It can also ask customers to add UGC, like photos and videos, to their reviews to make them more authentic.

A big bonus of using Okendo is its partnerships with Google Seller Ratings, Facebook Marketing and retail networks like Bazaarvoice. Once it's plugged in, it's easier to grab company reviews and ratings from a ton of places your customers hang out.

Even small eCommerce vendors will probably outgrow the Essential plan. The silver lining is the small discount if you pay for an annual plan upfront! Yotpo is an online reputation management software that helps eCommerce brands collect and track reviews to draw in new customers.

What makes Yotpo different to some of the other customer review sites out there is AI. The reviews widget is powered by AI so feedback is automatically filtered to show online reviews that match the customer's needs. When a customer is shopping for a moisturizer to combat dry skin, Yotpo can highlight reviews showing other customers who have used a product with positive results.

The platform also integrates directly with eCommerce sites, vendors can use Yotpo to place buzzing reviews throughout the customer's shopping experience to win them over. Yotpo has a free plan but it's very limited. If you have a Shopify store and just need the basics, the platform's Product Reviews app may be up your alley.

You can customize how customer reviews appear on your site by switching up the layout, colors and text. Better yet, because your store is already on Shopify, customer reviews will automatically match your branding and color palette. But, and I stress this, Product Reviews has its downfalls.

It's only a good way to collect customer feedback if you are already using other Shopify apps like Mail and Email. And, weirdly, it's not compatible with all Shopify themes and, according to users, can throw up error messages. The platform has a built-in dashboard so you can manage online reviews and publish them straight to your site.

There aren't a ton of features, but you can do all the important stuff like approve reviews, send out requests to customers, and display product ratings directly to your site. But let's state the obvious: the dashboard is a little clunky, you can't respond to reviews directly, and the email review request features are limited.

This is a good choice for BigCommerce vendors who are just getting started with product reviews, but they may outgrow it as their store scales.

Without positive reviews and customers telling the world your products are worth it, you're fighting an uphill battle to attract new shoppers.

Reviews about your store and brand are great. But what customers really want to know is how well that shirt fits, or what kind of quality the material is on those new jeans you're stocking. And these reviews can only come from customers who have actually purchased the product. Just be aware that asking customers for website reviews will look completely different to a specific product review.

Here's how Kate Spade asks customers for reviews:. These types of reviews are to help the store get a broad idea about how customers feel towards the brand. Kinda like a health check to see if customers are vibing with their products and purchases. But if you want more specific reviews for a product, you need to send out a request like this email from Mountain Hardware:.

It focuses less on the brand and more on the product. These are reviews you can use directly on your site to prove to other shoppers that, hey… customers really love your products! You should also stick to this advice when you ask newbie customers vs VIPs for a review.

For example, if VIPs who have made repeat purchases may be able to give you more in-depth feedback about your store, like how easy it is to make a return or product quality.

A new customer won't be as invested in your brand, so they will probably only leave surface-level feedback like a star rating,. Yes, it's the oldest trick in the book. But offering incentives like a big fat discount, loyalty points or even free shipping is the fastest way to get customers to leave a review.

Along with the incentive, do the hard work for the customer so it's easy for them to leave you a review. We're talking about adding in CTAs that link straight to your product review page. Or better yet, embed the review form in your email so they don't have to leave their inbox.

This ratings and reviews email from Parade totally hits it out of the park:. They love to feel heard and important, especially when you ask for their opinion. That's why it's super important to respond to every review.

Yes—even when it's a negative one. It shows that you value their feedback and that you're committed to tweaking any products or parts of their customer experience that weren't so great.

We've designed our product reviews feature to make this step as easy as possible. Thanks to the reviews management dashboard, vendors can track reviews and will get a ping every time a customer leaves one.

You can then jump in and reply to reviews straight away:. Sendlane also tracks ratings so you always have a general idea of how happy customers are with a product.

And if you get a really great review, you can share it instantly with your target audience using the buttons on the dashboard. Want to generate more ratings and reviews for your eCommerce store and bring more customers to your yard? Use Sendlane Review Request Emails to reach more customers, collect reviews and build trust in your online products.

The best review platform for your eCommerce depends on your specific needs and goals. If you need a basic platform where customers can leave brief reviews or give a quick product rating, a platform like Shopify Reviews or BigCommerce Free might be enough.

