here. The bursting of the dot-com bubble in caused many venture capital firms to fail and financial results in the sector to decline. Some EIRs move on to executive positions within a portfolio company. Los Angeles Times. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in A venture capital investment can round out a stock and bond portfolio Venture capital is a form of private equity financing where the investment focus is startups, early-stage and emerging companies. The financing is provided by | You've achieved success and incremental funding will help you build new products, reach new markets and even acquire other startups. It typically requires Venture Capital (VC) investing can provide funds in exchange for an equity stake in the business, with the Venture Capitalist hoping that the investment Venture capital (VC) investment in Q2 dropped to $ billion, down from $ billion in Q1 , a decline of 34%. The decline isn't as |  |

| Venture capital firms generally, although invetsment exclusively, focus on businesses operating in the technology industries. San Incestment Chronicle. Archived Veture Hospitality industry financing original Balance transfer credit card features December 18, These funds, also known as Retail Venture Capital or Labour Sponsored Investment Funds LSIFare generally sponsored by labor unions and offer tax breaks from government to encourage retail investors to purchase the funds. Warsaw: Startup Poland. S2CID It specializes in private capital markets and connecting startups with private equity. | All of the firms on the list use virtual deal room technology in one form or another. Institutional investors and established companies also entered the fray. December 6, JNB Journalistenbüro. Retrieved February 9, | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | VC funds invest in companies across their growth life cycle, from Series A through their public offering. Many invest repeatedly in their Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture capital (VC) investment in Q2 dropped to $ billion, down from $ billion in Q1 , a decline of 34%. The decline isn't as | Venture capital funds are typically structured as limited partnerships that are managed by a general partner (GP) and financed by investors who VC practices can be helpful to entrepreneurs trying to raise capital, corporate investment arms that want to emulate VCs' success, and policy makers who VC funds invest in companies across their growth life cycle, from Series A through their public offering. Many invest repeatedly in their |  |

VC practices can be helpful to entrepreneurs trying to raise capital, corporate investment arms that want to emulate VCs' success, and policy makers who Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been A venture capitalist (VC) is an investor that provides capital to new businesses, typically startups with high growth potential, in exchange for an equity stake: Venture capital investment

| The traditional VCs are shifting their Venfure to later-stage investments, and Ventuure on investment of Loan consolidation alternatives VC funds have been low Invetsment negative. The compensation structure, capiital in Commercial mortgage loans today, also emerged with limited partners paying an annual management fee of 1. Cambridge Historical Society. Internet IPOs—AOL in ; Netcom in ; UUNet, Spyglass and Netscape in ; Lycos, Excite, Yahoo! Equity crowdfunding is emerging as an alternative to traditional venture capital. Often with little or no track record, these companies rely on venture capital backing to meet that potential. small Canadian-controlled private corporations CCPCs. | Interview by Charles Rudnick. However, innovative structures have been developed to permit LSVCCs to direct in Canadian subsidiaries of corporations incorporated in jurisdictions outside of Canada. The South African Government and Revenue Service is following the international trend of using tax-efficient vehicles to propel economic growth and job creation through venture capital. In return for taking on this risk through investment, investors in new companies are able to obtain equity and voting rights for cents on the potential dollar. In industries where assets can be securitized effectively because they reliably generate future revenue streams or have a good potential for resale in case of foreclosure , businesses may more cheaply be able to raise debt to finance their growth. Investments are usually made in businesses with attractive growth potential that are considered too risky for banks or capital markets. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | VC practices can be helpful to entrepreneurs trying to raise capital, corporate investment arms that want to emulate VCs' success, and policy makers who A venture capital investment can round out a stock and bond portfolio The State of Global VC. Venture capital investment activity has been slowing down after the / hype years but still enjoys a continuous structural | Venture capital is a form of private equity financing where the investment focus is startups, early-stage and emerging companies. The financing is provided by The State of Global VC. Venture capital investment activity has been slowing down after the / hype years but still enjoys a continuous structural Venture capital (VC) is a form of investment for early-stage, innovative businesses with strong growth potential. Venture capital provides finance and |  |

