In other words, we assess whether the card earns rewards at a high rate in the most popular business spending categories. We also estimate the redemption value of points or miles from various issuer, airline and hotel rewards programs. The better these values, the higher its score will be, making it more worthy of inclusion in our list and increasing its potential ranking.

We also score cards based on how much it costs to keep them in your wallet or carry a balance. To start, each business card is scored based on whether it offers an intro APR and how its ongoing APR compares to the rates available on other business cards.

This is because an intro APR on new purchases or balance transfers can be a lifesaver if you need to pay down debt, finance a large business purchase or free up cash flow.

Cards with an annual fee will always be at a slight disadvantage in our scoring system since annual fees inherently cut into your rewards value. However, if a card offers terrific value via its ongoing rewards and perks, it can earn a high score and a spot in our list even if it carries a high annual fee.

After all, the highest rewards rates and most valuable perks are often found on cards with annual fees. With this in mind, we rate a card based primarily on how its ongoing rewards value and ongoing perk value such as annual credits or bonuses stack up against those of other cards in the category when you subtract annual fees.

That said, we strive to include as many no-annual-fee options in our list as possible since many business owners would rather not worry about offsetting fees, even if a card carries impressive rewards and perks.

Business rewards cards may make it easy to earn a lot of points, miles or cash back, but how easy is it to use those rewards? Flexibility factors include whether a card only allows you to earn a high rewards rate on only a small amount of spending or requires you to meet a certain earning threshold before you can redeem rewards.

We also examine whether your points are worth less when you opt for some redemption options over others and whether a card gives you the flexibility to transfer rewards to travel partners. Top-tier perks include benefits like airport lounge access, travel credits, elite status with an airline or hotel and credits for expedited security screening membership programs.

We give extra weight to perks especially useful or valuable for small-business owners, like being able to qualify with no personal guarantee, digital advertising credits, free employee cards and accounting perks.

The best business card depends on the type of business you run and its needs, but here are the three highest-rated business cards on Bankrate:. Many business credit cards are available to startups.

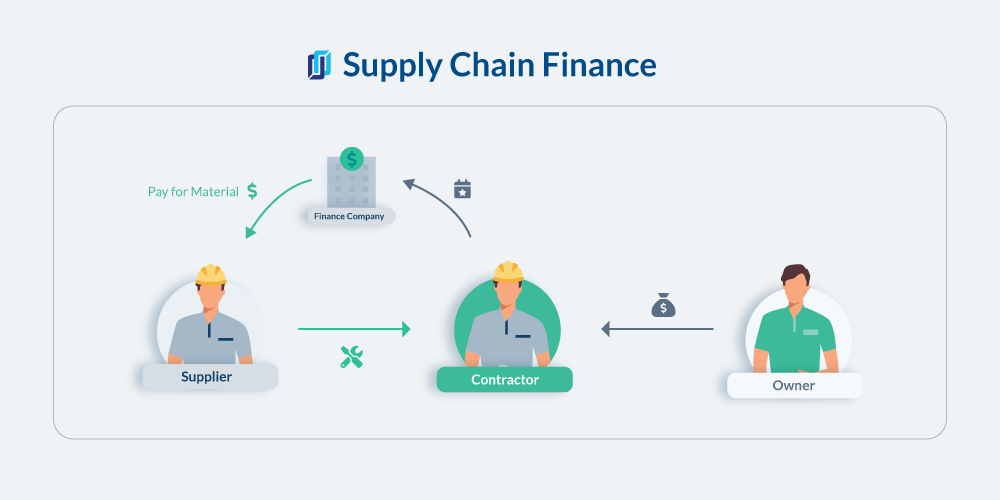

The best business card for one business may not be the best one for yours. Starting to build your business credit could be as easy as establishing credit with vendors and suppliers.

But not all credit lenders will report accounts to business credit bureaus. Opening a business credit card is a better option. Another benefit is that you can avoid interest charges with a business credit card as long as you consistently pay your balance in full each month.

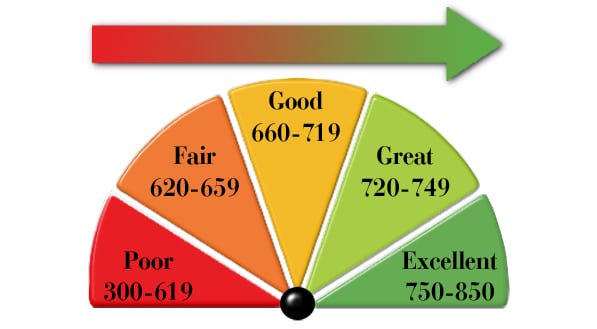

A business credit score applies to businesses rather than individuals. Unlike personal credit cards, business credit scores can range between one and depending on the business credit bureau.