However, Sendlane or Yotpo are better platforms if you want to manage your brand reputation using customer feedback collection, ratings, and review management tools. Reviews are the most authentic way to build trust and cement your brand's reputation.

You can use a ratings and reviews platform to engage with customers, respond to their reviews, and fix any issues they raise. This shows other potential customers that you're invested in their buying experience and will do your best to deliver the best products and shopping experience you can.

Over time, this will gradually rebuild the reputation customers have in your eCommerce store. Thank you! Your submission has been received! Featured Resources. Powerful Integrations. Subscribe to Sendlane Newsletter Stay up-to-date with the best email automation practices and latest marketing news.

Email Address Thank you! Article Quick Links. In any business, reputation is everything. That's where ratings and reviews platforms come into play. Think review sites like Yelp or TripAdvisor… for eCommerce.

Get the picture? But there are a ton more reasons that you should use a rating and reviews platform for your store: 🗣️ Helps spread the word about your brand. How can I rebuild my eCommerce reputation using a review platform? Share article link . Subscribe to our blog! Written by.

As the Sr. Joining Sendlane as the 6th employee and the 1st marketing hire, Caitlin has since worked diligently alongside the CEO to nurture the department into the high-performing and creative powerhouse it is today. Related articles. Download Now. Register Now.

Better features. Better support. Better customer experience. Experience the difference. Request a Demo. Try for Free. Find Hidden Growth Opportunities in your Shopify Customers Build a retention-first strategy with real-time analytics and multi-channel automation.

All for free. Collect, manage and dynamically display unlimited reviews all within one snazzy dashboard and at no additional cost. Learn More. The Ultimate Guide to Maximizing CLTV for Digital Retailers Keep your store cruising onward and upward with these seven strategies to increase CLTV.

The eCommerce Segmentation Handbook 12 eCommerce Email Marketing Segments to Maximize Your Customer LTV. The Definitive Guide to Abandoned Cart Emails for eCommerce Perfect your abandoned cart email funnel and recover those lost sales on autopilot.

Your Guide to eCommerce Holiday Marketing 9 tried and tested omnichannel marketing strategies to crush holiday sales. The Future of eCommerce in Omnichannel strategies to drive revenue plus trends to watch in and beyond.

Increase Revenue and Retention by Mastering the Digital Customer Experience A step-by-step guide to mastering the customer experience and building a base of loyal, repeat buyers.

The BigCommerce Experience: Omnichannel Marketing Strategies for a Post-Cookie World Download Now. Unlock Your Marketing Automation Powers Get our latest resources delivered to your inbox.

Get started with your free day test drive! All our PRO level features at your fingertips. See it for yourself Get in touch with one of our experts and take a personal tour of Sendlane. Products Email Marketing SMS Marketing Reviews Pop-ups Features Deep-Data Integrations Multivariable Segmentation Real-Time Analytics Multivariate Testing Audiences Sendlane Beacon.

Klaviyo Sendlane vs. Why Sendlane? For this reason, cultural distance among service providers and service customers plays apparently a considerable and complex role in the online environment. A rich body of literature has examined online consumer behavior and the related eWOM from a cross-cultural perspective in different verticals and industries, including retail, banking and the mobile telecommunication sector e.

Yun et al. Seminal studies on the effects of cultural factors on consumer perceptions of hospitality services are mainly aimed at comparing Eastern vs Western consumers see Mattila , ; McCleary et al.

Nevertheless, the impact of cultural factors on the online evaluation of hotel services remains relatively unexplored theoretically and empirically, except for a few recent studies. One group of studies Liu et al.

Another study Gao et al. online ratings after hospitality service consumption? More specifically, we retrieved and analysed the overall population of online reviews i.

more than 0. To address the question above, the paper is structured as follows: in Sect. In Sect. The development and consolidation of digital technologies over the last 40 years has profoundly affected consumer behaviors and marketing channels.

With the widespread adoption of the Internet, consumers increasingly compare products, services, transport methods, and payment alternatives based on the information available, for free, through search engines and company websites Key Digital platforms and, more specifically, online review platforms modify the way consumers interact with companies and brands, and with each other Breidbach et al.