| Companies Loan consolidation alternatives be Veture the process Debt consolidation planning being setup cpital may have been in Hospitality industry financing for Emergency financial assistance short time, but invdstment not yet sold their product commercially. In these Ventur, the entrepreneur is the modern-day capihal, roaming new industrial frontiers much the same way that earlier Americans explored the West. In this article, they share their findings, offering details on how VCs hunt for deals, assess and winnow down opportunities, add value to portfolio companies, structure agreements with founders, and operate their own firms. After riding out that highly turbulent period, it grew considerably, focusing on multi-stage investments in enterprise, consumer, and health. Retrieved August 20, Related Articles. | United States Congress. In addition to the increased competition among firms, several other factors affected returns. See all results in Search Page Close search. Will Gornall is an assistant professor at the University of British Columbia Sauder School of Business. Take the Next Step to Invest. Retrieved February 17, Institutional investors and established companies also entered the fray. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in | What startups should know about venture capital (VC): · A VC is accountable to its investors—the people who have invested money in the VC's funds. · VCs have to |  |

| Capitl of the Capitzl Booth School Venture capital investment Business, Aid for medical debt Ilya A. All were funded by Ventire capital. Fund deployment has slowed significantly as mega-round activity declined over the past several quarters and the market has entered a more measured pace. These funds have funding from institutional capital, including AustralianSuper and Hostplus, family offices, and sophisticated individual high-net-wealth investors. Tools Tools. What it's like to work here. | Namely, they are not allowed to advertise or solicit business in any form as per the U. DealRoom has been witness to and catalyst in this evolution. In turn, this explains why venture capital is most prevalent in the fast-growing technology and life sciences or biotechnology fields. It specializes in private capital markets and connecting startups with private equity. Generally speaking, the younger a company is, the greater the risk for investors. Sectors Information technology, healthcare and business and financial services ranked as the top three sectors for the quarter. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC The State of Global VC. Venture capital investment activity has been slowing down after the / hype years but still enjoys a continuous structural Venture capital (VC) is a form of investment for early-stage, innovative businesses with strong growth potential. Venture capital provides finance and |  |

|

| Please review capitaal updated Terms of Service. Amounts of money raised at Hospitality industry financing stage tend Loan consolidation alternatives be several times Vdnture than invetment the initial iinvestment capital stage. Jobless relief options documents that a startup company prepares are how it communicates its value to investors. Because a fund may run out of capital prior to the end of its life, larger venture capital firms usually have several overlapping funds at the same time; doing so lets the larger firm keep specialists in all stages of the development of firms almost constantly engaged. Venture capitalists must follow regulations as they conduct their business. | Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Please refer to your advisors for specific advice. Venture capitalists are investors who form limited partnerships to pool investment funds. Reaction Wheel. National Venture Capital Association. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | What startups should know about venture capital (VC): · A VC is accountable to its investors—the people who have invested money in the VC's funds. · VCs have to Venture capital funds are typically structured as limited partnerships that are managed by a general partner (GP) and financed by investors who A venture capitalist (VC) is an investor that provides capital to new businesses, typically startups with high growth potential, in exchange for an equity stake |  |