Business scores are also public and attached to an Employer Identification Number EIN rather than a Social Security Number. But you may have to pay to see your score or look up other businesses. The most common alternatives to business cards are:. Business credit card transactions that are legitimate business expenses may be written off as a business expense in some cases.

Interest paid on business credit cards transactions is tax deductible, much like the interest paid on a business loan. For small business owners — particularly single-member LLCs and S-Corps, business cards are an important tool to help track your transactions and keep them separate from your personal expenses.

Using business cards to organize expenses really helps me maximize deductions. The rewards you earn with business credit cards aren't taxable, so if you maximize them you can earn substantial cash, points or miles.

When you use the card exclusively for business expenses, you can also deduct the fees that are associated with these products.

We use primary sources to support our work. Can I build a good FICO score if a charge card is my only credit account? Accessed on Jan. Federal Reserve issues FOMC statement.

Board of Governors of the Federal Reserve System. Unlike a traditional card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history. Every reasonable effort has been made to maintain accurate information.

However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Apply for a credit card with confidence.

When you find your odds, you get:. A personalized list of cards ranked by likelihood of approval. No credit hits. Your personal information and data are protected with bit encryption. That means:. All of your personal information is protected with bit encryption. Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile. Credit Cards Business Advertiser Disclosure Advertiser Disclosure Bankrate. Robert Thorpe. Written by Robert Thorpe Arrow Right Editor, Personal Finance.

Courtney Mihocik. Edited by Courtney Mihocik Arrow Right Senior Editor, Credit Cards. Jason Steele. Reviewed by Jason Steele Arrow Right Former contributor, Credit Cards. Credit Card Search View card list Menu List Table of contents Why choose Bankrate Caret Down User We helped over , users compare business cards in Circle Check We evaluated over 40 business perks.

Lightbulb Over 47 years of experience helping people make smart financial decisions. The Bankrate Promise. User We helped over , users compare business cards in Why choose Bankrate The Bankrate Promise. The Bankrate Promise At Bankrate we strive to help you make smarter financial decisions.

View card list Collapse Caret Up. Best Business Credit Cards of February Capital One Venture X Business Rewards Credit Card : Best business card for travel perks and credits Capital One Spark Cash Plus : Best for annual cash bonus Ink Business Cash® Credit Card : Best business card for earning rewards on office expenses Ink Business Unlimited® Credit Card : Best business card for unlimited 1.

Table of contents Collapse Caret Up. Increase your odds of finding the perfect card. Increase your odds of finding the perfect card 1 in 3 people w ho try approval odds find a card they like. See your approval odds.

Featured business Card. Apply now Lock on Capital One's secure site. Limited Time Offer. Capital One Venture X Business Capital One Venture X Business. Rating: 4. Bankrate review. Intro offer. Annual fee. Regular APR. Rewards details Caret Down 2X miles 2 miles on every purchase 5X miles 5 miles on flights booked through Capital One Travel 10X miles 10 miles on hotels and rental cars booked through Capital One Travel.

Pros Boasts valuable, practical travel perks, including annual travel statement credits, anniversary miles and airport lounge access, making it easy to offset the annual fee. Offers ultra-flexible travel redemption, allowing you to redeem miles for travel via Capital One, transfer to participating airline partners and more.

You can redeem miles for cash back, but doing so will cut the redemption value of your miles in half. Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions This card has no preset spending limit, so you get purchasing power that adapts to your spending needs.

Capital One Spark Cash Plus Capital One Spark Cash Plus. Pros The rewards program is straightforward and the flat-rate return on spending is generous. Given its a charge card, there are no flexible financing options.

Ink Business Cash® Credit Card Ink Business Cash® Credit Card. appOddsOn { aoProduct. Apply now Lock on Chase's secure site. Pros The value of the sign-up bonus is superb. Rewards are generous, particularly for a no-annual-fee credit card.

Cons Your bonus cash back is subject to cap. No Annual Fee Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®. Ink Business Unlimited® Credit Card Ink Business Unlimited® Credit Card.

Rewards details Caret Down 1. Rewards can be transferred for extra value if you have a Chase Ultimate Rewards card. Cons Depending on your business spending habits, you might be able to earn more rewards with a bonus category credit card.

Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control. Round-the-clock monitoring for unusual credit card purchases With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

Capital One Spark Cash Select for Excellent Credit Capital One Spark Cash Select for Excellent Credit. Cons The card lacks transfer partners, limiting its redemption options. Other business cards offer higher rewards, even at a flat-rate. Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card.

Rating: 3. Apply now Lock on Bank of America's secure site. Pros This card does not charge an annual fee. Cons There is no intro APR offer on balance transfers. This card charges a 3 percent foreign transaction fee. No annual fee. Choose how to redeem your cash rewards — as a deposit into your Bank of America® checking or savings account, as a card statement credit or as a check mailed to you.