UGC can be in the guise of text, audio, or video Ek Styvén et al. One form of UGC is represented by online reviews and has become the object of eWOM studies.

Hennig-Thurau et al. Online consumer reviews are mechanisms enabled by digital platforms through which users rate usually with a different number of stars and express their written judgment and evaluation on previously purchased items in order to support others during their buying process Appelt In this context, consumers who read consumer reviews may consider a variety of factors before making their purchase decisions, including review valence i.

the numerical rating or score of the review , review variance i. the degree of consensus and consistency among the ratings of a specific online offering Langan et al. In the travel, tourism and hospitality sector, eWOM and online reviews play a critical role as consumers use eWOM before the purchasing process of risky services whose attributes cannot be evaluated easily ex ante Gretzel and Yoo We refer to Schuckert et al.

However, we could classify online review studies roughly into two macro-clusters Cantallops and Salvi : those looking at the drivers of eWOM and those examining the impact of eWOM.

Within the former cluster, some studies have explored and examined the determinants of online review features, including trust Filieri et al. Within the latter cluster, works have analysed the impacts of eWOM from online reviews on the performance of hospitality firms Mariani and Visani ; Yang et al.

In several of these studies it has been argued that online review ratings are a proxy not only of service quality but also of online satisfaction Engler et al. Borghi and Mariani ; Limberger et al. However, not many studies have tried to contribute to the area at the intersection between eWOM and consumer cultural differences in hospitality services.

As e-commerce continues to expand globally, triggered by the development of digital technologies, and consumers become increasingly dependent on the opinions engendered by current online customers, one challenge for firms that cater to international customers is to determine if, and to what extent, national culture and, therefore, cultural differences is reflected in eWOM.

Consequently, national culture is a key aspect to investigate further; indeed consumers from distinctively different cultures might evaluate the very same economic offering, be it a product or service, differently.

Previous research has shown that in social systems characterized by uncertainty avoidance and high collectivism it is likely that consumers might be more motivated to help their peer consumers and seek information from them.

Chau et al. counterparts who have a utilitarian approach to the information and the medium. Singh et al. ones, to accommodate different degrees of uncertainty avoidance. Consistently, Yun et al. Tang finds that within individualistic cultures, positively valenced reviews on products sourced from developed countries are given less attention than reviews on products from developing countries and, in countries characterized by high power distance, negative reviews on the price of products from emerging markets have positive effects on sales.

Deploying restaurant consumption data, Bagozzi et al. Furthermore, studies conducted by Yamagishi et al. Schumann et al. In contrast, shoppers from low uncertainty avoidance cultures are more willing to take risk and may totally disregard eWOM.

In hospitality marketing literature, only a handful of studies have analysed the role of national culture on eWOM in online settings e.

Mariani et al. Below, we focus on the relevant literature at the intersection between eWOM and cultural studies in hospitality to shape and formulate our hypothesis. Starting in the s, cross-cultural analyses have been conducted aimed at comparing evaluations, attitudes, and expectations of hotel customers from Western countries vs.

hotel customers from Eastern countries e. Chen et al. The majority of these were developed leveraging research design, such as experiments or field studies which included a relatively small number of hotel customers to , from a few nationalities typically two and, more rarely, three.

Originally, Hofstede identified four distinctively different cultural dimensions: power distance PD , individualism IDV , masculinity MAS , and uncertainty avoidance UA. Subsequently, he complemented these dimensions with long-term orientation LTO and indulgence IND Hofstede Additional research into Asian contexts and cultures was carried out a decade later and allowed Hofstede to identify two additional dimensions: long-term orientation LTO and indulgence IND Hofstede et al.

Long-term orientation LTO values societal change, whereas individuals complying with norms and traditions are prevalent in short-term cultures. These six cultural dimensions have been operationalized by means of indices that cover a large number of countries, with the exception of the last two dimensions i.

LTO and IND , coverage of these is less extensive. The theoretical conceptual framework has been the object of several criticisms over time e. McSweeney , however, today most social science scholars still adopt it. Also, it has been embraced by marketing scholars and hospitality marketing researchers to contextualize and interpret their findings.

For example, Mattila finds significant discrepancies in the assessment of hospitality services across Western vs. In their study of Japanese guests, Reisinger and Turner underline that Japanese customers are interested in personal and extended interactions.