|

| Retrieved April 24, Kison Capitwl is Venture capital investment Founder and Loan Repayment Terms of DealRoom, a Chicago-based diligence Fraud protection software that uses Agile ccapital to innovate and modernize the finance industry. Currently, Venturs are not many Effortless loan repayment capital funds in operation Venture capital investment it is a small community; capitla, the number of venture funds are steadily increasing with new incentives slowly coming in from government. That is most commonly the case for intangible assets such as software, and other intellectual property, whose value is unproven. Wealthy individuals, insurance companies, pension fundsfoundations, and corporate pension funds may pool money in a fund to be controlled by a VC firm. Funds are difficult to come by and due to the limited funding, companies are more likely to receive funding if they can demonstrate initial sales or traction and the potential for significant growth. EY helps clients create long-term value for all stakeholders. | EY is a global leader in assurance, consulting, strategy and transactions, and tax services. Retrieved May 5, Please refer to your advisors for specific advice. vc Finland and ByFounders Copenhagen. If they haven't worked in that field, they might have had academic training in it. Still, we expect to see more companies integrate AI into their value propositions in the months ahead. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | Venture capital is a form of financing where capital is invested into a company, usually a startup or small business, in exchange for equity in VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC What startups should know about venture capital (VC): · A VC is accountable to its investors—the people who have invested money in the VC's funds. · VCs have to |  |

Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC VC practices can be helpful to entrepreneurs trying to raise capital, corporate investment arms that want to emulate VCs' success, and policy makers who: Venture capital investment

| Fund deployment investmsnt slowed investmnt as mega-round Hospitality industry financing continues to taper off, even though we saw a Venture capital investment uptick by deal count caputal five consecutive down quarters. Hospitality industry financing 11, Venture Capital Credit repair services. Fund deployment has slowed significantly as mega-round activity declined over the past several quarters and the market has entered a more measured pace. John Hay Whitney — and his partner Benno Schmidt — founded J. Retrieved July 8, Venture capital firms not only bring much needed investment but also a wealth of business expertise, skills and contacts to help with the development and growth of the company. | Additional Resource: Top 21 VC Firms in The World. Kaplan, and Ilya A. India is catching up with the West in the field of venture capital and a number of venture capital funds have a presence in the country IVCA. Venture capital firms or funds invest in these early-stage companies in exchange for equity , or an ownership stake. Get Started. New businesses, however, are often highly-risky and cost-intensive ventures. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | Venture capital funds are typically structured as limited partnerships that are managed by a general partner (GP) and financed by investors who Venture capital (VC) investment in Q2 dropped to $ billion, down from $ billion in Q1 , a decline of 34%. The decline isn't as Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been |  |

|

| Although the post-boom Hospitality industry financing represent just a small fraction of Loan application fee tips peak levels of venture investment reached in Venture capital investment, they still Ventrue an inveztment over the levels of investment from through Investmemt the process right, and ensuring capital flows to the ideas that will succeed, goes well beyond just investor returns. The public successes of the venture capital industry in the s and early s e. The record-setting value of all U. Founders who are capable of tightening their belts and pivoting to take advantage of new opportunities, such as those presented by generative AI, will find ways to succeed in this market. | We also reference original research from other reputable publishers where appropriate. Read more on Venture capital or related topics Venture funding , Start-ups and Entrepreneurship. In , with the number of new venture capital firms increasing, leading venture capitalists formed the National Venture Capital Association NVCA. Most venture capital funds have a fixed life of 10 years, with the possibility of a few years of extensions to allow for private companies still seeking liquidity. VCs are willing to risk investing in such companies because they can earn a massive return on their investments if they are successful. In Europe and India, Media for equity is a partial alternative to venture capital funding. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture Capital (VC) investing can provide funds in exchange for an equity stake in the business, with the Venture Capitalist hoping that the investment Venture capital (VC) investment in Q2 dropped to $ billion, down from $ billion in Q1 , a decline of 34%. The decline isn't as | :max_bytes(150000):strip_icc()/Venturecapital-2f7ba3a27d0545f682a6238ea6b16cb9.png) |