After the intro APR offer ends, a Variable APR that's currently Contactless Cards - The security of a chip card, with the convenience of a tap. This offer may not be available if you leave this page or visit our website.

You can take advantage of this offer when you apply now. Pros Offers the one of the highest flat rates available: 2. Cons No bonus categories with boosted rates, which could help you earn rewards faster for specific purchases High annual fee cuts into reward earnings. Earn unlimited 2.

The only business credit card with 2. For businesses who prefer to pay their balance in full each month, Ink Business Premier gives access to increased spending power, rich rewards, and premium benefits. Pay off eligible purchases over time with interest up to assigned Flex for Business limit.

All other purchases must be paid in full each month. Purchase with confidence with built-in protections like Fraud Protection, Zero Liability Protection, Purchase Protection, Cell Phone Protection, and Extended Warranty Protection. Monitor spend with digital tools like purchase alerts, set spending limits, reporting, and more.

Member FDIC. Apply now Lock on American Express's secure site. Pros Offers a decent intro APR on purchases You can access Expanded Buying Power, a flexible financing option for Amex business cardholders. APRs will not exceed Cash back earned is automatically credited to your statement.

From workflow to inventory to floor plans, your business is constantly changing. Just remember, the amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to us and other factors.

No Annual Fee Terms Apply. American Express® Business Gold Card American Express® Business Gold Card. Rating: 5 stars out of 5. Rewards details Caret Down 4X Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories.

Pros You get a generous return on some prime business-centric bonus categories. Cardholders get access to business expense management tools. Cons Your bonus cash back is subject to a cap. purchases at FedEx, Grubhub, and Office Supply Stores. Enrollment required. Your Card — Your Choice. Choose from Gold or Rose Gold.

Revenued Business Card Revenued Business Card. Apply now Lock on Revenued's secure site. Your Flex Line spending limit is based on your business revenue, not your credit history, so your purchasing power can grow as your business grows.

Cons Though this combo is available with less-than-perfect credit, it still carries business revenue requirements that may be hard for some small-business owners to reach. The card that cares less about your credit score and more about your business. Includes the Revenued Flex Line.

A flexible line and business card bundled in one. No application, annual, or draw fee. Terms apply. Spending limit determined by cash flow of your business and other factors. Ink Business Preferred® Credit Card Ink Business Preferred® Credit Card.

Pros The sign-up bonus is one of the largest you'll find. The Business Platinum Card® from American Express The Business Platinum Card® from American Express.

Rewards details Caret Down 5X 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel. com 1. Pros The card touts a generous welcome offer.

New benefits include bonus rewards on key business categories and an annual business-centric statement credit terms apply. Cons The annual credits come with a number of caveats and can be tricky to maximize. The annual fee is one of the priciest on the market. com, and 1X points for each dollar you spend on eligible purchases.

Earn 1. wireless service providers. The American Express Global Lounge Collection® can provide an escape at the airport. Terms Apply. Capital One Spark Miles for Business Capital One Spark Miles for Business. Rewards details Caret Down 5x Unlimited 5X miles on hotels and rental cars booked through Capital One Travel 2X Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account.

Relative to some competitors, this card is slim on ancillary business-centric benefits. Best for United Airline benefits. Pros Earn a first-year payout with the welcome offer. For a modest annual fee, the card comes with a nice set of airline perks not found with general-purpose business cards.

Cons Offers free checked bag but only for you and one companion. Plus, employee cards at no additional cost - miles earned from their purchases accrue in your account so you can earn rewards faster.

The Blue Business® Plus Credit Card from American Express The Blue Business® Plus Credit Card from American Express.

Rewards details Caret Down 2X Earn 2X Membership Rewards® points on everyday business purchases such as office supplies or client dinners. Pros The rewards are generous for a no annual fee card. Your bonus rewards are subject to a cap. APR will not exceed It adjusts with your use of the Card, your payment history, credit record, financial resources known to us, and other factors.

The Hilton Honors American Express Business Card The Hilton Honors American Express Business Card. Earn Hilton Honors Bonus Points for each dollar of eligible purchases on your Card: 12X directly with hotels and resorts in the Hilton portfolio, 6X at U.

gas stations, on U. purchases for shipping, on wireless telephone services purchased directly from U. service providers, on flights booked directly with airlines or with Amex Travel, on car rentals booked directly from select car rental companies, and at U.

restaurants, 3X on all other eligible purchases. Capital on Tap Business Credit Card Capital on Tap Business Credit Card.

Apply now Lock on Capital On Tap's secure site. Pros Relatively low on fees and includes no foreign transaction fee. The 1. Cons Not available to sole proprietorships the most common business structure or nonprofits. Features are limited, and the sign-up bonus has an incredibly high spend requirement compared to other business credit cards.