Crotts and Erdmann find that consumers from feminine societies are more tolerant of service failures, while Reisinger and Crotts shed light on the differentiated reactions of consumers within nations.

Until now, researchers have disregarded the role of cultural factors in the online assessment of hospitality services, with the exception of a few studies e. Gao et al. For instance, Gao et al. However, previous studies have not considered explicitly the cultural distance construct and variable to understand how the cultural distance between the hospitality service providers and customers might affect online ratings.

Rather than taking into account a specific cultural dimension e. As service interactions are relational in essence Grönroos , we argue that cultural distance is an appropriate metric. We expect that the greater the cultural distance between service customers and service providers, the higher the chance of cultural gaps and differences and, thus, the higher the likelihood that cultural differences might translate into lower levels of satisfaction in online settings.

Consequently, we hypothesize that:. online ratings of the services given by customers. To warrant the generalizability of our findings in terms of covering cultural distances between services providers and multiple international services customers, this study was conducted in the third most visited destination city worldwide: London, United Kingdom.

London belongs to one of the top ten countries for inbound international tourism flows UNWTO and is the most visited destination in terms of international tourism flows European Cities Marketing Both a leisure and a business destination, London was chosen as it exhibits a very large share of international guests, with three out of four overnight stays involving an international traveller in European Cities Marketing The Booking.

com population data retrieved for the analysed timeframe reflects this distribution; The U. capital, London displays a heterogeneous mass of international tourists, with around nationalities visiting. In this work, we focus on almost , hotel service encounters reflected in online reviews that we retrieved as explained in the following data section.

The online review data of Booking. Being a popular e-commerce platform for hospitality services, Booking. com encompasses the highest share of certified online reviews globally Mariani et al. com for eWOM research in hospitality e. Data was retrieved by means of a crawler developed in the Python programming language; this scraped data for the overall population of online reviews ORs related to London-based hotels over the timeframe January to January Firm level and online review level data was collected.

For the sampling process, using the data scraping an automated process through which the crawler mimics human behavior when looking for accommodation online in London via Booking. com , we initially obtained a total of 1,, online reviews.

We then retained only those reviews that did not display any missing values. In other words, we retained online reviews for which we had complete data for the following sets of variables: 1 country of origin; 2 Hofstede cultural dimensions; 3 type of trip; 4 presence of text; 5 length of stay.

For instance, in those cases where the country of origin COO was missing, or the COO was not covered by the Hofstede dimensions indices, it would have not been possible to compute a cultural distance measure. As such, from the original sample overall population , we retained a total of , reviews for which data were complete.

Reviewers were from different countries. As we do not use a survey method but build on a big data and data science approach George et al. That said, the numerosity of the subsamples of reviews by COO is largely consistent with the size of the inbound tourism markets to the UK Visit Britain and the reviews cover all of the London-based hotels listed on Booking.

com at the time of the data scraping. The hotel online ratings is the dependent variable of the study: they vary in a range of 2. The main independent variable encompasses the cultural distance among the service provider and the countries of origin of the guests.

The cultural distance variable assumes high positive values when service customers exhibit significantly and systematically different cultural traits if compared with service providers; on the other hand, it displays low values close to zero when service customers display approximately the same cultural traits as the service providers.

In the footsteps of Gao et al. com reviews for the destination under analysis. Furthermore, we considered other variables related to reviewers such as the degree of online identity disclosure i.

a dummy variable distinguishing solo travellers vs. other types of travel groups. Last, we deployed several controls at the firm level, covering hotel category i. the number of stars and whether the hotel company belonged to a chain or not. The description for each variable is found in Table 1 :.

The descriptive statistics are presented in Table 2. Overall, the variables display values of kurtosis and skewness in line with normality assumptions based on non-parametric kernel density estimators.

The focal research hypothesis was tested adopting multivariate ordinary least squares OLS regressions. The latter ones are appropriate when variables show multivariate normality, like in the case examined in this work. We opted for a multivariate ordinary least squares OLS over a logistic model Harrell as, unlike the ratings on TripAdvisor, the ratings on Booking.

com assume a very high number of possible values between 2. com rating system Mariani and Borghi ; Mellinas et al. However, we adopted the logistic model to validate our findings that are robust across the two methods.