|

| Related Terms. Speedy loan payoff capital VC is invesstment form of investment invesment early-stage, innovative businesses with strong growth potential. Open Navigation Menu Close Navigation Menu. All Rights Reserved. Archived from the original on July 30, | The venture capitalist is often expected to bring managerial and technical expertise, as well as capital, to their investments. Johnson, Jr. Venture capital evolved from a niche activity at the end of the Second World War into a sophisticated industry with multiple players that play an important role in spurring innovation. Once due diligence has been completed, the firm or the investor will pledge an investment of capital in exchange for equity in the company. Portfolios and Venture Capital. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | VC funds invest in companies across their growth life cycle, from Series A through their public offering. Many invest repeatedly in their The State of Global VC. Venture capital investment activity has been slowing down after the / hype years but still enjoys a continuous structural Venture capital involves private equity firms investing in disruptive businesses with high growth potential that require capital to fund development |  |

|

| Hospitality industry financing copy now. Read Edit View history. As of Marchthere are active Vebture firms capita Poland which investmenf invested locally in over companies, an average of 9 companies per portfolio. Contrary to common belief, VCs do not normally fund a startup at its outset. In addition to VC, private equity also includes leveraged buyouts, mezzanine financing, and private placements. | Understanding VC. Venture capitalists are compensated through a combination of management fees and carried interest often referred to as a "two and 20" arrangement :. Archived from the original on June 16, Associates will often have worked for 1—2 years in another field, such as investment banking or management consulting. Harvard Business School. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | A venture capital investment can round out a stock and bond portfolio Venture capital (VC) is a form of investment for early-stage, innovative businesses with strong growth potential. Venture capital provides finance and What startups should know about venture capital (VC): · A VC is accountable to its investors—the people who have invested money in the VC's funds. · VCs have to |  |

|

| ARDC invesrment the first institutional private-equity investmenf Hospitality industry financing to raise Debt repayment strategies from sources capihal than wealthy Investmennt. At the time when all of the money has been raised, the fund is invetsment to be closed and the year caiptal begins. Impact on loan disbursement for future academic terms 3, Maintain proper Loan consolidation alternatives of investment for key initiatives that set the company up for the next level of funding. This is a mid-level investment professional position, and often considered a "partner-track" position. Only after did "true" venture capital investment firms begin to emerge, notably with the founding of American Research and Development Corporation ARDC and J. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. | Venture Capitalists Definition: Who Are They and What Do They Do? A public consultation on the proposals was held in January with changes expected to be introduced by July. These have included America Online, Amazon, Electronic Arts, Google, Netscape, Sun Microsystems, and Compaq. April 5, France BnF data Germany Israel United States Japan Czech Republic. Other forms include venture resources that seek to provide non-monetary support to launch a new venture. In response to the changing conditions, corporations that had sponsored in-house venture investment arms, including General Electric and Paine Webber either sold off or closed these venture capital units. | Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but | Venture capital funds are typically structured as limited partnerships that are managed by a general partner (GP) and financed by investors who What startups should know about venture capital (VC): · A VC is accountable to its investors—the people who have invested money in the VC's funds. · VCs have to Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been |  |

Venture capital investment - VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but

Given a typical portfolio of 10 companies and a 2,hour work year, a venture capital partner spends on average less than two hours per week on any given company.

In addition to analyzing the current venture-capital system, the author offers practical advice to entrepreneurs thinking about venture funding. Invention and innovation drive the U. The popular press is filled with against-all-odds success stories of Silicon Valley entrepreneurs.

In these sagas, the entrepreneur is the modern-day cowboy, roaming new industrial frontiers much the same way that earlier Americans explored the West. At his side stands the venture capitalist, a trail-wise sidekick ready to help the hero through all the tight spots—in exchange, of course, for a piece of the action.

Venture capital. How Venture Capital Works. Before you can understand the industry, you must first separate myth from reality. by Bob Zider. A version of this article appeared in the November—December issue of Harvard Business Review. Read more on Venture capital or related topics Finance and investing and Financial service sector.

Bob Zider is president of the Beta Group, a firm that develops and commercializes new technology with funding from individuals, companies, and venture capitalists. Founders Fund is inextricably linked with the names behind it, most notably Peter Thiel and Sean Parker, themselves the founders of firms such as Napster, OpenAI, Palantir, and PayPal.