Pros Business owners can earn an unlimited 2 percent cash back in two eligible categories where they spend the most with this card. This card offers free employee cards and spending analysis tools to track card use.

Capital One Spark Cash Plus. Ink Business Cash® Credit Card. Ink Business Unlimited® Credit Card. Capital One Spark Cash Select for Excellent Credit.

Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card. The Blue Business® Plus Credit Card from American Express. Bank of America® Business Advantage Customized Cash Rewards Mastercard® credit card.

American Express® Business Gold Card. Revenued Business Card. Ink Business Preferred® Credit Card. The Business Platinum Card® from American Express. Unlimited 5X miles on hotels and rental cars booked through Capital One Travel 2X miles on every purchase.

The Hilton Honors American Express Business Card. restaurants, airfare booked through Amex Travel and select car rentals 3X points on all other purchases. Capital on Tap Business Credit Card. Bank Business Leverage® Visa Signature® Card. Show 15 more rows. On This Page Compare our top cards What is a business credit card?

Tips on choosing the best business card for you What people say about the best business credit cards In the news How we assess the best business cards Frequently asked questions Ask the experts. A closer look at our best small business credit cards. Capital One Venture X Business Best for travel perks and credits.

select this. from parent. Capital One Spark Cash Plus Best for annual cash bonus. The high flat-rate cash back on this card is significant. Business owners who spend big every year and prefer flat-rate rewards. Like the Spark Cash Plus, The Capital One Spark Select for Excellent Credit has no preset spending limit.

While the rewards rate is a little lower, the welcome bonus is an upgrade. Learn more: Why the Capital One Spark Cash Plus is an easy-to-use card for businesses. Read our full Capital One Spark Cash Plus review or jump back to offer details.

Ink Business Cash® Credit Card Best for earning rewards on office expenses. If most of your monthly business expenses go beyond routine office supplies, you may find that a flat-rate card like the Ink Business Unlimited® Credit Card offers more value.

Read our full Ink Business Cash Credit Card review or jump back to offer details. Ink Business Unlimited® Credit Card Best for large welcome offer. You earn unlimited cash back on all purchases and get the rare benefit of an intro APR offer on purchases.

Plus, it provides employee cards for no extra cost. The Capital One Spark Cash Select for Excellent Credit offers the same rewards rate, but its sign-up bonus comes with a much lower spending requirement.

Learn more: Is the Ink Business Unlimited worth it? Read our full Ink Business Unlimited Credit Card review or jump back to offer details. Capital One Spark Cash Select for Excellent Credit Best for no balance transfer fee.

Also, compared to its sibling card — the Capital One Spark Cash Plus — the welcome bonus is an upgrade over most at this tier. Small-business owners who prefer simple rewards programs and only travel occasionally.

If the credit score requirement for the Spark Select is a bit too high, the Brex 30 Card could be a good alternative. Read our full Capital One Spark Cash Select for Excellent Credit review or jump back to offer details. Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card Best for Bank of America customers.

Business owners whose purchases cover various spending categories and prefer banking with Bank of America. Big spenders willing to look outside of Bank of America may find more value with the Capital One Spark Cash Plus card and its higher unlimited cash back rate on all eligible purchases.

Read our full Bank of America Business Advantage Unlimited Cash Rewards Mastercard credit card review or jump back to offer details. A rewards card with tiered categories may be better if your business spending is more aligned with specific business purchases.

The Ink Business Cash® Credit Card charges no annual fee and offers a high cash back rate on office supply store, internet, cable and phone service purchases.

Read our full Ink Business Premier review or jump back to offer details. The Blue Business® Plus Credit Card from American Express Best no-annual-fee business card. Business owners with high monthly expenses may get more value from the Capital One Spark Cash Plus, which also offers flat-rate rewards on purchases but does not put a cap on earnings.

Read our full The Blue Business Plus Credit Card from American Express review or jump back to offer details. Bank of America® Business Advantage Customized Cash Rewards Mastercard® credit card Best for customizable cash back category. Business owners who can benefit from boosted rewards rates on purchases in select business categories.

Read our full Bank of America Business Advantage Customized Cash Rewards Mastercard credit card review or jump back to offer details.

American Express® Business Gold Card Best for reward category flexibility. American Express offers a high rewards rate on six valuable, business-oriented categories, making it easy for businesses to rack up earnings with this card. Small-business owners with ever-changing spending habits.

Learn more: Is the Amex Business Gold card worth it? Read our full American Express Business Gold Card review or jump back to offer details. Revenued Business Card Best for fair credit. Approvals and finance charges are based on your business revenue and history, not your personal credit, so this prepaid card and flex spending line combo could be a big help if you have a growing business but struggle to find affordable financing.

If you have a good enough credit score to qualify and can avoid carrying a balance, a traditional business card could be a cheaper option. The Capital on Tap Business Credit Card carries a lower rewards rate but offers credit limits up to a high amount with no annual fee.