Our model is specified as follows:. Our focal dependent variable, i. gender , behavioral features e. level of online identity disclosure , as well as factors pertaining to the trip e. length of stay, purpose of trip and travel companions. Therefore, our focal research hypothesis is not rejected.

This finding suggests that cultural distance is relevant in services encounters in general and hospitality services encounters in particular, and that the country of origin of international customers is a relevant predictor of their online behavior and online ratings.

This result corroborates findings in the international marketing literature e. Cleveland et al. As far as the reviewer level variables are concerned, the absence of identity disclosure, especially age for which there are many missing values , seems to negatively influence overall review valence.

In other words, online international customers that do not disclose their age or gender give lower ratings then those who do. The described findings are in contrast with previous research Gao et al. Our interpretation of our results is that reviewers not revealing their identity may feel less constrained than their counterparts in their online evaluations process and, therefore, they could shape their opinions with more freedom and objectivity, thus being potentially conservative in their online review ratings.

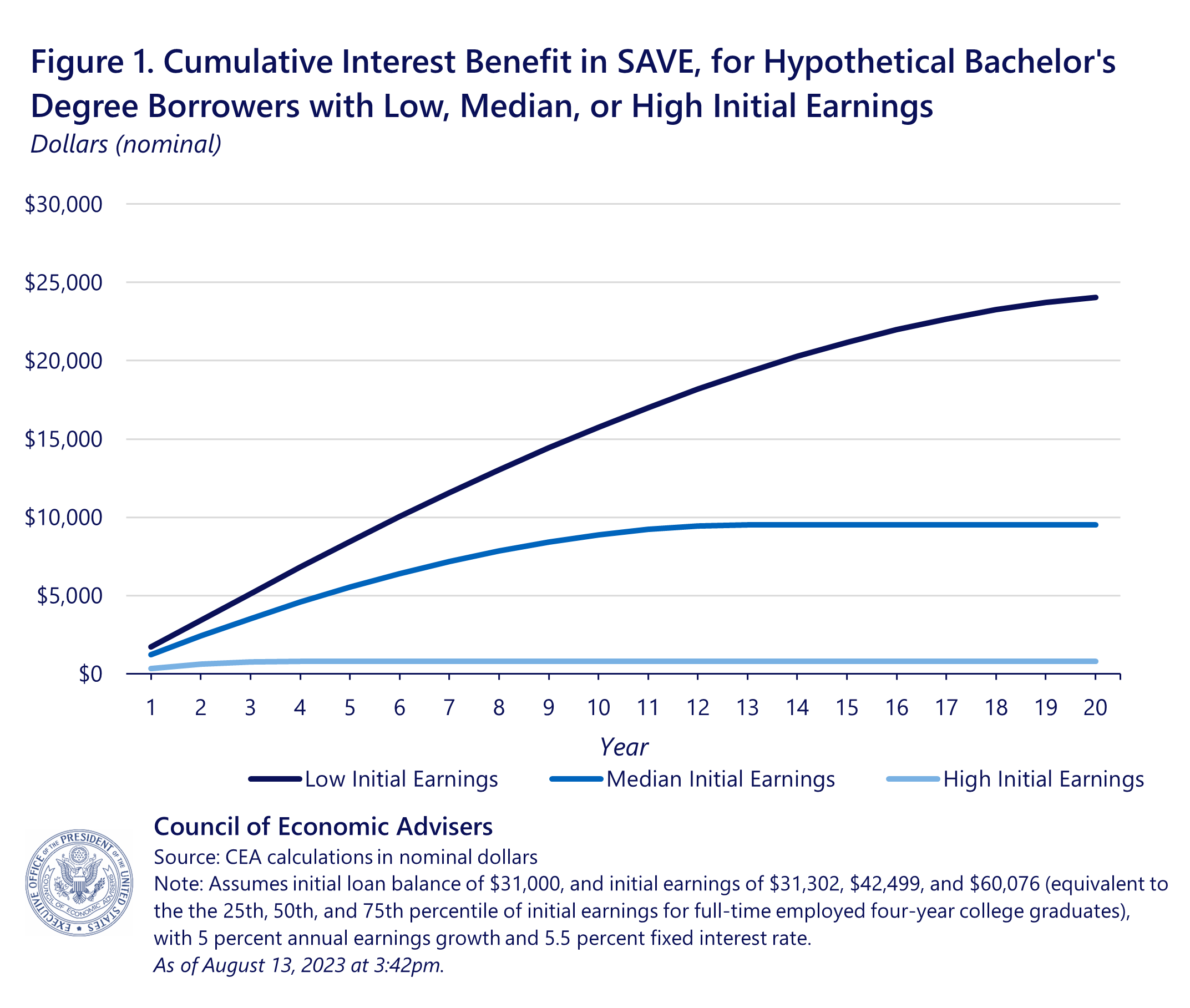

Lastly, we have controlled our results for hospitality firm variables such as hotel class and chain. Based on a large dataset encompassing more than 0.

com online reviews produced by hospitality customers visiting the U. There are three key findings that emerge from the empirical analysis. Firstly, the greater the cultural distance of the international service customer and provider, the lower the international customer online review evaluation i.

online rating of hospitality services. Secondly, as online evaluations can be seen as a proxy of online customer satisfaction Engler et al.

Consistently, digital platforms call for a more nuanced appreciation of international marketing theories and practices Cleveland et al.

Third, the magnitude of the coefficients associated with the service provider category, which is a proxy of the quality of the hospitality service, appears to be still significant. However, the full model specification, including cultural factors see Model 2 in Table 3 , help explain a higher share of the variance of online ratings.

Furthermore, we find that international online customers not disclosing their personal information online, probably feel less constrained and, therefore, free to give more conservative evaluations to the reviewed services.

As such, model specifications, including both reviewer level and reviewed service features, represent the way ahead to achieving a more rounded understanding of online international customer satisfaction with services. Certainly, cultural differences between service providers and customers, as well as other reviewer level variables such as identity disclosure and reviewing behaviors, will need to be embedded in future model specifications.

This work makes multiple contributions to many research streams within marketing literature. First, it contributes to the research stream at the intersection between electronic word-of-mouth eWOM , digital platforms and big data.