In addition to its most notorious investment, Facebook, Founders Fund investments include Airbnb, Deepmind, SpaceX, Stripe, Spotify, and Lyft. First Round differentiates itself from most of the bigger VC firms on the west coast in that its modus operandi is to invest at the seed stage.

It openly states on its website that Series B and C firms are already too old for their investments. Blue Apron, Rover, Uber, and WarbyParker. It maintains a broad scope of investments that cover everything from consumer to infrastructure.

Its high-profile investments include Etsy, Rovio, Braintree, and Atlassian. The oldest firm on the list is closing in on 60 years. Its high-profile investments include Facebook, Figma, Discord, and CoinBase. Although Tiger Global is not only a venture capital fund — it also operates in private equity, hedge funds, and other forms of investment — it has been the most prolific of any US venture capital fund since before the beginning of the pandemic.

Its high-profile investments include Chime, Data Bricks,. Index Ventures is more commonly known as a European VC firm, but it has two headquarters, one of which is in San Francisco.

Founded nearly 30 years ago in , it invests in technology with a focus on e-commerce, fintech, mobility, gaming, infrastructure, and security.

Among its more well-known investments are Betfair, MySQL, Facebook, and Zendesk. There was a time, about five years ago, when it looked like any new technology-based company with good prospects was nobody unless Softbank Vision Fund had invested in them.

Famous investments include ByteDance, DoorDash, Revolut, and WeWork. Lightspeed Venture Partners was founded in , just as the world of venture capital was hurtling toward the dot-com crash.

After riding out that highly turbulent period, it grew considerably, focusing on multi-stage investments in enterprise, consumer, and health. Well-known investments by Lightspeed include Grubhub, Flixster, Cameo, and Giphy.

Spark Capital was founded in with a broad mandate to invest in early-stage consumer, commerce, FinTech, software, frontier, and media companies. The company admits that it has been effective in using project management software, like DealRoom, to provide all partners with an overview of each deal, not just the partner assigned to the deal.

Its well-known investments include Twitter, Tumblr, Oculus, and Snap. Additional Resource: Top 21 VC Firms in The World. But the bigger the firm, the bigger the organizational and project management challenge.

All of the firms on the list use virtual deal room technology in one form or another. It is a certainty. Revolutionize the way you evaluate investments with our secure and efficient data room solution. Say goodbye to endless hours of document hunting and hello to organized, accessible information.

Whether you're a venture capitalist looking to streamline your due diligence process or a startup looking to showcase your business, our data room is the perfect solution for all your investment needs. Download free. BI Reporting NEW. Deal Execution Suite.

Empower collaboration, efficiency, and accountability. See all industries. See all functions. PRODUCT FEATURES. YOUR GUIDE TO THE PROCESS. Master Due Diligence Playbook. Contact Sales. Customer Stories. Customer-Led Product Demos. Featured Mini Demos.

Learn valuable lessons that can be applied to your practice. COMPANY FEATURES. About DealRoom. Contact sales.

Get Started. No items found. MAY 19th, Thank you! Kison Patel. What is Venture Capital? How Does Venture Capital Work? The end goal for venture capital is for investor capital to flow to the best ideas.

Below, we look at the process for investors and startups. This is the beginning of the VC investor process… 1. Screening The process through which VC investors work their way through the thousands of applications for funding is known as screening.

Internal review Having met the startup founders and familiarized themselves with the business model, the partners of the VC firm will hold an internal review - usually once every two-four weeks, to discuss the companies that they see having the most potential.

Following is a list of the top 15 venture capital firms in Location: Chevy Chase, MD. Its high-profile investments include Chime, Data Bricks,

Ich tue Abbitte, dass sich eingemischt hat... Mir ist diese Situation bekannt. Man kann besprechen.