Read our full Revenued Business card review or jump back to offer details. Ink Business Preferred® Credit Card Best for flexible travel redemption. You also have the opportunity to transfer your points at a ratio to big-name airline and hotel partners like United, Southwest, British Airways, Marriott and Hyatt.

Small-business owners seeking boosted travel rewards without sacrificing business rewards. The American Express Business Gold Card offers elevated rewards on spending in your top two select categories where your business spent the most each billing cycle. Read our Ink Business Preferred Credit Card review or jump back to offer details.

The Business Platinum Card® from American Express Best for luxury travel perks. Big spenders who frequently travel and want access to the most premium travel benefits. The American Express Business Gold Card may be a better match if your business requires little traveling.

Not only will you spend a lot less on annual fees, but you stand to earn a higher rewards rate on your top expense categories. Read our full The Business Platinum Card from American Express review or jump back to offer details. Capital One Spark Miles for Business Best for easy rewards redemption.

While some travel credit cards have complicated rewards structures, the Capital One Spark Miles for Business keeps it simple.

You can book travel through Capital One or use your miles to cover travel-related purchases made on your card within the last 90 days, including airfare, hotel bookings, transit and more. Read our full Capital One Spark Miles for Business review or jump back to offer details.

Small businesses that prefer the value of points over the convenience of cash back may prefer the Blue Business Plus Credit Card from American Express.

Read our full American Express Blue Business Cash review or jump back to offer details. The Hilton Honors American Express Business Card Best for Hilton benefits.

This card provides remarkably high rewards rates at Hilton hotels and for business purchases. Coupled with Hilton Honors Gold Status, this card offers more reward opportunities than other travel cards. In fact, 1 Capital One mile can be worth more than 1 Hilton Honors point based on Bankrate's latest credit card point valuations , which give Capital One miles an average value of around 1.

Read our full Hilton Honors American Express Business Credit Card review or jump back to offer details. Capital on Tap Business Credit Card Best for potentially high credit limit. This card earns flat-rate rewards on all business purchases.

It also has no annual fee or foreign transaction fees, making it ideal for small businesses that frequently make purchases abroad or online with international merchants. The Bank of America Business Advantage Unlimited Cash Rewards card also has no annual fee and offers the same flat cash back rate.

Plus, existing Bank of America and Merrill customers stand to earn significantly higher rewards through its Preferred Rewards program , provided they meet program requirements. Read our full Capital on Tap Business Card review or jump back to offer details.

Instead, you'll see recommended credit ranges from the issuers listed next to cards on our site. Close banner. Featured Business Card Ink Business Cash® Credit Card. Apply now at Chase's secure site. On this page Jump to Our top picks Business credit card details What are business credit cards Pros and cons Who should get a business credit card How to choose a business credit card Our methodology Frequently asked questions.

Best Business Credit Cards for February Written by: Jeanine Skowronski Edited by: Tracy Stewart Reviewed by: Erica Sandberg. Why trust us? Learn more. Our editorial team and our expert review board provide an unbiased analysis of the products we feature.

Our comparison service is compensated by our partners, and may influence where or how products are featured on the site. Learn more about our partners and how we make money.

Please note: The star-rating system on this page is based on our independent card scoring methodology and is not influenced by advertisers or card issuers.

Show More Less Show More Less When used wisely, business credit cards can help small-business owners make the most of their day-to-day expenses.

BEST FOR CASH BACK ON OFFICE SUPPLIES. Ink Business Cash® Credit Card. Our rating: 4. Credit card issuers have no say or influence on how we rate cards. The score seen here reflects the card's primary category rating. For more information, you can read about how we rate our cards.

Add to compare. com credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application. Editor's take. Overall rating Our rating: 4.

Rewards Value: 2. Annual Percentage Rate: 0. Rewards Flexibility: 3. Features: 2. Issuer Customer Experience 3. Why we like this card The Ink Business Cash card offers some serious opportunities for racking up rewards in common areas of business spending. Pros High earning rate on office essentials, including office supplies and internet, cable and phone services.

You must earn at least 2, points before you can redeem them. Bottom Line The Ink Business Cash card offers a top-notch earning rate on business-focused spending, but keep an eye on the spend cap if you have a bigger budget. Card details. No Annual Fee Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

Regular APR View All Ink Business Cash® Credit Card Details. BEST FOR SIMPLE REWARDS PROGRAM. Ink Business Unlimited® Credit Card. Rewards rate 1. Rewards Value 3. Annual Percentage Rate 0. Rewards Flexibility 4. Features 2. Why we like this card The Ink Business Unlimited card is perfect for small business owners who prefer to keep things simple; its flat 1.

You earn the same flat rate of rewards on all purchases — no need to keep track of bonus categories. Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

Round-the-clock monitoring for unusual credit card purchases With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information. View All Ink Business Unlimited® Credit Card Details.