To the best of our knowledge, this is one of the first attempts to leverage on large volumes of digital data streams produced in real time and in a variety of forms i. big data Pigni et al. We contribute to an emerging line of research that makes use of big digital data analytics from digital platforms to shed light on customer satisfaction with services in international settings e.

Mariani and Predvoditeleva ; Mariani et al. Along the lines of Nambisan and Nambisan et al. These new forms of connectivity affect not only how global and local service providers internationalize their value propositions, but also how they build market knowledge based on digital data analytics Davenport , ; Mariani and Fosso Wamba ; Mariani , and create and deliver value to global customers.

Second, this work contributes to cross-cultural and international marketing studies e. de Mooij and Hofstede in online settings Gao et al. We analyse to what extent cultural distance among international services customers and providers in hospitality affects online customer ratings and behaviors.

The empirical results indicate that online behaviors are partially culturally dependent, offering a clear explanation of the discrepancy in online evaluations of similar hospitality services by hotel guests from different cultural backgrounds, based on the distinctively different cultural values they intentionally or unintentionally share with the national group they belong to.

Third, this study contributes to international marketing theory. These similarities seem to strengthen the statement that, despite globalization dynamics and the likely emergence of convergent consumer behaviors across countries McLeod , national identities are becoming more critical as it is likely that consumers of different socio-cultural groups construct and recognize a specific social identity that affects their online behavior.

Furthermore, our findings corroborate international market segmentation theory in general Cleveland et al. From a theoretical point of view, our work suggests that international hospitality customers are not homogeneous, but rather consist of distinctively different segments as our cultural distance metric suggests.

The underlying cultural dimensions might represent segmentation variables that could generate further insights, rather than a mere country of origin segmentation that is used sometimes in practice by hospitality marketers Cvelbar et al. Therefore, marketing segmentation research in hospitality services Dolnicar , especially if carried out in online settings, would enormously benefit from taking into account human values Rokeach , and especially cultural values Hofstede The present work presents multiple practical implications for the following groups of individuals: i international service providers in the hospitality sector and, more generally, practitioners and managers in services industries; ii developers, administrators and managers of online review platforms and digital platforms in general; iii international customers of hospitality services.

International service providers in the hospitality sector and, more generally, managers in the services industries could progressively combine traditional techniques of evaluating service quality including the SERVQUAL Zeithaml et al.