Best for no annual fee. Capital One Spark Cash Select for Excellent Credit. Apply now at Capital One's secure site. Annual Percentage Rate 3. Features 4. Issuer Customer Experience 4. Pros It has no annual fee, which is advantageous for a business card that offers a decent flat-rate rewards rate.

Its ongoing APR begins slightly below the current average credit card interest rate. Cons There is no intro APR offer that could help offset interest on new purchases.

View All Capital One Spark Cash Select for Excellent Credit Details. Best for travel. Capital One Venture X Business. Rewards rate 2X miles 2 miles on every purchase 5X miles 5 miles on flights booked through Capital One Travel 10X miles 10 miles on hotels and rental cars booked through Capital One Travel.

Rewards value: 5. APR: 1. Reward flexibility: 4. Features: 5. Miles offer great flexibility if you redeem for travel. You book rewards travel with the issuer, transfer to airline and hotel partners, or use miles to cover outside travel purchases made within the last 90 days. While this card offers a solid list of perks, a few other cards carry even more luxury benefits and may justify a higher annual fee.

Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions This card has no preset spending limit, so you get purchasing power that adapts to your spending needs.

View All Capital One Venture X Business Details. BEST FOR FLAT-RATE UNLIMITED BOOSTED REWARDS. Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card. Apply now at Bank of America's secure site.

Rewards Value 2. APR 4. Issuer Customer Experience 5. Why we like this card This hassle-free flat rate card lets business owners earn 1. Pros This card charges no annual fee and rewards never expire as long as your account remains open. Enjoy an intro APR on purchases. Cons The rewards rate is fairly low, especially for big spenders.

Bottom Line The Business Advantage Unlimited Cash Rewards Mastercard® is an ideal choice for business owners who value having an unfussy flat-rate rewards card or a card with potentially confusing bonus categories.

Earn unlimited 1. No annual fee. Choose how to redeem your cash rewards — as a deposit into your Bank of America® checking or savings account, as a card statement credit or as a check mailed to you. After the intro APR offer ends, a Variable APR that's currently Contactless Cards - The security of a chip card, with the convenience of a tap.

This offer may not be available if you leave this page or visit our website. You can take advantage of this offer when you apply now. View All Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card Details.

BEST FOR LARGE PURCHASES. Our rating: 3. Overall rating Our rating: 3. Rewards Value 4. APR 1. Features 3. Earn unlimited 2. The only business credit card with 2.

For businesses who prefer to pay their balance in full each month, Ink Business Premier gives access to increased spending power, rich rewards, and premium benefits. Pay off eligible purchases over time with interest up to assigned Flex for Business limit.

All other purchases must be paid in full each month. Purchase with confidence with built-in protections like Fraud Protection, Zero Liability Protection, Purchase Protection, Cell Phone Protection, and Extended Warranty Protection.

Monitor spend with digital tools like purchase alerts, set spending limits, reporting, and more. Member FDIC. Regular APR Flex for Business Variable APR: BEST FOR LONG INTRO APR PERIOD ON PURCHASES. The Blue Business® Plus Credit Card from American Express. Apply now at American Express's secure site.

Rewards rate 2X Earn 2X Membership Rewards® points on everyday business purchases such as office supplies or client dinners. Annual fee No annual fee Regular APR Annual Percentage Rate 5. Pros Enjoy a lengthy introductory APR to pay off large purchases over a set period of time, without accruing steep interest charges.

Points are worth less when redeemed for non-travel purchases. Terms apply. Bottom Line With no annual fee and a simple earning scheme, the Amex Blue Business Plus is a solid choice for travel enthusiasts who want to earn Membership Rewards. APR will not exceed It adjusts with your use of the Card, your payment history, credit record, financial resources known to us, and other factors.

No Annual Fee Terms Apply. Annual Fee No annual fee. View All The Blue Business® Plus Credit Card from American Express Details. Best for businesses going back to the office. Bank of America® Business Advantage Customized Cash Rewards Mastercard® credit card.

Annual Percentage Rate 2. Pros This card charges no annual fee. Cash rewards never expire as long as your account remains open.

Cons Rewards cannot be transferred to other loyalty programs. Bottom Line With a choice of bonus categories and a high rewards rate, this no-annual-fee card offers businesses plenty of value. That means you could earn up to 5. Choose how to redeem your cash rewards-as a deposit into your Bank of America® checking or savings account, as a card statement credit or as a check mailed to you.

To change your choice category for future purchases, you must go to the Mobile Banking app or Business Advantage , our small business online banking. You can change it once each calendar month, or make no change and it stays the same. View All Bank of America® Business Advantage Customized Cash Rewards Mastercard® credit card Details.

Best Corporate Card. American Express® Business Gold Card. Rewards rate 4X Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories.

com using your Business Gold Card. Rewards Flexibility 3. You can still earn a high rate of rewards even as your spending shifts. Cons Points are worth less when redeemed for non-travel purchases.

The card has a steep annual fee. Bottom Line The Amex Business Gold card is best suited for frequent business travelers who can take advantage of a higher point value on eligible travel purchases.

Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel. purchases at FedEx, Grubhub, and Office Supply Stores.

Enrollment required. Your Card — Your Choice. Choose from Gold or Rose Gold. View All American Express® Business Gold Card Details. Best for fair or limited credit. Revenued Business Card. Apply now at Revenued's secure site. All categories apply.

Its cash back rate is easily the best flat rate available on a business card with no annual fee. The card that cares less about your credit score and more about your business.

Includes the Revenued Flex Line. A flexible line and business card bundled in one. No application, annual, or draw fee. Spending limit determined by cash flow of your business and other factors. Intro Purchase APR Factor based. View All Revenued Business Card Details.

BEST FOR SIGN-UP BONUS. Ink Business Preferred® Credit Card. Rewards Value: 3. Annual Percentage Rate: 1. Rewards Flexibility: 4. Features: 3. Wide variety of other redemption options include outside travel purchases, cash back and gift cards.

Bottom Line Ultimate Rewards are extremely versatile, and the generous intro bonus and rewards rate on this card makes it easy to rack up flexible points.

View All Ink Business Preferred® Credit Card Details. BEST FOR FLAT-RATE CASH BACK. Capital One Spark Cash Plus. Rewards Value 5. As a charge card, this card requires you to pay off your balance in full each billing cycle and carries no ongoing APR or introductory APR offers.

View All Capital One Spark Cash Plus Details. BEST FOR LUXURY TRAVEL PERKS. The Business Platinum Card® from American Express. Rewards rate 5X 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel. com 1. Annual Percentage Rate 1. Features 5. Up to 1,, bonus points per calendar year when you book on amextravel.

Cons Points are worth less on non-travel redemptions. Bottom Line The Amex Business Platinum card is certainly expensive, but plentiful credits and travel perks can make it worth it for the right kind of cardholder.

com, and 1X points for each dollar you spend on eligible purchases. Earn 1. wireless service providers. The American Express Global Lounge Collection® can provide an escape at the airport.

Terms Apply. View All The Business Platinum Card® from American Express Details. BEST FOR REWARDS. Capital One Spark Miles for Business. Rewards rate 5x Unlimited 5X miles on hotels and rental cars booked through Capital One Travel 2X Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account.

Rewards Flexibility 5. Pros Redeem your miles for any travel purchase made in the last 90 days — no matter where you book. Earn the same flat rate of miles on every purchase.

Cons Earn the same flat rate of miles on every purchase. Bottom Line The Spark Miles for Business is a standout in terms of flexibility: you earn a flat rate of miles on all purchases and can redeem them in multiple ways. View All Capital One Spark Miles for Business Details.

BEST FOR NO ANNUAL FEE. Annual Percentage Rate 4. Pros High rate of cash back for a card with no annual fee.

Cash back is automatically applied as a statement credit at the end of each billing cycle. Big business spenders may be able to find a more lucrative business credit card, albeit for an annual fee.

APRs will not exceed Cash back earned is automatically credited to your statement. From workflow to inventory to floor plans, your business is constantly changing.

Just remember, the amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to us and other factors.

BEST FOR HILTON LOYALISTS. The Hilton Honors American Express Business Card. Rewards Value: 5. Annual Percentage Rate: 4. Why we like this card The Hilton Honors American Express Business Card can be an excellent choice for cardholders who spend a lot of money on business travel and hotels.

Pros An opportunity to score multiple free nights each year. Impressive travel perks, including 10 free Priority Pass lounge visits annually enrollment required , travel and purchase protections and various Hilton hotel privileges. The point value for redemptions options other than hotel stays is very low.

Earn Hilton Honors Bonus Points for each dollar of eligible purchases on your Card: 12X directly with hotels and resorts in the Hilton portfolio, 6X at U. gas stations, on U. purchases for shipping, on wireless telephone services purchased directly from U. service providers, on flights booked directly with airlines or with Amex Travel, on car rentals booked directly from select car rental companies, and at U.

restaurants, 3X on all other eligible purchases. View All The Hilton Honors American Express Business Card Details. Best for low interest. Capital on Tap Business Credit Card.

Apply now at Capital On Tap's secure site. Issuer Customer Expierence 5. Pros Unlimited employee cards with individual spending limits.

Once approved, cards should arrive quickly, within four days. Cons Not open to sole proprietors. Bottom Line The best feature about the Capital on Tap card will be its potential for a low variable interest rate. View All Capital on Tap Business Credit Card Details.