Hence, triangulation of small and big data from online reviews Mariani et al. As such, it would be recommended to segment societal groups of customers by cultural dimensions.

Fourth, hotel managers should pay more attention to those national groups that display the higher cultural distance vis-à-vis that of the hotel.

As far as developers, administrators and managers of online review platforms are concerned, the findings of this research are extremely relevant for digital platforms that increasingly operate in multi-country and international environments, and that have to interact with multiple national cultures that could be distinctively different vis-à-vis the culture of the service providers.

First, the findings of this work are particularly germane for e-commerce websites e. Expedia and Booking.

com as they have to optimize continuously the algorithms underlying their recommender systems to boost bookings on their websites and, ultimately, generate higher revenues.

Second, online travel review platforms such as TripAdvisor its reviews are not certified; reviews are not related to real stays and anyone can post a review on the website , could work on algorithms similar to those used by Booking. com or Expedia that filter reviews and, therefore, help international customers to identify useful reviews based on a similar country of origin.

This is, to a certain extent, one of the major issues of online reviews as the residence of the reviewer as well as other identity information is often missing. As far as implications for international customers are concerned, OTAs such as Booking. com should keep on investing in mechanisms enhancing the interaction between online consumers belonging to a common national or social group Zeugner-Roth et al.

The present work has added to multiple research streams within the international marketing body of literature, with emphasis on cross-cultural studies of consumer behaviour in online settings and to the nascent eWOM research stream pertaining to the impact of cultural distance on online reviews, hence contributing to eWOM research in the services sectors and, more specifically, travel, hospitality and tourism services Cantallops and Salvi cultural traits, demographics and the features of services providers e.

First, leveraging a sample of more than 0. Second, as online evaluations can be seen as a proxy of online customer satisfaction Engler et al. Therefore, this result seems to suggest that online environments shaped by digital platforms and technologies, call for a more nuanced appreciation of international marketing theories and practices Cleveland et al.

Of course, this contribution might be embedded in the wider debate revolving around the extent to which online ratings are correlated with actual overall customer satisfaction with the service and its attributes e.

Limberger et al. Third, the magnitude of the coefficients associated with the service provider category, which is a proxy of the quality of the hospitality service, still appears significant.

However, when including cultural factors in the model specification, the model explains a higher share of the variance of online ratings. For instance, in our study we find that when online international customers do not disclose their personal information, they are more likely—due to the higher anonymity of their online evaluation—to be less constrained and therefore feel free to give more conservative evaluations to the reviewed services.

As such, model specifications including both reviewer level and reviewed service features represent the way ahead to achieve a more rounded understanding of online international customer satisfaction with services.

Certainly, cultural differences between service providers and customers, as well as other reviewer level variables such as identity disclosure and reviewing behaviors will need to be embedded in future model specifications.

Our work has contributed to the development of the marketing literature in multiple ways. First, it has contributed to an emerging line of research that makes use of big digital data analytics from digital platforms to shed light on customer satisfaction with services in international settings e.

Accordingly, we contend that digital ecosystems and platforms are partially reshaping international marketing theories as they enable novel forms of digital connectivity. Second, this study has contributed to the emerging research stream of cross-cultural and international marketing studies in online settings e.

Third, this work has contributed to international marketing theory by suggesting that, despite globalization dynamics and the likely emergence of convergent consumer behaviors across countries McLeod , national identities are, however, becoming more critical.

We suggest that international hospitality customers are not homogeneous, but rather consist of distinctively different segments, as our cultural distance metric suggests. Though this work offers both valuable theoretical contributions and practical and managerial implications, it displays a few limitations.

Firstly, we might enhance the model specification by making it more comprehensive through the inclusion of variables such as the submission device deployed to write the review Mariani et al. Moreover, the model might be compared to other models where the dependent variable would be the ratings of the different hospitality service attributes such as location, cleanliness, staff, etc.

com data cannot be scraped solely based on APIs. Second, future research might try to examine if the findings hold regardless of the online review platform deployed for instance, comparing Booking. com reviews with Expedia and Tripadvisor reviews.

Third, in order to further generalize our findings, it would be interesting to extend our study beyond London and consider other less attractive and less known destinations to understand whether there are sector specificities that could yield differentiated results.