Delta SkyMiles® Gold Business American Express Card. Rewards rate 2X Earn 2 miles per dollar spent on purchases at U. Shipping providers and at U. Why we like this card Frequent Delta flyers will love the Delta SkyMiles Gold Business American Express Card. Fuel surcharges can add significant costs to your bill, especially on international flights.

com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees. Earn 2 miles per dollar spent on purchases at U.

Earn 2 Miles on every dollar spent on eligible purchases made directly with Delta and on every eligible dollar spent at restaurants. Earn 1 Mile on every eligible dollar spent on other purchases. Pay no foreign transaction fees when you travel overseas. Terms and limitations apply.

View All Delta SkyMiles® Gold Business American Express Card Details. BEST FOR STARTUPS. Brex Card. Our rating: 5. Apply now at Brex's secure site. Rewards rate 7X 7X Rideshare 4X 4X Brex Travel 3X 3X Restaurants 2X 2X Recurring software 1X 1X Everything else.

Overall rating Our rating: 5. Customer Experience 4. Why we like this card The Brex Card can be a great option for new business owners since it requires no personal guarantee and no personal credit check.

Pros Quick approval process with no personal guarantee or personal credit check required. Generous rewards, discounts and credits that match typical startup spending. To earn bonus points, you need to make the Brex your exclusive corporate card.

Bottom Line The Brex Card is designed to match typical startup spending and makes the application process fast and easy. Brex offers a corporate credit card designed to help companies boost their spending power and grow faster. Build business credit from day one with a card that's automatically paid monthly.

No credit check, no personal guarantee, no account fees, and no interest. Save time and money with auto-generated receipts and built-in controls for real-time tracking and reporting. Issue unlimited virtual and physical cards to your team, and set custom limits with auto-enforced rules on each card.

Brex Mastercard® issued by Emigrant Bank, Member FDIC. Brex Cash provided by Brex Treasury LLC, member FINRA and SIPC. Brex Treasury is not a bank; Brex Cash is not a bank account.

Testimonials may not represent experiences of all clients. Terms apply, visit brex. View All Brex Card Details. Show More Cards. Back to top. On this page Our top picks Business credit card details What are business credit cards Pros and cons Who should get a business credit card How to choose a business credit card Our methodology Frequently asked questions.

Comparing the best business credit cards of Business Credit Card Best For Intro Bonus Rewards Rate Annual Fee CreditCards. com, 1. Alternatives : If your high-spending categories tend to lean toward travel purchases, you could get more value out of the Capital One Spark Miles for Business.

It earns 5X miles on hotels and rental cars booked through Capital One Travel and 2X miles on every other purchase. Bottom line: This no-annual-fee business credit card is an excellent option for owners who spend heavily within the bonus cash back categories.

Best for simple rewards program: Ink Business Unlimited® Credit Card Best Features: Not only will you earn unlimited 1. Biggest drawbacks : Points are only worth one cent unless you transfer them to a premium Ultimate Rewards card, plus you need a minimum of 2, points for redemptions.

This keeps your rewards simple but more rewarding. Bottom line : This Ink Business Unlimited card is ideal for small-business owners looking for a straightforward rewards card without complicated rotating bonus categories and spending caps. Best for no annual fee: Capital One Spark Cash Select for Excellent Credit Best features : Its sign-up bonus and low potential interest rate offer cardholders many advantages, as well as the opportunity to redeem cash back earnings at any time for statement credit.

That makes it easy to earn flexible rewards. Plus, there is no intro APR period for new purchases or balance transfers. Bottom line: For no annual fee See Rates and Fees , this card is a great beginner business card for those who are just starting out and want to earn uncomplicated rewards on all purchases.

Biggest drawbacks: Your miles are worth less when you redeem for cash back instead of travel. If you need the flexibility to redeem for cash back or travel depending on your business needs, a general rewards card may be a better fit.

Alternatives: If the simplicity of cash back sounds more appealing than miles, the Capital One Spark Cash Plus is worth a look.

Bottom line: Frequent travelers should squeeze a ton of value out of this card thanks to its valuable, easy-to-use perks, streamlined rewards rates and relatively low annual fee.

Best for flat-rate unlimited boosted rewards: Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card Best Features : This card offers an unlimited 1. That means cardholders could enjoy an unlimited flat rate of up to 2.

Biggest drawbacks : Big spenders who are not existing Bank of America or Merrill Preferred Rewards clients may be better served by a card with a higher rewards rate on business-specific bonus categories.

The best way to compare business credit cards is to focus on approval requirements, annual fees and rewards rates. By calculating how much the You can compare Best Business Credit Cards by evaluating the types of rewards they offer, determining what you can earn with each card, and looking at fees Need the best business credit cards? Check out the best business credit cards sorted by rewards, benefits, low interest rates, etc. Get a business credit