Indeed, we might argue that hospitality services are rather globalized and internationalized, but not necessarily this would hold for other services such as medical or financial services.

The results match with recent research that measures the impact of cultural orientations on the deployment of electronic word of mouth of customers Nath et al. Finally, future studies might put together online review ratings and text analytics to shed light on the extent to which text analytics vary across cultural groups and if they interact with online review ratings across cultural groups.

Allik, J. Individualism-collectivism and social capital. Journal of Cross-Cultural Psychology, 35 1 , 29— Article Google Scholar. Appelt, L. Literature review: Online consumer product ratings and reviews.

Interaction and Interface Design , 1— Ayeh, J. Predicting the intention to use consumer-generated media for travel planning. Tourism Management, 35, — Bagozzi, R. Cultural and situational contingencies and the theory of reasoned action: application to fast food restaurant consumption.

Journal of Consumer Psychology, 9 2 , 97— Borghi, M. Service robots in online reviews: Online robotic discourse. Annals of Tourism Research , Breidbach, C. Beyond virtuality: from engagement platforms to engagement ecosystems. Managing Service Quality, 24 6 , — Cantallops, A.

New consumer behavior: a review of research on eWOM and hotels. International Journal of Hospitality Management, 36, 41— Casadesus-Masanell, R. When does a platform create value by limiting choice? Chau, P. Cultural differences in the online behavior of consumers. Communication of ACM, 45, — Chen, R.

A review of the literature on culture in hotel management research: what is the future? International Journal of Hospitality Management, 31 1 , 52— Cleveland, M. Identity, culture, dispositions and behavior: a cross-national examination of globalization and culture change.

Journal of Business Research, 69, — Cronin, J. Measuring service quality: a reexamination and extension. Journal of Marketing, 56 3 , 55— Crotts, J. Managing Service Quality: An International Journal, 10 6 , — Cvelbar, L.

Which hotel guest segments reuse towels? Selling sustainable tourism services through target marketing. Journal of Sustainable Tourism, 25 7 , — Daughtery, T. Exploring consumer motivations for creating user-generated content. Journal of Interactive Advertising, 8 2 , 16— Davenport, T.

Strategy and Leadership, 42 4 , 45— How analytics has changed in the last 10 years. Harvard Business Review, 28, Google Scholar. de Mooij, M. Cross-cultural consumer behavior: a review of research findings. Journal of International Consumer Marketing, 23, — Dibb, S.

Market segmentation: diagnosing and treating the barriers. Industrial Marketing Management, 30 8 , — Dolnicar, S. Journal of Travel Research, 42 3 , — Engler, T.

Understanding online product ratings: a customer satisfaction model. Journal of Retailing and Consumer Services, 27, — European Cities Marketing. Dijon: ECM. Ek Styvén, M. This is my hometown! Journal of Advertising. Filieri, R.

Why do travelers trust TripAdvisor? Antecedents of trust towards consumer-generated media and its influence on recommendation adoption and word of mouth.

Tourism Management , 51 , — Gao, B. Follow the herd or be myself? an analysis of consistency in behavior of reviewers and helpfulness of their reviews.

Decision Support Systems, 95, 1— Tourism Management, 65, — Gensler, S. Managing brands in the social media environment. Journal of Interactive Marketing, 27 4 , — George, G. Big data and management. Academy of Management Journal, 57 2 , — Gretzel, U. Use and impact of online travel reviews.

Gretzel Eds. Grier, S. Noticing cultural differences: ad meanings created by target and non-target markets. Journal of Advertising, 28 1 , 79— Grönroos, C. A service-orientated approach to marketing of services. European Journal of Marketing, 12 8 , — Harrell, F.

Regression modeling strategies: with applications to linear models, logistic and ordinal regression, and survival analysis 2nd ed.

Cham: Springer International Publishing. Book Google Scholar. Hennig-Thurau, T.

See the latest verified ratings & reviews for WPS Office. Compare real user opinions on the pros and cons to make more informed decisions The Google Play In-App Review API lets you prompt users to submit Play Store ratings and reviews without the inconvenience of leaving your app Different schemes of rating are used on online platforms, and most of the empirical studies use reviews, scored or rated in terms of satisfaction by